1 - Internal Revenue Service

1 - Internal Revenue Service

1 - Internal Revenue Service

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

LP-1 ON 4<br />

L OVERLAP R LP-767 767-RP RP-1 ON 62<br />

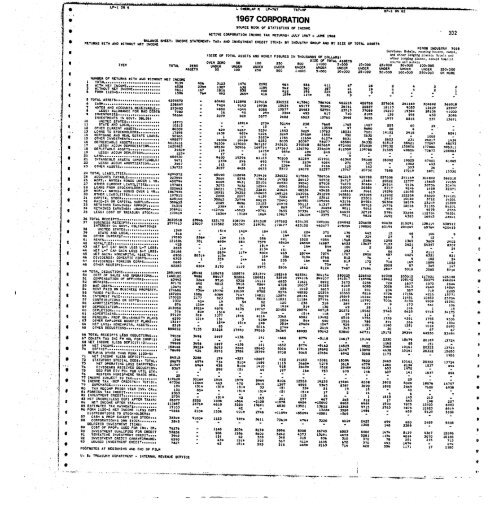

1967 CORPORATION<br />

SOURCE BOOK OF STATISTICS OF INCOME<br />

ACTIVE CORPORATION INCOME TAX RETURNS. JULY 1967 JUNE 1968<br />

RETURNS WITH AND WITHOUT NET<br />

BALANCE<br />

INCOME<br />

SHEET. INCOME STATEMENT/ TAX, AND INVESTMENT CREDIT ITEMS. BY INDUSTRY GROUP AND BY SIZE OF TOTAL ASSETS<br />

MINOR INDUSTRY 7018<br />

<strong>Service</strong>s: Hotels, rooming houses, camps,<br />

(SIZE OF TOTAL ASSETS AND MONEY FIGURES IN THOUSANDS OF DOLLARS)<br />

and °tier lodging places; Hoteln and<br />

other lodging places, except tourist<br />

OVER ZERO<br />

SIZE OF TOTAL ASSETS<br />

50 courts and motels<br />

ITEM<br />

100 250 500<br />

TOTAL<br />

1.000<br />

ZERO UNDER<br />

5.000<br />

UNDER<br />

10.000<br />

UNDER<br />

25.000<br />

UNDER UNDER<br />

50/000 100.000<br />

ASSETS<br />

UNDER<br />

50 100<br />

UNDER<br />

250<br />

UNDER UNDER<br />

500<br />

UNDER<br />

1.000<br />

UNDER<br />

5 1<br />

250.000<br />

000 ' 10.000 25.000 501000<br />

I<br />

100.000 250.000 OR MORE<br />

NUMBER OF RETURNS WITH AND WITHOUT NET INCOME<br />

1 TOTAL<br />

I<br />

9139 406 3123<br />

2 WITH NET INCOME<br />

1476 2092 964 556<br />

239*<br />

411<br />

1307 638<br />

67 28 8 4 2<br />

3 WITHOUT NET INCOME<br />

2<br />

:ZIT 167<br />

542 360<br />

1816 838<br />

187<br />

4 FORM 1120-S 19::<br />

41 19 4 4 2 1<br />

1586<br />

422<br />

76*<br />

196<br />

492<br />

224 26 9 4 ■ 1<br />

4<br />

265* 416 31 3 ■ ■<br />

-<br />

5 TOTAL ASSETS 4294572 ■ 60490 112898<br />

6 CASH<br />

319416 336532 417 184 40 * 786706 462215 426788 257608 241169<br />

■<br />

19739<br />

304892<br />

I<br />

238597<br />

15434 568018<br />

7 NOTES AND ACCOUNTS RECEIVABLE<br />

49177<br />

273493<br />

26161<br />

■ 74:::<br />

12113 9053<br />

B LESS ► ALLOWANCE FOR BAD DEBTS<br />

24483<br />

7980<br />

52754<br />

■ 16<br />

::::75 14210 ::::;<br />

9 INVENTORIES<br />

63:: 25*<br />

19344 28::<br />

495<br />

I<br />

58664 23;1:<br />

■ 2079 608ii<br />

2185<br />

INVESTMENTS IN GOVT. OBL/Gt<br />

5577<br />

139<br />

1:E*<br />

12:23:<br />

5E13498<br />

3655 1977<br />

10<br />

1::;*1<br />

UNITED STATES 18770 ■ ■<br />

11 STATE AND LOCAL<br />

1891*<br />

10212<br />

5214* 238 7668 1407<br />

■<br />

225<br />

60<br />

29<br />

12 OTHER CURRENT ASSETS 80009 • 629<br />

60<br />

4<br />

13 LOANS TO STOCKHOLDERS<br />

4267<br />

1553<br />

-<br />

3225<br />

143:<br />

1/;(17 *<br />

:;ii *<br />

7001 14122 3918 . 8241<br />

14 MORTGAGE AND REAL ESTATE LOANS<br />

324 9<br />

t70:::<br />

2460* 1550 350<br />

■<br />

