Rough seas for BC economy - Institute of Chartered Accountants of BC

Rough seas for BC economy - Institute of Chartered Accountants of BC

Rough seas for BC economy - Institute of Chartered Accountants of BC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

October 2009<br />

<strong>Rough</strong> <strong>seas</strong> <strong>for</strong> <strong>BC</strong> <strong>economy</strong><br />

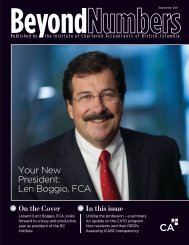

On the Cover<br />

The 2009 <strong>BC</strong> Check-Up report<br />

shows mixed results <strong>for</strong> 2008<br />

and a rough start <strong>for</strong> 2009.<br />

What does the future hold?<br />

In this issue<br />

News from the Executive Tour<br />

Crystallizing the capital gains exemption<br />

Don’t abdicate your pr<strong>of</strong>essional<br />

judgment

Left to Right:<br />

Farida Sukhia, Chris Halsey-Brandt, Ron Parks, Spencer Cotton,<br />

Rosanne Terhart, Robert D. Mackay, Gary M. W. Mynett, Hugh G. Livingstone,<br />

Cheryl Shearer, Jeff P. Matthews, Kiu Ghanavizchian, Vern Blai r.<br />

Blair Mackay Mynett Valuations Inc.<br />

is the leading independent business valuation and litigation support practice in British<br />

Columbia. Our practice focus is on business valuations, mergers and acquisitions,<br />

economic loss claims, <strong>for</strong>ensic accounting and other litigation accounting matters.<br />

We can be part <strong>of</strong> your team, providing you with the experience your clients require.<br />

Suite 1100<br />

1177 West Hastings Street<br />

Vancouver, <strong>BC</strong>, V6E 4T5<br />

Telephone: 604.687.4544<br />

Facsimile: 604.687.4577<br />

www.bmmvaluations.com<br />

Vern Blair: 604.697.5276<br />

Rob Mackay: 604.697.5201<br />

Gary Mynett: 604.697.5202<br />

Ron Parks: 604.697.5242<br />

Hugh Livingstone: 604.697.5238<br />

Spencer Cotton: 604.697.5212<br />

Jeff Matthews: 604.697.5203<br />

Cheryl Shearer: 604.697.5293<br />

Rosanne Terhart: 604.697.5286<br />

Farida Sukhia: 604.697.5271<br />

Chris Halsey-Brandt: 604.697.5294<br />

Kiu Ghanavizchian: 604.697.5297

contents<br />

On the Cover<br />

8<br />

Checking Up on the<br />

Provincial Economy<br />

What our provincial <strong>BC</strong><br />

Check-Up report reveals<br />

about living, working, and<br />

investing in <strong>BC</strong><br />

26<br />

CA Social Networking Group<br />

Hosts Baseball BBQ<br />

4 Notes from the CEO<br />

Thoughts on the <strong>economy</strong><br />

6 For the Pr<strong>of</strong>ession<br />

News from the Executive Tour<br />

16 Tax Traps & Tips<br />

Crystallizing the capital gains<br />

exemption in the context <strong>of</strong><br />

business succession<br />

18 PD News<br />

Fall PD highlights<br />

20 Plugged In<br />

News <strong>for</strong> and about members<br />

& students<br />

Movers and shakers in the<br />

pr<strong>of</strong>ession<br />

Reminder: Nominations <strong>for</strong><br />

the election <strong>of</strong> FCAs<br />

Nominate a future president<br />

30 Ethical Dilemmas<br />

Don’t abdicate your<br />

pr<strong>of</strong>essional judgment<br />

Want to get<br />

the word out?<br />

Advertise in Beyond Numbers!<br />

Here’s why:<br />

90% <strong>of</strong> <strong>BC</strong> CAs surveyed read<br />

Beyond Numbers<br />

Beyond Numbers goes out to<br />

more than 9,000 members,<br />

more than 1,800 students,<br />

and over 200 external<br />

stakeholders—including<br />

other institutes, associations,<br />

and pr<strong>of</strong>essional organizations<br />

Beyond Numbers has won<br />

awards <strong>for</strong> both content<br />

and design, including<br />

Blue Wave Awards <strong>of</strong> Merit<br />

from the International<br />

Association <strong>of</strong> Business<br />

Communications – <strong>BC</strong> Branch<br />

To place an ad in<br />

Beyond Numbers, contact our<br />

representatives at:<br />

Advertising in Print<br />

Tel: 604-681-1811<br />

710 – 938 Howe St.<br />

Vancouver, <strong>BC</strong> V6Z 1N9<br />

Fax: 604-681-0456<br />

Email:<br />

info@advertisinginprint.com<br />

10%<br />

Cert no. SCS-COC-00867

October 2009, No.482<br />

Published eight times annually by the<br />

<strong>Institute</strong> <strong>of</strong> <strong>Chartered</strong> <strong>Accountants</strong><br />

<strong>of</strong> British Columbia.<br />

Editor<br />

Michelle McRae<br />

Thoughts on the<br />

<strong>economy</strong><br />

Design<br />

Blindfolio Design<br />

604-761-9212<br />

Advertising<br />

Advertising In Print<br />

Phone: 604-681-1811<br />

Fax: 604-681-0456<br />

Senior Director <strong>of</strong> External Affairs<br />

Lesley MacGregor<br />

<strong>Institute</strong> Council<br />

Karen Keilty, FCA<br />

President<br />

Peter Norwood, CA<br />

1st Vice-President<br />

Lenard Boggio, FCA<br />

2nd Vice-President<br />

Michael Macdonell, CA<br />

Treasurer<br />

Jack Arnold, CA<br />

Linda Lee Brougham, CA<br />

Kyman Chan, CA<br />

Karen Christiansen, CA<br />

John Craw<strong>for</strong>d, CA<br />

Gordon Holloway, FCA<br />

David Hughes<br />

Anthony Mayer, CA<br />

Al McNair<br />

Sheila Nelson, CA<br />

John Sims, FCA<br />

James Topham, CA<br />

Kenneth Tung<br />

Praveen Vohora, CA<br />

Chief Executive Officer<br />

Richard Rees, FCA<br />

Beyond Numbers is printed in British Columbia and<br />

mailed eight times annually to more than 9,000<br />

chartered accountants and more than 1,800 CA students<br />

in public practice, industry, education, and government<br />

service throughout <strong>BC</strong>, Canada, and other countries.<br />

Beyond Numbers’ editorial and business <strong>of</strong>fices<br />

are located at:<br />

Suite 500, One Bentall Centre, 505 Burrard St., Box 22<br />

Vancouver, <strong>BC</strong> V7X 1M4<br />

Phone: 604-681-3264<br />

Toll-free in <strong>BC</strong>: 1-800-663-2677<br />

Fax: 604-681-1523<br />

Internet: www.ica.bc.ca<br />

Opinions expressed are not necessarily<br />

endorsed by the <strong>Institute</strong>.<br />

Beyond Numbers supports the CA pr<strong>of</strong>ession in <strong>BC</strong><br />

by sharing news from the <strong>Institute</strong> and news about<br />

members, by sharing viewpoints on issues <strong>of</strong> specific<br />

interest to members, and by promoting member<br />

involvement in <strong>Institute</strong> activities.<br />

Publications Mail Agreement No: 40062742<br />

Notes from the CEO<br />

What a difference a year can make. Just 12 months ago, <strong>BC</strong><br />

had one <strong>of</strong> the fastest growing economies in Canada. While the <strong>for</strong>estry sector<br />

was struggling, the overall unemployment rate was still relatively low, and <strong>for</strong><br />

the most part, we seemed to be working through the economic downturn. That<br />

all changed, however, with the financial meltdown last October, as the prices <strong>of</strong><br />

all <strong>of</strong> <strong>BC</strong>’s export commodities sank, and the province lost its tenuous grip on<br />

prosperity.<br />

This reversal <strong>of</strong> <strong>for</strong>tune is reflected in the 2009 <strong>BC</strong> Check-Up report, which<br />

details how our <strong>economy</strong> held its own <strong>for</strong> most <strong>of</strong> 2008, then took a sharp<br />

downturn in 2009. Specifically, the report indicates that while <strong>BC</strong> made strides<br />

in many LIVE and WORK indicators last year, much room <strong>for</strong> improvement<br />

remains when it comes to our INVEST indicators—especially with respect to<br />

productivity, exports, and corporate pr<strong>of</strong>its.<br />

It’s important to put the downturn in context. While <strong>BC</strong>’s <strong>economy</strong> has taken a<br />

hit since last fall, so too have the economies <strong>of</strong> our closest competitors. In<br />

addition, <strong>BC</strong>’s move to the HST will help maintain a competitive business and<br />

taxation climate, and should encourage investment.<br />

With the <strong>economy</strong> top <strong>of</strong> mind, we <strong>of</strong>fer this month’s cover story, which<br />

highlights the results <strong>of</strong> the 2009 <strong>BC</strong> Check-Up and features updated statistics<br />

