Oberoi Realty (OBEREA) - Myiris.com

Oberoi Realty (OBEREA) - Myiris.com

Oberoi Realty (OBEREA) - Myiris.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Initiating Coverage<br />

Rating Matrix<br />

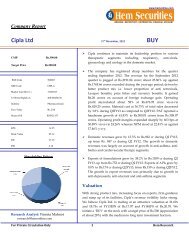

Rating : Buy<br />

Target : | 242<br />

Target Period : 12-15 months<br />

Potential Upside : 12%<br />

YoY Growth (%)<br />

FY10 FY11 FY12E FY13E<br />

Net Sales 82.7 26.7 14.7 56.3<br />

EBITDA 91.4 21.9 9.6 58.0<br />

Net Profit 81.6 12.9 10.0 29.0<br />

EPS 81.6 12.9 10.0 29.0<br />

Current & target multiple<br />

(x) FY10 FY11 FY12E FY13E<br />

P/E 15.5 13.8 12.5 9.7<br />

Target P/E 17.3 15.3 13.9 10.8<br />

EV / EBITDA 14.4 10.0 9.0 5.3<br />

P/BV 3.8 2.1 1.8 1.5<br />

RoNW 24.6 15.4 14.5 15.8<br />

RoCE 24.9 16.5 15.5 20.8<br />

Stock Data<br />

Bloomberg/Reuters Code<br />

OBER IN / OEBO.NS<br />

Sensex 15,858.5<br />

Average volumes 73,006<br />

Market Cap (| crore) 7,191.6<br />

52 week H/L 289/211<br />

Equity Capital (| crore) 328.2<br />

Promoter's Stake (%) 78.5<br />

FII Holding (%) 9.6<br />

DII Holding (%) 1.4<br />

Comparative return matrix (%)<br />

Return % 1M 3M 6M 12M<br />

<strong>Oberoi</strong> <strong>Realty</strong> (4.1) (0.4) (2.4) (19.2)<br />

DLF (13.0) 7.4 (12.3) (38.0)<br />

Unitech (12.7) (11.9) (27.0) (65.1)<br />

HDIL (29.6) (40.7) (57.1) (70.5)<br />

Price movement<br />

6,400<br />

5,550<br />

4,700<br />

3,850<br />

3,000<br />

Dec-10<br />

Jan-11<br />

Analyst’s name<br />

Feb-11<br />

Mar-11<br />

Apr-11<br />

May-11<br />

Price (R.H.S)<br />

Jun-11<br />

Deepak Purswani, CFA<br />

deepak.purswani@icicisecurities.<strong>com</strong><br />

Jul-11<br />

Bhupendra Tiwary<br />

bhupendra.tiwary@icicisecurities.<strong>com</strong><br />

Aug-11<br />

Sep-11<br />

Oct-11<br />

Nifty (L.H.S)<br />

Nov-11<br />

310<br />

260<br />

210<br />

160<br />

110<br />

Quality in real(i)ty…<br />

November 24, 2011<br />

<strong>Oberoi</strong> <strong>Realty</strong> (ORL) is an established brand in the Mumbai real estate<br />

market. Out of its total land bank of 20.6 million sq ft, <strong>Oberoi</strong> Garden City<br />

in Goregaon accounts for 50% of the land bank where it not only has land<br />

cost advantage but also enjoys premium realisation due to integrated<br />

development. Furthermore, its prudent land acquisition policy coupled<br />

with premium realisation across regions and recent IPO have made its<br />

balance sheet much superior <strong>com</strong>pared to its peers (ORL has net cash of<br />

|1347 crore as on Q2FY12) ensuring timely execution of the project<br />

pipeline. Moreover, ORL scores high in qualitative assessment of key<br />

factors further justifying its premium valuation. We initiate coverage on<br />

the stock with a BUY rating and target price of | 242.<br />

<strong>Oberoi</strong> Garden city, Goregaon – a cash cow for ORL<br />

<strong>Oberoi</strong> Garden city in Goregaon accounts for 50% of the total land bank<br />

and 64% to our NAV. ORL not only enjoys cost advantage (ORL land cost<br />

works out to | 96 psf vs. | 2245 psf at current land parcel prices), it also<br />

enjoys premium in the realisation due to very well diversified<br />

development in the region and for its quality of construction.<br />

Prudent land acquisition & balance sheet strength – a key differentiator<br />

ORL’s prudent land acquisition strategy (its land parcels are at<br />

significantly cheaper prices <strong>com</strong>pared to current market prices) coupled<br />

with premium realisation have made it one of the very few <strong>com</strong>panies in<br />

the sector that enjoys positive operating cash flow post interest paid (~|<br />

200 crore in FY11). This, coupled with recent IPO funds, means ORL has<br />

cash surplus of | 1347 crore in Q2FY12 making it the key differentiator<br />

<strong>com</strong>pared to its peers. The financial strength would not only ensure<br />

timely execution but also enable it to acquire the new land bank at better<br />

prices in case there is a slowdown in the sector.<br />

ORL scores high in our qualitative assessment<br />

ORL scores high in terms of our qualitative assessment of key factors<br />

such as quality of land bank, management track record, quality of<br />

earnings, disclosures and execution justifying its premium valuation.<br />

Valuations<br />

At the current price, ORL is trading at 9.7x FY13 EPS of | 22.4 and 1.5x<br />

FY13 P/BV. We are initiating coverage on ORL with a BUY<br />

re<strong>com</strong>mendation and a price target of | 242 (at implied ~13% discount to<br />

its NAV we have valued Mulund and <strong>com</strong>mercial developments at a 25%<br />

discount to NAV and have not considered <strong>com</strong>mercial and retail<br />

development at Worli, Sangam city and the I-Ven property).<br />

Exhibit 1: Valuation Metrics<br />

| crore FY09 FY10 FY11 FY12E FY13E<br />

Net Sales 425.4 777.2 984.3 1,129.5 1,765.0<br />

EBITDA 247.4 473.4 577.0 632.7 999.9<br />

EBITDA Margin (%) 58.2 60.9 58.6 56.0 56.7<br />

PAT 252.3 458.2 517.2 569.1 734.2<br />

EPS (|) 7.7 14.0 15.8 17.3 22.4<br />

Price / Book (x) 4.9 3.8 2.1 1.8 1.5<br />

EV/EBITDA (x) 28.4 14.4 10.0 9.0 5.3<br />

RoCE (%) 16.5 24.9 16.5 15.5 20.8<br />

RoNW (%) 17.5 24.6 15.4 14.5 15.8<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

<strong>Oberoi</strong> <strong>Realty</strong> (<strong>OBEREA</strong>)<br />

| 217<br />

ICICI Securities Ltd | Retail Equity Research

Shareholding pattern (as on Q2FY12)<br />

Shareholders<br />

% Holding<br />

Promoters 78.5<br />

FII 9.6<br />

DII 1.4<br />

Others 10.5<br />

Promoters and institutional holding trend (%)<br />

100.0<br />

80.0<br />

60.0<br />

40.0<br />

20.0<br />

0.0<br />

78.5 78.5 78.5 78.5<br />

11.0 10.6 10.5 10.4<br />

Q3FY11 Q4FY11 Q1FY12 Q2FY12<br />

Company background<br />

Incorporated in 1998, <strong>Oberoi</strong> <strong>Realty</strong> (ORL) is a Mumbai based real estate<br />

developer focused on premium development with a presence in<br />

residential, office space, retail, hospitality and social infrastructure<br />

projects. With almost ~94% of the land bank of 20.6 million sq ft in<br />

Mumbai and its suburbs, ORL is an established brand name with a strong<br />

track record of development in the suburbs of Mumbai. The promoters<br />

and promoter group had started operations in 1983 and collectively<br />

developed 33 projects covering over 5 million square feet (sq ft), as on<br />

the IPO date (October, 2010).<br />

ORL has differentiated itself with its prudent land acquisition strategy,<br />

strong execution track record, excellent corporate governance and<br />

pristine balance sheet. Few of the key projects of ORL are <strong>Oberoi</strong> Garden<br />

City (Goregaon), <strong>Oberoi</strong> Splendor (Andheri East), <strong>Oberoi</strong> Exotica (Mulund)<br />

and <strong>Oberoi</strong> Oasis (Worli). Each of the projects have been discussed in<br />

length in the Appendix section.<br />

Exhibit 2: Corporate structure<br />

<strong>Oberoi</strong> <strong>Realty</strong><br />

100% 100% 100% 31.67% 100% 100% 100%<br />

<strong>Oberoi</strong><br />

Construction Pvt.<br />

Ltd.<br />

<strong>Oberoi</strong> Mall Pvt.<br />

Ltd.<br />

Kingston Property<br />

Services Pvt. Ltd<br />

Sangam City<br />

Township Pvt Ltd<br />

Kingston<br />

Hospitality &<br />

Developers Pvt.<br />

Ltd.<br />

Expressions<br />

<strong>Realty</strong> Pvt. Ltd.<br />

Triumph <strong>Realty</strong><br />

Pvt. Ltd.<br />

50% 100%<br />

Siddhivinayak<br />

Realties Pvt. Ltd.<br />

Perspective<br />

<strong>Realty</strong> Pvt. Ltd.<br />

Oasis <strong>Realty</strong><br />

Zaco Aviation<br />

SPV jointly owned<br />

by ORL and other<br />

partners<br />

Unincorporated JV<br />

Subsidiary<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Exhibit 3: Segment wise business model<br />

