Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

B Capital management<br />

The Group’s objectives when managing capital are to safeguard the Group’s ability to continue as a going concern<br />

whilst seeking to maximize benefits to shareholders and other stakeholders. Capital is equity as shown in the<br />

consolidated balance sheet plus net debt.<br />

The Group actively and regularly reviews and manages its capital structure to ensure optimal capital structure and<br />

shareholder returns, taking into consideration the future capital requirements of the Group and capital efficiency,<br />

prevailing and projected profitability, projected operating cash flows, projected capital expenditures and projected<br />

strategic investment opportunities. In order to maintain or adjust the capital structure, the Group may adjust the<br />

amount of dividends paid to shareholders, purchase Group shares, return capital to shareholders, issue new shares<br />

or sell assets to reduce debt.<br />

The Group monitors capital on the basis of the Group’s consolidated gearing ratio and consolidated interest cover.<br />

The gearing ratio is calculated as net debt divided by total equity. Net debt is calculated as total borrowings less<br />

bank balances and other liquid funds. Interest cover is calculated as operating profit (excluding gain on disposal<br />

and the writeback of impairment) before interest and tax (including the Group’s share of operating profit from<br />

associates and joint venture) divided by net financing charges (including the Group’s share of net financing<br />

charges from associates and joint venture). The Group does not have a defined gearing or interest cover benchmark<br />

or range.<br />

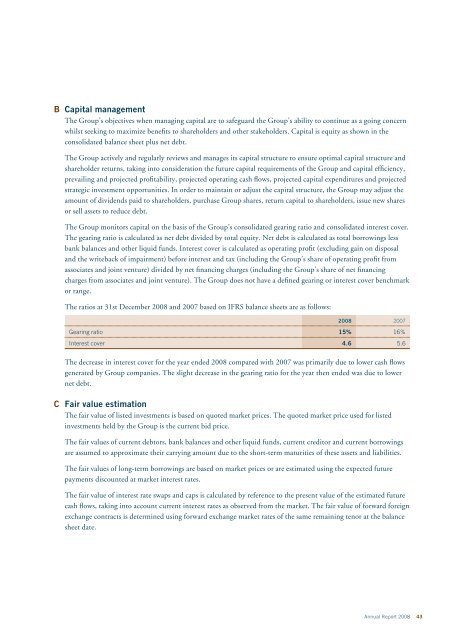

The ratios at 31st December 2008 and 2007 based on IFRS balance sheets are as follows:<br />

2008 2007<br />

Gearing ratio 15% 16%<br />

Interest cover 4.6 5.6<br />

The decrease in interest cover for the year ended 2008 compared with 2007 was primarily due to lower cash flows<br />

generated by Group companies. The slight decrease in the gearing ratio for the year then ended was due to lower<br />

net debt.<br />

C Fair value estimation<br />

The fair value of listed investments is based on quoted market prices. The quoted market price used for listed<br />

investments held by the Group is the current bid price.<br />

The fair values of current debtors, bank balances and other liquid funds, current creditor and current borrowings<br />

are assumed to approximate their carrying amount due to the short-term maturities of these assets and liabilities.<br />

The fair values of long-term borrowings are based on market prices or are estimated using the expected future<br />

payments discounted at market interest rates.<br />

The fair value of interest rate swaps and caps is calculated by reference to the present value of the estimated future<br />

cash flows, taking into account current interest rates as observed from the market. The fair value of forward foreign<br />

exchange contracts is determined using forward exchange market rates of the same remaining tenor at the balance<br />

sheet date.<br />

Annual Report 2008 43