<strong>for</strong> several economic indicators.<br />

The <strong>BC</strong> Check-Up is a central pillar <strong>of</strong> the <strong>Institute</strong>’s public affairs program,<br />

providing CAs across the province with an opportunity to <strong>of</strong>fer commentary<br />

on the <strong>economy</strong>. This year, we’re reshaping the process a bit. Hard copies <strong>of</strong><br />

the <strong>BC</strong> Check-Up will no longer be produced, but, as in previous years, members<br />

will be able to access and download the report from the <strong>Institute</strong>’s website at<br />

www.bccheckup.com.<br />

Comments or questions on this topic? Contact me at rees@ica.bc.ca.<br />

—Richard Rees, FCA<br />

Want to contribute to the <strong>BC</strong> Check-Up? Contact Kerri Brkich, our manager<br />

<strong>of</strong> public affairs, at 604-488-2625 or brkich@ica.bc.ca.<br />

4 ica.bc.ca October ’09

NEW<br />

the A<strong>BC</strong>s <strong>of</strong><br />

A complimentary e-learning course is now<br />

available to help you get started on the transition<br />

to International Financial Reporting Standards.<br />

This four part on-line program will provide you with the<br />

foundation you need to build your IFRS knowledge. Visit our<br />

dedicated web site and get started today.<br />

Your trusted source <strong>for</strong> everything IFRS.<br />

www.cica.ca/IFRS<br />

1297<br />

October ’09 ica.bc.ca 5

For the Pr<strong>of</strong>ession<br />

Executive Tour<br />

Addresses Key<br />

Pressures on <strong>BC</strong><br />

and the Pr<strong>of</strong>ession<br />

By Karen Keilty, FCA<br />

President<br />

By the time this issue <strong>of</strong> Beyond Numbers<br />

reaches your mailbox, I, along with the<br />

<strong>BC</strong> <strong>Institute</strong>’s executive team, will have<br />

visited Cranbrook, Kelowna, Vernon, Penticton,<br />

and Kamloops during the annual Executive<br />

Tour. While several other stops are planned over<br />

the next few months, I know that we will not<br />

reach all <strong>of</strong> you. So <strong>for</strong> those <strong>of</strong> you who cannot<br />

attend the remaining meetings, this article <strong>of</strong>fers<br />

a brief outline <strong>of</strong> the issues being addressed this<br />

year.<br />

The <strong>economy</strong><br />

We know the state <strong>of</strong> the <strong>BC</strong> <strong>economy</strong> is a concern<br />

<strong>for</strong> many members. During the Executive<br />

Tour, we are sharing details from the 2009<br />

edition <strong>of</strong> the provincial <strong>BC</strong> Check-Up report,<br />

and discussing what the report reveals in terms<br />

<strong>of</strong> the current <strong>economy</strong>. (For more details on<br />

the report, please see the cover story on page 8.)<br />

Ensuring the continued<br />

growth <strong>of</strong> the pr<strong>of</strong>ession<br />

Today, the <strong>BC</strong> <strong>Institute</strong> has approximately<br />

10,000 members and 2,000 students—record<br />

numbers in both categories. While we are<br />

proud to have so many qualified people in the<br />

pr<strong>of</strong>ession, we also recognize that demographics<br />

and market growth <strong>for</strong> services will continue to<br />

increase the demand <strong>for</strong> CAs in the future. We<br />

are mindful <strong>of</strong> this reality as we continue<br />

developing a strategy to ensure the pr<strong>of</strong>ession’s<br />

continued growth.<br />

During the Tour, we are updating members<br />

about a part <strong>of</strong> this strategy that has already been<br />

implemented: the new practical experience<br />

requirements <strong>for</strong> students.<br />

As detailed in the September 2009 issue <strong>of</strong><br />

Beyond Numbers (pages 12-13), the introduction<br />

<strong>of</strong> new practical experience requirements in<br />

September 2007 means that CA students can<br />

now train outside <strong>of</strong> audit and assurance to earn<br />

their designations. This change in experience<br />

requirements creates new opportunities <strong>for</strong> CAs<br />

in public practice and in industry.<br />

In <strong>BC</strong>, we have welcomed industry employers<br />

Telus and PRA group into our training<br />

program. They join CA firms Deloitte &<br />

Touche LLP (Tax & FAS), KPMG LLP (Tax),<br />

and PricewaterhouseCoopers LLP (Tax), which<br />

have taken this opportunity to expand their<br />

training programs into new areas.<br />

I encourage each <strong>of</strong> you to think about whether<br />

you work in the right environment to train the<br />

next generation <strong>of</strong> CAs. If you think you do,<br />

visit www.CATOadvantage.ca or contact Lara<br />

Greguric, CA, director <strong>of</strong> CA Training Offices<br />

<strong>for</strong> CASB, at greguric@casb.com, or Harp<br />

Bagri, CA, manager <strong>of</strong> CA Training Office<br />

Liaison <strong>for</strong> CASB, at bagri@casb.com, to find<br />

out how you can get involved.<br />

The expanded experience opportunities create<br />

an opportunity <strong>for</strong> the CA pr<strong>of</strong>ession to broaden<br />

the types <strong>of</strong> students trained and expand the<br />

number <strong>of</strong> students in the pr<strong>of</strong>ession as a whole.<br />

As our <strong>economy</strong> grows and more baby boomers<br />

retire, growth in the number <strong>of</strong> new members<br />

and in the range <strong>of</strong> their training will help ensure<br />

that the CA pr<strong>of</strong>ession remains the<br />

preferred choice <strong>for</strong> business, government, and<br />

not-<strong>for</strong>-pr<strong>of</strong>it organizations.<br />

Implementing new standards<br />

The Executive Tour also gives us an opportunity<br />

to update members about the status and<br />

implementation <strong>of</strong> new standards, and to<br />

remind members <strong>of</strong> the various resources that<br />

are available.<br />

IFRS<br />

As the January 1, 2011 conversion date nears,<br />

IFRS remains a hot topic. A wide variety <strong>of</strong><br />

resources are available to help members make<br />

the transition to IFRS. In particular, a very<br />

useful one-stop source <strong>for</strong> IFRS news can be<br />

found at www.cica.ca/IFRS.<br />

Private enterprise GAAP<br />

The comment deadline <strong>for</strong> the Exposure Draft<br />

on private enterprise GAAP has closed. The<br />

Accounting Standards Board (AcSB) received<br />

over 170 responses, and AcSB staff members also<br />

received feedback at stakeholder consultations<br />

across the country. At the time <strong>of</strong> this writing<br />

(mid-September 2009), the AcSB is in the<br />

process <strong>of</strong> reviewing the comments received,<br />

with the objective <strong>of</strong> issuing the standards in<br />

early 2010. We will continue to provide updates<br />

as we learn more.<br />

Upcoming Executive Tour dates (check <strong>for</strong> more dates at www.ica.bc.ca)<br />

Nelson/Castlegar/Trail<br />

Thursday, October 8, 2009<br />

5:30 pm: “No-Host Reception”<br />

6:00 pm: Dinner<br />

Victoria<br />

Wednesday, November 18, 2009<br />

12:00 pm: Lunch<br />

Duncan<br />

Thursday, November 19, 2009<br />

12:00 pm: Lunch<br />

Nanaimo<br />

Thursday, November 19, 2009<br />

5:30 pm: “No-Host Reception”<br />

6:00 pm: Dinner<br />

Campbell River<br />

Friday, November 20, 2009<br />

12:00 pm: Lunch<br />

Prince George<br />

Tuesday, November 24, 2009<br />

12:00 pm: Lunch<br />

6 ica.bc.ca October ’09

Financial reporting <strong>for</strong> NPOs<br />

Together with the Public Sector Accounting<br />

Board (PSAB), the AcSB is also deliberating on<br />

the future direction <strong>of</strong> financial reporting <strong>for</strong><br />

not-<strong>for</strong>-pr<strong>of</strong>it organizations. Stay tuned <strong>for</strong><br />

more in<strong>for</strong>mation in early 2010.<br />

New auditing standards<br />

Although the new auditing standards will come<br />

into effect <strong>for</strong> audits <strong>of</strong> financial statements with<br />

the year ended on or after December 14, 2010,<br />

the new quality control standard will actually<br />

come into effect a full year earlier, on December<br />

15, 2009. This new quality control standard will<br />

be applicable to firms that per<strong>for</strong>m audits and/or<br />

review engagements. It will also apply to many<br />

small practitioners, as the new standard will<br />

stipulate that anyone involved in the per<strong>for</strong>mance<br />

or quality control review <strong>of</strong> a particular<br />

engagement can no longer conduct an inspection<br />

<strong>of</strong> that engagement as part <strong>of</strong> the firm’s<br />

monitoring. This change will mean that sole<br />

practitioners who have previously self-inspected<br />

files will no longer be able to do so, effective<br />

December 15, 2009.<br />

To help practitioners make this change, the<br />

ICA<strong>BC</strong> has created a posting board at www.ica.bc.ca<br />

under Member Centre>Management In<strong>for</strong>mation<br />

and Tools>Trading <strong>of</strong> Quality Control Services<br />

(direct: www.ica.bc.ca/kb.php3?catid=1083), where<br />

members can post requests to trade quality<br />

control services with other members.<br />

Keeping you in<strong>for</strong>med<br />

I look <strong>for</strong>ward to speaking with more <strong>of</strong> you as<br />

