Company Update Dr. Reddy's Lab - Myiris.com - Personal finance ...

Company Update Dr. Reddy's Lab - Myiris.com - Personal finance ...

Company Update Dr. Reddy's Lab - Myiris.com - Personal finance ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

where great minds meet<br />

PHARMA<br />

CONFLUENCE<br />

Date : 18th Nov. 2011<br />

RESEARCH<br />

ANALYSTS<br />

Deepak Malik<br />

Senior Research Analyst<br />

Deepak.Malik@emkayglobal.<strong>com</strong><br />

022 66121257<br />

Ashish Thavkar<br />

Research Associate<br />

Ashish.Thavkar@emkayglobal.<strong>com</strong><br />

022 66121254<br />

Bhavita Nagrani<br />

Research Associate<br />

bhavita.nagrani@emkayglobal.<strong>com</strong><br />

022 66242486

Contents<br />

Confluence: Pharma; Pre-conference note<br />

Ajanta Pharma 3<br />

Biocon 9<br />

<strong>Dr</strong>. Reddy’s <strong>Lab</strong> 13<br />

Elder Pharma 19<br />

Glenmark Pharma 23<br />

Ipca <strong>Lab</strong>s 29<br />

Jubilant Life Sciences 35<br />

Sun Pharma 41<br />

Vivimed <strong>Lab</strong>s 49<br />

Emkay Research 16 November 2011 2

November 16, 2011<br />

Reco<br />

Not Rated<br />

CMP<br />

Rs322<br />

Target Price<br />

NA<br />

EPS change FY11E/12E (%) NA<br />

Target Price change (%) NA<br />

Nifty 5,030<br />

Sensex 16,756<br />

Price Performance<br />

(%) 1M 3M 6M 12M<br />

Absolute 1 1 12 32<br />

Rel. to Nifty 3 1 22 57<br />

Source: Bloomberg<br />

Relative Price Chart<br />

375<br />

330<br />

285<br />

240<br />

195<br />

Rs<br />

150<br />

Nov-10 Jan-11 Mar-11 May-11 Jul-11 Sep-11<br />

Source: Bloomberg<br />

Ajanta Pharma (LHS) Rel to Nifty (RHS)<br />

Stock Details<br />

Sector Pharmaceuticals<br />

Bloomberg AJP@IN<br />

Equity Capital (Rs mn) 117<br />

Face Value(Rs) 10<br />

No of shares o/s (mn) 12<br />

52 Week H/L 369/171<br />

Market Cap (Rs bn/USD mn) 4/79<br />

Daily Avg Volume (No of sh) 29620<br />

Daily Avg Turnover (US$mn) 0.2<br />

Shareholding Pattern (%)<br />

%<br />

80<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

Sep-11 Jun-10 Mar-10<br />

Promoters 66.8 66.8 66.8<br />

FII/NRI 0.3 0.5 1.0<br />

Institutions 0.0 0.0 0.0<br />

Private Corp 6.1 6.3 5.7<br />

Public 26.8 26.4 26.4<br />

Source: Capitaline<br />

Deepak Malik<br />

Deepak.malik@emkayglobal.<strong>com</strong><br />

+91 22 6612 1257<br />

Ashish Thavkar<br />

ashish.thavkar@emkayglobal.<strong>com</strong><br />

+91 22 6612 1254<br />

Bhavita Nagrani<br />

bhavita.nagrani@emkayglobal.<strong>com</strong><br />

+91 22 6624 2486<br />

Ajanta Pharma<br />

Pure Branded Play – Ideal candidate for re-rating<br />

� Focus on branded generics in the domestic and the exports<br />

emerging market. Gearing for entry into the regulated market<br />

of US<br />

� Higher thrust on domestic business by launching 10-12 new<br />

products & 10-15 line extensions per year to fuel 16-18%<br />

growth in domestic business over the next 2-3 years<br />

� RoE of 24.5x, RoIC of 19.4x, asset turnover of 1.2x and working<br />

capital position of 171 days provide <strong>com</strong>fort to investors<br />

� With pure branded profile, 15-18% sales CAGR going forward<br />

and entry into regulated market through capacity expansion<br />

makes it an ideal candidate for re-rating<br />

Domestic business – On a steady growth track<br />

In the Indian market Ajanta ranks 63 rd with sales growing at 27% CAGR over FY06-11<br />

on back of strong foothold in Opthalmology (FY06-11 sales CAGR - 35%), Dermatology<br />

(FY06-11 sales CAGR - 57%) and Cardiology (FY06-11 sales CAGR - 34%).<br />

� In the Opthal segment, the <strong>com</strong>pany has 30 brands with 9 of them in the top 5<br />

rankings. In the Derma segment, the <strong>com</strong>pany has 24 brands & 5 brands stand in<br />

top 4 rankings. In the Cardio segment, the <strong>com</strong>pany 8 brands with 3 in top 10.<br />

� 70-75% of the domestic sales are through prescriptions and the rest are tender<br />

based sales. The <strong>com</strong>pany has reduced its exposure to tender based sales (5% in<br />

FY11 vis-à-vis 23% in FY07) as a result of which EBITDA margins have expanded<br />

by 386bps to 19.1% over the same period.<br />

� With a total field force of over 2400 MRs, the management has guided for 16-18%<br />

CAGR growth from this geography over FY11-13E, driven by 10-12 new product<br />

launches, line extensions and therapy expansions.<br />

Exports – Focus on Asia/ Africa and capacity expansion to drive growth<br />

� During FY11, exports business contributed 63% of the total sales with Asia/ Africa<br />

collectively contributing 95% to the export revenues and remaining from the LatAM.<br />

� In African markets, the <strong>com</strong>pany derives 50:50 revenues from Anglo and French<br />

African markets. Going ahead, we expect margins in exports segment to expand as<br />

the <strong>com</strong>pany has deliberately reduced its focus on tender business in Afirca (16%<br />

contri to exports in FY11) and has not bidden for any of the WHO tenders.<br />

� The <strong>com</strong>pany has planned a capex of Rs1-1.25bn over FY13-14E in order to target<br />

the regulated market of US. Majority of the capex will be towards setting-up of<br />

manufacturing unit. The <strong>com</strong>pany anticipates 10-12 ANDA filings going ahead,<br />

which is evident from increased R&D spend of 4.5%. The <strong>com</strong>pany has 2 ANDAs<br />

approved and has filed for 3 more approvals.<br />

Valuations<br />

At CMP, Ajanta trades at 7.2x FY11E EPS and 5.7x FY11 EV/EBITDA. During FY07-11,<br />

sales have grown at a CAGR of 18%, EBITDA at 25% and PAT at 36% with EBITDA<br />

and PAT margin expanding by 368bps and 436bps to 19% and 10%, respectively.<br />

Although we do not have a formal rating on the stock, we are positively biased.<br />

Financials Rs mn<br />

YE- Net EBITDA EPS EPS RoE EV/<br />

Mar Sales (Core) (%) APAT (Rs) % chg (%) P/E EBITDA P/BV<br />

FY08 3,092 514 16.6 225 18.9 53.6 18.0 16.9 10.7 2.8<br />

FY09 3,492 651 18.6 254 21.4 13.1 17.4 15.0 9.6 2.4<br />

FY10 4,091 786 19.2 340 28.8 34.4 19.9 11.1 7.6 2.1<br />

FY11 5,049 963 19.1 507 43.0 49.2 24.5 7.5 5.8 1.7<br />

Emkay Global Financial Services Ltd 3<br />

<strong>Company</strong> <strong>Update</strong>

Key Financials – Quarterly<br />

Ajanta Pharma Confluence: Pharma; Pre-conference note<br />

<strong>Company</strong> Description<br />

Ajanta Pharma is a specialty pharma formulation <strong>com</strong>pany, having leading brands in the<br />

therapeutic segments of Ophthalmology, Dermatology and Cardiology. Many of the<br />

<strong>com</strong>pany's products are leading in their sub therapeutic segments. Ajanta Pharma’s<br />

business model is undergoing <strong>com</strong>plete business transformation from being an emerging<br />

market focused <strong>com</strong>pany to gearing up for entry into regulated market and defocusing on<br />

tender based business.<br />

The <strong>com</strong>pany has its R&D facility located at Kandivali Mumbai, with more than 200<br />

scientists working for formulation development and has four manufacturing facilities -<br />

located in India and one in Mauritius. The Aurangabad facility is approved by USFDA,<br />

UKMHRA and World health organisation (WHO).<br />

Rs mn Q2FY11 Q3FY11 Q4FY11 Q1FY12 Q2FY12 YoY (%) QoQ (%)<br />

Revenue 1,125 1,205 1,258 1,273 1,351 20.1 6.1<br />

Expenditure 916 977 979 1,060 1,119 22.2 5.5<br />

as % of sales 81.4 81.1 77.8 83.3 82.8<br />

Consumption of RM 411 544 454 418 430 4.5 2.9<br />

as % of sales 36.6 45.2 36.0 32.8 31.8<br />

Employee Cost 138 148 171 181 179 29.2 (1.3)<br />

as % of sales 12.3 12.2 13.6 14.2 13.2<br />

Other expenditure 366 285 354 462 511 39.4 10.6<br />

as % of sales 32.6 23.7 28.1 36.3 37.8<br />

Forex loss/gain 20 60<br />

EBITDA 209 228 280 213 232 11.0 9.1<br />

Adj. EBITDA 229 228 280 213 292 27.5 -<br />

Depreciation 59 62 65 66 76 29.3 14.8<br />

EBIT 150 166 214 146 156 3.8 6.5<br />

Other In<strong>com</strong>e 4 7 4 18 2 (32.9) (86.4)<br />

Interest 44 35 35 28 34 (22.5)<br />

PBT 110 138 183 136 125 13.0 (8.1)<br />

Total Tax 10 18 9 10 6 (37.4) (40.8)<br />

Reported PAT 101 119 175 125 119 17.9 (5.4)<br />

(Profit)/loss from JV's/Ass/MI 0 0 0 0 0<br />

APAT after MI 101 119 175 125 119 17.9 (5.4)<br />

Extra ordinary items 0 0 0 0 0<br />

Reported PAT 101 119 175 125 119 17.9 (5.4)<br />

Adj. PAT 119 119 175 125 176 47.9 40.1<br />

AEPS 10.1 10.1 14.8 10.6 14.9 47.9 40.1<br />

Margins (%) (bps) (bps)<br />

EBIDTA 18.6 18.9 22.2 16.7 17.2 -141 47<br />

Adj. EBITDA 20.4 18.9 22.2 16.7 21.6 125 491<br />

EBIT 13.3 13.7 17.0 11.5 11.5 -181 4<br />

EBT 9.8 11.4 14.6 10.7 9.2 -58 -143<br />

PAT 8.9 9.9 13.9 9.8 8.8 -16 -107<br />

Adj. PAT 10.6 9.9 13.9 9.8 13.0 244 315<br />

Effective Tax rate 8.8 13.4 4.8 7.6 4.9 (394) (270)<br />

Emkay Research 16 November 2011 4

Detailed Revenue Break-Up<br />

Ajanta Pharma Confluence: Pharma; Pre-conference note<br />

Rs mn FY07 FY08 YoY % FY09 YoY % FY10 YoY % FY11 YoY %<br />

Domestic 1234 1473 19.4 1377 -6.5 1510 9.7 1749 15.8<br />

% to Sales 46.3 46.6 39.1 36.8 34.3<br />

Branded 630 840 33.3 1030 22.6 1150 11.7 1480 28.7<br />

% to Sales 23.6 26.6 29.2 28.0 29.0<br />

Ophthalmology 160 220 37.5 260 18.2 340 30.8 408 20.0<br />

% to Sales 6.0 7.0 7.4 8.3 8.0<br />

Dermatology 120 180 50.0 250 38.9 310 24.0 470 51.6<br />

% to Sales 4.5 5.7 7.1 7.5 9.2<br />

Cardiology 170 240 41.2 300 25.0 350 16.7 390 11.4<br />

% to Sales 6.4 7.6 8.5 8.5 7.6<br />

Others 180 200 11.1 220 10.0 150 -31.8 212 41.3<br />

% to Sales 6.8 6.3 6.2 3.7 4.2<br />

Tender Sales 604 633 4.8 347 -45.2 360 3.7 269 -25.3<br />

% to Sales 22.7 20.0 9.8 8.8 5.3<br />

Exports 1431 1686 17.8 2147 27.3 2598 21.0 3350 28.9<br />

% to Sales 53.7 53.4 60.9 63.2 65.7<br />

Mauritius subsidiary 193 242 25.4 299 23.6 258 -13.7 478 85.3<br />

% to Sales 7.2 7.7 8.5 6.3 9.4<br />

Other EM’s 1238 1444 16.6 1848 28.0 2340 26.6 2872 22.7<br />

% to Sales 46.5 45.7 52.4 57.0 56.3<br />

Gross Sales 2665 3159 18.5 3524 11.6 4108 16.6 5099 24.1<br />

Emkay Research 16 November 2011 5

Financials<br />

Ajanta Pharma Confluence: Pharma; Pre-conference note<br />

In<strong>com</strong>e Statement (Rs. mn) Balance Sheet (Rs. mn)<br />

(Year Ending Mar 31) FY08 FY09 FY10 FY11 (Year Ending Mar 31) FY08 FY09 FY10 FY11<br />

