PNPM Mandiri Revolving Loan Fund (RLF) - PNPM Support Facility

PNPM Mandiri Revolving Loan Fund (RLF) - PNPM Support Facility

PNPM Mandiri Revolving Loan Fund (RLF) - PNPM Support Facility

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>PNPM</strong> SUPPORT FACILITY (PSF)<br />

Project Proposal<br />

Project Title:<br />

Objective:<br />

Executing Agency:<br />

Estimated Duration:<br />

Estimated Budget:<br />

Geographic<br />

Coverage:<br />

Implementation<br />

Arrangements:<br />

<strong>PNPM</strong> <strong>Mandiri</strong> <strong>Revolving</strong> <strong>Loan</strong> <strong>Fund</strong> (<strong>RLF</strong>) Capacity-Building and<br />

Sustainability Project<br />

The objective of the five year Project is to support the capacity building,<br />

restructuring and institutionalization of the <strong>PNPM</strong> <strong>RLF</strong> scheme and strengthen<br />

linkages between the <strong>PNPM</strong> <strong>RLF</strong>s and the commercial microfinance sector so<br />

as to help ensure growth and sustainability in the provision of financial services<br />

to the poor.<br />

World Bank<br />

Entire duration of the Project: 2010 – 2014 (5 years).<br />

<strong>Fund</strong>ing is being requested for activities covering August 2011-December<br />

2012.<br />

A total of US$ 31,000,000 has been tentatively committed for the five year<br />

Project. A first allocation of US$4,211,000 was approved by the JMC on 15<br />

January 2010. This proposal is seeking JMC approval for a second allocation of<br />

US$ 4,679,866.<br />

Four provinces (3,300 <strong>RLF</strong>s):<br />

• Central Java and D.I.Yogyakarta<br />

• West Sumatra and East Nusa Tenggara (NTT)<br />

To implement activities presented in this Project Proposal, the World Bank will<br />

use funding from the PSF Trust <strong>Fund</strong> to issue grants/sub-contracts to qualified<br />

service providers.<br />

I. Background<br />

1. <strong>PNPM</strong> <strong>Mandiri</strong> and its predecessor projects (KDP and UPP), have provided financing for<br />

community-managed revolving loan funds (<strong>RLF</strong>s) since their inception over a decade ago. <strong>PNPM</strong>’s<br />

provision of <strong>RLF</strong>s has been focused on facilitating access to credit for the poor, especially women, to<br />

overcome market failure. Access to credit from commercial banks, including banks which specialize in<br />

microfinance provision such as BRI, is indeed still very low in Indonesia, particularly in rural villages and<br />

low-income urban neighborhoods. Research conducted under this Project (2009) 1 shows that less than 18%<br />

of Indonesians have access to credit from the banking sector, while only 20% of poor households have access<br />

to banking services. The original of the Government of Indonesia (GoI) for the <strong>PNPM</strong> <strong>RLF</strong>s was that loan<br />

provision under <strong>PNPM</strong> would help poor people start-up and grow businesses, thus becoming more bankable,<br />

which would encourage the commercial banks to become more active in servicing the productive poor.<br />

2. These <strong>RLF</strong>s have become a significant national, community-based revolving fund operation<br />

reaching poor people who typically have no or limited access to other sources of credit. Over the past 10<br />

years, the revolving loan programs under <strong>PNPM</strong> have continued to grow and reached a significant volume,<br />

scale and outreach. The volume of <strong>RLF</strong>s under <strong>PNPM</strong> is much larger than originally estimated. According<br />

to latest data and estimates, the <strong>RLF</strong> capital in both <strong>PNPM</strong> Rural and Urban has reached more than US$600<br />

million and about 700,000 groups (many of them women groups), with an estimated outreach of nearly 5<br />

million individual borrowers. Client surveys suggest that <strong>RLF</strong>s have had positive impacts on household<br />

income, business development, job creation and children’s education. 2<br />

1 The World Bank (2009), Improving Access to Financial Services in Indonesia<br />

2 See MICRA Microcredit Strategy Formulation Mission for <strong>PNPM</strong>, November 2008, page 39 “Program Impact”.

3. Yet, there is little evidence that the original GoI objective of supporting the uptake of <strong>RLF</strong><br />

borrowers by commercial banks has been achieved. The sheer volume of funds currently revolving in<br />