the Executive Tour continues. For those <strong>of</strong> you<br />

who won’t be able to make it to the remaining<br />

meetings listed below, I hope this summary has<br />

given you a good sense <strong>of</strong> where things currently<br />

stand. If you have any questions, please do not<br />

hesitate to email me at president@ica.bc.ca.<br />

$125,000 – Director <strong>of</strong> Finance<br />

A CA with experience focused in the<br />

manufacturing sector is looking <strong>for</strong> an<br />

opportunity to further their career. This<br />

individual is seeking an opportunity with<br />

a progressive organization where their<br />

contributions will add value to the senior<br />

management team. They bring a strong<br />

skill set in systems, reporting, budgeting<br />

and business development.<br />

$85,000 – Hands-on Controller<br />

A designated individual is looking <strong>for</strong><br />

a position within a small to medium<br />

sized organization where they can be<br />

responsible <strong>for</strong> all finance related duties.<br />

They have gained excellent experience<br />

working <strong>for</strong> a number <strong>of</strong> years within<br />

the distribution industry. They have<br />

hands-on experience preparing financial<br />

statements, management reports,<br />

budgeting, cash management, as well<br />

as overseeing accounts payable and<br />

accounts receivable functions.<br />

$85,000 - Public Practice<br />

A CA with 2 years at a management<br />

level is seeking an opportunity where<br />

future Partnership exists. This candidate<br />

articled in a large firm to gain more<br />

exposure in working directly with<br />

clients on review and compilation<br />

engagements. This candidate is seeking<br />

an opportunity with a progressive and<br />

entrepreneurial public practice firm.<br />

$65,000 – Senior Corporate Accountant<br />

A recently designated individual with<br />

experience mainly within the resource<br />

sector is seeking an opportunity to<br />

move into a management role and gain<br />

more supervisory experience. They<br />

have solid experience in all areas <strong>of</strong><br />

full cycle accounting including month<br />

end journal entries, general ledger<br />

reconciliations and financial statement<br />

preparation. They have worked with a<br />

Controller on the budget preparation.<br />

This candidate thrives in a challenging<br />

and fast paced environment.<br />

$45,000 – Intermediate Accountant<br />

An accounting student, who is<br />

motivated to complete their studies and<br />

move <strong>for</strong>ward in their career, has gained<br />

a majority <strong>of</strong> their experience in the<br />

mining sector. They have experience in<br />

preparing balance sheet reconciliations,<br />

recording monthly depreciation,<br />

preparation <strong>of</strong> journal entries,<br />

processing <strong>of</strong> journal entries, processing<br />

their hourly payroll and assisting with<br />

month-end preparation.<br />

$40,000 – Accounts Receivable<br />

An Accounts Receivable Clerk with<br />

3 years experience is looking <strong>for</strong> a<br />

position with a stable company that will<br />

provide growth in the future. They are<br />

familiar with all aspects <strong>of</strong> accounts<br />

receivable.<br />

October ’09 ica.bc.ca 7

On the Cover<br />

How is <strong>BC</strong> Faring in a Troubled<br />

Economy?<br />

By Kerri Brkich, Manager <strong>of</strong> Public Affairs<br />

(The following article is based on a report from Chisholm Consulting.)<br />

The year 2008 was tumultuous <strong>for</strong> the<br />

economies <strong>of</strong> <strong>BC</strong>, Canada, and the<br />

world. Many jurisdictions, such as<br />

Ontario and the US, were already in the throes<br />

<strong>of</strong> an extended recession when news broke last<br />

fall that the US government was propping up<br />

Bear Stearns. Suddenly, the extent <strong>of</strong> bad debt<br />

on the books <strong>of</strong> major banks and investment<br />

houses became a topic <strong>of</strong> growing concern.<br />

In short order, US mortgage lenders Fannie<br />

Mae and Freddie Mac had to be bailed out, and<br />

Lehman Brothers—a company that had survived<br />

the Great Depression <strong>of</strong> 1929—went bankrupt.<br />

In the end, the US saw 25 banks and credit<br />

unions fail in 2008, compared to only three<br />

failures in 2007, and none in either 2006 or 2005.<br />

The financial carnage that ensued affected the<br />

credit and lending systems <strong>of</strong> every western,<br />

industrialized nation. Lending all but stopped,<br />

and credit streams dried up <strong>for</strong> many businesses<br />

and consumers.<br />

While much has been written about the<br />

impact <strong>of</strong> these events on Canada, our interest<br />

in producing this year’s <strong>BC</strong> Check-Up is more<br />

specific: What have these events meant <strong>for</strong> <strong>BC</strong>?<br />

Full <strong>BC</strong> Check-Up available at www.bccheckup.com.<br />

What the <strong>BC</strong> Check-Up reveals<br />

Since the <strong>Institute</strong> <strong>of</strong> <strong>Chartered</strong> <strong>Accountants</strong> <strong>of</strong><br />

<strong>BC</strong> began producing the <strong>BC</strong> Check-Up report in<br />

1999, we’ve seen the <strong>economy</strong> go through peaks<br />

and valleys. However, we’ve never seen anything<br />

like the results <strong>of</strong> this year’s edition.<br />

The story <strong>of</strong> 2008 has two very distinct phases:<br />

pre and post-financial crisis. For the most part,<br />

the province held its own <strong>for</strong> the first half <strong>of</strong><br />

2008. Forestry communities stumbled early on,<br />

as a result <strong>of</strong> non-existent US housing starts, but<br />

the rest <strong>of</strong> the province continued to tick along,<br />

buoyed by strong retail sales and robust construction<br />

and real estate sectors.<br />

However, as the financial meltdown worsened<br />

in the latter half <strong>of</strong> 2008, <strong>BC</strong>’s economic situation<br />

began to deteriorate rapidly. After years <strong>of</strong><br />

8 ica.bc.ca October ’09

P L A T I N U M M E M B E R<br />

record-low unemployment in <strong>BC</strong>, the third and In addition, we are seeing government debt<br />

fourth quarters <strong>of</strong> 2008 saw the number <strong>of</strong> job balloon to levels not seen since the beginning <strong>of</strong><br />

seekers rise steadily. Consumer confidence the decade. In its September Budget Update, the<br />

plunged, retail sales slumped, and the real estate provincial government announced three years <strong>of</strong><br />

market stagnated—particularly in tourist destinations<br />

like the Okanagan and Kootenays. expect to balance the books until at least 2013.<br />

substantial budget deficits and said it does not<br />

In addition, international demand <strong>for</strong> <strong>BC</strong>’s That said, other jurisdictions are also planning<br />

export commodities dried up, and workers in to use deficit financing to deliver vital public<br />

the mining and oil and gas industries joined their services and pay <strong>for</strong> fiscal stimulus packages in<br />

<strong>for</strong>estry counterparts in experiencing reduced the next few years. <strong>BC</strong> has an advantage here<br />

shifts and job losses.<br />

over many <strong>of</strong> its competitors: our low rate <strong>of</strong><br />

Many companies that had been scraping by, debt going into the crisis, which will help<br />

especially those in the coastal <strong>for</strong>est industry, cushion the blow to the <strong>BC</strong> government’s bottom<br />

lost access to vital lines <strong>of</strong> credit, and in the latter line.<br />

half <strong>of</strong> 2008, business and consumer bankruptcies The provincial government also recently<br />

began to spike in communities around <strong>BC</strong>. announced that <strong>BC</strong> will move to an HST as <strong>of</strong><br />

As detailed in the <strong>BC</strong> Check-Up, the yearly results<br />

<strong>for</strong> <strong>BC</strong>’s live, work, and invest indicators in should provide some welcome relief to a<br />

July 1, 2010. In the short-term, this change<br />

2008 were cushioned by strong first and second beleaguered <strong>economy</strong> and help preserve existing<br />

quarters. The proportion <strong>of</strong> high-technology jobs; in the long-term it should have a positive<br />

jobs in the work<strong>for</strong>ce continued to increase; <strong>BC</strong> impact on both productivity and investment. Of<br />

enjoyed a comparatively low rate <strong>of</strong> government course, the devil, as they say, is in the details,<br />

debt; and real wages and job creation increased and how the provincial government chooses to<br />

at rates above the national average. However, implement this important tax change will<br />

our investment climate lagged behind last year, determine how much <strong>BC</strong> stands to gain from<br />

with declines in productivity, corporate pr<strong>of</strong>its, the benefits inherent in a value-added consumption<br />

tax.<br />

and exports per worker, all <strong>of</strong> which have<br />

declined further in the first half <strong>of</strong> 2009.<br />

While the first half <strong>of</strong> 2009 has been grim,<br />

In 2009, there is no question that <strong>BC</strong> is there are indications that the second half may be<br />

currently battling one <strong>of</strong> the worst recessions in better—or at least, no worse. For example, the<br />

a generation. The employment picture has pace <strong>of</strong> Canadian housing starts picked up in<br />

steadily worsened, and the <strong>economy</strong> has slowed, August, with <strong>BC</strong>’s urban housing starts recording<br />

with most major industrial sectors struggling in a 56% gain over July; and it is expected that this<br />

the face <strong>of</strong> the global recession. Moreover, the positive momentum will be maintained into the<br />

housing market remains fragile in many regions, third quarter. Another example is the optimism<br />

and many <strong>BC</strong> consumers put a hold on major expressed about the <strong>economy</strong> by senior-level<br />

purchases and investments in the first half <strong>of</strong> the CAs in response to a recent survey: The measure<br />

