Same commitment. - Seaway Bank and Trust Company

Same commitment. - Seaway Bank and Trust Company

Same commitment. - Seaway Bank and Trust Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Seaway</strong> Bancshares, Inc. 2008 Annual Report<br />

New name.<br />

New look.<br />

<strong>Same</strong> <strong>commitment</strong>.

New name.<br />

New look.<br />

<strong>Same</strong> <strong>commitment</strong>.<br />

<strong>Seaway</strong> Bancshares, Inc.<br />

Financial highlights year ended: december 31, 2008 December 31, 2007 % Change<br />

Total Stockholders’ Equity $30,140,014 $29,107,889 3.54%<br />

Return on Average Equity 9.62% 9.92% (3.02)%<br />

Total Assets $363,575,457 $346,734,308 4.86%<br />

<strong>Seaway</strong> <strong>Bank</strong> <strong>and</strong> <strong>Trust</strong> <strong>Company</strong><br />

Financial highlights year ended: december 31, 2008 December 31, 2007 % Change<br />

Net Income $3,286,353 $3,201,531 2.65%<br />

Total Deposits $315,295,240 $301,033,769 4.74%<br />

Total Loans $196,822,548 $181,246,604 8.59%<br />

Quality Service Statement<br />

<strong>Seaway</strong> <strong>Bank</strong> <strong>and</strong> <strong>Trust</strong> <strong>Company</strong> will develop <strong>and</strong> deliver products <strong>and</strong> services that satisfy<br />

the financial needs of our customers. Our goal is to be recognized as the premier quality<br />

bank in the community we serve. All marketing, products, systems, processes <strong>and</strong> training<br />

will be designed to prevent errors <strong>and</strong> to provide customers with consistently high levels of<br />

quality service, which will be monitored continuously.<br />

If service problems develop, emphasis will be placed on timely <strong>and</strong> courteous resolution,<br />

including responsive communication with the customer. Success will be measured in terms<br />

of our ability to meet customers’ requirements, <strong>and</strong> employees will be rewarded for quality<br />

performance.<br />

Table of Contents<br />

1 Letter to Our Shareholders<br />

7 Consolidated Financial Statements <strong>Seaway</strong> Bancshares, Inc. <strong>and</strong> Subsidiary<br />

11 Financial Statements <strong>Seaway</strong> <strong>Bank</strong> <strong>and</strong> <strong>Trust</strong> <strong>Company</strong><br />

15 Notes to Financial Statements<br />

23 Independent Auditor’s Report<br />

24 Board of Directors <strong>and</strong> Officers<br />

25 Facilities<br />

©2009 <strong>Seaway</strong> Bancshares, Inc. Printed in the U.S.A.

Letter to Our Shareholders<br />

Without question, 2008 will prove to be a defining<br />

<strong>and</strong> historic year for our country. Many<br />

have even compared the economic crisis to<br />

that of the Great Depression era. Individuals<br />

<strong>and</strong> families lost not just their jobs but they<br />

lost their homes, as well. Businesses operating<br />

for years have had to close their doors.<br />

On the other h<strong>and</strong>, for the first time in our<br />

nation’s history, an African-American man<br />

was elected 44th President of the United<br />

States.<br />

<strong>Seaway</strong>, too, made history as the huge<br />

<strong>Seaway</strong> sign installed in 1965 came down<br />

<strong>and</strong> a new one with our new bank name <strong>and</strong><br />

logo went up. It was as if the raising of our<br />

new sign meant the advent of new opportunities.<br />

Our new charter, proudly displaying our<br />

new bank name, <strong>Seaway</strong> <strong>Bank</strong> <strong>and</strong> <strong>Trust</strong><br />

<strong>Company</strong>, gives us a number of competitive<br />

advantages in the financial market. Among<br />

them, we now have the ability to lend significantly<br />

larger amounts to our borrowers,<br />

<strong>and</strong> we spend fewer dollars on regulatory<br />

oversight.<br />

Being of service to individuals <strong>and</strong> businesses<br />

is at the core of the principles on<br />

which <strong>Seaway</strong> <strong>Bank</strong> <strong>and</strong> <strong>Trust</strong> <strong>Company</strong> was<br />

founded back in 1965. By staying true to<br />

these values during the past year we enjoyed<br />

a 2.65% growth in earnings. Maintaining<br />

our community focus has also enabled us to<br />

steer clear of the kinds of loans capable of<br />

negatively impacting the bank’s core goals<br />

<strong>and</strong> objectives. Our $196 million loan portfolio,<br />

our <strong>Trust</strong> Department bond issues aggregating<br />

a total principal outst<strong>and</strong>ing of more<br />

than $6.5 billion, <strong>and</strong> our 9.62% return on<br />

average shareholders’ equity at December<br />

31, 2008 were clear proof that our enduring<br />

<strong>commitment</strong> to principles really does work.<br />

Also, beginning in 2008, <strong>Seaway</strong> <strong>Bank</strong><br />

<strong>and</strong> <strong>Trust</strong> <strong>Company</strong> participated in the Federal<br />

Deposit Insurance Corporation’s (FDIC)<br />

Temporary Liquidity Guarantee Program,<br />

which ensures that all non-interest bearing<br />

dem<strong>and</strong> deposit accounts are protected with<br />

FDIC insurance. Every day at <strong>Seaway</strong> we see<br />

Caring. Responsible. Strong. That’s <strong>Seaway</strong> <strong>Bank</strong><br />

<strong>and</strong> <strong>Trust</strong> <strong>Company</strong> — now <strong>and</strong> always.<br />

just how important this kind of <strong>commitment</strong><br />

to the community we serve can be. We underst<strong>and</strong><br />

that simply knowing a customer’s<br />

first name can be reassuring in these difficult<br />

economic times.<br />

As we see large commercial banks stack<br />

their bricks in our neighborhood, we realize<br />

a striking difference. At <strong>Seaway</strong>, we are not<br />

simply in the community; we are of the community.<br />

We pride ourselves on being a safe<br />

<strong>and</strong> secure place for customers to keep their<br />

money <strong>and</strong> where shareholders can be confident<br />

that their share value is being maintained.<br />

This turned out to be more important<br />

than ever in 2008. Our individual-based<br />

approach to lending may be unconventional,<br />

but it’s proven effective, despite the growing<br />

wave of foreclosures currently affecting the<br />

country.<br />

We have a proud history of opening doors<br />

<strong>and</strong> creating opportunities, <strong>and</strong> last year was<br />

no exception. Whether it’s opening a stateof-the-art<br />

facility, assembling a mortgage<br />

rescue plan, participating in a multi-million<br />

dollar credit or simply offering customers a<br />

free gas card in exchange for opening a new<br />

account, we live up to the promise of our<br />

new bank name by practicing the art of good<br />

community stewardship each <strong>and</strong> every day.<br />

Caring. Responsible. Strong. That’s<br />

<strong>Seaway</strong> <strong>Bank</strong> <strong>and</strong> <strong>Trust</strong> <strong>Company</strong> — now <strong>and</strong><br />

always.<br />

Jacoby Dickens<br />

Chairman of the Board<br />

Walter E. Grady<br />

President <strong>and</strong> Chief Executive Officer<br />

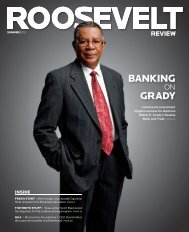

Jacoby Dickens, Chairman<br />

of the Board (left) <strong>and</strong><br />

Walter E. Grady, President<br />

<strong>and</strong> Chief Executive<br />

Officer (right).<br />

1

<strong>Seaway</strong> Bancshares, Inc. 2008 Annual Report<br />

Times change. St<strong>and</strong>ards do not.<br />

Commitment To St<strong>and</strong>ards<br />

Times change. St<strong>and</strong>ards do not.<br />

The st<strong>and</strong>ards <strong>Seaway</strong> has in place for<br />

lending <strong>and</strong> investing have never wavered<br />

since the bank’s inception. They continue<br />

to provide a guiding philosophy for every<br />

decision <strong>Seaway</strong> makes. They were also the<br />

key to our success in 2008.<br />

What defines <strong>Seaway</strong>’s st<strong>and</strong>ards? Sharp<br />

fiscal discipline, coupled with a communityfirst<br />

approach to doing business, are two<br />

primary factors. <strong>Seaway</strong> has never believed<br />

in quick fixes or easy money. We have been<br />

steadfast in our <strong>commitment</strong> to fiscal prudence.<br />

We also believe the results of <strong>Seaway</strong>’s<br />

steadfast philosophy speak for themselves.<br />

<strong>Seaway</strong>’s earnings were up again in 2008, despite<br />

a severe economic downturn <strong>and</strong> the collapse of the<br />

real estate market.<br />

<strong>Seaway</strong>’s earnings were up again in 2008,<br />

despite a severe economic downturn <strong>and</strong><br />

the collapse of the real estate market. It’s a<br />

remarkable achievement, but <strong>Seaway</strong> <strong>Bank</strong><br />

President Walter E. Grady insists it shouldn’t<br />

come as a surprise.<br />

“Our job is to be of service to this community<br />

<strong>and</strong> to be responsible stewards of<br />

our customers’ hard-earned money,” he says.<br />

“As long as we stay focused on these objectives,<br />

success will take care of itself.” Nearly<br />

a half-century after the founding of the<br />

bank, Mr. Grady’s point is well taken.<br />

<strong>Seaway</strong> is proud of its accomplishments<br />

in 2008. We’ve served our customers, supported<br />

our community <strong>and</strong> set a positive<br />

example for others in the banking sector.<br />

It may well be that 2009 marks a shift to<br />

community-banking values for larger financial<br />

institutions.<br />

Refusing to lower our st<strong>and</strong>ards is more<br />

than a pledge. It’s the very foundation of<br />

our business.<br />

2

The installation of<br />

the new <strong>Seaway</strong> <strong>Bank</strong><br />

<strong>and</strong> <strong>Trust</strong> <strong>Company</strong><br />

sign in October, 2008<br />

was a symbol of <strong>Seaway</strong>’s<br />

<strong>commitment</strong> to<br />

the community.<br />

Commitment To Our Community<br />

Putting community first is one of the core<br />

principles upon which <strong>Seaway</strong> <strong>Bank</strong> <strong>and</strong><br />

