view - Western Desert Resources

view - Western Desert Resources

view - Western Desert Resources

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

WESTERN DESERT RESOURCES LIMITED<br />

ANNUAL<br />

REPORT<br />

2008

A B N 4 8 1 2 2 3 0 1 8 4 8<br />

ANNUAL GENERAL MEETING<br />

The annual meeting will be held as follows:<br />

Venue<br />

ADELAIDE PAVILION<br />

VEALE GARDENS<br />

CNR SOUTH TERRACE AND PEACOCK ROAD<br />

ADELAIDE SA 5000<br />

Date<br />

FRIDAY 28 NOVEMBER 2008<br />

Time<br />

11.00 AM<br />

CONTENTS<br />

Page<br />

Chairman’s Report 1<br />

Managing Director’s Report 2<br />

Re<strong>view</strong> of Exploration Projects 4<br />

Construction materials 4<br />

Gold and Base Metals 12<br />

Uranium – Rare Earth Elements 19<br />

Schedule of Tenements 26<br />

Corporate Governance Statement 27<br />

Financial Report 31<br />

Directors’ Declaration 69<br />

Independent Auditor’s Report 70<br />

Shareholders’ Information 72<br />

Corporate Directory 75

W E S T E R N D E S E R T R E S O U R C E S L I M I T E D A B N 4 8 1 2 2 3 0 1 8 4 8<br />

CHAIRMAN’S REPORT<br />

Dear fellow shareholders,<br />

At our annual general meeting in November 2007,<br />

I promised shareholders an interesting year with<br />

plenty of activity. I am pleased to report that we have<br />

been able to follow through with that promise and your<br />

company is now well placed compared with many<br />

others in our industry.<br />

Our first priority, following listing in July 2007, was to<br />

establish a sound team to carry out our exploration<br />

activities and under the leadership of John Fabray our<br />

exploration manager we have done that. John and his<br />

team have approached the exploration challenge with<br />

gusto and those activities are discussed later in this<br />

annual report.<br />

In April 2008 we announced the acquisition of a<br />

substantial shareholding in Thor Mining PLC (Thor).<br />

Subsequently the directors of Thor invited myself, along<br />

with Norm Gardner and Mick Ashton, to join the board.<br />

The principle asset of Thor is the Molyhil, molybdenum<br />

and tungsten project, north east of Alice Springs in the<br />

Northern Territory. This project has progressed through<br />

feasibility studies and an off-take agreement has been<br />

signed with CITIC Australia Commodity Trading Pty Ltd,<br />

a subsidiary of CITIC Australia Trading Limited which<br />

commits CITIC to take 100% of the Molybdenum and<br />

Tungsten concentrates to be produced from the Molyhil<br />

Project. Thor is currently seeking finance to commence<br />

construction activities.<br />

In July of this year Mr Alastair Mackie resigned as a<br />

director of the Company. Mr Mackie was a founding<br />

director of the company and was responsible for<br />

identifying a number of the projects which made up our<br />

initial portfolio. His contribution was significant and<br />

we wish him well in his future endeavours. Since then<br />

Mick Ashton has accepted an invitation to join the board<br />

as a non-executive director after previously serving as<br />

alternate. We welcome Mr Ashton’s experience<br />

and insight.<br />

While it is expected that difficult trading conditions on<br />

world stock markets may persist in the near term, the<br />

potential of the Company’s projects, particularly the<br />

Roper Bar iron ore project is exciting. Metal prices,<br />

while retracting from record highs are still at historically<br />

high levels. With the funding by IMEA and the agreement<br />

for a continuous 12 month drilling program we believe<br />

that there are significant opportunities for improvement<br />

in shareholder wealth from your investment in <strong>Western</strong><br />

<strong>Desert</strong> <strong>Resources</strong> Limited in the next year.<br />

In conclusion the directors and I gratefully acknowledge<br />

the efforts of our small band of employees, contractors<br />

and consultants who continue to assist in exploration<br />

and evaluation, where the goal is world class discoveries<br />

of iron ore, and other metals used in the construction<br />

industry as well as gold, uranium, and base metals.<br />

Your directors and management have energetically<br />

sought to add new quality projects to the exploration<br />

portfolio. This has resulted in the acquisition of iron<br />

ore tenements at Roper Bar along with manganese<br />

and other precious and base metal projects. The Roper<br />

Bar iron ore project in particular has the potential<br />

to be a world class iron ore project and has attracted<br />

significant funding via a joint venture farm-in from<br />

ITOCHU Minerals and Energy of Australia Pty Ltd (IMEA).<br />

Mick Billing<br />

Chairman<br />

1

MANAGING DIRECTOR’S REPORT<br />

<strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> have had a very exciting<br />

and productive first year. We are very happy with both<br />

exploration progress on our existing projects, and the<br />

addition of a number of new projects to our portfolio<br />

which provide our shareholders with opportunities in a<br />

broader product range.<br />

Our exploration team, headed by Exploration Manager<br />

John Fabray, has completed a large volume of work<br />

which has enabled us to make a detailed assessment of<br />

a large number of our original projects, as well as some<br />

very good new acquisitions. We have had technical<br />

success with our drilling programs to date and we are<br />

confident that a range of projects to be tested this year<br />

will deliver the impetus to transform <strong>Western</strong> <strong>Desert</strong><br />