Segment Residential Office Space Retail Hospitality Social Infrastructure<br />

Business Model Sale Sale/Lease Sale/Lease Owned Lease<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 2

Investment Rationale<br />

ORL scores high on qualitative assessment of key factors<br />

We have done the qualitative assessment for ORL on given key<br />

parameters. We have rated ORL on each of these parameters on a scale<br />

of 1 to 5 with 5 being the highest. We discuss each one of them in detail<br />

below:-<br />

• Quality of land bank: ORL has a presence in the Mumbai region, a<br />

key real estate market. Moreover, ORL is primarily into integrated<br />

development, which <strong>com</strong>mands higher realisation<br />

• Management track record: ORL’s promoters have been in the real<br />

estate business for the last three decades and have delivered over 5<br />

million sq ft of projects<br />

• Execution: Almost the entire land bank of ORL is in Mumbai<br />

enabling it to handle projects closely. Secondly, it has strong<br />

financial strength along with quality contractor such as L&T that<br />

provides us <strong>com</strong>fort in terms of the execution<br />

• Quality of earnings: ORL follows a conservative revenue recognition<br />

policy. It does not consider land cost in the total project cost while<br />

recognising the revenues through the percentage <strong>com</strong>pletion<br />

method. Furthermore, ORL has a debt-free balance sheet, which<br />

gives us <strong>com</strong>fort in terms of quality of earnings<br />

• Disclosures: ORL provides exhaustive disclosures in terms of the<br />

land bank, project details and units sold during the time period.<br />

Furthermore, ORL has a very simple corporate structure with very<br />

few subsidiaries, which makes it easy to keep track.<br />

Exhibit 4: Qualitative assessment of ORL<br />

Disclosure<br />

ORL scores high in terms of our qualitative assessment of<br />

key factors such as quality of land bank, management<br />

track record, quality of earnings, disclosures and<br />

execution, thereby justifying its premium valuation<br />

Quality of Earning<br />

Execution<br />

Management Track<br />

Record<br />

Quality Land Bank<br />

1 2 3 4 5<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

* Rating of 5 is highest and 1 is lowest<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 3

<strong>Oberoi</strong> Garden City, Goregaon - a cash cow for ORL<br />

<strong>Oberoi</strong> Garden City project, an integrated mix development on 84 acres of<br />

land in Goregaon, is a cash cow for ORL where it <strong>com</strong>mands higher<br />

margins <strong>com</strong>pared to its peers. ORL had bought ~84 acres of land during<br />

1999-2005 at a meagre ~| 107 crore implying | 1.3 crore/acre while the<br />

last reported land deal (in July, 2010) in Goregaon was done at | 25<br />

crore/acre. Additionally, currently the land parcels in the area are quoting<br />

at | 30-35 crore per acre.<br />

On the other hand, ORL enjoys a premium in the realisation <strong>com</strong>pared to<br />

the market price due to very well integrated developed projects. ORL’s<br />

diversified offering, which includes <strong>com</strong>mercial, retail, hospitality and<br />

social infrastructure developments along with residential offerings make it<br />

an attractive proposition for the customers. This helps ORL to <strong>com</strong>mand<br />

higher realisation vis-à-vis its peers. Furthermore, ORL also <strong>com</strong>mands a<br />

premium for the quality and timeliness in execution (ensured with<br />

projects contracted to L&T).<br />

With premium realisation and low cost land holding in the area, ORL<br />

<strong>com</strong>mands superior margins vis-à-vis developers who own land at the<br />

current land parcel prices. As a result, though this geography accounts for<br />

50% of the developable area, it contributes 64% to our target price.<br />

With premium realisation and low cost land holding in the<br />

area, ORL <strong>com</strong>mands superior margins vis-à-vis other<br />

developers<br />

Exhibit 5: Lower Land cost enables ORL to <strong>com</strong>mand higher OPM per sq ft<br />

ORL<br />

Other developer<br />

Acres 1 1<br />

Sq ft 43560 43560<br />

Saleable Area (sq ft) 133196 133196<br />

Realisation per sq ft (|) 12500 10000<br />

Land cost per acre (| crore) 1.3 30<br />

Land cost per sq ft (|) 96 2252<br />

Construction & other costs per sq feet (|) 4258 3758<br />

Total cost per sq ft (|) 4354 6010<br />

EBITDA per sq ft (|) 8146 3990<br />

Margin 65.2% 39.9%<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

*we have assumed the same FSI (implied at 3.1x) used by ORL at <strong>Oberoi</strong> Garden City<br />

Exhibit 6: Goregaon en<strong>com</strong>passes 10.4 msf (~50%) of developable area<br />

Exhibit 7: …and contributes | 157 per share (64%) to our target price<br />

3.2<br />

16%<br />

2.6<br />

13%<br />

3.1<br />

15%<br />

1.3<br />

6%<br />

10.4<br />

50%<br />

in mn sq ft<br />

16.2<br />

3.9 7%<br />

2% 16.8<br />

7%<br />

48.1<br />

20%<br />

156.7<br />

64%<br />

(|)<br />

Goregaon Andheri Worli Mulund Pune<br />

Goregaon Andheri Worli Mulund Pune Cash<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 4

Prudent land acquisition strategy – Quality land bank bought at cheaper price<br />

ORL has been a prudent land buyer. The <strong>com</strong>pany has a track record of<br />

acquiring land bank at city centric locations at reasonable rates. This<br />

enables it to enjoy high margins post development on those land parcels.<br />

The Goregaon land purchase has been one of its smart buys where the<br />

<strong>com</strong>pany started the acquisition of land in 1999 and went on acquiring the<br />

adjacent parcels at attractive prices over the next six years. We notice that<br />

land prices in this region are at | 30-40 crore per acre currently. In 2010,<br />

the transaction done by Sunteck <strong>Realty</strong> implies a land cost of | 25/ acre. If<br />

we assume the same FSI (3.1x) used by <strong>Oberoi</strong> on this transaction, land<br />

cost per sq ft works out to ~| 1877 per sq ft vis-à-vis the <strong>Oberoi</strong> land cost<br />

per sq ft of | 96 per sq ft. Similarly, the <strong>com</strong>pany’s land acquisition cost in<br />

the Andheri and Mulund area is significantly lower than recent acquisition<br />

cost. Such a prudent land acquisition strategy would enable better<br />

profitability and return ratios (currently reflected in its financials).<br />

Prudent land acquisition strategy enables better<br />

profitability and return ratio for ORL<br />

While this strategy has been fruitful so far, going ahead, it will be difficult<br />

for ORL to repeat the past track record in land purchase considering the<br />

rising land prices in Mumbai and its suburbs. Nevertheless, availability of<br />

financial resources (cash balance and investment of ~| 1347 crore in<br />

Q2FY12) and a strategy of being prudent in land purchase ensures that<br />

land acquisition will not be a major problem for ORL. Moreover, with cash<br />

at its disposal, ORL would be best suited to lap up a land deal in the<br />

scenario where most of it peers are debt ridden.<br />

Exhibit 8: Land parcel details<br />

Cost per acre Developeable Area (<br />

(| crore) in mn sq ft)<br />

Land cost per<br />

sq ft (| )<br />

Land Parcel Year Area (acres) Cost (| crore)<br />

Goregaon 1999-2005 83.9 106.8 1.3 11.2 96<br />

Andheri West 2005 7.0 31.7 4.6 0.6 508<br />

Andheri East 2005 24.5 106.0 4.3 3.1 339<br />

Mulund 2005 18.8 221.0 11.7 3.2 690<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Exhibit 9: Recent land acquisition deals<br />

Cost per acre<br />

(| crore)<br />

Land cost per<br />

sq ft* (|)<br />

Land Parcel Year Area (acres) Cost (| crore)<br />

Buyer<br />

Mulund (W) Jul-10 4.5 200 44.4 2611 Kalpaturu<br />

Mulund (W)# Jan-10 18 200 11.1 653 Runwal group<br />

Goregaon Jul-10 6 150 25.0 1877 Sunteck <strong>Realty</strong><br />

JVLR Oct-10 15 200 13.3 1489 DB <strong>Realty</strong><br />

Source: Media Articles, ICICIdirect.<strong>com</strong> Research<br />

*In order to see like to like land cost per sq ft, we have assumed same FSI, which is implied by <strong>Oberoi</strong><br />

projects in that areas<br />

#This deal seems to be distressed (plot sold by Wockhardt). Otherwise, Raheja Universal quoted<br />

| 700 crore in 2008 but backed out at a later stage. On those quotes, the land cost per acre works out<br />

to | 38.9 crore and land cost per sq ft works out to | 2285 psf<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 5

I-Ven stake buy reiterates our “smart buyer” stance for ORL on relative basis…<br />

ORL has announced that it has recently bought a 50% stake in I-<strong>Realty</strong><br />

(the JV between ICCI Venture and promoter group <strong>com</strong>pany of ORL) from<br />

ICICI Venture. While the <strong>com</strong>pany did not disclose the financial details<br />

about the deals, media reports indicate that it has bought a 50% stake for<br />

~| 300 crore valuing the 4.1 acre project at | 600 crore or | 150 per acre.<br />