<strong>Trust</strong> <strong>Company</strong> was founded.<br />

<strong>Seaway</strong>’s response to last year’s economic<br />

downturn provides yet another compelling<br />

example of the invaluable role a community<br />

bank plays. Loan delinquencies nationwide<br />

are at their highest level since 1993, according<br />

to the Federal Deposit Insurance Corporation.<br />

True to the spirit of its founders,<br />

however, <strong>Seaway</strong>’s response to this challenge<br />

was to continue to put the community first.<br />

“I’ve spoken with people who have been<br />

in business for 30 years <strong>and</strong> have never experienced<br />

anything like this,” <strong>Bank</strong> President<br />

Walter E. Grady says, referring to the<br />

overall economic plight faced by many of<br />

<strong>Seaway</strong>’s customers. “The question they all<br />

ask is, What now? Our responsibility is to<br />

give them an answer, <strong>and</strong> we do.”<br />

<strong>Seaway</strong> answered the call in 2008 by<br />

working with each client to address specific,<br />

individual financial needs, whether that<br />

meant restructuring loans or assembling<br />

mortgage rescue plans to assist borrowers<br />

severely impacted by the economic crisis.<br />

It’s a strategy that mirrors the bank’s approach<br />

to lending. No two customers are<br />

alike, <strong>and</strong> <strong>Seaway</strong>’s lending team is committed<br />

to providing the personalized lending<br />

solutions each client deserves.<br />

Initiatives like the Management Trainee<br />

Program, Board of Education Work Study<br />

<strong>and</strong> Internship Programs <strong>and</strong> <strong>Bank</strong>-at-<br />

School programs continue to be popular,<br />

<strong>and</strong> are all testaments to <strong>Seaway</strong>’s ongoing<br />

effort to make a positive difference in the<br />

community we serve.<br />

This personal <strong>commitment</strong> has been<br />

more than a source of satisfaction for <strong>Seaway</strong><br />

<strong>and</strong> its employees. It’s also been one of<br />

the primary keys to our continued success.<br />

<strong>Seaway</strong>’s new look is<br />

applied to the many<br />

banking products<br />

offered to customers<br />

including consumer<br />

accounts <strong>and</strong> home<br />

equity loans.<br />

<strong>Seaway</strong> worked with<br />

customers in 2008<br />

to restructure loans<br />

or assemble mortgage<br />

rescue plans to<br />

ensure families could<br />

stay in their homes.<br />

3

<strong>Seaway</strong> Bancshares, Inc. 2008 Annual Report<br />

<strong>Seaway</strong> is always searching for innovative ways to<br />

improve the quality of services we provide.<br />

Commitment To Our Employees<br />

There’s a reason <strong>Seaway</strong> experiences very<br />

little staff turnover. <strong>Seaway</strong> is deeply committed<br />

to bringing out the best in each of<br />

its more than 250 employees. We do this by<br />

finding ways to maximize each employee’s<br />

abilities while giving them a strong sense<br />

of purpose that only a community-focused<br />

institution can provide.<br />

“We promote from within <strong>and</strong> develop<br />

talent where we see it,” Walter E. Grady<br />

says.<br />

Commitment To Innovation<br />

Whether it’s opening a new office or<br />

investing in the latest in financial services<br />

technology, <strong>Seaway</strong> believes that a <strong>commitment</strong><br />

to innovation is an integral part of<br />

delivering great service.<br />

<strong>Seaway</strong> is always searching for innovative<br />

ways to improve the quality of services we<br />

provide. In 2008, products like our Platinum<br />

Money Market Account <strong>and</strong> our Free<br />

Student Checking program continued to be<br />

well-received by customers. Similarly, being<br />

<strong>Seaway</strong> is deeply committed.<br />

4<br />

<strong>Seaway</strong> has a number of programs to<br />

support this effort. Our tuition reimbursement<br />

program is one example of <strong>Seaway</strong>’s<br />

<strong>commitment</strong> to the professional growth of<br />

its employees. Helping to pay for an employee’s<br />

continued education is an expensive<br />

proposition, but it’s an investment<br />

<strong>Seaway</strong> is willing to make in order to help<br />

every member of our team achieve his or<br />

her true potential.<br />

Above all, employees have the satisfaction<br />

of being part of an organization that<br />

is dedicated to providing solutions to both<br />

individual <strong>and</strong> community challenges. For<br />

example, <strong>Seaway</strong>’s well-established community<br />

involvement is often cited as one of<br />

the main points of differentiation between<br />

<strong>Seaway</strong> <strong>and</strong> other bank employers.<br />

Growing professionally while working<br />

for an institution that is committed to giving<br />

back — it’s a winning combination, <strong>and</strong><br />

it’s one that continues to serve our employees<br />

<strong>and</strong> customers well.<br />

part of the AllPoint/STARsf debit network<br />

has made it possible for our customers to<br />

access their money in thous<strong>and</strong>s of places.

Best of all, our new charter promises to<br />

make banking at <strong>Seaway</strong> more convenient<br />

than ever. State-of-the-art technology meets<br />

state-of-the-art service: It happens every<br />

day at <strong>Seaway</strong> <strong>Bank</strong> <strong>and</strong> <strong>Trust</strong> <strong>Company</strong>.<br />

Commitment To Opening Doors<br />

<strong>Seaway</strong> <strong>Bank</strong> <strong>and</strong> <strong>Trust</strong> <strong>Company</strong> has a<br />

