Download This Feature

Download This Feature

Download This Feature

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

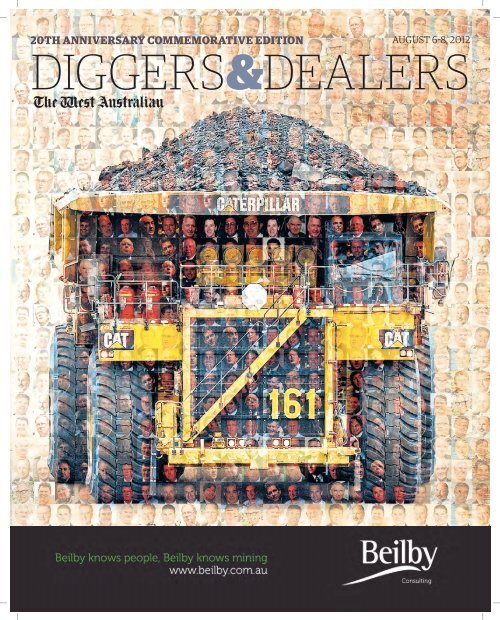

20TH ANNIVERSARY COMMEMORATIVE EDITION AUGUST 6-8, 2012<br />

DIGGERS&DEALERS

A NEW ERA<br />

BEGINS

Diggers&Dealers 4<br />

20-year anniversary edition<br />

WESTBUSINESS<br />

Resources<br />

vital to WA<br />

To say it has come<br />

a long way would<br />

be a massive<br />

understatement.<br />

Confidence in future: Mines and Petroleum Minister Norman Moore.<br />

■ Norman Moore<br />

<strong>This</strong> year will celebrate 20 years<br />

since the first Diggers & Dealers<br />

conference.<br />

To say it has come a long way<br />

would be a massive<br />

understatement. It is not just<br />

the conference that has come a<br />

long way, but the very region<br />

this event celebrates — the<br />

Goldfields.<br />

Back in 1992, when Diggers &<br />

Dealers was first held, the<br />

Goldfields’ resources industry<br />

was worth $1.9 billion. Last year<br />

it soared to $8.3 billion, with<br />

gold alone worth $5.6 billion.<br />

I have no doubt that the<br />

Goldfields, and Diggers &<br />

Dealers, will continue to build<br />

on this remarkable success.<br />

However, it is important we<br />

make the most of these<br />

opportunities. One way the<br />

State Government is<br />

encouraging further investment<br />

in the industry is with the<br />

Exploration Incentive Scheme’s<br />

(EIS) flagship co-funded drilling<br />

program.<br />

The State Government has<br />

extended funding for EIS until<br />

the end of June 2016 and a total<br />

of $138.1 million will have been<br />

committed to exploration<br />

incentives since its start in 2009.<br />

It also means the co-funded<br />

drilling program will continue<br />

offering twice-yearly funding<br />

grants. In the last round of<br />

co-funded drilling, 22 of the 56<br />

exploration projects to receive<br />

funding were Goldfields-based.<br />

Beadell Resources’ Tropicana<br />

East project and West Musgrave<br />

prospect have both benefited<br />

from previous EIS funding and<br />

it goes to show that there is still<br />

plenty of gold (and other<br />

resources) in the Goldfields just<br />

waiting to be discovered.<br />

Programs such as EIS will<br />

ensure the Goldfields continue<br />

to play an essential part in WA’s<br />

resources industry, as it has<br />

done for more than 110 years.<br />

Another crucial part of the<br />

industry’s longevity is<br />

maintaining high safety<br />

standards. Nowhere is this more<br />

apparent than in the Goldfields.<br />

The commitment the<br />

Goldfield’s mining community<br />

has shown to the annual<br />

underground and surface mine<br />

rescue competitions is just one<br />

indication of this.<br />

The State Government is<br />

committed to improving safety<br />

in the industry. The reforms we<br />

have undertaken address how<br />

the Department of Mines and<br />

Petroleum, as the regulator,<br />

works with industry to save<br />

lives and reduce injuries.<br />

Twenty years of Diggers &<br />

Dealers is a tremendous<br />

achievement and no doubt this<br />

year’s conference will continue<br />

to build on that success.<br />

Crazy idea<br />

that grew<br />

There were very<br />

few forums for<br />

these activities to<br />

occur.<br />

■ Kate Stokes<br />

Twenty years ago, my late<br />

husband Geoff had a concept<br />

where he envisaged the cream of<br />

the resources industry meeting<br />

in Kalgoorlie annually to<br />

promote and discuss activities<br />

in which companies were<br />

involved.<br />

The idea was to create an<br />

