1 - Internal Revenue Service

1 - Internal Revenue Service

1 - Internal Revenue Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

•<br />

sit.<br />

LP-1 ON 4 L OVERLAP R LP-361 ifii.wP RP-1 ON 62<br />

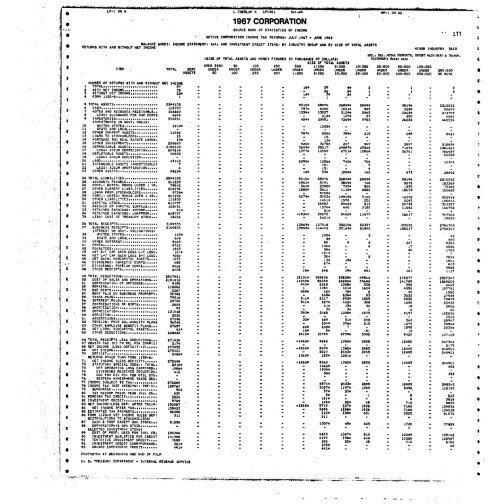

1967 CORPORATION<br />

SOURCE 800K OF STATISTICS OF INCOME<br />

• ACTIVE CORPORATION INCOME TAX RETURNS. JULY 1967 ■ JUNE 1968<br />

BALANCE SHEET. INCOME STATEMENT. TAX, AND INVESTMENT CREDIT ITEMS. BY INDUSTRY GROUP AND BY SIZE OF TOTAL ASSETS<br />

• RETURNS WITH AND WITHOUT NET INCOME MINOR INDUSTRY 3410<br />

117<br />

t<br />

0<br />

ITEM<br />

TOTAL<br />

ZERO<br />

ASSETS<br />

(SIZE OF TOTAL ASSETS AND MONEY FIGURES IN THOUSANDS OF DOLLARS(<br />

SIZE OF TOTAL ASSETS<br />

OVER ZERO 50 100 250 500 1.000 5,000<br />

UNDER UNDER UNDER UNDER UNDER UNDER UNDER<br />

50 100 250 500 11000 5.000 10,000<br />

10.000<br />

UNDER<br />

25.000<br />

NYC.. ► AB. METAL PRODUCTS, EXCEPT MACHINERY& TRAMP.<br />

EQUIPMENT) Metal can.<br />

25.000 500000 100,000<br />

UNDER UNDER UNDER 2501000<br />

50.000 100.000 2501000 OR MORE<br />

4.<br />

I<br />

2<br />

1<br />

1<br />

1<br />

)I,<br />

I<br />

1<br />

1<br />

4<br />

4<br />

0<br />

4<br />

C<br />

*<br />

0<br />

• NUMBER OF RETURNS WITH AND WITHOUT NET INCOME<br />

1 TOTAL 57<br />

2 WITH NET INCOME 35<br />

3 WITHOUT NET INCOME 22*<br />

4 FORM 1120-S 1<br />

5 TOTAL ASSETS 2544105<br />

6 CASH 105747<br />

7 NOTES AND ACCOUNTS RECEIVABLE 316863<br />

8 LESS' ALLOWANCE FOR BAD DEBTS 4608<br />

9 INVENTORIES 510261<br />

INVESTMENTS IN GOVT. OBLIG.<br />

10 UNITED STATES 1543*<br />

11 STATE AND LOCAL ■<br />

12 OTHER CURRENT ASSETS 11016<br />

13 LOANS TO STOCKHOLDERS 15<br />

14 MORTGAGE ANC REAL ESTATE LOANS 13*<br />

15 OTHER INVESTMENTS 226643<br />

16 DEPRECIABLE ASSETS 2150149<br />

17 LESS. ACCUM DEPRECIATION 857819<br />

18 DEPLETABLE ASSETS 40898<br />

19 LESS. ACCUM DEPLETION -<br />

20 LAND 15142<br />

21 INTANGIBLE ASSETS (AMORTIZABLE/ 7<br />

22 LESS. ACCUM AMORTIZATION 4<br />

23 OTHER ASSETS 28239<br />

24 TOTAL LIABILITIES 2544105<br />

25 ACCOUNTS PAYABLE 201533<br />

26 MONT.' NOTES. BONDS UNDER 1 YR 78942<br />

27 OTHER CURRENT LIABILITIES 204234<br />

28 . LOANS FROM STOCKHOLDERS 9758*<br />

29 MORT.. NOTES. BONDS OVER 1 YR 547258<br />

30 OTHER LIABILITIES 111800<br />

31 CAPITAL STOCK 416757<br />

32 PAID-IN OR CAPITAL SURPLUS 183491<br />

33 RETAINED EARNINGS. APPROP 51*<br />

34 RETAINED EARNINGS, UNAPPROP 808737<br />

35 LESS/ COST OF TREASURY STOCK 18456<br />

36 TOTAL RECEIPTS 3189355<br />

37 BUSINESS RECEIPTS 3160855<br />

INTEREST ON GOVT. OBLIGATIONS/<br />

38 UNITED STATES 125*<br />

39 STATE AND LOCAL 648<br />

40 OTHER INTEREST 5660<br />

41 RENTS ' 4725<br />

