Shell Refining Company (Federation of Malaya) Berhad (3926-U)

Shell Refining Company (Federation of Malaya) Berhad (3926-U)

Shell Refining Company (Federation of Malaya) Berhad (3926-U)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Middle<br />

East<br />

31%<br />

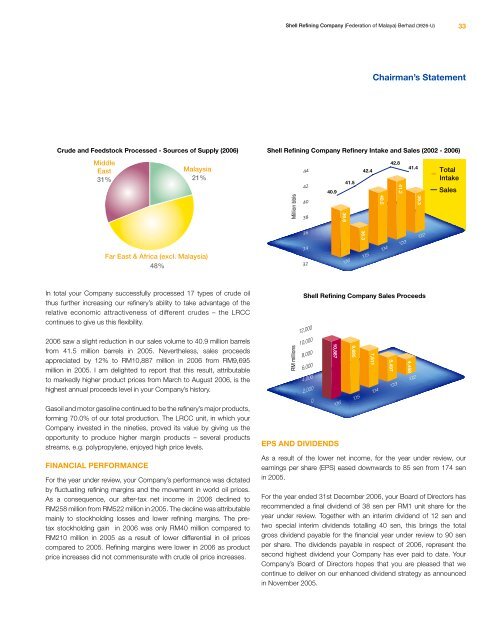

In total your <strong>Company</strong> successfully processed 17 types <strong>of</strong> crude oil<br />

thus further increasing our refinery’s ability to take advantage <strong>of</strong> the<br />

relative economic attractiveness <strong>of</strong> different crudes – the LRCC<br />

continues to give us this flexibility.<br />

2006 saw a slight reduction in our sales volume to 40.9 million barrels<br />

from 41.5 million barrels in 2005. Nevertheless, sales proceeds<br />

appreciated by 12% to RM10,887 million in 2006 from RM9,695<br />

million in 2005. I am delighted to report that this result, attributable<br />

to markedly higher product prices from March to August 2006, is the<br />

highest annual proceeds level in your <strong>Company</strong>’s history.<br />

Gasoil and motor gasoline continued to be the refinery’s major products,<br />

forming 70.0% <strong>of</strong> our total production. The LRCC unit, in which your<br />

<strong>Company</strong> invested in the nineties, proved its value by giving us the<br />

opportunity to produce higher margin products – several products<br />

streams, e.g. polypropylene, enjoyed high price levels.<br />

FinanCial PerFormanCe<br />

Malaysia<br />

21%<br />

Far East & Africa (excl. Malaysia)<br />

48%<br />

For the year under review, your <strong>Company</strong>’s performance was dictated<br />

by fluctuating refining margins and the movement in world oil prices.<br />

As a consequence, our after-tax net income in 2006 declined to<br />

RM258 million from RM522 million in 2005. The decline was attributable<br />

mainly to stockholding losses and lower refining margins. The pretax<br />

stockholding gain in 2006 was only RM40 million compared to<br />

RM210 million in 2005 as a result <strong>of</strong> lower differential in oil prices<br />

compared to 2005. <strong>Refining</strong> margins were lower in 2006 as product<br />

price increases did not commensurate with crude oil price increases.<br />

<strong>Shell</strong> <strong>Refining</strong> <strong>Company</strong> (<strong>Federation</strong> <strong>of</strong> <strong>Malaya</strong>) <strong>Berhad</strong> (<strong>3926</strong>-U) 33<br />

Chairman’s statement<br />

Crude and Feedstock Processed - sources <strong>of</strong> supply (2006) shell refining <strong>Company</strong> refinery intake and sales (2002 - 2006)<br />

Million bbls<br />

44<br />

42<br />

40<br />

38<br />

36<br />

34<br />

32<br />

40.9<br />

39.6<br />

41.5<br />

42.4<br />

36.3<br />

40.5<br />

42.8<br />

41.2<br />

41.4<br />

39.3<br />

‘06 ‘05 ‘04 ‘03 ‘02<br />

shell refining <strong>Company</strong> sales Proceeds<br />

12,000<br />

10,000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

ePs and dividends<br />

0<br />

4,458<br />

5,497<br />

7,511<br />

9,695<br />

10,887 ‘06 ‘05 ‘04 ‘03 ‘02<br />

As a result <strong>of</strong> the lower net income, for the year under review, our<br />

earnings per share (EPS) eased downwards to 85 sen from 174 sen<br />

in 2005.<br />

For the year ended 31st December 2006, your Board <strong>of</strong> Directors has<br />

recommended a final dividend <strong>of</strong> 38 sen per RM1 unit share for the<br />

year under review. Together with an interim dividend <strong>of</strong> 12 sen and<br />

two special interim dividends totalling 40 sen, this brings the total<br />

gross dividend payable for the financial year under review to 90 sen<br />

per share. The dividends payable in respect <strong>of</strong> 2006, represent the<br />

second highest dividend your <strong>Company</strong> has ever paid to date. Your<br />

<strong>Company</strong>’s Board <strong>of</strong> Directors hopes that you are pleased that we<br />

continue to deliver on our enhanced dividend strategy as announced<br />

in November 2005.

![Download Shell AutoGas Stationen [Stand: Januar 2013] (PDF](https://img.yumpu.com/9982753/1/190x245/download-shell-autogas-stationen-stand-januar-2013-pdf.jpg?quality=85)