environment where all players,<br />

from brokers to investors,<br />

miners, suppliers and<br />

professionals, could develop<br />

relationships, do deals and<br />

generally advance the<br />

opportunities and dreams that<br />

many in the resources’ sector<br />

have.<br />

It was in some ways a crazy<br />

idea, as apart from technical<br />

conferences, there were very<br />

few forums for these activities<br />

to occur and as such it required<br />

enthusiasm and drive to make<br />

the first Diggers & Dealers in<br />

Kalgoorlie happen.<br />

Geoff used stockbroker David<br />

Reed to help in getting<br />

companies involved and<br />

Graham Thomson to assist with<br />

the logistics.<br />

The first year about 125 people<br />

attended.<br />

<strong>This</strong> year we will host more<br />

than 2200 people in Kalgoorlie-<br />

Boulder.<br />

Despite current uncertain<br />

markets, industry enthusiasm<br />

and the Diggers can-do attitude<br />

will facilitate an environment<br />

where the broad industry will<br />

find deals, raise funds and<br />

generally advance the positive<br />

cause that the resources<br />

industry represents.<br />

Unfortunately, Geoff passed<br />

away in 1997 while Diggers was<br />

still evolving but I have no doubt<br />

that he would be exceptionally<br />

proud of the manner in which<br />

Diggers has been embraced, and<br />

that the whole industry is<br />

represented from the<br />

international mining majors to<br />

the explorers, the brokers and<br />

investors, and to the suppliers<br />

and professionals, all with a<br />

common goal of promoting their<br />

industry. That was what Geoff<br />

was passionate about and that is<br />

the reason our family remains<br />

committed to facilitating the<br />

forum.<br />

I have no doubt that Diggers &<br />

Dealers will remain in<br />

Kalgoorlie Boulder for many<br />

years to come.<br />

Proud involvement: Kate Stokes reflects on two decades. Picture: Bill Hatto

Diggers&Dealers 5<br />

20-year anniversary edition<br />

WESTBUSINESS<br />

Why Diggers is the place to be<br />

■ Peter Klinger<br />

Business editor<br />

It’s easy to be critical of some<br />

aspect or another of Diggers &<br />

Dealers. Heck, I have been in the<br />

past — a lack of news thanks to<br />

continuous disclosure regimes,<br />

an overly-tight presentation<br />

schedule and too few world<br />

mining leaders attending as<br />

speakers.<br />

Yet every year I am one of 50<br />

or so media cohorts who return<br />

to Kalgoorlie-Boulder because if<br />

you want to understand the<br />

mining sector in Australia, you<br />

need to be at Diggers.<br />

Nowhere else in Australia do<br />

you get such a big ensemble of<br />

mining industry insiders,<br />

supporters and onlookers as at<br />

Diggers. An ensemble captive to<br />

the confines of the conference<br />

and its surrounding drinking<br />

holes like nowhere else in<br />

Australia, or maybe the world.<br />

It forces networking. It<br />

demands striking up<br />

acquaintances.<br />

It ensures all and sundry are<br />

on a level footing. Late at night,<br />

Nowhere else in Australia do you get<br />

such a big ensemble of mining industry<br />

insiders, supporters and onlookers.<br />

in the front bar of the Palace,<br />

there no longer is a segregation<br />

between mining company<br />

bosses, fund managers,<br />

well-heeled private investors,<br />

analysts and members of the<br />

media pack. Friendships are<br />

struck and relationships<br />

renewed, seeds are sown for<br />

deals of the future as well as<br />

story ideas.<br />

And that it why attendance at<br />