42 ROYALTIES 1863<br />

43 NET S-T CAP GAIN LESS L.1. LOSS (5)*<br />

44 NET L-T CAP GAIN LESS S.T LOSS 7050<br />

45 NET GAIN, NONCAPITAL ASSETS 1073<br />

46 DIVIDENDS. DOMESTIC CORPS 485<br />

47 DIVIDENDS. FOREIGN CORPS 4466<br />

46 OTHER RECEIPTS 2405<br />

■<br />

-<br />

■<br />

.<br />

• ■•<br />

■••<br />

-<br />

-<br />

■<br />

-<br />

16* 29 6*<br />

. 26 4*<br />

16* 3* 2*<br />

1<br />

9410* 68970 36898*<br />

787* 6484 1031*<br />

1934* 13527 3124*<br />

. 213* 107*<br />

459* 20951 7269*<br />

• 1543* -<br />

. . .<br />

787* 524* 384*<br />

- 15 -<br />

. 13*<br />

820* 3278* 207<br />

3689* 35217 29887*<br />

1377* 13959 6721*<br />

. . -<br />

. . .<br />

2295* 1056* 740*<br />

(5) -<br />

. (51 ■<br />

16* 534 1084*<br />

9410* 68970 36898*<br />

4541* 3791 3509*<br />

541* 2392* 795*<br />

1885* 3811 1110*<br />

. 9758*<br />

4279* 3703* 14908*<br />

- 1451* 1570<br />

- 15983 8966*<br />

1076* 640<br />

' 51* -<br />

•1836* 29575 5400*<br />

2621* -<br />

13869* 117518 35220*<br />

13853* 116402 35183*<br />

a<br />

1<br />

28099<br />

485<br />

2465<br />

27<br />

9783<br />

-<br />

.<br />

215<br />

-<br />

547<br />

25846<br />

12064<br />

.<br />

.<br />

706<br />

7<br />

4<br />

140<br />

28099<br />

748<br />

500<br />

6086<br />

5100<br />

220<br />

813<br />

3155<br />

-<br />

11477<br />

-<br />

52357<br />

51890<br />

1 3<br />

1 - 3 0<br />

90196 2310532<br />

3286 93674<br />

22038 273775<br />

200 4061<br />

26265 445534<br />

.<br />

..<br />

685<br />

-<br />

2897<br />

71053<br />

36701<br />

.<br />

-<br />

873<br />

8421<br />

218894<br />

1984457<br />

786997<br />

40898<br />

10345<br />

25592<br />

90196 2310532<br />

5575 183369<br />

1350 73364<br />

10659 - 180683<br />

16350 502918<br />

2045 106514<br />

25738 365257<br />

11662 166758<br />

- -<br />

16617 747504<br />

- 15835<br />

185682 2784709<br />

185217 2758310<br />

-<br />

100*<br />

3<br />

- 22<br />

-<br />

-<br />

- . 640 e<br />

- 4<br />

3<br />

247 5326<br />

-<br />

134*<br />

8<br />

17<br />

.<br />

4566<br />

.<br />

.<br />

-<br />

40<br />

1785<br />

c<br />

-<br />

-<br />

-<br />

-<br />

-<br />

■<br />

2<br />

■<br />

7018<br />

13 ► 19* -<br />

-<br />

■ 67* -<br />

.<br />

..<br />

5<br />

.<br />

-<br />

-<br />

■ .<br />

.<br />

•<br />

•<br />

-<br />

76* 646 14* 451<br />

■ 161 c<br />

49 TOTAL DEDUCTIONS 2917931<br />

■<br />

-<br />

15131* 108036<br />

SO<br />

33838* 49502<br />

COST OF SALES AND OPERATIONS 2191812<br />

-<br />

.<br />

-<br />

-<br />

51<br />

11459* 66459<br />

COMPENSATION OF OFFICERS<br />

24286* 38690<br />

141709<br />

9154<br />

N:19;; 977<br />

-<br />

w<br />

