- Page 1 and 2: IOI Corporation Berhad Annual repor

- Page 3 and 4: our vision …is to be a leading co

- Page 5: Profit Before Taxation 2011 Rm2.86

- Page 8 and 9: chairman’s statement Dear Shareho

- Page 10 and 11: Prospects Palm oil production volum

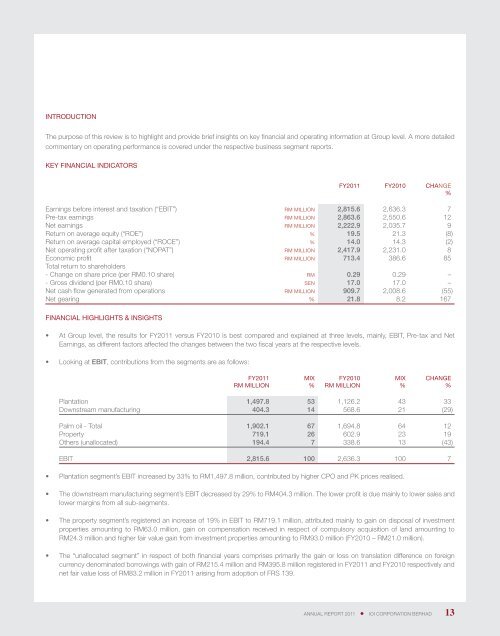

- Page 12 and 13: group financial overview CASH FLOWs

- Page 14 and 15: group performance highlights RM’0

- Page 16 and 17: five-year financial highlights RM

- Page 20 and 21: FINANCIAL HIGHLIGHTS & INSIGHTS (co

- Page 22 and 23: COE, ROCE, WACC AND ECONOMIC PROFIT

- Page 25 and 26: Boosting plantation productivity th

- Page 27 and 28: The Group has 82 estates, unchanged

- Page 29 and 30: AREA STATEMENT In Hectares 2011 201

- Page 31: For FY2011, the Group’s plantatio

- Page 34 and 35: management’s discussion and analy

- Page 36 and 37: Our manufacturing facilities are th

- Page 38 and 39: IOI City Development @ IOI Resort C

- Page 40 and 41: management’s discussion and analy

- Page 42 and 43: The Group’s property investment p

- Page 44 and 45: KEPONG Kuala Lumpur City Centre Nor

- Page 46 and 47: CORPORATE SOCIAL RESPONSIBILITY The

- Page 48 and 49: After being awarded the top rating

- Page 50 and 51: CORPORATE SOCIAL RESPONSIBILITY Soc

- Page 52 and 53: DECember 2010 A Christmas charity b

- Page 54 and 55: CORPORATE INFORMATION BOARD OF DIRE

- Page 56 and 57: profile of directors TAN SRI DATO

- Page 58 and 59: LEE CHENG LEANG Executive Director,

- Page 60 and 61: QUAH POH KEAT Independent Non-Execu

- Page 62 and 63: SENIOR MANAGEMENT TEAM Corporate Gr

- Page 64 and 65: Global presence North America USA

- Page 66 and 67: location of operations in malaysia

- Page 68 and 69:

corporate Calendar August 2010 Goma

- Page 70 and 71:

March 2011 IOI received two awards

- Page 72 and 73:

AUDIT COMMITTEE REPORT A MEMBERS Da

- Page 74 and 75:

viii To do the following, in relati

- Page 76 and 77:

Number of Meetings and Details of A

- Page 78 and 79:

Board Composition and Balance The B

- Page 80 and 81:

Dato’ Lee Yeow Chor CEO Dialogue

- Page 82 and 83:

Appointment to the Board and the ef

- Page 84 and 85:

The Group has also established seve

- Page 86 and 87:

statement on internal control INTRO

- Page 88 and 89:

RISK MANAGEMENT The Group’s activ

- Page 90 and 91:

other information composition of sh

- Page 92 and 93:

PENALTIES There were no sanctions a

- Page 94 and 95:

directors’ report The Directors o

- Page 96 and 97:

Directors’ report USD600 Million

- Page 98 and 99:

Directors’ report Executive Share

- Page 100 and 101:

Directors’ report Directors’ In

- Page 102 and 103:

Directors’ report Statutory Infor

- Page 104 and 105:

Directors’ report Significant Eve

- Page 106 and 107:

INCOME STATEMENTS for the Financial

- Page 108 and 109:

STATEMENTS OF FINANCIAL POSITION as

- Page 110 and 111:

STATEMENTS OF CHANGES IN EQUITY for

- Page 112 and 113:

STATEMENTS OF CHANGES IN EQUITY for

- Page 114 and 115:

STATEMENTS OF CASH FLOWS for the Fi

- Page 116 and 117:

