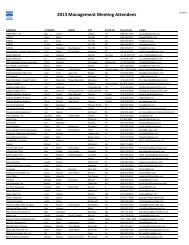

2011 AIMCAL MARCH MANAGEMENT MEETING Speakers

2011 AIMCAL MARCH MANAGEMENT MEETING Speakers

2011 AIMCAL MARCH MANAGEMENT MEETING Speakers

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

orders indexes rising into the high 50s.<br />

However, the reacceleration in China<br />

could be mostly behind us. The People’s<br />

Bank of China has raised reserve<br />

requirements for the fifth time this year<br />

to slow inflation and is likely to raise<br />

interest rates before the end of the year.<br />

This would presumably slow growth next<br />

year. Allowing the Yuan to appreciate<br />

against the dollar, perhaps necessary to<br />

keep quantitative easing in the United<br />

States from causing unacceptably high<br />

inflation in China, would also curb<br />

export-led growth.<br />

PMIs (total and new orders) also<br />

turned up in the Euro-Zone, United<br />

Kingdom, and India in October after<br />

recent declines. The PMI rose to a new<br />

cyclical high in Poland, where growth in<br />

industrial production is nearly as strong<br />

as in China. PMIs fell in Japan and in<br />

Korea. The latter is a bit of a concern<br />

since Korea tends to lead the global<br />

economy. Except in China and perhaps<br />

Taiwan, industrial production indexes,<br />

which have a long publication lag in<br />

many countries, do not show any acceleration<br />

yet. On a seasonally adjusted<br />

basis, production has been flat to slightly<br />

down over the last several months in<br />

Japan, India, Korea, and Brazil. Any<br />

reacceleration is either prospective or too<br />

recent to be captured by the industrial<br />

production data.<br />

The biggest source of uncertainty<br />

about the global economic outlook is<br />

Europe. In the aggregate, the European<br />

economy is doing better than expected<br />

(so far) as strength in Germany, Sweden,<br />

and Poland has offset weakness in<br />

Greece, Portugal, Spain, and Ireland.<br />

Easier monetary policy, to aid countries<br />

affected by sovereign debt crises (Ireland<br />

being the most current example) could<br />

continue to boost growth in the healthier<br />

economies. However, a spreading financial<br />

crisis combined with fiscal consolidation<br />

could ultimately slow growth<br />

even in the stronger countries.<br />

The good run of<br />

economic data in<br />

the United States,<br />

particularly the<br />

improvement in<br />

leading indicators,<br />

does not mean that<br />

the U.S. economy<br />

will now experience<br />

the kind of strong<br />

recovery that typically<br />

follows a deep<br />

recession; recovery<br />

will remain sub-par.<br />

It does mean that<br />

the risk of falling<br />

back into recession<br />

has declined<br />

and that growth is<br />

likely to be stronger in <strong>2011</strong> than previously<br />

thought. A temporary extension<br />

of the Bush tax cuts, more likely now<br />

than before the elections, would bolster<br />

the case for stronger growth. But even<br />

if growth throughout <strong>2011</strong> is no stronger<br />

than previously expected, better-thanexpected<br />

growth in the fourth quarter of<br />

2010 will mean that forecasts for annual<br />

growth rates in <strong>2011</strong> need to be revised<br />

up. Nevertheless, annual growth is likely<br />

to be no higher in the United States in<br />

<strong>2011</strong> than in 2010 and will be lower in<br />

most of the world. Furthermore, even if<br />

sequential (month-to-month, quarter-toquarter)<br />

growth accelerates soon, yearover-year<br />

growth is likely to slow into<br />

the second quarter of next year before it<br />

turns up again.<br />

Copyright © 2010 E. I. du Pont de<br />

Nemours and Company. All rights<br />

reserved. Reprinted with permission.<br />

Save the Dates<br />

March Management<br />

Meeting <strong>2011</strong><br />

March 20-23, <strong>2011</strong><br />

The Boulders Resort<br />

Carefree, Arizona<br />

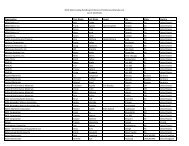

<strong>AIMCAL</strong><br />

Index<br />

Optimism Fades<br />

With eight out of 10 indicators falling,<br />

the Current General Activity Index<br />

in <strong>AIMCAL</strong>’s Business Outlook Survey<br />

plummeted 16 points to 45.85 in the third<br />

quarter of 2010 from 61.70 at the end of<br />

the second quarter of 2010.<br />

On the bright side, the Number of<br />

Employees and Capital Expenditures<br />

indicators registered increases for the<br />

quarter. In addition, even with the<br />

decline in the Current General Activity<br />

Index, it’s 10 points higher than it was at<br />

the end of the third quarter in 2009.<br />

Optimism about <strong>2011</strong> has slipped<br />

three points since the six-month forcast at<br />

the end of the second quarter of 2010 and<br />

six points since the third quarter of 2009.<br />

Although <strong>AIMCAL</strong> members scored six<br />

out of 10 forecasted business indicators<br />

positively, lower confidence in New<br />

Orders, Delivery Time, Inventories and<br />

Average Employee Work Week dragged<br />

the Forecasted General Activity Index<br />

down.<br />

The third quarter 2010 survey<br />

includes responses from 48 member<br />

companies: 15 converters, 15 equipment<br />

suppliers, 13 material suppliers and five<br />

firms that participate in more than one of<br />

the business segments. The full report is<br />

available in the Members Only section of<br />

the <strong>AIMCAL</strong> Website, www.aimcal.org.<br />

GOT NEWS?<br />

If your company has a<br />

People On The Move<br />

announcement or press<br />

release for Member News,<br />

send it via email to:<br />

Tracey@<strong>AIMCAL</strong>.org<br />

Please include the subject<br />

line:<br />

GOT NEWS?<br />

10 Holiday 2010 www.aimcal.org