09.OBRTurnbullAd1 9/21/09 9:45 AM Page 1<br />

year.<br />

was up to 28%—a huge increase from the low <strong>of</strong><br />

4% recorded in the first quarter <strong>of</strong> the year, and<br />

the even lower 2% recorded in the fourth quarter<br />

<strong>of</strong> 2008. 1<br />

Many economists are predicting that <strong>BC</strong>’s<br />

<strong>economy</strong> will improve in late 2009 and in 2010,<br />

due to spending on public infrastructure, the<br />

stimulus from the 2010 Winter Olympics, and<br />

recovering consumer confidence. However, in<br />

order <strong>for</strong> <strong>BC</strong>’s <strong>economy</strong> to experience significant<br />

recovery and growth, global markets and commodities<br />

prices will have to rebound. Until this<br />

happens, recovery will be slow at best.<br />

In the meantime, here’s a closer look at the data.<br />

1<br />

CICA/R<strong>BC</strong> Business Monitor (Q2 2009).<br />

Protect it. Grow it.<br />

In That Order<br />

Ross Turnbull, CA, CBV, CFA<br />

Director, Portfolio Manager<br />

Average Monthly Per<strong>for</strong>mance<br />

(Dec/94-Sept/09)<br />

3.6%<br />

4.1%<br />

Per<strong>for</strong>mance Since Inception<br />

(Dec/94-Sept/09)<br />

777%<br />

Tel 604 844 5363<br />

Toll Free 1 888 886 3586<br />

rturnbull@odlumbrown.com<br />

up months<br />

(59% <strong>of</strong> time)<br />

down months<br />

(41% <strong>of</strong> time)<br />

276%<br />

odlumbrown.com<br />

trust • vision • investment integrity<br />

*The Model is an all-equity portfolio established by the Research Department in December 1994, with a<br />

hypothetical investment <strong>of</strong> $250,000. The Model provides a basis with which to measure the quality <strong>of</strong><br />

our advice and the effectiveness <strong>of</strong> our disciplined investment strategy. Trades are made using the<br />

closing price on the day a change is announced. These are gross figures be<strong>for</strong>e fees. Past per<strong>for</strong>mance is<br />

not indicative <strong>of</strong> future per<strong>for</strong>mance. MEMBER CIPF<br />

-1.9%<br />

-3.8%<br />

ob model portfolio*<br />

s&p/tsx total return index<br />

Portfolio measurements and comparisons are done at mid-month and not month end.<br />

ob model<br />

portfolio*<br />

s&p/tsx total<br />

return index<br />

October ’09 ica.bc.ca 9

live<br />

<strong>BC</strong> saw some improvement as a place to LIVE in 2008. For the tenth year in a row, <strong>BC</strong> led the comparison jurisdictions<br />

in both reducing the number <strong>of</strong> youth at risk (-1 ppt) and absolute levels (8%).<br />

In addition, the province’s personal disposable income growth rate (2.9%) ranked second in our comparison and was<br />

ahead <strong>of</strong> the national average (2.4%) last year. In 2008, <strong>BC</strong>’s debt-to personal disposable income ratio was down slightly<br />

(-0.8%), and shelter costs were up only 0.4 ppt, due to shelter and other expenses rising at roughly the same rate.<br />

Increased wages and lower debt will positively impact British Columbians’ standard <strong>of</strong> living. However, <strong>BC</strong>’s health care<br />

spending ranked last among our comparison jurisdictions, although, its health care delivery system was rated as second<br />

best among all Canadian provinces. The table below shows how <strong>BC</strong> compared with Alberta, Ontario, and the national<br />

average on our five key indicators over one and five-year periods.<br />

Summary <strong>of</strong> LIVE Key Indicators * <strong>BC</strong> AB ON CAN<br />

Real Personal Disposable Income per Capita $28,616 $37,189 $28,847 $28,591<br />

Debt to Personal Disposable Income 1.28 0.84 0.97 0.92<br />

Shelter Costs as % <strong>of</strong> Total Household Expenditures 20.7% 17.4% 21.3% 19.5%<br />

Youth at Risk 8.0% 12.5% 9.8% 10.9%<br />

2008 Value<br />

health<br />

Health Expenditures per Capita $2,894 $3,149 $2,964 $3,016<br />

Health Consumer Index National Ranking in 2008** 2 nd 5 th 1 st n/a<br />

Real Personal Disposable Income per Capita 2.9% 3.5% 1.7% 2.4%<br />

Debt to Personal Disposable Income -0.8% -1.2% -4.0% -2.1%<br />

Shelter Costs as % <strong>of</strong> Total Household Expenditures 0.4 ppt*** 0.2 ppt 0.6 ppt 0.3 ppt<br />

Youth at Risk -1.0 ppt 0.1 ppt 0.0 ppt -0.3 ppt<br />

health<br />

Health Expenditures per Capita 1.1% -3.3% 4.8% 2.5%<br />

Health Consumer Index National Ranking in 2008 n/a n/a n/a n/a<br />

2007-08 % Change<br />

Real Personal Disposable Income per Capita 17.3% 24.0% 8.9% 13.1%<br />

Debt to Personal Disposable Income 17.4% 15.1% 7.8% 10.8%<br />

Shelter Costs as % <strong>of</strong> Total Household Expenditures 0.1 ppt -1.0 ppt 0.9 ppt 0.5 ppt<br />

Youth at Risk -1.4 ppt -1.2 ppt -3.1 ppt -1.6ppt<br />

health<br />

Health Expenditures per Capita -3.2% 6.9% 29.3% 15.6%<br />

Health Consumer Index National Ranking in 2008 n/a n/a n/a n/a<br />

2003-08 % Change<br />

* Improvements in quality <strong>of</strong> life are indicated by increases in real disposable income per capita and per capita health care expenditures,<br />

and decreases in debt/personal disposable income, cost <strong>of</strong> living, and youth at risk.<br />

** This is how <strong>BC</strong> ranked among all Canadian provinces.<br />

*** ppt = percentage point.<br />

10 ica.bc.ca October ’09

live<br />

Combined, our five “live” indicators provide a measure <strong>of</strong> British Columbia’s social well-being and standard <strong>of</strong> living. Understandably, each indicator is interconnected:<br />

Access to education and quality health care leads to a more stable and productive work<strong>for</strong>ce; this, in turn, drives up personal disposable<br />

incomes. And higher disposable incomes are key to managing mortgage debt, especially in <strong>BC</strong>, which has one <strong>of</strong> the most expensive real estate markets in<br />

Canada.<br />

So how did <strong>BC</strong>’s live indicators fare in 2008?<br />

Youth education and employment<br />

<strong>BC</strong> continues to lead the country in high school completion rates. In 2008, 8% <strong>of</strong> <strong>BC</strong> youth did not graduate from high school, compared to 9.8% in<br />

Ontario, 12.5% in Alberta, and a national average <strong>of</strong> 10.9%. In fact, since 2002, <strong>BC</strong> has had the lowest percentage <strong>of</strong> “youth at risk” in our comparison.<br />

Youth at risk are defined as the percentage <strong>of</strong> the labour <strong>for</strong>ce, aged 19 to 24, who have not completed high school.<br />

Youth unemployment in <strong>BC</strong> was at its lowest (6.9%) in March 2008, when jobs in construction, manufacturing, and trade were plentiful. By March 2009,<br />

however, youth unemployment had reached 13.5%, the highest it had been in nearly five years. 2,3 However, despite the challenges it presents <strong>for</strong> young jobseekers,<br />

the current global recession may provide an increased incentive <strong>for</strong> <strong>BC</strong> youth to remain in school, creating a better chance <strong>for</strong> a prosperous future.<br />

Provincial health care expenditures<br />

In addition to being a leader among the comparison jurisdictions in terms <strong>of</strong> high school completion, <strong>BC</strong> also scored well when looking at the “bang <strong>for</strong> buck”<br />

<strong>of</strong> provincial health care expenditures. In 2008, <strong>BC</strong>’s real health care expenditures per capita rose by 1.1%, to $2,894—the lowest amount <strong>of</strong> health care<br />

spending in our comparison by $70 per capita. However, a comparison <strong>of</strong> the Health Consumer Index rankings—an indicator we’re introducing in this<br />

edition <strong>of</strong> the Check-Up—shows that <strong>BC</strong> placed highly among all Canadian provinces in terms <strong>of</strong> health care delivery last year—second only to Ontario.<br />