rich history of opening doors <strong>and</strong> creating<br />

opportunities. The fact is, <strong>Seaway</strong> was created<br />

by a group of savvy entrepreneurs who<br />

were committed to giving opportunities to<br />

city residents that other banks refused to<br />

provide.<br />

The proud tradition of opening doors<br />

continues today. We opened the doors to<br />

a $2 million state-of-the-art facility in the<br />

Rosel<strong>and</strong> neighborhood, thus planting the<br />

first seeds of community revitalization.<br />

We’ve opened the doors to financial literacy<br />

with popular youth initiatives like our<br />

<strong>Bank</strong>-at-School program as well as periodic<br />

workshops in area churches.<br />

Above all, our 1% Down Mortgage<br />

program has a long history of opening the<br />

door to homeownership for individuals<br />

who might otherwise have struggled to<br />

achieve this goal.<br />

Richard S. Abrams,<br />

Executive Vice<br />

President <strong>and</strong> Chief<br />

Operating Officer<br />

(right), works hard to<br />

open doors <strong>and</strong> create<br />

opportunity for<br />

<strong>Seaway</strong> customers.<br />

Opening doors <strong>and</strong> creating opportunities:<br />

They are the twin pillars on which <strong>Seaway</strong>’s<br />

philosophy has been built. If anything,<br />

2008 proved that philosophy to be as sound<br />

as ever.<br />

Commitment To Personal Service<br />

It’s a familiar sight at <strong>Seaway</strong> to see an employee<br />

from one department assisting a customer<br />

who is seeking another department.<br />

Wherever personal service can be rendered,<br />

<strong>Seaway</strong> is committed to providing it. We<br />

diligently observe market conditions in<br />

order to create timely products <strong>and</strong> services<br />

that will benefit our customers most.<br />

We’re constantly setting the bar higher<br />

<strong>and</strong> striving to improve the level of personal<br />

service we provide. Our officers routinely<br />

visit with our business customers to ensure<br />

their personal <strong>and</strong> business financial needs<br />

are being met. Officers also regularly offer<br />

guidance on developing business plans. And<br />

in 2008, we customized many mortgage<br />

rescue plans to help customers cope with<br />

the mortgage crisis.<br />

What will exceptional customer service<br />

mean in 2009? Only time will tell, but<br />

<strong>Seaway</strong> has a proud history of rising to the<br />

challenge. You might say we’re driven to be<br />

the best community bank we can be.<br />

Today’s banking consumers<br />

want the convenience<br />

of accessing<br />

financial information<br />

quickly. <strong>Seaway</strong>’s online<br />

banking service<br />

provides an easy way<br />

to see your balances,<br />

pay bills <strong>and</strong> more.<br />

5

<strong>Seaway</strong> Bancshares, Inc. 2008 Annual Report<br />

Walter E. Grady,<br />

President <strong>and</strong> CEO,<br />

looks on as students,<br />

Diamond Simpson<br />

(left) <strong>and</strong> Tyriq Amerson<br />

(right) work out<br />

a problem at John T.<br />

Pirie Fine Arts <strong>and</strong><br />

Academic Center<br />

where <strong>Seaway</strong> sponsors<br />

a <strong>Bank</strong>-at-School<br />

program.<br />

Commitment To The Future<br />

Forecasting the future of banking is not<br />

an easy task. “It’s difficult to predict the<br />

outcome,” Mr. Grady says of his industry’s<br />

prospects in 2009. “The fact is we have to<br />

be ready for anything.”<br />

Change <strong>and</strong> innovation will be motivated by<br />

<strong>Seaway</strong>’s desire to “do well by doing good.”<br />

Adjustments to the new realities in the<br />

country’s financial sector will be an important<br />

consideration in 2009. And yet, <strong>Seaway</strong>’s<br />

management believes that any changes<br />

to policy <strong>Seaway</strong> makes going forward<br />

should be minimal. It’s not the first financial<br />

storm <strong>Seaway</strong> has weathered, <strong>and</strong> the bank<br />

has been well served by its mission. This was<br />

especially true last year.<br />

<strong>Seaway</strong>’s positive earnings report from<br />

2008 sends a clear signal to customers that<br />

the bank is strong <strong>and</strong> secure. The bank<br />

is well capitalized, has money to lend <strong>and</strong><br />

remains as committed as ever to meeting<br />

the needs <strong>and</strong> exceeding the expectations of<br />

our valued customers.<br />

Still, <strong>Seaway</strong> isn’t about to rest on its past<br />

achievements. As ever, change <strong>and</strong> innovation<br />

will be motivated by <strong>Seaway</strong>’s desire<br />

to “do well by doing good” <strong>and</strong> to make a<br />

positive difference in the community.<br />

New name. New look. <strong>Same</strong> <strong>commitment</strong>.<br />

You might even say the more things<br />

change, the more they remain the same at<br />

<strong>Seaway</strong> <strong>Bank</strong> <strong>and</strong> <strong>Trust</strong> <strong>Company</strong>.<br />

New name. New look. <strong>Same</strong> <strong>commitment</strong>.<br />

6

<strong>Seaway</strong> Bancshares, Inc. 2008 Annual Report<br />

<strong>Seaway</strong> Bancshares, Inc. <strong>and</strong> Subsidiary<br />

Consolidated Statements of Condition<br />

For the Years Ended December 31, 2008 <strong>and</strong> 2007<br />

Assets<br />

2008 2007<br />

Cash <strong>and</strong> due from banks $ 14,545,169 $ 9,652,122<br />

Interest Bearing Balances 253,814 8,760,715<br />

Total Cash <strong>and</strong> cash equivalents 14,798,983 18,412,837<br />

Securities available-for-sale (Note 4) 137,928,610 132,414,918<br />

Securities held-to-maturity (Note 4) 685,493 654,172<br />

Loans, net of unearned discount (Note 5) 196,822,548 181,246,604<br />

Less-Allowance for possible loan losses (Note 6) (2,160,958) (1,840,318)<br />

Loans, net 194,661,590 179,406,286<br />

Premises <strong>and</strong> equipment, net (Note 7) 4,789,088 4,872,806<br />

Other real estate owned 389,032 231,532<br />

Intangible Assets (Note 19) 90,000 300,000<br />

Other assets (Note 9) 10,232,661 10,441,757<br />

Total Assets $ 363,575,457 $ 346,734,308<br />

Liabilities <strong>and</strong> Stockholders’ Equity:<br />

Deposits (Note 8)<br />

Non-interest-bearing deposits $ 36,583,341 $ 46,822,228<br />

Interest-bearing deposits 278,697,521 253,326,079<br />

Total Deposits 315,280,862 300,148,307<br />

Federal funds purchased <strong>and</strong> other borrowed funds 7,078,790 6,125,000<br />

Long-term Debt Subordinated Debentures (Note 10) 6,186,000 6,186,000<br />

Other liabilities (Note 9 <strong>and</strong> 13) 4,889,791 5,167,112<br />

Total Liabilities $ 333,435,443 $ 317,626,419<br />

Commitments <strong>and</strong> Contingencies (Note 8, 14 <strong>and</strong> 17)<br />

Stockholders’ Equity<br />

Common stock (Note 11) 301,513 301,513<br />

Surplus 3,915,994 3,915,994<br />

Undivided profits (Note 12) 25,161,822 24,875,756<br />

Accumulated Other Comprehensive Income 760,685 14,626<br />

Total Stockholders’ Equity 30,140,014 29,107,889<br />

Total Liabilities <strong>and</strong> Stockholders’ Equity $ 363,575,457 $ 346,734,308<br />

The accompanying Notes to Financial Statements are an integral part of these statements.<br />

7

<strong>Seaway</strong> Bancshares, Inc. 2008 Annual Report<br />

<strong>Seaway</strong> Bancshares, Inc. <strong>and</strong> Subsidiary<br />

Consolidated Statements of Income<br />

For the Years Ended December 31, 2008 <strong>and</strong> 2007<br />

Interest Income<br />

2008 2007<br />

Interest <strong>and</strong> fees on loans $ 11,982,006 $ 11,929,081<br />

Interest on investment securities<br />

US Government Obligations & Treasury Securities<br />

Agency Obligations 5,902,903 5,649,897<br />

Mortgage-Backed Securities 417,510 410,289<br />

Obligations of state <strong>and</strong> political subdivisions 148,519 65,748<br />

Other securities 163,592 130,814<br />

Interest on federal funds sold <strong>and</strong> other interest-bearing balances 5,013 463,127<br />

Total Interest Income $ 18,619,543 $ 18,648,956<br />

Interest Expense<br />

Interest on time deposits $100,000 or more 4,918,108 5,385,515<br />

Interest on other deposits 1,387,820 2,241,412<br />

Interest on Long-term Debentures 397,760 397,760<br />

Interest on federal funds purchased <strong>and</strong> other borrowed funds 292,529 353,081<br />

Total Interest Expense 6,996,217 8,377,768<br />

Net interest income 11,623,326 10,271,188<br />

Provision for possible loan losses (Note 6) (995,000) (80,000)<br />

Net interest income after provision for possible loan losses $ 10,628,326 $ 10,191,188<br />

Other Income<br />

Service charges on deposit accounts 2,997,496 3,073,580<br />

Other operating income 6,610,010 5,946,556<br />

Gain on sale of investment securities 145,197 —<br />

Total Other Income $ 9,752,703 $ 9,020,136<br />

Other Expenses:<br />

Salaries <strong>and</strong> employee benefits (Note 15 <strong>and</strong> 16) 10,341,935 10,052,723<br />

Occupancy expense of <strong>Bank</strong> premises (Note 7) 2,729,043 2,396,680<br />

Other operating expenses 4,426,424 3,999,309<br />

Total Other Expenses 17,497,402 16,448,712<br />

Income before income taxes 2,883,627 2,762,612<br />

Applicable income taxes (Note 9) (34,700) (5,000)<br />

Net Income $ 2,848,927 $ 2,757,612<br />

Net Income Per Share (Note 11) $ 9.45 $ 9.15<br />

The accompanying Notes to Financial Statements are an integral part of these statements.<br />

8

<strong>Seaway</strong> Bancshares, Inc. <strong>and</strong> Subsidiary<br />

Consolidated Statements of Cash Flows<br />

For the Years Ended December 31, 2008 <strong>and</strong> 2007<br />

Operating Activities<br />

2008 2007<br />

Net Income $ 2,848,927 $ 2,757,612<br />

Adjustments to reconcile net income to net cash<br />

provided from (used by) operating activities:<br />

Provision for loan losses 995,000 80,000<br />

Provision for depreciation <strong>and</strong> amortization 666,869 567,843<br />

Amortization of investment security premiums 14,109 42,207<br />

Accretion of investment security discounts (148,847) (47,462)<br />

Net change in deferred income taxes (48,370) (6,275)<br />

Net (increase) decrease in interest receivable (83,752) 176,975<br />

Net (decrease) increase in interest payable (511,052) 405,385<br />

Net decrease (increase) in other assets 441,095 (71,647)<br />

Net increase in other liabilities 1,082,582 935,435<br />

Net cash provided from operating activities $ 5,256,561 $ 4,840,073<br />

Investing activities<br />

Proceeds from sales <strong>and</strong> maturities of investment securities available for sale 92,886,740 15,265,000<br />

Principal collected on investment securities available for sale 2,707,305 3,018,158<br />

