Worksheet: - SaveAndInvest.org

Worksheet: - SaveAndInvest.org

Worksheet: - SaveAndInvest.org

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

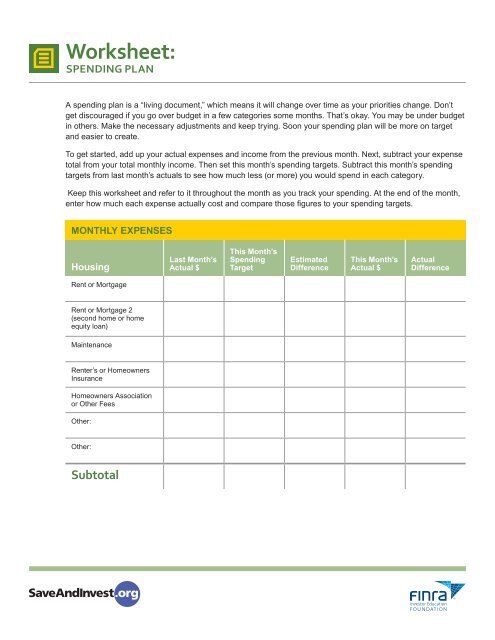

<strong>Worksheet</strong>:<br />

Spending Plan<br />

A spending plan is a “living document,” which means it will change over time as your priorities change. Don’t<br />

get discouraged if you go over budget in a few categories some months. That’s okay. You may be under budget<br />

in others. Make the necessary adjustments and keep trying. Soon your spending plan will be more on target<br />

and easier to create.<br />

To get started, add up your actual expenses and income from the previous month. Next, subtract your expense<br />

total from your total monthly income. Then set this month’s spending targets. Subtract this month’s spending<br />

targets from last month’s actuals to see how much less (or more) you would spend in each category.<br />

Keep this worksheet and refer to it throughout the month as you track your spending. At the end of the month,<br />

enter how much each expense actually cost and compare those figures to your spending targets.<br />

