Annual report and accounts - Cattles Limited

Annual report and accounts - Cattles Limited

Annual report and accounts - Cattles Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Cattles</strong> plc <strong>Annual</strong> Report <strong>and</strong> Financial Statements 2004<br />

49<br />

1 Accounting policies continued<br />

(n)<br />

(o)<br />

(p)<br />

(q)<br />

Leasing<br />

Assets held under finance leases <strong>and</strong> hire purchase contracts are capitalised at their fair value on the inception of the<br />

agreement <strong>and</strong> depreciated over the shorter of the period of the agreement <strong>and</strong> the estimated useful economic lives of the<br />

assets. The finance charges are allocated over the period of the agreement in proportion to the capital amount outst<strong>and</strong>ing<br />

<strong>and</strong> are charged to the profit <strong>and</strong> loss account.<br />

Rentals payable under operating leases are charged to the profit <strong>and</strong> loss account over the period of the lease on a straight<br />

line basis.<br />

Borrowings<br />

Interest payable on bank borrowings, debenture loans <strong>and</strong> other borrowings is charged to the profit <strong>and</strong> loss account as it is<br />

incurred. Accrued finance charges <strong>and</strong> issue costs in relation to debenture loans, <strong>and</strong> facility fees in relation to bank<br />

borrowings, are charged to the profit <strong>and</strong> loss account over the term of the loan <strong>and</strong> facility respectively.<br />

Hedging<br />

(i)<br />

Interest rate hedging<br />

The group manages the risk of the exposure of floating rate borrowings to adverse interest rate fluctuations by the use of<br />

financial hedging instruments, primarily swaps. Amounts payable or receivable in respect of these hedging instruments<br />

are recognised as adjustments to the interest expense over the period of the contracts.<br />

The cost of any premium paid for the purchase of other financial hedging instruments, such as interest rate caps or<br />

collars, is amortised on a straight line basis over the life of the contract <strong>and</strong> reflected in the profit <strong>and</strong> loss account in the<br />

total charge for interest on borrowings.<br />

(ii) Foreign currencies<br />

All foreign currency denominated borrowings are immediately swapped into Sterling at the commencement of the facility<br />

agreement. Consequently, the group is not exposed to currency rate fluctuations. These borrowings are translated at the<br />

hedged rate.<br />

Current asset investments<br />

During 2004 the reinsurance company changed its current asset investment policy from a managed fund of mainly fixed<br />

interest securities <strong>and</strong> bonds to wholly fixed interest bank deposits. Prior to the change, the managed fund investments were<br />

stated at market value, in accordance with the Association of British Insurers Statement of Recommended Practice on<br />

accounting for insurance business, with unrealised gains <strong>and</strong> losses arising from changes in the market value of such<br />

securities <strong>and</strong> bonds being credited or charged to the profit <strong>and</strong> loss account.<br />

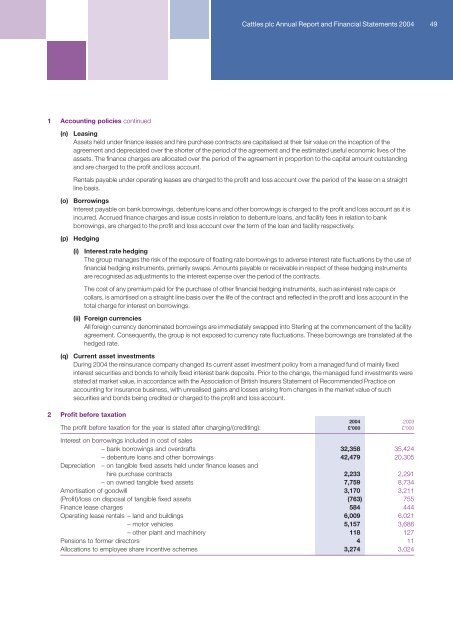

2 Profit before taxation<br />

2004 2003<br />

The profit before taxation for the year is stated after charging/(crediting): £’000 £’000<br />

Interest on borrowings included in cost of sales<br />

– bank borrowings <strong>and</strong> overdrafts 32,358 35,424<br />

– debenture loans <strong>and</strong> other borrowings 42,479 20,305<br />

Depreciation – on tangible fixed assets held under finance leases <strong>and</strong><br />

hire purchase contracts 2,233 2,291<br />

– on owned tangible fixed assets 7,759 8,734<br />

Amortisation of goodwill 3,170 3,211<br />

(Profit)/loss on disposal of tangible fixed assets (763) 755<br />

Finance lease charges 584 444<br />

Operating lease rentals – l<strong>and</strong> <strong>and</strong> buildings 6,009 6,021<br />

– motor vehicles 5,157 3,686<br />

– other plant <strong>and</strong> machinery 118 127<br />

Pensions to former directors 4 11<br />

Allocations to employee share incentive schemes 3,274 3,024