The Health Consumer Index evaluates provincial health care delivery based on five criteria: outcomes, waiting times <strong>for</strong> treatment, primary care, patient<br />

rights, and “generosity.” 4 The idea <strong>of</strong> a consumer-based assessment <strong>of</strong> health care is new to Canada, but <strong>of</strong>fers a fresh and rigorous way <strong>of</strong> measuring success,<br />

both within Canada and internationally. Combining this new indicator with our traditional one (real provincial health care expenditures per capita) provides<br />

a balanced approach to evaluating our province’s standing in terms <strong>of</strong> health care.<br />

Although <strong>BC</strong> has one <strong>of</strong> the lowest expenditures per capita <strong>of</strong> all the comparison jurisdictions, it obtained a high Index value in 2008—in fact, the second<br />

highest <strong>of</strong> all the provinces. Consequently, <strong>BC</strong> had one <strong>of</strong> the highest “bang <strong>for</strong> buck” ratios <strong>of</strong> all the provinces last year.<br />

Personal disposable income<br />

Just as health and education are important indicators <strong>of</strong> <strong>BC</strong>’s social well-being, personal disposable income, or “take home pay adjusted <strong>for</strong> inflation,” 5 is an<br />

important indicator <strong>of</strong> economic well-being.<br />

In 2008, <strong>BC</strong>’s real personal disposable income rose by 2.9%; this was the second highest increase after Alberta (3.5%), ranking ahead <strong>of</strong> Ontario and the<br />

national average (1.7% and 2.4% respectively). Between 2003 and 2008, <strong>BC</strong>’s real personal disposable income grew by 17.3%; once again, this was second<br />

to Alberta (24%) and ahead <strong>of</strong> Ontario and the national average (8.9% and 13.1% respectively).<br />

These gains were crucial to raising <strong>BC</strong>’s standard <strong>of</strong> living, as <strong>BC</strong>’s absolute disposable income levels have consistently lagged those <strong>of</strong> the comparison<br />

jurisdictions and the national average. In fact, 2008 marked the first time in the last five years that the disposable incomes <strong>of</strong> British Columbians (averaging<br />

$28,616) surpassed the national average ($28,591).<br />

While <strong>BC</strong> has seen this indicator improve over one-year and five-year periods, wages and salaries in some cornerstone industries began to drop in 2009.<br />

When comparing the first quarter <strong>of</strong> 2009 to the same period in 2008, wages and salaries in goods-producing industries decreased by 7.7%, with the biggest<br />

decreases occurring in agriculture, <strong>for</strong>estry, fishing and hunting (-19%) and manufacturing (-12.8%). Services-producing industries saw wages and salaries<br />

rise by 2.3%, but this slight increase was mainly due to increases in public sector administration jobs, not in private sector jobs.<br />

Improving wages is crucial to mitigating British Columbians’ financial vulnerability. Over the past decade, <strong>BC</strong> has sustained the highest personal disposable<br />

debt-to-income ratio in our comparison. In 2008, <strong>BC</strong>’s ratio was 1.28, compared to 0.84 in Alberta, 0.97 in Ontario, and a national average <strong>of</strong> 0.92.<br />

While our province’s personal debt-to-disposable income ratio declined by 0.8% in 2008, this was the weakest one-year result in our comparison: Alberta’s<br />

ratio declined by 1.2%, the national average declined by 2.1%, and Ontario’s ratio declined by 4%.<br />

2<br />

<strong>BC</strong> Stats, Labour Force Survey, March 2009.<br />

3<br />

In the <strong>BC</strong> Check Up report, we compare both one and five-year trends. Where possible, we also identify important longer-term trends that will shape<br />

our future.<br />

4<br />

“Generosity” refers to the range <strong>of</strong> services provided in each province. The methodology was developed and used by the Health Consumer Powerhouse,<br />

Europe’s leading independent provider <strong>of</strong> consumer in<strong>for</strong>mation. The work <strong>of</strong> the Health Consumer Powerhouse has initiated improvement in healthcare<br />

systems in Europe.<br />

5<br />

Take-home pay is the income left over after deductions <strong>for</strong> taxes, social insurance, and other fees. Statistics Canada, May 2007.<br />

October ’09 ica.bc.ca 11

Housing and shelter<br />

In 2008, mortgage debt in <strong>BC</strong> represented<br />

roughly 70% <strong>of</strong> total consumer debt—hardly<br />

surprising given that average real housing prices<br />

in <strong>BC</strong> were at least $100,000 greater than prices<br />

in Alberta and Ontario. But while our province<br />

continues to lag in this indicator, <strong>BC</strong> consumers<br />

appear to be holding their own. Despite expensive<br />

real estate prices, British Columbia has<br />

some <strong>of</strong> the lowest mortgage arrears rates and<br />

personal bankruptcy rates in the country. 6<br />

This is more important than ever, especially<br />

when looking at the shelter share <strong>of</strong> total household<br />

expenditures 7 (shelter share), which reflects<br />

the cost <strong>of</strong> living. In 2007, shelter accounted <strong>for</strong><br />

20.7%, or one fifth, <strong>of</strong> total household expenditures<br />

in <strong>BC</strong>. Only Ontario exceeded this<br />

percentage, with 21.3%.<br />

In 2007, <strong>BC</strong>’s housing prices rose and vacancy<br />

rates declined, causing the shelter share indicator<br />

to increase by 0.4 percentage points (ppt), the<br />

first significant gain in several years. Only<br />

Ontario saw its shelter share grow more quickly,<br />

increasing by 0.6 ppt. For British Columbians<br />

whose incomes did not rise at the same rate as<br />

the cost <strong>of</strong> shelter, this increase in shelter share<br />

represented a decline in standard <strong>of</strong> living, as<br />

more income was diverted to housing.<br />

dap_beyondnumbers_sep09.eps 9/9/2009 1:56:57 PM<br />

Shelter Cost as a Percentage <strong>of</strong> Total Household<br />

Expenditure, Provinces and Canada, 2003 to 2007<br />

22<br />

21<br />

20<br />

19<br />

18<br />

17<br />

2003 2004 2005 2006 2007<br />

<strong>BC</strong> 20.6% 20.2% 20.4% 20.3% 20.7%<br />

AB 18.4% 18.6% 17.4% 17.2% 17.4%<br />

ON 20.4% 20.6% 19.9% 20.7% 21.3%<br />

CDN Average 19.0% 19.2% 18.9% 19.2% 19.5%<br />

Source: Statistics Canada<br />

Between 2003 and 2007, <strong>BC</strong> saw only a slight<br />

increase in this indicator (0.1 ppt), as shelter and<br />

other nominal household expenditures rose at<br />

similar, and rapid, rates.<br />

Overall<br />

Our live indicators will face challenges in 2009.<br />

While health care and education should remain<br />

constant or improve, wages will likely decrease,<br />

negatively affecting the debt to disposable income<br />

ratio and shelter share <strong>of</strong> household<br />

expenditures.<br />

6<br />

CI<strong>BC</strong>, Household Credit Analysis, March<br />

2009.<br />

7<br />

Household expenditure includes total current<br />

consumption, personal taxes, personal<br />

insurance payments and pension<br />

contributions, and gifts <strong>of</strong> money and<br />

contributions. Shelter costs include<br />

expenditures on principal accommodation<br />

(either owned or rented) and on other<br />

accommodation, such as vacation homes or<br />

accommodation while travelling. Expenditure<br />

on owned principal accommodation includes<br />

regular mortgage payments, if any.<br />

12 ica.bc.ca October ’09

work<br />

<strong>BC</strong> saw improvement in three <strong>of</strong> the five WORK indicators in 2008, and tied <strong>for</strong> first among the comparison<br />

jurisdictions <strong>for</strong> growth in educational attainment (1 ppt), and ranked second in real wage growth (1.3%) and job<br />

creation (2.1%).<br />

Pay equality declined by 1.2% last year, and the unemployment rate increased by 0.4 ppt. It could be argued—from<br />

the perspective <strong>of</strong> employers—that the increase in the unemployment rate was desirable, as the previous record-low<br />

unemployment levels caused shortages <strong>of</strong> workers in some industries over the last two to three years. However, the<br />

unemployment rate has surged in 2009, indicating <strong>BC</strong>’s <strong>economy</strong> is feeling the brunt <strong>of</strong> the recession.<br />

The table below shows how <strong>BC</strong> compared with Alberta, Ontario, and the national average on our five key indicators<br />

over one and five-year periods.<br />

Summary <strong>of</strong> WORK Key Indicators* <strong>BC</strong> AB ON CAN<br />