Diggers is such a worthwhile<br />

exercise.<br />

And which is why each year<br />

the media room is packed more<br />

tightly than the year before,<br />

with local, national and<br />

increasing numbers of<br />

international media<br />

representatives.<br />

There is another reason<br />

Diggers is special to many in the<br />

media. It is here, in the heart of<br />

the Goldfields, where many of<br />

us, including me, first got their<br />

lucky breaks, working and or<br />

living in Kalgoorlie-Boulder<br />

surrounded by some of the most<br />

famous mines in Australia.<br />

Tania Winter, Neale Prior,<br />

Ron Berryman, Matt<br />

Chambers, Michael<br />

Vaughan, the late but not<br />

forgotten Kevin Andrusiak,<br />

Andrew Burrell, Kate<br />

Askew, Russell Woolf<br />

and Sarah-Jane Tasker<br />

to name but a few have<br />

spent time in the<br />

Goldfields capital. For<br />

many of us, Diggers &<br />

Dealers is a return to<br />

where it all began.<br />

Keen supporter: WestBusiness editor Peter Klinger. Picture: Simon Santi<br />

Achieve<br />

world-class energy and<br />

minerals solutions<br />

At The University of Western Australia<br />

we are harnessing the powerful capability<br />

of our world-class researchers and<br />

facilities to deliver innovative solutions<br />

that meet the challenges in the energy<br />

and minerals sector.<br />

From world-class engineering solutions<br />

to high-performance multi-million dollar<br />

infrastructure and unique experimental<br />

technology, our University supports<br />

cutting-edge research across the depth<br />

and breadth of resource-related issues.<br />

The UWA Energy and Minerals Institute<br />

(EMI) is the gateway for industry to engage<br />

with some of the best experts in the fi eld.<br />

EMI facilitates the University’s energy<br />

and minerals research partnerships –<br />

addressing industry needs by bringing<br />

together the right expertise.<br />

If you’re passionate about tackling energy<br />

challenges to create life-changing benefi ts<br />

for the global community, join us to<br />

achieve international excellence.<br />

emi.uwa.edu.au

Diggers&Dealers 7<br />

Remember 1992<br />

20-year anniversary edition<br />

Way back where it all began<br />

WESTBUSINESS<br />

It’s been two decades<br />

of highs and lows and<br />

high jinks at the State’s<br />

premier mining<br />

conference. Neale<br />

Prior delves into the<br />

archives of The West<br />

Australian and the<br />

Kalgoorlie Miner for an<br />

insight into a<br />

remarkable era.<br />

After evolving from the<br />

Diggers’ Bash in<br />

Kalgoorlie and<br />

incorporating annual<br />

Diggers & Dealers awards from<br />

Perth, the Diggers & Dealers<br />

conference had a relatively<br />

humble start in February 1992.<br />

Australia was just emerging<br />

from Paul Keating’s recession<br />

we had to have and the<br />

reputation of WA business had<br />

been damaged by the events of<br />

the late 1980s and early 1990s.<br />

Yet some green shoots were<br />

emerging in investment markets<br />

even as the WA Inc scandal was<br />

being unravelled at a royal<br />

commission in Perth.<br />

Some 200 delegates, including<br />

six stockbrokers and two<br />

merchant bankers from<br />

interstate, attended the event,<br />

along with international gold<br />

shares investor Willie McLucas.<br />

The conference was the<br />

brainchild of businessman,<br />

accountant and Palace Hotel<br />

publican Geoff Stokes.<br />

The Goldfields spirit of<br />

irreverence and optimism took<br />

Stalwart: Ron Manners, here with<br />

Tamara Stevens of AMEC, gave the<br />

government of the day a piece of<br />