Net Sales 3,092 3,492 4,091 5,049 Share Capital 118 118 118 118<br />

Growth (%) 20 13 17 23 Reserves & Surplus 1,231 1,453 1,731 2,170<br />

Other In<strong>com</strong>e 15 25 11 28 Networth 1,349 1,571 1,849 2,288<br />

Total In<strong>com</strong>e 3,107 3,517 4,102 5,077 Minority Interest 3 0 0 0<br />

Expenditure 2,578 2,841 3,306 4,086 Secured Loans 1,414 2,109 2,062 1,593<br />

Raw Materials 1,402 1,271 1,398 1,729 Unsecured Loans 322 394 218 314<br />

Employee Cost 305 427 478 637 Loan funds 1,735 2,502 2,280 1,906<br />

Other Expenses 165 194 304 266 Net Deferred Tax -29 6 53 109<br />

Selling and Admin Expenses 707 950 1,126 1,454 Total Liabilities 3,058 4,079 4,182 4,304<br />

Operating Profit 514 651 786 963<br />

EBITDA Margin (%) 16.6 18.6 19.2 19.1 Gross Block 1,416 1,925 2,426 3,132<br />

Depreciation 79 142 207 247 Less: Acc. Depreciation 398 542 741 991<br />

EBIT 435 509 578 716 Net Block 1,018 1,383 1,685 2,140<br />

EBIT margin (%) 14.1 14.6 14.1 14.2 Capital Work in Progress 239 552 470 172<br />

Interest 161 236 202 178 Investments 85 85 85 85<br />

Profit Before Tax 289 298 388 566 Current Assets 2,228 2,573 2,712 2,825<br />

Tax 0 0 1 2 Inventories 928 1,039 1,196 1,131<br />

Fringe Benefit Tax 8 9 0 0 Sundry Debtors 868 1,001 967 1,040<br />

Deferred Tax 60 35 47 57 Cash and Bank 58 81 148 148<br />

Net Profit 220 254 340 507 Loans and Advances 375 452 400 506<br />

Minority Interest (after tax) 2 0 0 0 Current Liab and Prov 512 513 769 918<br />

Profit after Min. Int. 219 254 340 507 Current Liabilities 426 455 693 809<br />

Extraordinary Items -6 0 0 0 Provisions 86 57 76 109<br />

Adjusted Net Profit 225 254 340 507 Net Current Assets 1,716 2,060 1,942 1,907<br />

Net margin (%) 7.3 7.3 8.3 10.0 Total Assets 3,058 4,079 4,182 4,304<br />

Cash Flow (Rs. mn) Key Ratios<br />

(Year Ending Mar 31) FY08 FY09 FY10 FY11 (Year Ending Mar 31) FY08 FY09 FY10 FY11<br />

Opening Cash 75 58 81 148 Profitability (%)<br />

Net Cash from Operations 191 346 951 1,006 EBITDA Margin 16.6 18.6 19.2 19.1<br />

Net Cash Used in Investing -591 -819 -427 -405 Net Margin 7.3 7.3 8.3 10.0<br />

Net Cash Used in Financing 384 497 -457 -601 ROCE 16.4 14.3 14.0 16.9<br />

Net Inc/(Dec) in Cash -17 23 68 -1 ROE 18.0 17.4 19.9 24.5<br />

Closing Cash 58 81 148 148 ROIC 18.8 16.8 16.9 19.4<br />

Per Share Data (Rs)<br />

EPS 18.9 21.4 28.8 43.0<br />

CEPS 25.6 33.4 46.1 63.6<br />

BVPS 113.7 132.5 155.9 192.9<br />

DPS 2.5 2.5 3.4 4.9<br />

Valuations (x)<br />

PER 16.4 14.5 10.8 7.2<br />

P/CEPS 12.2 9.3 6.7 4.9<br />

P/BV 2.7 2.3 2.0 1.6<br />

EV / Sales 1.7 1.7 1.4 1.1<br />

EV / EBITDA 10.5 9.4 7.4 5.7<br />

Dividend Yield (%) 0.8 0.8 1.1 1.6<br />

Gearing Ratio (x)<br />

Net Debt/ Equity 1.2 1.5 1.2 0.8<br />

Net Debt/EBIDTA 3.3 3.7 2.7 1.8<br />

Source: Capitaline<br />

Emkay Research 16 November 2011 6

Notes<br />

Ajanta Pharma Confluence: Pharma; Pre-conference note<br />

Emkay Research 16 November 2011 7

Notes<br />

Ajanta Pharma Confluence: Pharma; Pre-conference note<br />

Emkay Research 16 November 2011 8

November 17, 2011<br />

Reco<br />

Not Rated<br />

CMP<br />

Rs332<br />

Target Price<br />

NA<br />

EPS change FY11E/12E (%) NA<br />

Target Price change (%) NA<br />

Nifty<br />

5,030<br />

Sensex<br />

16,756<br />

Price Performance<br />

(%) 1M 3M 6M 12M<br />

Absolute (8) (2) (11) (20)<br />

Rel. to Nifty (6) (2) (3) (5)<br />

Source: Bloomberg<br />

Relative Price Chart<br />

450<br />

420<br />

390<br />

360<br />

330<br />

Rs<br />

300<br />

Nov-10 Jan-11 Mar-11 May-11 Jul-11 Sep-11<br />

Source: Bloomberg<br />

Biocon (LHS) Rel to Nifty (RHS)<br />

Stock Details<br />

Sector Pharmaceuticals<br />

Bloomberg BIOS@IN<br />

Equity Capital (Rs mn) 1000<br />

Face Value(Rs) 5<br />

No of shares o/s (mn) 200<br />

52 Week H/L 430/301<br />

Market Cap (Rs bn/USD mn)<br />

%<br />

10<br />

4<br />

-2<br />

-8<br />

-14<br />

-20<br />

66/1389<br />

Daily Avg Volume (No of sh) 242685<br />

Daily Avg Turnover (US$mn) 1.7<br />

Shareholding Pattern (%)<br />

Sep-11 Jun-11 Mar-11<br />

Promoters 60.9 60.9 60.9<br />

FII/NRI 6.9 6.2 5.5<br />

Institutions 11.1 11.3 10.9<br />

Private Corp 3.7 4.0 5.2<br />

Public 17.5 17.7 17.6<br />

Source: Capitaline<br />

Deepak Malik<br />

Deepak.malik@emkayglobal.<strong>com</strong><br />

+91 22 6612 1257<br />

Ashish Thavkar<br />

ashish.thavkar@emkayglobal.<strong>com</strong><br />

+91 22 6612 1254<br />

Bhavita Nagrani<br />

bhavita.nagrani@emkayglobal.<strong>com</strong><br />

+91 22 6624 2486<br />

Biocon<br />

Multiple growth drivers<br />

� Ramp in supply of Fidaxomicin API to US partner Optimer and<br />

insulin to Pfizer would strengthen Biocon's revenues as well<br />

as profitability in H2FY12<br />

� Biocon has begun work on the Malaysian plant (expected to<br />

start operations by 2014) that will serve its deal with Pfizer.<br />

Investment of US$161mn is lined-up for Phase I construction<br />

� Biocon is looking to out license IN105, Anti CD6 and BVX20.<br />

Phase I study for BVX20 is expected to start in Q1’13 &<br />

phase III study for Psoriasis is expected to <strong>com</strong>plete in Q4’12<br />

� Listing of Syngene remains a long term opportunity for value<br />

unlocking<br />

Near term growth drivers<br />

� Fidaxomicin supply to Optimer (exclusive supply contract) have already started in<br />

June for US market<br />

� Pfizer has launched insulin and Glargine in the Indian market from Biocon’s portfolio<br />

under its own brand names - Univia and Glarvia<br />

� <strong>Company</strong> is in talks to supply atorvastatin API to one of its partner post 180-days<br />

exclusivity in the US market<br />

� Syngene has changed its business model from low risk fee based model which is<br />

very volatile to sharing risk-reward model. We believe, on research front Syngene will<br />

show better performance going forward and Clingene will take some time to<br />

turnaround<br />

Long term growth drivers<br />

� Bicon’s deal with Myaln for emerging markets, US & Europe for supplying biosimilars<br />

� Biocon is in talks to out license IN105, Anti CD6 and BVX20. Phase I study for<br />

BVX20 is expected to start in Q1FY13. Currently ongoing phase III study in Psoriasis<br />

is expected to be <strong>com</strong>pleted in Q4FY12 with the results likely to be available in the<br />

first quarter of next year<br />

� Syngene listing has been delayed by almost a year, but these value unlocking<br />

opportunities would remain a trigger in future<br />

Valuations<br />

At current price, the stock trades at 19x FY11 EPS of Rs18 and 12X FY11 EV/EBITDA.<br />

Financials Rs mn<br />

YE- Net EBITDA EPS EPS RoE EV/<br />

Mar Sales (Core) (%) APAT (Rs) % chg (%) P/E EBITDA P/BV<br />

FY08 10,542 2501.9 24.6 2,031 22.8 1.4 15.9 14.6 26.6 4.5<br />

FY09 16,087 2592.1 6.9 2,379 4.2 -81.8 15.9 80.0 64.0 4.4<br />

FY10 23,678 1117.4 18.3 2,969 14.3 244.3 18.2 23.2 16.1 3.8<br />

FY11 27,707 4344.2 20.2 3,681 17.9 25.2 19.4 18.6 11.7 3.3<br />

Emkay Global Financial Services Ltd 9<br />

<strong>Company</strong> <strong>Update</strong>

Key Financials – Quarterly<br />

Biocon Confluence: Pharma; Pre-conference note<br />

<strong>Company</strong> Description<br />

From being a predominantly fermentation based APIs and enzymes manufacturer, the<br />

<strong>com</strong>pany has emerged as a R&D based biotechnology <strong>com</strong>pany having developed its own<br />

proprietary products as well as offering contract research services to global pharmaceutical<br />

majors. Biocon is the India’s largest biotechnology <strong>com</strong>pany with a presence in<br />

biopharmaceuticals, custom research (Syngene) and clinical research (Clinigene). Biocon<br />

sold its enzymes business to Novozymes, Denmark –the world’s leading industrial enzyme<br />

producer for $102m in July’07.<br />

The <strong>com</strong>pany’s product offering includes the world’s first re<strong>com</strong>binant human insulin<br />

Insugen. It is the leading player in statins and exports over 80% of its production,<br />

<strong>com</strong>mands over 20% global market share and derives over 30% of its revenues from this<br />

business. Biocon caters to regulated markets like US and Europe and is one of the largest<br />

exporters of Lovastatin to the US. The <strong>com</strong>pany manufactures all four statins namely:<br />