Educational Attainment 62.7% 62.3% 67.5% 65.6%<br />

Unemployment Rate 4.6% 3.6% 6.5% 6.1%<br />

Real Wage Rate $23.43 $26.32 $23.94 $23.52<br />

Female/Male Wage Ratio 0.827 0.790 0.837 0.838<br />

2008 Value<br />

Job Creation 48,000 53,900 93,500 259,400<br />

Educational Attainment 1.0 ppt** 0.8 ppt 1.0 ppt 0.7 ppt<br />

Unemployment Rate 0.4 ppt 0.1 ppt 0.1 ppt 0.1 ppt<br />

Real Wage Rate 1.3% 3.1% 0.3% 0.8%<br />

Female/Male Wage Ratio -1.2% 0.3% 0.1% -0.2%<br />

Job Creation 2.1% 2.8% 1.4% 1.5%<br />

2007-08 % Change<br />

Educational Attainment 3.8 ppt 3.4 ppt 5.6 ppt 4.6 ppt<br />

Unemployment Rate -3.4 ppt -1.5 ppt -0.4 ppt -1.5 ppt<br />

Real Wage Rate 5.2% 8.6% 4.1% 5.6%<br />

Female/Male Wage Ratio -1.5% 1.8% 2.4% 1.8%<br />

Job Creation 14.9% 17.3% 7.6% 9.3%<br />

2003-08 % Change<br />

* A positive increase in the value <strong>of</strong> these indicators (except <strong>for</strong> unemployment levels where a decrease indicates improvement)<br />

means an improvement in the quality <strong>of</strong> the province’s work environment.<br />

** ppt = percentage point.<br />

October ’09 ica.bc.ca 13

work<br />

Overall, <strong>BC</strong>’s job creation level and real wages increased at rates above the national average in 2008, and educational attainment levels increased at the fastest<br />

pace in years. Un<strong>for</strong>tunately, while many <strong>of</strong> <strong>BC</strong>’s work indicators improved last year, unemployment increased and pay equality deteriorated. The global<br />

economic slowdown began to affect work indicators late in 2008, and many work indicators have not been faring well in 2009.<br />

Our work indicators give an overview <strong>of</strong> <strong>BC</strong>’s domestic <strong>economy</strong>: Job gains and losses directly affect the unemployment rate, pay equity, and real wages;<br />

and the level <strong>of</strong> educational attainment in the work<strong>for</strong>ce can dictate how quickly an <strong>economy</strong> rebounds from a downturn, as a highly educated work<strong>for</strong>ce will<br />

<strong>of</strong>ten translate into higher productivity levels.<br />

Job creation and loss<br />

The most important indicator <strong>for</strong> an <strong>economy</strong>’s overall health is job creation or loss, which measures the absolute change in the number <strong>of</strong> employed workers,<br />

and shows where new opportunities or losses have occurred in the various sectors <strong>of</strong> the <strong>economy</strong>.<br />

<strong>BC</strong>’s <strong>economy</strong> created 48,000 new jobs in 2008, an increase <strong>of</strong> 2.1%, which was well above the national job growth rate <strong>of</strong> 1.5%, and Ontario’s increase<br />

<strong>of</strong> 1.4%. However, this was down from the 60,000 - 70,000 new jobs created over the last three years. By comparison, Alberta’s job creation was up by 2.8%<br />

in 2008, following its huge 80,000+ job creation pace in 2006 and 2007. Between 2003 and 2008, almost 300,000 jobs have been created in <strong>BC</strong>, signifying<br />

a total employment growth rate <strong>of</strong> 14.9%. Over this same period, Alberta created an almost identical number <strong>of</strong> jobs—296,600—which represented employment<br />

growth <strong>of</strong> 17.3%. Interestingly, <strong>BC</strong> and Alberta generated over 40% <strong>of</strong> the new jobs in Canada between 2003 and 2008, despite representing only 25%<br />

<strong>of</strong> the total Canadian population.<br />

While <strong>BC</strong> enjoyed one <strong>of</strong> the fastest growing economies in Canada in the past few years, the downturn has hit hard. Compared with 2008, the first seven<br />

months <strong>of</strong> 2009 have signalled job losses in both the goods and services-producing sectors, as the number <strong>of</strong> jobs in <strong>BC</strong>’s <strong>economy</strong> dropped by 2.6%.<br />

Overall, the goods-producing sector saw jobs drop by 10.5%, as economic staples such as agriculture (-6.2%); <strong>for</strong>estry, fishing, mining, oil and gas (-9.2%);<br />

utilities (-11.6%), construction (-9.9%); and manufacturing (-11.6%) all took significant hits. Services-producing sectors faired better, but were still down<br />

by 0.4%. While some sectors such as health care and social assistance (7.5%); trade (1.4%); and in<strong>for</strong>mation, culture, and recreation (0.9%) saw job growth,<br />

all other services-producing sectors saw declines. Those with the worst number <strong>of</strong> losses included transportation and warehousing (-10%); business, building<br />

and other support services (-4.3%); and finance, insurance, real estate and leasing (-3.7%).<br />

Unemployment<br />

It should come as no surprise that the unemployment rate, which measures the number <strong>of</strong> unemployed persons as a percentage <strong>of</strong> the population, aged 15<br />

and older, who are employed or actively looking <strong>for</strong> work, has been rising steadily over the past ten months. <strong>BC</strong>’s record-low unemployment rate <strong>of</strong> 4.2% in<br />

2007 rose to 4.6% in 2008—still far below the unemployment rates in Ontario and Canada (6.5 % and 6.1% respectively). 8<br />

Between 2003 and 2008, <strong>BC</strong>’s unemployment rate dropped by a whopping 3.4 percentage points (ppt). This was more than double the Canadian average<br />

(-1.5 ppt) and more than eight times the progress made in Ontario (-0.4 ppt). 9 However, unemployment has risen continuously in 2009, reflecting the growing<br />

challenges <strong>of</strong> the <strong>BC</strong> <strong>economy</strong>. By August 2009, <strong>BC</strong>’s unemployment rate was 8%, which is back up to levels seen at the beginning <strong>of</strong> the decade. It was<br />

highest in the resource-dependent Cariboo (13.3%), and lowest in the more economically diverse Vancouver Island/Coast (6.6%).<br />

Wages<br />

A slowing job market and higher unemployment levels may put downward pressure on wages in many industries. As our province has continually lagged<br />

behind our comparison jurisdictions in real wages <strong>for</strong> the last five years, closing the wage gap will continue to be a significant problem. In 2008, real wages<br />

in <strong>BC</strong> were $23.43 per hour, which was the lowest in our comparison. That said, <strong>BC</strong>’s one-year wage growth <strong>of</strong> 1.3% in 2008 was higher than average and<br />

narrowed the wage gap with Ontario.<br />

Alberta pulled ahead <strong>of</strong> <strong>BC</strong> in 2008, with a real wage gain <strong>of</strong> 3.1%, as lower costs <strong>for</strong> shelter and gasoline helped tame the high levels <strong>of</strong> inflation that had<br />

nullified Alberta’s wage gains in 2007. 10,11<br />

Between 2003 and 2008, Alberta saw an 8.6% increase in real wages, compared to <strong>BC</strong>’s growth rate <strong>of</strong> 5.2%, and Ontario’s increase <strong>of</strong> 4.1%. <strong>BC</strong>’s gains<br />

lagged behind the national average (5.6%) during this same period.<br />

<strong>BC</strong>’s mining and oil and gas industries continued to have the highest wages, which increased by 9% in 2008 to an average <strong>of</strong> $44.73/hour. 12 Other top<br />

earners were workers in utilities ($40.51/hr); in<strong>for</strong>mation & cultural industries ($32.76/hr); pr<strong>of</strong>essional, scientific and technical services ($32.60/hr); and<br />

public administration ($32.30/hr). However, as there have been job losses in many <strong>of</strong> these sectors, it is likely that wage rates in these sectors may also drop<br />

over time and be reflected in next year’s results.<br />

As most <strong>of</strong> the wage gains and higher wage positions were in male-dominated fields, it is not surprising that <strong>BC</strong>’s female-to-male wage ratio declined by<br />

1.2% in 2008, down to 0.827. By comparison, the national average declined by 0.2%, while Alberta and Ontario both realized small gains (0.3% and 0.1%<br />

respectively).<br />

8<br />

Statistics Canada, Labour Force Survey, 2008.<br />

9<br />

Ibid.<br />

10<br />

Statistics Canada, Survey <strong>of</strong> Employment, Payrolls, and Hours and Consumer Price Index, 2008.<br />

11<br />

Alberta Finance & Enterprise, Economics and Statistics – Alberta Inflation, June 13, 2008.<br />

12<br />

Statistics Canada, Survey <strong>of</strong> Employment, Payrolls, and Hours and Consumer Price Index, 2008.<br />