<strong>PNPM</strong> communities reinforces the need to put the <strong>RLF</strong>s on a clear path towards sustainability. <strong>RLF</strong>s present<br />

an inherently high potential risk of misuse of fund and corruption, as well as a potentially high incidence of<br />

non-performing loans. A number of measures have been taken to reinforce formal and social controls on<br />

<strong>RLF</strong>s operation, resulting in improvements in redress processes and repayment rates on new loans, which<br />

now exceed 80%. Phasing-out the GoI’s direct support of <strong>RLF</strong>s by supporting the transition of the <strong>RLF</strong>s<br />

from being a government-backed scheme to becoming operationally and financially independent<br />

microfinance institutions has been defined by GoI as a strategic objective. Addressing systemic issues faced<br />

by current <strong>RLF</strong>s operations under <strong>PNPM</strong> (e.g. improve oversight and capacity building, data accuracy and<br />

reporting etc.) also requires attention during a transition period.<br />

4. In its meeting on January 15 2010 meeting, the JMC approved a concept for a five year,<br />

US$ 31 million <strong>PNPM</strong> <strong>Mandiri</strong> <strong>Revolving</strong> <strong>Loan</strong> <strong>Fund</strong> (<strong>RLF</strong>) Capacity-Building and Sustainability<br />

Project. The overall goal of the Project is to contribute to poverty reduction initiatives within the target<br />

communities by scaling-up sustainable access to finance to support the larger underserved population and the<br />

development and expansion of microenterprises. US$ 4.2 million for were allocated for start-up activities.<br />

With this proposal, the Project team seeks approval for a second allocation for activities to be implemented<br />

from August 2011 to December 2012.<br />

II.<br />

Project Description & Progress to Date<br />

5. The Project acts as a bridge between Cluster 2 (community empowerment) and Cluster 3<br />

(access to finance for the poor and for private sector development) of the GoI’s overall national<br />

poverty reduction strategy. The Project’s strategic value lies in its potential to leverage debt from<br />

commercial banks for the benefit of Indonesia’s poorer communities. This will induce client level social<br />

and economic improvements such as increases in business sales, household income, employment, assets,<br />

spending on education and health, financial literacy, increased self-esteem.<br />

6. The Project’s development objective is to support the capacity building, restructuring and<br />

institutionalization of the <strong>PNPM</strong> <strong>RLF</strong> scheme and strengthen linkages between the <strong>PNPM</strong> <strong>RLF</strong>s<br />

and the commercial microfinance sector so as to help ensure growth and sustainability in the<br />

provision of financial services to the poor. Specifically, the Project has four key components:<br />

a) Develop and implement a strategy to support the capacity building and institutionalization of the<br />

<strong>PNPM</strong> <strong>RLF</strong>s.<br />

b) Strengthen linkages between the <strong>RLF</strong>s and the commercial financial sector so as to help ensure<br />

growth and sustainability in the provision of financial services to the poor.<br />

c) Develop and establish a monitoring and supervision system to provide fiduciary oversight of the<br />

microfinance operations and to track the institutional development and performance of the <strong>RLF</strong>s.<br />

d) Develop a clear policy and strategy for the phasing-out of Government’s direct support of <strong>RLF</strong>s<br />

by supporting the transition of the <strong>RLF</strong>s from being a government-backed scheme to becoming<br />