Lovastatin, Simvastatin, Pravastatin and Atorvastatin by fermentation process, which<br />

requires high technological skills.<br />

Rs mn 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 YoY Gr. QoQ Gr.<br />

Revenues 4204 7281 7016 4417 5084 21.0 15.1<br />

Other Operating In<strong>com</strong>e 11.8 17.2 16 17.9 49.9 322.9 178.8<br />

Other In<strong>com</strong>e 135 79 133 105 110 (18.6) 4.0<br />

Total In<strong>com</strong>e 4350 7377 7165 4540 5244 20.5 15.5<br />

Total Expenditure 2907 5597 5581 3213 3750 29.0 16.7<br />

Consumption of RM 1692 3632 3932 1891 2142 26.6 13.3<br />

as % of sales 40.2 49.9 56.0 42.8 42.1 - -<br />

Employee Cost 581 811 820 693 778 33.9 12.4<br />

as % of sales 13.8 11.1 11.7 15.7 15.3 - -<br />

Other expenditure 634 1154 830 630 830 30.9 31.8<br />

as % of sales 15.1 15.9 11.8 14.3 16.3 - -<br />

EBITDA 1443 1780 1584 1327 1494 3.5 12.6<br />

Interest 62 66 57 57 20 (67.4) (64.4)<br />

EBDT 1382 1714 1527 1270 1474 6.7 16.1<br />

Depreciation 379 406 396 451 429 13.3 (4.8)<br />

Minority Interest 0 0 0 0 0 - -<br />

PBT 1003 1308 1131 820 1045 4.2 27.5<br />

Tax 111 291 111 119 188 69.9 57.7<br />

Reported Profit before EOI 892 1017 1021 701 857 (3.9) 22.3<br />

EOI 0 10 13 0 0 - -<br />

Reported Profit 892 1008 1008 701 857 (3.9) 22.3<br />

EPS 4.57 5.15 5.16 3.58 4.38 (4.2) 22.3<br />

Margins (%) (bps) (bps)<br />

EBIDTA 34.3 24.4 22.6 30.0 29.4 -494 -65<br />

EBIT 25.3 18.9 16.9 19.8 21.0 -437 111<br />

EBT 21.0 14.0 15.0 16.0 17.0 -400 100<br />

PAT 21.2 13.8 14.4 15.9 16.9 -437 100<br />

Effective Tax rate 11.0 22.2 9.8 14.6 18.0 696 345<br />

Emkay Research 17 November 2011 10

Financials<br />

In<strong>com</strong>e Statement Balance Sheet<br />

Biocon Confluence: Pharma; Pre-conference note<br />

(Year Ending Mar 31) FY08 FY09 FY10 FY11 (Year Ending Mar 31) FY08 FY09 FY10 FY11<br />

Net Sales 10,542 16,087 23,678 27,707 Share Capital 500 1,000 1,000 1,000<br />

Growth (%) 7% 53% 47% 17% Reserves & Surplus 14,342 14,107 16,579 19,328<br />

Other In<strong>com</strong>e 3,836 1,213 741 702 Networth 14,842 15,107 17,579 20,328<br />

Total In<strong>com</strong>e 14,378 17,299 24,419 28,409 Minority Interest -73 248 338 377<br />

Expenditure 7,950 14,969 19,334 22,112 Secured Loans 1,350 3,957 3,315 2,039<br />

Raw Materials 5,265 9,625 14,424 16,328 Unsecured Loans 1,200 1,282 1,821 1,304<br />

% to Sales 49.9% 59.8% 60.9% 58.9% Loan funds 2,551 5,239 5,136 3,342<br />

Employee Cost 1,127 1,811 2,450 3,123 Net Deferred Tax 465 466 508 497<br />

% to Sales 10.7% 11.3% 10.3% 11.3% Total Liabilities 17,784 21,060 23,561 24,544<br />

Other Expenses 321 395 643 784<br />

% to Sales 3.0% 2.5% 2.7% 2.8% Gross Block 11,849 15,817 18,371 20,630<br />

Selling and Admin Expenses 1,238 3,139 1,817 1,877 Less: Acc Depreciation 2,536 3,701 4,992 6,519<br />

% to Sales 11.7% 19.5% 7.7% 6.8% Net Block 9,313 12,116 13,379 14,111<br />

Operating Profit 2,592 1,117 4,344 5,595 Capital Work in Progress 1,382 1,720 755 1,796<br />

EBITDA Margin (%) 24.6 6.9 18.3 20.2 Investments 4,748 3,676 4,306 4,605<br />

Depreciation 939 1,103 1,401 1,568 Current Assets 5,346 7,924 10,921 15,030<br />

EBIT 1,653 15 2,943 4,027 Inventories 1,790 3,192 3,716 4,137<br />

EBIT margin (%) 15.7 0.1 12.4 14.5 Sundry Debtors 2,591 3,667 4,461 5,124<br />

Interest 102 177 169 257 Cash and Bank 96 118 1,399 4,414<br />

% to Debt 4.0% 3.4% 3.3% 7.7% Loans and Advances 869 947 1,344 1,355<br />

Profit Before Tax 5,387 1,051 3,515 4,472 Current Liab and Prov 3,005 4,376 5,800 10,997<br />

Tax 781 21 445 733 Current Liabilities 2,300 3,570 4,909 9,855<br />

Fringe Benefit Tax 15 19 0 0 Provisions 705 806 891 1,141<br />

Deferred Tax 17 1 42 -12 Net Current Assets 2,341 3,548 5,121 4,033<br />

Net Profit 4,574 1,010 3,028 3,751 Total Assets 17,784 21,060 23,561 24,544<br />

Minority Interest (after tax) -65 64 96 75<br />

Profit after Min. Int. 4,639 946 2,932 3,675<br />

Extraordinary Items 2,608 -1,434 -37 -6<br />

Adjusted Net Profit 2,031 2,379 2,969 3,681<br />

Net margin (%) 19.3 14.8 12.5 13.3<br />

Cash Flow (Rs. mn) Key Ratios<br />

(Year Ending Mar 31) FY08 FY09 FY10 FY11 (Year Ending Mar 31) FY08 FY09 FY10 FY11<br />

Opening Cash Position 86 96 118 1399 Profitability (%)<br />

Operating Cash Flow 3179 975 4438 8090 Net Margin 19.3 14.8 12.5 13.3<br />

Investing Cash Flow -3401 -2322 -2305 -2330 ROCE 10.7 0.1 13.2 16.7<br />

Financing Cash Flow 232 1369 -852 -2745 ROE 15.9 15.9 18.2 19.4<br />

Net Change in Cash 10 22 1281 3014 ROIC 14.4 0.1 18.0 26.1<br />

Closing Cash Position 96 118 1399 4414 Per Share Data (Rs)<br />

EPS 22.8 4.2 14.3 17.9<br />

CEPS 14.9 17.4 21.9 26.2<br />

BVPS 74.2 75.5 87.9 101.6<br />

DPS 2.5 3.0 3.5 4.5<br />

Valuations (x)<br />

PER 14.6 80.0 23.2 18.6<br />

P/CEPS 22.4 19.1 15.2 12.6<br />

P/BV 4.5 4.4 3.8 3.3<br />

EV / Sales 6.5 4.4 3.0 2.4<br />

EV / EBITDA 26.6 64.0 16.1 11.7<br />

Dividend Yield (%) 0.8 0.9 1.1 1.4<br />

Gearing Ratio (x)<br />

Net Debt/ Equity 0.2 0.3 0.2 -0.1<br />

Net Debt/EBIDTA 0.9 4.6 0.9 -0.2<br />

Source: Capitaline<br />

Emkay Research 17 November 2011 11

Notes<br />

Biocon Confluence: Pharma; Pre-conference note<br />

Emkay Research 17 November 2011 12

November 17, 2011<br />

Reco<br />

Hold<br />

CMP<br />

Rs1,617<br />

Previous Reco<br />

Hold<br />

Target Price<br />

Rs1,604<br />

EPS change FY11E/12E (%) NA<br />

Target Price change (%) NA<br />

Nifty<br />

5,069<br />

Sensex<br />

16,883<br />

Price Performance<br />

(%) 1M 3M 6M 12M<br />

Absolute 6 9 (1) (8)<br />

Rel. to Nifty 7 9 6 11<br />

Source: Bloomberg<br />

Relative Price Chart<br />

1850<br />

1760<br />

1670<br />

1580<br />

1490<br />

Rs<br />

1400<br />

Nov-10 Jan-11 Mar-11 May-11 Jul-11 Sep-11<br />

Source: Bloomberg<br />

<strong>Dr</strong>. <strong>Reddy's</strong> <strong>Lab</strong> (LHS) Rel to Nifty (RHS)<br />

Stock Details<br />

Sector Pharmaceuticals<br />

Bloomberg DRRD@IN<br />

Equity Capital (Rs mn) 847<br />

Face Value(Rs) 5<br />

No of shares o/s (mn) 169<br />

52 Week H/L 1,855/1,387<br />

Market Cap (Rs bn/USD mn)<br />

%<br />

10<br />

6<br />

2<br />

-2<br />

-6<br />

-10<br />

274/5,407<br />

Daily Avg Volume (No of sh) 327081<br />

Daily Avg Turnover (US$mn) 9.8<br />

Shareholding Pattern (%)<br />

Sep-11 Jun-11 Mar-11<br />

Promoters 25.6 25.6 25.7<br />

FII/NRI 45.6 45.4 46.3<br />

Institutions 14.4 14.7 14.0<br />

Private Corp 6.0 5.6 5.5<br />

Public 8.4 8.6 8.6<br />

Source: Capitaline<br />

Deepak Malik<br />

deepak.malik@emkayglobal.<strong>com</strong><br />

+91 22 6612 1257<br />

Ashish Thavkar<br />

ashish.thavkar@emkayglobal.<strong>com</strong><br />

+91 22 6612 1254<br />

Bhavita Nagrani<br />

bhavita.nagrani@emkayglobal.<strong>com</strong><br />

+91 22 6624 2486<br />

<strong>Dr</strong>. Reddy’s <strong>Lab</strong><br />

Attractive Para-IV pipeline<br />

� New launches, gain in market share in existing products &<br />

limited <strong>com</strong>petition opportunities to drive the growth in US<br />

� Upside from Para IV in FY12 and FY13 is Rs 19.2 and Rs 14.3<br />

respectively, mainly driven by launches like zyprexa,<br />

clopidogrel and ziprasidone<br />

� <strong>Dr</strong>. Reddy to witness modest growth of ~12% CAGR (FY11-<br />

FY13) in domestic market, due to issues in pain management<br />

and anti infective therapy<br />

� Upsides from Para-IVs largely factored-in. Maintain Hold<br />

rating with a price target of Rs1604<br />

Domestic business to witness gradual recovery and Russian Business to<br />

Show Strong Growth<br />

� DRL has been witnessing slower growth in the Indian market due to controversy<br />

related to one of its key brand in pain management i.e Nise. Though there has been<br />

favorable ruling by DCGI, but it will take some time to regain lost market share.<br />

However if we exclude, this impact than the domestic business grew at a healthy<br />

rate of ~15% <strong>com</strong>pared to industry rate of 12-14%<br />

� Russia & CIS which contributes 15%, to grow by 18% on back of significant volume<br />

growth in key brands and acquisition of JB Chemicals Rx Russian business<br />

Revenue growth to be led by US Business<br />

� North American business, to witness growth of ~19% CAGR (FY11- FY13) due to<br />

new product launches and increase in MS of existing products<br />

o Already launched 9 new products including 4 SKU’s from its Bristols penicillin<br />

facility acquired from GSK in Sept’11<br />

o Key Para – IV’s opportunities -<br />

– Olanzapine (20mg) – Market size of US$900 mn, launched on Oct 25 th ,<br />

2011, under 180-days unshared exclusivity<br />

– Olanzapine ODT – Market size of US$80mn, launch to be under 180-days<br />

exclusivity with 2 other players<br />

– Ziprasidone – Market Size US$800m, expected in Mar 12’ (Shared with<br />

two other <strong>com</strong>panies). But the launch can be delayed by 6months, if<br />

