download-report

download-report

download-report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Section 02 | The Global Top 100<br />

Newcomers | Category Changes<br />

Newcomers<br />

Technology and financial<br />

brands lead newcomers<br />

Category Changes<br />

Led by apparel growth, every<br />

category rises in brand value<br />

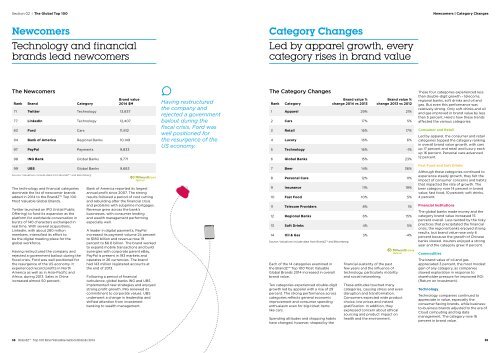

The Newcomers<br />

Rank Brand Category<br />

Brand value<br />

2014 $M<br />

71 Twitter Technology 13,837<br />

77 LinkedIn Technology 12,407<br />

83 Ford Cars 11,812<br />

94 Bank of America Regional Banks 10,149<br />

97 PayPal Payments 9,833<br />

98 ING Bank Global Banks 9,771<br />

Having restructured<br />

the company and<br />

rejected a government<br />

bailout during the<br />

fiscal crisis, Ford was<br />

well positioned for<br />

the resurgence of the<br />

US economy.<br />

The Category Changes<br />

Rank<br />

Category<br />

Brand value %<br />

change 2014 vs 2013<br />

Brand value %<br />

change 2013 vs 2012<br />

1 Apparel 29% 21%<br />

2 Cars 17% 5%<br />

3 Retail 16% 17%<br />

4 Luxury 16% 6%<br />

5 Technology 16% -1%<br />

6 Global Banks 15% 23%<br />

These four categories experienced less<br />

than double-digit growth – telecoms,<br />

regional banks, soft drinks and oil and<br />

gas. But even this performance was<br />

relatively strong. Only soft drinks and oil<br />

and gas improved in brand value by less<br />

than 5 percent. Here’s how these trends<br />

affected the various categories:<br />

Consumer and Retail<br />

Led by apparel, the consumer and retail<br />

categories topped the category ranking<br />

in overall brand value growth, with cars<br />

up 17 percent and retail and luxury each<br />

up 16 percent. Personal care advanced<br />

12 percent.<br />

99 UBS Global Banks 9,683<br />

Source: Valuations include data from BrandZ and Bloomberg<br />

The technology and financial categories<br />

dominate the list of newcomer brands<br />

added in 2014 to the BrandZ Top 100<br />

Most Valuable Global Brands.<br />

Twitter launched an IPO (Initial Public<br />

Offering) to fund its expansion as the<br />

platform for worldwide conversation in<br />

bursts of 140 characters exchanged in<br />

real time. With several acquisitions,<br />

LinkedIn, with about 280 million<br />

members, intensified its effort to<br />

be the digital meeting place for the<br />

global workforce.<br />

Having restructured the company and<br />

rejected a government bailout during the<br />

fiscal crisis, Ford was well positioned for<br />

the resurgence of the US economy. It<br />

experienced record profits in North<br />

America as well as in Asia-Pacific and<br />

Africa, during 2013. Sales in China<br />

increased almost 50 percent.<br />

Bank of America <strong>report</strong>ed its largest<br />

annual profit since 2007. The strong<br />

results followed a period of cost cutting<br />

and rebuilding after the financial crisis<br />

and problems with subprime mortgages.<br />

Revenue grew across the bank’s<br />

businesses, with consumer lending<br />

and wealth management performing<br />

especially well.<br />

A leader in digital payments, PayPal<br />

increased its payment volume 24 percent<br />

to $180 billion and revenue rose 19<br />

percent to $6.6 billion. The brand worked<br />

to expand mobile transactions and build<br />

synergies with corporate parent eBay.<br />

PayPal is present in 193 markets and<br />

operates in 26 currencies. The brand<br />

had 143 million registered accounts at<br />

the end of 2013.<br />

Following a period of financial<br />

turbulence, global banks ING and UBS<br />

implemented new strategies and enjoyed<br />

strong profit growth. ING renewed its<br />

commitment to corporate values. UBS<br />

underwent a change in leadership and<br />

shifted attention from investment<br />

banking to wealth management.<br />

7 Beer 14% 36%<br />

8 Personal Care 12% 11%<br />

9 Insurance 11% 19%<br />

10 Fast Food 10% 5%<br />

11 Telecom Providers 8% 1%<br />

12 Regional Banks 6% 15%<br />

13 Soft Drinks 4% 5%<br />

14 Oil & Gas 3% -4%<br />

Source: Valuations include data from BrandZ and Bloomberg<br />

Each of the 14 categories examined in<br />

the BrandZ Top 100 Most Valuable<br />

Global Brands 2014 increased in overall<br />

brand value.<br />

Ten categories experienced double-digit<br />

growth led by apparel with a rise of 29<br />

percent. The strong performance across<br />

categories reflects general economic<br />

improvement and consumer spending<br />

enthusiasm even for big-ticket items<br />

like cars.<br />

Spending attitudes and shopping habits<br />

have changed, however, shaped by the<br />

financial austerity of the past<br />

few years and the influence of<br />

technology, particularly mobility<br />

and social networking.<br />

These attitudes touched many<br />

categories, causing stress and even<br />

disruption and transformation.<br />

Consumers expected wide product<br />

choice, low prices and instant<br />

gratification. In addition, they<br />

expressed concern about ethical<br />

sourcing and product impact on<br />

health and the environment.<br />

Fast Food and Soft Drinks<br />

Although these categories continued to<br />

experience steady growth, they felt the<br />

impact of consumer concerns and habits<br />

that impacted the rate of growth. The<br />

beer category rose 14 percent in brand<br />

value; fast food, 10 percent; soft drinks,<br />

4 percent.<br />

Financial Institutions<br />

The global banks made money and the<br />

category brand value increased 15<br />

percent overall. Less tainted by the risky<br />

practices that precipitated the financial<br />

crisis, the regional banks enjoyed strong<br />

results, but brand value rose only 6<br />

percent because the growth of Chinese<br />

banks slowed. Insurers enjoyed a strong<br />

year and the category grew 11 percent.<br />

Commodities<br />

The brand value of oil and gas<br />

appreciated 3 percent, the most modest<br />

gain of any category, as companies<br />

slowed exploration in response to<br />

shareholder pressure for improved ROI<br />

(Return on Investment).<br />

Technology<br />

Technology companies continued to<br />

appreciate in value, especially the<br />

consumer-facing brands, while businessto-business<br />

brands adjusted to the era of<br />

Cloud computing and big data<br />

management. The category rose 16<br />

percent in brand value.<br />

34 BrandZ Top 100 Most Valuable Global Brands 2014 35