Tax Incentives Regarding Research & Development In Turkey

Tax Incentives Regarding Research & Development In Turkey

Tax Incentives Regarding Research & Development In Turkey

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

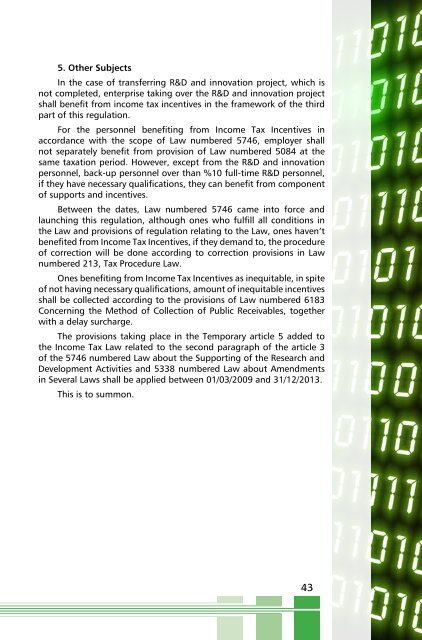

5. Other Subjects<br />

<strong>In</strong> the case of transferring R&D and innovation project, which is<br />

not completed, enterprise taking over the R&D and innovation project<br />

shall benefit from income tax incentives in the framework of the third<br />

part of this regulation.<br />

For the personnel benefiting from <strong>In</strong>come <strong>Tax</strong> <strong><strong>In</strong>centives</strong> in<br />

accordance with the scope of Law numbered 5746, employer shall<br />

not separately benefit from provision of Law numbered 5084 at the<br />

same taxation period. However, except from the R&D and innovation<br />

personnel, back-up personnel over than %10 full-time R&D personnel,<br />

if they have necessary qualifications, they can benefit from component<br />

of supports and incentives.<br />

Between the dates, Law numbered 5746 came into force and<br />

launching this regulation, although ones who fulfill all conditions in<br />

the Law and provisions of regulation relating to the Law, ones haven’t<br />

benefited from <strong>In</strong>come <strong>Tax</strong> <strong><strong>In</strong>centives</strong>, if they demand to, the procedure<br />

of correction will be done according to correction provisions in Law<br />

numbered 213, <strong>Tax</strong> Procedure Law.<br />

Ones benefiting from <strong>In</strong>come <strong>Tax</strong> <strong><strong>In</strong>centives</strong> as inequitable, in spite<br />

of not having necessary qualifications, amount of inequitable incentives<br />

shall be collected according to the provisions of Law numbered 6183<br />

Concerning the Method of Collection of Public Receivables, together<br />

with a delay surcharge.<br />

The provisions taking place in the Temporary article 5 added to<br />

the <strong>In</strong>come <strong>Tax</strong> Law related to the second paragraph of the article 3<br />

of the 5746 numbered Law about the Supporting of the <strong>Research</strong> and<br />

<strong>Development</strong> Activities and 5338 numbered Law about Amendments<br />

in Several Laws shall be applied between 01/03/2009 and 31/12/2013.<br />

This is to summon.<br />

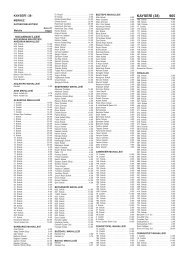

43