download-report

download-report

download-report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Section 02 | The Global Top 100<br />

Overview<br />

Overview<br />

Value of BrandZ Top 100<br />

up 98 percent since 2006<br />

All components of brand equity strengthen,<br />

technology leads in total brands and value<br />

Technology brands have led the growth in brand value<br />

since the introduction of the BrandZ Top 100 Most<br />

Valuable Global Brands in 2006. The technology brands<br />

ranked in the BrandZ Global Top 100 totaled $826.9 billion<br />

in value in 2014, an increase of 141 percent since 2006.<br />

The 12 percent brand value increase in<br />

the BrandZ Top 100 Most Valuable<br />

Global Brands 2014 represents a<br />

resurgence of growth following the<br />

financial downturn in 2008, and a 98<br />

percent increase in value since the<br />

ranking was introduced in 2006.<br />

The technology category, which rose 16<br />

percent in the 2014 BrandZ Global 100,<br />

represents nearly a third of the total<br />

brand value and almost a fifth of the<br />

brands. The technology category has<br />

grown 141 percent in brand value since<br />

the ranking began.<br />

Of the Top 10 brands that grew most in<br />

brand value since 2006, five are in the<br />

technology category. During those eight<br />

years, Apple increased in value by $131.9<br />

billion or 826 percent, followed by<br />

Google with a 324 percent or $121.4<br />

billion rise in brand value.<br />

The Top 100 are resilient. Since the<br />

financial crisis, the BrandZ Global Top<br />

100 brands have strengthened in each<br />

component of brand equity, which is<br />

the consumer’s predisposition to select<br />

a brand.<br />

The components are: meaningful<br />

(generating appeal or “love”), different<br />

(setting trends that benefit the<br />

consumer) and salient (coming to mind<br />

spontaneously). The BrandZ Top 100<br />

Most Valuable Global Brands<br />

significantly outscore other brands<br />

in each component.<br />

Difference and salience<br />

drive and sustain value<br />

In the telecom provider category, where<br />

brands are struggling to differentiate and<br />

be viewed as more than a conduit of<br />

data, UK-based BT rose 61 percent in<br />

brand value and moved up 30 positions<br />

in the ranking.<br />

The brand value rise was driven in part<br />

by acquiring rights to English Premier<br />

Football, adding over two million<br />

new subscribers, a successful<br />

Olympic sponsorship and increasing<br />

revenue. The added value helped justify<br />

premium pricing.<br />

Being different was a key driver for<br />

Amazon, which continued to grow its<br />

consumer share of life, expanding into<br />

food and other businesses, while also<br />

disrupting business-to-business<br />

technology pricing with its Cloud<br />

computing services.<br />

With a 41 percent brand value increase<br />

to $64.3 billion, Amazon entered the<br />

BrandZ Global Top 10 for the first time.<br />

Brand salience helped sustain Coca-Cola.<br />

Because of consumer health concerns<br />

the sale of CSDs (Carbonated Soft<br />

Drinks) declined for the ninth consecutive<br />

year in the US. The Coca-Cola brand rose<br />

3 percent, however.<br />

Coca-Cola slipped one spot in the<br />

BrandZ Global Top 10, as did<br />

McDonald’s, another salient brand in a<br />

category impacted by consumer health<br />

concerns. At the same time, Microsoft,<br />

a salient technology brand, gained three<br />

places in the ranking on a 29 percent<br />

increase in brand value.<br />

Brands gain in trust and<br />

value metrics<br />

Two other BrandZ metrics, TrustR and<br />

ValueD, also help explain brand value<br />

increases. TrustR measures how much<br />

consumers trust a brand (because it<br />

consistently has met its promises in the<br />

past) and the likelihood consumers would<br />

recommend a brand (because it<br />

consistently keeps its promises today).<br />

The three logistics companies ranked in<br />

the BrandZ Global Top 100 score high in<br />

TrustR. Each increased significantly in<br />

brand value, led by DHL with a rise of 53<br />

percent, followed by Fedex, 24 percent,<br />

and UPS, 12 percent.<br />

ValueD measures the gap between a<br />

consumer’s desire for a brand and the<br />

consumer’s perception of the price.<br />

The measurement is important because,<br />

coming out of the recession, consumers<br />

are significantly more concerned about<br />

obtaining good value for money.<br />

Responding to this change in consumers<br />

attitude, the BrandZ Global Top 100<br />

have improved their desire and price<br />

scores. A high desire score gives a<br />

brand flexibility to be premium priced<br />

or good value.<br />

How brands manage the desire/price<br />

balance depends on the product<br />

category and brand proposition. Some<br />

brands with high desirability, like<br />

Pampers, are able to command a<br />

premium. Consumers view IKEA as<br />

good value for money. IKEA improved<br />

61 percent in brand value.<br />

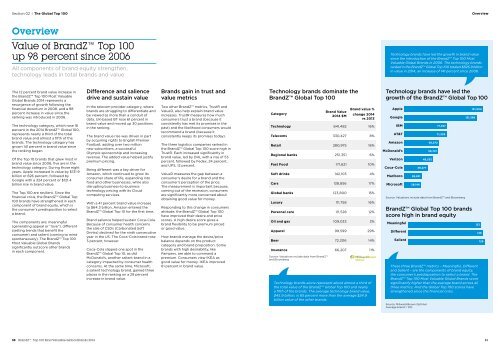

Technology brands dominate the<br />

BrandZ Global Top 100<br />

Category<br />

Brand Value<br />

2014 $M<br />

Brand value %<br />

change 2014<br />

vs 2013<br />

Technology 841,482 16%<br />

Telecoms 330,427 8%<br />

Retail 280,975 16%<br />

Regional banks 251,351 6%<br />

Fast Food 171,621 10%<br />

Soft drinks 142,103 4%<br />

Cars 138,856 17%<br />

Global banks 123,800 15%<br />

Luxury 111,758 16%<br />

Personal care 111,528 12%<br />

Oil and gas 109,033 3%<br />

Apparel 99,599 29%<br />

Beer 72,306 14%<br />

Insurance 66,207 11%<br />

Source: Valuations include data from BrandZ<br />

and Bloomberg<br />

Technology brands alone represent about almost a third of<br />

the total value of the BrandZ Global Top 100 and nearly<br />

a fifth of the brands. The average technology brand value,<br />

$45.9 billion, is 85 percent more than the average $24.9<br />

billion value of the other brands.<br />

Technology brands have led the<br />

growth of the BrandZ Global Top 100<br />

Apple<br />

Google<br />

IBM<br />

AT&T<br />

Amazon<br />

McDonald’s<br />

Verizon<br />

Coca-Cola<br />

Marlboro<br />

Microsoft<br />

Meaningful<br />

Different<br />

Salient<br />

28,831<br />

28,146<br />

39,277<br />

48,552<br />

58,272<br />

56,721<br />

71,457<br />

71,203<br />

Source: Valuations include data from BrandZ and Bloomberg<br />

121,398<br />

BrandZ Global Top 100 brands<br />

score high in brand equity<br />

131,904<br />

These three BrandZ metrics – Meaningful, Different<br />

and Salient – are the components of brand equity,<br />

the consumer’s predisposition to select a brand. The<br />

BrandZ Top 100 Most Valuable Global Brands score<br />

significantly higher than the average brand across all<br />

three metrics. And the Global Top 100 scores have<br />

strengthened since the financial crisis.<br />

Source: Millward Brown Optimor<br />

Average brand = 100<br />

123<br />

126<br />

129<br />

30 BrandZ Top 100 Most Valuable Global Brands 2014 31