USFDA grants PED to innovator<br />

o Upsides may <strong>com</strong>e from the <strong>com</strong>pany’s Bristol facility in H2FY12<br />

Valuation<br />

We expect <strong>Dr</strong>. Reddy to report 17%% revenue growth in FY12E and 7% growth in<br />

FY13E. We expect EBIDTA margins to move from 22.4% in FY11 to 22.8% in FY12 and<br />

23.5%% in FY13. Earnings will grow by 12% CAGR over FY11-13E. We maintain our<br />

target price on the stock to Rs1604 (20x base business earnings of Rs77 + NPV of<br />

Rs64 from Para IVs) with a Hold rating. At CMP, the stock is trading at 20x FY12E and<br />

18x FY13E earnings.<br />

Financials Rs mn<br />

YE- Net EBITDA EPS EPS RoE EV/<br />

Mar Sales (Core) (%) APAT (Rs) % chg (%) P/E EBITDA P/BV<br />

FY10 70,310 15,762 22.4 8,435 50.0 101.9 9.6 32.4 17.8 7.2<br />

FY11 76,558 17,121 22.4 12,314 72.8 10.8 30.6 22.2 16.9 6.4<br />

FY12E 89,789 20,443 22.8 13,659 80.7 45.6 22.2 20.0 13.8 5.4<br />

FY13E 96,268 22,621 23.5 15,431 91.2 10.9 23.2 17.7 12.1 4.5<br />

Emkay Global Financial Services Ltd 13<br />

<strong>Company</strong> <strong>Update</strong>

Key Financials<br />

<strong>Dr</strong>. Reddy’s <strong>Lab</strong> Confluence: Pharma; Pre-conference note<br />

Rs mn Q1FY11 Q2FY11 Q4FY11 Q1FY12 Q2FY12 YoY % QoQ %<br />

Revenues 16831 18704 20173 19783 22679 21.3 14.6<br />

Raw Material 5035.2 5707 4059 5830 6804 19.2 16.7<br />

% to sales 29.9 30.5 20.1 29.5 30.0<br />

Manufacturing Cost 2882.3 3011 5165 3303 3669 - -<br />

% to sales 17.1 16.1 25.6 16.7 16.2<br />

Gross Profit 8914 9986 10949 10651 12206 22.2 14.6<br />

Operating Expenses<br />

SGA 4508.8 4661 5064 5483 5948 27.6 8.5<br />

% to base sales 26.8 24.9 25.1 27.7 26.2<br />

R&D cost 992.9 1270 1491 1197 1459 14.9 21.9<br />

% to base sales 5.9 6.8 7.4 6.0 6.4<br />

Total operating expenses 5501.7 5931 6555 6680 7407 24.9 10.9<br />

EBITDA 3412.1 4055 4394 3971 4799 18.3 20.8<br />

Depreciation 973 1048 1061 1233 1268 21.0 2.8<br />

Other exp/ (in<strong>com</strong>e) -186.4 -218 -512 -187 -390 78.9 108.6<br />

Finance exp/ (in<strong>com</strong>e) 9 -34.9 99 -221 -225 - -<br />

Share of profit/loss 4.7 -3 -4 4 -13 - -<br />

PBT 2639 3193 3742 2708 3709 16.1 36.9<br />

Tax -357.3 -326.5 -567 -119.4 -631.0 93.3 428.5<br />

Reported PAT 2096 2867 3346 2628 3078 7.4 17.1<br />

EPS 12.4 17.0 19.8 15.6 18.2 7.4 17.1<br />

Extraordinary<br />

VRS 0 0 0 136 -98 - -<br />

Forex gain/ (loss) -225 49 171 158 151 - -<br />

Interest on debentures 0 0 0 0 118<br />

Profit on sale on investment 39 0 0 17 0 - -<br />

PBT after EO 2453 3242 3913 2747 3729 15.0 35.7<br />

Adjusted PAT 2257 2872 3201 2591 2973 3.5 14.7<br />

Adjusted EPS 13.4 17.0 19.0 15.3 17.6 3.5 14.7<br />

bps bps<br />

EBITDA margins 20.3 21.7 21.8 20.1 21.2 -52 109<br />

PAT margins 12.5 15.3 16.6 13.3 13.6 -176 29<br />

Tax Rate 13.5 10.2 15.2 4.4 17.0 679 1260<br />

Revenue break-up<br />

(Rs mn) Q2FY11 Q3FY11 Q4FY11 Q1FY12 Q2FY12 YoY (%) QoQ (%)<br />

Global Generics 13,667 13,589 14,166 14,424 16,136 18.1 11.9<br />

NA 4416 4765 5918 5756 6287 42.4 9.2<br />

Europe 2366 2123 2005 1917 2117 -10.5 10.4<br />

India 3160 3007 2745 2936 3459 9.5 17.8<br />

Russia & Other CIS 2751 2875 2680 3018 3380 22.9 12.0<br />

Others 974 819 818 797 893 -8.3 12.0<br />

PSAI 4,617 4,980 5,551 4,832 5,933 28.5 22.8<br />

North America 814 770 749 842 1068 31.2 26.8<br />

Europe 1551 1830 2084 1693 2303 48.5 36.0<br />

India 653 622 711 662 752 15.2 13.6<br />

RoW 1599 1758 2007 1635 1810 13.2 10.7<br />

Proprietary products 420 417 453 528 610 45.2 15.5<br />

Total 18,704 18,986 20,170 19,784 22,679 21.3 14.6<br />

Emkay Research 17 November 2011 14

<strong>Dr</strong>. Reddy’s – Domestic Metrics<br />

<strong>Dr</strong>. Reddy’s <strong>Lab</strong> Confluence: Pharma; Pre-conference note<br />

<strong>Dr</strong>. Reddy’s therapeutic growth Field force productivity<br />

Therapies<br />

FY11 %<br />

Contribution<br />

MAT<br />

Sep'11<br />

MAT<br />

Sep'10<br />

% YoY<br />

Gr.<br />

Gastro 24.5 297.1 270.8 9.7<br />

CVS 19.5 236.1 214.2 10.2<br />

Pain Mgmt 10.9 132.0 141.8 -6.9<br />

Anti-infective 8.8 106.5 106.5 0.0<br />

Anti-diabetic 6.3 76.9 65.9 16.7<br />

Respiratory 5.7 69.2 58.8 17.6<br />

Dermatology 6.3 76.5 55.4 38.1<br />

Gynecology 1.2 15.0 15.3 -2.3<br />

CNS 0.9 10.6 10.5 0.6<br />

Others 15.9 192.4 180.2 6.8<br />

Acute 69.5 842.1 786.4 7.1<br />

Chronic 30.5 370.2 333.1 11.1<br />

Total Sales 100.0 1212.2 1119.4 8.3<br />

x<br />

Sep’11 MAT growth for <strong>Dr</strong>. Reddy has been lower at 8%<br />

� Acute segment which contributes 70% grew by 7%<br />

� Chronic segment which contributes 30% grew by 11%<br />

Emkay Research 17 November 2011 15<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

FY08 FY09 FY10 FY11<br />

Field force Productivity<br />

� The <strong>com</strong>pany has hired ~600 people during FY11<br />

� MR productivity declined due to higher attrition rate<br />

Growth drivers - Volume/ Price/ New launches Top 10 brand performance<br />

Total Gr. 8.3%<br />

4.0<br />

2.8<br />

1.5<br />

Total Gr. 14.4%<br />

4.3<br />

2.5<br />

7.6<br />

<strong>Dr</strong>. Reddy Industry<br />

Vol Gr. Price Gr. New launches<br />

� <strong>Dr</strong>. Reddy’s underperformed industry due to subdued volume growth in<br />

existing brands during MAT Sep’11<br />

� This was mainly due to increased <strong>com</strong>petition and high attrition rate in<br />

its field force<br />

Source: AIOCD, Emkay Research<br />

Rs Cr Therapy<br />

MAT<br />

Sep'11<br />

MAT<br />

Sep'10<br />

5.4<br />

5.2<br />

5.0<br />

4.8<br />

4.6<br />

4.4<br />

4.2<br />

4.0<br />

% YoY<br />

Gr.<br />

Omez Gastro 116.9 110.9 5.4<br />

Nise NSAID 71.3 87.3 -18.3<br />

Stamlo CVS 56.3 54.9 2.5<br />

Omez D Gastro 41.9 35.8 17.0<br />

Stamlo Beta CVS 39.1 36.6 6.9<br />

Atocor CVS 35.6 31.8 12.0<br />

Razo Gastro 33.8 31.8 6.1<br />

Mintop CVS 29.7 23.6 25.6<br />

Econorm Gastro 26.2 22.0 18.8<br />

Razo D Gastro 25.0 21.1 18.7<br />

Total 475.8 455.8 4.4<br />

� Top 10 brands contribute 43% to the domestic formulation sales<br />

� As iterated earlier, <strong>com</strong>petition continues to hurt the growth of the<br />

<strong>com</strong>pany’s top brand Omez. Also recent issues with DCGI has<br />

led to de-growth of Nise brand

Financial Snapshot<br />

<strong>Dr</strong>. Reddy’s <strong>Lab</strong> Confluence: Pharma; Pre-conference note<br />

(Rs mn) FY11 FY12E YoY % FY13E YoY %<br />

Global Generics 53,340 63,958 20 69,208 8<br />

NA 18,996 26,278 38 26,738 2<br />

Europe 8,431 8,361 -1 8,599 3<br />

India 11,690 12,911 10 14,744 14<br />

Russia & Other CIS 10,858 12,369 14 14,077 14<br />

Others 3366 4039 20 5049 25<br />

PSAI 19,647 21,409 9 23,541 10<br />

North America 3170 3329 5 3528 6<br />

Europe 7,020 7,792 11 8,727 12<br />

India 2619 2698 3 2860 6<br />

RoW 6,838 7,591 11 8,426 11<br />

Proprietary products 675 844 25 1013 20<br />

Others 1030 1184 15 1303 10<br />

Gross Revenues 74,692 87,395 17 95,064 9<br />

FTF 4,677 7,024 50 6,538 -7<br />

Base business 70,015 80,371 15 88,526 10<br />

EBITDA 17,121 20,443 19 22,579 10<br />

EBITDA % 22.9 23.4 47 23.8 36<br />

FTF - EBITDA 3,180 3,783 19 2,818 -26<br />

Base business - EBITDA 13,941 16,661 20 19,761 19<br />

Base EBITDA % 19.9 20.7 - 22.3 -<br />

PAT 12,314 13,660 11 15,393 13<br />

PAT % 16.5 15.6 -86 16.2 56<br />

FTF - PAT 1,590 3,253 105 2,423 -26<br />

Base business - PAT 10,724 10,407 -3 12,970 25<br />

EPS 72.9 80.7 11 91.2 13<br />

FTF - EPS 9.4 19.2 - 14.3 -<br />

Base - EPS 63.5 61.6 -3 76.7 25<br />

PE @ CMP 22.2 20.0 - 17.7 -<br />

Base PE @ CMP 25.5 26.3 - 20.2 -<br />

FTF/ Para-IV Opportunities<br />

Product Generic Name<br />

EPS<br />

2012<br />

Sales<br />

($ mn) FY12<br />

EPS<br />

2013<br />

Sales<br />

($ Mn) FY13<br />

Expected<br />

Launch<br />

Brand Sales<br />

($ Mn)<br />

Gemzar Gemcitabine 0.4 3.6 0.0 0.0 Launched 634 10+<br />

Effexor XR Venlafaxine 0.9 7.7 0.0 0.0 Launched 2300 10+<br />

Exclusivity<br />

Exelon Rivastigmine 0.7 5.3 0.2 1.7 Launched 379 Shared<br />

Zyprexa (20mg) Olanzipine 16.1 103.1 1.5 9.4 Launched 900 Sole<br />

Propecia Finasteride 0.0 0.0 2.6 16.8 Jan-12 500 Sole<br />

Avandia Rosiglitazone 0.1 0.8 0.8 9.1 Mar-12 400 Shared<br />

Boniva Ibandronate 0.1 0.6 0.6 6.8 Mar-12 500 Shared<br />

Plavix Clopidogrel 0.0 0.0 3.7 33.3 May-12 6666 Many<br />

Geodon * Ziprasidone 0.6 3.6 3.1 20.1 Sep-12 800 Shared<br />

Lexapro Escitlopram 0.0 0.0 0.8 6.9 Sep-12 2300 10+<br />

Clarinex Desloratidine 0.5 4.8 0.5 5.3 Sep -12 * 400 Shared¹<br />

Actos Pioglitazone 0.0 0.0 0.4 3.9 Jan-13 3100 10+<br />

Total 19.2 129.3 14.3 113.3 18879<br />

Emkay Research 17 November 2011 16

Financials<br />

In<strong>com</strong>e Statement Balance Sheet<br />

<strong>Dr</strong>. Reddy’s <strong>Lab</strong> Confluence: Pharma; Pre-conference note<br />

