Stockland Direct Retail Trust No.1

Stockland Direct Retail Trust No.1

Stockland Direct Retail Trust No.1

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

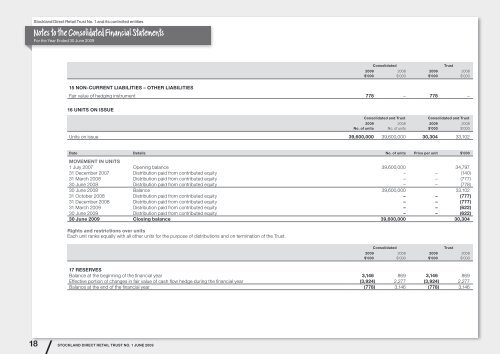

<strong>Stockland</strong> <strong>Direct</strong> <strong>Retail</strong> <strong>Trust</strong> No. 1 and its controlled entities<br />

Notes to the Consolidated Financial Statements<br />

For the Year Ended 30 June 2009<br />

Consolidated<br />

<strong>Trust</strong><br />

2009 2008 2009 2008<br />

$’000 $’000 $’000 $’000<br />

15 Non-current liabilities – Other liabilities<br />

Fair value of hedging instrument 778 – 778 –<br />

16 Units on issue<br />

Consolidated and <strong>Trust</strong><br />

Consolidated and <strong>Trust</strong><br />

2009 2008 2009 2008<br />

No. of units No. of units $’000 $’000<br />

Units on issue 39,600,000 39,600,000 30,304 33,102<br />

Date Details No. of units Price per unit $’000<br />

Movement in units<br />

1 July 2007 Opening balance 39,600,000 34,797<br />

31 December 2007 Distribution paid from contributed equity – – (140)<br />

31 March 2008 Distribution paid from contributed equity – – (777)<br />

30 June 2008 Distribution paid from contributed equity – – (778)<br />

30 June 2008 Balance 39,600,000 33,102<br />

31 October 2008 Distribution paid from contributed equity – – (777)<br />

31 December 2008 Distribution paid from contributed equity – – (777)<br />

31 March 2009 Distribution paid from contributed equity – – (622)<br />

30 June 2009 Distribution paid from contributed equity – – (622)<br />

30 June 2009 Closing balance 39,600,000 30,304<br />

Rights and restrictions over units<br />

Each unit ranks equally with all other units for the purpose of distributions and on termination of the <strong>Trust</strong>.<br />

Consolidated<br />

<strong>Trust</strong><br />

2009 2008 2009 2008<br />

$’000 $’000 $’000 $’000<br />

17 Reserves<br />

Balance at the beginning of the financial year 3,146 869 3,146 869<br />

Effective portion of changes in fair value of cash flow hedge during the financial year (3,924) 2,277 (3,924) 2,277<br />

Balance at the end of the financial year (778) 3,146 (778) 3,146<br />

18<br />

<strong>Stockland</strong> <strong>Direct</strong> <strong>Retail</strong> <strong>Trust</strong> No. 1 June 2009