Equinox IR Print - fixed CoD - Barclays Capital

Equinox IR Print - fixed CoD - Barclays Capital

Equinox IR Print - fixed CoD - Barclays Capital

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

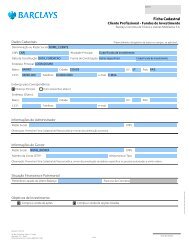

EQUINOX (ECLIPSE 2006-1) plc<br />

LOAN BY LOAN INFORMATION<br />

Loan Details Loan Amortisation Lease Break and Maturity Profile<br />

Loan Name Holland Park Towers Period Scheduled amortisation 100%<br />

Loan ID 6 Jul-06 -<br />

Senior Loan<br />

Oct-06 -<br />

80%<br />

Cut-Off Date Senior Loan balance<br />

21,700,000 Jan-07 -<br />

Current Balance<br />

21,431,000 Apr-07 -<br />

60%<br />

Loan Factor<br />

98.76% Jul-07 -<br />

Interest Rate<br />

5.71127% Oct-07 -<br />

40%<br />

Swap Fixed Rate 4.76600% Jan-08 -<br />

Loan balloon<br />

Margin 0.88802% Apr-08 -<br />

20%<br />

% Lease remaining to maturity<br />

All-in Interest Rate 5.65402% Jul-08 -<br />

% Lease remaining to break<br />

NOI 466,166 Oct-08 -<br />

0%<br />

Current ICR<br />

155.61% Jan-09 -<br />

Current DSCR<br />

119.66% Apr-09 -<br />

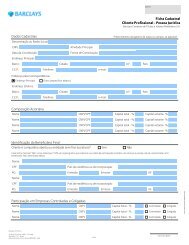

Projected ICR 155.10% Jul-09 91,000<br />

Current LTV<br />

69.13% Oct-09 88,000 Projected Loan Balance (Servicer report date to loan maturity)<br />

Whole Loan Jan-10 90,000<br />

Current Balance 25,131,000 Apr-10 99,000<br />

25,000,000<br />

Loan Factor 98.94% Jul-10 96,000<br />

Interest Rate 5.81600% Oct-10 94,000<br />

20,000,000<br />

Swap Fixed Rate 4.76600% Jan-11 95,000<br />

Margin 1.05000% Apr-11 105,000<br />

15,000,000<br />

All-in Interest Rate 5.81600% Jul-11 102,000<br />

Current ICR 126.08% Oct-11 100,000<br />

10,000,000<br />

Current DSCR 101.40% Jan-12 101,000<br />

Cash Trap ICR 125.00% Apr-12 106,000<br />

5,000,000<br />

Default ICR 110.00% Jul-12 108,000<br />

Projected ICR 127.84% Oct-12 106,000<br />

0<br />

Current LTV 81.07% Jan-13 107,000<br />

# of properties 1 Apr-13 117,000<br />

# of units 2 Jul-13 115,000<br />

Remaining loan term 6.00 years Oct-13 113,000 ICR History<br />

Jan-14 115,000<br />

Tenant Concentration Apr-14 124,000<br />

3.0<br />

ID % Rent WA lease expiry to WA lease expiry to Jul-14 122,000<br />

2.5<br />

first break (years) lease maturity (years) Oct-14 120,000<br />

Tenant 1 100.00% 8.37 years 10.38 years Jan-15 120,000<br />

2.0<br />

Tenant 2 - - - Apr-15 131,000<br />

Tenant 3 - - - Jul-15 129,000<br />

1.5<br />

Tenant 4 - - - Oct-15 127,000<br />

1.0<br />

Tenant 5 - - - Jan-16 18,879,000<br />

Subtotal 100.00% 8.37 years 10.38 years<br />

0.5<br />

Rest - - -<br />

0.0<br />

Total 100.00% 8.37 years 10.38 years<br />

Property Concentration<br />

ID Region % Total DSCR History<br />

Property 1 Greater London 100.00%<br />

- - -<br />

3.0<br />

- - -<br />

2.5<br />

Jan-10<br />

Cut off<br />

Apr-10<br />

Jan-10<br />

Oct-06<br />

Apr-10<br />

Jul-10<br />

Jul-10<br />

Apr-07<br />

Oct-10<br />

Oct-10<br />

Jan-11<br />

Oct-07<br />

Jan-11<br />

Apr-11<br />

Apr-11<br />

Apr-08<br />

Jul-11<br />

Jul-11<br />

Oct-08<br />

Oct-11<br />

Oct-11<br />

Apr-09<br />

Jan-12<br />

Jan-12<br />

Apr-12<br />

Apr-12<br />

Oct-09<br />

Jul-12<br />

Jul-12<br />

Apr-10<br />

Oct-12<br />

Oct-12<br />

Jan-13<br />

Oct-10<br />

Jan-13<br />

Apr-13<br />

Apr-13<br />

Apr-11<br />

Jul-13<br />

Jul-13<br />

Oct-13<br />

Oct-11<br />

Oct-13<br />

Jan-14<br />

Apr-12<br />

Jan-14<br />

Apr-14<br />

Apr-14<br />

Jul-14<br />

Oct-12<br />

Jul-14<br />

Oct-14<br />

Apr-13<br />

Jan-15<br />

Oct-14<br />

Oct-13<br />

Apr-15<br />

Jan-15<br />

Jul-15<br />

Apr-14<br />

Apr-15<br />

Oct-15<br />

Jul-15<br />

Oct-14<br />

Jan-16<br />

Oct-15<br />

Apr-16<br />

Apr-15<br />

Jan-16<br />

Jul-16<br />

Oct-15<br />

- - -<br />

- - -<br />

Subtotal - 100.00%<br />

Rest - -<br />

Total - 100.00%<br />

Loan Comment<br />

This loan is secured against an office building located in West London, with one tenant.<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

Cut off<br />

Oct-06<br />

Apr-07<br />

Oct-07<br />

Apr-08<br />

Oct-08<br />

Apr-09<br />

Oct-09<br />

Apr-10<br />

Oct-10<br />

Apr-11<br />

Oct-11<br />

Apr-12<br />

Oct-12<br />

Apr-13<br />

Oct-13<br />

Apr-14<br />

Oct-14<br />

Apr-15<br />

Oct-15<br />

There is a <strong>fixed</strong> interest rate and lease (rent paid in full), with no uplifts in the next year. ICR remains constant, both historic & projected.<br />

There are no irrecoverable costs as this building is fully let on an FRI lease.<br />

Amortisation took place (£90,000) so DSCR is just over 1x, (whole loan) as modelled. Actual ICR of 126% and projected ICR of 127% (whole loan) is above the<br />

cash trap of 125% so surplus funds to be released.<br />

Page 20 of 29