Eng - IOI Group

Eng - IOI Group

Eng - IOI Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

notes to the<br />

financial statements<br />

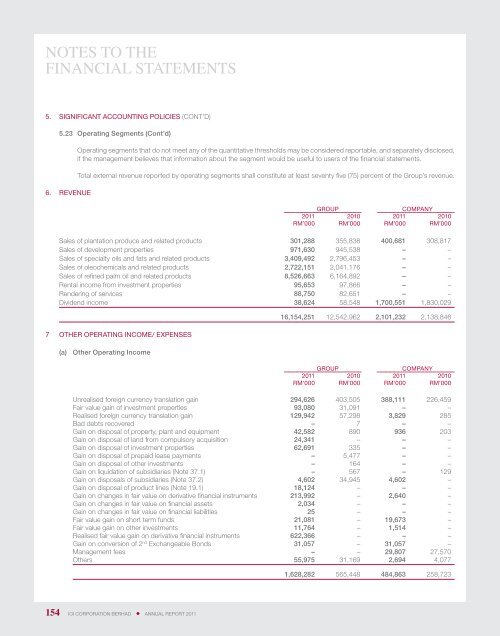

5. SIGNIFICANT ACCOUNTING POLICIES (cont’d)<br />

5.23 Operating Segments (Cont’d)<br />

6. REVENUE<br />

Operating segments that do not meet any of the quantitative thresholds may be considered reportable, and separately disclosed,<br />

if the management believes that information about the segment would be useful to users of the financial statements.<br />

Total external revenue reported by operating segments shall constitute at least seventy five (75) percent of the <strong>Group</strong>’s revenue.<br />

GrouP<br />

company<br />

2011 2010 2011 2010<br />

rm’000 RM’000 RM’000 RM’000<br />

Sales of plantation produce and related products 301,288 355,838 400,681 308,817<br />

Sales of development properties 971,630 945,538 – –<br />

Sales of specialty oils and fats and related products 3,409,492 2,796,453 – –<br />

Sales of oleochemicals and related products 2,722,151 2,041,176 – –<br />

Sales of refined palm oil and related products 8,526,663 6,164,892 – –<br />

Rental income from investment properties 95,653 97,866 – –<br />

Rendering of services 88,750 82,651 – –<br />

Dividend income 38,624 58,548 1,700,551 1,830,029<br />

7 OTHER OPERATING INCOME/ EXPENSES<br />

(a) Other Operating Income<br />

16,154,251 12,542,962 2,101,232 2,138,846<br />

GrouP<br />

company<br />

2011 2010 2011 2010<br />

rm’000 RM’000 RM’000 RM’000<br />

Unrealised foreign currency translation gain 294,626 403,505 388,111 226,459<br />

Fair value gain of investment properties 93,080 31,091 – –<br />

Realised foreign currency translation gain 129,942 57,298 3,829 285<br />

Bad debts recovered – 7 – –<br />

Gain on disposal of property, plant and equipment 42,582 890 936 203<br />

Gain on disposal of land from compulsory acquisition 24,341 – – –<br />

Gain on disposal of investment properties 62,691 335 – –<br />

Gain on disposal of prepaid lease payments – 5,477 – –<br />

Gain on disposal of other investments – 164 – –<br />

Gain on liquidation of subsidiaries (Note 37.1) – 567 – 129<br />

Gain on disposals of subsidiaries (Note 37.2) 4,602 34,945 4,602 –<br />

Gain on disposal of product lines (Note 19.1) 18,124 – – –<br />

Gain on changes in fair value on derivative financial instruments 213,992 – 2,640 –<br />

Gain on changes in fair value on financial assets 2,034 – – –<br />

Gain on changes in fair value on financial liabilities 25 – – –<br />

Fair value gain on short term funds 21,081 – 19,673 –<br />

Fair value gain on other investments 11,764 – 1,514 –<br />

Realised fair value gain on derivative financial instruments 622,366 – – –<br />

Gain on conversion of 2 nd Exchangeable Bonds 31,057 – 31,057 –<br />

Management fees – – 29,807 27,570<br />

Others 55,975 31,169 2,694 4,077<br />

1,628,282 565,448 484,863 258,723<br />

154 ioi corporation berhad • annual report 2011