Annual report and accounts - Cattles Limited

Annual report and accounts - Cattles Limited

Annual report and accounts - Cattles Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Cattles</strong> plc <strong>Annual</strong> Report <strong>and</strong> Financial Statements 2004<br />

55<br />

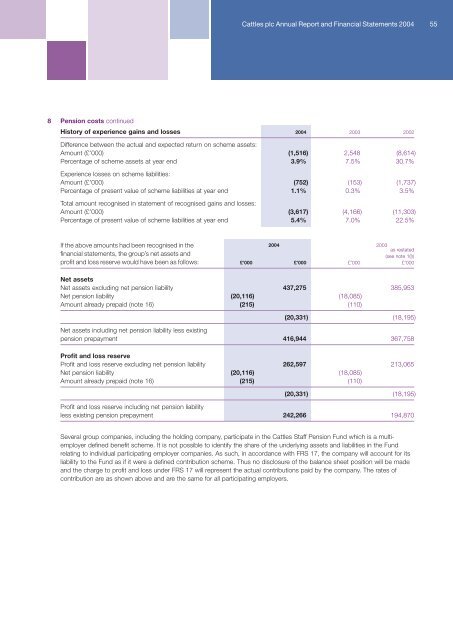

8 Pension costs continued<br />

History of experience gains <strong>and</strong> losses 2004 2003 2002<br />

Difference between the actual <strong>and</strong> expected return on scheme assets:<br />

Amount (£’000) (1,516) 2,548 (8,614)<br />

Percentage of scheme assets at year end 3.9% 7.5% 30.7%<br />

Experience losses on scheme liabilities:<br />

Amount (£’000) (752) (153) (1,737)<br />

Percentage of present value of scheme liabilities at year end 1.1% 0.3% 3.5%<br />

Total amount recognised in statement of recognised gains <strong>and</strong> losses:<br />

Amount (£’000) (3,617) (4,166) (11,303)<br />

Percentage of present value of scheme liabilities at year end 5.4% 7.0% 22.5%<br />

If the above amounts had been recognised in the<br />

financial statements, the group’s net assets <strong>and</strong><br />

profit <strong>and</strong> loss reserve would have been as follows:<br />

2004 2003<br />

as restated<br />

(see note 1(l))<br />

£’000 £’000 £’000 £’000<br />

Net assets<br />

Net assets excluding net pension liability 437,275 385,953<br />

Net pension liability (20,116) (18,085)<br />

Amount already prepaid (note 16) (215) (110)<br />

(20,331) (18,195)<br />

Net assets including net pension liability less existing<br />

pension prepayment 416,944 367,758<br />

Profit <strong>and</strong> loss reserve<br />

Profit <strong>and</strong> loss reserve excluding net pension liability 262,597 213,065<br />

Net pension liability (20,116) (18,085)<br />

Amount already prepaid (note 16) (215) (110)<br />

(20,331) (18,195)<br />

Profit <strong>and</strong> loss reserve including net pension liability<br />

less existing pension prepayment 242,266 194,870<br />

Several group companies, including the holding company, participate in the <strong>Cattles</strong> Staff Pension Fund which is a multiemployer<br />

defined benefit scheme. It is not possible to identify the share of the underlying assets <strong>and</strong> liabilities in the Fund<br />

relating to individual participating employer companies. As such, in accordance with FRS 17, the company will account for its<br />

liability to the Fund as if it were a defined contribution scheme. Thus no disclosure of the balance sheet position will be made<br />

<strong>and</strong> the charge to profit <strong>and</strong> loss under FRS 17 will represent the actual contributions paid by the company. The rates of<br />

contribution are as shown above <strong>and</strong> are the same for all participating employers.