14 ica.bc.ca October ’09

<strong>BC</strong> was the only jurisdiction to see a decline in<br />

wage parity between 2003 and 2008, with its ratio<br />

declining by 1.5%. During this same period,<br />

Ontario’s wage parity ratio rose by 2.4%, and<br />

Alberta and Canada both saw an increase <strong>of</strong><br />

1.8%.<br />

From the late 1990s to about 2004, our<br />

comparison jurisdictions experienced improvements<br />

in wage parity, most likely due to the<br />

increased number <strong>of</strong> women who obtained a<br />

post-secondary education throughout the<br />

1990s. 13 In <strong>BC</strong>, wage parity slowed because the<br />

proportion <strong>of</strong> women in management declined<br />

from 38% in 1998 to 34.1% in 2008. 14 There<br />

was also a corresponding reduction in the share<br />

<strong>of</strong> high-wage jobs held by women. Another<br />

factor to consider is that although women’s<br />

nominal wages in <strong>BC</strong> rose by 11.9% between<br />

2003 and 2008, men’s rose by 13.6% during the<br />

same period.<br />

While <strong>BC</strong>’s wage parity lost ground in 2008,<br />

the preliminary results from 2009 show a slight<br />

rebound, no doubt due to massive job losses in<br />

male-dominated resource industries. When<br />

comparing the first quarter <strong>of</strong> 2009 with that<br />

<strong>of</strong> 2008, pay equity was 0.5% higher; when<br />

looking at the second quarter results <strong>for</strong> both<br />

periods, the 2009 rate was 2.1% higher.<br />

Real Average Hourly Wages (2008$), Provinces<br />

and Canada, 2003 to 2008<br />

27<br />

26<br />

25<br />

24<br />

23<br />

22<br />

2003 2004 2005 2006 2007 2008<br />

<strong>BC</strong> $22.28 $22.40 $22.52 $22.80 $23.12 $23.43<br />

AB $24.24 $24.75 $25.19 $25.45 $25.54 $26.32<br />

ON $22.99 $23.25 $23.40 $23.51 $23.87 $23.94<br />

CDN Average $22.28 $22.57 $22.74 $22.92 $23.33 $23.52<br />

Source: Statistics Canada, Survey <strong>of</strong> Employment, Payrolls and Hours and<br />

Consumer Price Index<br />

Educational attainment<br />

Just as the number <strong>of</strong> jobs, the unemployment rate, and wage levels are key indicators <strong>of</strong> the health <strong>of</strong> our domestic <strong>economy</strong>, the level <strong>of</strong> educational attainment<br />

is a predictor <strong>of</strong> labour productivity and competitiveness.<br />

Educational attainment measures the percentage <strong>of</strong> the labour <strong>for</strong>ce, aged 25 to 54, that has received some level <strong>of</strong> post-secondary education. 15 In 2008, the<br />

educational attainment <strong>of</strong> <strong>BC</strong>’s labour <strong>for</strong>ce rose by 1 ppt, reaching 62.7%. 16 While this is the highest level <strong>of</strong> education <strong>BC</strong>’s labour <strong>for</strong>ce has ever achieved,<br />

it was still lower than Ontario’s level and the national average (67.5% and 65.6% respectively).<br />

Notwithstanding their current rankings among the comparison jurisdictions, <strong>BC</strong> and Alberta are seeing faster growth in educational attainment, and they<br />

are likely to catch up to Eastern Canada in the coming years. This is not only due to improved graduation rates and greater post-secondary participation, but<br />

also due to an influx <strong>of</strong> highly skilled workers. Between 2007 and 2008, the number <strong>of</strong> workers with education above a bachelor’s degree rose by 15.8% in<br />

<strong>BC</strong> and 11.1% in Alberta—well above growth rates in Ontario and Canada (7.9% and 7% respectively).<br />

Considering <strong>BC</strong>’s dismal results in labour productivity, gains in educational attainment are likely key to improving our overall productivity and economic<br />

per<strong>for</strong>mance.<br />

Overall<br />

While <strong>BC</strong>’s work environment fared relatively well in 2008, it has already faced a myriad <strong>of</strong> challenges in 2009. In addition, a weak investment climate may<br />

hinder the pace <strong>of</strong> our eventual economic recovery.<br />

13<br />

Marc Frenette and Simon Coulombe, Has Higher Education Among young Women Substantially Reduced the Gender Gap in Employment and Earnings?<br />

Statistics Canada, Analytical Studies Branch Research Paper Series, June 2007.<br />

14<br />

Statistics Canada, Labour Force Survey, 2008.<br />

15<br />

Includes post-secondary certificate, diploma, or higher, which includes diploma programs at colleges, as well as trades and technical certification programs.<br />

16<br />

Statistics Canada, Labour Force Survey, 2008.<br />

October ’09 ica.bc.ca 15

invest<br />

<strong>BC</strong>’s investment climate continued to see lacklustre results in 2008, ranking lowest or second-lowest in three out <strong>of</strong><br />

five indicators. This is not a surprise, given that <strong>BC</strong>’s real GDP declined 0.3%, and was below the national average<br />

growth rate <strong>of</strong> 0.5%.<br />

In 2008, the value <strong>of</strong> <strong>BC</strong>’s exports declined by 9.1%, due primarily to the slump in US demand <strong>for</strong> solid wood products,<br />

and lower mineral and gas prices. <strong>BC</strong>’s labour productivity declined by 1.7% and corporate pr<strong>of</strong>its declined by 0.3 ppt.<br />

On the bright side, <strong>BC</strong> tied <strong>for</strong> first in employment in the sciences, posting a 0.2 ppt increase. In addition, <strong>BC</strong>’s<br />

financial liabilities/GDP declined 2 ppt, the best result in our comparison.<br />

The table below shows how <strong>BC</strong> compared with Alberta, Ontario, and the national average on our five key indicators<br />

over one and five-year periods.<br />

Summary <strong>of</strong> INVEST Key Indicators <strong>BC</strong> AB ON CAN<br />

Productivity 38.0 47.5 41.7 40.9<br />

Employment in the Sciences 6.6% 7.6% 7.6% 7.1%<br />

Value <strong>of</strong> Exports per Worker $27,915 $51,881 $46,135 $26,548<br />

Net Provincial Financial Liabilities<br />

as a Percentage <strong>of</strong> GDP*<br />

6.9% -6.4% 21.4% 20.8%<br />

2008 Value<br />

After-Tax Corporate Pr<strong>of</strong>its-to-GDP Ratio 9.34% 18.79% 7.27% 10.80%<br />

Productivity -1.7% -1.4% -0.6% -0.5%<br />

Employment in the Sciences 0.2 ppt** -0.3 ppt 0.2 ppt 0.1 ppt<br />

Value <strong>of</strong> Exports per Worker -9.1% -4.2% -6.7% -6.3%<br />

Net Provincial Financial Liabilities<br />

as a Percentage <strong>of</strong> GDP<br />

-2.0 ppt -1.5 ppt -1.1 ppt -1.7 ppt<br />

After-Tax Corporate Pr<strong>of</strong>its-to-GDP Ratio -0.3 ppt 2.1 ppt -1.0 ppt 0.2 ppt<br />

2007-08 % Change<br />

Productivity -0.6% 2.5% 3.4% 3.3%<br />

Employment in the Sciences 0.3 ppt 0.7 ppt 0.4 ppt 0.5 ppt<br />

Value <strong>of</strong> Exports per Worker -4.3% -0.8% -4.5% -3.9%<br />

Net Provincial Financial Liabilities<br />

as a Percentage <strong>of</strong> GDP<br />

-7.1 ppt -7.3 ppt -2.7 ppt -6.6 ppt<br />

After-Tax Corporate Pr<strong>of</strong>its-to-GDP Ratio 2.3 ppt 2.2 ppt -2.1 ppt 1.1 ppt<br />

2003-08 % Change<br />

* Net provincial financial liabilities as a Percentage <strong>of</strong> GDP — 2007 value presented and % changes from 2003 to 2007 and 2006 to<br />

2007. An increase in all <strong>of</strong> the <strong>for</strong>egoing indicators except net financial liabilities is a desirable change in terms <strong>of</strong> investment conditions.<br />

Conversely, a decline in government net financial liabilities to GDP ratio is a desirable change.<br />

** ppt = percentage point.

invest<br />

A vibrant investment climate is the key to raising <strong>BC</strong>’s standard <strong>of</strong> living. High productivity and exports per worker positively affect corporate pr<strong>of</strong>its, encouraging<br />

investment and leading to higher wages <strong>for</strong> workers. Greater corporate pr<strong>of</strong>its and higher wages affect government revenue, and government<br />

surpluses present an opportunity to pay down debt. All <strong>of</strong> these factors help to create a competitive, vibrant <strong>economy</strong> that attracts educated workers; and,<br />

again, educated workers have a positive impact on productivity.<br />

Productivity<br />

Productivity is crucial to long-term economic growth. Real labour productivity measures the efficiency <strong>of</strong> the work<strong>for</strong>ce, or the amount <strong>of</strong> output per personhour<br />

worked. 17 In 2008, <strong>BC</strong>’s productivity declined by 1.7% and Alberta’s by 1.4%, while Ontario and Canada as a whole saw declines <strong>of</strong> 0.6% and 0.5%<br />

respectively.<br />

Between 2003 and 2008, <strong>BC</strong>’s productivity declined by 0.6%. Productivity was dampened by the service sector, which plays a large role in the <strong>economy</strong><br />

and is more labour-intensive than the goods sector. (Productivity growth in most <strong>of</strong> <strong>BC</strong>’s service industries has actually been weak since 1990.) Another<br />

factor is the low educational attainment <strong>of</strong> <strong>BC</strong>’s labour <strong>for</strong>ce. Without investment in “human capital,” labour simply cannot achieve its full potential.<br />

