Annual Report - Bina Puri

Annual Report - Bina Puri

Annual Report - Bina Puri

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

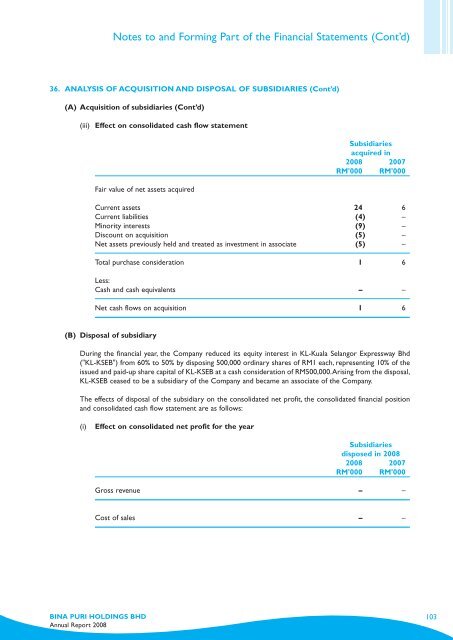

Notes to and Forming Part of the Financial Statements (Cont’d)<br />

36. ANALYSIS OF ACQUISITION AND DISPOSAL OF SUBSIDIARIES (Cont’d)<br />

(A) Acquisition of subsidiaries (Cont’d)<br />

(iii) Effect on consolidated cash flow statement<br />

Fair value of net assets acquired<br />

Subsidiaries<br />

acquired in<br />

2008 2007<br />

RM'000 RM'000<br />

Current assets 24 6<br />

Current liabilities (4) –<br />

Minority interests (9) –<br />

Discount on acquisition (5) –<br />

Net assets previously held and treated as investment in associate (5) –<br />

Total purchase consideration 1 6<br />

Less:<br />

Cash and cash equivalents – –<br />

Net cash flows on acquisition 1 6<br />

(B) Disposal of subsidiary<br />

During the financial year, the Company reduced its equity interest in KL-Kuala Selangor Expressway Bhd<br />

("KL-KSEB") from 60% to 50% by disposing 500,000 ordinary shares of RM1 each, representing 10% of the<br />

issued and paid-up share capital of KL-KSEB at a cash consideration of RM500,000.Arising from the disposal,<br />

KL-KSEB ceased to be a subsidiary of the Company and became an associate of the Company.<br />

The effects of disposal of the subsidiary on the consolidated net profit, the consolidated financial position<br />

and consolidated cash flow statement are as follows:<br />

(i)<br />

Effect on consolidated net profit for the year<br />

Subsidiaries<br />

disposed in 2008<br />

2008 2007<br />

RM'000 RM'000<br />

Gross revenue – –<br />

Cost of sales – –<br />

BINA PURI HOLDINGS BHD<br />

<strong>Annual</strong> <strong>Report</strong> 2008<br />

103