Annual Report 2006 - Fairfax County Economic Development Authority

Annual Report 2006 - Fairfax County Economic Development Authority

Annual Report 2006 - Fairfax County Economic Development Authority

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

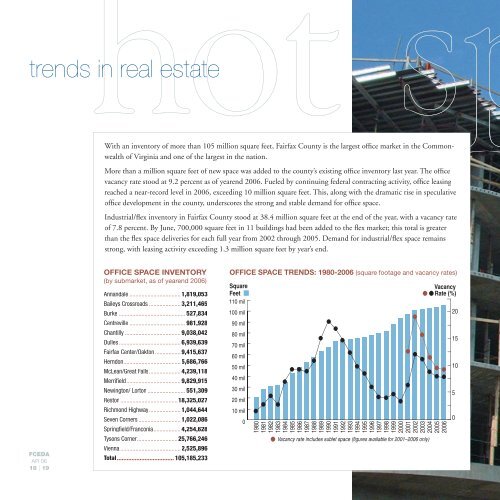

trends in real estate<br />

With an inventory of more than 105 million square feet, <strong>Fairfax</strong> <strong>County</strong> is the largest office market in the Commonwealth<br />

of Virginia and one of the largest in the nation.<br />

More than a million square feet of new space was added to the county’s existing office inventory last year. The office<br />

vacancy rate stood at 9.2 percent as of yearend <strong>2006</strong>. Fueled by continuing federal contracting activity, office leasing<br />

reached a near-record level in <strong>2006</strong>, exceeding 10 million square feet. This, along with the dramatic rise in speculative<br />

office development in the county, underscores the strong and stable demand for office space.<br />

Industrial/flex inventory in <strong>Fairfax</strong> <strong>County</strong> stood at 38.4 million square feet at the end of the year, with a vacancy rate<br />

of 7.8 percent. By June, 700,000 square feet in 11 buildings had been added to the flex market; this total is greater<br />

than the flex space deliveries for each full year from 2002 through 2005. Demand for industrial/flex space remains<br />

strong, with leasing activity exceeding 1.3 million square feet by year’s end.<br />

FCEDA<br />

AR 06<br />

18 | 19<br />

OFFICE SPACE INVENTORY<br />

(by submarket, as of yearend <strong>2006</strong>)<br />

Annandale .................................. 1,819,053<br />

Baileys Crossroads ..................... 3,211,465<br />

Burke ............................................ 527,834<br />

Centreville ..................................... 981,928<br />

Chantilly ..................................... 9,038,042<br />

Dulles ......................................... 6,939,639<br />

<strong>Fairfax</strong> Center/Oakton ................. 9,415,637<br />

Herndon ...................................... 5,686,766<br />

McLean/Great Falls ..................... 4,239,118<br />

Merrifi eld .................................... 9,829,915<br />

Newington/ Lorton ......................... 551,309<br />

Reston ......................................18,325,027<br />

Richmond Highway ..................... 1,044,644<br />

Seven Corners ............................ 1,022,086<br />

Springfi eld/Franconia .................. 4,254,628<br />

Tysons Corner ...........................25,766,246<br />

Vienna ........................................ 2,525,896<br />

Total ................................... 105,185,233<br />

OFFICE SPACE TRENDS: 1980-<strong>2006</strong> (square footage and vacancy rates)<br />

Square<br />

Feet<br />

110 mil<br />

100 mil<br />

90 mil<br />

80 mil<br />

70 mil<br />

60 mil<br />

50 mil<br />

40 mil<br />

30 mil<br />

20 mil<br />

10 mil<br />

0<br />

Vacancy<br />

Rate (%)<br />

1980<br />

1981<br />

1982<br />

1983<br />

1984<br />

1985<br />

1986<br />

1987<br />

1988<br />

1989<br />

1990<br />

1991<br />

1992<br />

1993<br />

1994<br />

1995<br />

1996<br />

1997<br />

1998<br />

1999<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

<strong>2006</strong><br />

Vacancy rate includes sublet space (figures available for 2001–<strong>2006</strong> only)<br />

20<br />

15<br />

10<br />

5<br />

0