Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

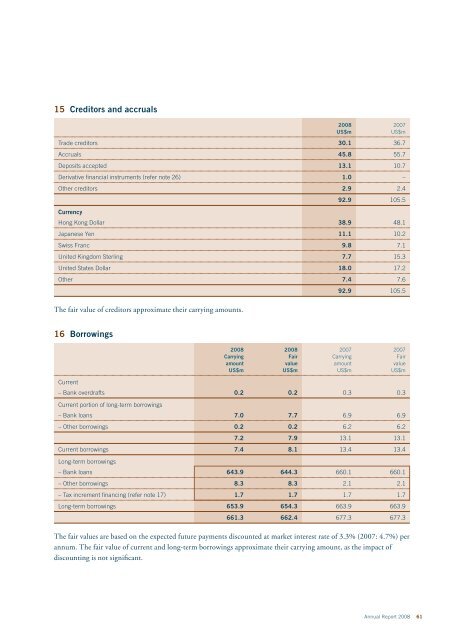

15 Creditors and accruals<br />

2008 2007<br />

US$m US$m<br />

Trade creditors 30.1 36.7<br />

Accruals 45.8 55.7<br />

Deposits accepted 13.1 10.7<br />

Derivative financial instruments (refer note 26) 1.0 –<br />

Other creditors 2.9 2.4<br />

92.9 105.5<br />

Currency<br />

Hong Kong Dollar 38.9 48.1<br />

Japanese Yen 11.1 10.2<br />

Swiss Franc 9.8 7.1<br />

United Kingdom Sterling 7.7 15.3<br />

United States Dollar 18.0 17.2<br />

Other 7.4 7.6<br />

92.9 105.5<br />

The fair value of creditors approximate their carrying amounts.<br />

16 Borrowings<br />

2008 2008 2007 2007<br />

Carrying Fair Carrying Fair<br />

amount value amount value<br />

US$m US$m US$m US$m<br />

Current<br />

– Bank overdrafts 0.2 0.2 0.3 0.3<br />

Current portion of long-term borrowings<br />

– Bank loans 7.0 7.7 6.9 6.9<br />

– Other borrowings 0.2 0.2 6.2 6.2<br />

7.2 7.9 13.1 13.1<br />

Current borrowings 7.4 8.1 13.4 13.4<br />

Long-term borrowings<br />

– Bank loans 643.9 644.3 660.1 660.1<br />

– Other borrowings 8.3 8.3 2.1 2.1<br />

– Tax increment financing (refer note 17) 1.7 1.7 1.7 1.7<br />

Long-term borrowings 653.9 654.3 663.9 663.9<br />

661.3 662.4 677.3 677.3<br />

The fair values are based on the expected future payments discounted at market interest rate of 3.3% (2007: 4.7%) per<br />

annum. The fair value of current and long-term borrowings approximate their carrying amount, as the impact of<br />

discounting is not significant.<br />

Annual Report 2008 61