download-report

download-report

download-report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Section 03 | The Categories<br />

Financial | Insurance<br />

Insurance<br />

Insurers shift focus from<br />

selling products to building<br />

customer relationships<br />

US brands lead the global trend<br />

11%<br />

Definition<br />

The insurance category includes<br />

brands in both the business-toconsumer<br />

– life, property and<br />

casualty – and the businessto-business<br />

sectors. Health<br />

insurance is excluded.<br />

For insurance brands, it was the year of<br />

personalized customer engagement.<br />

Many of the major US property and<br />

casualty carriers, and some life insurers,<br />

started to organize their big data to<br />

provide a 360-consumer view. European<br />

companies worked to simplify and speed<br />

up their systems to respond in real time<br />

and facilitate customer centricity.<br />

Traditionally, only two transactions have<br />

connected insurers with their customers<br />

– closing a sale and processing a claim.<br />

Neither event produced the kind of<br />

relationships that can pay off over time,<br />

building a base of loyal customers with<br />

continuous and changing needs for<br />

a range of products.<br />

There’s often been a mismatch between<br />

the competencies that would best serve<br />

customers – speed, ease of use and<br />

innovation – and the legacy baggage of<br />

insurers – disaggregated big data,<br />

secure and complicated systems,<br />

siloed organizations and businesses<br />

designed to push products rather than<br />

retain customers.<br />

Although tension sometimes remains<br />

between the priorities of the risk<br />

managers and those responsible for<br />

cultivating customer relationships, closer<br />

coordination exists. Recent initiatives<br />

haven’t eliminated organizational siloes,<br />

but they’ve funneled them through new<br />

functions responsible for the customer<br />

experience. State Farm created a<br />

company-wide taskforce to reorient<br />

around the customer. These other<br />

trends also unfolded:<br />

Ad spending Property and casualty<br />

insurers spent heavily on advertising<br />

to enter new markets and grow share.<br />

Balancing channels Brands looked<br />

at ways to expand their direct<br />

business while maintaining their<br />

agent networks.<br />

Data protection The industry<br />

experienced rising concern about<br />

protecting the personal information<br />

of its customers.<br />

Need to rebuild<br />

trust drives change<br />

Several factors drove the customer<br />

centric initiatives. First, especially during<br />

the financial crisis, carriers struggled with<br />

customer retention and recognized the<br />

importance of developing a customer<br />

relationship beyond the point of sale.<br />

Insurers still struggle to rebuild trust<br />

eroded during the crisis.<br />

The second factor is demographic.<br />

Insurers want to reach younger<br />

consumers and retain them over<br />

the course of a lifetime. Like earlier<br />

generations, Millennials consider<br />

insurance only when a life need<br />

arises. But with marriage, children<br />

and homeownership happening<br />

later, insurance opportunity points<br />

are postponed.<br />

The challenge impacts both US<br />

companies, which have traditionally<br />

presented their brands with more<br />

emotion, and European-based insurers<br />

with consumer and enterprise businesses,<br />

whose more steady, institutional<br />

approach often worked well during<br />

the recession.<br />

The German-based Allianz expanded<br />

its business and <strong>report</strong>ed strong results,<br />

driven by property and casualty, with<br />

brand value rising 48 percent. AXA,<br />

headquartered in France, improved<br />

earning substantially, based on<br />

efficiencies gained in mature markets and<br />

expansion into fast growing markets. The<br />

brand has over 100 million customers in<br />

56 countries, a presence that helps<br />

recruit additional customers, talent and<br />

partners, particularly in new markets.<br />

AXA’s brand value increased 44 percent.<br />

Reaching Millennial<br />

consumers<br />

Even life insurers, which lag property<br />

and casualty companies in the use of<br />

social media, are looking at ways to<br />

reach Millennials. They’re introducing<br />

easy-to-buy products with low benefit<br />

amounts. MetLife offers an entry-level<br />

life insurance product that’s packaged<br />

in a box and priced for retail sale off<br />

a shelf or peg hook.<br />

Allstate acquired Esurance, an online<br />

direct-to-consumer business, in 2013.<br />

Esurance purchased TV ad space<br />

immediately after the Super Bowl.<br />

A Millennial celebrity spokesperson<br />

explained that the post-game placement<br />

saved $1.5 million, or 30 percent, the<br />

brand’s typical discount. He invited<br />

viewers to tweet for a chance to win<br />

this jackpot. Over five million people<br />

responded, connecting Esurance to<br />

a youthful audience less accessible to<br />

its parent brand.<br />

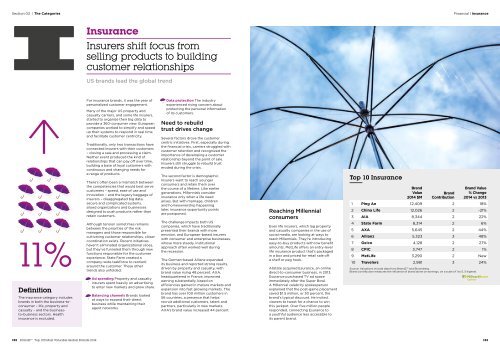

Top 10 Insurance<br />

Brand<br />

Value<br />

2014 $M<br />

Brand<br />

Contribution<br />

Brand Value<br />

% Change<br />

2014 vs 2013<br />

1 Ping An 12,409 2 18%<br />

2 China Life 12,026 2 -21%<br />

3 AIA 8,344 2 22%<br />

4 State Farm 8,314 2 6%<br />

5 AXA 5,645 2 44%<br />

6 Allianz 5,323 3 48%<br />

7 Geico 4,128 2 27%<br />

8 CPIC 3,747 2 1%<br />

9 MetLife 3,290 2 New<br />

10 Travelers 2,981 3 24%<br />

Source: Valuations include data from BrandZ and Bloomberg.<br />

Brand contribution measures the influence of brand alone on earnings, on a scale of 1 to 5, 5 highest.<br />

102 BrandZ Top 100 Most Valuable Global Brands 2014 103