2632<br />

15 OTHER INVESTMENTS<br />

123<br />

•<br />

.<br />

1168756!<br />

.<br />

408877<br />

■ 1400* 1:::: :::2*<br />

1310i<br />

2603 231<br />

46077<br />

26:1)/<br />

16 DEPRECIABLE ASSETS 4013416 ■<br />

34330 61813 58421<br />

17<br />

76309<br />

LESS, ACCUM DEPRECIATION<br />

117020 367157 343631 370348 825669<br />

77047<br />

472400<br />

4t;?;<br />

1620983<br />

■ 45530<br />

372839 139132 155800 177800<br />

18 DEPLETABLE ASSETS<br />

50966 169714 595311<br />

3482* -<br />

137563 136790<br />

114<br />

336009 212559 138785 31585 49806<br />

19<br />

72873<br />

LESS, ACCUM DEPLETION<br />

238803<br />

123•<br />

20 LAND<br />

-<br />

49* 849<br />

■<br />

49<br />

11<br />

606530<br />

49*<br />

-<br />

.<br />

■ 86/0<br />

8<br />

. .<br />

70205 62259 101901<br />

.<br />

—<br />

21 INTANGIBLE ASSETS (AMORTIZABLE)<br />

19396 6 1617:5;*<br />

-<br />

233* 296<br />

61:181 58005 35392 19025<br />

22<br />

47401<br />

3457<br />

4084<br />

61845<br />

LESS, ACCUM AMORTIZATION<br />

23 OTHER ASSETS 271<br />

623<br />

■<br />

72 73::<br />

493<br />

136733 2166<br />

.<br />

3057 4428 6935 5573 14:ii:<br />

303<br />

22377<br />

36<br />

—<br />

20732 7685 1:::: 6971<br />

24 TOTAL LIABILITIES<br />

13330<br />

4294572 ■ 60490<br />

25 ACCOUNTS PAYABLE<br />

11::::<br />

336532<br />

I<br />

223594<br />

417840 7::;::<br />

■ 3864<br />

416152472861 51* 426788<br />

26 MORT.. NOTES. BONDS UNDER 1 YR<br />

17822<br />

257608<br />

408794<br />

14755<br />

241169<br />

26413<br />

304892 568018<br />

■<br />

27<br />

6605<br />

24717 7<br />

OTHER CURRENT LIABILITIES<br />

25106 26530<br />

20522<br />

197481<br />

39540<br />

19155<br />

— 3073<br />

74270<br />

::::<br />

1::::<br />

:::: 25962<br />

13181;:<br />

28 LOANS PROM STOCKHOLDERS<br />

12544<br />

30474<br />

220663 14821<br />

26888<br />

■<br />

21626<br />

2:/11/<br />

I 29 MORT.. NOTES. BONDS OVER 1<br />

17562 22810 E<br />

32071<br />

YR•• 1867934<br />

30 OTHER LIABILITIES 142408<br />

3061<br />

■ 10551<br />

19298<br />

107015<br />

168126 143956 391299<br />

T.:<br />

148850<br />

■<br />

193095 112902 12iiii<br />

31<br />

2806<br />

86020 3<br />

CAPITAL STOCK<br />

7284 23512<br />

1:;:!<br />

V<br />

605140<br />

4873<br />

30803<br />

32 PAID—IN OR CAPITAL SURPLUS<br />

32775 89215 72440<br />

2913<br />

389635<br />

64950<br />

10083<br />

109296<br />

3712<br />

2089<br />

g::(5):<br />

33 RETAINEO EARNINGS/ APPROP<br />

:::: 1:::: 20:::<br />

18579<br />

36314<br />

35113 61317<br />

15399<br />

38703 14776 18026<br />

84271<br />

34 RETAINED EARNINGS. UNAPPROP 61910;1!<br />

g<br />

338421 -12724 -5823<br />

35 LESSI COST OF TREASURY STOCK<br />

—5741 9695<br />

555<br />

37334<br />

—<br />

100419 ■ 1636*<br />

