Member Booklet - UKZN Retirement Fund - University of KwaZulu ...

Member Booklet - UKZN Retirement Fund - University of KwaZulu ...

Member Booklet - UKZN Retirement Fund - University of KwaZulu ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

10.<br />

If you have a normal career progression over thirty years and at least 17.5% <strong>of</strong> your <strong>Fund</strong> Salary<br />

has been contributed towards retirement funding during that time (this is based on a total<br />

contribution rate <strong>of</strong> 22.5% <strong>of</strong> <strong>Fund</strong> Salary), the <strong>Fund</strong> currently aims to provide you with a Net<br />

Replacement Ratio (NRR) <strong>of</strong> at least 65% <strong>of</strong> your Final <strong>Fund</strong> Salary.<br />

Your Net Replacement Ratio (NRR) is the retirement income that you can expect to receive,<br />

shown as a percentage <strong>of</strong> your final <strong>Fund</strong> Salary. It can be worked out by dividing your income at<br />

retirement date by your <strong>Fund</strong> Salary immediately before you retire, and expressing it as a<br />

percentage. A NRR <strong>of</strong> 65% indicates an initial retirement income <strong>of</strong> about two thirds <strong>of</strong> your <strong>Fund</strong><br />

Salary prior to retirement.<br />

10.1 PORTFOLIO STRUCTURE<br />

Contributions for members who are under 53 years <strong>of</strong> age are automatically invested in<br />

Main Portfolio. When you are within seven years <strong>of</strong> normal retirement you are given a choice<br />

about how you would like your <strong>Fund</strong> Credit to be invested.<br />

Main Portfolio<br />

The Main Portfolio is currently invested with two asset managers with investment styles that<br />

complement one another. In terms <strong>of</strong> mandates given by the <strong>Fund</strong>, the managers are allowed to<br />

vary the proportions invested locally and <strong>of</strong>fshore, and within asset classes (i.e. Shares, Bonds,<br />

Property, Cash etc.) within defined limits and subject to the limitations <strong>of</strong> Regulation 28 <strong>of</strong> the<br />

Pensions <strong>Fund</strong> Act. This Regulation governs the investments <strong>of</strong> all retirement funds.<br />

In terms <strong>of</strong> their mandates, the asset managers are permitted to adopt fairly aggressive investment<br />

positions if they see value in doing so, so short-term losses are possible. If you are within seven<br />

years <strong>of</strong> retirement, you have the option <strong>of</strong> transferring to portfolios where short-term losses are<br />

less likely.<br />

The Alexander Forbes Lifestage Range<br />

When you are within seven years <strong>of</strong> your retirement age, you may choose to either leave your<br />

<strong>Fund</strong> Credit in the Main Portfolio or to transfer your <strong>Fund</strong> Credit to one or more <strong>of</strong> the Alexander<br />

Forbes Lifestage portfolios. These portfolios are managed by Investment Solutions. You can<br />

either select your own portfolios or opt to follow one <strong>of</strong> the Alexander Forbes Lifestage Model<br />

(AFLM), which will automatically adjust your investment portfolios depending on the number <strong>of</strong><br />

years you have remaining to your Normal <strong>Retirement</strong> Date.<br />

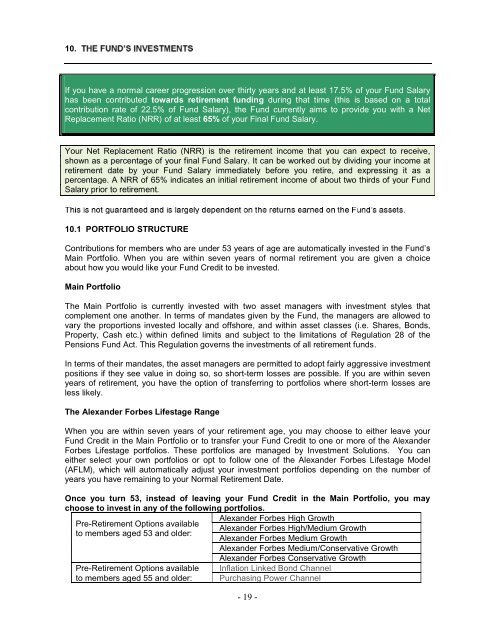

Once you turn 53, instead <strong>of</strong> leaving your <strong>Fund</strong> Credit in the Main Portfolio, you may<br />

choose to invest in any <strong>of</strong> the following portfolios.<br />

Alexander Forbes High Growth<br />

Pre-<strong>Retirement</strong> Options available<br />

Alexander Forbes High/Medium Growth<br />

to members aged 53 and older:<br />

Alexander Forbes Medium Growth<br />

Alexander Forbes Medium/Conservative Growth<br />

Alexander Forbes Conservative Growth<br />

Pre-<strong>Retirement</strong> Options available Inflation Linked Bond Channel<br />

to members aged 55 and older: Purchasing Power Channel<br />

- 19 -