Since 2001, <strong>BC</strong> has made some tentative steps towards improving productivity, mainly through government investment in public infrastructure and tax<br />

changes. However, the economic downturn reveals the tenuousness <strong>of</strong> our foothold on prosperity, and underscores the amount <strong>of</strong> work that still needs to be<br />

done.<br />

After <strong>BC</strong> moves to an HST, businesses will save nearly $2 billion in production costs and $150 million in tax compliance costs. In the short-term, these<br />

savings should buoy the <strong>economy</strong>. In the long-term, these savings will lead to greater capital investment and will improve the productivity gap, as businesses<br />

invest in new machinery, new technology, and improved training <strong>for</strong> workers.<br />

To boost <strong>BC</strong>’s productivity growth, we need ongoing investment in private and public infrastructure, in technological innovation and dissemination, and<br />

in the education and training <strong>of</strong> <strong>BC</strong>’s labour <strong>for</strong>ce.<br />

Pr<strong>of</strong>its<br />

Low productivity directly affects corporate pr<strong>of</strong>its, and corporate pr<strong>of</strong>itability is a strong indicator <strong>of</strong> a province’s current and future investment climate. 18<br />

In 2008, <strong>BC</strong>’s ratio <strong>of</strong> after-tax corporate pr<strong>of</strong>its declined by 0.3 percentage points (ppt) to 9.34%. Ontario declined even further, with a 1 ppt drop to<br />

7.27%. The national average increased by a meagre 0.2 ppt to 10.80%, and Alberta saw this indicator rise by 2.1 ppt to 18.79%, due to oil and gas revenues.<br />

In 2008, Canadian corporations saw pr<strong>of</strong>its begin to decline as the world financial system and markets stalled. Canadian pre-tax operating pr<strong>of</strong>its declined<br />

from $68.3 billion in the first quarter <strong>of</strong> 2008, to $62.4 billion in the fourth quarter <strong>of</strong> the same year. Between the first quarter <strong>of</strong> 2008 and the first quarter<br />

<strong>of</strong> 2009, Canadian industry pre-tax operating pr<strong>of</strong>its declined by 19.3%, or $13.2 billion. However, some <strong>of</strong> the gross pr<strong>of</strong>it losses were <strong>of</strong>fset by declining<br />

provincial and federal general corporate tax rates in 2008.<br />

In <strong>BC</strong>, many corporate pr<strong>of</strong>it losses occurred in the resource sector, reflecting the decline in quantity and price <strong>of</strong> <strong>for</strong>est products shipments, our major<br />

export. Export revenue is a significant source <strong>of</strong> basic income into our provincial <strong>economy</strong>, but it is sensitive to global demand conditions.<br />

Exports per worker<br />

An increase in the exports per worker value reflects an improvement in the trade environment and investment climate. In 2008, <strong>BC</strong>’s exports per worker<br />

value declined by 6.8% to $27,915, and Ontario’s declined by 6.7% to $46,135. Although the value <strong>of</strong> Alberta’s exports per worker declined by 4.2% to<br />

$51,881 last year, it was still almost double that <strong>of</strong> <strong>BC</strong> and ranked as the highest value in Canada. 19<br />

Between 2003 and 2008, the value <strong>of</strong> <strong>BC</strong>’s exports per worker was down by 4.3%. During this same period, Ontario saw a decline <strong>of</strong> 4.5%, and Alberta<br />

saw a decline <strong>of</strong> 0.8%. While the value <strong>of</strong> total exports from <strong>BC</strong> rose by 5.9% between 2003 and 2008, the number <strong>of</strong> workers increased at almost double<br />

this rate (10.7%). In the first five months <strong>of</strong> 2009, the value <strong>of</strong> <strong>BC</strong>’s domestic exports per worker was down by 17.8%.<br />

Workers in the sciences sector<br />

The labour market share <strong>of</strong> workers in the natural and applied sciences is a barometer <strong>of</strong> technological dissemination throughout the work<strong>for</strong>ce. 20 In 2008,<br />

Alberta and Ontario led the comparison jurisdictions with 7.6% <strong>of</strong> the labour <strong>for</strong>ce employed in science-related occupations, while the national average was<br />

7.1%. <strong>BC</strong> lagged behind, with 6.6%.<br />

17<br />

Ideally, a productivity measure should account <strong>for</strong> both labour and capital inputs used in production; however, labour productivity is generally used as a<br />

proxy measure <strong>for</strong> total change in productivity.<br />

18<br />

Our indicator is the ratio <strong>of</strong> after-tax operating pr<strong>of</strong>its to GDP, which allows us to compare jurisdictions. Our definition <strong>of</strong> pr<strong>of</strong>its includes those accrued<br />

in both private sector and government business enterprises. Government business enterprises (GBEs), which constitute 5-10% <strong>of</strong> total pr<strong>of</strong>its, are legal<br />

entities with a separate set <strong>of</strong> financial statements, which qualifies them in the parlance <strong>of</strong> Statistics Canada as “institutional units.” GBEs differ from<br />

other government services in that they generally charge prices that are related to the cost <strong>of</strong> production, as in the case in private enterprises, and are<br />

subject to tax. Gaming and liquor sales are excluded from GBE pr<strong>of</strong>its because <strong>of</strong> the nature <strong>of</strong> their pr<strong>of</strong>its. Governments have established monopolies<br />

<strong>for</strong> these enterprises, and it is impossible to distinguish between pr<strong>of</strong>its earned as a margin on their operations or earned as monopoly producers. They<br />

are, there<strong>for</strong>e, classified as indirect taxes—specifically, taxes on products.<br />

19<br />

The value <strong>of</strong> Canadian exports per worker was $26,548 in 2008, but as this figure nets out inter-provincial shipments, and it is not comparable to the<br />

provinces’ values.<br />

20<br />

Natural and applied sciences include pr<strong>of</strong>essional occupations in physical and life sciences, engineering, architecture, planning, and a range <strong>of</strong> related<br />

technical occupations.<br />

October ’09 ica.bc.ca 17

Not only was <strong>BC</strong>’s percentage <strong>of</strong> workers in the sciences comparatively low, it also showed only a small increase <strong>of</strong> 0.2 ppt in 2008. Nevertheless, this small<br />

increase was on par with Ontario’s gain, and just slightly above the national average gain <strong>of</strong> 0.1 ppt. Alberta, by contrast, saw a decline <strong>of</strong> 0.3 ppt, as its oil<br />

and gas sector slowed down.<br />

In a labour market study conducted in February 2008, the <strong>BC</strong> Technology Industries Association predicted that <strong>BC</strong> would see 5,000 new technology jobs<br />

by September 1, 2008. 21 The economic challenges in late 2008 dampened the real numbers, but there is no question that many <strong>of</strong> these predicted jobs were<br />

realized. In addition, science-related jobs emerged in several <strong>of</strong> <strong>BC</strong>’s traditional sectors, as industry evolved to become more competitive and meet growing<br />

market challenges. Hopefully this growth will continue, as it will have a positive impact on <strong>BC</strong>’s productivity.<br />

Net government liabilities<br />

Without a strong and productive work and investment climate, the <strong>BC</strong> government is severely limited in its ability to meet the needs <strong>of</strong> citizens, and in its<br />

ability to pay down debt.<br />

The net government liability indicator measures past fiscal policy and future tax burden. 22 In 2007, <strong>BC</strong>’s financial liabilities declined by 2 ppt, comprising<br />

only 6.9% <strong>of</strong> the GDP. In Alberta, where all provincial government debt has been eliminated, the ratio was -6.4%. Ontario posted a decline <strong>of</strong> 1.1 ppt, and<br />

saw its government liabilities drop to 21.4%; while Canada posted a decline <strong>of</strong> 1.7 ppt, and saw its government liabilities drop to 20.8%. By the end <strong>of</strong> 2007,<br />

strong economic growth, positive government revenues, and prudent fiscal policy had all laid the groundwork <strong>for</strong> lower government debt in <strong>BC</strong>. But the<br />

tumultuous economic and financial events <strong>of</strong> 2008, and a correlative growth in unemployment, severely altered the context <strong>for</strong> government spending.<br />

In February 2009, the government <strong>for</strong>ecast a budget deficit <strong>of</strong> $495 million. However, by the time the September 2009 budget update was released, that<br />

figure had jumped to $2.8 billion <strong>for</strong> the 2009/10 fiscal year, $1.7 billion <strong>for</strong> 2010/11, and $945 million <strong>for</strong> 2011/12. It is clear that the economic downturn<br />

hit the <strong>BC</strong> <strong>economy</strong> much harder than the government had anticipated. Other jurisdictions, like Alberta, are also predicting increased debt as the full implications<br />

<strong>of</strong> the economic downturn become clear.<br />

Lower than <strong>for</strong>ecasted income tax and resource royalties are the primary causes <strong>for</strong> this about-face. According to the provincial government, compared to<br />

the February 2009 Budget, taxation revenue is expected to decline by 6.9% in the fiscal year 2009/10, by a further 4.6% in 2010/11, and by another 2.9%<br />

in 2011/12. In addition, the estimates <strong>for</strong> natural resource royalties <strong>for</strong> the next three years have declined by $2.1 billion since February.<br />

Overall<br />