443* 2365<br />

52 REPAIRS 338<br />

- 4445<br />

115802<br />

53<br />

-<br />

-<br />

-<br />

.<br />

108L<br />

BAD DEBTS<br />

16:i<br />

. 171;<br />

0<br />

- 107751<br />

.<br />

54 RENT PAiD ON BUSINESS PROPERTY 32342<br />

.<br />

.<br />

-<br />

.<br />

40 - 1580<br />

0<br />

.<br />

55 TAXES PAID 79516<br />

.<br />

3022 27935<br />

.<br />

.<br />

56<br />

:::: 2217 g4::<br />

INTEREST PA.D<br />

1009<br />

455 0<br />

■ 70829<br />

29790<br />

.<br />

.<br />

.<br />

.<br />

57<br />

541*<br />

44:: 398<br />

CONTRIBUTIONS OR GIFTS<br />

- 1650 -<br />

/<br />

2508<br />

...<br />

.<br />

.<br />

58 AMORTIZATION 93<br />

.<br />

656: 871 4:<br />

.<br />

12!!! 30<br />

-<br />

2 :( 9 .<br />

-<br />

.<br />

59 DEPRECIATION<br />

3*<br />

1<br />

131948<br />

-<br />

-<br />

80<br />

-<br />

393* 2465<br />

60<br />

10::: 1509<br />

DEPLETION<br />

4197<br />

2520<br />

..<br />

0<br />

-<br />

-<br />

.<br />

■<br />

■<br />

61 ADVERTISING 27286<br />

■<br />

.<br />

..<br />

12TO<br />

-<br />

33* 689<br />

62 PENSION. PROF<br />

208<br />

362<br />

SH.,ANNUITY PLANS<br />

- 25943<br />

36340<br />

■<br />

.<br />

-<br />

-<br />

534*<br />

63<br />

376* r<br />

OTHER EMPLOYEE BENEFIT PLANSee<br />

212<br />

33944<br />

27687<br />

•<br />

.<br />

4<br />

.<br />

64 66*<br />

■<br />

NET LOSS. NONCAPITAL ASSETS 43* .<br />

-<br />

.<br />

63 OTHER<br />

16* 8<br />

DEDUCTIONS<br />

(51<br />

-<br />

.<br />

228883<br />

.<br />

.<br />

-<br />

.<br />

.<br />

1410* 10799 4759* 5392<br />

119fii<br />

T<br />

66 TOTAL RECEIPTS LESS DEDUCTIONS<br />

271424<br />

-<br />

.<br />

.<br />

-<br />

67 CONSTR<br />

•.1262*<br />

TAX INC FM REL FOR<br />

8682<br />

CORP111<br />

1382*<br />

- 12405<br />

-<br />

2179 .<br />

12 294 57E<br />

■<br />

-<br />

-<br />

■<br />

68 NET INCOME (LESS<br />

. .<br />

DEFICIT1(2)<br />

272955<br />

-<br />

.<br />

.<br />

.<br />

.<br />

69 NET INCOME<br />

.4262* 8674<br />

::::<br />

. 12405<br />

■<br />

275421<br />

.<br />

.0<br />

70 DEFICIT<br />

01:g<br />

2466* .<br />

2855<br />

■<br />

a<br />

-<br />

.<br />

giiF 1<br />

RETURNS OTHER THAN FORM 1120.51<br />

1262* 10:1*<br />

.<br />

. .<br />

■ 1<br />

71 NET INCOME (LESS DEFICIT/ 272644<br />

.<br />

.<br />

.<br />

.<br />

.<br />

72<br />

.12:2*<br />

STATUTORY SPECIAL DEDS.t TOTAL<br />

1382* 2855<br />

- 12405<br />

2318*<br />

- 24T:<br />

.<br />

.<br />

-<br />

73<br />

11;5:32:<br />

■<br />

NET OPERATING LOSS CARRYFRO.i<br />

.<br />

1906* .<br />

.<br />

.<br />

$<br />

.<br />

■<br />

74 DIVIDENDS RECEIVED DEDUCTION,<br />

.0 . ■<br />

412<br />

.<br />

.<br />