operationally and financially independent microfinance institutions.<br />

Page 2 of 10

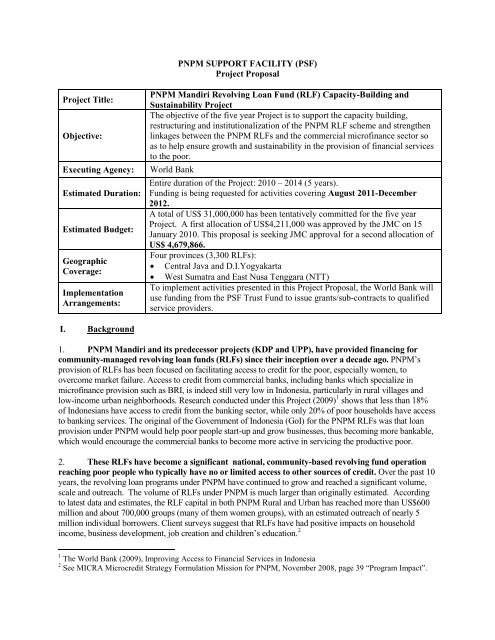

Towards <strong>RLF</strong>s’ self-sustainability Component 4<br />

(Policy and Strategy)<br />

Component 3<br />

(Monitoring and Supervision System)<br />

Component 2<br />

(Bank Linkage)<br />

Component 1 (Capacity Building and Institutionalization)<br />

Sub-Component 1-A: <strong>RLF</strong>’s needs Assessment<br />

Sub-Component 1-B: Legal Review & TA<br />

Sub-Component 1-c: Capacity Building<br />

Sub-Component 1-D: <strong>Support</strong> for MIS<br />

The World Bank Executed Period<br />

(2010- 2013)<br />

GoI Executed<br />

(2014)<br />

7. Overall implementation progress to date. The first US $ 4.2 million allocation has supported<br />

project start-up activities, which are well underway. Milestones reached to date include: project locations<br />

selected; UPKs mapped; project concept socialized to key stakeholders at central, regional and provincial<br />

levels, as well as to a number of UPKs; and assessments of <strong>PNPM</strong> <strong>Mandiri</strong> <strong>RLF</strong>s nearly completed for Rural<br />

and well underway for Urban. Procurement of core technical assistance packages is in the final stages.<br />

Detailed information on progress to date under each component is provided in Annex 2.<br />

III.<br />

New Activities under Each Component<br />

8. Component 1. Capacity Building and Institutionalization. This component will support the<br />

restructuration and improved performance of current <strong>PNPM</strong> <strong>RLF</strong> operations through the provision of<br />

technical assistance and training which take into account variances in human capital, operating procedures<br />

and future legal structure of the <strong>RLF</strong>s. An in-depth assessment of a representative sample of <strong>RLF</strong>s (15% or<br />

507), which will foster a better understanding of <strong>RLF</strong>s’ current performance on core indicators (e.g.<br />

Governance, Management and Financial Performance), development potential and capacity building needs,<br />

will be completed by September 2011. <strong>Fund</strong>ing is being requested to start preparations and launch the<br />

following activities:<br />

a. A Legal Review, which will a) clarify the ownership of the <strong>RLF</strong>s capital and b) determine the<br />

appropriate legal structure for <strong>RLF</strong>s based on a menu of institutional options, which will take into<br />

account the institutional capacity of <strong>RLF</strong>s as well as their local context. An international expert on<br />

legal issues associated with micro-finance schemes has already been hired to support the replication<br />

of international best practice, and a local legal firm expected to start working in July 2011. The Legal<br />

Review should be completed by the end of 2011.<br />

b. Consulting Services for Capacity Building: This activity will be conducted after the completion of<br />

the aforementioned <strong>RLF</strong>s assessment, drawing on its findings. The Project will develop and conduct a<br />

customized capacity building program in two provinces in Java to restructure and improve<br />

performance of current <strong>RLF</strong> operations. In a second stage, capacity building will be rolled out to off-<br />

Java and to <strong>PNPM</strong> Urban <strong>RLF</strong>s, for a total of over 3,000 <strong>RLF</strong>s. A firm will be contracted to oversee<br />

implementation. Work is expected to start in July 2011 and should be completed by the end of 2012.<br />

Page 3 of 10

c. Implementation <strong>Support</strong> for <strong>RLF</strong> MIS: This activity will also start upon completion of the <strong>RLF</strong><br />

assessment. The Project will develop a robust data recording and information system that captures<br />

transactional data of the groups and UPKs to help improve the efficiency and effectiveness of <strong>RLF</strong><br />

operations and ensure that <strong>RLF</strong> data fed into <strong>PNPM</strong>’s MIS is reliable. This is a critical activity, as the<br />

ongoing <strong>RLF</strong> assessments suggest that <strong>RLF</strong> data is unreliable. Accurate and transparent data will<br />

improve governance and increase opportunities for bank linkages. Implementation is expected to<br />

start in July 2011 and to be completed by the end of 2012.<br />

9. Component 2. Bank Linkages. Activities under this component will support the establishment<br />

of actual linkages between <strong>RLF</strong>s and the commercial financial sector, building on the activities conducted<br />

under Component 1 and based on a “graduating institution” concept. <strong>RLF</strong>s whose performance is rated as<br />

