Annual Report FY2011 - Sujana Group

Annual Report FY2011 - Sujana Group

Annual Report FY2011 - Sujana Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

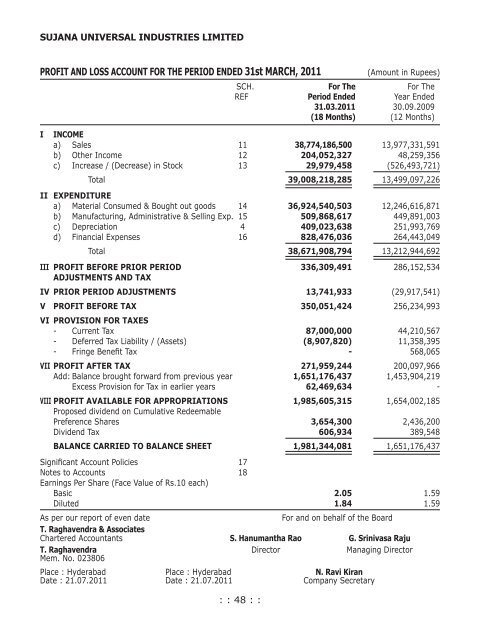

SUJANA UNIVERSAL INDUSTRIES LIMITED<br />

PROFIT AND LOSS ACCOUNT FOR THE PERIOD ENDED 31st MARCH, 2011<br />

I<br />

: : 48 : :<br />

(Amount in Rupees)<br />

SCH. For The For The<br />

REF Period Ended Year Ended<br />

31.03.2011 30.09.2009<br />

(18 Months) (12 Months)<br />

INCOME<br />

a) Sales 11 38,774,186,500 13,977,331,591<br />

b) Other Income 12 204,052,327 48,259,356<br />

c) Increase / (Decrease) in Stock 13 29,979,458 (526,493,721)<br />

Total 39,008,218,285 13,499,097,226<br />

II EXPENDITURE<br />

a) Material Consumed & Bought out goods 14 36,924,540,503 12,246,616,871<br />

b) Manufacturing, Administrative & Selling Exp. 15 509,868,617 449,891,003<br />

c) Depreciation 4 409,023,638 251,993,769<br />

d) Financial Expenses 16 828,476,036 264,443,049<br />

Total 38,671,908,794 13,212,944,692<br />

III PROFIT BEFORE PRIOR PERIOD 336,309,491 286,152,534<br />

ADJUSTMENTS AND TAX<br />

IV PRIOR PERIOD ADJUSTMENTS 13,741,933 (29,917,541)<br />

V PROFIT BEFORE TAX 350,051,424 256,234,993<br />

VI PROVISION FOR TAXES<br />

- Current Tax 87,000,000 44,210,567<br />

- Deferred Tax Liability / (Assets) (8,907,820) 11,358,395<br />

- Fringe Benefit Tax - 568,065<br />

VII PROFIT AFTER TAX 271,959,244 200,097,966<br />

Add: Balance brought forward from previous year 1,651,176,437 1,453,904,219<br />

Excess Provision for Tax in earlier years 62,469,634 -<br />

VIII PROFIT AVAILABLE FOR APPROPRIATIONS 1,985,605,315 1,654,002,185<br />

Proposed dividend on Cumulative Redeemable<br />

Preference Shares 3,654,300 2,436,200<br />

Dividend Tax 606,934 389,548<br />

BALANCE CARRIED TO BALANCE SHEET 1,981,344,081 1,651,176,437<br />

Significant Account Policies 17<br />

Notes to Accounts 18<br />

Earnings Per Share (Face Value of Rs.10 each)<br />

Basic 2.05 1.59<br />

Diluted 1.84 1.59<br />

As per our report of even date<br />

For and on behalf of the Board<br />

T. Raghavendra & Associates<br />

Chartered Accountants S. Hanumantha Rao G. Srinivasa Raju<br />

T. Raghavendra Director Managing Director<br />

Mem. No. 023806<br />

Place : Hyderabad Place : Hyderabad N. Ravi Kiran<br />

Date : 21.07.2011 Date : 21.07.2011 Company Secretary