Annual Report - Bina Puri

Annual Report - Bina Puri

Annual Report - Bina Puri

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to and Forming Part of the Financial Statements (Cont’d)<br />

21. OTHER CAPITAL RESERVES, non-distributable<br />

Other capital reserves represent retained earnings of subsidiaries which have been capitalised for the issue of<br />

bonus shares to the Company.As a result of this capitalisation, these retained earnings are no longer available for<br />

distribution, and as such, have been transferred from retained earnings to other capital reserves and considered<br />

non-distributable.<br />

22. GOVERNMENT GRANT<br />

A subsidiary was awarded a government grant of RM108,000 in 2006, which represented the fair value of a<br />

factory equipment pursuant to a subgrant agreement entered between Government of Malaysia and the said<br />

subsidiary. The factory equipment is used by the subsidiary for the purpose of converting its manufacturing<br />

process using chlorofluorocarbon-free technology, and the grant received is being recognised as income over the<br />

useful life of the factory equipment.<br />

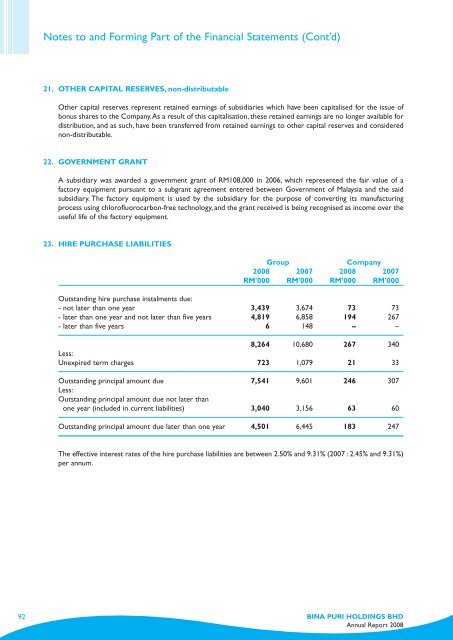

23. HIRE PURCHASE LIABILITIES<br />

Group<br />

Company<br />

2008 2007 2008 2007<br />

RM'000 RM'000 RM'000 RM'000<br />

Outstanding hire purchase instalments due:<br />

- not later than one year 3,439 3,674 73 73<br />

- later than one year and not later than five years 4,819 6,858 194 267<br />

- later than five years 6 148 – –<br />

8,264 10,680 267 340<br />

Less:<br />

Unexpired term charges 723 1,079 21 33<br />

Outstanding principal amount due 7,541 9,601 246 307<br />

Less:<br />

Outstanding principal amount due not later than<br />

one year (included in current liabilities) 3,040 3,156 63 60<br />

Outstanding principal amount due later than one year 4,501 6,445 183 247<br />

The effective interest rates of the hire purchase liabilities are between 2.50% and 9.31% (2007 : 2.45% and 9.31%)<br />

per annum.<br />

92 BINA PURI HOLDINGS BHD<br />

<strong>Annual</strong> <strong>Report</strong> 2008