COMMERCIAL REAL ESTATE MARKET - Knight Frank

COMMERCIAL REAL ESTATE MARKET - Knight Frank

COMMERCIAL REAL ESTATE MARKET - Knight Frank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2009<br />

Commercial<br />

real estate market<br />

Moscow<br />

Balance of payments and<br />

international reserves<br />

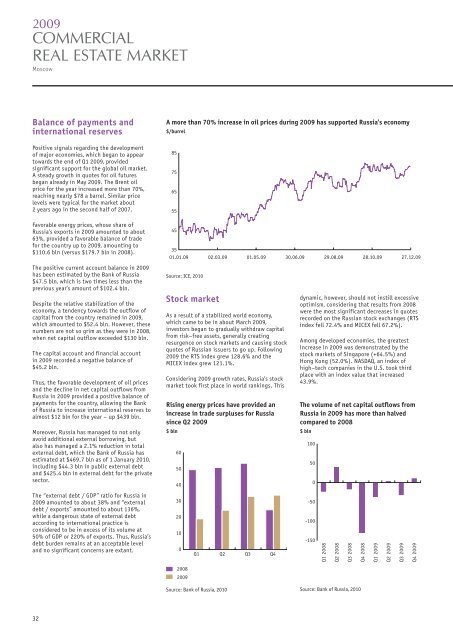

A more than 70% increase in oil prices during 2009 has supported Russia's economy<br />

$/burrel<br />

Positive signals regarding the development<br />

of major economies, which began to appear<br />

towards the end of Q1 2009, provided<br />

significant support for the global oil market.<br />

A steady growth in quotes for oil futures<br />

began already in May 2009. The Brent oil<br />

price for the year increased more than 70%,<br />

reaching nearly $78 a barrel. Similar price<br />

levels were typical for the market about<br />

2 years ago in the second half of 2007.<br />

Favorable energy prices, whose share of<br />

Russia's exports in 2009 amounted to about<br />

63%, provided a favorable balance of trade<br />

for the country up to 2009, amounting to<br />

$110.6 bln (versus $179.7 bln in 2008).<br />

85<br />

75<br />

65<br />

55<br />

45<br />

35<br />

01.01.09 02.03.09 01.05.09 30.06.09 29.08.09 28.10.09 27.12.09<br />

The positive current account balance in 2009<br />

has been estimated by the Bank of Russia<br />

$47.5 bln, which is two times less than the<br />

previous year’s amount of $102.4 bln.<br />

Despite the relative stabilization of the<br />

economy, a tendency towards the outflow of<br />

capital from the country remained in 2009,<br />

which amounted to $52.4 bln. However, these<br />

numbers are not so grim as they were in 2008,<br />

when net capital outflow exceeded $130 bln.<br />

The capital account and financial account<br />

in 2009 recorded a negative balance of<br />

$45.2 bln.<br />

Thus, the favorable development of oil prices<br />

and the decline in net capital outflows from<br />

Russia in 2009 provided a positive balance of<br />

payments for the country, allowing the Bank<br />

of Russia to increase international reserves to<br />

almost $12 bln for the year – up $439 bln.<br />

Moreover, Russia has managed to not only<br />

avoid additional external borrowing, but<br />

also has managed a 2.1% reduction in total<br />

external debt, which the Bank of Russia has<br />

estimated at $469.7 bln as of 1 January 2010,<br />

including $44.3 bln in public external debt<br />

and $425.4 bln in external debt for the private<br />

sector.<br />

Source: ICE, 2010<br />

Stock market<br />

As a result of a stabilized world economy,<br />

which came to be in about March 2009,<br />

investors began to gradually withdraw capital<br />

from risk–free assets, generally creating<br />

resurgence on stock markets and causing stock<br />

quotes of Russian issuers to go up. Following<br />

2009 the RTS index grew 128.6% and the<br />

MICEX index grew 121.1%.<br />

Considering 2009 growth rates, Russia's stock<br />

market took first place in world rankings. This<br />

Rising energy prices have provided an<br />

increase in trade surpluses for Russia<br />

since Q2 2009<br />

$ bln<br />

60<br />

50<br />

40<br />

dynamic, however, should not instill excessive<br />

optimism, considering that results from 2008<br />

were the most significant decreases in quotes<br />

recorded on the Russian stock exchanges (RTS<br />

index fell 72.4% and MICEX fell 67.2%).<br />

Among developed economies, the greatest<br />

increase in 2009 was demonstrated by the<br />

stock markets of Singapore (+64.5%) and<br />

Hong Kong (52.0%). NASDAQ, an index of<br />

high–tech companies in the U.S. took third<br />

place with an index value that increased<br />

43.9%.<br />

The volume of net capital outflows from<br />

Russia in 2009 has more than halved<br />

compared to 2008<br />

$ bln<br />

100<br />

50<br />

0<br />

The “external debt / GDP” ratio for Russia in<br />

2009 amounted to about 38% and “external<br />

debt / exports” amounted to about 136%,<br />

while a dangerous state of external debt<br />

according to international practice is<br />

considered to be in excess of its volume at<br />

50% of GDP or 220% of exports. Thus, Russia’s<br />

debt burden remains at an acceptable level<br />

and no significant concerns are extant.<br />

30<br />

20<br />

10<br />

0<br />

Q1 Q2 Q3 Q4<br />

50<br />

100<br />

150<br />

Q1 2008<br />

Q2 2008<br />

Q3 2008<br />

Q4 2008<br />

Q1 2009<br />

Q2 2009<br />

Q3 2009<br />

Q4 2009<br />

2008<br />

2009<br />

Source: Bank of Russia, 2010<br />

Source: Bank of Russia, 2010<br />

32

![[PDF] ÐÑогÑамма меÑоÐÑиÑÑÐ¸Ñ - Knight Frank](https://img.yumpu.com/43099779/1/184x260/pdf-n-3-4-n-1-4-1-4-1-4-un-3-4-nnnn-knight-frank.jpg?quality=85)

![[PDF] Ð Ñнок коммеÑÑеÑкой недвижимоÑÑи - Knight Frank](https://img.yumpu.com/36235407/1/184x260/pdf-n-1-2-3-4-3-4-1-4-1-4-unnun-3-4-1-2-u-1-4-3-4-nn-knight-frank.jpg?quality=85)

![[PDF] ÐлиÑÐ½Ð°Ñ Ð¶Ð¸Ð»Ð°Ñ Ð½ÐµÐ´Ð²Ð¸Ð¶Ð¸Ð¼Ð¾ÑÑÑ - Knight Frank](https://img.yumpu.com/35569291/1/184x260/pdf-n-1-2-n-n-1-2-u-1-4-3-4-nnn-knight-frank.jpg?quality=85)

![[pdf] ÑÑнок оÑиÑной недвижимоÑÑи - Knight Frank](https://img.yumpu.com/34340947/1/184x260/pdf-nn-1-2-3-4-3-4-nn-1-2-3-4-1-2-u-1-4-3-4-nn-knight-frank.jpg?quality=85)

![[PDF] СкладÑкой ÑÐµÐ³Ð¼ÐµÐ½Ñ - Knight Frank](https://img.yumpu.com/31048046/1/184x260/pdf-n-3-4-nu-1-4-u-1-2-n-knight-frank.jpg?quality=85)