The financials and balance sheet also seem to suggest that the deal could<br />

have been done at a similar valuation. The implied land price of ~| 150<br />

crore/acre is much lower than the recent quotes for land available in the<br />

Worli area (please refer Exhibit 10).<br />

The deal, if <strong>com</strong>pared with other quoted property deals in this area,<br />

seems to be much better and reiterates our view in terms of the prudent<br />

land acquisition policy of ORL. In terms of NAV contribution, this deal<br />

contributes | 3.9/share after considering the assumption in Exhibit 11 and<br />

12. We highlight that FSI would play a major role for value accretion in the<br />

future. Currently, we have considered FSI of 2.7x (including 1x of car<br />

parking FSI) as guided by the management.<br />

However, we highlight we have not considered the same in our target<br />

price estimates as the <strong>com</strong>mencement of work on the project could take<br />

nine to 12 months after the BMC issue gets settled and lack of clarity on<br />

parking FSI continues to persist. Therefore, availability of parking FSI on<br />

this plot would play a major role in terms of value accretion in future. We<br />

show the sensitivity to our NAV valuation at different FSI levels in Exhibit<br />

13.<br />

The implied land price of ~| 150 crore/acre is much lower<br />

than recent quotes for land available in the Worli area<br />

Exhibit 10: Recent land parcels offers in Worli<br />

Property Size (acres) Quoted Sale Price (| crore) Cost/Acre (| crore)<br />

Poddar Mills Land 2.4 474 197.5<br />

HUL Land 1.0 300 300.0<br />

Dunlop Land 1.0 300-350 300.0<br />

<strong>Oberoi</strong> stake in Worli project 4.1 600 146.3<br />

Source: Press reports, ICICIdirect.<strong>com</strong> Research<br />

Exhibit 11: Assumptions<br />

Assumption<br />

Acres 4.1<br />

FSI 2.7x<br />

Saleable Area ( in mn sq ft) 0.5<br />

Project launch date<br />

FY14E<br />

Project <strong>com</strong>pletion<br />

FY18E<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Exhibit 12: Per sq ft assumptions<br />

Per sq assumption |<br />

Realisation 45000<br />

Construction cost 5000<br />

Other cost 740.7<br />

SG&A exps 2250<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Exhibit 13: NAV contribution sensitivity to FSI<br />

Availability of parking FSI on this plot would play a major<br />

role in terms of value accretion in future<br />

FSI 2.0 x 2.5 x 2.7 x 3.0 x 3.5 x<br />

NAV (| cr) 22.1 98.2 129 174.3 250.4<br />

NAV/share 0.7 3.0 3.9 5.3 7.6<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 6

Project launches to keep sales momentum strong<br />

Residential projects launch of ~3.2 msf over 6-12 months<br />

ORL has a strong pipeline of ongoing and planned projects, which are<br />

launched/to be launched over the next six to 12 months in the residential<br />

segment. This should ensure strong sales momentum for ORL. ORL is<br />

likely to launch ~3.2 million sq ft over the next six to 12 months. This<br />

includes Oasis Residential - Worli (1.54 million sq ft), which is likely to be<br />

launched in Q4FY12 and <strong>Oberoi</strong> Exotica I - Mulund (1.61 million sq ft)<br />

expected to be launched in Q1FY13.<br />

After the launch of all the residential projects in ORL’s<br />

current portfolio, we expect the yearly residential sales<br />

volumes to inch up to 2 million sq ft in FY16E from ~0.7<br />

million sq ft in FY11<br />

Additionally, the launch of the next phase of residential projects in<br />

Goregaon (Esquire II), Mulund (Exotica II) and Pune (Sangam city<br />

residential) would keep sales volumes robust, going forward.<br />

Consequently, from the residential sales volumes of ~0.7 million sq ft in<br />

FY11, we expect it to be<strong>com</strong>e ~2.9x to 2 million sq ft in FY16E.<br />

Exhibit 14: Trend in residential sales volume ( in million sq ft)<br />

(mn sq ft)<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

2.0 2.0<br />

1.7 0.2 0.2<br />

1.4 0.2 0.6<br />

0.8<br />

0.3 0.5<br />

0.9 0.1<br />

0.2<br />

0.7<br />

0.3 0.1 0.3 0.2<br />

0.2<br />

0.1<br />

0.3<br />

0.2<br />

0.6 0.6 0.7 0.6<br />

0.8<br />

0.6<br />

FY11 FY12E FY13E FY14E FY15E FY16E<br />

Goregaon Andheri Worli Mulund Pune<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Note: I Venture volume is not considered the above sales volumes.<br />

We expect ORL’s lease in<strong>com</strong>e to more than quadruple to<br />

~| 524 crore by FY17E from | 113 crore in FY11<br />

Addition to lease portfolio to provide stable in<strong>com</strong>e, going ahead…<br />

With the <strong>com</strong>pletion of Phase I of Commerz II, ORL would add ~0.73<br />

million sq ft to it current leasable portfolio of ~0.92 million sq ft (~0.8<br />

million sq ft already leased). Furthermore, the <strong>com</strong>pletion of phase II of<br />

Commerz will add ~1.66 million sq ft to the total leasable portfolio.<br />

Consequently, we expect ORL’s lease in<strong>com</strong>e to more than quadruple to<br />

~| 524 crore by FY17E from | 113 crore in FY11. Therefore, the addition<br />

to the lease portfolio will ensure a stable in<strong>com</strong>e, going forward, for ORL.<br />

Exhibit 15: We expect area leased to quadruple by FY17E…<br />

Exhibit 16: …and lease in<strong>com</strong>e to increase to 4.6x by FY17E<br />

(sq ft)<br />

3.5<br />

3.0<br />

3.0<br />

2.5<br />

2.0<br />

0.5<br />

2.0<br />

1.4 1.5<br />

0.5 1.5<br />

1.5<br />

1.2<br />

0.8 0.9<br />

0.5 0.5 0.4<br />

1.0<br />

0.5<br />

0.5 0.5 0.4 0.5 0.7 0.7 0.7<br />

0.5<br />

0.1<br />

0.3 0.3 0.3 0.4 0.4 0.4 0.4<br />

0.0<br />

FY11 FY12E FY13E FY14E FY15E FY16E FY17E<br />

Commerz I Commerz II Phase I Commerz II Phase II <strong>Oberoi</strong> Mall<br />

(| crore)<br />

600.0<br />

524<br />

500.0<br />

89<br />

400.0<br />

325<br />

300.0<br />

227 248<br />

87 267<br />

168<br />

200.0 113 124<br />

84 86 73<br />

100.0<br />

82<br />

83 101 102 103<br />

67 79 32<br />

46 45 54 60 62 63 65<br />

0.0<br />

FY11 FY12E FY13E FY14E FY15E FY16E FY17E<br />

Commerz I Commerz II Phase I Commerz II Phase II <strong>Oberoi</strong> Mall<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 7

ORL is one of the very few <strong>com</strong>panies in the sector, which<br />

enjoys a positive operating cash flow post interest paid<br />

and has a strong cash balance and investment<br />

Rich balance sheet – superior to peers<br />

Given its prudent land acquisition policy and premium realisation<br />

enabling it to fetch better profitability and the recent IPO, ORL has strong<br />

financial strength with a debt-free balance sheet. While almost all major<br />

players in the industry suffer from a high debt level and interest cost<br />

pains, ORL is clearly hassle-free in this regard. It is also one of the very<br />

few <strong>com</strong>panies in the sector, which enjoys a positive operating cash flow<br />

post interest paid (~| 200 crore in FY11) and has a strong cash balance<br />

and investment of ~| 1347 crore (as on Q2FY12).<br />

Financial strength ensures that the <strong>com</strong>pany will not have to depend upon<br />

external financing to fund its construction capex. Thus, unlike its peers,<br />

ORL does not cough out interest expenses (peers had to shell out as high<br />

as 43-94% of operating cash flows as interest expenses in FY11). The<br />

strong financial health also provides us <strong>com</strong>fort in the timely execution of<br />

projects. Additionally, the financial health would also enable it to acquire<br />

the new land bank at a better valuation in case there is a slowdown in the<br />

sector.<br />

Exhibit 17: Peer <strong>com</strong>parison (FY11 financials abstract)<br />

Debt-Equity Ratio<br />

Operating Cash Flow<br />

(| crore)<br />

Gross Interest paid (|<br />

crore)<br />

Interest paid as % of<br />

Operating CF<br />

<strong>Oberoi</strong> <strong>Realty</strong> (0.3) 200.3 0.0 0.0<br />

DLF 0.9 2,757.0 2,591.3 94.0<br />

Unitech 0.5 1,163.4 1,071.3 92.1<br />

Sobha Developer 0.7 403.5 174.2 43.2<br />

HDIL 0.4 (2,363.4) 83.6<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Exhibit 18: Net debt to equity - Peer group analysis<br />

