Same commitment. - Seaway Bank and Trust Company

Same commitment. - Seaway Bank and Trust Company

Same commitment. - Seaway Bank and Trust Company

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

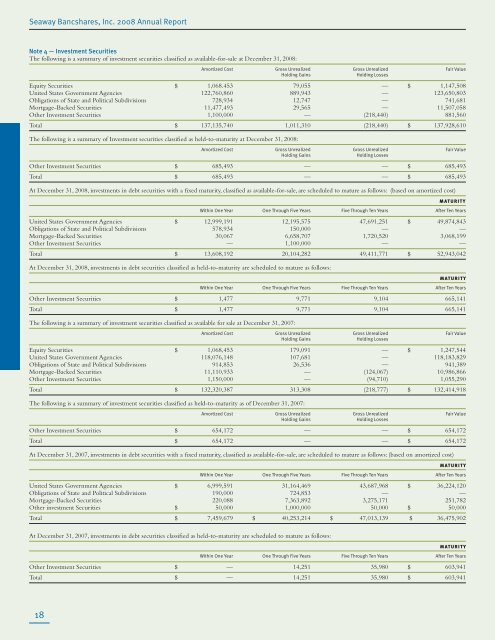

<strong>Seaway</strong> Bancshares, Inc. 2008 Annual Report<br />

Note 4 — Investment Securities<br />

The following is a summary of investment securities classified as available-for-sale at December 31, 2008:<br />

Amortized Cost Gross Unrealized Gross Unrealized F fair Value<br />

holding Gains H holding Losses<br />

Equity Securities $ 1,068.453 79,055 — $ 1,147,508<br />

United States Government Agencies 122,760,860 889,943 — 123,650,803<br />

Obligations of State <strong>and</strong> Political Subdivisions 728,934 12,747 — 741,681<br />

Mortgage-Backed Securities 11,477,493 29,565 — 11,507,058<br />

Other Investment Securities 1,100,000 — (218,440) 881,560<br />

Total $ 137,135,740 1,011,310 (218,440) $ 137,928,610<br />

The following is a summary of Investment securities classified as held-to-maturity at December 31, 2008:<br />

Amortized Cost Gross Unrealized Gross Unrealized F fair Value<br />

holding Gains H holding Losses<br />

Other Investment Securities $ 685,493 — — $ 685,493<br />

Total $ 685,493 — — $ 685,493<br />

At December 31, 2008, investments in debt securities with a fixed maturity, classified as available-for-sale, are scheduled to mature as follows: (based on amortized cost)<br />

maturity<br />

Within One Year One Through Five Years five Through Ten Years After Ten Years<br />

United States Government Agencies $ 12,999,191 12,195,575 47,691,251 $ 49,874,843<br />

Obligations of State <strong>and</strong> Political Subdivisions 578,934 150,000 — —<br />

Mortgage-Backed Securities 30,067 6,658,707 1,720,520 3,068,199<br />

Other Investment Securities — 1,100,000 — —<br />

Total $ 13,608,192 20,104,282 49,411,771 $ 52,943,042<br />

At December 31, 2008, investments in debt securities classified as held-to-maturity are scheduled to mature as follows:<br />

maturity<br />

Within One Year One Through Five Years five Through Ten Years After Ten Years<br />

Other Investment Securities $ 1,477 9,771 9,104 665,141<br />

Total $ 1,477 9,771 9,104 665,141<br />

The following is a summary of investment securities classified as available for sale at December 31, 2007:<br />

Amortized Cost Gross Unrealized Gross Unrealized F fair Value<br />

holding Gains H holding Losses<br />

Equity Securities $ 1,068,453 179,091 — $ 1,247,544<br />

United States Government Agencies 118,076,148 107,681 — 118,183,829<br />

Obligations of State <strong>and</strong> Political Subdivisions 914,853 26,536 — 941,389<br />

Mortgage-Backed Securities 11,110,933 — (124,067) 10,986,866<br />

Other Investment Securities 1,150,000 — (94,710) 1,055,290<br />

Total $ 132,320,387 313,308 (218,777) $ 132,414,918<br />

The following is a summary of investment securities classified as held-to-maturity as of December 31, 2007:<br />

Amortized Cost Gross Unrealized Gross Unrealized F fair Value<br />

holding Gains H holding Losses<br />

Other Investment Securities $ 654,172 — — $ 654,172<br />

Total $ 654,172 — — $ 654,172<br />

At December 31, 2007, investments in debt securities with a fixed maturity, classified as available-for-sale, are scheduled to mature as follows: (based on amortized cost)<br />

maturity<br />

Within One Year One Through Five Years five Through Ten Years After Ten Years<br />

United States Government Agencies $ 6,999,591 31,164,469 43,687,968 $ 36,224,120<br />

Obligations of State <strong>and</strong> Political Subdivisions 190,000 724,853 — —<br />

Mortgage-Backed Securities 220,088 7,363,892 3,275,171 251,782<br />

Other investment Securities $ 50,000 1,000,000 50,000 $ 50,000<br />

Total $ 7,459,679 $ 40,253,214 $ 47,013,139 $ 36,475,902<br />

At December 31, 2007, investments in debt securities classified as held-to-maturity are scheduled to mature as follows:<br />

maturity<br />

Within One Year One Through Five Years five Through Ten Years After Ten Years<br />

Other Investment Securities $ — 14,251 35,980 $ 603,941<br />

Total $ — 14,251 35,980 $ 603,941<br />

18