his mind.<br />

Founder: Geoff Stokes and his wife Kate.<br />

hold from the start at what was<br />

then called the Diggers &<br />

Dealers Bash.<br />

The theme for the conference<br />

was “let the boom begin”, and<br />

there was no shortage of<br />

confidence about which sector<br />

of society was best qualified to<br />

lead the nation back to wealth.<br />

There was broad agreement<br />

with the sign at the Palace<br />

Hotel: “If this country has a<br />

future it depends on the<br />

continuing mining of gold and<br />

the control of the country by<br />

resources men — we can’t trust<br />

the politicians any longer.”<br />

Kalgoorlie stalwart Ron<br />

Manners picked up on this<br />

theme and the fact that a<br />

representative of the State<br />

Government’s Small Business<br />

Development Corporation had<br />

only recently visited the<br />

Goldfields town offering free<br />

advice on tax and corporate<br />

affairs.<br />

“What I find amusing is that<br />

all this advice is brought to us<br />

free by our loved State<br />

Government,” Mr Manners told<br />

delegates.<br />

“Yes, the very same people<br />

who brought us WA Inc, the<br />

Petrochemical fiasco, the WA<br />

Development Corporation and<br />

the Rothwells rescue. The same<br />

people who have shown cash in<br />

paper bags is a preferred style of<br />

doing business.”<br />

Former Boulder Block Hotel<br />

owner and racehorse enthusiast<br />

John Jones won the award for<br />

the best deal of the year for<br />

selling the pub to Kalgoorlie<br />

Consolidated Gold Mines for the<br />

ever-expanding gold Super Pit.<br />

KCGM did not want the pub<br />

but was instead interested in the<br />

dirt underneath it.<br />

Mr Jones was already a<br />

legend for his sale of Jones<br />

Mining shares worth $15 million<br />

to Consolidated Exploration<br />

during a takeover bid that<br />

spanned the October 1987<br />

sharemarket crash.<br />

In addition to the de facto<br />

recognition of his contribution<br />

to Mr Jones’ already sizeable<br />

bank balance, KCGM executive<br />

Ian Burston was given the<br />

community contributions award<br />

for his commitment to the new<br />

Hannans North tourist mine.<br />

Mr Manners won the industry<br />

contribution award for his work<br />

with the Association of Mining<br />

and Exploration Companies.<br />

Winner: John Jones, pictured with Rod Russell and Keith Biggs, won the<br />

deal of the year award over the Boulder Block Hotel sale.<br />

There’s nothing like<br />

a good resources<br />

boom to kick-start<br />

our stuffed Aussie<br />

economy.<br />

Geoff Stokes<br />

DIGGERS<br />

&DEALERS<br />

LIFTOUT<br />

Stories: Neale Prior<br />

Design: Andy Piggford<br />

Cover: John Henderson<br />

For up-to-date news from<br />

Diggers & Dealers 2012<br />

check out WestBUSINESS<br />

in The West Australian or at<br />

thewest.com.au/business

Diggers&Dealers 8<br />

20-year anniversary edition<br />

Pollie bashing<br />

The event took on the<br />

posher sounding name<br />

Diggers & Dealers<br />

Forum.<br />

But bash was still on the<br />

menu at one of the event’s<br />

dinners, with Eltin chairman<br />

Graeme Smith taking the<br />

pollie-bashing baton from<br />

industry stalwart Ron Manners.<br />

The millionaire mining<br />

contractor described politicians<br />

as egotists who had to be<br />

relegated back to their rightful<br />

position as “hired help”.<br />

He claimed politicians were<br />

the major threat to Australia’s<br />

growth and particularly the<br />

growth of the mining industry.<br />

“It’s one of our few industries<br />

which is world-class and<br />