Y/E, Mar (Rs. mn) FY10 FY11 FY12E FY13E Y/E, Mar (Rs. mn) FY10 FY11 FY12E FY13E<br />

Net Sales 70,310 76,558 89,789 96,268 Equity share capital 844 846 846 846<br />

Growth (%) 2.2 8.9 17.3 7.2 Reserves & surplus 36,924 41,797 50,204 60,242<br />

Expenditure 54,549 59,437 69,346 73,648 Net worth 37,768 42,643 51,050 61,088<br />

Raw Materials 22,688 21,987 26,007 29,265 Minority Interest 0 0 0 0<br />

SGA 18,179 21,576 24,258 24,602 Secured Loans 9,275 14,394 13,394 11,894<br />

Employee Cost 10,948 12,786 14,663 15,080 Unsecured Loans 5,568 9,311 8,311 7,311<br />

Other Exp 2,734 3,088 4,418 4,701 Loan Funds 14,843 23,705 21,705 19,205<br />

EBITDA 15,762 17,121 20,443 22,620 Net deferred tax liability 71 -224 -224 -224<br />

Growth (%) 6.9 8.6 19.4 10.6 Total Liabilities 52,682 66,124 72,531 80,069<br />

EBITDA margin (%) 22.4 22.4 22.8 23.5<br />

Depreciation 4,131 3,981 4,366 4,756 Gross Block 64,469 79,752 84,752 89,752<br />

EBIT 11,631 13,140 16,077 17,864 Less: Depreciation 40,946 45,896 50,230 54,986<br />

EBIT margin (%) 16.5 17.2 17.9 18.6 Net block 23,522 33,855 34,522 34,766<br />

Other In<strong>com</strong>e 1,014 1,259 1,376 1,767 Capital work in progress 7,622 6,045 5,085 5,385<br />

Interest expenses 312 246 795 818 Investment 3,580 9 9 9<br />

PBT 6,183 14,153 12,692 15,857 Current Assets 38,202 49,842 56,843 66,152<br />

Tax 2,668 1,839 2,285 2,847 Inventories 13,394 15,992 16,262 17,586<br />

Effective tax rate (%) 43.2 13.0 18.0 18.0 Sundry debtors 11,599 16,507 17,548 18,802<br />

Adjusted PAT 8,435 12,314 13,660 18,687 Cash & bank balance 6,600 8,076 12,505 18,482<br />

(Profit)/loss from JV's/Ass/MI 0 0 0 3,253 Loans & advances 0 0 0 0<br />

Adjusted PAT after MI 8,435 12,314 13,660 15,434 Other current assets 6,609 9,267 10,529 11,281<br />

Growth (%) 11.0 46.0 10.9 13.0 Current lia & Prov 20,245 23,628 23,927 26,243<br />

Net Margin (%) 12.0 16.1 15.2 16.0 Current liabilities 16,746 20,188 20,697 22,172<br />

E/O items -6,150 0 0 0 Provisions 3,499 3,440 3,230 4,071<br />

Reported PAT 3,515 12,314 13,660 15,434 Net current assets 17,957 26,214 32,915 39,909<br />

Growth (%) -138.3 250.3 10.9 13.0 Misc. exp & Def. Assets 0 0 0 0<br />

Cash Flow Key Ratios<br />

Total Assets 52,682 66,124 72,531 80,069<br />

Y/E, Mar (Rs. mn) FY10 FY11 FY12E FY13E Y/E, Mar FY10 FY11 FY12E FY13E<br />

PBT (Ex-Other in<strong>com</strong>e) 5,169 12,894 11,316 14,091 Profitability (%)<br />

Depreciation 4,131 3,981 4,366 4,756 EBITDA Margin 22.4 22.4 22.8 23.5<br />

Interest Provided 312 246 795 818 Net Margin 12.0 16.1 15.2 16.0<br />

Other Non-Cash items 0 0 0 0 ROCE 23.4 24.2 25.1 25.7<br />

Chg in working cap 4,709 -6,784 -2,291 -1,017 ROE 9.6 30.6 22.2 23.2<br />

Tax paid -2,668 -1,839 -2,284 -2,855 RoIC 13.8 21.9 22.2 24.0<br />

Operating Cashflow 11,653 8,498 11,901 15,793 Per Share Data (Rs)<br />

Capital expenditure -1,709 -12,737 -4,072 -5,300 EPS 50.0 72.8 80.7 91.2<br />

Free Cash Flow 9,944 -4,239 7,829 10,493 CEPS 110.9 96.3 106.5 119.3<br />

Other in<strong>com</strong>e 1,014 1,259 1,375 1,772 BVPS 223.7 252.0 301.7 361.0<br />

Investments -3,057 3,571 0 0 DPS 11.3 11.3 10.0 15.0<br />

Investing Cashflow -3,752 -7,907 -2,698 -3,528 Valuations (x)<br />

Equity Capital Raised 226 243 3,253 2,423 PER 32.4 22.2 20.0 17.7<br />

Loans Taken / (Repaid) -5,133 8,862 -2,000 -2,500 P/CEPS 14.6 16.8 15.2 13.6<br />

Interest Paid -312 -246 -795 -818 P/BV 7.2 6.4 5.4 4.5<br />

Dividend paid (incl tax) -2,216 -2,217 -1,980 -2,969 EV / Sales 4.0 3.8 3.1 2.8<br />

In<strong>com</strong>e from investments 0 0 0 0 EV / EBITDA 17.8 16.9 13.8 12.1<br />

Others 511 -5,757 -3,253 -2,423 Dividend Yield (%) 0.7 0.7 0.6 0.9<br />

Financing Cashflow -6,924 885 -4,774 -6,288 Gearing Ratio (x)<br />

Net chg in cash 977 1,476 4,429 5,977 Net Debt/ Equity 0.2 0.4 0.2 0.0<br />

Opening cash position 5,623 6,600 8,076 12,505 Net Debt/EBIDTA 0.5 0.9 0.5 0.0<br />

Closing cash position 6,600 8,076 12,505 18,482 Working Cap Cycle (days) 77 103 96 97<br />

Emkay Research 17 November 2011 17

Notes<br />

<strong>Dr</strong>. Reddy’s <strong>Lab</strong> Confluence: Pharma; Pre-conference note<br />

Emkay Research 17 November 2011 18

November 17, 2011<br />

Reco<br />

Not Rated<br />

CMP<br />

Rs375<br />

Target Price<br />

NA<br />

EPS change FY11E/12E (%) NA<br />

Target Price change (%) NA<br />

Nifty 5,030<br />

Sensex 16,756<br />

Price Performance<br />

(%) 1M 3M 6M 12M<br />

Absolute (1) 3 4 (4)<br />

Rel. to Nifty 1 3 14 14<br />

Source: Bloomberg<br />

Relative Price Chart<br />

425<br />

400<br />

375<br />

350<br />

325<br />

Rs<br />

300<br />

Nov-10 Jan-11 Mar-11 May-11 Jul-11 Sep-11<br />

Source: Bloomberg<br />

Elder Pharma (LHS) Rel to Nifty (RHS)<br />

Stock Details<br />

Sector Pharmaceuticals<br />

Bloomberg ELDP@IN<br />

Equity Capital (Rs mn) 206<br />

Face Value(Rs) 10<br />

No of shares o/s (mn) 21<br />

52 Week H/L 435/309<br />

Market Cap (Rs bn/USD mn)<br />

%<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

8/161<br />

Daily Avg Volume (No of sh) 90672<br />

Daily Avg Turnover (US$mn) 0.7<br />

Shareholding Pattern (%)<br />

Sep-11 Jun-10 Mar-10<br />

Promoters 38.5 38.5 39.6<br />

FII/NRI 32.3 32.5 32.0<br />

Institutions 8.3 9.1 7.9<br />

Private Corp 7.5 7.2 7.9<br />

Public 13.5 12.8 12.7<br />

Source: Capitaline<br />

Deepak Malik<br />

Deepak.malik@emkayglobal.<strong>com</strong><br />

+91 22 6612 1257<br />

Ashish Thavkar<br />

ashish.thavkar@emkayglobal.<strong>com</strong><br />

+91 22 6612 1254<br />

Bhavita Nagrani<br />

bhavita.nagrani@emkayglobal.<strong>com</strong><br />

+91 22 6624 2486<br />

Elder Pharma<br />

New launches to drive future growth<br />

� <strong>Company</strong> raised Rs 2.6bn to fund international investment in<br />

Nutraceutical business to access foothold in Regulated<br />

markets<br />

� Launched the brand “Carnisure” in CVS category which has<br />

achieved Rs.160 mn revenue in the first year of launch<br />

� Entered into a 50:50 Joint venture in Guernsey, UK for web<br />

marketing of its products<br />

� <strong>Company</strong>’s main focus is on Women’s healthcare, Pain<br />

Management, Nutraceuticals and Anti Infective<br />

Key Highlights<br />

� The <strong>Company</strong> raised Rs619mn by way of QIP and Rs1.92bn through NCDs in two<br />

tranches of Rs1.18bn and Rs730mn on 23 rd Dec 2010 and 31 st March 2011<br />

� Elder acquired 100% stake in UK based Nutraceutical <strong>com</strong>pany NutraHealth PLC UK<br />

in November 2010 for GBP 9.8mn to access multiple Nutrition brands in UK and to<br />

establish footprint in Regulated markets<br />

� <strong>Company</strong> enhanced the stake in Biomeda, Bulgaria to 92.2% by acquiring additional<br />

stake of 31.2% with an investment of Rs400mn. <strong>Company</strong> is further planning<br />

investment of Rs220mn in its facilities and making them EU <strong>com</strong>pliant<br />

� In the Indian market the <strong>com</strong>pany is known for its shelcal brand, which is 23rd largest<br />

brand in the Indian pharma market with ~25% market share. This brand is a part of<br />

women’s healthcare portfolio (contributes 23% to domestic sales) – other brands in<br />

this category are Deviry, B-Long and Hormorin<br />

Going Forward<br />

� Elder Pharma is planning to foray into the growing and lifestyle healthcare sector<br />

including hypertension, diabetes and Cardiac care<br />

� The <strong>com</strong>pany is also planning to spend up to Rs550mn in next 2 years for increasing<br />

sales force, updating its R&D facilities and for brand building exercises<br />

� Elder Pharmaceuticals will launch 12 new products this fiscal in the areas of<br />

gynecology, pain management and nutraceuticals<br />

� The newly launched Vitamin D drug under the name of D-360 is expected to boost<br />

sales in this therapy in the <strong>com</strong>ing quarters<br />

Valuations<br />

At current price, the stock trades at 12x FY11 EPS of Rs31 and 17X FY11 EV/EBITDA.<br />