<strong>Resources</strong> into a self funding small mining house.<br />

We are very aware and appreciative of the loyalty that<br />

has been shown by shareholders during what has been<br />

a very tough year in the stock market. We believe that<br />

a shift in focus due to some opportunities presented<br />

to the company during the year will reap benefits and<br />

create wealth for our shareholders into the future.<br />

During tough times we have been very fortunate to<br />

secure three very good projects which will all receive<br />

a great deal of attention over the coming 12 months.<br />

The first of these is the Roper Bar Iron Ore project.<br />

As at the time of printing your company has entered<br />

into a Memorandum of Understanding (MOU) with<br />

ITOCHU Minerals and Energy Australia Pty Ltd (IMEA),<br />

a subsidiary of Japanese conglomerate ITOCHU<br />

Corporation. Subject to internal and regulatory<br />

approvals, the terms of this agreement will see IMEA<br />

spend up to $15,000,000 on exploration funding to<br />

earn 51% of the project.<br />

We have been working over the last 4 months to get all<br />

regulatory processes finalised and will be drilling<br />

at this site from early October 2008. IMEA have been<br />

involved in the iron ore industry in Australia since 1962,<br />

and have world class experience in iron ore mining<br />

and marketing.<br />

The ability of Roper Bar to attract a joint venture<br />

partner of the stature of ITOCHU is testimony to the<br />

quality of the project. The first round of drilling will<br />

help to confirm our belief that there is a significant<br />

medium grade deposit that will have commercial<br />

viability. This project will be ongoing for three years<br />

during the exploration stage.<br />

The second project that is becoming increasingly<br />

exciting as we get through the geological and<br />

geophysical work programs is the Gladstone Manganese<br />

project. This project is a joint venture with unlisted<br />

company Genesis <strong>Resources</strong> Limited, with WDR having<br />

the opportunity to earn a 45% interest in the project.<br />

A drilling campaign is proposed for the Mount Miller<br />

area, site of substantial historical mine workings.<br />

Geological mapping and a subsequent IP survey<br />

of this area has identified significant potential for<br />

mineralised zones.<br />

We look forward to some exciting drilling early next<br />

year in the hope of delineating a commercially viable<br />

operation that is within 15 kms of the Gladstone port.<br />

Pricing for manganese, like that of iron ore, has been<br />

strong during some turbulent times in the market.<br />

Based on historic production grades from Mount Miller,<br />

there is significant potential for delineating a high<br />

grade deposit with access to first rate infrastructure<br />

and port facilities.<br />

Another exciting project is Rover Project near Tennant<br />

Creek in the NT. This area has been recently opened<br />

up for exploration after a long moratorium due to native<br />

title issues. Our joint venture agreement with TNG<br />

Limited gives WDR the opportunity to earn up to an<br />

80% interest in the Rover Field tenements by spending<br />

$1,350,000 on exploration. There has been some very<br />

successful recent drilling by companies on tenements<br />

adjacent to those included in the TNG joint venture.<br />

Of particular note are recent intersections by<br />

Westgold <strong>Resources</strong> Limited at the Rover 1 project.<br />

These included intersections of 21 metres at 33.5 g/t<br />

gold and 65 metres at 11 g/t gold.<br />

2

WESTERN DESERT RESOURCES LIMITED ABN 48 122 301 848<br />

The Rover Field is emerging as a duplication of the<br />

very rich Tennant Creek Ironstones where orebodies<br />

such as Warrego and White Devil were discovered.<br />

In respect to exploration, we will also continue with<br />

follow up work on our Tenements in the Alice Springs<br />

area, with particular emphasis on the Winnecke/Sliding<br />

Rock Well and Limbla areas. We hope to have defined<br />

drill targets at Winnecke/Sliding Rock Well in the<br />

near future, with a <strong>view</strong> to a first pass drilling program<br />

commencing in early 2009.<br />

In April 2008, WDR acquired a 16.7% interest in Thor<br />

Mining PLC. This interest provides WDR shareholders<br />

with a significant investment in Thor Mining’s Molyhil<br />

molybdenum/tungsten project, some 220 kms north east<br />

of Alice Springs. Three WDR directors, Mick Billing,<br />

Mick Ashton and myself, were elected to the Board of<br />

Thor Mining, and we hope to add substantial value to<br />

the project by re<strong>view</strong>ing the capital expenditure<br />

requirements and strategies, as well as adding to mine<br />

life by further exploration in the Molyhil area.<br />

Norm Gardner<br />

Managing Director<br />

In summary, we are very well placed with an exciting<br />

portfolio of projects. With the prospect of Thor Mining<br />

commencing construction at Molyhil, and our agreement<br />

with IMEA providing funding for our flagship Roper Bar<br />

Iron Ore project, we expect a challenging but rewarding<br />

year ahead.<br />

I would like to take this opportunity to thank all<br />

shareholders for their support, and the <strong>Western</strong> <strong>Desert</strong><br />

<strong>Resources</strong> team for their efforts, over the course of the<br />

past year. We look forward to a mutually successful<br />

year ahead.<br />

I look forward to providing you with updates in respect<br />

to our activities over the course of what I feel will be a<br />

defining 12 months for our company.<br />

Norm Garner<br />

Managing Director<br />

3

REVIEW 0F EXPLORATION PROJECTS<br />

CONSTRUCTION MATERIALS<br />

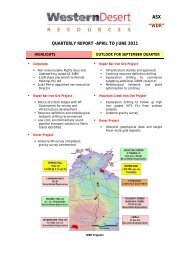

Roper Bar Iron Ore<br />

The Roper Bar iron ore project is <strong>Western</strong> <strong>Desert</strong><br />

<strong>Resources</strong>’ flagship construction materials project. It is<br />

located in the “Gulf country” of the Northern Territory,<br />

40 kms inland from the Gulf of Carpentaria. The nearest<br />

settlement is at Roper Bar, 80 kms to the northwest.<br />

On 29 September 2008, WDR announced the signing of<br />

a Memorandum of Understanding (MOU) with ITOCHU<br />

Minerals & Energy Australia Pty Ltd (IMEA), a fully<br />

owned subsidiary of Japanese resources and trading<br />

conglomerate ITOCHU Corporation. Under the terms<br />

of the MOU, and subject to due diligence and internal<br />

approvals, IMEA will spend up to A$15m to earn a 51%<br />

interest in the Roper Bar Iron Ore project. In addition,<br />

Itochu will have marketing rights to 100% of product<br />

from the JV on an arms length basis and can withdraw<br />

after the completion of each stage or payment of the<br />

committed expenditure for that stage.<br />

The Roper Bar tenement area currently totals<br />

900 sq kms, comprising one granted exploration licence<br />

EL25672 and one licence application ELA26759. The<br />

project is located in the northern part of the Northern<br />

Territory, a geological region endowed with numerous<br />

world class mineral deposits.<br />

The iron ore deposits have many attractive attributes to<br />

develop into a major project. Located only 40 kms from<br />

the coast, the area is ideally placed for export of a bulk<br />

commodity. An alternative transport option is afforded<br />

by access to the Australasian Railway, 240 kms to the<br />

west. Furthermore, the top end of Australia is closer<br />

to Asian steel mills than any other major iron ore<br />

producing region. Geologically, the Roper Bar project<br />

area is located in the McArthur Basin, a Proterozoic<br />

province extending from Arnhem Land to the<br />

Queensland border.<br />

4

WESTERN DESERT RESOURCES LIMITED ABN 48 122 301 848<br />

WDR Chairman Mick Billing with<br />

high grade hematite at Roper Bar<br />

project area.<br />

A sedimentary iron formation called the Sherwin<br />

Ironstone Member occurs in the McMinn formation of<br />

the Mesoproterozoic Roper Group. The strata is<br />

predominantly flat-lying with gentle dips, although in<br />

places folding and steep dips due to structural<br />

dislocation are observed.<br />

The iron formation is comprised of multiple oolitic beds,<br />

consisting of closely packed hematite concretions, or<br />

oolites, and well rounded quartz grains. Mineralogical<br />

studies show the iron formation in hand specimen is<br />

best described as a hematitic sandstone. Importantly,<br />

they have been locally enriched by the addition of<br />

microcrystalline specular hematite. This event has<br />

substantially upgraded the iron content of the original<br />

oolitic iron formation. The regional government<br />

airborne geophysical data shows the magnetic activity<br />

over the entire area is very subdued, confirming the<br />

iron mineralogy is hematite rather than magnetite.<br />

Although the iron formation outcrops over an area in<br />

excess of 30 sq kms, it has been subject to surprisingly<br />

little previous exploration. A small number of surface<br />

samples were collected ten years ago, but no drilling<br />

has ever been carried out. The nearest historical<br />

drillhole was completed four kilometres from the<br />

nearest outcrop. Importantly, “ironstone bands” were<br />

intersected at ten metres depth, suggesting the<br />

formation could extend under cover over a large area.<br />

During 2008 the Company completed reconnaissance<br />

surface sampling, acquired high resolution colour<br />

photography and commenced detailed geological<br />

mapping. Assay results show the ironstones have an<br />

iron content of 30% to 60%. Importantly, levels of<br />

phosphorous and other impurities are consistently low.<br />

The mapping confirms the ironstone beds are in<br />

places up to 10 metres thick. They have mostly shallow<br />

dips and are reasonably continuous. This is very<br />

encouraging, for it increases the potential for discovery<br />

of significant tonnages of ironstone under shallow cover<br />

over a large part of the project area.<br />

In July <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> personnel attended<br />