“excellent” and “good” under component 1, will receive support to develop relationships with banks as<br />

soon as they can be registered as a suitable legal entity. For other <strong>RLF</strong>s, alternative and/or gradual linkage<br />

options will be explored. Ways to accelerate linkages between <strong>PNPM</strong> <strong>RLF</strong>s borrowers themselves will<br />

also be explored. The feasibility and cost of creating commercial bank linkages including an effective<br />

incentive scheme (e.g. providing loan funds for on-lending to <strong>RLF</strong>s) will be finally determined after the<br />

ongoing assessment of the financial soundness of the <strong>RLF</strong>s and further dialogue with commercial banks.<br />

<strong>Fund</strong>ing is being requested to start preparations and launch the following activities:<br />

a) Revision of Current Standard Operating Procedures: The activity will assist GoI in reviewing,<br />

updating and upgrading current SOPs for <strong>PNPM</strong> <strong>RLF</strong>s to ensure that <strong>RLF</strong>s accounting follows<br />

international best practice and support <strong>RLF</strong> borrowers with good track records in accessing to formal<br />

financial services. The on-going needs assessment conducted by M-Cril includes a review of SOPs. It<br />

findings will be utilized by the Project team to provide technical assistance to GoI for the revision of<br />

SOPs.<br />

b) Product Design: This activity will support the upgrading of <strong>RLF</strong>s as a financial product (e.g.<br />

adjustment of loan size and repayment schedule) to respond to the needs expressed by borrowers and<br />

<strong>RLF</strong>s staff during the aforementioned assessments and explore the feasibility of developing new<br />

products (e.g. micro-insurance, savings etc.). Upgraded product design (e.g. aligning <strong>RLF</strong> ceiling<br />

with the government’s partial guarantee program - KUR) will support the graduation of <strong>RLF</strong>s and<br />

their linkages with commercial institutions.<br />

10. Component 3. Monitoring and Supervision System: A project logical framework was<br />

developed as part of start-up activities to support Project monitoring and evaluation (M&E). The Project<br />

involves inherent challenges as over 3,000 <strong>RLF</strong>s, with high variance as regards capacity and incentives<br />

(especially between rural and urban UPKs), will need to be supervised and monitored on an ongoing basis.<br />

Ensuring that appropriate monitoring and supervision systems based on internationally accepted performance<br />

indicators and standards are put in place is therefore important.<br />

a) Design of Impact Assessments: In collaboration with the PSF M&E team, the Project team will<br />

design a mixed-methods evaluation to assess the Project impacts on borrowers’ welfare (inc.<br />

sustainability of their businesses) and access to financial services.<br />

11. Component 4. Policy and Strategy: The aforementioned activities under Component 1 to 3 will<br />

provide a solid foundation for the development of a long-term strategy to phase out the Government’s<br />

direct support to the <strong>RLF</strong>s and establish sustainable <strong>RLF</strong> operations. The Project team will provide<br />

technical assistance to GoI in the form of policy briefings and discussion notes summarizing the findings<br />

of ongoing and planned assessments and laying-out options for consideration by decision-makers.<br />

Page 4 of 10

IV.<br />

Estimated Budget<br />

12. A total of US$ 31 million has been committed by the JMC for the Project over the five year<br />

period. An initial budget of US$ 4.211 million was allocated for start-up activities by the JMC meeting on<br />

January 15 2010, and has been released accordingly.<br />

13. The Project team is seeking approval of an additional allocation of US$ 4,679,866 for new<br />

activities to be conducted between August 2011 and December 2012. A breakdown of the budget is<br />

provided in the table below. Reallocations across expense categories may be needed during the course of<br />

implementation.<br />

Category<br />

Aug 2011 - Dec 2012 (US$)<br />

Component 1<br />

Legal and Regulatory Advisory Services 785,000<br />

Training and Capacity-Building <strong>Support</strong> 1,984,000<br />

Improving Monitoring and Information System (MIS) for <strong>RLF</strong>s<br />

operations<br />

1,100,000<br />

Component 2<br />

Bank Linkage Scheme 1,000,000<br />

Component 3&4<br />

Monitoring & Evaluations / Strategy & Policy recommendations 300,000<br />

Implementation costs of above all (Component 1- 4)<br />

Operating Costs (inc. costs for travel/field trips, workshops etc.) 346,000<br />