Financials Rs mn<br />

YE- Net EBITDA EPS EPS RoE EV/<br />

Mar Sales (Core) (%) APAT (Rs) % chg (%) P/E EBITDA P/BV<br />

FY08 5,512 1173.4 19.4 698 36.6 32.2 20.3 10.2 8.8 2.1<br />

FY09 6,203 919.4 13.0 467 31.8 -13.2 12.3 11.8 12.2 2.0<br />

FY10 7,216 666.2 6.9 532 25.7 -19.1 12.2 14.6 19.0 1.6<br />

FY11 9,595 838.4 5.7 678 30.7 19.5 12.4 12.2 16.7 1.3<br />

Emkay Global Financial Services Ltd 19<br />

<strong>Company</strong> <strong>Update</strong>

Key Financials – Quarterly<br />

Elder Pharma Confluence: Pharma; Pre-conference note<br />

<strong>Company</strong> Description<br />

Elder Pharma was incorporated in 1983. The <strong>com</strong>pany is engaged into manufacturing and<br />

marketing of prescription pharmaceutical brands, surgical and medical devices. Elder is one<br />

the leading <strong>com</strong>panies in the pharmaceutical formulation market in India. It holds market<br />

leader position in three therapeutic segments - Women’s Healthcare, Wound Care and<br />

Nutraceuticals. It entered into alliances with foreign <strong>com</strong>panies for manufacture and sale of<br />

their products under license from them.<br />

In the domestic space, <strong>com</strong>pany’s large part of revenues <strong>com</strong>es from Shelcal brand in<br />

women healthcare segment. This brand contributes ~17% to its topline and women’s<br />

healthcare portfolio contributes 23% of the domestic sales. Anti Infectives contribute ~12%<br />

to total sales; the key brands in this space are Cefixime and Formic. <strong>Company</strong> has made<br />

two major acquisitions Biomeda (Bulgaria) and Brunel Healthcare (Brunel). Brunel’s<br />

acquisition has MHRA approved manufacturing facility. Glucosamine is a major API<br />

manufactured at this facility. Elder has raised the stake in Biomeda to 92.2%. Further<br />

<strong>com</strong>pany is intending to inject CAPEX of ~$5mn for up-gradation of facilities and making<br />

the plant EU <strong>com</strong>pliant.<br />

Rs mn Q2FY11 Q3FY11 Q4FY11 Q1FY12 Q2FY12 YoY (%) QoQ (%)<br />

Net Sales 2107 2515 3027 2997 3311 57.2 10.5<br />

Other Operating In<strong>com</strong>e 2 2 5 3 4 82.6 27.3<br />

Other In<strong>com</strong>e 12 19 9 22 22 85.7 1.8<br />

Total In<strong>com</strong>e 2121 2536 3040 3022 3337 57.4 10.4<br />

Total Expenditure 1704 2080 2529 2486 2780 63.2 11.8<br />

as % of sales 80.9 82.7 83.5 83.0 84.0<br />

Consumption of RM 1036 1304 1497 1503 1657 60.0 10.3<br />

as % of sales 49.2 51.8 49.4 50.1 50.1<br />

Employee Cost 284 281 479 433 468 64.7 8.2<br />

as % of sales 13.5 11.2 15.8 14.4 14.1<br />

Other expenditure 384 495 553 551 655 70.6 18.8<br />

as % of sales 18.2 19.7 18.3 18.4 19.8<br />

EBITDA 417 456 511 535 557 33.6 4.1<br />

Adj. EBITDA 431 456 524 544 572 32.8 5.1<br />

Interest 149 176 214 195 212 42.3 8.9<br />

PBDT 268 280 297 340 345 28.8 1.3<br />

Depreciation 75 80 90 87 91 21.0 3.9<br />

PBT 193 200 207 253 254 31.9 0.4<br />

Tax 58 43 34 53 62 7.8 17.0<br />

Reported Profit 135 157 173 200 192 42.1 (3.9)<br />

Extra-ordinary Items -11 -11 -11 -8 -12 10.8 57.7<br />

RPAT 147 168 184 208 205 39.7 (1.6)<br />

EPS 7.2 7.71 8.45 9.79 9.42 30.8 (3.8)<br />

Margins (%) (bps) (bps)<br />

EBIDTA 19.8 18.1 16.9 17.9 16.8 -296 -103<br />

Adj. EBITDA 20.5 18.1 17.3 18.2 17.3 -317 -88<br />

EBIT 16.2 14.9 13.9 15.0 14.1 -215 -86<br />

EBT 2.7 1.7 1.1 1.8 1.9 -86 10<br />

PAT 7.0 6.7 6.1 6.9 6.2 -77 -76<br />

Effective Tax rate 29.8 21.3 16.4 20.9 24.4 -544 345<br />

Emkay Research 17 November 2011 20

Financials<br />

Elder Pharma Confluence: Pharma; Pre-conference note<br />

In<strong>com</strong>e Statement (Rs. mn) Balance Sheet (Rs. mn)<br />

(Year Ending Mar 31) FY08 FY09 FY10 FY11 (Year Ending Mar 31) FY08 FY09 FY10 FY11<br />

Net Sales 5,512 6,203 7,216 9,595 Share Capital 188 189 189 206<br />

Growth (%) 23% 13% 16% 33% Reserves & Surplus 3,458 3,733 4,616 5,886<br />

Other In<strong>com</strong>e -43 312 601 908 Networth 3,646 3,922 4,805 6,092<br />

Total In<strong>com</strong>e 5,469 6,516 7,817 10,503 Minority Interest 0 0 104 31<br />

Expenditure 4,339 5,284 6,550 8,757 Secured Loans 1,704 3,345 4,041 7,056<br />

Raw Materials 2,584 3,139 4,055 5,583 Unsecured Loans 1,712 1,647 1,698 1,954<br />

% to Sales 46.9% 50.6% 56.2% 58.2% Loan funds 3,416 4,991 5,739 9,011<br />

Employee Cost 728 838 967 1,191 Net Deferred Tax 52 50 38 35<br />

% to Sales 13.2% 13.5% 13.4% 12.4% Total Liabilities 7,114 8,964 10,686 15,168<br />

Other Expenses 128 104 118 136<br />

% to Sales 2.3% 1.7% 1.6% 1.4% Gross Block 2,115 2,249 5,610 8,184<br />

Selling & Admin Expenses 899 1,203 1,411 1,848 Less: Acc Depreciation 424 536 705 1,709<br />

% to Sales 16.3% 19.4% 19.5% 19.3% Net Block 1,692 1,713 4,904 6,475<br />

Operating Profit 1,173 919 666 838 Capital Work in Progress 1,634 2,522 657 950<br />

EBITDA Margin (%) 21.3 14.8 9.2 8.7 Investments 879 502 660 102<br />

Depreciation 106 115 172 287 Current Assets 3,771 5,393 5,702 9,878<br />

EBIT 1,067 804 494 551 Inventories 837 881 1,434 2,418<br />

EBIT margin (%) 19.4 13.0 6.9 5.7 Sundry Debtors 1,396 1,776 1,954 2,825<br />

Interest 238 414 530 655 Cash and Bank 790 1,464 786 2,671<br />

% to Debt 7.0% 8.3% 9.2% 7.3% Loans and Advances 749 1,271 1,528 1,965<br />

Profit Before Tax 786 703 565 804 Current Liab and Prov 861 1,166 1,238 2,238<br />

Tax 77 80 105 172 Current Liabilities 626 879 986 1,881<br />

Fringe Benefit Tax 15 16 0 0 Provisions 235 286 252 357<br />

Deferred Tax -3 -2 -12 -3 Net Current Assets 2,910 4,227 4,464 7,641<br />

Net Profit 697 608 472 636 Total Assets 7,114 8,964 10,686 15,168<br />

Minority Interest (after tax) 0 0 -23 -7<br />

Profit after Min. Int. 697 608 495 642<br />

Extraordinary Items -1 141 -37 -35<br />

Adjusted Net Profit 698 467 532 678<br />

Net margin (%) 12.7 7.5 7.4 7.1<br />

Cash Flow (Rs. mn) Key Ratios<br />

(Year Ending Mar 31) FY08 FY09 FY10 FY11 (Year Ending Mar 31) FY08 FY09 FY10 FY11<br />

Opening Cash Position 570 790 1464 786 Profitability (%)<br />

Operating Cash Flow 208 1361 -910 431 EBITDA Margin 21.3 14.8 9.2 8.7<br />

Investing Cash Flow -1083 -347 -1611 -1552 Net Margin 12.7 7.5 7.4 7.1<br />

Financing Cash Flow 1095 -339 1843 3006 ROCE 16.7 10.0 5.0 4.3<br />

Net Change in Cash 220 674 -678 1885 ROE 20.3 12.3 12.2 12.4<br />

Closing Cash Position 790 1464 786 2671 ROIC 29.8 19.4 7.6 5.5<br />

Per Share Data (Rs)<br />

EPS 36.6 31.8 25.7 30.7<br />

CEPS 39.2 28.4 34.3 47.1<br />

BVPS 177.9 191.3 234.4 297.2<br />

DPS 2.3 2.3 2.8 3.0<br />

Valuations (x)<br />

PER 10.2 11.8 14.6 12.2<br />

P/CEPS 9.6 13.2 10.9 8.0<br />

P/BV 2.1 2.0 1.6 1.3<br />

EV / Sales 1.9 1.8 1.8 1.5<br />

EV / EBITDA 8.8 12.2 19.0 16.7<br />

Dividend Yield (%) 0.6 0.6 0.7 0.8<br />

Gearing Ratio (x)<br />

Net Debt/ Equity 0.7 0.9 1.0 1.0<br />

Net Debt/EBIDTA 2.2 3.8 7.4 7.6<br />

Source: Capitaline<br />

Emkay Research 17 November 2011 21

Notes<br />

Elder Pharma Confluence: Pharma; Pre-conference note<br />

Emkay Research 17 November 2011 22

November 16, 2011<br />

Reco<br />

Buy<br />

CMP<br />

Rs 334<br />

Previous Reco<br />

Buy<br />

Target Price<br />

Rs 401<br />

EPS change FY12E/13E (%) NA<br />

Target Price change (%) NA<br />

Nifty 5,069<br />

Sensex 16,883<br />

Price Performance<br />

(%) 1M 3M 6M 12M<br />

Absolute 13 4 10 (4)<br />

Rel. to Nifty 14 4 18 15<br />

Source: Bloomberg<br />

Relative Price Chart<br />

400<br />

370<br />

340<br />

310<br />

280<br />

Rs<br />

250<br />

Nov-10 Jan-11 Mar-11 May-11 Jul-11 Sep-11<br />

Source: Bloomberg<br />

Glenmark Pharma (LHS) Rel to Nifty (RHS)<br />

Stock Details<br />

Sector Pharmaceuticals<br />

Bloomberg GNP@IN<br />

Equity Capital (Rs mn) 270<br />

Face Value(Rs) 1<br />

No of shares o/s (mn) 270<br />

52 Week H/L 390/242<br />

Market Cap (Rs bn/USD mn)<br />

%<br />

20<br />

12<br />

4<br />

-4<br />

-12<br />

-20<br />

90/1,776<br />

Daily Avg Volume (No of sh) 577746<br />

Daily Avg Turnover (US$mn) 3.6<br />

Shareholding Pattern (%)<br />

Sep-11 Jun-11 Mar-11<br />

Promoters 48.3 48.3 48.3<br />

FII/NRI 33.2 31.9 31.2<br />

Institutions 6.4 6.9 6.9<br />

Private Corp 1.9 2.2 2.7<br />

Public 10.2 10.7 11.0<br />

Source: Capitaline<br />

Deepak Malik<br />

deepak.malik@emkayglobal.<strong>com</strong><br />

+91 22 6612 1257<br />

Ashish Thavkar<br />

ashish.thavkar@emkayglobal.<strong>com</strong><br />

+91 22 6612 1254<br />

Bhavita Nagrani<br />

bhavita.nagrani@emkayglobal.<strong>com</strong><br />

+91 22 6624 2486<br />

Glenmark Pharma<br />

Growth from all the corners<br />

� Domestic operations are cash cow for the <strong>com</strong>pany. Focus on<br />

specialties like derma, respiratory, CVS & gynaec will lead to<br />

16-18% revenue CAGR over FY11-13E<br />

� In US, strong ANDA basket coupled with limited <strong>com</strong>petition<br />

launches such as the Malorene, Cutivate and Oxycodone<br />

would lead to 15% revenue CAGR over FY11-13E<br />

� Post restructuring of operations (reducing working capital) in<br />

the SRM markets, we expect SRM sales to grow at 18% CAGR<br />

over FY11-13E<br />

� On account of good momentum in key business verticals, we<br />

maintain our Buy rating on the stock with a target price of<br />

Rs401 (18x FY12 Base Business EPS + Adjusted NPV of Rs45)<br />

India business – On a strong footing<br />

� Glenmark is gaining market share in the domestic market driven by steady volume<br />

growth and new product introductions. Focused approach on key specialty<br />

segments like dermatology, cardiology, respiratory, analgesics and gynecology has<br />

led to improvement in overall margins.<br />

� Indian operations are cash cow for the <strong>com</strong>pany. Strong performance from key<br />

specialties, new product launches coupled with recent addition to the filed force<br />

would lead to 16-18%+ growth in the Indian business. Total MR strength is ~2400<br />

