Same commitment. - Seaway Bank and Trust Company

Same commitment. - Seaway Bank and Trust Company

Same commitment. - Seaway Bank and Trust Company

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Seaway</strong> Bancshares, Inc. 2008 Annual Report<br />

results of its operations was not material.<br />

EARNINGS PER SHARE<br />

Earnings per share is computed by dividing income by the weighted average<br />

number of shares outst<strong>and</strong>ing during the period.<br />

CASH FLOW REPORTING<br />

The Corporation uses the indirect method to report cash flows from operating<br />

activities. Under this method, net income is adjusted to reconcile to net cash<br />

flow from operating activities. Net reporting cash transactions is used when the<br />

balance sheet items consist predominantly of maturities of three months or less,<br />

or where otherwise permitted. Other items are reported gross. Cash <strong>and</strong> cash<br />

equivalents consist of cash <strong>and</strong> due from banks.<br />

Derivatives<br />

The Financial Accounting St<strong>and</strong>ard Board (FASB) Statement No. 133, Accounting<br />

for Derivative Instruments <strong>and</strong> Hedging Activities, as amended, established<br />

accounting <strong>and</strong> reporting st<strong>and</strong>ards for derivatives. These st<strong>and</strong>ards require that all<br />

derivatives be recognized at their fair value as either assets or liabilities on the balance<br />

sheet <strong>and</strong> specify the accounting for changes in fair value depending upon<br />

the intended use of the derivative (FAS No. 133, as amended, in the year 2001).<br />

The Corporation’s utilization of derivative instruments for trading or non-trading<br />

is minimal, <strong>and</strong> the provisions of these st<strong>and</strong>ards are not applied because the<br />

impact on the Corporation’s financial statements is not material.<br />

Goodwill<br />

The Corporation adopted FAS 142 effective January 1, 2002. The Corporation<br />

periodically evaluates goodwill for impairment by comparing the carrying value<br />

to implied fair value. The fair value is determined using a reasonable estimate of<br />

future cash flows from operations <strong>and</strong> a risk adjusted discount rate to compute a<br />

net present value of future cash flows. Information pertaining to the accounting<br />

for goodwill is presented in Note 19.<br />

New accounting pronouncement<br />

The Corporation adopted SFAS No. 157, Fair Value Measurements (SFAS 157)<br />

effective January 1, 2008. SFAS 157 defines fair value, establishes a framework<br />

for measuring fair value <strong>and</strong> exp<strong>and</strong>s disclosure of fair value measurements. The<br />

adoption of SFAS 157 did not have a material impact on the consolidated financial<br />

statements or results of operations of the Corporation. In accordance with<br />

Financial Accounting St<strong>and</strong>ards Board Staff Position (FSP) No. 157-2, “Effective<br />

Date of FASB Statement No. 157,” the Corporation will delay application of<br />

SFAS 157 for non-financial assets <strong>and</strong> non-financial liabilities such as goodwill,<br />

other intangibles, real estate owned, <strong>and</strong> repossessed assets until January 1, 2009.<br />

SFAS 157 applies to all assets <strong>and</strong> liabilities that are measured <strong>and</strong> reported on a<br />

fair value basis.<br />

Note 2 — Fair Value of Financial Instruments<br />

The following methods <strong>and</strong> assumptions were used to estimate the fair value of<br />

each class of financial instruments for which it is practicable to estimate such<br />

value:<br />

Cash <strong>and</strong> short-term investments<br />

For those short-term instruments, the carrying amount is a reasonable estimate of<br />

fair value.<br />

Investment securities<br />

Fair value equals the quoted market price, if available. If a quoted market price is<br />

not available, fair value is estimated using quoted market prices for similar investment<br />

securities.<br />

Loans<br />

The fair value is estimated by discounting future cash flows using the appropriate<br />

rate from the treasury yield curve, adjusted for credit risk <strong>and</strong> allocated expense.<br />

Deposit liabilities <strong>and</strong> short-term borrowings<br />

The fair value of dem<strong>and</strong> deposits, savings accounts, NOW <strong>and</strong> money market<br />

deposits is the amount payable on dem<strong>and</strong> at the reporting date. The fair value of<br />

fixed maturity certificates of deposit is estimated by discounting future cash flows<br />

using the appropriate rate from the treasury yield curve adjusted for allocated<br />

expense. For short-term borrowings the carrying amount is a reasonable estimate<br />

of fair value.<br />

Long-term debt <strong>and</strong> securities sold not owned<br />

The fair value of long-term debt <strong>and</strong> securities sold not owned are estimated by<br />

discounting future cash flows using an appropriate rate from the treasury yield<br />

curve adjusted for allocated expenses.<br />

Core Deposit Intangibles<br />

The fair value of core deposit intangibles is the present value of the projected<br />

cash flow of core deposits discounted at the appropriate rate from the treasury<br />

yield curve adjusted for allocated expenses <strong>and</strong> service charge income.<br />

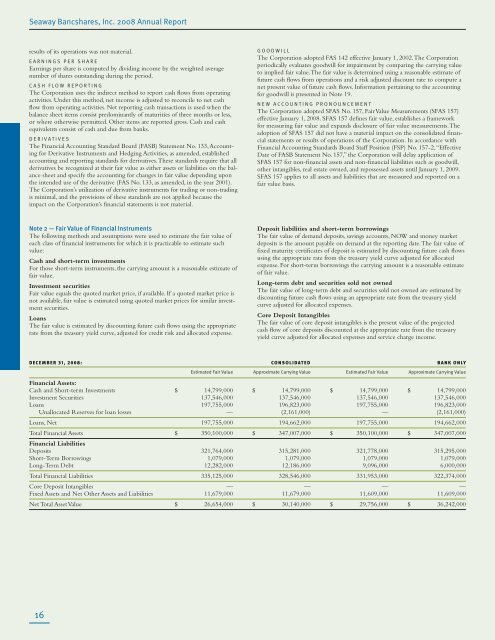

December 31, 2008: consolidated B bank Only<br />

estimated Fair Value Approximate Carrying Value estimated Fair Value Approximate Carrying Value<br />

Financial Assets:<br />

Cash <strong>and</strong> Short-term Investments $ 14,799,000 $ 14,799,000 $ 14,799,000 $ 14,799,000<br />

Investment Securities 137,546,000 137,546,000 137,546,000 137,546,000<br />

Loans 197,755,000 196,823,000 197,755,000 196,823,000<br />

Unallocated Reserves for loan losses — (2,161,000) — (2,161,000)<br />

Loans, Net 197,755,000 194,662,000 197,755,000 194,662,000<br />

Total Financial Assets $ 350,100,000 $ 347,007,000 $ 350,100,000 $ 347,007,000<br />

Financial Liabilities<br />

Deposits 321,764,000 315,281,000 321,778,000 315,295,000<br />

Short-Term Borrowings 1,079,000 1,079,000 1,079,000 1,079,000<br />

Long-Term Debt 12,282,000 12,186,000 9,096,000 6,000,000<br />

Total Financial Liabilities 335,125,000 328,546,000 331,953,000 322,374,000<br />

Core Deposit Intangibles — — — —<br />

Fixed Assets <strong>and</strong> Net Other Assets <strong>and</strong> Liabilities 11,679,000 11,679,000 11,609,000 11,609,000<br />

Net Total Asset Value $ 26,654,000 $ 30,140,000 $ 29,756,000 $ 36,242,000<br />

16