WB staff 402,500<br />

Consultants 315,000<br />

SUB TOTAL 6,232,500<br />

Contingency (approx 5% of total budget) 311,625<br />

TOTAL 6,544,125<br />

Start-up (‘Phase 1’) activities – Balance on 1 st JMC allocation 2,058,366<br />

TOTAL FOR NEW ALLOCATION 4,679,866<br />

V. Implementation Arrangements<br />

14. The Task Team Leader for this Project is based within the Finance and Private Sector<br />

Development (FPD) Unit of the World Bank Office in Jakarta, and cooperates closely with the <strong>PNPM</strong><br />

<strong>Support</strong> <strong>Facility</strong> (PSF) and the World Bank task teams for both <strong>PNPM</strong> Rural and Urban.<br />

15. Project activities will be World Bank executed. The GoI expressed its preference for this<br />

modality, which makes it easier to test out different approaches while a parallel dialogue is being<br />

conducted between different government agencies on longer-term strategy for the <strong>RLF</strong> scheme and the<br />

Bank team coordinates with the National Team of Poverty Reduction (TNP2K). A gradual handing over<br />

of project components will take place once adequate arrangements have been agreed upon with concerned<br />

government stakeholders. The project will be fully handed over to GoI at the beginning of Year 5, at the<br />

latest.<br />

16. GoI oversight and strategic guidance. In light of the large stake the GoI has in the <strong>PNPM</strong><br />

<strong>Mandiri</strong> program, ensuring broad ownership over the Project among regional and national stakeholders is<br />

of crucial importance. The Bank team coordinates with key stakeholders at national and regional level,<br />

including Bappnas, Coordinating Ministry of People’s Welfare, Ministry of Home Affairs, Ministry of<br />

Page 5 of 10

Public Works, National Team of Poverty Reduction (TNP2K) etc. To this end, a working group<br />

comprising relevant ministries (i.e. the Ministry of Home Affairs, the Ministry of Public Work and<br />

Bappenas) has been established, ensuring adequate institutional representation of oversight agencies for<br />

both <strong>PNPM</strong> Rural and Urban. The Project team is also assisting GoI in establishing working groups at the<br />

regional level. The Project will support the GoI in ensuring that regular information shared and discussed<br />

with key stakeholders through existing structures such as the TNP2K and Pokja Pengendali.<br />

VI.<br />

Key Performance Indicators<br />

17. The indicators presented below are for the entire, five year program. Early results for the indicators<br />

highlighted in italic will materialize after the completion of proposed new activities in December<br />