internationally competitive —<br />

and it’s being forced to look<br />

outside of Australia, “ Mr Smith<br />

said. "It’s a ridiculous situation<br />

and if we allow it to continue it<br />

will bring the country to a<br />

standstill and bring<br />

unemployment to 15 per cent."<br />

New Liberal Premier Richard<br />

Court gently hit back at a<br />

commemorative dinner to<br />

celebrate Kalgoorlie’s centenary,<br />

starting his talk by addressing<br />

the audience as “ladies and<br />

Survivor: Phil Crabb.<br />

gentlemen… and Graeme<br />

Smith”.<br />

Former Labor minister and<br />

Eyre MLA Julian Grill was not<br />

so nice, saying Mr Smith’s<br />

attack was a “swaggering<br />

display of arrogance and<br />

insensitivity” and claiming the<br />

contractor was the big<br />

beneficiary of a lack of a State<br />

royalty on gold.<br />

“The truth is other WA<br />

taxpayers are subsidising his<br />

multimillion-dollar lifestyle in<br />

the Swan Valley,” Mr Grill said.<br />

The gold sector was going<br />

Critic: Graeme Smith.<br />

through what veteran<br />

stockbroker David Reed, of<br />

forum backer Eyres Reed,<br />

described as a boom to exceed<br />

the nickel boom of the late 1960s.<br />

The gold price had headed<br />

north from about $US300/oz in<br />

early 1993 towards $US400/oz at<br />

the time of the conference.<br />

In line with the rising market<br />

and after a solid start in 1992,<br />

the number of Diggers &<br />

Dealers delegates surged to an<br />

estimated 500 and the<br />

conference was moved from the<br />

Palace to the more spacious<br />

1993<br />

That hired help is not your wife or your<br />

staff — it’s your State and Federal<br />

Members of Parliament.<br />

Graeme Smith checking whether anyone had beaten up their hired help<br />

Hitting back: Julian Grill<br />

Boulder Town Hall. Most<br />

companies presenting papers<br />

were in the transition stage<br />

from explorer to miner.<br />

In the spirit of optimism,<br />

Great Central Mines’<br />

exploration boss Ed Eshuys<br />

vowed to step up the company’s<br />

$500,000-a-month exploration<br />

program to fulfil a prophecy by<br />

New York rabbi Menachem<br />

Schneerson that Great Central<br />

boss Joe Gutnick would find<br />

gold and diamonds.<br />

Heading towards production<br />

at its Bronzewing mine, Great<br />

Diggers&Dealers<br />

20-year anniversary edition 1994<br />

WESTBUSINESS<br />

Central was aggressively<br />

drilling nearby tenements.<br />

Spirits were lifted even more<br />

at the forum’s awards night with<br />

unlimited amounts of food, beer,<br />

wine and spirits served up by a<br />

team of scantily-clad<br />

Diggerettes.<br />

The exploration medal was<br />

won by Great Central for its<br />

outstanding work at<br />

Bronzewing. The Contractor’s<br />

Medal went to Goldfields<br />

drilling firm Glindemann and<br />

Kitching, which had set up a<br />

base at Meekatharra to service<br />

the Bronzewing discovery.<br />

The entrepreneurial medal<br />

went to Phil Crabb, who was<br />

wiped out in the 1987 crash but<br />

maintained his links with<br />

Kalgoorlie-Boulder.<br />

The company promotion<br />

medal was won by Mr Manners’<br />

Croesus Mining because of what<br />

was described as its continued<br />

prominence in the media and<br />

the way it promoted its<br />

interests.<br />

Toecutters<br />

join party<br />

You have to get into<br />

training quite early to go<br />

the distance.<br />

David Reed on the gruelling festivities<br />

It is the measure of an<br />

event’s growing importance<br />

when company share prices<br />

start moving in anticipation<br />

of what might be going down.<br />