STATEMENTS OF CASH FLOWS for the Fi

- Page 118 and 119:

notes to the financial statements 3

- Page 120 and 121:

notes to the financial statements 3

- Page 122 and 123:

notes to the financial statements 3

- Page 124 and 125:

notes to the financial statements 3

- Page 126 and 127:

notes to the financial statements 3

- Page 128 and 129:

notes to the financial statements 3

- Page 130 and 131:

notes to the financial statements 3

- Page 132 and 133:

notes to the financial statements 3

- Page 134 and 135:

notes to the financial statements 4

- Page 136 and 137:

notes to the financial statements 5

- Page 138 and 139:

notes to the financial statements 5

- Page 140 and 141:

notes to the financial statements 5

- Page 142 and 143:

notes to the financial statements 5

- Page 144 and 145:

notes to the financial statements 5

- Page 146 and 147:

notes to the financial statements 5

- Page 148 and 149:

notes to the financial statements 5

- Page 150 and 151:

notes to the financial statements 5

- Page 152 and 153:

notes to the financial statements 5

- Page 154 and 155:

notes to the financial statements 5

- Page 156 and 157:

notes to the financial statements 5

- Page 158 and 159:

notes to the financial statements 5

- Page 160 and 161:

notes to the financial statements 5

- Page 162 and 163:

notes to the financial statements 8

- Page 164 and 165:

notes to the financial statements 9

- Page 166 and 167:

notes to the financial statements 1

- Page 168 and 169:

notes to the financial statements 1

- Page 170 and 171:

notes to the financial statements 1

- Page 172 and 173:

notes to the financial statements 1

- Page 174 and 175:

notes to the financial statements 1

- Page 176 and 177:

notes to the financial statements 1

- Page 178 and 179:

notes to the financial statements 1

- Page 180 and 181:

notes to the financial statements 2

- Page 182 and 183:

notes to the financial statements 2

- Page 184 and 185:

notes to the financial statements 2

- Page 186 and 187:

notes to the financial statements 2

- Page 188 and 189:

notes to the financial statements 2

- Page 190 and 191:

notes to the financial statements 3

- Page 192 and 193:

notes to the financial statements 3

- Page 194 and 195:

notes to the financial statements 3

- Page 196 and 197:

notes to the financial statements 3

- Page 198 and 199:

notes to the financial statements 3

- Page 200 and 201:

notes to the financial statements 3

- Page 202 and 203:

notes to the financial statements 3

- Page 204 and 205:

notes to the financial statements 3

- Page 206 and 207:

notes to the financial statements 3

- Page 208 and 209:

notes to the financial statements 3

- Page 210 and 211:

notes to the financial statements 3

- Page 212 and 213:

notes to the financial statements 3

- Page 214 and 215:

notes to the financial statements 3

- Page 216 and 217:

notes to the financial statements 3

- Page 218 and 219:

notes to the financial statements 4

- Page 220 and 221:

notes to the financial statements 4

- Page 222 and 223:

notes to the financial statements 4

- Page 224 and 225:

notes to the financial statements 4

- Page 226 and 227:

notes to the financial statements 4

- Page 228 and 229:

notes to the financial statements 4

- Page 230 and 231:

notes to the financial statements 4

- Page 232 and 233:

notes to the financial statements 4

- Page 234 and 235:

notes to the financial statements 4

- Page 236 and 237:

notes to the financial statements 4

- Page 238 and 239:

notes to the financial statements 4

- Page 240 and 241:

notes to the financial statements 4

- Page 242 and 243:

notes to the financial statements 4

- Page 244 and 245:

notes to the financial statements 4

- Page 246 and 247:

notes to the financial statements 4

- Page 248 and 249:

notes to the financial statements 4

- Page 250 and 251:

notes to the financial statements 4

- Page 252 and 253:

notes to the financial statements 4

- Page 254 and 255:

notes to the financial statements 4

- Page 256 and 257:

notes to the financial statements 4

- Page 258 and 259:

notes to the financial statements 4

- Page 260 and 261:

notes to the financial statements 4

- Page 262 and 263:

notes to the financial statements 4

- Page 264 and 265:

notes to the financial statements 4

- Page 266 and 267:

notes to the financial statements 4

- Page 268 and 269:

notes to the financial statements 4

- Page 270 and 271:

notes to the financial statements 4

- Page 272 and 273:

STATEMENT BY DIRECTORS In the opini

- Page 274 and 275:

INDEPENDENT AUDITORS’ REPORT to t

- Page 276 and 277:

GROUP PROPERTIES A. PLANTATION ESTA

- Page 278 and 279:

GROUP PROPERTIES B. DEVELOPMENT PRO

- Page 280 and 281:

GROUP PROPERTIES B. DEVELOPMENT PRO

- Page 282 and 283:

GROUP PROPERTIES C. INVESTMENT PROP

- Page 284 and 285:

GROUP PROPERTIES D. INDUSTRIAL PROP

- Page 286 and 287:

GROUP PROPERTIES E. OTHER PROPERTIE

- Page 288 and 289:

notice of annual general meeting NO

- Page 290 and 291:

notice of annual general meeting AG

- Page 292 and 293:

statement accompanying notice of an

- Page 294 and 295:

SHAREHOLDERS INFORMATION As at 29 A

- Page 296 and 297:

notes

- Page 298 and 299:

FOLD HERE stamp The Company Secreta