2012.<br />

Objectives and Outcomes<br />

Overall Goal<br />

Achieve poverty reduction in <strong>PNPM</strong> target<br />

communities by scaling up of sustainable access<br />

to financial services by Indonesia’s poorer<br />

communities<br />

Project Development Objective(PDO)<br />

Sustainable provision of financial services by<br />

<strong>RLF</strong> in four selected provinces through<br />

restructuring and improving the performance of<br />

<strong>RLF</strong> operations<br />

(“Building a bridge between cluster 2 and<br />

cluster 3”)<br />

Component 1 : Eligible <strong>RLF</strong> have the capacity<br />

to manage the funds in a professional way and<br />

based on good practice MF principles<br />

Component 2: Linkages between the <strong>RLF</strong>s and<br />

the commercial financial sector are established<br />

Component 3: Effective and timely monitoring<br />

and supervision system for <strong>RLF</strong> is in place<br />

Component 4: Clear policy and strategy for<br />

sustainable <strong>RLF</strong> operations is developed and<br />

agreed (including a phasing-out of the<br />

Government’s direct support to <strong>RLF</strong>s)<br />

Result Indicators<br />

Impact assessment indicators (tbd)<br />

1. Increase in no. and amount of loans to groups and<br />

their members.<br />

2. Improvements in the types and quality of products<br />

and services offered (e.g. savings services)*<br />

3. No of <strong>RLF</strong> that cover the full operating cost from<br />

their interest spread*<br />

4. No. or % of <strong>RLF</strong>s that have received high quality<br />

microfinance technical assistance and training.<br />

5. No. or % of <strong>RLF</strong>s that have improved in their<br />

rating based on key performance indicators.<br />

6. No. or % of <strong>RLF</strong>s that have institutionalized in a<br />

legal form that is appropriate to the local<br />

context.*<br />

7. No. or % of <strong>RLF</strong>s with linkages with commercial<br />

banks<br />

8. Increased access to sustainable sources of<br />

financing: (i) bank loan amounts (ii) leverage ratio<br />

9. No. or % of <strong>RLF</strong>s that receive less/no block grants<br />

and achieve financial self-sufficiency (for good<br />

performing <strong>RLF</strong>s) or are liquidated (for poor<br />

performing <strong>RLF</strong>s)*<br />

10. No. or % of <strong>RLF</strong>s for which regular, complete and<br />

timely performance rating results are available<br />

11. No. or % of <strong>RLF</strong>s under supervision of a qualified<br />

financial supervisory agency*<br />

12. Key stakeholders have agreed on initial strategy<br />

before implementation<br />

13. No. of good practice inputs provided to and<br />

adopted by <strong>PNPM</strong> <strong>Mandiri</strong><br />

Page 6 of 10

14. By end of year 5, key stakeholders agree on longterm<br />

strategy and phasing-out of direct<br />

government support*<br />

ANNEX 1: LIST OF PROJECT ACTIVITIES (FIVE YEAR PROGRAM)<br />

Component 1 - Capacity Building of <strong>RLF</strong>s<br />

1.1 Assessment of <strong>RLF</strong> capacity and capacity building needs in both rural and urban <strong>PNPM</strong><br />

1.2 Develop and clearly define good microfinance principles adapted to <strong>RLF</strong><br />

1.3 Assessment of support provided by the <strong>PNPM</strong> facilitators to (i) the <strong>RLF</strong> for a) establishment and b)<br />

on-going operations , (ii) formation and guidance of SPP (groups)<br />

a. Can this function be integrated in the UPK system? e.g. TPK<br />

b. If a. cannot: Can the UPK hire outside technical assistance?<br />

1.4 Legal assessment and options for <strong>RLF</strong> legal status<br />

1.5 Design capacity building measures based on institutional development strategies<br />

(Ref. Component 4 Policy and Strategy)<br />

1.6 Develop eligibility criteria (based on graduation philosophy) for <strong>RLF</strong> capacity building<br />

1.7 Implement capacity building and training for eligible <strong>RLF</strong>s<br />

Component 2 – Bank Linkages:<br />

2.1 Identify early potential <strong>RLF</strong> candidates for bank linkage<br />

2.2 Identify potential banks and initiate discussions on feasibility and type of linkages<br />

2.3 Develop linkage models, incl. potential role as agents for banks:<br />

• Bank – UPK<br />

• Bank – SPP<br />

• Bank – individual<br />

2.4 Establish eligibility criteria for a. <strong>RLF</strong>s and b. banks<br />

2.5 Initiate first demonstration and show cases of pilot linkages<br />

2.6 Evaluate pilot linkages and refine linkage models<br />

2.7 Conduct regional linkage workshops to socialize and disseminate the concept<br />

2.8 Develop and implement a linkage training program for <strong>RLF</strong>s “how to deal with a bank”<br />

2.9 Conduct short exposure programs for banks to gain a direct insight into <strong>RLF</strong> operations<br />

2.10 Develop a cadre of “linkage facilitators” (e.g. twinning FK with a bank officer)<br />

2.11 Implement bank linkages<br />

2.12 Monitor and evaluate bank linkages<br />

Component 3 – Monitoring and Supervision System<br />

3.1 Develop a project monitoring system based on PDO, outcomes, indicators and activities<br />

3.2 Develop a <strong>RLF</strong> rating system (governance, management and financial performance)<br />

Page 7 of 10

3.3 Develop an institutional performance monitoring system based on <strong>RLF</strong> rating system and up to date<br />

financial reporting standards<br />

3.4 Develop institutional performance monitoring system into a supervisory rating system<br />

3.5 Determine an appropriate supervisory agency (or agencies: non-prudential vs prudential)<br />

3.6 Conduct capacity building of supervisors<br />

Component 4 – Policy and Strategy<br />

4.1 Develop initial strategy for restructuring and improving rural <strong>RLF</strong> operations based on 100 <strong>RLF</strong>s in<br />

CJ/Yog (year 2)<br />

- Institutional development strategies and options (as basis for capacity building – Component 1)<br />

- Transition from grant (BLM) to loans “phasing-out of BLM, phasing-in of bank loan”<br />