(x)<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

(0.5)<br />

(1.0)<br />

3.7<br />

2.5<br />

2.3<br />

2.0<br />

1.8 1.7<br />

0.5 0.7<br />

0.8 0.9<br />

0.6 0.8<br />

0.9<br />

0.7 0.7 0.8<br />

0.7 0.5<br />

(0.3) 0.1 (0.1)(0.2)(0.4)<br />

ORL DLF Unitech Sobha Developer HDIL<br />

0.5<br />

0.4<br />

FY07 FY08 FY09 FY10 FY11<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Exhibit 19: Interest paid as percentage of operating cash flows (FY11)<br />

100.0<br />

94.0 92.1<br />

Unlike it peers, ORL did not cough out interest expenses as<br />

high as 43-94% of operating cash flows as interest<br />

expenses in FY11<br />

(%)<br />

75.0<br />

50.0<br />

43.2<br />

25.0<br />

-<br />

0.0<br />

ORL DLF Unitech Sobha Developer<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 8

Mumbai residential realty – Long-term growth outlook intact<br />

Unaffordability to keep short-term volume offtake under pressure<br />

Sustained higher prices in Mumbai and suburb region have led to a sharp<br />

rise in the affordability ratio and, therefore, cooling off of volume offtake<br />

in the last couple of quarters. With volumes drying up due to property<br />

prices inching beyond the means at the given in<strong>com</strong>e level, a price<br />

correction is warranted at the current levels.<br />

While other developers could go for a price cut to support<br />

their sales momentum, ORL, with a strong balance sheet<br />

will be better placed than its peers who have been<br />

struggling with their leveraged balance sheet<br />

We believe a price correction of ~10% from current levels coupled with a<br />

respite in interest rate by ~50-100 bps will bring the affordability back to<br />

the 2009 level where a pick-up in demand was seen. While interest rate is<br />

governed by macroeconomic factors, the continued sluggishness in<br />

volume offtake is likely to force developers to go for a price cut to support<br />

their sales momentum. We highlight that ORL, with a strong balance<br />

sheet, will be better placed than its peers who have been struggling with<br />

their leveraged balance sheet.<br />

Exhibit 20: Slow volume offtake reflected in falling property registration<br />

Exhibit 21: Rising unaffordability warrants price correction…<br />

10000<br />

8000<br />

6000<br />

4000<br />

Average<br />

(x)<br />

5.2<br />

5.0<br />

4.8<br />

4.6<br />

4.4<br />

4.2<br />

4.3<br />

4.6<br />

5.0<br />

5.1<br />

5.0<br />

4.5<br />

4.7<br />

4.8<br />

60.0%<br />

55.0%<br />

50.0%<br />

45.0%<br />

2000<br />

Dec-08<br />

Mar-09<br />

Jun-09<br />

Sep-09<br />

Dec-09<br />

Mar-10<br />

Jun-10<br />

Sep-10<br />

Dec-10<br />

Mar-11<br />

June-11<br />

4.0<br />

2004 2005 2006 2007 2008 2009 2010 2011<br />

Property to in<strong>com</strong>e (x) Affordability ratio (%)<br />

40.0%<br />

Source: ICICI Property Services Group, ICICIdirect.<strong>com</strong> Research<br />

Source: HDFC Q2FY12 presentation, ICICIdirect.<strong>com</strong> Research<br />

Long-term residential demand to outpace supply<br />

The growth in the real GDP, changing in<strong>com</strong>e demographics, shortage of<br />

housing units and increased corporate spending being the financial hub<br />

of the country supports the long-term outlook for the Mumbai real estate.<br />

Cushman & Wakefield in its report “Embracing Change – Scripting the<br />

future of Indian Real Estate” has estimated a shortfall of 1.3 million<br />

residential units during CY11-15 in India. As per the report, Mumbai is<br />

likely to record demand growth at 14% CAGR during CY11-15 and is<br />

expected to experience a shortfall of 0.4 million residential units during<br />

the same period. As a consequence of this demand supply gap, the longterm<br />

property pricing in the Mumbai region is expected to be robust.<br />

Exhibit 22: Residential demand-supply projection CY11-15<br />

As a consequence of this demand supply gap, the long<br />

term property pricing in Mumbai region is expected to be<br />

robust<br />

Region Supply (units) Demand (units) Gap (units)<br />

NCR 287,000 717,000 -430,000<br />

Mumbai 240,000 651,000 -411,000<br />

Bangalore 111,000 287,000 -176,000<br />

Hyderabad 104,000 197,000 -93,000<br />

Chennai 118,000 176,000 -58,000<br />

Pune 76,500 170,000 -93,500<br />

Kolkata 87,500 166,000 -78,500<br />

Total 1,024,000 2,364,000 -1,340,000<br />

Source: Cushman & Wakefield, Hindu Business line dated October 9, 2011, ICICIdirect.<strong>com</strong> Research<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 9

Financials<br />

Revenue to grow at 33.9% CAGR during FY11-13E<br />

The revenues of ORL grew at 52.1% CAGR during FY09-11 on the back of<br />

strong revenue recognition from the projects launched. We expect ORL’s<br />

topline to grow at 33.9% CAGR during FY11-13E driven mainly by the<br />

revenue recognition from the ongoing projects. We highlight that we have<br />

built in slower execution and, consequently, stronger execution by ORL<br />

would pose an upside risk to our estimates.<br />

Exhibit 23: Revenue growth trend<br />

We expect ORL’s topline to grow at 33.9% CAGR during<br />

FY11-13E driven mainly by revenue recognition from<br />

ongoing projects<br />

(| crore)<br />

2000<br />

1800<br />

1600<br />

1400<br />

1200<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

33.9% CAGR 1,765.0<br />

52.1% CAGR<br />

1,129.5<br />

984.3<br />

777.2<br />

425.4<br />

FY09 FY10 FY11 FY12E FY13E<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

EBITDA margins to be maintained at 56-57% during FY12E-FY13E<br />

We expect ORL to maintain its EBITDA margin of 56-57%<br />

during FY12E-13E as the increased cost of construction<br />

would be set off by the lower cost of land and premium<br />

pricing<br />

We expect ORL to maintain its EBITDA margin of 56-57% during FY12E-<br />

13E as the increased cost of construction would be set off by the lower<br />

cost of land and premium pricing <strong>com</strong>manded by the <strong>com</strong>pany.<br />

Exhibit 24: EBITDA margin trend<br />

(%)<br />

62<br />

61<br />

60<br />

59<br />

58<br />

57<br />

56<br />

55<br />

54<br />

53<br />

58.2<br />

60.9<br />

58.6<br />

56.0<br />

56.7<br />

FY09 FY10 FY11 FY12E FY13E<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 10

Bottomline to grow at 19.2% CAGR during FY11-FY13E<br />

Strong revenue growth and a robust EBITDA margin led to bottomline<br />

growth at 43.2% CAGR during FY09-11. We expect ORL’s bottomline to<br />

grow at 19.2% CAGR during FY11-13E, led by the strong topline growth,<br />

robust margins and no leverage on its balance sheet.<br />

We expect ORL’s bottomline to grow at 19.2% CAGR<br />

Exhibit 25: Bottomline growth trend<br />

during FY11-FY13E, led by the strong topline growth,<br />

robust margins and no leverage on its balance sheet<br />

800<br />

19.2% CAGR<br />

734.2<br />

(| crore)<br />

700<br />

600<br />

500<br />

400<br />

300<br />

252.3<br />

43.2% CAGR<br />

458.2<br />

517.2<br />

569.1<br />

200<br />

100<br />

0<br />

FY09 FY10 FY11 FY12E FY13E<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Return ratios to remain strong despite strong cash balance…<br />

Strong revenue growth and robust margins on the back of low cost of<br />

land have enabled ORL to enjoy strong return ratios historically. We<br />

expect ORL to maintain its strong return ratios (RoNW of 15-16%) on the<br />

back of healthy revenue and bottomline growth, robust margins and<br />

premium pricing that it <strong>com</strong>mands. The marginal decline in RoNW is due<br />

to the higher tax rate that ORL would have to pay on the new projects.<br />

We expect ORL to maintain its strong return ratios (RoNW<br />

Exhibit 26: Return ratios trend<br />

of 15-16%) on the back of healthy revenue and bottomline<br />

growth, robust margins and premium pricing that it<br />

<strong>com</strong>mands<br />

(%)<br />

30<br />

25<br />

20<br />

15<br />

10<br />

16.5<br />

17.5<br />

24.9<br />

24.6<br />

16.5<br />

15.4<br />

15.5<br />

20.8<br />

14.5 15.8<br />

5<br />

0<br />

FY09 FY10 FY11 FY12E FY13E<br />

RoCE<br />

RoNW<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 11

Risk & concerns<br />

Delays in execution of projects<br />

Few of the projects of ORL have faced delays due to regulatory approvals<br />

and further delays in clearances could add to the woes. In terms of<br />

delays, the Sangam City project and <strong>Oberoi</strong> Exotica are still awaiting a few<br />

clearances due to which the development has still not been taken up for<br />

the projects.<br />

<strong>Oberoi</strong> Exotica, Mulund: The land was originally declared as forest land<br />

and ordered the same in the High Court. ORL subsequently appealed<br />

against the High Court order and got relief from Supreme Court allowing<br />

the <strong>com</strong>pany to construct and create third party interest. However,<br />