US Generics – Strong portfolio with limited <strong>com</strong>petition opportunities<br />

� ANDA basket consists of 69 generic products authorized for distribution with 40<br />

pending for approval with the USFDA including 13 Para IV filings till date<br />

� Malorene – expected launch in Q3FY12 and Cutivate – expected launch in Q4FY12<br />

are key upside triggers for the stock<br />

� Management has guided for launch of 7 new products in the OCs, oral solids and<br />

semi solids space, as well as exclusive launches. It has already launched 5 OC<br />

products. We expect US business to clock 15% revenue CAGR over FY11-13E<br />

Glenmark’s NCE pipeline lends credibility to its research capabilities<br />

� Glenmark currently has a pipe-line of 5 NCE & NBE molecules which are under<br />

various stages of clinical development. This includes Crofelemer, which has been<br />

in-licensed by Glenmark from Napo Pharma<br />

� Glenmark has been successful in monetizing part of its NCE pipeline. While it has<br />

suffered a few setbacks in the past, we believe that overall, Glenmark’s ability to<br />

derive value from the NCE pipeline has been credible<br />

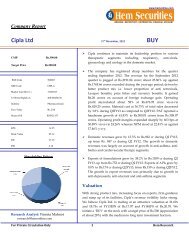

Valuation<br />

We expect Glenmark Pharma to report 24% revenue growth in FY12E and 8% growth in<br />

FY13E. We expect EBIDTA margins to move from 20.1% in FY11 to 26.1% in FY12 and<br />

23.8% in FY13. Earnings will grow by 19% CAGR over FY11-13E. We maintain Buy<br />

rating on the stock with a target of Rs401 (18x FY12 base business earnings + adjusted<br />

NPV of Rs45). At CMP, the stock is trading at 13.9x FY12E and 14.1x FY13E earnings.<br />

Financials Rs mn<br />

YE- Net EBITDA EPS EPS RoE EV/<br />

Mar Sales (Core) (%) APAT (Rs) % chg (%) P/E EBITDA P/BV<br />

FY10 24848 6196 24.9 3287 12.2 8.3 15.6 27.4 16.1 3.9<br />

FY11 29491 5923 20.1 4532 16.8 37.9 20.9 19.9 18.8 4.5<br />

FY12E 36475 9520 26.1 6477 24.0 42.9 27.9 13.9 10.9 3.4<br />

FY13E 39323 9437 24.0 6413 23.8 -1.0 22.0 14.1 10.7 2.8<br />

Emkay Global Financial Services Ltd 23<br />

<strong>Company</strong> <strong>Update</strong>

Key Financials – Quarterly<br />

Glenmark Pharma Confluence: Pharma; Pre-conference note<br />

Rs mn Q1FY11 Q2FY11 Q1FY12 Q2FY12 YoY % QoQ % YTD'12 YTD'11 YoY %<br />

Net Sales 6817.7 7235.8 8682.5 10554.5 45.9 21.6 19237.0 14053.5 36.9<br />

Other operating in<strong>com</strong>e 30.8 4.8 2.1 2.1 -55.3 0.0 4.3 35.5 -88.0<br />

Total Sales 6848.5 7240.5 8684.7 10556.6 45.8 21.6 19241.3 14089.0 36.6<br />

One-time licensing In<strong>com</strong>e 900 0 1125 1184.55 - 5.3 2309.55 900 156.6<br />

Base Sales 5948.5 7240.5 7559.7 9372.1 29.4 24.0 16931.7 13189.0 28.4<br />

Raw material cost 1905.2 2485.6 2307.8 3334.7 34.2 44.5 5642.4 4390.8 28.5<br />

% to Base Sales 32.0 34.3 30.5 35.6 33.3 33.3<br />

Staff cost 1054.2 1331.8 1347.0 1575.4 18.3 17.0 2922.4 2386.0 22.5<br />

% to Base Sales 17.7 18.4 17.8 16.8 17.3 18.1<br />

Other expenses 1565.6 2009.9 2062.0 3390.8 68.7 64.4 5452.9 3575.4 52.5<br />

% to Base Sales 26.3 27.8 27.3 36.2 32.2 27.1<br />

Total Expenditure 4525.0 5827.2 5716.8 8300.9 42.5 45.2 14017.7 10352.2 35.4<br />

% to Base Sales 76.1 80.5 75.6 88.6 82.8 78.5<br />

EBITDA 2323.5 1413.3 2967.9 2255.7 59.6 -24.0 5223.6 3736.8 39.8<br />

Adj. EBITDA 1423.5 1413.3 1842.9 1871.1 32.4 1.5 3714.0 2836.8 30.9<br />

Other in<strong>com</strong>e 90.6 154.4 123.4 -80.8 -152.3 -165.5 42.6 245.1 -82.6<br />

Interest 360.6 400.3 408.1 290.6 -27.4 -28.8 698.7 760.9 -8.2<br />

Depreciation 230.3 227.8 263.8 247.2 8.5 -6.3 511.0 458.1 11.5<br />

Exceptional Item 1316.8<br />

PBT 1823.2 939.6 2419.4 320.4 -65.9 -86.8 2739.7 2762.9 -0.8<br />

Tax 117.5 77.9 318.9 -237.9 -405.3 -174.6 81.0 195.4 -58.5<br />

PAT 1705.7 861.7 2100.4 558.3 -35.2 -73.4 2658.7 2567.4 3.6<br />

Exceptional Item 0.0 0.0 0.0 2116.8 - - 2116.8 0.0 -<br />

Payment to Paul Capital 0.0 1316.8<br />

Forex loss -80.0 800.0<br />

Adj PAT 863.7 781.7 1123.7 1252.6 60.2 11.5 2376.3 1645.4 44.4<br />

R EPS 6.3 3.2 7.8 2.1 -35.2 -73.4 9.8 9.5 3.6<br />

Adj. EPS 3.2 2.9 4.2 4.6 60.2 11.5 8.8 6.1 44.4<br />

bps bps bps<br />

EBITDA % 33.9 19.5 34.2 21.4 184.8 -1280.7 27.1 26.5 62.5<br />

Adj EBITDA % 23.9 19.5 24.4 20.0 44.5 -441.3 21.9 21.5 42.6<br />

PAT % 24.9 11.9 24.2 5.3 -661.3 -1889.7 13.8 18.2 -440.5<br />

Adj PAT % 14.5 10.8 14.9 13.4 256.9 -149.9 14.0 12.5 155.9<br />

Tax Rate % 6.4 8.3 13.2 -74.3 -8255.3 -8744.3 3.0 7.1 -411.5<br />

Rs mn Q1FY11 Q2FY11 Q1FY12 Q2FY12 YoY % QoQ % YTD'12 YTD'11 YoY %<br />

US 1830 2238 2512 3001 34.1 19.5 5512 4068 35.5<br />

Europe 80 134 175 185 37.9 5.7 361 215 67.9<br />

Latin America (Argentina) 75 115 29 41 -64.1 42.7 70 190 -63.1<br />

API 634 787 646 763 -3.0 18.2 1409 1421 -0.8<br />

Total Generics Business [A] 2620 3274 3362 3990 21.9 18.7 7352 5894 24.7<br />

Latin America ( Brazil & Others) 366 493 592 738 49.8 24.7 1330 859 54.9<br />

Semi Regulated Markets [SRM] 733 811 1047 1479 82.4 41.3 2526 1544 63.6<br />

Europe 212 351 215 378 7.4 75.5 593 563 5.2<br />

India 1878 2122 2254 2539 19.7 12.7 4793 3999 19.8<br />

Speciality Formulation [1] 3189 3777 4108 5134 35.9 25.0 9242 6966 32.7<br />

Recurring Revenues 5809 7051 7469 9124 29.4 22.2 16593 12860 29.0<br />

Out-licensing Revenues [2] 895 0 1112 1185 - - 2297 895 -<br />

Speciality Business (B= 1+2) 4084 3777 5220 6319 67.3 21.0 11539 7861 46.8<br />

Others 114 184 101 246 - - 347 298 16.2<br />

Consolidated Revenues 6818 7236 8683 10554 45.9 21.6 19237 14053 36.9<br />

Emkay Research 16 November 2011 24

Glenmark Pharma – Domestic Metrics<br />

Glenmark Pharma Confluence: Pharma; Pre-conference note<br />

Glenmark Pharma’s - therapeutic growth Field force productivity<br />

Therapies<br />

FY11 %<br />

Contribution<br />

MAT<br />

Sep'11<br />

MAT<br />

Sep'10<br />

YoY<br />

Gr. %<br />

Derma 31.0 316.4 272.7 16.0<br />

CVS 18.3 186.6 136.8 36.4<br />

Anti-infective 15.6 158.6 145.8 8.8<br />

Respiratory 15.4 157.4 135.3 16.3<br />

Pain 5.1 51.6 50.8 1.4<br />

Anti-Daibetic 4.7 48.4 49.8 -2.8<br />

Gastro 2.6 26.1 22.5 15.9<br />

Gynaec 2.3 23.5 23.0 1.9<br />

Opthalmology 2.2 22.6 19.6 15.0<br />

Others 2.8 28.4 17.4 63.5<br />

Acute 75.3 767.6 676.2 13.5<br />

Chronic 24.7 251.9 197.6 27.4<br />

Total Sales 100.0 1019.4 873.9 16.7<br />

X<br />

Sep’11 MAT growth for Glenmark has been strong at 17%<br />

� Acute segment which contributes 75% grew by 14%<br />

� Chronic segment which contributes 25% grew by 27%<br />

Emkay Research 16 November 2011 25<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