Principal collected on investment securities held for maturity 182,705 119,957<br />

Purchases of investment securities available for sale (100,972,999) (17,720,909)<br />

Purchases of investment securities held to maturity (214,026) (113,932)<br />

Net increase in long-term loans (16,250,517) (6,799,446)<br />

Purchases of premises <strong>and</strong> equipment (net) (575,607) (847,033)<br />

Net increase in other real estate (157,500) (160,651)<br />

Net cash (used by) investing activities $ (22,393,899) $ (7,238,856)<br />

Financing activities<br />

Net decrease in non-interest-bearing deposits (10,238,887) (23,380,488)<br />

Net increase in interest-bearing deposits 25,371,442 10,481,239<br />

Net increase (decrease) in federal funds purchased <strong>and</strong> other borrowed funds 953,790 (2,923,205)<br />

Cash Dividends paid (2,562,861) (2,412,104)<br />

Net cash provided from (used by) financing activities 13,523,484 (18,234,558)<br />

Net decrease in Cash <strong>and</strong> Cash Equivalents (3,613,854) (20,633,341)<br />

Cash And Cash Equivalents At Beginning of Year 18,412,837 39,046,178<br />

Cash And Cash Equivalents At Year-End $ 14,798,983 $ 18,412,837<br />

Interest Paid $ 6,996,217 $ 8,377,768<br />

Income Taxes Paid $ 9,000 $ 5,000<br />

The accompanying Notes to Financial Statements are an integral part of these statements.<br />

9

<strong>Seaway</strong> Bancshares, Inc. 2008 Annual Report<br />

<strong>Seaway</strong> Bancshares, Inc. <strong>and</strong> Subsidiary<br />

Consolidated Statements of Change in Stockholders’ Equity<br />

For the Years Ended December 31, 2008 <strong>and</strong> 2007<br />

Accumulated<br />

Stockholders’<br />

Other<br />

Common undivided Comprehensive Total<br />

Stock Surplus ProfiTS income eQuity<br />

Balance December 31, 2006 $ 301,513 $ 3,915,994 $ 24,530,248 $ (2,270,633) $ 26,477,122<br />

Dividends - $ 8.00/Share — — (2,412,104) — (2,412,104)<br />

Retirement of common stock<br />

Comprehensive Income<br />

Net Income — — 2,757,612 — 2,757,612<br />

Other Comprehensive Income<br />

Unrealized Gain on Available<br />

for Sale Securities, Net of Tax — — — 2,285,259 2,285,259<br />

Balance December 31, 2007 $ 301,513 $ 3,915,994 24,875,756 14,626 $ 29,107,899<br />

Dividends $8.50/Share — — (2,562,861) — (2,562,861)<br />

Comprehensive Income<br />

Net Income — — 2,848,927 — 2,848,927<br />

Other Comprehensive Income<br />

Unrealized Gain on Available<br />

for Sale Securities, Net of Tax — — — 746,059 746,059<br />

Balance December 31, 2008 $ 301,513 $ 3,915,994 $ 25,161,822 $ 760,685 $ 30,140,014<br />

The accompanying Notes to Financial Statements are an integral part of these statements.<br />

10

<strong>Seaway</strong> <strong>Bank</strong> <strong>and</strong> <strong>Trust</strong> <strong>Company</strong><br />

Statements of Condition<br />

For the Years Ended December 31, 2008 <strong>and</strong> 2007<br />

Assets<br />

2008 2007<br />

Cash <strong>and</strong> due from banks $ 14,545,169 $ 9,649,642<br />

Interest Bearing Balances 253,814 8,760,715<br />

Total Cash <strong>and</strong> cash equivalents 14,798,983 18,410,357<br />

Securities available for sale (Note 4) 137,928,610 132,414,918<br />

Securities held-to-maturity (Note 4) 685,493 654,172<br />

Loans, net of unearned discount (Note 5) 196,822,548 181,246,604<br />

Less-Allowance for possible loan losses (Note 6) (2,160,958) (1,840,318)<br />

Loans, net 194,661,590 179,406,286<br />

Premises <strong>and</strong> equipment, net (Note 7) 4,930,945 5,014,663<br />

Other real estate owned 389,032 231,532<br />

Intangible assets (Note 19) 90,000 300,000<br />

Other assets (Note 9) 10,037,674 10,226,933<br />

Total Assets $ 363,522,327 $ 346,658,861<br />

Liabilities And Stockholders’ Equity<br />

Deposits (Note 8)<br />

Non-interest-bearing deposits $ 36,597,719 47,707,690<br />

Interest-bearing deposits 278,697,521 253,326,079<br />

Total Deposits 315,295,240 301,033,769<br />

Federal funds purchased <strong>and</strong> other borrowed funds 7,078,790 6,125,000<br />

Other liabilities (Note 9) 4,896,836 4,313,960<br />

Total Liabilities $ 327,270,866 $ 311,472,729<br />

Commitments & Contingencies (Note 8 <strong>and</strong> 17)<br />

Stockholders’ Equity<br />

Common stock (Note 11) 851,010 851,010<br />

Surplus 7,053,958 7,053,958<br />

Undivided profits (Note 12) 27,585,808 27,266,538<br />

Accumulated other comprehensive income 760,685 14,626<br />

Total Stockholders’ Equity 36,251,461 35,186,132<br />

Total Liabilities <strong>and</strong> Stockholders’ Equity $ 363,522,327 $ 346,658,861<br />

The accompanying Notes to Financial Statements are an integral part of these statements.<br />

11

<strong>Seaway</strong> Bancshares, Inc. 2008 Annual Report<br />

<strong>Seaway</strong> <strong>Bank</strong> <strong>and</strong> <strong>Trust</strong> <strong>Company</strong><br />

Statements of Income<br />

For the Years Ended December 31, 2008 <strong>and</strong> 2007<br />

Interest Income<br />

2008 2007<br />

Interest <strong>and</strong> fees on loans $ 11,982,006 $ 11,929,081<br />

Interest on investment securities<br />

United States Government Obligations:<br />

US Government <strong>and</strong> Treasuries 5,902,903 5,649,897<br />

Mortgage-Backed Securities 417,510 410,289<br />

Obligations of state <strong>and</strong> political subdivisions 148,519 65,748<br />

Other securities 151,632 118,854<br />

Interest on federal funds sold <strong>and</strong> on other interest-bearing balances 5,013 463,127<br />

Total Interest Income $ 18,607,583 $ 18,636,996<br />

Interest Expense<br />

Interest on time deposits $100,000 or more 4,918,108 5,385,515<br />

Interest on other deposits 1,387,820 2,241,412<br />

Interest on federal funds purchased <strong>and</strong> other borrowed funds 292,529 353,081<br />

Total Interest Expense 6,598,457 7,980,008<br />

Net interest income 12,009,126 10,656,988<br />

Provision for possible loan losses (Note 6) (995,000) (80,000)<br />

Net interest income after provision for possible loan losses $ 11,014,126 $ 10,576,988<br />

Other Income<br />

Service charges on deposit accounts 2,997,496 3,073,580<br />

Other operating income 6,610,010 5,946,556<br />

Gain on sale of investment securities 145,197 —<br />

Total Other Income $ 9,752,703 $ 9,020,136<br />

Other Expenses<br />

Salaries <strong>and</strong> employee benefits (Notes 15 <strong>and</strong> 16) 10,341,935 10,052,723<br />

Occupancy expense of <strong>Bank</strong> premises (Note 7) 2,728,593 2,396,680<br />

Other operating expenses 4,375,248 3,941,190<br />

Total Other Expenses 17,445,776 16,390,593<br />

Income before income taxes 3,321,053 3,206,531<br />

Applicable income taxes (Note 9) (34,700) (5,000)<br />

Net Income $ 3,286,353 $ 3,201,531<br />

Net Income Per Share (Note 11) $ 38.62 $ 37.62<br />

The accompanying Notes to Financial Statements are an integral part of these statements.<br />

12

<strong>Seaway</strong> <strong>Bank</strong> <strong>and</strong> <strong>Trust</strong> <strong>Company</strong><br />

Statements of Cash Flows<br />

For the Years Ended December 31, 2008 <strong>and</strong> 2007<br />

Operating Activities<br />

2008 2007<br />

Net Income $ 3,268,353 $ 3,201,531<br />

Adjustments to reconcile net income to net cash<br />

provided from (used by) operating activities:<br />

Provision for loan losses 995,000 80,000<br />

Provision for depreciation <strong>and</strong> amortization 666,869 567,843<br />

Amortization of investment security premiums 14,109 42,207<br />

Accretion of investment security discounts (148,847) (47,462)<br />

Net change in deferred income taxes (48,370) (6,275)<br />

Net (increase) decrease in interest receivable (83,752) 176,975<br />

Net (decrease) increase in interest payable (511,052) 405,385<br />

Net decrease (increase) in other assets 441,095 (44,952)<br />

Net increase in other liabilities 1,940,942 754,577<br />

Net cash provided from operating activities $ 6,534,347 $ 5,129,829<br />

Investing activities<br />

Proceeds from sales <strong>and</strong> maturities of investment securities available for sale 92,886,740 15,265,000<br />