..1iii* 64654 32719<br />

1869 13817<br />

5:::: 33298<br />

13610*<br />

l!iiii<br />

6:::: 9828 2692 4385 23541<br />

36 TOTAL RECEIPTS<br />

I<br />

3030518 28946 12 :<br />

37 BUSINESS RECEIPTS<br />

10 :::926<br />

231520 187682<br />

2777413<br />

4 56<br />

25007<br />

499036<br />

118582 294842 236688 94638 215091 1::::: 438912<br />

INTEREST O. GOVT. OBLIGATIONS,<br />

106347 219751 178477 425150 462477 275354 198850 80194 201045<br />

38<br />

65764<br />

UNITED STATES<br />

420415<br />

1349<br />

39 STATE AND LOCAL<br />

*<br />

(!)* 142* 18* 115<br />

518<br />

22* 270<br />

*<br />

170 442 15 46 100 9<br />

40 OTHER INTEREST 19890<br />

16*<br />

286*<br />

44*<br />

12*<br />

92<br />

586<br />

324 27<br />

491<br />

3 12 ■<br />

41 RENTS 121896<br />

1520 4354 2286 1295 1365<br />

1 42<br />

3609<br />

ROYALTIES<br />

884<br />

1568<br />

425<br />

4542*<br />

43<br />

•<br />

26:6: 12887<br />

2402<br />

13637<br />

■<br />

NET S ■ T CAP GAIN ,ESS L-T LOSS,<br />

7N7*<br />

71::<br />

2665<br />

-<br />

16*<br />

2621<br />

54*<br />

54357<br />

6:::<br />

104<br />

83 2:<br />

2 222<br />

■<br />

3 ■<br />

44 NET L-T CAP GAIN LESS S ■ T LOSS. 28188<br />

15)<br />

.<br />

.<br />

263*<br />

8* 253<br />

:0:: 965 3<br />

■<br />

I 45 NET GAIN. NONCAPITAL ASSETS•• 6908 2651* 29;0 457<br />

46<br />

821<br />

DIVIDENDS, DOMESTIC CORPS<br />

103*<br />

1767<br />

16* 35*<br />

4429 63,1<br />

6303 1<br />

1i:: 66<br />

74<br />

■<br />

47 235 arlii IF:i 813<br />

714<br />

I<br />

■<br />

48 OTHER RECEIPTS 62283<br />

.<br />

165<br />

6 24<br />

DIVIDENDS. FOREIGN CORPS 2680 ■<br />

16 1808 1052<br />

■<br />

620*<br />

70*<br />

2170 1119 2975<br />

2008<br />

2806<br />

87<br />

1862 8124<br />

147<br />

7487 17994<br />

2507 5318 3585<br />

49 TOTAL DEDUCTIONS<br />

5716<br />

2951449<br />

I<br />

25448 120678<br />

50 COST OF SALES AND OPERATIONS..•<br />

108875 231379<br />

1440100<br />

188348<br />

9988<br />

425361<br />

56447<br />

504154 280225 226542 92308 205012<br />

51<br />

117931<br />

COMPENSATION OF OFFICERS<br />

52286 106921 82595 425188<br />

63403<br />

194106<br />

324<br />

248107 141817 116586<br />

■ 5710 6325 14111<br />

48462 108142<br />

6853<br />

30379<br />

52 REPAIRS 11621<br />

244264<br />

87176 640 4012<br />

6992<br />

3918<br />

3173 2254 729<br />

I<br />

1637<br />

53 BAD DEBTS 8564 6728 1070 2644<br />

10471<br />

10607<br />

30<br />

14325 8249<br />

1. 849<br />

6085<br />

232<br />

3028<br />

556<br />

3513<br />

• 1443<br />

2643<br />

1663<br />

14864<br />

54 RENT PAID ON BUSINESS PROPERTY 174686 734* 19770 10159<br />

1112 841 234 587 718<br />

55 TAXES PAID 8788 2205<br />

187204<br />

5576<br />

1806<br />

48550 20354<br />

6359<br />

10660 8216 4736<br />