a meeting organised by the Northern Land Council<br />

with traditional owners at Ngukurr, near Roper Bar.<br />

The company’s short-term and long-term proposals for<br />

exploring and eventually mining were explained, and<br />

two traditional owners were flown over the project area.<br />

There were no objections to the proposals; in fact the<br />

community is very supportive of mining operations that<br />

will bring jobs to the area.<br />

5

CONSTRUCTION MATERIALS<br />

Roper Bar Iron Ore continued<br />

The company is fast-tracking a drilling program to<br />

establish the extent, thickness and tenor of the<br />

sedimentary iron formations. Drilling will commence<br />

on area “D” in October 2008. This will include pattern<br />

RC drilling and selected diamond drilling to obtain core<br />

samples for metallurgical and beneficiation test work.<br />

The company is investigating present day beneficiation<br />

technology, comprising simple washing and screening,<br />

to optimise processing to a product suitable for direct<br />

shipping.<br />

WDR and Itochu representatives<br />

in front of massive ironstone<br />

outcrop at Roper Bar Area “D”.<br />

Gladstone Manganese<br />

The Gladstone project forms part of a joint venture with<br />

unlisted company Genesis <strong>Resources</strong> Limited. Under<br />

the joint venture agreement, which also includes the<br />

McArthur River tenement in the Northern Territory,<br />

WDR can earn a 45% interest by spending $600,000 on<br />

exploration and issuing 5 million shares to Genesis<br />

<strong>Resources</strong> Limited. The share issue was approved by<br />

shareholders at an Extraordinary General Meeting on<br />

19 September 2008 and the shares were issued on<br />

23 September 2008.<br />

6

WESTERN DESERT RESOURCES LIMITED ABN 48 122 301 848<br />

The smaller manganese shows were found to be of<br />

little interest due to insufficient size or access<br />

issues due to cultural encroachment. However, the<br />

sampling and mapping at Mount Miller confirmed the<br />

historical spectacular high grades of manganese ore.<br />

The mine-site area has never been drill-tested, and<br />

is a standout target for drilling.<br />

The IP survey recorded a unique signature over the<br />

manganese mineralisation at the old mine area, and<br />

traverses to the north and south reported similar<br />

signatures adjacent to small outcrops of manganiferous<br />

sediments. Furthermore, the mapping revealed a<br />

significant new manganese prospect 800 metres to the<br />

southwest of Mount Miller.<br />

The work completed to date has brought this project to<br />

drill-ready status. Three types of targets will be tested<br />

in a drilling program planned to commence early in the<br />

third quarter. These are:<br />

• Testing the known mineralisation at the Mount<br />

Miller mine-site.<br />

The Gladstone project is prospective for manganese,<br />

a crucial element in the steel-making process.<br />

It comprises one granted exploration permit, EPM15771,<br />

located 15 kms west of Gladstone in Queensland.<br />

The area includes numerous manganese deposits<br />

extending over 21 kms. The largest deposit, Mount<br />

Miller, produced over 20,000 tonnes of high-grade<br />

manganese at an average of 40%-50% Mn. At current<br />

prices this equates to approximately US$500 per<br />

tonne of ore.<br />

• Near-mine drilling on the IP anomalies<br />

and manganese shows along strike from the<br />

Mount Miller mine.<br />

• “Brownfields” exploration drilling on the new<br />

manganese show identified in the recent mapping.<br />

If the drilling program is successful in proving up even<br />

a relatively small resource, and given the project is<br />

located extremely close to major port, road and power<br />

infrastructure, the company will be rewarded with an<br />

extremely low-cost export opportunity.<br />

Work completed over the past year includes field<br />

reconnaissance of all manganese prospects in the<br />

project area, and surface sampling, detailed geological<br />

mapping and IP (induced polarisation) survey of the<br />

Mount Miller prospect.<br />

7

CONSTRUCTION MATERIALS<br />

McArthur River Manganese<br />

This single exploration licence of 500 sq kms, EL24814,<br />

is located in the McArthur Basin of the Northern<br />

Territory, about 100 kms from the Queensland border.<br />

The tenement forms part of a joint venture agreement<br />

with Genesis <strong>Resources</strong> Limited, under which WDR<br />

has the right to earn a 45% interest in the tenement.<br />

The primary commodity of interest is manganese,<br />

although historical exploration has also revealed some<br />

base metal potential.<br />

The tenement area has outcrop of Mesoproterozoic<br />

McArthur Group sediments. Three separate areas of<br />

outcropping mineralisation have been identified.<br />

The Masterton No.2 prospect has manganese lenses<br />

up to 160 metres in length and 10 metres wide, with<br />

assays up to 63% Mn. Historical exploration for other<br />

commodities included airborne EM surveys and stream<br />

sediment sampling. Specific areas of interest were<br />

generated by these previous explorers but were never<br />

investigated further due to the worldwide exploration<br />

downturn in the 1990’s.<br />

The forward program includes detailed mapping and<br />

sampling of the areas of interest. This will lead to<br />

definition of drill-sites to test for manganese and base<br />

metal mineralisation.<br />

8

WESTERN DESERT RESOURCES LIMITED ABN 48 122 301 848<br />

Burt Plain Project<br />

This project comprises one exploration licence,<br />

EL25338, of about 800 sq kms which is located<br />

40 kms north of Alice Springs. The area of interest<br />

was originally identified as an iron ore prospect from<br />

government aeromagnetic data.<br />

<strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Ltd and NuPower <strong>Resources</strong><br />

Ltd entered into the “Bushy Park” joint venture on<br />

5th February 2008. NuPower <strong>Resources</strong> Ltd can earn a<br />

51% interest in energy minerals on the tenement by<br />

spending a total of $1,000,000 on this EL and Mueller<br />

Creek EL25658 within three years. The tenement area<br />

includes outcrop of high grade metamorphics of the<br />

Palaeoproterozoic Arunta Block.<br />

Interpretation of government aeromagnetic and gravity<br />

information shows anomalies indicative of a huge iron<br />

oxide system. Gravity and induced polarisation (IP)<br />

surveys carried out last year at the Capricorn prospect<br />

confirmed the likely presence of significant amounts<br />

of sulphides and iron oxides.<br />

This suggested possible targets of commercial interest<br />

include Olympic Dam style IOCG deposits or nickel<br />

sulphide deposits of the Voisey’s Bay or Norilsk type.<br />

Five holes were drilled on various gravity, magnetic<br />

and IP anomalies within the Capricorn Prospect for a<br />

total of 1,832.5 metres.<br />

Hole No. E_GDA N_GDA Final depth Start date Target<br />

DD07BP01 374800 7416250 397.0 25/10/07 Chargeability anomaly<br />

DD07BP02 375600 7416100 337.5 5/11/07 Chargeability anomaly<br />

DD07BP03 374400 7416700 322.0 8/11/07 Gravity and magnetic high<br />

DD07BP05 376900 7417550 349.0 10/11/07 Highest magnetic anomaly<br />

DD07BP06 379000 7416200 427.0 14/11/07 Weak, deep IP anomaly<br />

9

CONSTRUCTION MATERIALS<br />

Burt Plain Project continued<br />

The holes intersected mafic gneisses from shallow<br />

depth with a consistent magnetite content of about<br />

10%, which explains the observed magnetic and gravity<br />

anomalies. All holes also intersected substantial<br />

intervals of pyrite, which is clearly the source of the IP<br />

responses. Drill core samples were analysed for a<br />

suite of elements. Base metals, precious metals and<br />

uranium values were uniformly low.<br />

Significantly, all holes show enrichment in vanadium<br />

with weak associated cobalt, nickel and barium values.<br />

Better vanadium intersections are shown below:<br />

Drillhole Downhole depth Thickness Assay result<br />

DD07BP01 227-370m 143m 533ppm V2O5<br />

DD07BP01 362-370m 8m 971ppm V2O5<br />

DD07BP02 200-235m 35m 443ppm V2O5<br />

DD07BP02 260-320m 60m 471ppm V2O5<br />

DD07BP03 25-145m 120m 452ppm V2O5<br />

DD07BP03 180-255m 75m 445ppm V2O5<br />

DD07BP05 55-70m 15m 516ppm V2O5<br />

DD07BP05 130-155m 25m 485ppm V2O5<br />

DD07BP06 235-420m 185m 486ppm V2O5<br />

It is postulated that the vanadium is associated with<br />

magnetite. Vanidiferous magnetite occurs in many<br />

gabbroic bodies worldwide and is mined in South Africa<br />

and Russia. Vanadium is an essential element in the<br />

composition of certain types of specialised steel.<br />

Further exploration will be required to determine<br />

whether zones of higher magnetite content occur within<br />

the mafic gneisses. Any magnetite-rich zones could<br />

be expected to contain higher and possibly economic<br />

vanadium values. A detailed airborne magnetic survey<br />

is planned to determine targets for further drilling.<br />

Diamond drilling at the Capricorn<br />

prospect, Burt Plain.<br />

During 2008 exploration work on the tenement included:<br />

• Acquisition of airborne EM data over the<br />

tenement using the Tempest system.<br />

• Acquisition of gravity data over the western<br />

part of the tenement in conjunction with the<br />

NT government’s regional gravity program.<br />

• Collection of water samples from six bores.<br />

Following interpretation of the EM data, drilling may be<br />

undertaken by NuPower <strong>Resources</strong> for palaeochannel<br />

uranium deposits.<br />

10

WESTERN DESERT RESOURCES LIMITED ABN 48 122 301 848<br />

Limmen Bight River<br />

The Limmen Bight River Exploration licence, EL25905,<br />

is located in the McArthur Basin of the Northern<br />

Territory. Previous exploration has focussed on base<br />

metals, diamonds and energy metals. WDR believe it<br />

may have potential for iron ore, as the geology is<br />

of a similar age to that at the Roper Bar project area,<br />

100 kms to the north.<br />

No field work was undertaken during the 2008<br />

financial year.<br />

The project area encompasses an ironstone unit of<br />

Jurassic age, which crops out over an area in excess<br />

of 400 sq kms. Wide-spaced drilling carried out by<br />

explorers in the early 1980s, identified a metallurgically<br />

complex iron deposit. Assays from most drillholes<br />

returned iron values in the range 30%-40%.<br />

During 2008 the company conducted field reconnaissance<br />

including rock chip sampling. Twenty-one<br />

samples assayed 19.2% to 43.9% Fe. Significantly, the<br />

phosphorous values are consistently high, in the range<br />

of 0.2% to 2.8%.<br />

Dawsonvale<br />

The Dawsonvale project comprises three contiguous<br />

EPM’s located east of Taroom, about 400 kms northwest<br />

of Brisbane. The tenements were purchased from<br />

Bluekebble Pty Ltd in January 2008, to investigate the<br />

iron ore potential.<br />

In August 2008 the company reached agreement for the<br />

sale of the Dawsonvale tenements to Aard Metals<br />

Limited (“AAM”) an explorer with a specific interest in<br />

Queensland based exploration projects. Consideration<br />

for the sale is five million fully paid shares in the<br />

capital of AAM and a royalty of $1.75/tonne of any iron<br />

ore produced from the tenements. In the event that<br />

AAM fails to list on ASX prior to 31 December 2008 then<br />

the tenements revert to <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Ltd<br />