Principal collected on investment securities available for sale 2,707,305 3,018,158<br />

Principal collected on investment securities held for maturity 182,705 119,957<br />

Purchases of investment securities available for sale (100,972,999) (17,720,909)<br />

Purchases of investment securities held to maturity (214,026) (113,932)<br />

Net increase in long-term loans (16,250,517) (6,799,446)<br />

Purchases of premises <strong>and</strong> equipment (net) (575,607) (847,033)<br />

Net increase in other real estate (157,500) (160,651)<br />

Net cash (used by) investing activities $ (22,393,899) $ (7,238,856)<br />

Financing activities<br />

Net decrease in non-interest-bearing deposits (11,109,971) (23,284,453)<br />

Net increase in interest-bearing deposits 25,371,442 10,481,239<br />

Net increase (decrease) in federal funds purchased <strong>and</strong> other borrowed funds 953,790 (2,923,205)<br />

Cash Dividends paid (2,967,083) (2,800,000)<br />

Net cash provided from (used by) financing activities 12,248,178 (18,526,419)<br />

Net decrease in Cash <strong>and</strong> Cash Equivalents (3,611,374) (20,635,446)<br />

Cash And Cash Equivalents At Beginning of Year 18,410,357 39,045,803<br />

Cash And Cash Equivalents At Year-End $ 14,798,983 $ 18,410,357<br />

Interest Paid $ 6,996,217 $ 7,980,008<br />

The accompanying Notes to Financial Statements are an integral part of these statements.<br />

13

<strong>Seaway</strong> Bancshares, Inc. 2008 Annual Report<br />

<strong>Seaway</strong> <strong>Bank</strong> <strong>and</strong> <strong>Trust</strong> <strong>Company</strong><br />

Statements of Change in Stockholders’ Equity<br />

For the Years Ended December 31, 2008 <strong>and</strong> 2007<br />

Accumulated<br />

Stockholders’<br />

Other<br />

Common undivided Comprehensive Total<br />

Stock Surplus ProfiTS income eQuity<br />

Balance December 31, 2006 $ 851,010 $ 7,053,958 $ 26,865,007 $ (2,270,633) $ 32,499,342<br />

Dividends - $32.90/Share — — (2,800,000) — (2,800,000)<br />

Comprehensive Income<br />

Net Income — — 3,201,531 — 3,201,531<br />

Other Comprehensive Income<br />

Unrealized Gain on Available<br />

for Sale Securities, Net of Tax — — — 2,285,259 2,285,259<br />

Balance December 31, 2007 $ 851,010 $ 7,053,958 $ 27,266,538 $ 14,626 $ 35,186,132<br />

Dividends - $34.86/Share — — (2,967,083) — (2,967,083)<br />

Comprehensive Income<br />

Net Income — — 3,286,353 — 3,286,353<br />

Other Comprehensive Income<br />

Unrealized Gain on Available<br />

for Sale Securities, Net of Tax — — — 746,059 746,059<br />

Balance December 31, 2008 $ 851,010 $ 7,053,958 $ 27,585,808 $ 760,685 $ 36,251,461<br />

The accompanying Notes to Financial Statements are an integral part of these statements.<br />

14

Notes to Financial Statements<br />

For the Years Ended December 31, 2008 <strong>and</strong> 2007<br />

Note 1 — Summary of Significant Accounting <strong>and</strong> Reporting Policies<br />

The financial reporting <strong>and</strong> accounting policies of <strong>Seaway</strong> Bancshares, Inc. (the<br />

“Corporation”) <strong>and</strong> its subsidiary, <strong>Seaway</strong> <strong>Bank</strong> <strong>and</strong> <strong>Trust</strong> <strong>Company</strong> (the “<strong>Bank</strong>”),<br />

conform to accounting principles generally accepted in the United States <strong>and</strong> to<br />

general practices within the banking industry. The following is a summary of the<br />

significant accounting policies.<br />

NATURE OF OPERATIONS<br />

<strong>Seaway</strong> Bancshares, Inc. is a bank holding company whose principal activity is<br />

the ownership <strong>and</strong> management of its wholly-owned subsidiary <strong>Seaway</strong> <strong>Bank</strong><br />

<strong>and</strong> <strong>Trust</strong> <strong>Company</strong>. The <strong>Bank</strong> generates commercial, mortgage <strong>and</strong> consumer<br />

loans <strong>and</strong> receives deposits from customers located primarily in Chicago, Illinois<br />

<strong>and</strong> the surrounding area. On December 30, 2007, the Illinois Department of<br />

Financial <strong>and</strong> Professional Regulation (IDFPR) approved the conversion of<br />

<strong>Seaway</strong> National <strong>Bank</strong> of Chicago to a bank chartered by the State of Illinois.<br />

IDFPR issued a charter to the converting bank under the name of <strong>Seaway</strong> <strong>Bank</strong><br />

<strong>and</strong> <strong>Trust</strong> <strong>Company</strong>. The <strong>Bank</strong> is subject to regulation by the Federal Deposit<br />

Insurance Corporation.<br />

PRINCIPLES OF CONSOLIDATION<br />

The accompanying consolidated financial statements include the accounts of the<br />

Corporation <strong>and</strong> the <strong>Bank</strong>. All intercompany accounts <strong>and</strong> transactions have been<br />

eliminated in the consolidated financial statements.<br />

In accordance with Financial Accounting St<strong>and</strong>ards Board Interpretation<br />

No. 46, (R),“Consolidation of Variable Interest Entities” [“FIN 46 (R)”], the<br />

accompanying consolidated financial statements do not include the accounts of<br />

a wholly-owned financed subsidiary (the “<strong>Trust</strong>”). The <strong>Trust</strong> was formed for the<br />

sole purpose of issuing <strong>Trust</strong> Preferred securities <strong>and</strong>, in turn, purchasing subordinated<br />

debentures from the Corporation.<br />

Under the provisions of FIN 46 (R), the <strong>Trust</strong> is considered a “Variable Interest<br />

Entity” (“VIE”), which can only be consolidated if the Corporation is subject<br />

to a majority of the risk of loss from the VIE activity or is entitled to receive a<br />

majority of the entity’s residual returns. The design of the <strong>Trust</strong>, which is very<br />

common in the banking industry, is such that the Corporation is neither subject<br />

to the majority of risk of loss nor entitled to receive the majority of any residual<br />

returns. As a result, the <strong>Trust</strong> is not consolidated.<br />

The Corporation does, however, report the subordinated debentures sold to<br />

the <strong>Trust</strong> as a liability in the Consolidated Balance Sheets <strong>and</strong> associated interest<br />

expense in the Consolidated Statements of Income.<br />

USE OF ESTIMATES<br />

The preparation of financial statements in conformity with generally accepted<br />

accounting principles in the United States of America requires management to<br />

make estimates <strong>and</strong> assumptions that affect the reported amounts of assets <strong>and</strong><br />

liabilities <strong>and</strong> disclosure of contingent assets <strong>and</strong> liabilities at the date of the financial<br />

statements <strong>and</strong> the reported amounts of revenue <strong>and</strong> expenses during the<br />

reporting period. Actual results could differ from those estimates.<br />

Classification Accounting Treatment<br />

Held-to-Maturity Carried at Amortized Cost<br />

Trading Securities Carried at fair value with unrealized holding<br />

gains <strong>and</strong> losses included in earnings<br />

Available-For-Sale Carried at fair value with unrealized holding gains<br />

<strong>and</strong> losses excluded from earnings, <strong>and</strong> reported as a<br />

separate component of Shareholders’ equity, net of tax,<br />

as accumulated other comprehensive income<br />

The decision to purchase securities is based on a current assessment of expected<br />

economic conditions including the interest rate environment. The determination<br />

to sell such securities is based on management’s assessment of changes in<br />

economic or financial market conditions, interest rate risk <strong>and</strong> balance sheet <strong>and</strong><br />

liquidity positions. The adjusted cost of the specific security sold is the basis for<br />

determining gains <strong>and</strong> losses.<br />

LOANS<br />

The Corporation’s loan portfolio includes residential <strong>and</strong> commercial mortgages<br />

<strong>and</strong> commercial <strong>and</strong> consumer loan products. Loans are stated at unpaid<br />

principal balances less the allowance for loan losses <strong>and</strong> net deferred loan fees <strong>and</strong><br />

unearned discounts. Unearned discount is recognized as income over the terms<br />

of the loan by the sum-of-the-months digit method, the result of which is not<br />

materially different from that obtained by using the interest method. Interest on<br />

other loans is reported on the accrual basis throughout the terms of the loans.<br />