And that is just what seems to<br />

have happened with the 1994<br />

Diggers & Dealers Forum as<br />

more than 400 brokers,<br />

investors, analysts, geologists,<br />

investment bankers, mining<br />

company promoters and<br />

regulators descended on<br />

Kalgoorlie-Boulder.<br />

Mt Edon Gold Mines<br />

attributed a rally in its shares to<br />

market anticipation of<br />

showcasing its WA gold<br />

operations at the forum.<br />

Shares in Plutonic Resources<br />

flew after corporate manager<br />

Denis Clarke said the explorer<br />

could be sitting on a giant<br />

resource around its eponymous<br />

mine. For its digging efforts,<br />

Plutonic won the outstanding<br />

producer award with Herald<br />

Resources.<br />

Not surprisingly, three<br />

officers from the Australian<br />

Stock Exchange’s Sydney-based<br />

surveillance division were<br />

spotted among delegates at the<br />

conference. Led by manager Jim<br />

Berry, the toecutters found<br />

themselves deeply emerged in<br />

what must be one of Australia’s<br />

most fertile breeding grounds<br />

for scarce information.<br />

“A regulator can’t shut<br />

himself off and sit in his ivory<br />

tower,” Mr Berry said. “He<br />

needs to know what is going<br />

on.” It did not take long for the<br />

Berry crew to swoop, slapping a<br />

short suspension on Great<br />

Central Mines after exploration<br />

director Ed Eshuys had given an<br />

Watching: Exchange analyst Joann Condon and surveillance<br />

chief Jim Berry check the markets.<br />

update on its drilling at<br />

Bronzewing and Jundee,<br />

allegedly without first telling<br />

the stock exchange.<br />

Some companies had used the<br />

mid-July conference to release<br />

their June quarter reports, but<br />

other had to rely on their March<br />

quarter reports to make general<br />

presentations to avoid getting<br />

up the nose of the exchange’s<br />

watchdogs.<br />

<strong>This</strong> prompted Diggers &<br />

Dealers organiser Geoff Stokes<br />

to look at moving the 1995<br />

conference to August so<br />

companies could prepare<br />

presentations based on their<br />

latest quarterly releases.<br />

“We don’t want it to happen<br />

again where a company is<br />

suspended because everyone<br />

hears it first at Diggers &<br />

Dealers, ” Mr Stokes said.<br />

David Reed, from sponsoring<br />

stockbroker Eyres Reed, said<br />

the growing international<br />

reputation of the forum was best<br />

summed up by former Delta<br />

Gold chief executive Peter<br />

Vanderspuy. “He told me after<br />

last year’s conference it was the<br />

best in the world,” Mr Reed said.<br />

Amid the beer and banter,<br />

rumours circulated that St<br />

Barbara Mines boss Ross Atkins<br />

planned to spend $8 million<br />

refurbishing his riverside<br />

Dalkeith mansion, formerly<br />

owned by Alan Bond.<br />

On the social side, the<br />

Diggerettes continued to feature<br />

in what was turning into one of<br />

Australia’s top three-day<br />

swim-throughs. One digger’s<br />

excessive attention to a<br />

Diggerette earned him a solid<br />

right hook and brought a tray of<br />

glasses crashing to the floor of<br />

the old town hall.<br />

On the awards front, nickel<br />

miner WMC was recognised for<br />

its mineral development efforts<br />

and its role in forming the<br />

Goldfields pipeline consortium.<br />

Ron Sayers’ Ausdrill was<br />

recognised for its efforts<br />

expanding in Australia and<br />

overseas. Eltin’s Graeme Smith<br />

was recognised for finding the<br />

finance for a new student<br />

amenities building at the WA<br />

School of Mines.