for nominal consideration.<br />

<strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> geologist<br />

Suzanne Roberts sampling ironstone<br />

at Dawsonvale.<br />

11

GOLD AND BASE METALS<br />

Winnecke – Sliding Rock Well Project<br />

This project area comprises two adjacent tenements,<br />

EL23630 and EL25469, located on the Arunta Block –<br />

Amadeus Basin unconformity. Winnecke EL23630<br />

encompasses the historical workings of the Winnecke<br />

Goldfield, with a recorded production of 12,000 oz gold.<br />

The area has been the subject of much work by previous<br />

explorers, but this is the first time a systematic approach<br />

using high resolution geophysics on a tenement scale<br />

has been applied.<br />

Sliding Rock Well EL 25469 was secured to investigate<br />

an isolated high intensity magnetic anomaly with<br />

possible copper-gold affinities.<br />

During the past 12 months exploration activities<br />

have included:<br />

• Acquisition of high resolution magnetics and<br />

radiometrics data on 100 metre flight lines.<br />

• Acquisition of detailed airborne EM data<br />

(“SkyTEM”) on 150 metre flight lines.<br />

• Interpretation of all datasets to define priority<br />

targets for drilling.<br />

• Acquisition of ground magnetic data and drill-site<br />

definition at Sliding Rock Well.<br />

The interpretation of the EM, magnetic and radiometric<br />

data has resulted in identification of three priority 1<br />

and four priority 2 targets. The priority 1 targets are<br />

conductors with time constants of 0.7 to 4.8, which is<br />

consistent with anomalous accumulations of sulphides.<br />

These may be sulphides of copper or lead, or possibly<br />

iron sulphides with associated gold mineralisation.<br />

The Sliding Rock Well aeromagnetic anomaly is an<br />

isolated 2,500 nT response in greenschist facies schist<br />

with some mylonite and breccia. Similar magnetic<br />

anomalies are observed over the Johnnies Reward<br />

copper-gold mineralisation 14 kms to the north, and<br />

over the Molyhil molybdenum-tungsten deposit further<br />

to the northeast.<br />

12

WESTERN DESERT RESOURCES LIMITED ABN 48 122 301 848<br />

A ground magnetic survey has been completed to<br />

define drillsites to investigate the magnetic anomaly,<br />

and to test for possible associated mineralisation.<br />

The proposed program for the next year focuses<br />

on drilling:<br />

• Geological mapping to define the geophysical<br />

anomalies on EL23630.<br />

• Selection of targets for drilling on EL23630.<br />

• Drilling the magnetic anomaly at Sliding Rock<br />

Well prospect.<br />

Plan showing proposed drillholes<br />

on contours of ground magnetic<br />

intensity.<br />

13

GOLD AND BASE METALS<br />

Rover Project<br />

The Rover project encompasses a 3,980 sq kms package<br />

in the Tennant Creek region of the Northern Territory.<br />

It comprises one granted tenement, EL24471,<br />

and three licence applications, ELA25581, ELA25582<br />

and ELA25587.<br />

The project is the subject of a joint venture with TNG Ltd.<br />

Under the terms of the agreement, <strong>Western</strong> <strong>Desert</strong><br />

<strong>Resources</strong> Ltd has to spend $500,000 within 18 months<br />

to earn a 51% interest, with the option to increase to<br />

80% by spending $850,000 within 30 months of<br />

exercise of option.<br />

The ground was secured to explore for classic Tennant<br />

Creek style copper-gold mineralisation. The attributes<br />

that make the Rover area a key part of <strong>Western</strong> <strong>Desert</strong><br />

<strong>Resources</strong>’ gold and base metals portfolio include:<br />

• The Tennant Creek IOCG deposits are characterised<br />

by very high gold grades. This means that<br />

commercially viable deposits may be found at<br />

depths of hundreds of metres.<br />

• Drilling by Westgold <strong>Resources</strong> Ltd on the Rover 1<br />

anomaly, located less than one kilometre from<br />

the boundary of EL25581, returned a spectacular<br />

intersection of 65 metres at 11 g/t gold.<br />

• Historical drilling over a number of years by<br />

explorers in the Rover field has determined that<br />

large areas of the Warramunga Formation, which<br />

hosts the orebodies at Tennant Creek, exist at<br />

depth under cover.<br />

• Recent drilling on Explorer 108 has revealed the<br />

area is also highly prospective for base metals.<br />

The Rover tenements are on Aboriginal Freehold land<br />

and pastoral lease under Native Title claim. At present<br />

an ILUA (Indigenous Land Use Agreement) is in place for<br />

EL24471. Negotiations for an ALRA (Aboriginal Land<br />

Rights Agreement) on EL25581 are at an advanced<br />

stage, and the company is hopeful that exploration on<br />

the ground will be possible in the first half of 2009.<br />

14

WESTERN DESERT RESOURCES LIMITED ABN 48 122 301 848<br />

Work on the Rover tenements over the past year has<br />

included:<br />

• Re-assessment of previous interpretations in the<br />

light of results announced from drilling of Rover 1,<br />

Rover 4 and Explorer 108.<br />

• Diamond drilling of the Explorer 42 prospect on<br />

EL24471.<br />

• Assessment of government airborne geophysical<br />

data to define areas of interest on ELA25581.<br />

At the Explorer 42 prospect, one diamond hole was<br />

drilled to test a combined magnetic and gravity anomaly<br />

at depth. Holes drilled by previous explorers did not<br />

intersect significant gold or copper mineralisation, nor<br />

did they adequately explain the observed geophysical<br />

anomalies.<br />

Diamond drilling at the<br />

Explorer 42 prospect.<br />

Drillhole E3DD05 was completed at 446 metres after<br />

testing two magnetic banded ironstone formation (BIF)<br />

zones. The magnetic zones exhibit high magnetic<br />

susceptibilities, and explain the magnetic anomaly.<br />

Assays of core cut from the two BIF zones did not report<br />

anomalous gold values.<br />

15

GOLD AND BASE METALS<br />

Musgraves Project<br />

The Musgraves project comprises ten exploration<br />

licences for a total of 8,800 sq kms. It is part of the<br />

Musgrave Block, which remains one of the least<br />

studied areas of Australia. The tenement package has<br />

been assembled through joint ventures and acquisitions<br />

as described below:<br />

• EL’s 25562, 25564, 26382, 26383 and 26384 – Joint<br />

venture with TNG Ltd whereby <strong>Western</strong> <strong>Desert</strong><br />

<strong>Resources</strong> Ltd can earn a 51% interest through the<br />

expenditure of $750,000 within 18 months of grant<br />

of tenement, with the option to earn a further 29%<br />

with the expenditure in the subsequent 30 months<br />

of another $1,250,000.<br />

• EL25434 – Joint venture with Washington<br />

<strong>Resources</strong> whereby <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Ltd<br />

can earn a 51% interest through the expenditure<br />

of $350,000 within 24 months of grant of tenement<br />

with the option to earn a further 29% with the<br />

expenditure in the subsequent 3 years of another<br />

$700,000. The joint venture includes all elements<br />

except tin, tungsten and molybdenum.<br />

• EL’s 26741, 26742, 26743, 26744 – Purchased<br />

from the previous holders for $150,000 and<br />

1.5 million <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Ltd shares.<br />