Loans are placed on a non-accrual (cash) basis for recognition of interest<br />

income when interest earned in excess of ninety days is delinquent or principal<br />

is delinquent in excess of ninety days <strong>and</strong> the loan is either not well collateralized<br />

or is in the process of collection. The non-recognition of interest does not<br />

constitute forgiveness of the interest.<br />

ALLOWANCE FOR LOAN LOSSES<br />

The allowance for loan losses is maintained at a level that, in management’s judgment,<br />

is adequate to provide for estimated probable losses from loans. The amount<br />

of the allowance is based on management’s formal review <strong>and</strong> analysis of potential<br />

losses, as well as prevailing economic conditions. The allowance is increased by<br />

provisions for losses, which are charged to earnings <strong>and</strong> reduced by charge-offs,<br />

net of recoveries.<br />

The allowance consists of specific, general, <strong>and</strong> unallocated components. The<br />

specific component relates to loans that are classified as doubtful, subst<strong>and</strong>ard, or<br />

special mention. For such loans that are also classified as impaired, an allowance<br />

is established when the discounted cash flows (or collateral value or observable<br />

market price) of the impaired loan is lower than the carrying value of that loan.<br />

The general component covers non-classified loans <strong>and</strong> is based on historical loss<br />

experience adjusted for qualitative factors. An unallocated component is maintained<br />

to cover uncertainties that could affect management’s estimate of probable<br />

losses.<br />

While management uses available information to recognize losses on loans,<br />

further reduction in the carrying amounts of loans maybe necessary based on<br />

changes in local economic conditions. It is reasonably possible that the estimated<br />

losses on loans may change materially in the near term. However, the amount of<br />

the change that is reasonably possible cannot be estimated.<br />

IMPAIRMENT OF LOANS<br />

Loans are considered impaired when it is probable that the total amount due,<br />

including accrued interest, will not be collected according to the contracted<br />

terms <strong>and</strong> schedules of the Loan Agreement. Income related to impaired loans is<br />

recognized when earned, unless the loan has also been placed on a non-accrual<br />

(cash) basis, for the recognition of interest income.<br />

FEES RELATED TO LENDING ACTIVITIES<br />

Loan origination fees <strong>and</strong> direct loan origination costs that are incurred on a<br />

specific loan are offset against each other <strong>and</strong> the net amount is deferred <strong>and</strong><br />

recognized over the life of the loan as an adjustment of the loans’ yield. Commitment<br />

fees <strong>and</strong> direct loan origination costs that are incurred to make a <strong>commitment</strong><br />

to originate a specific loan shall be offset against each other <strong>and</strong> only the<br />

net amount is deferred <strong>and</strong> recognized over the life of the loan as an adjustment<br />

of the loans’ yield.<br />

PREMISES AND EQUIPMENT<br />

Premises <strong>and</strong> equipment are stated at cost less accumulated depreciation. Depreciation<br />

is computed on the straight-line method over the estimated useful lives of<br />

the related assets, ranging from 3 to 40 years.<br />

INCOME TAXES<br />

Prior to 2001 the Corporation filed a consolidated Federal Income Tax return.<br />

Amounts provided for income taxes were based on income reported for financial<br />

statement purposes. Provisions for deferred income taxes were made as a result of<br />

timing differences between the period in which certain income <strong>and</strong> expenses are<br />

recognized for financial reporting purposes <strong>and</strong> the period in which they affect<br />

taxable income. The principal items causing these timing differences were the<br />

provision for possible loan losses <strong>and</strong> depreciation. Effective January I, 2001, the<br />

Corporation <strong>and</strong> the <strong>Bank</strong> jointly elected to be treated as an S Corporation for<br />

federal income tax purposes. As an S Corporation, both the Corporation <strong>and</strong> the<br />

<strong>Bank</strong> are liable for federal corporate level income taxes on certain “built-in gains”<br />

existing at December 31, 2000, which are recognized after that date <strong>and</strong> any<br />

applicable state corporate level income taxes, (including the Illinois Replacement<br />

Tax). As a further consequence of the S Corporation election, both the Corporation<br />

<strong>and</strong> the <strong>Bank</strong> were required to revalue deferred tax assets <strong>and</strong> liabilities at the<br />

lower statutory tax rates applicable to S Corporations.<br />

In June 2006, the Financial Accounting St<strong>and</strong>ards Board (“FASB”) issued<br />

FASB Interpretation No. 48 (“FIN 48”), “Accounting for Uncertainty in<br />

Income Taxes-an interpretation of FASB Statement No. 109” (“FIN 48”). FIN<br />

48 prescribes a recognition threshold <strong>and</strong> measurement process for recording in<br />

the financial statements uncertain tax positions taken or expected to be taken in a<br />

tax return in accordance with SFAS No. 109 “Accounting for Income Taxes.” Tax<br />

positions must meet a more-likely-than-not recognition threshold at the effective<br />

date to be recognized upon the adoption of FIN 48 <strong>and</strong> in subsequent periods.<br />

The accounting provision of FIN 48 was effective for the Corporation beginning<br />

January 1, 2007. The impact of adoption on the <strong>Bank</strong>’s financial position <strong>and</strong><br />

15

<strong>Seaway</strong> Bancshares, Inc. 2008 Annual Report<br />

results of its operations was not material.<br />

EARNINGS PER SHARE<br />

Earnings per share is computed by dividing income by the weighted average<br />

number of shares outst<strong>and</strong>ing during the period.<br />

CASH FLOW REPORTING<br />

The Corporation uses the indirect method to report cash flows from operating<br />

activities. Under this method, net income is adjusted to reconcile to net cash<br />

flow from operating activities. Net reporting cash transactions is used when the<br />

balance sheet items consist predominantly of maturities of three months or less,<br />

or where otherwise permitted. Other items are reported gross. Cash <strong>and</strong> cash<br />

equivalents consist of cash <strong>and</strong> due from banks.<br />

Derivatives<br />

The Financial Accounting St<strong>and</strong>ard Board (FASB) Statement No. 133, Accounting<br />

for Derivative Instruments <strong>and</strong> Hedging Activities, as amended, established<br />

accounting <strong>and</strong> reporting st<strong>and</strong>ards for derivatives. These st<strong>and</strong>ards require that all<br />

derivatives be recognized at their fair value as either assets or liabilities on the balance<br />

sheet <strong>and</strong> specify the accounting for changes in fair value depending upon<br />

the intended use of the derivative (FAS No. 133, as amended, in the year 2001).<br />

The Corporation’s utilization of derivative instruments for trading or non-trading<br />

is minimal, <strong>and</strong> the provisions of these st<strong>and</strong>ards are not applied because the<br />

impact on the Corporation’s financial statements is not material.<br />

Goodwill<br />

The Corporation adopted FAS 142 effective January 1, 2002. The Corporation<br />

periodically evaluates goodwill for impairment by comparing the carrying value<br />

to implied fair value. The fair value is determined using a reasonable estimate of<br />

future cash flows from operations <strong>and</strong> a risk adjusted discount rate to compute a<br />

net present value of future cash flows. Information pertaining to the accounting<br />

for goodwill is presented in Note 19.<br />

New accounting pronouncement<br />

The Corporation adopted SFAS No. 157, Fair Value Measurements (SFAS 157)<br />

effective January 1, 2008. SFAS 157 defines fair value, establishes a framework<br />

for measuring fair value <strong>and</strong> exp<strong>and</strong>s disclosure of fair value measurements. The<br />

adoption of SFAS 157 did not have a material impact on the consolidated financial<br />

statements or results of operations of the Corporation. In accordance with<br />

Financial Accounting St<strong>and</strong>ards Board Staff Position (FSP) No. 157-2, “Effective<br />

Date of FASB Statement No. 157,” the Corporation will delay application of<br />

SFAS 157 for non-financial assets <strong>and</strong> non-financial liabilities such as goodwill,<br />

other intangibles, real estate owned, <strong>and</strong> repossessed assets until January 1, 2009.<br />

SFAS 157 applies to all assets <strong>and</strong> liabilities that are measured <strong>and</strong> reported on a<br />

fair value basis.<br />

Note 2 — Fair Value of Financial Instruments<br />

The following methods <strong>and</strong> assumptions were used to estimate the fair value of<br />

each class of financial instruments for which it is practicable to estimate such<br />

value:<br />

Cash <strong>and</strong> short-term investments<br />

For those short-term instruments, the carrying amount is a reasonable estimate of<br />

fair value.<br />

Investment securities<br />

Fair value equals the quoted market price, if available. If a quoted market price is<br />

not available, fair value is estimated using quoted market prices for similar investment<br />

securities.<br />

Loans<br />

The fair value is estimated by discounting future cash flows using the appropriate<br />

rate from the treasury yield curve, adjusted for credit risk <strong>and</strong> allocated expense.<br />

Deposit liabilities <strong>and</strong> short-term borrowings<br />

The fair value of dem<strong>and</strong> deposits, savings accounts, NOW <strong>and</strong> money market<br />

deposits is the amount payable on dem<strong>and</strong> at the reporting date. The fair value of<br />

fixed maturity certificates of deposit is estimated by discounting future cash flows<br />

using the appropriate rate from the treasury yield curve adjusted for allocated<br />

expense. For short-term borrowings the carrying amount is a reasonable estimate<br />

of fair value.<br />

Long-term debt <strong>and</strong> securities sold not owned<br />

The fair value of long-term debt <strong>and</strong> securities sold not owned are estimated by<br />

discounting future cash flows using an appropriate rate from the treasury yield<br />

curve adjusted for allocated expenses.<br />

Core Deposit Intangibles<br />

The fair value of core deposit intangibles is the present value of the projected<br />

cash flow of core deposits discounted at the appropriate rate from the treasury<br />

yield curve adjusted for allocated expenses <strong>and</strong> service charge income.<br />