- Potential legalization of <strong>RLF</strong>s<br />

4.2 Develop initial strategy for restructuring and improving urban <strong>RLF</strong> operations<br />

4.3 Develop refined strategy for rural and urban <strong>RLF</strong>s in four pilot provinces (year 3)<br />

4.4 Provide lessons learned and good practice inputs to <strong>PNPM</strong> <strong>Mandiri</strong> on an incremental basis<br />

4.5 Develop long-term policy and strategy for sustainable <strong>RLF</strong> operations and nationwide replication by<br />

the government, including exit strategy for the government’s direct support for <strong>RLF</strong>s (year 5)<br />

ANNEX 2. DETAILED DESCRIPTION OF PROGRESS TO DATE<br />

18. Overall implementation progress. Implementation is well underway, with project locations selected;<br />

UPKs mapped; project concept socialized to key stakeholders at central, regional and provincial levels, as<br />

well as to a number of UPKs; and assessments of <strong>PNPM</strong> <strong>Mandiri</strong> <strong>Revolving</strong> <strong>Loan</strong> <strong>Fund</strong>s (<strong>RLF</strong>s) nearly<br />

completed for Rural and well underway for Urban. Procurement of core technical assistance packages is in<br />

the final stages. General progress and progress by component is detailed below. More information about the<br />

components is included in Annex 2.<br />

19. Project preparation. Following project approval by the JMC in January 2010, the core project team<br />

was established; a Child Trust <strong>Fund</strong> was created and JMC-approved budget of US$4.211 million<br />

transferred to the TF account. A series of meetings were held with national level counterparts, the<br />

Ministry of Home Affairs, Bappenas, Coordinating Ministry for People’s Welfare (Menko Kesra), NMC,<br />

donors and the Social Development team in the World Bank Indonesia’s PSF Office.<br />

20. A working group of relevant stakeholders from the Government has been established. A first<br />

meeting, chaired by Bappenas, was held on 5 November 2010. On that occasion, the working group<br />

endorsed the selection of the two off-Java provinces (i.e., West Sumatra and East Nusa Tenggara (NTT)).<br />

Working group meetings at both national and regional level are expected to be held on a regular basis in<br />

due course.<br />

21. The Project concept note has also been subjected to the World Bank internal peer review and was<br />

approved on 11 November 2010. Specifically, the World Bank management approved implementation of the<br />

Project by the Bank and the allocation of staff and management resources. The peer review also included<br />

external microfinance specialists from CGAP.<br />

22. Inventory and mapping of <strong>RLF</strong>s. An inventory and mapping of all existing <strong>Revolving</strong> <strong>Loan</strong> <strong>Fund</strong>s<br />

(<strong>RLF</strong>s) in the four provinces in both rural and urban areas was conducted (see table below). The project will<br />

broadly target approximately 3,300 <strong>RLF</strong>s, with the majority (75%) in Java. Furthermore, the <strong>RLF</strong>s in <strong>PNPM</strong><br />

Page 8 of 10

Urban are larger in number but much smaller in size as they are located at the village (kelurahan) level as<br />

opposed to <strong>RLF</strong>s under <strong>PNPM</strong> Rural which are operating at the sub-district (kecamatan).<br />

Pilot Province Rural <strong>RLF</strong>s Urban <strong>RLF</strong>s Total <strong>RLF</strong>s<br />

1 Central Java 444 1,795 2,239 68%<br />

2 Yogyakarta (DIY) 56 169 225 7%<br />

3 West Sumatra 141 340 481 15%<br />

4 East Nusa Tenggara (NTT) 245 110 355 11%<br />

Total 886 2,414 3,300 100%<br />

<strong>RLF</strong> sample for assessment 266 241 507 15%<br />

Note: Number of <strong>RLF</strong>s is as of December 2010. Numbers will fluctuate with formation of new groups.<br />

Component 1: Capacity Building and Institutionalization<br />

23. This component is largely on track. Socialization of the new pilot program began in May 2010<br />

with regional and local governments and local stakeholders in both Central Java and Yogyakarta for<br />

<strong>PNPM</strong> Rural. In a series of field workshops, initial inputs on the project concept were obtained from<br />

more than 1,000 UPK representatives and Kecamatan facilitators. This also included field visits to <strong>RLF</strong><br />

operations in Central Java, Yogyakarta, and some other provinces. Following agreement to start<br />

expansion of the program to <strong>PNPM</strong> Urban <strong>RLF</strong>s from early 2011, the program has now been socialized to<br />

nearly 300 <strong>PNPM</strong> Urban Economic Facilitators, City Coordinators and Assistant City Coordinators in<br />

