Annual Report & Accounts 2007-2008 - Historic Scotland

Annual Report & Accounts 2007-2008 - Historic Scotland

Annual Report & Accounts 2007-2008 - Historic Scotland

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

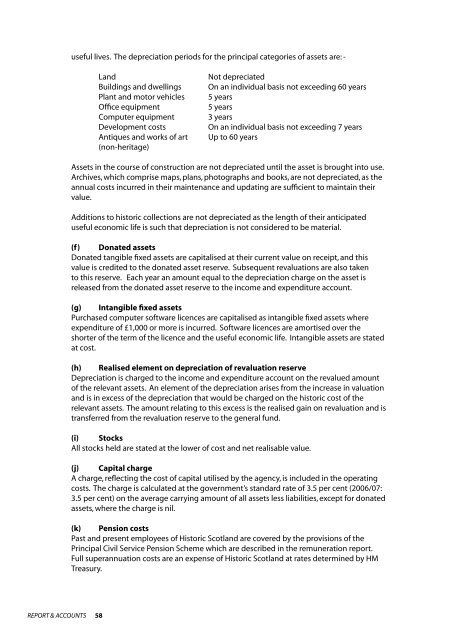

useful lives. The depreciation periods for the principal categories of assets are: -<br />

Land<br />

Buildings and dwellings<br />

Plant and motor vehicles<br />

Office equipment<br />

Computer equipment<br />

Development costs<br />

Antiques and works of art<br />

(non-heritage)<br />

Not depreciated<br />

On an individual basis not exceeding 60 years<br />

5 years<br />

5 years<br />

3 years<br />

On an individual basis not exceeding 7 years<br />

Up to 60 years<br />

Assets in the course of construction are not depreciated until the asset is brought into use.<br />

Archives, which comprise maps, plans, photographs and books, are not depreciated, as the<br />

annual costs incurred in their maintenance and updating are sufficient to maintain their<br />

value.<br />

Additions to historic collections are not depreciated as the length of their anticipated<br />

useful economic life is such that depreciation is not considered to be material.<br />

(f) Donated assets<br />

Donated tangible fixed assets are capitalised at their current value on receipt, and this<br />

value is credited to the donated asset reserve. Subsequent revaluations are also taken<br />

to this reserve. Each year an amount equal to the depreciation charge on the asset is<br />

released from the donated asset reserve to the income and expenditure account.<br />

(g) Intangible fixed assets<br />

Purchased computer software licences are capitalised as intangible fixed assets where<br />

expenditure of £1,000 or more is incurred. Software licences are amortised over the<br />

shorter of the term of the licence and the useful economic life. Intangible assets are stated<br />

at cost.<br />

(h) Realised element on depreciation of revaluation reserve<br />

Depreciation is charged to the income and expenditure account on the revalued amount<br />

of the relevant assets. An element of the depreciation arises from the increase in valuation<br />

and is in excess of the depreciation that would be charged on the historic cost of the<br />

relevant assets. The amount relating to this excess is the realised gain on revaluation and is<br />

transferred from the revaluation reserve to the general fund.<br />

(i) Stocks<br />

All stocks held are stated at the lower of cost and net realisable value.<br />

(j) Capital charge<br />

A charge, reflecting the cost of capital utilised by the agency, is included in the operating<br />

costs. The charge is calculated at the government’s standard rate of 3.5 per cent (2006/07:<br />

3.5 per cent) on the average carrying amount of all assets less liabilities, except for donated<br />

assets, where the charge is nil.<br />

(k) Pension costs<br />

Past and present employees of <strong>Historic</strong> <strong>Scotland</strong> are covered by the provisions of the<br />

Principal Civil Service Pension Scheme which are described in the remuneration report.<br />

Full superannuation costs are an expense of <strong>Historic</strong> <strong>Scotland</strong> at rates determined by HM<br />

Treasury.<br />

REPORT & ACCOUNTS 58