December 31, 2008: consolidated B bank Only<br />

estimated Fair Value Approximate Carrying Value estimated Fair Value Approximate Carrying Value<br />

Financial Assets:<br />

Cash <strong>and</strong> Short-term Investments $ 14,799,000 $ 14,799,000 $ 14,799,000 $ 14,799,000<br />

Investment Securities 137,546,000 137,546,000 137,546,000 137,546,000<br />

Loans 197,755,000 196,823,000 197,755,000 196,823,000<br />

Unallocated Reserves for loan losses — (2,161,000) — (2,161,000)<br />

Loans, Net 197,755,000 194,662,000 197,755,000 194,662,000<br />

Total Financial Assets $ 350,100,000 $ 347,007,000 $ 350,100,000 $ 347,007,000<br />

Financial Liabilities<br />

Deposits 321,764,000 315,281,000 321,778,000 315,295,000<br />

Short-Term Borrowings 1,079,000 1,079,000 1,079,000 1,079,000<br />

Long-Term Debt 12,282,000 12,186,000 9,096,000 6,000,000<br />

Total Financial Liabilities 335,125,000 328,546,000 331,953,000 322,374,000<br />

Core Deposit Intangibles — — — —<br />

Fixed Assets <strong>and</strong> Net Other Assets <strong>and</strong> Liabilities 11,679,000 11,679,000 11,609,000 11,609,000<br />

Net Total Asset Value $ 26,654,000 $ 30,140,000 $ 29,756,000 $ 36,242,000<br />

16

Note 2, continued<br />

December 31, 2007: consolidated B bank Only<br />

estimated Fair Value Approximate Carrying Value estimated Fair Value Approximate Carrying Value<br />

Financial Assets:<br />

Cash <strong>and</strong> Short-term Investments $ 18,463,000 $ 18,463,000 $ 18,462,000 $ 18,462,000<br />

Investment Securities 131,951,000 131,951,000 131,951,000 131,951,000<br />

Loans 177,571,000 181,246,000 177,571,000 181,246,000<br />

Unallocated Reserves for loan losses — (1,840,000) — (1,840,000)<br />

Loan, Net 177,571,000 179,406,000 177,571,000 179,406,000<br />

Total Financial Assets $ 327,985,000 $ 329,820,000 $ 327,984,000 $ 329,819,000<br />

Financial Liabilities<br />

Deposits 300,148,000 300,148,000 301,034,000 301,034,000<br />

Short-Term Borrowings 1,125,000 1,125,000 1,125,000 1,125,000<br />

Long-Term Debt 10,660,000 11,186,000 5,597,000 5,000,000<br />

Total Financial Liabilities 311,933,000 312,459,000 307,756,000 307,159,000<br />

Core Deposit Intangibles 12,631,000 — 12,691,000 —<br />

Fixed Assets <strong>and</strong> Net Other Assets <strong>and</strong> Liabilities 11,747,000 11,747,000 12,528,000 12,528,000<br />

Net Total Asset Value $ 40,430,000 $ 29,108,000 $ 45,447,000 $ 35,188,000<br />

Note 3 — Fair Value Measurements<br />

Effective January 1, 2008 the Corporation adopted the provisions of SFAS No.<br />

157, “Fair Value Measurements” for assets <strong>and</strong> liabilities measured <strong>and</strong> reported at<br />

fair value. SFAS 157 defined fair value, establishes a framework for measuring fair<br />

value <strong>and</strong> exp<strong>and</strong>s disclosures about fair value measurements.<br />

SFAS 157 defines fair value as the price that would be received to sell an asset<br />

or paid to transfer a liability in an orderly transaction between market participants.<br />

SFAS 157 requires the use of valuation techniques that are consistent with<br />

the market approach, the income approach <strong>and</strong>/or the cost approach. Inputs to<br />

valuation techniques refer to the assumptions that market participants would<br />

use in pricing the asset or liability. Inputs may be observable, meaning those that<br />

reflect the assumptions market participants would use in pricing the asset or<br />

liability developed based on market data obtained from independent sources, or<br />

unobservable, meaning those that reflect the reporting entity’s own assumptions<br />

about the assumptions market participants would use in pricing the asset or liability<br />

developed based on the best information available in the circumstances. In<br />

that regard, SFAS 157 established a fair value hierarchy for valuation inputs that<br />

gives the highest priority to quoted prices in active markets for identical assets or<br />

liabilities <strong>and</strong> the lowest priority to unobservable inputs. The fair value hierarchy<br />

is as follows:<br />

Level 1: Quoted prices (unadjusted) for identical assets or liabilities in active<br />

markets that the entity has the ability to access as of the measurement date.<br />

Level 2: Significant other observable inputs other than Level 1 prices such as<br />

quoted prices for similar assets or liabilities; quoted prices in markets that are not<br />

active; or other inputs that are observable or can be corroborated by observable<br />

market data.<br />

Level 3: Significant unobservable inputs that reflect a reporting entity’s own<br />

assumptions about the assumptions that market participants would use in pricing<br />

an asset or liability.<br />

A description of the valuation methodologies used for assets <strong>and</strong> liabilities<br />

measure at fair value, as well as the general classification of such instruments<br />

pursuant to the valuation hierarchy, is set forth below.<br />

Securities Available for Sale<br />

When available, quoted market prices are used to determine the fair value of<br />

investment securities <strong>and</strong> such items are classified within Level 1 of the fair value<br />

hierarchy. An example is U.S. Treasury securities. For other securities, the Corporation<br />

determines fair value based on various sources <strong>and</strong> may apply matrix pricing<br />

with observable prices for similar bonds where a price for the identical bond<br />

is not observable. Securities measured at fair value by such methods are classified<br />

as Level 2. Certain securities are not valued based on observable transactions <strong>and</strong><br />

are, therefore, classified as Level 3. The fair value of these securities is based on<br />

management’s best estimates.<br />

Impaired Loans<br />

Impaired loans are evaluated <strong>and</strong> valued at the time the loan is identified as<br />

impaired, at the lower cost of fair value. Fair value is measured based on the value<br />

of the collateral securing these loans <strong>and</strong> is classified at a level 3 in the fair value<br />

hierarchy. Collateral may be real estate <strong>and</strong>/or business assets including equipment,<br />

inventory <strong>and</strong>/or accounts receivable <strong>and</strong> is determined based on appraisals<br />

by qualified licensed appraisers hired by the Corporation. Appraised <strong>and</strong> reported<br />

values may be discounted based on management’s historical knowledge, changes<br />

in market conditions from the time of valuation, <strong>and</strong>/or management’s expertise<br />

<strong>and</strong> knowledge of the client <strong>and</strong> client’s business.<br />

Loans Held for Sale<br />

Loans held for sale are carried at the lower of cost or market value. The fair value<br />

of loans held for sale is based on what secondary markets are currently offering<br />

for portfolios with similar characteristics. As such, the Corporation classifies loans<br />

subjected to nonrecurring fair value adjustments as Level 2.<br />

Assets <strong>and</strong> Liabilities Recorded at Fair Value on a Recurring Basis<br />

The following table summarizes assets <strong>and</strong> liabilities measured at fair value on a recurring basis as of December 31, 2008, segregated by the level of the valuation inputs<br />

within the fair value hierarchy utilized to measure fair value.<br />

Fair Value Measurements at December 31, 2008 Using:<br />

December 31, 2008 Quoted Prices in Active Significant Other Significant<br />

markets for Identical Observable Inputs unobservable Inputs<br />

Assets (Level 1) (Level 2) (Level 3)<br />

Securities available for sale 137,928,610 1,147,508 136,781,102 —<br />

Assets <strong>and</strong> Liabilities Recorded at Fair Value on a Nonrecurring Basis<br />

The Corporation may be required, from time to time, to measure certain assets <strong>and</strong> liabilities at fair value on a nonrecurring basis in accordance with U.S. generally accepted<br />

accounting principles. These include assets that are measured at the lower of cost or market that were recognized at fair value below cost at the end of the period.<br />

Assets measured at fair value on a nonrecurring basis are included in the table below.<br />

Fair Value Measurements at December 31, 2008 Using:<br />

December 31, 2008 Quoted Prices in Active Significant Other Significant<br />

markets for Identical Observable Inputs unobservable Inputs<br />

Assets (Level 1) (Level 2) (Level 3)<br />

Impaired loans 1,000,000 — — 1,000,000<br />

Loans held for sale 220,918 — 220,918 —<br />

Impaired loans with a carrying amount of $1,060,000 were written down to the fair value $1,000,000 less cost to sell of $100,000 resulting in a valuation allowance of<br />