16

WESTERN DESERT RESOURCES LIMITED ABN 48 122 301 848<br />

The Proterozoic terrain is considered to be highly<br />

prospective for a range of commodities including<br />

• Nickel-Copper sulphides +/- Platinum Group<br />

Element deposits like the giant Norilsk (>300mt)<br />

mine in Russia.<br />

• Lode gold deposits such as Telfer (150 tonnes Au).<br />

• High-grade unconformity style uranium deposits of<br />

the Alligator Rivers Uranium Field type e.g. Ranger.<br />

• IOCG deposits such as Ernest Henry (160mt @<br />

1.5% Cu, 0.5 g/t Au) and Warrego (1.6m ozs Au,<br />

90K tonnes Cu).<br />

All of the Musgraves project ground is Aboriginal<br />

Freehold, and discussions in respect of the ground<br />

under joint venture are at the negotiating phase of the<br />

ALRA process. It is hoped that initial meetings with<br />

the Traditional Owners will commence early in 2009.<br />

The other tenements have recently come out of the<br />

veto period, and applications for consent to grant are<br />

in the submission process.<br />

Tanami East<br />

This is one isolated tenement of 460 sq kms located<br />

in the Granites/Tanami Block of the Northern territory.<br />

It is a joint venture with TNG Ltd, whereby <strong>Western</strong><br />

<strong>Desert</strong> <strong>Resources</strong> Ltd can earn a 51% interest through<br />

spending $250,000 within 18 months, with the option<br />

to earn a further 29% interest by spending $500,000<br />

over 30 months.<br />

The area has been subject of very little exploration by<br />

past explorers. It is known to host significant malachite<br />

mineralisation outcropping over 1,200 metres. Elevated<br />

gold values were recorded from exploration in the 1970’s,<br />

and analysis of more recent government airborne<br />

geophysical data indicates the area is prospective for<br />

deposits of energy metals. It also has potential for<br />

deposits of the IOCGU type.<br />

Spring Hill Project<br />

Spring Hill is located in the Pine Creek Gold Field,<br />

150 kms south of Darwin. The tenement package<br />

comprises an 1035 ha Mining Lease, ML23812,<br />

surrounded by the 36 sq kms Exploration Licence,<br />

EL22957. <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Ltd has 100%<br />

interest in the tenements.<br />

The project area is in the southern part of the<br />

Palaeoproterozoic to Mesoproterozoic Pine Creek<br />

Geosyncline, straddling a regional shear zone, the<br />

Pine Creek shear. The shear is related to a<br />

number of significant gold deposits in the region.<br />

The area has also been identified as prospective<br />

for tin mineralisation.<br />

Exploration work completed on the EL and ML includes:<br />

• Acquisition of SkyTEM airborne EM data over the<br />

EL area on 150 metre spaced flight lines.<br />

• Purchase of Satellite imagery (Quickbird VHR) for<br />

the Spring Hill EL area.<br />

• Office studies including database compilation,<br />

literature research, drill section output and<br />

planning for future drilling programs.<br />

• The previous metallurgical testwork carried<br />

out by Ross Mining NL has been re<strong>view</strong>ed by<br />

Bemex Corporation.<br />

Results from the SkyTEM EM survey were received in<br />

September. The survey defined one stand-out anomaly,<br />

a conductor one kilometre long adjacent to the old<br />

Horseshoe tin mine. Geologically, the conductor is<br />

located in the Koolpin Formation, which contains<br />

carbonaceous facies. The nature of the conductor and<br />

possible associated mineralisation will be investigated<br />

by a program of geological mapping, surface sampling<br />

and drilling.<br />

The tenement is on Aboriginal Freehold, and discussions<br />

to commence negotiations for assembling an ALRA are<br />

under way by the tenement holders, TNG Ltd.<br />

17

GOLD AND BASE METALS<br />

Spring Hill Project continued<br />

At the Spring Hill gold deposit a database was compiled<br />

containing all of the previous drilling information.<br />

Studies of the drill hole sections showed that the gold<br />

mineralisation was erratic and that higher grade<br />

zones could rarely be traced between section lines<br />

25 metres apart.<br />

Initial results from the metallurgical testwork by<br />

Ammtec indicate that the Bond ball mill work index is in<br />

the typical range for oxide gold ore and has a moderate<br />

value. The results also indicate that SAG milling could<br />

be considered as an option.<br />

The proposed exploration programme for the Spring Hill<br />

gold deposit in 2008-2009 will include a scoping study<br />

covering the metallurgical and processing aspects of any<br />

development and further geological studies. Depending<br />

on the results of this work further exploration drilling<br />

may be undertaken.<br />

Tennant Creek – Hopeful Star, Golden Mile, M18,<br />

M19, M20, M29<br />

This is a group of small Mineral Claims and Mining<br />

Leases in the Tennant Creek Goldfield.<br />

No field work was carried out during the year<br />

under re<strong>view</strong>.<br />

18

WESTERN DESERT RESOURCES LIMITED ABN 48 122 301 848<br />

URANIUM – RARE EARTH ELEMENTS (REE)<br />

Limbla Project<br />

<strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong>’ primary project area for<br />

uranium exploration is the 100% owned Limbla group<br />

of tenements, comprising EL25331, EL25332, El25373,<br />

EL25402 and EL2554. The tenements are located<br />

120 kms east of Alice Springs. Included in this area<br />

are two known uranium occurrences identified by Esso<br />

Australia Ltd in 1978 called Tourmaline Gorge and<br />

Albarta. The area has also been subject of previous<br />

exploration for base metals and diamonds.<br />

19

URANIUM – RARE EARTH ELEMENTS (REE)<br />

Limbla Project continued<br />

Late last year the company commissioned a detailed,<br />

low-level airborne geophysical survey involving the<br />

acquisition of over 10,000 line kilometres of high<br />

resolution magnetics and radiometric data. The survey<br />

covered 900 sq kms encompassing all areas exhibiting<br />

regionally elevated uranium values, including the<br />

Tourmaline Gorge and Albarta prospects. The survey<br />

was completed in January 2008.<br />

The survey results better defined the known prospects<br />

at Tourmaline Gorge and Albarta/H41. Importantly,<br />

a number of new areas were defined which represent<br />

targets for uranium mineralisation.<br />

A helicopter-supported geological reconnaissance<br />

and sampling program of some of the target areas was<br />

completed. Assay results show uranium values are<br />

anomalous but generally low. The Kay Creek and<br />

5 Mile Creek are lateritised gossans in dolomites of the<br />

Bitter Springs Formation, Uranium samples returned up<br />

to 24ppm, but of interest are elevated base metal values<br />

of up to 168ppm Co, 243ppm Cu, 160ppm Ni, 420ppm Zn.<br />

Three samples were collected from the Tourmaline<br />

Gorge prospect. The results show elevated uranium<br />

values up to 46ppm and thorium up to 28 ppm; together<br />

with elevated rare earths and anomalous barium<br />

values to 0.15%.<br />

No work was carried out on the primary target at<br />

the Albarta/H41 prospect. The exploration program for<br />

the following year includes detailed investigation<br />

of this and the rugged Tourmaline Gorge area using<br />

helicopter-borne radiometric equipment. This will<br />

define specific sites of interest for drill testing, planned<br />

to commence in 2009.<br />

Target Area Target Size & Intensity ( x background) Previous work completed<br />

Albarta / H41 5 kms long & 10 x b/g Mapping, sampling & drilling<br />

Tourmaline Gorge One kms long & 10 x b/g Limited mapping & sampling<br />

Kay Creek area Multiple sites up to 1.3 kms long & 8 x b/g Limited sampling<br />

Hale River One kms long & 10 x b/g New prospect<br />

Illogwa Creek 0.5 kms long & 4 x b/g New prospect<br />

Coulthards One kms long & 6 x b/g New prospect<br />

5 Mile Creek 1.5 kms long & 6 x b/g New prospect<br />

20

WESTERN DESERT RESOURCES LIMITED ABN 48 122 301 848<br />

Blueys Project<br />

Blueys EL 10228 is a single tenement of 54 sq kms<br />

located adjacent to the historic Arltunga Goldfield.<br />

It is 100% owned by <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Ltd.<br />

