Annual report and accounts - Cattles Limited

Annual report and accounts - Cattles Limited

Annual report and accounts - Cattles Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

64 <strong>Cattles</strong> plc <strong>Annual</strong> Report <strong>and</strong> Financial Statements 2004<br />

Notes to the Accounts<br />

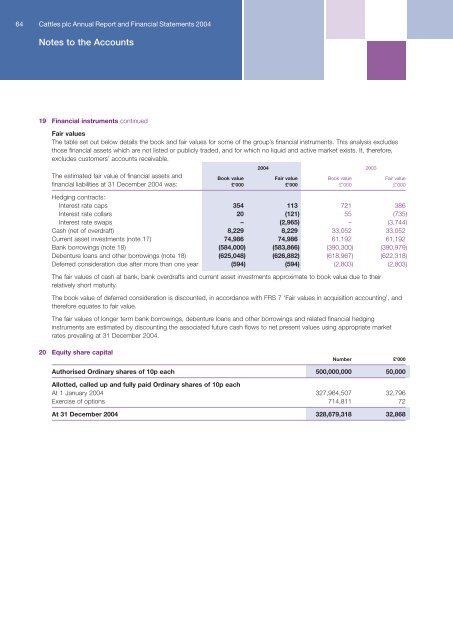

19 Financial instruments continued<br />

Fair values<br />

The table set out below details the book <strong>and</strong> fair values for some of the group’s financial instruments. This analysis excludes<br />

those financial assets which are not listed or publicly traded, <strong>and</strong> for which no liquid <strong>and</strong> active market exists. It, therefore,<br />

excludes customers’ <strong>accounts</strong> receivable.<br />

2004 2003<br />

The estimated fair value of financial assets <strong>and</strong> Book value Fair value Book value Fair value<br />

financial liabilities at 31 December 2004 was: £’000 £’000 £’000 £’000<br />

Hedging contracts:<br />

Interest rate caps 354 113 721 386<br />

Interest rate collars 20 (121) 55 (735)<br />

Interest rate swaps – (2,965) – (3,744)<br />

Cash (net of overdraft) 8,229 8,229 33,052 33,052<br />

Current asset investments (note 17) 74,986 74,986 61,192 61,192<br />

Bank borrowings (note 18) (584,000) (583,866) (390,300) (390,979)<br />

Debenture loans <strong>and</strong> other borrowings (note 18) (625,048) (626,882) (618,967) (622,318)<br />

Deferred consideration due after more than one year (594) (594) (2,803) (2,803)<br />

The fair values of cash at bank, bank overdrafts <strong>and</strong> current asset investments approximate to book value due to their<br />

relatively short maturity.<br />

The book value of deferred consideration is discounted, in accordance with FRS 7 ‘Fair values in acquisition accounting’, <strong>and</strong><br />

therefore equates to fair value.<br />

The fair values of longer term bank borrowings, debenture loans <strong>and</strong> other borrowings <strong>and</strong> related financial hedging<br />

instruments are estimated by discounting the associated future cash flows to net present values using appropriate market<br />

rates prevailing at 31 December 2004.<br />

20 Equity share capital<br />

Number £’000<br />

Authorised Ordinary shares of 10p each 500,000,000 50,000<br />

Allotted, called up <strong>and</strong> fully paid Ordinary shares of 10p each<br />

At 1 January 2004 327,964,507 32,796<br />

Exercise of options 714,811 72<br />

At 31 December 2004 328,679,318 32,868