Supreme Court also gave a qualification saying they need MoEF approval.<br />

The state government has applied for the MoEF approval and it is still<br />

awaited.<br />

Sangam City, Pune: The said land is in a green zone. The permission for<br />

conversion of the land from agricultural to non-agricultural use is under<br />

process and the <strong>com</strong>pany is awaiting clearance for the same.<br />

Failure to buy land at reasonable rates<br />

ORL currently enjoys a debt free balance sheet and cash balances of ~|<br />

1347 crore (as on Q2FY12) and is poised to be better placed in terms of<br />

lapping up a land buy. However, the land prices have not seen a respite.<br />

Therefore, failure to augment its land bank considering the high cost or<br />

giving in to a pricey deal could be a key risk for the <strong>com</strong>pany limiting its<br />

growth, going forward.<br />

Interest rate risk & bank regulation<br />

High inflation has led to a rate hike of 375 basis points in the last year and<br />

half by RBI. Consequently, home loan rates have gone up ~250 bps in the<br />

same period. With inflation showing no respite, the rates are expected to<br />

remain high and could keep the borrowing cost for consumers high,<br />

which discourages demand.<br />

Additionally, the RBI has also increased the risk weights for loans more<br />

than | 75 lakh and restrained lending more than 80% of the value of the<br />

home. Such a move reflects RBI’s dis<strong>com</strong>fort at the rise in residential<br />

prices. Continued regulatory tightening would mean pressure on demand<br />

and, consequently, residential prices.<br />

Exhibit 27: Series of rate hikes during last year and half<br />

9.00<br />

8.00<br />

7.00<br />

6.00<br />

5.00<br />

4.00<br />

Feb-10<br />

Mar-10<br />

Apr-10<br />

May-10<br />

Jun-10<br />

Jul-10<br />

Aug-10<br />

Sep-10<br />

Oct-10<br />

Nov-10<br />

Dec-10<br />

Jan-11<br />

Feb-11<br />

Mar-11<br />

Apr-11<br />

May-11<br />

Jun-11<br />

Jul-11<br />

Aug-11<br />

Sep-11<br />

Source: RBI, ICICIdirect.<strong>com</strong> Research<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 12

Risk of car parking FSI regulations<br />

The Maharashtra government has done away with the old FSI scheme<br />

and has introduced a new scheme wherein 40% of the unearned in<strong>com</strong>e<br />

from additional car parking FSI has to be shared with the government.<br />

ORL is awaiting clarity on the same. We highlight that we have not<br />

factored in the profit sharing <strong>com</strong>ponent and in case ORL is asked to<br />

share profit, there may be a downward risk to the NAV of new projects.<br />

Business concentrated in Mumbai region<br />

ORL has primarily focussed its development on the Mumbai region.<br />

However, we believe a sustained slowdown in volume offtake could pose<br />

a concentration risk for ORL due to its inability to expand into areas<br />

outside Mumbai.<br />

Continued oversupply in <strong>com</strong>mercial segment<br />

DTZ is anticipating new supply of 40 million sq ft in the <strong>com</strong>mercial space<br />

in the Mumbai region over the next three years vs. annual absorption of<br />

8-9 million sq ft. This oversupply may lead to a prolonged weakness in<br />

leasing and project execution, thereby limiting ORL’s <strong>com</strong>mercial<br />

segment growth.<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 13

NAV work outs to | 278/share with target price of | 242<br />

implying a discount of ~13% as we have valued Mulund<br />

and <strong>com</strong>mercial developments at a 25% discount to NAV<br />

and have not considered <strong>com</strong>mercial and retail<br />

development at Worli, Sangam city and the I-Ven property<br />

Valuation<br />

We have valued ORL on the NAV methodology as this methodology<br />

captures the true value from the entire land bank. We have considered<br />

discounting rate of 15% for valuing the projects. To value the <strong>com</strong>mercial<br />

and retail property, we have used the cap rate of 11%. Based on these<br />

assumptions, our NAV work outs to | 278/share and target price of | 242.<br />

Our target price implies a discount of 13% to our NAV as we have valued<br />

the Mulund project at a 25% discount to NAV due to regulatory delays.<br />

Additionally, we have valued <strong>com</strong>mercial developments at a discount of<br />

25% and have not incorporated <strong>com</strong>mercial and retail development at<br />

Worli, Sangam city and I-Ven property in our target price.<br />

Exhibit 28: Valuation table<br />

Location Type Status<br />

Saleable Area (<br />

in mn sq ft) NAV NAV Multiple Value (| cr) |/share<br />

Goregaon 10.4 5616.7 5141.1 157<br />

<strong>Oberoi</strong> Mall Retail Completed 0.6 711.4 1.0x 711.4 22<br />

Commerz I Commercial Completed 0.4 487.3 1.0x 487.3 15<br />

Westin Hotel Completed 0.4 403.5 1.0x 403.5 12<br />

Exquisite I Residential Ongoing 1.5 680.7 1.0x 680.7 21<br />

Exquisite II Residential Ongoing 2.0 775.1 1.0x 775.1 24<br />

Commerz II Phase I Commercial Ongoing 0.7 897.8 0.8x 673.4 21<br />

Exquisite III Residential Planned 1.7 544.2 1.0x 544.2 17<br />

Commerz II Phase II Commercial Planned 1.7 1004.8 0.8x 753.6 23<br />

<strong>Oberoi</strong> International school Ongoing 0.3<br />

Education <strong>com</strong>plex Social Infrastructure Planned 0.9 111.9 1.0 x 111.9<br />

3<br />

Hospital Planned 0.4<br />

Andheri 3.1 640.5 551.3 17<br />

<strong>Oberoi</strong> Splendor Residential Ongoing 1.3 147.2 1.0x 147.2 4<br />

<strong>Oberoi</strong> Splendor Grande Residential Ongoing 0.3 128.0 1.0x 128.0 4<br />

<strong>Oberoi</strong> Maxima Commercial Ongoing 0.3 118.0 0.8x 88.5 3<br />

<strong>Oberoi</strong> Prisma Commercial Ongoing 0.7 203.9 0.8x 152.9 5<br />

<strong>Oberoi</strong> Splendour IT park Commercial Planned 0.1 28.7 0.8x 23.0 1<br />

<strong>Oberoi</strong> Splendour school Social Infrastructre Planned 0.4 14.7 0.8x 11.7 0<br />

Worli 2.6 483.4 128.8 4<br />

Oasis Residential Residential Ongoing 1.5 161.0 0.8x 128.8 4<br />

Oasis Commercial Commercial Ongoing 0.2 88.5 0.0x 0.0 0<br />

Oasis Mall Retail Ongoing 0.1 44.8 0.0x 0.0 0<br />

Oasis Hospitality Hospital Ongoing 0.2 60.5 0.0x 0.0 0<br />

I-Ventures Residential 0.5 128.6 0.0x 0.0 0<br />

Mulund 3.2 709.6 532.2 16<br />

<strong>Oberoi</strong> Exotica I Residential Planned 1.6 386.8 0.8x 290.1 9<br />

<strong>Oberoi</strong> Exotica II Residential Planned 1.6 322.8 0.8x 242.1 7<br />

Pune 1.3 101.7 0.0 0<br />

Sangam city - Residential Residential Planned 0.8 76.7 0.0x 0.0 0<br />

Sangam city - Commercial Commercial Planned 0.3 12.7 0.0x 0.0 0<br />

Sangam city - Retail Retail Planned 0.3 12.3 0.0x 0.0 0<br />

Net cash/ (Debt) 1577 1.0x 1577.4 48<br />

Total 20.6 9129.3 0.87x 7930.7 242<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 14

Exhibit 29: NAV distribution<br />

(|)<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

18<br />

49<br />

Unlike its peers, ORL's 85% NAV is<br />

skewed over the next five years<br />

47 48<br />

130 134 149<br />

54<br />

173<br />

62<br />

85<br />

236 253<br />

91<br />

99 99 100<br />

274 275 278<br />

Operational FY12E FY13E FY14E FY15E FY16E FY17E FY18E FY19E FY20E<br />

Cumulative NAV (|) Cumulative %<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

(%)<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Exhibit 30: Target price break-up<br />

300<br />

250<br />

200<br />

20<br />

15<br />

22<br />

3<br />

48<br />

37<br />

Goregaon contributes | 171 (64%) to our NAV<br />

150<br />

278<br />

100<br />

50<br />

171<br />

242<br />

0<br />

Goregaon<br />

Andheri<br />

Worli<br />

Mulund<br />

Pune<br />

Cash<br />

NAV<br />

Discount<br />

Target Price<br />

(|)<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

ORL, with superior return ratios, a strong balance sheet and cash at its<br />

disposal, <strong>com</strong>mands a premium <strong>com</strong>pared to it peers. The sector<br />

concerns over leveraged balance sheet, corporate government issues and<br />

sluggish volume offtake have led to a sharp correction in the share price<br />

of the leading players. ORL meanwhile with its consistent performance,<br />

high disclosure and financial strength has rightly justified its premium.<br />

Exhibit 31: Peer valuation metrics<br />

Mkt Cap<br />

(| crore)<br />

EPS Price/Earnings(x) EV / EBITDA (x)<br />

Price / Book (x) RoE (%)<br />

FY11 FY12E FY13E FY11 FY12E FY13E FY11 FY12E FY13E FY11 FY12E FY13E FY11 FY12E FY13E<br />

DLF 33606 9.6 9.7 11.7 18.2 20.3 16.9 13.7 13.1 12.0 1.3 1.3 1.2 6.8 6.3 7.1<br />

