Annual report and accounts - Cattles Limited

Annual report and accounts - Cattles Limited

Annual report and accounts - Cattles Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Cattles</strong> plc <strong>Annual</strong> Report <strong>and</strong> Financial Statements 2004<br />

61<br />

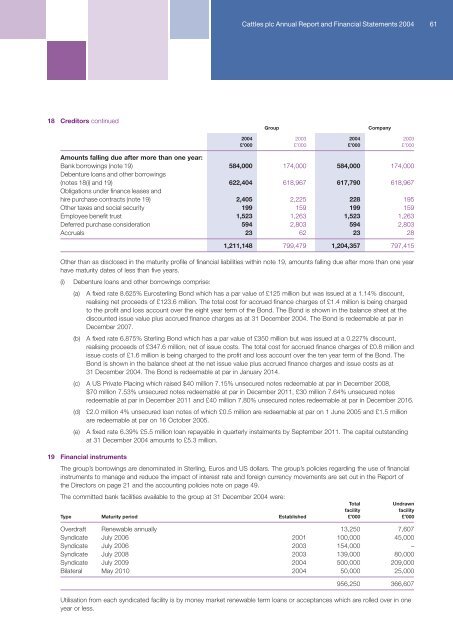

18 Creditors continued<br />

Group<br />

Company<br />

2004 2003 2004 2003<br />

£’000 £’000 £’000 £’000<br />

Amounts falling due after more than one year:<br />

Bank borrowings (note 19) 584,000 174,000 584,000 174,000<br />

Debenture loans <strong>and</strong> other borrowings<br />

(notes 18(i) <strong>and</strong> 19) 622,404 618,967 617,790 618,967<br />

Obligations under finance leases <strong>and</strong><br />

hire purchase contracts (note 19) 2,405 2,225 228 195<br />

Other taxes <strong>and</strong> social security 199 159 199 159<br />

Employee benefit trust 1,523 1,263 1,523 1,263<br />

Deferred purchase consideration 594 2,803 594 2,803<br />

Accruals 23 62 23 28<br />

1,211,148 799,479 1,204,357 797,415<br />

Other than as disclosed in the maturity profile of financial liabilities within note 19, amounts falling due after more than one year<br />

have maturity dates of less than five years.<br />

(i) Debenture loans <strong>and</strong> other borrowings comprise:<br />

(a) A fixed rate 8.625% Eurosterling Bond which has a par value of £125 million but was issued at a 1.14% discount,<br />

realising net proceeds of £123.6 million. The total cost for accrued finance charges of £1.4 million is being charged<br />

to the profit <strong>and</strong> loss account over the eight year term of the Bond. The Bond is shown in the balance sheet at the<br />

discounted issue value plus accrued finance charges as at 31 December 2004. The Bond is redeemable at par in<br />

December 2007.<br />

(b) A fixed rate 6.875% Sterling Bond which has a par value of £350 million but was issued at a 0.227% discount,<br />

realising proceeds of £347.6 million, net of issue costs. The total cost for accrued finance charges of £0.8 million <strong>and</strong><br />

issue costs of £1.6 million is being charged to the profit <strong>and</strong> loss account over the ten year term of the Bond. The<br />

Bond is shown in the balance sheet at the net issue value plus accrued finance charges <strong>and</strong> issue costs as at<br />

31 December 2004. The Bond is redeemable at par in January 2014.<br />

(c) A US Private Placing which raised $40 million 7.15% unsecured notes redeemable at par in December 2008,<br />

$70 million 7.53% unsecured notes redeemable at par in December 2011, £30 million 7.64% unsecured notes<br />

redeemable at par in December 2011 <strong>and</strong> £40 million 7.80% unsecured notes redeemable at par in December 2016.<br />

(d)<br />

(e)<br />

£2.0 million 4% unsecured loan notes of which £0.5 million are redeemable at par on 1 June 2005 <strong>and</strong> £1.5 million<br />

are redeemable at par on 16 October 2005.<br />

A fixed rate 6.39% £5.5 million loan repayable in quarterly instalments by September 2011. The capital outst<strong>and</strong>ing<br />

at 31 December 2004 amounts to £5.3 million.<br />

19 Financial instruments<br />

The group’s borrowings are denominated in Sterling, Euros <strong>and</strong> US dollars. The group’s policies regarding the use of financial<br />

instruments to manage <strong>and</strong> reduce the impact of interest rate <strong>and</strong> foreign currency movements are set out in the Report of<br />

the Directors on page 21 <strong>and</strong> the accounting policies note on page 49.<br />

The committed bank facilities available to the group at 31 December 2004 were:<br />

Total<br />

Undrawn<br />

facility<br />

facility<br />

Type Maturity period Established £’000 £’000<br />

Overdraft Renewable annually 13,250 7,607<br />

Syndicate July 2006 2001 100,000 45,000<br />

Syndicate July 2006 2003 154,000 –<br />

Syndicate July 2008 2003 139,000 80,000<br />

Syndicate July 2009 2004 500,000 209,000<br />

Bilateral May 2010 2004 50,000 25,000<br />

956,250 366,607<br />

Utilisation from each syndicated facility is by money market renewable term loans or acceptances which are rolled over in one<br />

year or less.