Central Java and Yogyakarta, and received support from Bappeda in both locations. The project has placed<br />

one core team member with the <strong>PNPM</strong> Urban team in the World Bank to support project preparation and<br />

implementation.<br />

24. Sub-component 1-A: <strong>Revolving</strong> <strong>Loan</strong> <strong>Fund</strong> Assessments. One of the first major project activities<br />

is the in-depth assessment of a sufficiently large number of <strong>RLF</strong>s to gain a better understanding of the<br />

operations, the development potential and the capacity building needs of <strong>RLF</strong>s. Given the large number<br />

of <strong>RLF</strong>s in the pilot provinces, a representative sample of 507 <strong>RLF</strong>s – approx. 15% of the total - has been<br />

chosen for the in-depth assessment. In line with the initial proposal, the assessment is being conducted in<br />

four stages: (i) a first batch of 100 rural <strong>RLF</strong>s in Central Java and Yogyakarta was completed in March<br />

2011; (ii) 50 remaining rural <strong>RLF</strong>s in the same area have been completed in May 2011; (iii) 197 urban<br />

<strong>RLF</strong>s in Central Java and Yogyakarta will be completed by end-July 2011; and (iv) 116 rural <strong>RLF</strong>s and<br />

44 urban <strong>RLF</strong>s in West Sumatra and NTT are planned to be finalized by October 2011.<br />

25. The consulting firm to carry out the assessments of the <strong>RLF</strong>s was contracted in October 2010<br />

following a six-month procurement process under World Bank guidelines. The following steps have been<br />

conducted regarding the <strong>RLF</strong> assessment:<br />

• November 2010 – Initial assessment (pre-test) of 14 rural <strong>RLF</strong>s conducted<br />

• December 2010 – Assessment methodology reviewed in a technical workshop and fine-tuned for<br />

rollout<br />

• March 2011:<br />

- Assessment of 100 rural <strong>RLF</strong>s completed<br />

- Mid-term review of rural assessments shared in workshop with key central, regional and<br />

provincial stakeholders<br />

• April 2011 - Initial assessment (pre-test) of 10 urban <strong>RLF</strong>s conducted<br />

• May 2011:<br />

- Assessment of additional 50 rural <strong>RLF</strong>s completed<br />

- Assessment methodology for urban <strong>RLF</strong>s reviewed in a technical workshop and fine-tuned<br />

for rollout<br />

Page 9 of 10

- Assessment of additional 187 urban <strong>RLF</strong>s begin (to be completed end-July)<br />

26. Sub-component 1-B: Legal Review. A second major assessment has been launched to clarify the<br />

ownership of the <strong>RLF</strong> capital and to determine the appropriate legal structure for <strong>RLF</strong>s based on a menu<br />

of institutional options. The procurement process to select a legal firm to support this activity is in the<br />

final stages. A part time international legal expert has been hired to support this activity.<br />

27. Sub-component 1-C: Consulting Services for Capacity Building. Following the initial assessment,<br />

the Project will develop and conduct a customized program of capacity building in the two provinces in<br />

Java in order to restructure and improve performance of current <strong>RLF</strong> operations. In a second stage,<br />

capacity building will be rolled out to off-Java and to <strong>PNPM</strong> Urban <strong>RLF</strong>s. Terms of Reference (TOR)<br />

were developed for the assignment, RFP issued and procurement is in the final stages. Implementation is<br />

expected to start in July 2011.<br />

28. Sub-component 1-D: Implementation <strong>Support</strong> for <strong>RLF</strong> MIS. The Project will develop a robust<br />

data recording and information system that captures transactional data of the groups and UPKs to help<br />

improve the efficiency and effectiveness of <strong>RLF</strong> operations and provide data to <strong>PNPM</strong> stakeholders. This<br />

is a critical activity, as the assessments underway now reveal that the <strong>RLF</strong> data is weak. Accurate and<br />

transparent data will improve governance and increase opportunities for bank linkages with and<br />

sustainability of the <strong>RLF</strong>s. TORs for the assignment were developed, RFP issued and procurement is in<br />

the final stages. Implementation is expected to start in July 2011.<br />

Page 10 of 10