$160,000 included in the allowance for loan losses.<br />

17

<strong>Seaway</strong> Bancshares, Inc. 2008 Annual Report<br />

Note 4 — Investment Securities<br />

The following is a summary of investment securities classified as available-for-sale at December 31, 2008:<br />

Amortized Cost Gross Unrealized Gross Unrealized F fair Value<br />

holding Gains H holding Losses<br />

Equity Securities $ 1,068.453 79,055 — $ 1,147,508<br />

United States Government Agencies 122,760,860 889,943 — 123,650,803<br />

Obligations of State <strong>and</strong> Political Subdivisions 728,934 12,747 — 741,681<br />

Mortgage-Backed Securities 11,477,493 29,565 — 11,507,058<br />

Other Investment Securities 1,100,000 — (218,440) 881,560<br />

Total $ 137,135,740 1,011,310 (218,440) $ 137,928,610<br />

The following is a summary of Investment securities classified as held-to-maturity at December 31, 2008:<br />

Amortized Cost Gross Unrealized Gross Unrealized F fair Value<br />

holding Gains H holding Losses<br />

Other Investment Securities $ 685,493 — — $ 685,493<br />

Total $ 685,493 — — $ 685,493<br />

At December 31, 2008, investments in debt securities with a fixed maturity, classified as available-for-sale, are scheduled to mature as follows: (based on amortized cost)<br />

maturity<br />

Within One Year One Through Five Years five Through Ten Years After Ten Years<br />

United States Government Agencies $ 12,999,191 12,195,575 47,691,251 $ 49,874,843<br />

Obligations of State <strong>and</strong> Political Subdivisions 578,934 150,000 — —<br />

Mortgage-Backed Securities 30,067 6,658,707 1,720,520 3,068,199<br />

Other Investment Securities — 1,100,000 — —<br />

Total $ 13,608,192 20,104,282 49,411,771 $ 52,943,042<br />

At December 31, 2008, investments in debt securities classified as held-to-maturity are scheduled to mature as follows:<br />

maturity<br />

Within One Year One Through Five Years five Through Ten Years After Ten Years<br />

Other Investment Securities $ 1,477 9,771 9,104 665,141<br />

Total $ 1,477 9,771 9,104 665,141<br />

The following is a summary of investment securities classified as available for sale at December 31, 2007:<br />

Amortized Cost Gross Unrealized Gross Unrealized F fair Value<br />

holding Gains H holding Losses<br />

Equity Securities $ 1,068,453 179,091 — $ 1,247,544<br />

United States Government Agencies 118,076,148 107,681 — 118,183,829<br />

Obligations of State <strong>and</strong> Political Subdivisions 914,853 26,536 — 941,389<br />

Mortgage-Backed Securities 11,110,933 — (124,067) 10,986,866<br />

Other Investment Securities 1,150,000 — (94,710) 1,055,290<br />

Total $ 132,320,387 313,308 (218,777) $ 132,414,918<br />

The following is a summary of investment securities classified as held-to-maturity as of December 31, 2007:<br />

Amortized Cost Gross Unrealized Gross Unrealized F fair Value<br />

holding Gains H holding Losses<br />

Other Investment Securities $ 654,172 — — $ 654,172<br />

Total $ 654,172 — — $ 654,172<br />

At December 31, 2007, investments in debt securities with a fixed maturity, classified as available-for-sale, are scheduled to mature as follows: (based on amortized cost)<br />

maturity<br />

Within One Year One Through Five Years five Through Ten Years After Ten Years<br />

United States Government Agencies $ 6,999,591 31,164,469 43,687,968 $ 36,224,120<br />

Obligations of State <strong>and</strong> Political Subdivisions 190,000 724,853 — —<br />

Mortgage-Backed Securities 220,088 7,363,892 3,275,171 251,782<br />

Other investment Securities $ 50,000 1,000,000 50,000 $ 50,000<br />

Total $ 7,459,679 $ 40,253,214 $ 47,013,139 $ 36,475,902<br />

At December 31, 2007, investments in debt securities classified as held-to-maturity are scheduled to mature as follows:<br />

maturity<br />

Within One Year One Through Five Years five Through Ten Years After Ten Years<br />

Other Investment Securities $ — 14,251 35,980 $ 603,941<br />

Total $ — 14,251 35,980 $ 603,941<br />

18

Note 4, continued<br />

During 2008, sales proceeds <strong>and</strong> gross realized gains <strong>and</strong> losses on investment securities classified as available-for-sale <strong>and</strong> held to maturity were:<br />

Available for Sale<br />

held to Maturity<br />

Sale Proceeds $ 92,886,740 $ —<br />

Gross Realized (Losses) — —<br />

Realized Gains $ 145,197 $ —<br />

During 2007, sales proceeds <strong>and</strong> gross realized gains <strong>and</strong> losses on investment securities classified as available-for-sale <strong>and</strong> held to maturity were:<br />

Available for Sale<br />

held to Maturity<br />

Sale Proceeds $ 15,265,000 $ —<br />

Gross Realized (Losses) — —<br />

Realized Gains $ — $ —<br />

Investment securities carried at approximately $119,683,650 <strong>and</strong> $102,986,212 at December 31, 2008 <strong>and</strong> 2007 respectively, were pledged to secure public deposits <strong>and</strong> for<br />

other purposes required by law.<br />

Note 5 - Loans<br />

Major classifications of loans included in the accompanying Statements of Condition at December 2008 <strong>and</strong> 2007 are as follows:<br />

2008 2007<br />

Consumer Loans $ 3,049,855 $ 4,130,092<br />

Commercial <strong>and</strong> Industrial loans 42,952,122 22,555,480<br />

Real Estate Loans 138,502,493 125,209,853<br />

Real Estate Construction Loans 13,318,078 29,351,302<br />

Gross Loans 196,822,548 181,246,727<br />

Less-Unearned Discount — (123)<br />

Loans, Net of Unearned Discount $ 196,822,548 $ 181,246,604<br />

At December 31, 2008 <strong>and</strong> 2007, loans aggregating $3,400,526 <strong>and</strong> $3,499,068 respectively, were outst<strong>and</strong>ing to Officers, Directors <strong>and</strong> principal shareholders of the<br />

<strong>Bank</strong> or to corporations in which such officers or directors had a beneficial interest. These loans were all made with substantially the same interest rates <strong>and</strong> collateral<br />

requirements as comparable loans to non-related borrowers. During 2008, <strong>and</strong> 2007, new loans to such related parties amounted to $475,305 <strong>and</strong> $459,924 respectively.<br />

Loan repayments during the year amounted to $573,847 <strong>and</strong> $1,104,375 respectively. Non-accrual loans at December 31, 2008 <strong>and</strong> 2007 approximated $10,243,603 <strong>and</strong><br />

$1,868,085 respectively. The amount of interest income, which would have been recorded if the loans were on an accrual basis, would have approximated $691,761 during<br />

2008, <strong>and</strong> $111,357 during 2007. Commercial <strong>and</strong> multi-family real estate loans aggregated approximately $44,939,160 <strong>and</strong> $25,000,200 at December 31,2008 <strong>and</strong><br />

December 31, 2007 respectively. A majority of these properties are located in the Chicago metropolitan area. These loans are collateralized by the related properties <strong>and</strong> the<br />

loan-to-value ratios generally do not exceed 75 percent.<br />

During the year the Corporation made a $5,000,000 loan to the Metavante Corporation. Metavante provides data processing services. The loan was made with substantially<br />

the same interest rate <strong>and</strong> collateral requirements as the comparable loans to non-related borrowers.<br />

Note 6 — Allowance for Possible Loan Losses <strong>and</strong> Impaired Loans<br />

As of December 31, 2008 <strong>and</strong> December 31, 2007, the total recorded investment in impaired loans was $14,815,147 <strong>and</strong> $2,576,824, respectively. Of these amounts, in<br />

2008 <strong>and</strong> 2007, $3,117,666 <strong>and</strong> $936,201 were subject to an allowance for possible loan losses of $552,234 <strong>and</strong> $72,823 respectively. During 2008, the average recorded<br />

investment in impaired loans was $15,265,122 <strong>and</strong> $2,939,857 in 2007. Interest income recognized in 2008 <strong>and</strong> 2007 during the period in which the loans were impaired<br />

was $493,880 <strong>and</strong> $140,588. The amount of income that would have been recorded on a cash basis during 2008 <strong>and</strong> 2007 would have been $564,768 <strong>and</strong> $154,180.<br />

Following is a summary of the activity in the Allowance for Possible Loan Losses:<br />

2008 2007<br />

Balance at Beginning of Year $ 1,840,318 $ 1,734,781<br />

Recoveries credited to the allowance 29,506 335,431<br />

Provision for possible loan losses 995,000 80,000<br />

Loans charged-off (704,079) (309,894)<br />

Balance at End of Year $ 2,160,745 $ 1,840,318<br />

Note 7 — Premises <strong>and</strong> Equipment<br />