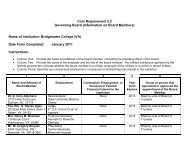

Cash Transaction Procedures

Cash Transaction Procedures

Cash Transaction Procedures

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

with the bank is flagged and must be approved for payment by the Controller on the bank<br />

website. If it is not approved, the check will be returned.<br />

Accounts payable checks are posted into the general ledger by the Controller. The<br />

backup position for this task is the AA.<br />

Checks are issued by the APM for employee travel advances upon receipt of a<br />

properly approved form in the business office. Faculty travel advances require prior<br />

approval by the Academic Dean. The employee then must return any money with receipts<br />

to the cashier when their trip is complete. The Controller generates a list of outstanding<br />

travel advances. Employees with advances outstanding longer than two weeks may not<br />

receive another travel advance and after a month, the list of outstanding advances is<br />

reported to the appropriate vice president for handling.<br />

Petty cash may be used to reimburse employees for authorized purchases of less<br />

than $25. A form with the necessary approvals is required before the funds are<br />

reimbursed. The employee signs the petty cash form to indicate that they received the<br />

funds. The Controller reconciles the petty cash box every two weeks and submits a<br />

request for reimbursement of the funds.<br />

To initiate an outgoing wire transfer, the Controller or the VP calls the bank wire<br />

room to initiate the transfer; an individually-assigned pin number is required and the bank<br />

periodically changes the pin number. The only employees with a pin number are the VP<br />

for Finance, the Controller and the President. Some, but not all, of the investment<br />

managers will call to verify that the transfer is legitimate. After the wire has been sent,<br />

the Controller will confirm receipt with the destination agency. The bank randomly calls<br />

an authorized person other than the person initiating a wire, for verification; the pin<br />

number and wire details (amount, destination account, etc.) are required for that<br />

verification.