ORL 7192 15.8 17.3 22.4 13.8 12.5 9.7 10.0 9.0 5.3 2.1 1.8 1.5 15.4 14.5 15.8<br />

Unitech 6288 2.2 2.1 2.7 8.8 11.3 8.9 10.0 12.8 10.2 0.6 0.5 0.5 6.7 4.7 5.8<br />

Godrej Properties 4501 18.7 20.0 32.1 39.3 32.2 20.1 62.7 28.2 16.6 5.1 4.4 3.7 13.6 14.6 20.5<br />

HDIL 2761 20.7 20.1 25.3 2.9 3.3 2.6 5.6 5.3 4.2 0.3 0.3 0.2 11.0 8.5 9.7<br />

Sobha Developer 2182 17.8 19.1 24.3 11.8 11.6 9.2 10.2 9.9 7.9 1.3 1.1 1.0 10.6 9.5 11.0<br />

Orbit Corporation 305 6.9 3.0 5.8 5.3 11.9 6.2 6.4 8.2 4.8 0.4 0.4 0.4 8.7 3.5 6.4<br />

Source: Company, ICICIdirect.<strong>com</strong> Research, Bloomberg Consensus Estimates<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 15

Key assumption & sensitivity analysis<br />

In order to derive ORL’s NAV of | 278/share and target price of |<br />

242/share, we have built up the key assumption. We discuss them below<br />

and show the sensitivity to our key assumptions.<br />

• Exhibit 30 and 31 provides the realisation and construction cost<br />

psf assumption for each of the projects along with the project<br />

<strong>com</strong>pletion assumption<br />

• We have considered the realisation and cost escalation of 5% per<br />

annum from FY13E onwards in each of the projects. Exhibit 32<br />

shows the sensitivity to these assumptions<br />

• In terms of <strong>com</strong>mercial and lease portfolio, we have considered<br />

the cap rate of 11% in order to derive NAV. Exhibit 33 shows the<br />

sensitivity to this assumption. Every 100 bps decline in the cap<br />

rate would increase our target price by ~ | 9 per share<br />

• We have considered the discount rate of 15% in order to value<br />

ORL’s land bank. Exhibit 34 shows the sensitivity to this<br />

assumption. Every 100 bps change in discount rate would impact<br />

our target price by | 4 per share<br />

Exhibit 32: Development portfolio assumptions<br />

FY2012E<br />

Realisation psf Construction cost psf Completion<br />

Exquisite I 14020 3,500 FY14E<br />

Esquire 11740 3,500 FY15E<br />

Esquire II 11740 3,500 FY17E<br />

Splendour 21875 3,500 FY12E<br />

Splendour Grande 13374 3,500 FY13E<br />

Exotica I & II 8500 3000 FY16E-FY17E<br />

<strong>Oberoi</strong> Maxima 10000 3500 FY14E<br />

<strong>Oberoi</strong> Prisma 10000 3500 FY16E<br />

<strong>Oberoi</strong> Splendour IT park 10000 3500 FY16E<br />

Oasis Residential 35000* 5000 FY19E<br />

Oasis Commercial 30000* 5000 FY19E<br />

Oasis Mall 35000* 6000 FY19E<br />

Oasis Hotel 40000* 10000 FY19E<br />

I-Ventures 45000 5741 FY18E<br />

Sangam city - Residential 6000 2000 FY17E<br />

Sangam city - Commercial 6000 2000 FY18E<br />

Sangam city - Retail 7500 2500 FY18E<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

* <strong>Oberoi</strong> has revenues share of 25%-40% in realisation in Oasis projects.<br />

Exhibit 33: Lease portfolio assumption<br />

FY2012E<br />

Lease rate pm psf Construction cost psf Completion<br />

<strong>Oberoi</strong> Mall 124 Operational<br />

Commerz I 132 Operational<br />

Commerz II Phase I 120 3500 FY13E<br />

Commerz II Phase II 120 3500 FY16E<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 16

Exhibit 34: Impact of cost escalation and realisation growth sensitivity on target price<br />

Realisation growth rate (%)<br />

242 0.0% 2.0% 5.0% 8.0% 10.0%<br />

0.0% 231 237 247 258 266<br />

2.0% 229 235 245 256 264<br />

5.0% 226 232 242 253 261<br />

8.0% 222 228 238 249 257<br />

10.0% 219 226 236 247 254<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Cost escalation (%)<br />

We have assumed a conservative cap rate of 11% for the<br />

<strong>com</strong>mercial projects. An increase/decrease of 1% in the<br />

cap rate would lead to a change in our target price to | 234<br />

and | 251 per share, respectively<br />

Exhibit 35: Impact of cap rate sensitivity for <strong>com</strong>mercial projects on target price<br />

<strong>Oberoi</strong> Mall Commerz I<br />

Commerz II<br />

Phase I<br />

Commerz II<br />

Phase II Target price<br />

8% 29.8 20.4 28.2 34.6 275<br />

9% 26.5 18.2 25.1 29.9 261<br />

10% 23.9 16.3 22.6 26.1 251<br />

11% 21.7 14.9 20.5 23.0 242<br />

12% 19.9 13.6 18.8 20.4 234<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Cap Rate<br />

Exhibit 36: Impact of discounting rate sensitivity on target price<br />

Goregaon Andheri Mulund Worli Target Price<br />

13% 161.8 17.4 17.5 4.5 249<br />

14% 159.2 17.1 16.9 4.2 245<br />

15% 156.7 16.8 16.2 3.9 242<br />

16% 154.4 16.5 15.6 3.7 238<br />

17% 152.1 16.3 15.1 3.4 235<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Discount Rate<br />

Exhibit 37: One year forward P/BV<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Nov-10 Apr-11 Sep-11<br />

CLOSE P/BV 2.5 P/BV 2 P/BV 1.5 P/BV 1 P/BV 0.5<br />

Price<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 17

Financial Snapshot<br />

Exhibit 38: Profit & loss account<br />

(| Crore) FY09 FY10 FY11 FY12E FY13E<br />

Net Sales 425.4 777.2 984.3 1,129.5 1,765.0<br />

Other Operating In<strong>com</strong>e - 12.7 11.7 12.2 13.4<br />

Total Operating In<strong>com</strong>e 425.4 789.9 996.0 1,141.7 1,778.5<br />

Other In<strong>com</strong>e 29.5 15.6 62.7 150.3 137.3<br />

Total Revenue 454.9 805.5 1,058.8 1,292.0 1,915.8<br />

Raw Material Expenses 159.6 304.3 376.6 462.4 727.3<br />

Employee Expenses 8.7 7.0 27.0 29.7 32.7<br />

Other Expenses 9.7 5.1 15.3 16.9 18.5<br />

Total Operating Expenditure 178.0 316.4 419.0 509.0 778.6<br />

EBITDA 247.4 473.4 577.0 632.7 999.9<br />

Interest 0.4 0.0 0.2 0.3 -<br />

PBDT 276.5 489.0 639.6 782.7 1,137.2<br />

Depreciation 7.3 9.1 23.7 24.0 33.2<br />

PBT 269.2 480.0 615.9 758.7 1,104.0<br />

Total Tax 17.7 22.6 98.3 189.1 369.8<br />

PAT before MI 251.5 457.4 517.6 569.6 734.2<br />

Minority Interest - - - - -<br />

PAT after MI 251.5 457.4 517.6 569.6 734.2<br />

Less: Prior Period Items (0.8) (0.8) 0.5 0.5 -<br />

PAT 252.3 458.2 517.2 569.1 734.2<br />

EPS 7.7 14.0 15.8 17.3 22.4<br />

Exhibit 39: Balance sheet<br />

(| Crore) FY09 FY10 FY11 FY12E FY13E<br />

Equity Capital 2.6 288.7 328.2 328.2 328.2<br />

Preference Capital 57.1 35.9 35.9 35.9 35.9<br />

Reserve and Surplus 1,383.5 1,539.3 2,983.4 3,552.5 4,286.7<br />

Total Shareholders funds 1,443.2 1,863.8 3,347.6 3,916.7 4,650.8<br />

Total Debt 10.7 - - - -<br />

Total Liabilities 1,453.9 1,863.8 3,347.6 3,916.7 4,650.8<br />

Assets<br />

Gross Block 283.7 325.8 799.6 1,105.6 1,105.6<br />

Less Accumulated Depreciation 9.6 18.8 41.5 65.5 98.7<br />

Net Block 274.1 307.0 758.1 1,040.1 1,006.9<br />

Capital WIP 385.1 510.1 211.0 80.0 204.6<br />

Total Fixed Assets 659.1 817.0 969.1 1,120.1 1,211.6<br />

Investments 15.0 79.0 65.0 65.0 65.0<br />

Inventory 712.2 619.4 774.2 971.6 1,132.7<br />

Debtors 27.2 40.4 46.8 53.6 83.8<br />

Loans and Advances 272.5 625.9 716.3 977.9 1,140.2<br />

Cash 166.0 360.7 1,399.3 1,512.4 1,863.1<br />

Other Current Assets 0.5 5.2 17.3 8.5 31.8<br />

Total Current Assets 1,178.4 1,651.6 2,953.8 3,524.0 4,251.6<br />

Creditors 396.2 674.5 600.2 742.7 822.1<br />

Provisions 3.1 9.7 41.0 50.7 56.1<br />

Net Current Assets 779.1 967.4 2,312.6 2,730.7 3,373.4<br />

Deferred Tax Assets 0.7 0.4 0.9 0.9 0.9<br />

Total Assets 1,453.9 1,863.8 3,347.6 3,916.7 4,650.8<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 18