i<br />

7147 14811 12874<br />

17156<br />

56 28134<br />

4216<br />

INTEREST PAID<br />

15771<br />

133020 2177 823<br />

30079 19848 14244 3894 11451 10853<br />

57 CONTRIBUTIONS OR GIFTS<br />

2896 8518 , 25704<br />

2332<br />

11831<br />

40*<br />

11184 27774<br />

19<br />

5*<br />

11581<br />

82<br />

12790 7006<br />

120<br />

8190<br />

58 238<br />

9909<br />

AMORTIZATION 318<br />

18341<br />

876 128* 18 284 377 9 173<br />

1 59<br />

561<br />

DEPRECIATION<br />

51 54 106<br />

208958<br />

191*<br />

1926*<br />

51*<br />

4975<br />

130 49 28 11 146<br />

60 DEPLETION 6135 19747 20456 1 18<br />

376 80*<br />

20874 . 40718<br />

(5)* .<br />

20272 15562 5748 8625<br />

61 ADVERTISING 33* 9745 34175<br />

59129 319<br />

(5)*<br />

1377<br />

118 29 111<br />

• 62 PENSION. PROF SH..ANNUITY PLANS<br />

1548 4114<br />

6290<br />

3348<br />

121*<br />

6582 13492<br />

(5)<br />

6516 4756 1735 4 351 1755<br />

. 63 OTHER EMPLOYEE BENEFIT PLANS 525* 9536<br />

13217 — 206* 54*<br />

154*<br />

580<br />

(53<br />

1526 788 371<br />

64<br />

366 446<br />

NET LOSS. NONCAPITAL ASSETS<br />

)* 298 1304<br />

8319<br />

351*<br />

-<br />

2962* 1247<br />

85<br />

926 1150 1140 1281<br />

65 OTHER DEDUCTIONS 5016 1018 2690<br />

555852<br />

274* .<br />

7135 21228<br />

2414<br />

17553<br />

343<br />

39565<br />

23<br />

36389<br />

30<br />

88955<br />

.<br />

95843<br />

67<br />

531140<br />

67<br />

42731 15175 39394<br />

66 TOTAL RECEIPTS LESS DEDUCTIONS<br />

44550 53494<br />

79069 3498 1497<br />

67 CONSTR TAX INC FM RE4 FOR CORP(I) -136 141<br />

1398<br />

*<br />

.<br />

-666 8774 -5118 14617<br />

.<br />

10146 2330 10079 20183 13724<br />

68 NET INCOME (LESS DEFICIT)(2) 79949 3498<br />

69 NET INCOME<br />

1497 -136 141<br />

158448<br />

*682 8774 -5162 14525 9822 3465 10161<br />

• 70 DEFICIT<br />

3922* 5073 3648 15940 20322 13724<br />

' 76499<br />

8026<br />

424<br />

17619<br />

3576<br />

18692 21467 13090 4638 10161 20322<br />

RETURNS OTHER THAN FORM 1120-SI<br />

3784 15799 8708 9045 23854<br />

15650<br />

6942 3268<br />

71<br />

1173<br />

NET INCOME (LESS DEFICIT)<br />

- 1926<br />

04515<br />

72<br />

3288 159<br />

STATUTORY SPECIAL DEDSot TOTAL<br />

-537 -2607<br />

26679<br />

422<br />

697*<br />

14283 ■<br />

734<br />

3081<br />

510*<br />

15094 9622 3465<br />

73<br />

10161 . 20322<br />

NET OPERATING LOSS CARRYFRD•. 1459 13724<br />

21347<br />

1115<br />

, ...<br />

696*<br />

3665*<br />

438<br />

4275 3618 4779 1260<br />

74<br />

2136 1537<br />

DIVIDENDS RECEIVED DEDUCTION.<br />

510* 1410- ale 894<br />

5307<br />

3649* 3522 2948* 4633 653 1970<br />

■<br />

9 75 DED FOR DIV PD. PUB UTIL SIR.<br />

1 296'<br />

(5)<br />

49 197<br />

■ •<br />

16*<br />

.<br />

