Tax Incentives Regarding Research & Development In Turkey

Tax Incentives Regarding Research & Development In Turkey

Tax Incentives Regarding Research & Development In Turkey

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

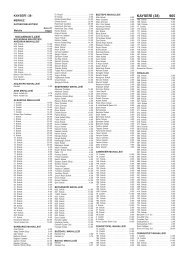

e submitted to the concerning tax office in the annex of withholding<br />

tax return.<br />

<strong>Tax</strong>payers shall demonstrate the sum of “Amount that shall be<br />

subjected to cancellation” taking place in the last column of Annex:1<br />

“Communiqué Related to the <strong>In</strong>come <strong>Tax</strong> Stoppage in scope of R&D”<br />

in the (18/c) numbered line, cancelled amount of the stoppage over<br />

the wage payments in accordance with the Law numbered 5746, of<br />

the “Basis and <strong>Tax</strong> Notification” part of Table 1. This amount shall<br />

be deducted from sum of income tax deduction demonstrated in<br />

line numbered (17/b) and the amount of remaining income tax after<br />

cancellation shall be demonstrated in line numbered (19).<br />

3.2. <strong>In</strong>itial of the Application<br />

Implementation of income tax withholding incentive has been put<br />

into effect from 01.04.2008. It shall be benefited within the framework<br />

procedures and rules of “Implementation Regulation and Auditing for<br />

the Support of <strong>Research</strong> and <strong>Development</strong> Activities” published under<br />

that Law from incentive implementation.<br />

Therefore; under the provisions of the mentioned regulation;<br />

- At R&D centers, when R&D certificate is drawn ;<br />

- on pre-competition cooperation projects, when project contract<br />

come into force;<br />

- At technology center enterprises, when R&D and innovation<br />

project is accepted;<br />

- When business plan is accepted by public administration capital<br />

support provided to technological enterprises;<br />

- On R&D and innovation projects supported by public enterprises<br />

and establishments, foundations established pursuant by Law or<br />

projects that supported by international funds or executed by<br />

TUBITAK when support decision document is written or project<br />

contract come into force;<br />

shall be benefited from income tax incentives from the date<br />

mentioned above.<br />

On the other hand; in the R&D and innovation projects starting<br />

before from effective date of Law no 5746;<br />

- <strong>In</strong> the case of putting into effect before 01.04.2008 the<br />

support decision document or the project contract’s for the R&D and<br />

innovation projects supported by public enterprises and establishments,<br />

foundations established pursuant by Law or projects that supported by<br />

international funds or executed by TUBITAK, from 01.04.2008;<br />

- On R&D and innovation projects executed at R&D centers, when<br />

R&D certificate is drawn;<br />

shall be benefited from incentive provisions for the income tax<br />

withholding from that date.<br />

41