.<br />

.<br />

.<br />

75 .<br />

.<br />

DED FOR DIV PD. PUB UTIL STK,<br />

I::<br />

.<br />

. .<br />

.<br />

.<br />

356<br />

.<br />

.<br />

.<br />

.<br />

76<br />

-<br />

WESTERN HEMISPHERE TRADE DEN<br />

.<br />

. •<br />

■<br />

■<br />

.<br />

.<br />

.<br />

.<br />

77 INCOME SUBJECT TO TAX<br />

272809<br />

-<br />

-<br />

.<br />

-<br />

.<br />

'<br />

.<br />

-<br />

0<br />

■<br />

.<br />

65;1* 2433*<br />

78 INCOME TAX (BEF CREDITS). TOT(3)<br />

2855<br />

■ 12408<br />

129767<br />

-<br />

-<br />

a<br />

. 248549<br />

a.<br />

-<br />

79 SURCHARGE 3057*<br />

90* .<br />

11!;: 136:<br />

.<br />

.<br />

- 595;<br />

-<br />

-<br />

-<br />

80 TAX RECOMP PRIOR YEAR INV. CR 537<br />

n<br />

.<br />

a<br />

n<br />

.<br />

no<br />

a<br />

81 FOREIGN TAX CREDIT<br />

.<br />

3824<br />

.<br />

.<br />

.<br />

a<br />

.<br />

62 INVESTMENT CREDIT . . .<br />

9769<br />

.<br />

n<br />

0<br />

.<br />

.<br />

126*<br />

83 NET INCOMEILESS DM AFTER TAX(4)<br />

58731 19425183<br />

52* 45<br />

152957<br />

.<br />

a<br />

716<br />

11 ;iii<br />

.<br />

a .1262*<br />

84 NET INCOME AFTER TAX<br />

237*<br />

155423<br />

a<br />

1536<br />

7165<br />

-<br />

.<br />

a<br />

a<br />

85 ESTIMATED TAX PAYMENTS<br />

1255*<br />

86206<br />

a<br />

1536<br />

.<br />

a<br />

a<br />

71:5<br />

.<br />

a<br />

.<br />

5:2*<br />

86 FORM 1120.S NET INCOME (LESS DEFT<br />

651<br />

.<br />

311<br />

3225,<br />

.<br />

.<br />

.<br />

Tiii<br />

.<br />

.<br />

-<br />

DISTRIBUTIONS TO STOCKHOLDERS.<br />

.<br />

.<br />

87 CASH It PROP EXCEPT OWN STOCK 81559<br />

■<br />

.<br />

.<br />

.<br />

.<br />

Be<br />

1307* 3 :::<br />

CORPORATION'S OWN STOCK<br />

625<br />

.<br />

■<br />

.<br />

1720<br />

.<br />

n<br />

. 77859<br />

.<br />

SELECTED INVESTMENT ITEMS'<br />

-<br />

- -<br />

■<br />

89 COST OF PROP. USED FOR INV. CR . 156346<br />

0<br />

2<br />

.<br />

.<br />

.<br />

. 4855<br />

90<br />

10;<br />

INVESTMENT QUALIFIED FOR CREDIT<br />

813<br />

10469<br />

141308<br />

. 139142<br />

-<br />

.<br />

-<br />

■ 41:;<br />

91 TENTATIVE INVESTMENT CREDIT•••.<br />

758*<br />

9889<br />

-<br />

-<br />

644<br />

10226<br />

■<br />

-<br />

125487<br />

92<br />

.<br />

INVESTMENT CREDIT CARRYFORWARD<br />

45<br />

-<br />

716 - I<br />

-<br />

-<br />

a,<br />

4.<br />

-<br />

.<br />

93 UNUSED INVESTMENT CREDIT g 1 :<br />

.<br />

.<br />

. :74T:<br />

. -<br />

FOOTNOTES AT BEGINNING AND END OF FILM 4<br />

. U. S. TREASURY DEPARTMENT • INTERNAL REVENUE SERVICE<br />

C<br />

1<br />

O<br />

0<br />

O

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)