753 670 146 607<br />

76<br />

141<br />

■<br />

WESTERN HEMISPHERE TRADE DED•<br />

1537<br />

■<br />

894<br />

25 ■ . . - - —<br />

77 INCOME SUBJECT TO TAX • .<br />

119628<br />

. ■ ■<br />

3016*<br />

. . •<br />

II 1944 1979 8964 5106 12526<br />

25<br />

78 INCOME TAX (BEF CREDITS), TOT(3) 14235 17884<br />

.<br />

47306 1246* 463 470<br />

8338<br />

79<br />

3975<br />

SURCHARGE 2414<br />

8026 18876 14757<br />

194 (5)*<br />

1397<br />

(5)*<br />

4595<br />

(5)*<br />

5345 8387<br />

33<br />

3690<br />

80<br />

1892 2869<br />

TAX RECOMP PRIOR YEAR INV. CR•• (5) 7600 6938<br />

130<br />

33* 51 19 18<br />

#<br />

.. 40<br />

81 FOREIGN TAX CREDIT<br />

80* • 15)*<br />

.<br />

2303<br />

15)* 15)<br />

.<br />

(5)* 17<br />

■<br />

2<br />

■<br />

14<br />

82 INVESTMENT CREDIT<br />

4<br />

-<br />

6 . 7<br />

2734<br />

. - 115<br />

■ (5)* 42<br />

16 ■<br />

1 1813 145 213 ■<br />

B3 NET INCOME(LESS DEC) AFTER TAX(4) 165<br />

35377 2252<br />

201 277<br />

1034 -564<br />

467<br />

-2108<br />

265 ' 312 17<br />

84 NET INCOME AFTER.TAX<br />

583 198 207<br />

113887<br />

-1878<br />

2676*<br />

. 4456<br />

4610<br />

-10040<br />

3220<br />

6403 6444 1590 7875<br />

85 ESTIMATED TAX PAYMENTS 13691 12920 6993<br />

17103 6830 13501 13822<br />

■ 42<br />

13345<br />

.<br />

9715 2763<br />

86 FORM 1120-S NET INCOME (LESS DEFI<br />

7875 12920 8919<br />

■<br />

-4566 210* 1338 401*<br />

1322* 3558 1486 ■<br />

I<br />

458<br />

DISTRIBUTIONS TO STOCKHOLDERS) 2748 ■ 1104* -5509* -2081<br />

5129<br />

—569<br />

5108<br />

■ • . .<br />

. .<br />

87 CASH 8 PROP EXCEPT OWN STOCK••• 38349 9100*<br />

88 CORPORATION'S OWN STOCK<br />

1123 787* 3611<br />

3845 7361* 474*<br />

■<br />

g<br />

SELECTED INVESTMENT ITEMS.<br />

.<br />

3220<br />

.<br />

602* 2425 699 680 2459<br />

—<br />

5808<br />

1308 148 2389<br />

89 COST OF PROP. USED FOR INV. CR.<br />

.<br />

90 INVESTMENT QUALIFIED FOR CREDIT 76276 58858 - 1148 2056 8238 5996 5308 16745<br />

■<br />

91 TENTATIVE INVESTMENT CREDIT<br />

906 1286<br />

6503 3942<br />

5600 5242 4373 6406 1474 5139 4367 12896<br />

■ (5)<br />

13291<br />

42<br />

4473 5281 1134<br />

92<br />

4014 3070<br />

INVESTMENT CREDIT CARRYFORWARD• 333 10188<br />

6590<br />

349 315<br />

■ 43*<br />

936 310 370 78 281 215 713<br />

• 93 UNUSED INVESTMENT CREDIT (5)* 393<br />

7827 -<br />

367 411*<br />

42<br />

1695<br />

(5)*<br />

670<br />

593 516<br />

370<br />

449*<br />

493 1474<br />

2163<br />

.<br />

714<br />

674<br />

428 554 1171<br />

FOOTNOTES AT BEGINNING AND END OF FILM<br />

17 1180<br />

U. S. TREASURY DEPARTMENT ■ INTERNAL REVENUE SERVICE<br />

•<br />

302<br />

S<br />

O<br />

9<br />

p<br />

51<br />

6 .

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)