Same commitment. - Seaway Bank and Trust Company

Same commitment. - Seaway Bank and Trust Company

Same commitment. - Seaway Bank and Trust Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Seaway</strong> Bancshares, Inc. 2008 Annual Report<br />

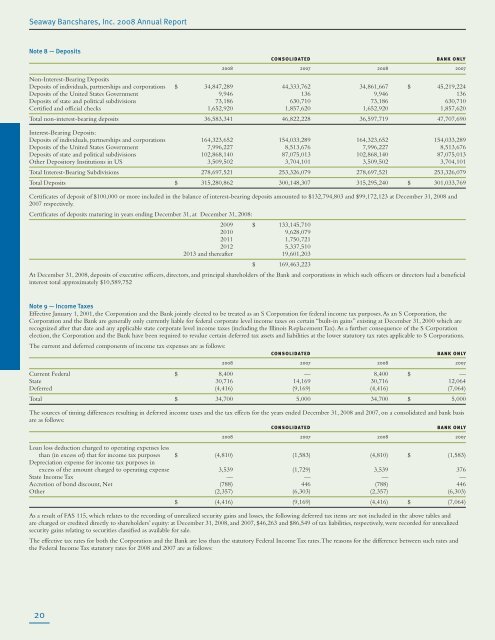

Note 8 — Deposits<br />

consolidated B bank Only<br />

2008 2007 2008 2007<br />

Non-Interest-Bearing Deposits<br />

Deposits of individuals, partnerships <strong>and</strong> corporations $ 34,847,289 44,333,762 34,861,667 $ 45,219,224<br />

Deposits of the United States Government 9,946 136 9,946 136<br />

Deposits of state <strong>and</strong> political subdivisions 73,186 630,710 73,186 630,710<br />

Certified <strong>and</strong> official checks 1,652,920 1,857,620 1,652,920 1,857,620<br />

Total non-interest-bearing deposits 36,583,341 46,822,228 36,597,719 47,707,690<br />

Interest-Bearing Deposits:<br />

Deposits of individuals, partnerships <strong>and</strong> corporations 164,323,652 154,033,289 164,323,652 154,033,289<br />

Deposits of the United States Government 7,996,227 8,513,676 7,996,227 8,513,676<br />

Deposits of state <strong>and</strong> political subdivisions 102,868,140 87,075,013 102,868,140 87,075,013<br />

Other Depository Institutions in US 3,509,502 3,704,101 3,509,502 3,704,101<br />

Total Interest-Bearing Subdivisions 278,697,521 253,326,079 278,697,521 253,326,079<br />

Total Deposits $ 315,280,862 300,148,307 315,295,240 $ 301,033,769<br />

Certificates of deposit of $100,000 or more included in the balance of interest-bearing deposits amounted to $132,794,803 <strong>and</strong> $99,172,123 at December 31, 2008 <strong>and</strong><br />

2007 respectively.<br />

Certificates of deposits maturing in years ending December 31, at December 31, 2008:<br />

2009 $ 133,145,710<br />

2010 9,628,079<br />

2011 1,750,721<br />

2012 5,337,510<br />

2013 <strong>and</strong> thereafter 19,601,203<br />

$ 169,463,223<br />

At December 31, 2008, deposits of executive officers, directors, <strong>and</strong> principal shareholders of the <strong>Bank</strong> <strong>and</strong> corporations in which such officers or directors had a beneficial<br />

interest total approximately $10,589,752<br />

Note 9 — Income Taxes<br />

Effective January 1, 2001, the Corporation <strong>and</strong> the <strong>Bank</strong> jointly elected to be treated as an S Corporation for federal income tax purposes. As an S Corporation, the<br />

Corporation <strong>and</strong> the <strong>Bank</strong> are generally only currently liable for federal corporate level income taxes on certain “built-in gains” existing at December 31, 2000 which are<br />

recognized after that date <strong>and</strong> any applicable state corporate level income taxes (including the Illinois Replacement Tax). As a further consequence of the S Corporation<br />

election, the Corporation <strong>and</strong> the <strong>Bank</strong> have been required to revalue certain deferred tax assets <strong>and</strong> liabilities at the lower statutory tax rates applicable to S Corporations.<br />

The current <strong>and</strong> deferred components of income tax expenses are as follows:<br />

consolidated B bank Only<br />

2008 2007 2008 2007<br />

Current Federal $ 8,400 — 8,400 $ —<br />

State 30,716 14,169 30,716 12,064<br />

Deferred (4,416) (9,169) (4,416) (7,064)<br />

Total $ 34,700 5,000 34,700 $ 5,000<br />

The sources of timing differences resulting in deferred income taxes <strong>and</strong> the tax effects for the years ended December 31, 2008 <strong>and</strong> 2007, on a consolidated <strong>and</strong> bank basis<br />

are as follows:<br />

consolidated B bank Only<br />

2008 2007 2008 2007<br />

Loan loss deduction charged to operating expenses less<br />

than (in excess of) that for income tax purposes $ (4,810) (1,583) (4,810) $ (1,583)<br />

Depreciation expense for income tax purposes in<br />

excess of the amount charged to operating expense 3,539 (1,729) 3,539 376<br />

State Income Tax — — — —<br />

Accretion of bond discount, Net (788) 446 (788) 446<br />

Other (2,357) (6,303) (2,357) (6,303)<br />

$ (4,416) (9,169) (4,416) $ (7,064)<br />

As a result of FAS 115, which relates to the recording of unrealized security gains <strong>and</strong> losses, the following deferred tax items are not included in the above tables <strong>and</strong><br />

are charged or credited directly to shareholders’ equity: at December 31, 2008, <strong>and</strong> 2007, $46,263 <strong>and</strong> $86,549 of tax liabilities, respectively, were recorded for unrealized<br />

security gains relating to securities classified as available for sale.<br />

The effective tax rates for both the Corporation <strong>and</strong> the <strong>Bank</strong> are less than the statutory Federal Income Tax rates. The reasons for the difference between such rates <strong>and</strong><br />

the Federal Income Tax statutory rates for 2008 <strong>and</strong> 2007 are as follows:<br />

20