MONTHLY EXPENSES<br />

Housing<br />

Last Month’s<br />

Actual $<br />

This Month’s<br />

Spending<br />

Target<br />

Estimated<br />

Difference<br />

This Month’s<br />

Actual $<br />

Actual<br />

Difference<br />

Rent or Mortgage<br />

Rent or Mortgage 2<br />

(second home or home<br />

equity loan)<br />

Maintenance<br />

Renter’s or Homeowners<br />

Insurance<br />

Homeowners Association<br />

or Other Fees<br />

Other:<br />

Other:<br />

Subtotal

<strong>Worksheet</strong>:<br />

Spending Plan<br />

MONTHLY EXPENSES (continued)<br />

Utilities<br />

Last Month’s<br />

Actual $<br />

This Month’s<br />

Spending<br />

Target<br />

Estimated<br />

Difference<br />

This Month’s<br />

Actual $<br />

Actual<br />

Difference<br />

Electricity<br />

Gas<br />

Water<br />

Trash Service<br />

Telephone<br />

Cell Phone<br />

Cable or Satellite TV<br />

Internet Service<br />

Other:<br />

Other:<br />

Subtotal

<strong>Worksheet</strong>:<br />

Spending Plan<br />

MONTHLY EXPENSES (continued)<br />

Transportation<br />

Last Month’s<br />

Actual $<br />

This Month’s<br />

Spending<br />

Target<br />

Estimated<br />

Difference<br />

This Month’s<br />

Actual $<br />

Actual<br />

Difference<br />

Car payment 1<br />

Car payment 2<br />

Auto Insurance<br />

Fuel<br />

Maintenance<br />

Parking<br />

Other:<br />

Other:<br />

Subtotal<br />

Food<br />

Last Month’s<br />

Actual $<br />

This Month’s<br />

Spending<br />

Target<br />

Estimated<br />

Difference<br />

This Month’s<br />

Actual $<br />

Actual<br />

Difference<br />

Groceries<br />

Eating Out<br />

Other:<br />

Other:<br />

Subtotal

<strong>Worksheet</strong>:<br />

Spending Plan<br />

MONTHLY EXPENSES (continued)<br />

Clothing<br />

Last Month’s<br />

Actual $<br />

This Month’s<br />

Spending<br />

Target<br />

Estimated<br />

Difference<br />

This Month’s<br />

Actual $<br />

Actual<br />

Difference<br />

Adult<br />

Children<br />

Dry Cleaning/Laundry<br />

Other Payment:<br />

Other Payment:<br />

Subtotal<br />

Health<br />

Last Month’s<br />

Actual $<br />

This Month’s<br />

Spending<br />

Target<br />

Estimated<br />

Difference<br />

This Month’s<br />

Actual $<br />

Actual<br />

Difference<br />

Medications<br />

Contacts and Supplies<br />

Gym Memberships<br />

Other:<br />

Other:<br />

Subtotal

<strong>Worksheet</strong>:<br />

Spending Plan<br />

MONTHLY EXPENSES (continued)<br />

Personal<br />

Last Month’s<br />

Actual $<br />

This Month’s<br />

Spending<br />

Target<br />

Estimated<br />

Difference<br />

This Month’s<br />

Actual $<br />

Actual<br />

Difference<br />

Alimony/Child Support<br />

Education<br />

Child Care<br />

Life Insurance (not paid<br />

through payroll deduction)<br />

Charitable Contributions<br />

Barber/Beauty Shop<br />

Vacations<br />

Recreational/Hobbies<br />

Alcohol/Tobacco<br />

Entertainment<br />

Video/Game Rental<br />

Music/App Downloads<br />

Subscriptions<br />

Pet Food/Supplies/Other<br />

Other:<br />

Other:<br />

Subtotal

<strong>Worksheet</strong>:<br />

Spending Plan<br />

MONTHLY EXPENSES (continued)<br />

Personal Debt<br />

Last Month’s<br />

Actual $<br />

This Month’s<br />

Spending<br />

Target<br />

Estimated<br />

Difference<br />

This Month’s<br />

Actual $<br />

Actual<br />

Difference<br />

Credit Card Payment<br />

Credit Card Payment<br />

Credit Card Payment<br />

Loan Payment<br />

Loan Payment<br />

Loan Payment<br />

Other Payment:<br />

Other Payment:<br />

Subtotal<br />

Add up each of your<br />

subtotals and enter<br />

them in the space<br />

below<br />

Last Month’s<br />

Actual $<br />

This Month’s<br />

Spending<br />

Target<br />

Estimated<br />

Difference<br />

This Month’s<br />

Actual $<br />

Actual<br />

Difference<br />

Total Monthly<br />

Expenses

<strong>Worksheet</strong>:<br />

Spending Plan<br />

MONTHLY INCOME<br />

Last Month’s<br />

Actual $<br />

This Month’s<br />

Spending<br />

Target<br />

Estimated<br />

Difference<br />

This Month’s<br />

Actual $<br />

Actual<br />

Difference<br />

Net Monthly Salary (Take-<br />

Home Pay) - Self<br />

Net Monthly Salary - Spouse<br />

Part-Time Job<br />

Tips or bonuses<br />

Military Retirement Pay<br />

Child Support<br />

Social Security Payment<br />

AFDC<br />

Food Stamps<br />

Other:<br />

Other:<br />

Total Monthly<br />

Income<br />

TOTAL ACTUAL MONTHLY INCOME<br />

– Total Actual Monthly EXPENSES –<br />

= Money you can SAVE or PAY DOWN DEBTS!<br />

If you have a negative number look back at your expenses and see where you can spend less. Enter your new<br />

spending targets and the amount saved in the appropriate columns. For example, say you want to trim your eating<br />

out expense from $350 to $250, enter $250 in “This Month’s Spending Target” column and $100 in the “Estimated<br />

Difference” column.<br />

If you have a positive number, consider adding it to your savings or paying down high-interest debts. You may still want to<br />

review your expenses and look for possible cuts to help you pay down your debt or reach your savings goals faster.

<strong>Worksheet</strong>:<br />

Spending Plan<br />

HOW MUCH CAN YOU SAVE?<br />

Savings<br />

Last Month’s<br />

Actual $<br />

This Month’s<br />

Spending<br />

Target<br />

Estimated<br />

Difference<br />

This Month’s<br />

Actual $<br />

Actual<br />

Difference<br />

Emergency Savings<br />

TSP<br />

401(k)/403(b)<br />

Individual Retirement<br />

Accounts<br />

College Savings<br />

Personal Savings<br />

Investments<br />

Other:<br />

Total<br />

Small Change = Big Savings<br />

See how much the few changes in your budget will affect your savings over time. If you reduced your spending in a<br />

number of categories, add up the “Estimated Difference” column and multiply that number by 12. This is how much<br />

more money you could save over a year if you stuck to your spending targets.<br />

Estimated Difference Total $_______________<br />

X 12<br />

Total Savings<br />

$_______________