The focus of exploration here is Blueys prospect,<br />

located approximately 500 metres south of a prominent<br />

quartzite hill. Discovered in 1983 when malachite<br />

veining was noted within dolomite, the prospect has<br />

copper mineralisation associated with lead and silver.<br />

Previous exploration included soil sampling, revealing<br />

an average 29gm/tonne silver anomaly and with<br />

elevated based metals. A rock chip sampling and RC<br />

drilling programme confirmed the presence of surficial<br />

high grade silver-copper-lead, oxidised, supergene<br />

mineralisation. The prospect occurs on the Arunta<br />

Block – Amadeus Basin unconformity, further enhancing<br />

the potential for mineralisation.<br />

During the past 12 months exploration activities<br />

have included:<br />

• Acquisition of high resolution magnetic and<br />

radiometric data on 100 metre flight lines.<br />

• Acquisition of detailed airborne EM data<br />

(“SkyTEM”) over the tenement on 150 metre<br />

flight lines.<br />

• Ground radiometric surveys and rock chip sampling.<br />

• Diamond drilling two holes to test a substantial<br />

EM conductor.<br />

The SkyTEM survey defined two dominant conductors<br />

at the inferred position of the unconformity. The best<br />

response occurs adjacent to the historical workings at<br />

Blueys Prospect. In addition, the magnetic/radiometric<br />

survey defined an area of anomalous response in the<br />

uranium and thorium channels, again adjacent to the<br />

Blueys prospect.<br />

21

URANIUM – RARE EARTH ELEMENTS (REE)<br />

Blueys Project continued<br />

Rock chip sampling traverses were conducted over<br />

the thorium anomalies in the Blueys area over several<br />

occasions during the reporting period. A significant<br />

thorium anomaly in the south of Blueys area was<br />

sampled; it is associated with an altered granite gneiss<br />

close to the unconformity/contact with the Heavitree<br />

Quartzite. One rock chip sample (WDR5_001) was taken<br />

on the southern thorium anomaly located about 1kms<br />

southwest of the Blueys prospect. Results from this<br />

sample show significant elevation in thorium, zirconium<br />

and rare earth values including thorium 0.14%, cerium<br />

663ppm, lanthanum 340ppm, neodymium 188ppm and<br />

zirconium 0.25%.<br />

Rock chip sampling undertaken on the main thorium<br />

anomaly resulted in high thorium, uranium, rare earths,<br />

titanium and zirconium values. Three of the samples<br />

were re-assayed as zirconium and cerium values were<br />

higher than the detection limits.<br />

Two diamond holes were completed by Titeline Drilling<br />

P/L in June 2008. The first hole, BL001, was drilled<br />

to a depth of 237 metres and the second hole, BL002,<br />

was drilled to a depth of 173.5 metres. Both holes<br />

intersected a similar sequence of pyritic, carbonaceous,<br />

black shales overlying the Heavitree Quartzite.<br />

These rocks are the cause of the conductivity anomalies<br />

outlined by the airborne EM survey. The pyritic zones<br />

from both holes have been sampled. There were no<br />

significant base metal values.<br />

The proposed exploration programme for next year<br />

will include further rock chip sampling, geological<br />

mapping and ground radiometric surveying to outline<br />

possible drill targets on the thorium and rare earth<br />

element anomalies.<br />

Plan showing eppm thorium<br />

contours, rock chip sample<br />

sites, and diamond drillholes.<br />

Diamond drilling at Blueys.<br />

22

WESTERN DESERT RESOURCES LIMITED ABN 48 122 301 848<br />

Cloughs Dam<br />

The Cloughs Dam Project, EL26757, is located to the<br />

west-northwest of Alice Springs, which by the sealed<br />

Tanami Road is only about 35 kms from the tenement.<br />

<strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Ltd has 100% interest in the<br />

tenement. The project covers an area of 672 sq kms,<br />

and comprises granulites, mylonitic gneisses and<br />

granitiod rocks of the Palaeoproterozoic Arunta Block.<br />

It is within a region that is known to host significant<br />

uranium and polymetallic mineralisation and, despite<br />

its proximity to the major centre of Alice Springs,<br />

it has been subject to very little company exploration.<br />

It contains major structures that may have acted<br />

as feeder zones for mineralising fluids and has high<br />

background radiometric levels.<br />

A regional stream sediment survey with helicopter<br />

support was completed during May 2008. A sample<br />

of -5mm stream sediment was collected from 134 sites<br />

covering the entire tenement area. This was split<br />

off-site and one portion was retained for BLEG analysis<br />

for gold and the other portion was sieved to -40#<br />

for multi-element analysis by ICP-Mass Spectrometry.<br />

Three water bores in the north eastern part of the<br />

licence were also sampled.<br />

The results of the stream sediment survey show<br />

some anomalous areas for cerium, lanthanum, uranium<br />

and thorium, which will require ground follow-up.<br />

Two creeks in the northern part of the EL show weakly<br />

anomalous base metal values and will require ground<br />

checking. Anomalous water geochemistry has<br />

been reported from two of the water bores sampled.<br />

Proposed exploration includes an airborne EM survey<br />

over the northern part of the EL, which is prospective<br />

for palaeochannel uranium deposits. Reconnaissance<br />

geological mapping and ground follow-up is required<br />

to further investigate the anomalous stream sediment<br />

results. It is expected that this work will lead to the<br />

definition of targets for costeaning and/or drilling.<br />

23

URANIUM – RARE EARTH ELEMENTS (REE)<br />

Hayes Dam<br />

24<br />

The Hayes Dam project area, EL25660, is located<br />

40 sq kms east of Alice Springs, and covers an area of<br />

406 sq kms. <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Ltd has 100%<br />

interest in the tenement. It is located in the Proterozoic<br />

Arunta Block and includes granitic gneisses and<br />

metamorphics. Neoproterozoic sediments of the Bitter<br />

Springs Formation and Heavitree Quartzite crop out<br />

in the south and east of the tenement area. Marine<br />

sediments of Cambrian age occur in the extreme<br />

southern part of the EL.<br />

No significant previous company exploration has been<br />

recorded within the Hayes Dam project area.<br />

Regional magnetic and radiometric data acquired by<br />

the Northern Territory government shows elevated<br />

uranium values in the northeast of the EL, over granitic<br />

gneisses. Anomalous values are also associated with<br />

sediments of the Cambrian Pertaoorrta Group in the<br />

south of the tenement.<br />

A regional stream sediment survey with helicopter<br />

support was completed during May 2008.<br />

Samples sieved to less than 5 millimetres in diameter<br />

were collected from 40 sites. Each sample was<br />

then split off-site and one portion was retained for<br />

BLEG analysis for gold and the other portion was<br />

sieved to -40# for multi-element analysis by ICP-Mass<br />

Spectrometry.<br />

The results of the stream sediment survey show<br />

several locations with anomalous values for thorium,<br />

cerium, lanthanum, lead and zinc. The base metal<br />

values are located within the Amadeus basin sediments<br />

in the south east of the area while the rare earths<br />

are scattered throughout the metamorphic rocks and<br />

granites of the Arunta Block.<br />

The proposed exploration programme includes follow<br />

up ground work and infill sampling around the areas<br />

of interest identified from the initial reconnaissance<br />

sampling and mapping. Costeaning and drilling will be<br />

undertaken on sites of encouraging results.

WESTERN DESERT RESOURCES LIMITED ABN 48 122 301 848<br />

Mueller Creek<br />

The Mueller Creek Project, EL25658, is located<br />

north of the Plenty Highway, about 80kms northeast of<br />

Alice Springs.<br />

<strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Ltd and NuPower <strong>Resources</strong><br />

Ltd entered into the “Bushy Park” joint venture on<br />

5 February 2008. NuPower <strong>Resources</strong> Ltd can earn a<br />

51% interest in energy minerals on the tenement by<br />

spending a total of $1,000,000 on this EL and Burt Plain<br />

EL25338 within three years.<br />

The tenement area is located in the Proterozoic Arunta<br />

Block, over gneisses, granulites, and amphibolites of<br />

the Strangways Metamorphic Complex. The Proterozoic<br />

age rocks have been deeply weathered during<br />

Cretaceous to early Tertiary times forming a thick<br />

lateritic profile over most of the licence area. The Late<br />

Tertiary Waite Formation consisting of limestone,<br />

mudstone and sandstone occurs in two north trending<br />

palaeochannels.<br />

Regional geophysical data acquired in 1998 by the<br />

Northern Territory government shows elevated uranium<br />

channel values in the north, south, and west of the<br />

project area.<br />

During the reporting period open file information was<br />

re<strong>view</strong>ed and six water bores were sampled. The results<br />

returned uranium values between 2.4 and 10.8ppb.<br />

The proposed exploration programme in the following<br />

year will include an airborne EM survey over the western<br />

part of the EL, gravity surveying and reconnaissance<br />

geological mapping. Surface sampling, costeaning and<br />

drilling may be undertaken on any prospects vectored<br />

from these surveys.<br />

25

SCHEDULE OF TENEMENTS as at 30 June 2008<br />

Nature and % of<br />

Project Tenement Area kms 2 Registered Holder or Applicant Company’s Interest<br />

