Download - Tenaga Nasional Berhad

Download - Tenaga Nasional Berhad

Download - Tenaga Nasional Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

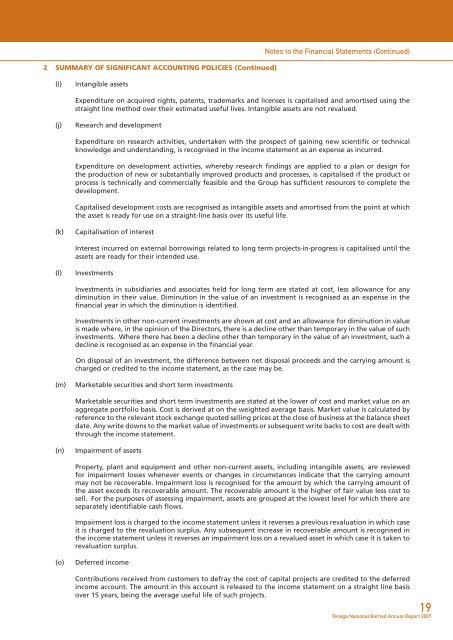

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)<br />

Notes to the Financial Statements (Continued)<br />

(i)<br />

Intangible assets<br />

Expenditure on acquired rights, patents, trademarks and licenses is capitalised and amortised using the<br />

straight line method over their estimated useful lives. Intangible assets are not revalued.<br />

(j)<br />

Research and development<br />

Expenditure on research activities, undertaken with the prospect of gaining new scientific or technical<br />

knowledge and understanding, is recognised in the income statement as an expense as incurred.<br />

Expenditure on development activities, whereby research findings are applied to a plan or design for<br />

the production of new or substantially improved products and processes, is capitalised if the product or<br />

process is technically and commercially feasible and the Group has sufficient resources to complete the<br />

development.<br />

Capitalised development costs are recognised as intangible assets and amortised from the point at which<br />

the asset is ready for use on a straight-line basis over its useful life.<br />

(k)<br />

Capitalisation of interest<br />

Interest incurred on external borrowings related to long term projects-in-progress is capitalised until the<br />

assets are ready for their intended use.<br />

(l)<br />

Investments<br />

Investments in subsidiaries and associates held for long term are stated at cost, less allowance for any<br />

diminution in their value. Diminution in the value of an investment is recognised as an expense in the<br />

financial year in which the diminution is identified.<br />

Investments in other non-current investments are shown at cost and an allowance for diminution in value<br />

is made where, in the opinion of the Directors, there is a decline other than temporary in the value of such<br />

investments. Where there has been a decline other than temporary in the value of an investment, such a<br />

decline is recognised as an expense in the financial year.<br />

On disposal of an investment, the difference between net disposal proceeds and the carrying amount is<br />

charged or credited to the income statement, as the case may be.<br />

(m)<br />

Marketable securities and short term investments<br />

Marketable securities and short term investments are stated at the lower of cost and market value on an<br />

aggregate portfolio basis. Cost is derived at on the weighted average basis. Market value is calculated by<br />

reference to the relevant stock exchange quoted selling prices at the close of business at the balance sheet<br />

date. Any write downs to the market value of investments or subsequent write backs to cost are dealt with<br />

through the income statement.<br />

(n)<br />

Impairment of assets<br />

Property, plant and equipment and other non-current assets, including intangible assets, are reviewed<br />

for impairment losses whenever events or changes in circumstances indicate that the carrying amount<br />

may not be recoverable. Impairment loss is recognised for the amount by which the carrying amount of<br />

the asset exceeds its recoverable amount. The recoverable amount is the higher of fair value less cost to<br />

sell. For the purposes of assessing impairment, assets are grouped at the lowest level for which there are<br />

separately identifiable cash flows.<br />

Impairment loss is charged to the income statement unless it reverses a previous revaluation in which case<br />

it is charged to the revaluation surplus. Any subsequent increase in recoverable amount is recognised in<br />

the income statement unless it reverses an impairment loss on a revalued asset in which case it is taken to<br />

revaluation surplus.<br />

(o)<br />

Deferred income<br />

Contributions received from customers to defray the cost of capital projects are credited to the deferred<br />

income account. The amount in this account is released to the income statement on a straight line basis<br />

over 15 years, being the average useful life of such projects.<br />

19<br />

<strong>Tenaga</strong> <strong>Nasional</strong> <strong>Berhad</strong> Annual Report 2007