PA - Banco Security

PA - Banco Security

PA - Banco Security

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

10business areas<br />

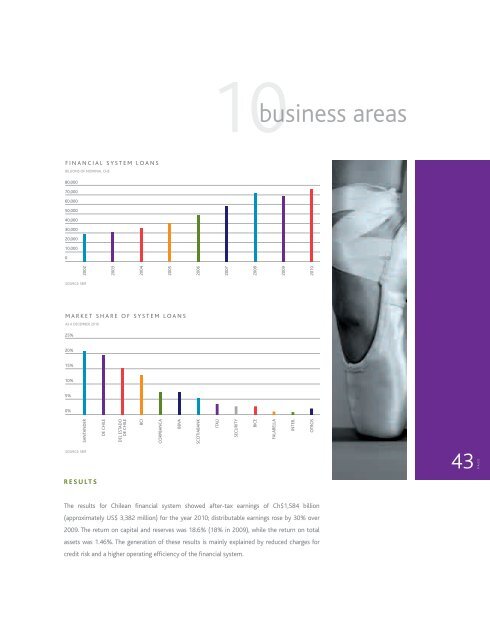

FINANCIAL SYSTEM LOANS<br />

BILLIONS OF NOMINAL CH$<br />

80,000<br />

70,000<br />

60,000<br />

50,000<br />

40,000<br />

30,000<br />

20,000<br />

10,000<br />

0<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

SOURCE: SBIF<br />

MARKET SHARE OF SYSTEM LOANS<br />

AS A DECEMBER 2010<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

SANTANDER<br />

SOURCE: SBIF<br />

DE CHILE<br />

DEL ESTADO<br />

DE CHILE<br />

BCI<br />

CORPBANCA<br />

BBVA<br />

SCOTIABANK<br />

ITAÚ<br />

SECURITY<br />

BICE<br />

FALABELLA<br />

INTER.<br />

OTROS<br />

43<br />

<strong>PA</strong>GE<br />

RESULTS<br />

The results for Chilean financial system showed after-tax earnings of Ch$1,584 billion<br />

(approximately US$ 3,382 million) for the year 2010; distributable earnings rose by 30% over<br />

2009. The return on capital and reserves was 18.6% (18% in 2009), while the return on total<br />

assets was 1.46%. The generation of these results is mainly explained by reduced charges for<br />

credit risk and a higher operating efficiency of the financial system.