Blueys EL10228 53.50 WDR Base Metals Pty Ltd 100%<br />

Burt Plain EL25338 806.20 WDR Base Metals Pty Ltd 100%<br />

Sliding Rock Well EL25469 153.60 WDR Base Metals Pty Ltd 100%<br />

Cloughs Dam EL25657 672.40 Red <strong>Desert</strong> Minerals Pty Ltd 100%<br />

Hayes Dam EL25660 406.50 Red <strong>Desert</strong> Minerals Pty Ltd 100%<br />

Limbla EL25331 18.93 Red <strong>Desert</strong> Minerals Pty Ltd 100%<br />

EL25332 123.00 Red <strong>Desert</strong> Minerals Pty Ltd 100%<br />

EL25373 641.6 Red <strong>Desert</strong> Minerals Pty Ltd 100%<br />

EL25402 364.80 Red <strong>Desert</strong> Minerals Pty Ltd 100%<br />

EL25554 540.70 Red <strong>Desert</strong> Minerals Pty Ltd 100%<br />

Limmen Bight River ELA25905 583.50 Red <strong>Desert</strong> Minerals Pty Ltd 100%<br />

Mueller Creek EL25658 1047.00 Red <strong>Desert</strong> Minerals Pty Ltd 100%<br />

Golden Mile MLC625 .08 WDR Gold Pty Ltd 100%<br />

Hopeful Star MLC624 .05 WDR Gold Pty Ltd 100%<br />

MLC632 .03 WDR Gold Pty Ltd 100%<br />

MLC1057 .24 WDR Gold Pty Ltd 100%<br />

Tennant Creek MCC1035 .18 WDR Gold Pty Ltd 100%<br />

MCC1036 .20 WDR Gold Pty Ltd 100%<br />

MCC1040 .20 WDR Gold Pty Ltd 100%<br />

MCC1041 .30 WDR Gold Pty Ltd 100%<br />

MCC1042 .19 WDR Gold Pty Ltd 100%<br />

MCC1089 .36 WDR Gold Pty Ltd 100%<br />

MCC1090 .40 WDR Gold Pty Ltd 100%<br />

MCC1091 .40 WDR Gold Pty Ltd 100%<br />

MCC1092 .40 WDR Gold Pty Ltd 100%<br />

MCC1093 .40 WDR Gold Pty Ltd 100%<br />

MCC1094 .40 WDR Gold Pty Ltd 100%<br />

MCC1095 .40 WDR Gold Pty Ltd 100%<br />

MCC1112 .34 WDR Gold Pty Ltd 100%<br />

MCC1113 .40 WDR Gold Pty Ltd 100%<br />

MCC1117 .40 WDR Gold Pty Ltd 100%<br />

MCC1118 .36 WDR Gold Pty Ltd 100%<br />

MCC1119 .16 WDR Gold Pty Ltd 100%<br />

MCC1120 .25 WDR Gold Pty Ltd 100%<br />

MCC1351 .32 WDR Gold Pty Ltd 100%<br />

Spring Hill EL22957 35.57 WDR Gold Pty Ltd 100%<br />

ML23812 10.35 WDR Gold Pty Ltd 100%<br />

Winnecke EL23630 56.77 WDR Gold Pty Ltd 100%<br />

Dawsonvale EPM16602 194.00 WDRFE Pty Ltd (1) 100%<br />

Roper Bar ELA26759 767.90 WDRFE Pty Ltd (2) 100%<br />

(1) In August 2008 the company entered into an agreement to sell its wholly owned subsidiary company, WDRFE Pty Ltd, to Aard Metals Limited.<br />

(2) In August 2008 the company entered into an agreement to sell its wholly owned subsidiary company, WDRFE Pty Ltd, to Aard Metals Limited. This agreement provides that WDRFE Pty Ltd holds the<br />

application for tenement EL26759 on trust for <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Limited, and will effect transfer of the tenement to <strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Limited or its nominee, upon formal grant of<br />

the tenement application.<br />

26

WESTERN DESERT RESOURCES LIMITED ABN 48 122 301 848<br />

CORPORATE GOVERNANCE STATEMENT<br />

In March 2003 the Australian Stock Exchange Corporate<br />

Governance Council (“ASXCGC”) released its best<br />

practice recommendations based on ten core principles<br />

for corporate governance. These recommendations<br />

were not intended to be prescriptions to be followed by<br />

all ASX listed companies, but rather guidelines<br />

designed to produce an efficiency, quality or integrity<br />

outcome. The Corporate Governance Council has<br />

recognised that a “one size fits all” approach to<br />

Corporate Governance is not required. Instead, it states<br />

aspirations of best practice for optimising corporate<br />

performance and accountability in the interests of<br />

shareholders and the broader economy. A company<br />

may consider that a recommendation is not appropriate<br />

to its particular circumstances and has flexibility to not<br />

adopt it and explain why.<br />

<strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Limited to date has not<br />

adopted the ASXCGC best practice recommendations<br />

other than those specifically identified and disclosed<br />

below because the Board believes that it cannot justify<br />

the necessary cost given the size and early stage of<br />

its life as a listed exploration company. However the<br />

Board is committed to ensuring that appropriate<br />

Corporate Governance practices are in place for the<br />

proper direction and management of the Company.<br />

This statement outlines the main Corporate Governance<br />

practices of the Company disclosed under the principles<br />

outlined in the ASXCGC including those that comply<br />

with best practice that, unless otherwise disclosed, were<br />

in place during the whole of the financial year ended<br />

30 June 2008.<br />

Principle 1:<br />

Role of the Board<br />

Lay solid foundations for management<br />

and oversight<br />

The Board is governed by the Corporations Act 2001,<br />

ASX listing rules and a formal constitution.<br />

The Board’s primary role is the protection and<br />

enhancement of shareholder value.<br />

The Board takes responsibility for the overall<br />

Corporate Governance of the Company including its<br />

strategic direction, management goal setting and<br />

monitoring, internal risk control, risk management<br />

and financial reporting.<br />

Board processes and management<br />

The Board has an established framework for the<br />

management of the company including a system of<br />

internal control, a business risk management process<br />

and appropriate ethical standards.<br />

The Board appoints a Managing Director with<br />

responsibility for the day to day management of the<br />

Company including management of financial, physical,<br />

and human resources, development and implementation<br />

of risk management, internal control and regulatory<br />

compliance policies and procedures, recommending<br />

strategic direction and planning for the operations of<br />

the business and the provision of relevant information<br />

to the Board.<br />

Principle 2:<br />

Structure the Board to add value<br />

Composition of the Board<br />

The names of the directors of the Company and terms<br />

in office at the date of this Statement together with their<br />

experience and expertise are set out in the Directors’<br />

Report section of this report. The directors’ terms in<br />

office are considered appropriate in <strong>view</strong> of the fact that<br />

