Tax Incentives Regarding Research & Development In Turkey

Tax Incentives Regarding Research & Development In Turkey

Tax Incentives Regarding Research & Development In Turkey

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

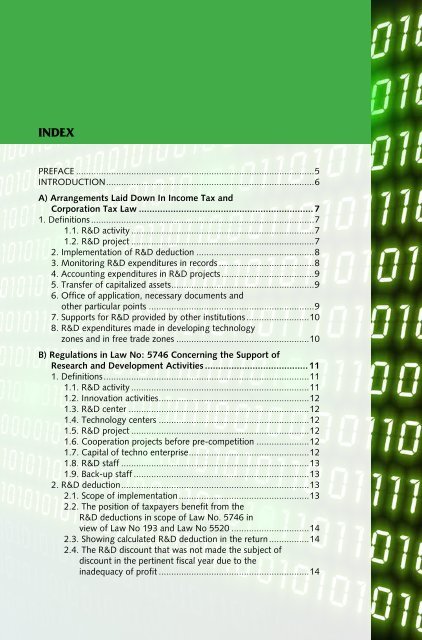

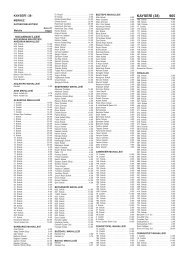

INDEX<br />

PREFACE ...............................................................................................5<br />

INTRODUCTION ...................................................................................6<br />

A) Arrangements Laid Down <strong>In</strong> <strong>In</strong>come <strong>Tax</strong> and<br />

Corporation <strong>Tax</strong> Law ..................................................................7<br />

1. Definitions .........................................................................................7<br />

1.1. R&D activity .........................................................................7<br />

1.2. R&D project .........................................................................7<br />

2. Implementation of R&D deduction ...............................................8<br />

3. Monitoring R&D expenditures in records ......................................8<br />

4. Accounting expenditures in R&D projects .....................................9<br />

5. Transfer of capitalized assets .........................................................9<br />

6. Office of application, necessary documents and<br />

other particular points ..................................................................9<br />

7. Supports for R&D provided by other institutions .........................10<br />

8. R&D expenditures made in developing technology<br />

zones and in free trade zones .....................................................10<br />

B) Regulations in Law No: 5746 Concerning the Support of<br />

<strong>Research</strong> and <strong>Development</strong> Activities .......................................11<br />

1. Definitions ..................................................................................11<br />

1.1. R&D activity .......................................................................11<br />

1.2. <strong>In</strong>novation activities ............................................................12<br />

1.3. R&D center ........................................................................12<br />

1.4. Technology centers ............................................................12<br />

1.5. R&D project .......................................................................12<br />

1.6. Cooperation projects before pre-competition .....................12<br />

1.7. Capital of techno enterprise ................................................12<br />

1.8. R&D staff ...........................................................................13<br />

1.9. Back-up staff ......................................................................13<br />

2. R&D deduction ...........................................................................13<br />

2.1. Scope of implementation ....................................................13<br />

2.2. The position of taxpayers benefit from the<br />

R&D deductions in scope of Law No. 5746 in<br />

view of Law No 193 and Law No 5520 ...............................14<br />

2.3. Showing calculated R&D deduction in the return ................14<br />

2.4. The R&D discount that was not made the subject of<br />

discount in the pertinent fiscal year due to the<br />

inadequacy of profit ............................................................14