Exhibit 40: Cash flow statement<br />

(| Crore) FY09 FY10 FY11 FY12E FY13E<br />

Profit after Tax 252.3 458.2 517.2 569.1 734.2<br />

Depreciation 7.3 9.1 23.7 24.0 33.2<br />

Cash Flow before working capital changes 259.6 467.2 540.9 593.1 767.3<br />

Net Increase in Current Assets (159.4) (278.5) (263.6) (457.2) (376.8)<br />

Net Increase in Current Liabilities 44.4 284.9 (43.0) 152.1 84.8<br />

Net cash flow from operating activities 144.6 473.6 234.3 288.1 475.3<br />

(Purchase)/Sale of Fixed Assets (230.1) (167.0) (175.7) (175.0) (124.6)<br />

Net Cash flow from Investing Activities 137.6 (230.7) (162.2) (175.0) (124.6)<br />

Inc / (Dec) in Equity Capital - 286.1 39.6 - -<br />

Inc / (Dec) in Loan Funds (110.1) (0.0) - - -<br />

Inc / (Dec) in Loan Funds (22.7) (10.7) - - -<br />

Net Cash flow from Financing Activities (162.2) (48.2) 966.5 - -<br />

Net Cash flow 120.1 194.7 1,038.6 113.1 350.7<br />

Cash and Cash Equivalent at the beginning 45.9 166.0 360.7 1,399.3 1,512.4<br />

Closing Cash/ Cash Equivalent 166.0 360.7 1,399.3 1,512.4 1,863.1<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Exhibit 41: DuPont analysis<br />

(%) FY09 FY10 FY11 FY12E FY13E<br />

PAT/PBT 93.7 95.5 84.0 75.0 66.5<br />

PBT/EBIT 112.1 103.4 111.3 124.6 114.2<br />

EBIT/Sales 56.4 59.8 56.2 53.9 54.8<br />

Sales/Asset 29.3 41.7 29.4 28.8 38.0<br />

Asset/Equity 100.7 100.0 100.0 100.0 100.0<br />

ROE 17.5 24.6 15.4 14.5 15.8<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Exhibit 42: Key ratios<br />

FY09 FY10 FY11 FY12E FY13E<br />

Per Share Data (|)<br />

EPS 7.7 14.0 15.8 17.3 22.4<br />

Cash EPS 7.9 14.2 16.5 18.1 23.4<br />

BV 44.0 56.8 102.0 119.3 141.7<br />

Operating profit per share 7.5 14.4 17.6 19.3 30.5<br />

Operating Ratios (%)<br />

EBITDA / Total Operating In<strong>com</strong>e 58.2 59.9 57.9 55.4 56.2<br />

PAT / Total Operating In<strong>com</strong>e 59.3 58.0 51.9 49.8 41.3<br />

Return Ratios (%)<br />

RoE 17.5 24.6 15.4 14.5 15.8<br />

RoCE 16.5 24.9 16.5 15.5 20.8<br />

RoIC 17.4 29.4 23.9 19.0 23.1<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 19

Exhibit 43: Key ratios<br />

FY09 FY10 FY11 FY12E FY13E<br />

Valuation Ratios (x)<br />

EV / EBITDA 28.4 14.4 10.0 9.0 5.3<br />

P/E 28.2 15.5 13.8 12.5 9.7<br />

EV / Net Sales 16.5 8.8 5.9 5.0 3.0<br />

Sales / Equity 0.3 0.4 0.3 0.3 0.4<br />

Market Cap / Sales 16.9 9.3 7.3 6.4 4.1<br />

Price to Book Value 4.9 3.8 2.1 1.8 1.5<br />

Turnover Ratios (x)<br />

Asset turnover 0.3 0.5 0.4 0.3 0.4<br />

Debtors Turnover Ratio 15.7 19.2 21.1 21.1 21.1<br />

Creditors Turnover Ratio 1.1 1.2 1.6 1.5 2.1<br />

Solvency Ratios (x)<br />

Debt / Equity 0.0 - - - -<br />

Current Ratio 3.0 2.4 4.6 4.4 4.8<br />

Quick Ratio 2.5 1.9 2.4 2.5 2.7<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 20

Appendix<br />

Land bank details<br />

Exhibit 44: Residential projects details<br />

Saleable Area ( Area sold/ booked for sale<br />

Project Name Location Status<br />

sq ft)<br />

(sq ft)<br />

<strong>Oberoi</strong> Splendor Andheri (E) Ongoing 1,279,152 1,192,296<br />

<strong>Oberoi</strong> Exquisite Goregaon (E) Ongoing 1,506,810 772,570<br />

<strong>Oberoi</strong> Splendor Grande Andheri (E) Ongoing 283,920 109,200<br />

<strong>Oberoi</strong> Esquire Goregaon (E) Ongoing 1,970,530 439,860<br />

Oasis - Residential Worli Ongoing 1,541,738 -<br />

<strong>Oberoi</strong> Exotica I Mulund (W) Planned 1,619,800 -<br />

<strong>Oberoi</strong> Exotica II Mulund (W) Planned 1,581,580 -<br />

<strong>Oberoi</strong> Esquire II Goregaon (E) Planned 1,678,600 -<br />

Sangam City Pune Planned 773,951 -<br />

Total Residential 12,236,081<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Exhibit 45: Retail projects details<br />

Saleable Area ( Area sold/leased<br />

sq ft) (in sq ft)<br />

Rev per sqft./month<br />

on area leased (|)<br />

Project Name Location Status<br />

<strong>Oberoi</strong> Mall Goregaon (E) Operational 552,893 520,671 127<br />

Oasis - Mall Worli Ongoing 121,095 -<br />

Sangam city -Retail Pune Planned 279,939 -<br />

Total Retail 953,927<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Exhibit 46: Commercial projects details<br />

Project Name Location Status<br />

Saleable Area (<br />

sq ft)<br />

Area<br />

sold/leased (sq<br />

ft)<br />

Rev per<br />

sqft./month on<br />

area leased (|)<br />

Commerz I Goregaon (E) Operational 364,888 275855 132<br />

Commerz II Phase I Goregaon (E) Ongoing 725,769 -<br />

Commerz II Phase II Goregaon (E) Ongoing 1,661,650 -<br />

Oasis - Commercial Worli Ongoing 242,190 -<br />

<strong>Oberoi</strong> Splendor - Maxima Andheri (E) Ongoing 318,804 -<br />

<strong>Oberoi</strong> Splendor IT Tower Andheri (E) Planned 93,873 -<br />

<strong>Oberoi</strong> Splendor Prisma Andheri (E) Ongoing 711,577 -<br />

Sangam City - Commercial Pune Planned 279,939 -<br />

Total Office space 4,398,690<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Exhibit 47: Hospitality projects details<br />

Project Name Location Status Saleable Area ( sq ft) No of rooms<br />

The Westin Mumbai Goregaon (E) Completed 381,820 269<br />

Oasis - Hotel Worli Ongoing 215,280 125<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 21

Appendix<br />

ORL offers quality play on Mumbai <strong>Realty</strong>…<br />

ORL is an established brand name with a strong track record of<br />

development in the suburbs of Mumbai offering premium residential and<br />

<strong>com</strong>mercial properties. The brand name of the <strong>com</strong>pany is reflected in<br />

the premium pricing and the offtake in its product offerings. ORL is known<br />

for its diversified offering. Most of its development plans also include<br />

<strong>com</strong>mercial and retail development along with residential offerings<br />

making it an attractive proposition for customers. The <strong>com</strong>pany has a<br />

strong presence in the Mumbai market with projects in Mumbai (Worli)<br />

and its suburbs (Goregaon, Andheri [East and West] and Mulund).<br />

The quality and timeliness in execution of ORL is also ensured given the<br />

fact that all ongoing projects are contracted to L&T, which has a strong<br />

execution record with high specifications. The <strong>com</strong>pany has also played<br />

the cycle well as it has acquired most of its land by 2005 before prices<br />

started spiralling up in the Mumbai market. The management has also not<br />

gone overboard in buying land at premium prices.<br />

Exhibit 48: Segment-wise developable area break-up (%)<br />

10.6%<br />

5.1%<br />

3.2% 59.6%<br />

21.6%<br />

Residential Office space Retail Hospitality Social Infrastructure<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

