Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Review Continued<br />

In 2008, the contribution from management activities<br />

before depreciation was US$16.4 million, largely<br />

unchanged from US$16.2 million in 2007. Revenues<br />

on which management fees are largely based, were stable<br />

year on year, as revenues from newly opened hotels<br />

offset a decline in revenues at existing hotels. In 2008,<br />

the Group’s management activity also benefited from<br />

branding fees from the sales of The Residences at<br />

<strong>Mandarin</strong> <strong>Oriental</strong> in Boston which were completed<br />

as the hotel opened. This was offset however, by<br />

higher overheads at the corporate level as the Group<br />

strengthened its management capability to support<br />

new hotel openings.<br />

Depreciation and amortization expenses were<br />

US$39.3 million for 2008 slightly up from<br />

US$38.5 million in 2007.<br />

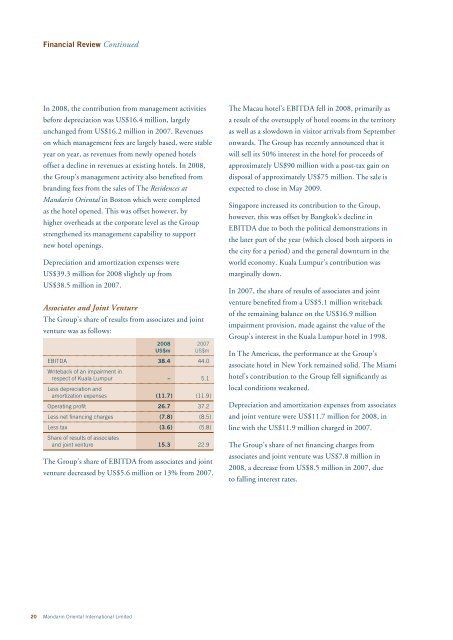

Associates and Joint Venture<br />

The Group’s share of results from associates and joint<br />

venture was as follows:<br />

2008 2007<br />

US$m US$m<br />

EBITDA<br />

Writeback of an impairment in<br />

38.4 44.0<br />

respect of Kuala Lumpur – 5.1<br />

Less depreciation and<br />

amortization expenses (11.7 ) (11.9 )<br />

Operating profit 26.7 37.2<br />

Less net financing charges (7.8 ) (8.5 )<br />

Less tax (3.6 ) (5.8 )<br />

Share of results of associates<br />

and joint venture 15.3 22.9<br />

The Group’s share of EBITDA from associates and joint<br />

venture decreased by US$5.6 million or 13% from 2007.<br />

20 <strong>Mandarin</strong> <strong>Oriental</strong> <strong>International</strong> <strong>Limited</strong><br />

The Macau hotel’s EBITDA fell in 2008, primarily as<br />

a result of the oversupply of hotel rooms in the territory<br />

as well as a slowdown in visitor arrivals from September<br />

onwards. The Group has recently announced that it<br />

will sell its 50% interest in the hotel for proceeds of<br />

approximately US$90 million with a post-tax gain on<br />

disposal of approximately US$75 million. The sale is<br />

expected to close in May 2009.<br />

Singapore increased its contribution to the Group,<br />

however, this was offset by Bangkok’s decline in<br />

EBITDA due to both the political demonstrations in<br />

the later part of the year (which closed both airports in<br />

the city for a period) and the general downturn in the<br />

world economy. Kuala Lumpur’s contribution was<br />

marginally down.<br />

In 2007, the share of results of associates and joint<br />

venture benefited from a US$5.1 million writeback<br />

of the remaining balance on the US$16.9 million<br />

impairment provision, made against the value of the<br />

Group’s interest in the Kuala Lumpur hotel in 1998.<br />

In The Americas, the performance at the Group’s<br />

associate hotel in New York remained solid. The Miami<br />

hotel’s contribution to the Group fell significantly as<br />

local conditions weakened.<br />

Depreciation and amortization expenses from associates<br />

and joint venture were US$11.7 million for 2008, in<br />

line with the US$11.9 million charged in 2007.<br />

The Group’s share of net financing charges from<br />

associates and joint venture was US$7.8 million in<br />

2008, a decrease from US$8.5 million in 2007, due<br />

to falling interest rates.