Growth drivers - Volume/ Price/ New launches Top 10 brand performance<br />

Total Gr. 16.7%<br />

6.9<br />

7.4<br />

2.5<br />

� Glenmark out-performed industry due to healthy increase in price and<br />

good growth in new brands during MAT Sep’11<br />

Source: AIOCD, Emkay Research<br />

Total Gr. 14.4%<br />

4.3<br />

2.5<br />

7.6<br />

Glenmark Industry<br />

New launches Price Gr. Vol Gr.<br />

500<br />

0<br />

FY08 FY09 FY10 FY11<br />

Field force Productivity<br />

� The <strong>com</strong>pany has hired ~300 people during last year. Attrition rate<br />

stood at 18-20% for Glenmark<br />

� MR productivity hovers around 3.5 - 3.8x for the last 3 years<br />

Rs Cr Therapy<br />

MAT<br />

Sep'11<br />

MAT<br />

Sep'10<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

% YoY<br />

Gr.<br />

Telma CVS 63.3 48.0 31.7<br />

Telma H CVS 59.3 45.3 30.9<br />

Candid-B Derma 52.9 46.6 13.7<br />

Ascoril Plus Respiratory 45.1 42.9 5.2<br />

Candid Derma 36.7 31.9 15.3<br />

Ascoril Resp 31.9 30.5 4.5<br />

Lizolid Anti-Infective 23.5 25.8 -8.8<br />

Alex Resp 21.9 20.7 5.7<br />

Altacef Anti-Infective 21.3 19.4 9.7<br />

Elovera Derma 19.1 17.8 7.3<br />

Total 375.0 328.8 14.0<br />

� Top 10 brands contribute 37% to the domestic formulation sales<br />

� Telma, Telma-H and the derma brands clocked healthy growth

Financial Snapshot<br />

Glenmark Pharma Confluence: Pharma; Pre-conference note<br />

(Rs mn) FY10 FY11 YoY % FY12E YoY % FY13E YoY %<br />

US Base Business 7230 8352 16 9578 15 11069 16<br />

Limited Competition 677 492 -27 500 2 1327 165<br />

Tarka 0 492 - 0 - 0 -<br />

Malorene 0 0 - 500 - 1001 -<br />

Cutivate 0 0 - 0 - 326 -<br />

Europe 299 544 82 652 20 783 20<br />

Latin America (Argentina) 343 401 17 421 5 442 5<br />

API 2627 3337 27 3683 10 4039 10<br />

1. Total Generics Business 10500 12633 20 14835 17 17659 19<br />

Latin America ( Brazil & Others) 1361 1919 41 2311 20 2718 18<br />

Semi Regulated Markets 3864 4070 5 4878 20 5622 15<br />

Europe 1363 1528 12 1742 14 2055 18<br />

India 7529 8447 12 9784 16 11268 15<br />

2. Speciality Business 14116 15963 13 18716 17 21663 16<br />

Recurring Revenues ( 1 + 2 ) 24616 28596 16 33550 17 39323 17<br />

3. Out-licensing Revenues 232 895 - 2925 - 0 -<br />

Medicis Pharma 232 0 - 0 - 0 -<br />

GRC 15300 (Sanofi) 0 895 - 0 - 0 -<br />

GBR 500 (Sanofi) 0 0 - 2925 - 0 -<br />

Consolidated Revenues ( 1 + 2 + 3 ) 24848 29491 19 36475 24 39323 8<br />

Limited <strong>com</strong>petition 677 492 - 500 - 1327 -<br />

Licensing Revenues 232 895 - 2925 - 0 -<br />

Base (Excl- limited <strong>com</strong>petition) 23939 28103 17 33050 18 37996 15<br />

Reported EBITDA 6,196 5,923 -4 9,520 61 9,437 -1<br />

EBITDA margins % 24.9% 20.1% 26.1 24.0<br />

EBITDA - Limited Competition 542 246 - 350 - 1061 -<br />

EBITDA - Licensing In<strong>com</strong>e 186 448 - 1901 - 0 -<br />

EBITDA - Base business 5468 5229 -4 7269 39 8376 15<br />

EBITDA % - Base Business 22.8% 18.6% 22.0 22.0<br />

Reported PAT 3,287 4,532 38 6,477 43 6,413 -1<br />

PAT margins % 13.2 15.4 17.8 16.3<br />

PAT - Limited Competition 271 123 - 140 - 424 -<br />

PAT - Licensing In<strong>com</strong>e 74 179 - 1141 - 0 -<br />

PAT - Base business 2942 4230 44 5197 23 5989 15<br />

PAT % - Base Business 12.3% 15.1% 15.7 15.8<br />

EPS 12.2 16.8 38 24.0 43 23.8 -1<br />

- Limited Competition 1.0 0.5 - 0.5 - 1.6 -<br />

- Licensing In<strong>com</strong>e 0.3 0.7 - 4.2 - 0.0 -<br />

- Base business 10.9 15.7 44 19.2 23 22.2 15<br />

Total Base EPS 11.9 16.1 35 19.8 23 23.8 20<br />

PE @ CMP 27.4 19.9 13.9 14.1<br />

PE - base 28.1 20.7 16.9 14.1<br />

Emkay Research 16 November 2011 26

Financials<br />

In<strong>com</strong>e Statement Balance Sheet<br />

Glenmark Pharma Confluence: Pharma; Pre-conference note<br />

Y/E, Mar (Rs. mn) FY10 FY11 FY12E FY13E Y/E, Mar (Rs. mn) FY10 FY11 FY12E FY13E<br />

Net Sales 24,848 29,491 36,475 39,323 Equity share capital 270 270 270 270<br />

Growth (%) 17.4 18.7 23.7 7.8 Reserves & surplus 23,018 20,102 26,105 32,044<br />

Expenditure 18,653 23,568 26,955 29,885 Net worth 23,288 20,372 26,375 32,314<br />

Raw Materials 8,061 9,918 11,782 12,623 Minority Interest 130 267 267 267<br />

SGA 4,583 5,009 6,493 6,999 Secured Loans 14,926 14,802 13,302 12,302<br />

Employee Cost 3,425 5,103 4,851 5,505 Unsecured Loans 3,768 6,314 5,314 4,314<br />

Other Exp 2,583 3,538 3,830 4,758 Loan Funds 18,694 21,116 18,616 16,616<br />

EBITDA 6,196 5,923 9,520 9,437 Net deferred tax liability 710 -1,081 -1,081 -1,081<br />

Growth (%) 47.3 -11.6 68.7 -0.3 Total Liabilities 42,822 40,674 44,177 48,117<br />

EBITDA margin (%) 24.9 20.1 26.1 24.0<br />

Depreciation 1,206 947 1,015 1,130 Gross Block 21,755 26,952 29,452 31,952<br />

EBIT 4,990 4,976 8,505 8,308 Less: Depreciation 3,882 4,829 5,844 6,974<br />

EBIT margin (%) 20.1 16.9 23.3 21.1 Net block 17,873 22,123 23,608 24,978<br />

Other In<strong>com</strong>e 507 1,359 473 529 Capital work in progress 6,008 0 0 0<br />

Interest expenses 1,640 1,566 1,490 1,291 Investment 181 319 319 319<br />

PBT 3,857 4,770 7,488 7,545 Current Assets 24,211 25,978 26,443 29,674<br />

Tax 569 237 1,011 1,132 Inventories 7,085 8,070 7,886 8,732<br />

Effective tax rate (%) 14.8 5.0 13.5 15.0 Sundry debtors 10,783 11,308 12,706 13,697<br />

Adjusted PAT 3,287 4,532 6,477 6,413 Cash & bank balance 1,070 1,949 927 1,936<br />

(Profit)/loss from JV's/Ass/MI 0 0 0 0 Loans & advances 5,273 4,651 4,924 5,309<br />

Adjusted PAT after MI 3,287 4,532 6,477 6,413 Other current assets 0 0 0 0<br />

Growth (%) 8.3 37.9 42.9 -1.0 Current lia & Prov 5,451 7,746 6,192 6,855<br />

Net Margin (%) 13.2 15.4 17.8 16.3 Current liabilities 5,251 7,560 5,827 6,461<br />

E/O items -249 0 0 0 Provisions 200 185 365 393<br />

Reported PAT 3,038 4,532 6,477 6,413 Net current assets 18,760 18,232 20,251 22,820<br />

Growth (%) 58.5 49.2 42.9 -1.0 Misc. exp & Def. Assets 0 0 0 0<br />

Cash Flow Key Ratios<br />

Total Assets 42,822 40,674 44,177 48,117<br />

Y/E, Mar (Rs. mn) FY10 FY11 FY12E FY13E Y/E, Mar FY10 FY11 FY12E FY13E<br />

PBT (Ex-Other in<strong>com</strong>e) 3,059 3,410 7,015 7,016 Profitability (%)<br />

Depreciation 1,206 947 1,015 1,130 EBITDA Margin 24.9 20.1 26.1 24.0<br />

Interest Provided 1,640 1,566 1,490 1,291 Net Margin 13.2 15.4 17.8 16.3<br />

Other Non-Cash items 0 0 0 0 ROCE 13.5 11.5 20.0 18.2<br />

Chg in working cap -2,441 1,670 -2,927 -1,560 ROE 15.6 20.9 27.9 22.0<br />

Tax paid -392 -237 -1,123 -1,132 RoIC 16.2 12.9 20.9 18.9<br />

Operating Cashflow 3,073 7,356 5,469 6,746 Per Share Data (Rs)<br />

Capital expenditure -3,970 -3,000 -2,500 -2,500 EPS 12.2 16.8 24.0 23.8<br />

Free Cash Flow -897 4,356 2,969 4,246 CEPS 17.7 20.3 27.8 28.0<br />

Other in<strong>com</strong>e 507 1,359 473 529 BVPS 86.0 74.8 97.0 119.0<br />

Investments 0 -138 0 0 DPS 0.4 0.5 1.5 1.5<br />

Investing Cashflow -3,463 -1,778 -2,027 -1,971 Valuations (x)<br />

Equity Capital Raised 4,092 396 0 0 PER 27.4 19.9 13.9 14.1<br />

Loans Taken / (Repaid) -1,985 2,158 -2,500 -2,000 P/CEPS 18.8 16.4 12.0 11.9<br />

Interest Paid -1,640 -1,566 -1,490 -1,291 P/BV 3.9 4.5 3.4 2.8<br />

Dividend paid (incl tax) -126 -158 -474 -474 EV / Sales 4.3 3.8 3.0 2.7<br />

In<strong>com</strong>e from investments 0 0 0 0 EV / EBITDA 16.1 18.8 10.9 10.7<br />

Others 405 -5,529 0 0 Dividend Yield (%) 0.1 0.1 0.4 0.4<br />

Financing Cashflow 745 -4,699 -4,464 -3,766 Gearing Ratio (x)<br />

Net chg in cash 355 879 -1,022 1,009 Net Debt/ Equity 0.7 0.9 0.7 0.5<br />

Opening cash position 715 1,070 1,949 927 Net Debt/EBIDTA 2.4 3.2 1.8 1.5<br />

Closing cash position 1,070 1,949 927 1,936 Working Cap Cycle (days) 267 204 196 196<br />

Emkay Research 16 November 2011 27

Notes<br />

Glenmark Pharma Confluence: Pharma; Pre-conference note<br />

Emkay Research 16 November 2011 28

November 17, 2011<br />

Reco<br />

Buy<br />

CMP<br />

Rs25<br />

Previous Reco<br />

Buy<br />

Target Price<br />

Rs392<br />

EPS change FY12E/13E (%) NA<br />

Target Price change (%) NA<br />

Nifty 5,069<br />

Sensex 16,883<br />

Price Performance<br />

(%) 1M 3M 6M 12M<br />

Absolute 6 (21) (16) (25)<br />

Rel. to Nifty 7 (21) (10) (9)<br />

Source: Bloomberg<br />

Relative Price Chart<br />

350<br />

320<br />

290<br />

260<br />

230<br />

Rs<br />

200<br />

Nov-10 Jan-11 Mar-11 May-11 Jul-11 Sep-11<br />

Source: Bloomberg<br />

Ipca <strong>Lab</strong> (LHS) Rel to Nifty (RHS)<br />

Stock Details<br />

Sector Pharmaceuticals<br />

Bloomberg IPCA@IN<br />

Equity Capital (Rs mn) 251<br />

Face Value(Rs) 2<br />

No of shares o/s (mn) 126<br />

52 Week H/L 351/230<br />

Market Cap (Rs bn/USD mn) 31/612<br />

Daily Avg Volume (No of sh) 203977<br />

Daily Avg Turnover (US$mn) 1.1<br />

Shareholding Pattern (%)<br />

%<br />

20<br />

12<br />

4<br />

-4<br />

-12<br />

-20<br />

Sep-11 Jun-11 Mar-11<br />

Promoters 46.1 46.1 46.1<br />

FII/NRI 10.1 10.4 9.1<br />

Institutions 22.2 22.2 22.7<br />

Private Corp 10.1 9.7 10.4<br />

Public 11.5 11.6 11.8<br />

Source: Capitaline<br />

Deepak Malik<br />

deepak.maliki@emkayglobal.<strong>com</strong><br />

+91 22 6612 1257<br />

Ashish Thavkar<br />

ashish.thavkar@emkayglobal.<strong>com</strong><br />

+91 22 6612 1254<br />

Bhavita Nagrani<br />

bhavita.nagrani@emkayglobal.<strong>com</strong><br />