the company listed in July 2007.<br />

The composition of the Board consists of five directors of<br />

whom four, including the Chairman, are non-executives.<br />

Mr Billing’s role as Chairman of the Board is separate<br />

27

CORPORATE GOVERNANCE STATEMENT<br />

Composition of the Board continued<br />

from that of the Managing Director, Mr Gardner who<br />

is responsible for the day to day management of<br />

the Company and is in compliance with the ASXCGC<br />

best practice recommendation that these roles not be<br />

exercised by the same individual.<br />

The Company’s constitution stipulated that the number<br />

of directors must be at least three. The Board may<br />

at any time appoint a director to fill a casual vacancy.<br />

Directors appointed by the Board are subject to election<br />

by shareholders at the following annual general<br />

meeting and thereafter directors (other than the<br />

Managing Director) are subject to re-election at least<br />

every three years.<br />

The Board has not established a nominations committee<br />

because of the small size of both the Board and the<br />

Company. The Board believes however in the renewal<br />

of members to ensure the ongoing vitality of the<br />

Company, and will seek to recruit additional members<br />

as appropriate.<br />

All directors are entitled to take such legal advice as<br />

they require at any time, and from time to time, on any<br />

matter concerning or in relation to their rights, duties,<br />

and obligations as directors in relation to the affairs<br />

of the Company.<br />

Principle 3:<br />

Ethical standards<br />

Promote ethical and responsible<br />

decision making<br />

The Company aims for a high standard of corporate<br />

governance and ethical standard by directors and<br />

employees.<br />

Directors are expected to use skills commensurate with<br />

their knowledge and experience to increase the value<br />

of Company assets. Directors must also maintain strict<br />

confidentiality in relation to Company matters<br />

All directors are required to provide the Company with<br />

details of all securities registered in the director’s name<br />

or an entity in which the director has a relevant interest<br />

within the meaning of section 9 of the Corporations Act<br />

2001 and details of all contracts, other than contracts to<br />

which the Company is a party to which the director is a<br />

party or under which the director is entitled to a benefit,<br />

and that confer a right to call for or deliver shares in the<br />

Company and the nature of the director’s interest under<br />

the contract.<br />

Directors are required to disclose to the Board any<br />

material contract in which they may have an interest.<br />

In accordance with section 195 of the Corporations Act<br />

2001, a director having a material personal interest in<br />

any matter to be dealt with by the Board, will not be<br />

present when that matter is considered by the Board<br />

and will not vote on that matter.<br />

Trading in the Company’s Securities<br />

Directors, officers and employees are not permitted<br />

to trade in securities of the Company at any time<br />

whilst in possession of price sensitive information not<br />

readily available to the market. Section 1043A of the<br />

Corporations Act 2001 also prohibits the acquisition<br />

and disposal of securities where a person possesses<br />

information that is not readily available and which<br />

may reasonably be expected to have a material effect<br />

on the price of the securities if the information was<br />

generally available. In particular, trading in Company<br />

securities is prohibited within three days prior to, and<br />

one day following material announcements to ASX.<br />

Principle 4:<br />

Safeguard integrity in financial reporting<br />

The Managing Director and Chief Financial Officer<br />

provide a certificate to the Board regarding the<br />

Financial Reports providing a true and fair <strong>view</strong> in<br />

accordance with accounting standards.<br />

Audit Committee<br />

<strong>Western</strong> <strong>Desert</strong> <strong>Resources</strong> Limited was not a Company<br />

required by ASX Listing Rule 12.7 to have an Audit<br />

Committee during the year, although it is a best practice<br />

recommendation of the ASXCGC. Those activities,<br />

normally the responsibility of an audit committee, are<br />

undertaken by the Board as a whole.<br />

28

WESTERN DESERT RESOURCES LIMITED ABN 48 122 301 848<br />

Principle 5:<br />

Make timely and balanced disclosure<br />

• Notices of all meetings of shareholders;<br />

Continuous Disclosure<br />

The Company operates under the continuous disclosure<br />

requirements of the ASX Listing Rules and ensures<br />

that all information, apart from information which is<br />

confidential, and ASX has not formed the <strong>view</strong> that the<br />

information has ceased to be confidential, which may<br />

be expected to affect the value of the Company’s<br />

securities or influence investment decisions is released<br />

to the market in order that all investors have equal and<br />

timely access to material information concerning the<br />

Company. This information is made publicly available<br />

on the Company’s website following release to the ASX.<br />

Principle 6:<br />

Respect the rights of shareholders<br />

Communication with shareholders<br />

The Board aims to ensure that shareholders<br />

are informed of all major developments affecting the<br />

Company’s state of affairs. In accordance with the<br />

ASXCGC best practice recommendations, information<br />

is communicated to shareholders as follows:<br />

• The annual financial report which includes<br />

relevant information about the operations of the<br />

Company during the year, changes in the state<br />

of affairs of the entity and details of future<br />

developments, in addition to other disclosures<br />

required by the Corporations Act 2001;<br />

• The half yearly financial report is to be lodged<br />

with the Australian Stock Exchange and Australian<br />

Securities and Investments Commission and sent<br />

to all shareholders who request it;<br />

• Notifications relating to any proposed major<br />

changes in the Company which may impact on<br />

share ownership rights that are submitted to<br />

a vote of shareholders;<br />

• Publicly released documents including the full text<br />

of notices of meetings and explanatory material<br />

made available on the Company’s internet web-site<br />

at www.westerndesertresources.com.au ; and<br />

• Disclosure of the Company’s Corporate Governance<br />

practices and communications strategy on the<br />

internet web-site.<br />

The Board encourages full participation of shareholders<br />

at the Annual General Meeting to ensure a high level<br />

of accountability and identification with the Company’s<br />

strategy and goals. Important issues are presented<br />

to the shareholders as single resolutions. The external<br />

auditor of the Company is also invited to the Annual<br />

General Meeting of shareholders and is available to<br />

answer any questions concerning the conduct, preparation<br />

and content of the auditor’s report. Pursuant to<br />

Section 249K of the Corporations Act 2001 the external<br />

auditor is provided with a copy of the notice of meeting<br />

and related communications received by shareholders.<br />

Principle 7:<br />

Recognise and manage risk<br />

Risk Assessment and Management<br />

The Board recognises that there are inherent risks<br />

associated with the Company’s operations including<br />

mineral exploration, environmental, title, native title,<br />

legal, and other operational risks. The Board endeavours<br />

to mitigate such risks by continually re<strong>view</strong>ing the<br />

activities of the Company in order to identify key<br />

business and operational risks and ensuring that they<br />

are appropriately assessed and managed.<br />

Principle 8:<br />

Performance Evaluation<br />

Encourage enhanced performance<br />

The Board evaluates the performance of the Managing<br />

Director on a regular basis and encourages continuing<br />

professional development.<br />

29

WESTERN DESERT RESOURCES LIMITED ABN 48 122 301 848<br />

CORPORATE GOVERNANCE STATEMENT<br />

Principle 9:<br />

Remuneration Policy<br />

Remunerate fairly and responsibly<br />

The Company’s Constitution specifies that the total<br />

amount of remuneration of non-executive directors<br />

shall be fixed from time to time by a general meeting.<br />

The current maximum aggregate remuneration of<br />

non-executive directors is set at $250,000 per annum.<br />

Directors may apportion any amount up to this<br />

maximum amount amongst the non-executive directors<br />

as they determine. Directors are also entitled to be<br />

paid reasonable travelling, accommodation and<br />

other expenses incurred in performing their duties<br />

as directors.<br />

• Not improperly use their position or information<br />

obtained through their position to gain a personal<br />

advantage or for the advantage of another person<br />

to the detriment of the Company;<br />

• Disclose material personal interests and avoid<br />

actual or potential conflicts of interests;<br />

• Keep themselves informed of relevant<br />

Company matters;<br />

• Keep confidential the business of all directors<br />

meetings; and<br />

• Observe and support the Board’s Corporate<br />

Governance practices and procedures.<br />

The remuneration of the Managing Director is<br />

determined by the Board as part of the terms and<br />

conditions of his engagement which are subject to<br />

re<strong>view</strong> from time to time. The remuneration of<br />

employees is determined by the Managing Director<br />

subject to the approval of the Board.<br />

Further details of directors’ and executives/officers’<br />

remuneration, superannuation and retirement payments<br />

are set out in the Directors’ Report.<br />

Principle 10: Recognise the legitimate interests<br />

of stakeholders<br />

Code of Conduct<br />

The Company requires all its directors and employees<br />

to abide by the highest standards of behaviour, business<br />

ethics, and in accordance with the law. In discharging<br />

their duties, Directors of the Company are required to:<br />

• Act in good faith and in the best interests of<br />

the Company;<br />

• Exercise care and diligence that a reasonable<br />

person in that role would exercise;<br />

• Exercise their powers in good faith for a proper<br />

purpose and in the best interests of the Company;<br />

30

WESTERN DESERT RESOURCES LIMITED<br />

ABN 48 122 301 848<br />

FINANCIAL<br />

R E P O R T<br />

2008<br />

CONTENTS<br />

Page<br />

Directors’ Report 32<br />

Auditor’s Independence Declaration 41<br />

Income Statement 42<br />

Balance Sheet 43<br />

Consolidated Cash Flow Statement 44<br />

Consolidated Statement of Change in Equity 45<br />

Notes to the Financial Statements 46<br />