ORL currently has five development projects under its portfolio. Out of the<br />

same three projects (Goregaon, Andheri [East] and Worli) are ongoing,<br />

which are under construction while two projects (Mulund and Sangam<br />

City, Pune) have been planned and are awaiting a few clearances.<br />

ORL currently has five development projects under its<br />

portfolio<br />

Key projects summary<br />

<strong>Oberoi</strong> Garden City – Goregaon, Mumbai<br />

It is an integrated development on ~ 84 acres of land in Goregaon in the<br />

western suburbs of Mumbai, adjacent to the Western Express Highway.<br />

The project at <strong>Oberoi</strong> Garden City involves mixed-use development of<br />

residential, office, retail, hotel and school projects. The <strong>com</strong>pany has so<br />

far <strong>com</strong>pleted <strong>Oberoi</strong> Woods (saleable area – 598200 sq ft) in the<br />

residential space, Commerz I (saleable/leasable area – 364888 sq ft) in the<br />

<strong>com</strong>mercial space, <strong>Oberoi</strong> Mall (saleable/leasable area – 552893 sq ft) in<br />

the retail space, Westin Hotel in the hospitality space and a school as<br />

social infrastructure.<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 22

Exhibit 49: <strong>Oberoi</strong> Garden City project details<br />

Project Type Status Area (sq ft)<br />

Rehabilitation Project Residential Completed 56,794<br />

<strong>Oberoi</strong> Woods Residential Completed 598,200<br />

<strong>Oberoi</strong> Seven Residential Completed 39,550<br />

<strong>Oberoi</strong> Esquire Residential Ongoing 1,970,530<br />

<strong>Oberoi</strong> Esquire II Residential Planned 1,678,600<br />

Commerz I Commercial Operational 364,888<br />

Commerz II Phase I Commercial Ongoing 725,769<br />

Commerz II Phase II Commercial Ongoing 1,661,650<br />

<strong>Oberoi</strong> Mall Retail Operational 552,893<br />

The Westin Mumbai Hospitality Completed 381,820<br />

<strong>Oberoi</strong> International School Social Infrastructure Completed 305,309<br />

Education <strong>com</strong>plex Social Infrastructure Planned 866,130<br />

Hospital Social Infrastructure Planned 375,481<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

<strong>Oberoi</strong> Splendor – Andheri (East), Mumbai<br />

While all residential projects in <strong>Oberoi</strong> Splendor have<br />

already been launched, three <strong>com</strong>mercial projects are still<br />

to be launched<br />

<strong>Oberoi</strong> Splendor is a mixed-use development <strong>com</strong>prising residential,<br />

office and social infrastructure projects. ORL is close to <strong>com</strong>pletion of<br />

<strong>Oberoi</strong> Splendor and has launched Splendor Grande (residential) and<br />

Splendor-Maxima (<strong>com</strong>mercial) projects.<br />

Exhibit 50: <strong>Oberoi</strong> Splendor project details<br />

Project Type Status Area (sq ft)<br />

<strong>Oberoi</strong> Splendor Residential Ongoing 1,279,152<br />

<strong>Oberoi</strong> Splendor Grande Residential Ongoing 283,920<br />

<strong>Oberoi</strong> Splendor - Maxima Commercial Ongoing 318,804<br />

<strong>Oberoi</strong> Splendor IT Tower Commercial Planned 93,873<br />

<strong>Oberoi</strong> Splendor Prisma Commercial Ongoing 711,577<br />

<strong>Oberoi</strong> Splendour - School Social Infrastructure Planned 430,990<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Oasis <strong>Realty</strong> – Worli, Mumbai<br />

Oasis <strong>Realty</strong> is a JV between OCPL (subsidiary of ORL), Skylark Build and<br />

Shree Vrunda Enterprises to develop a mixed-use development of ~2.1<br />

msf of saleable area in Worli. As a JV partner, OCPL will be responsible<br />

for developing the free-sale portion arising from the slum redevelopment<br />

project being undertaken on the property. The rehabilitation <strong>com</strong>ponent<br />

of the slum redevelopment project is the responsibility of the other JV<br />

partners.<br />

For the residential, office space and retail <strong>com</strong>ponents of the<br />

development, the share of net revenues has been calculated on the basis<br />

of the sale price per sq ft according to a graded scale, pursuant to which<br />

OCPL will receive 25-40% of net revenues depending on the sale price per<br />

sq ft of each premises. For the hospitality <strong>com</strong>ponent, OCPL will receive a<br />

36.25% share of net revenues, provided that construction of the hotel<br />

premises is performed by OCPL.<br />

Exhibit 51: Oasis <strong>Realty</strong> (Worli) project details<br />

Project Type Status Area (sq ft)<br />

Oasis - Residential Residential Ongoing 1,541,738<br />

Oasis - Commercial Commercial Ongoing 242,190<br />

Oasis - Mall Retail Ongoing 121,095<br />

Oasis - Hotel Hospitality Ongoing 215,280<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 23

<strong>Oberoi</strong> Exotica – Mulund (West), Mumbai<br />

The <strong>com</strong>pany plans to develop 3.2 msf of residential space over two<br />

phases on 18.8 acres of land. The land acquired in 2005 from<br />

GlaxoSmithKline has faced regulatory hurdles and is awaiting MoEF<br />

approval. The land was originally declared as forest land and ordered the<br />

same in the High Court. Subsequently, ORL appealed against the High<br />

Court order and got relief from the Supreme Court allowing ORL to<br />

construct and create third-party interest. However, the Supreme Court<br />

also gave a qualification saying they need MoEF approval, which the state<br />

government needs to apply for. The state government has applied for the<br />

MoEF approval and it is still awaited.<br />

Exhibit 52: <strong>Oberoi</strong> Exotica project details<br />

Project Type Status Area (sq ft)<br />

<strong>Oberoi</strong> Exotica I Residential Planned 1,619,800<br />

<strong>Oberoi</strong> Exotica II Residential Planned 1,581,580<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

Sangam City -Pune<br />

ORL holds 31.67% interest in Sangam City Project. The Sangam City<br />

Township has entered into agreements to acquire development rights<br />

with respect to ~65 acres of land, which will be developed as a mixed use<br />

development, <strong>com</strong>prising residential, office space and retail <strong>com</strong>ponents<br />

in the Sangamwadi area of Pune. The permission for conversion of the<br />

land from agricultural to non-agricultural use is under process and the<br />

<strong>com</strong>pany is awaiting clearance for the same.<br />

Exhibit 53: Sangam City project details<br />

Project Type Status Area (sq ft)<br />

Sangam City Residential Planned 773,951<br />

Sangam City - Commercial Commercial Planned 279,939<br />

Sangam city -Retail Retail Planned 279,939<br />

Source: Company, ICICIdirect.<strong>com</strong> Research<br />

ICICI Securities Ltd | Retail Equity Research<br />

Page 24

RATING RATIONALE<br />

ICICIdirect.<strong>com</strong> endeavours to provide objective opinions and re<strong>com</strong>mendations. ICICIdirect.<strong>com</strong> assigns<br />

ratings to its stocks according to their notional target price vs. current market price and then categorises them<br />

as Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the notional<br />

target price is defined as the analysts' valuation for a stock.<br />

Strong Buy: >15%/20% for large caps / midcaps, respectively, with high conviction;<br />

Buy: >10%/15% for large caps / midcaps, respectively;<br />

Hold: Up to +/-10%;<br />

Sell: -10% or more;<br />

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.<strong>com</strong><br />

ICICIdirect.<strong>com</strong> Research Desk,<br />

ICICI Securities Limited,<br />

1 st Floor, Akruti Trade Centre,<br />

Road No. 7, MIDC,<br />

Andheri (East)<br />

Mumbai – 400 093<br />

research@icicidirect.<strong>com</strong><br />

ANALYST CERTIFICATION<br />

We /I, Deepak Purswani, CFA, PGDM (FINANCE) Bhupendra Tiwary MBA (FINANCE) research analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this<br />

research report accurately reflect our personal views about any and all of the subject issuer(s) or securities. We also certify that no part of our <strong>com</strong>pensation was, is, or will be directly or indirectly related to<br />

the specific re<strong>com</strong>mendation(s) or view(s) in this report. Analysts aren't registered as research analysts by FINRA and might not be an associated person of the ICICI Securities Inc.<br />

Disclosures:<br />

ICICI Securities Limited (ICICI Securities) and its affiliates are a full-service, integrated investment banking, investment management and brokerage and financing group. We along with affiliates are leading<br />

underwriter of securities and participate in virtually all securities trading markets in India. We and our affiliates have investment banking and other business relationship with a significant percentage of<br />

<strong>com</strong>panies covered by our Investment Research Department. Our research professionals provide important input into our investment banking and other business selection processes. ICICI Securities<br />

generally prohibits its analysts, persons reporting to analysts and their dependent family members from maintaining a financial interest in the securities or derivatives of any <strong>com</strong>panies that the analysts<br />

cover.<br />

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and<br />

meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without<br />

prior written consent of ICICI Securities. While we would endeavour to update the information herein on reasonable basis, ICICI Securities, its subsidiaries and associated <strong>com</strong>panies, their directors and<br />

employees (“ICICI Securities and affiliates”) are under no obligation to update or keep the information current. Also, there may be regulatory, <strong>com</strong>pliance or other reasons that may prevent ICICI Securities<br />

from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in <strong>com</strong>pliance with applicable regulations and/or ICICI Securities<br />

policies, in circumstances where ICICI Securities is acting in an advisory capacity to this <strong>com</strong>pany, or in certain other circumstances.<br />

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or <strong>com</strong>pleteness guaranteed. This<br />

report and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial<br />

instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their<br />