Our mining future<br />

starts with<br />

Australia’s oldest<br />

mining school.<br />

For over 100 years, Curtin’s Western Australian<br />

School of Mines (WASM) has earned a<br />

reputation globally for excellence in mining<br />

education and research.<br />

With campuses in Perth and Kalgoorlie, WASM<br />

is committed to a sustainable mining future<br />

by building strong industry partnerships and<br />

continually investing in new hi-tech facilities.<br />

WASM is proud of its contribution to the<br />

minerals and resources sector by creating<br />

highly sought after graduates with a focus on<br />

making tomorrow better.<br />

To find out more, come and see us at the<br />

Diggers and Dealers Expo in Kalgoorlie from<br />

6 to 8 August, where you will be able to<br />

experience our new CYBERMINE 4 simulator.<br />

Make tomorrow better.<br />

wasm.curtin.edu.au

Farewell to a g<br />

Diggers&Dealers 10<br />

20-year anniversary edition<br />

Clouds on<br />

the horizon<br />

1995<br />

WESTBUSINESS<br />

D<br />

20<br />

N<br />

Tpip<br />

se<br />

The Diggers & Dealers<br />

Forum had grown into a<br />

major event on the<br />

investment conference<br />

calendar, with more than 300<br />

delegates visiting from outside<br />

WA and helping to swell<br />

numbers beyond 700.<br />

And it was not only the<br />

official presentations at the<br />

Goldfields Arts Centre and the<br />

gala closing dinner at the<br />

Eastern Goldfields Aboriginal<br />

Advancement Council centre in<br />

Lionel Street that drew the<br />

delegates.<br />

There were unofficial site<br />

visits, in addition to the<br />

nocturnal investor relations<br />

activities conducted at locations<br />

such as the Palace and<br />

Exchange hotels.<br />

The presence of influential<br />

brokers, analysts and investors<br />

was being used by companies to<br />

tell the world that the Goldfields<br />

was living up to its reputation<br />

as the premier Australian<br />

mineral province ripe for<br />

investment.<br />

Projects that were up and<br />

running included WMC’s giant<br />

Mt Keith nickel project, which<br />

cost $450 million, and Great<br />

Central Mines’ $64 million<br />

Bronzewing gold mine.<br />

Work had begun on the $400<br />

million Goldfields to Pilbara gas<br />

pipeline project and gas-fired<br />

power stations that had been<br />

spawned as a result.<br />

Closer to Kalgoorlie-Boulder,<br />

well-advanced projects included<br />

Kalgoorlie Consolidated Gold<br />

Mines’ $115 million Fimiston<br />

plant expansion and $81 million<br />

Kanowna Belle underground<br />

development by North and Delta<br />

Gold.<br />

Yet it was not all good news,<br />

with St Barbara Mines chief<br />

executive Robin Dean warning<br />

Native title warning: Robin Dean.<br />

We work hard during the day at Diggers<br />

and then we play at night.<br />

Geoff Stokes on booze not being served at lunch<br />

companies that concerns about<br />

native title were causing<br />

companies to drill in less<br />

prospective areas not affected by<br />

potential claims, or looking<br />

overseas.<br />

Prospecting legend Mark<br />

Creasy, who had just banked a<br />

$117 million cheque for selling<br />

tenements to Great Central<br />

Mines, agreed.<br />

“How can anyone invest when<br />

you don’t know what’s going to<br />

Legend: Mark Creasy said uncertainty threatened future investment.<br />

happen in the future?” he said.<br />

Australian resources<br />

companies and investors were<br />

hedging their bets, with<br />

emerging enthusiasm for<br />

exploration in Africa on show at<br />

Diggers & Dealers.<br />

After the previous year’s<br />

two-hour trading stock<br />

exchange suspension of Great<br />

Central, mining companies were<br />

being very coy pre-conference<br />

about what they would be<br />

releasing and then were making<br />

sure market announcements<br />

were made first.<br />

With the stock exchange<br />

watching at close quarters,<br />

there was no room for slip-ups.<br />

Companies such as Plutonic,<br />

Great Central, and Delta Gold<br />

provided project and<br />

exploration updates that were<br />

described by one observer as<br />

“frequently nothing short of<br />

breathtaking”.<br />

Foremost among these was<br />

Plutonic’s resource and reserve<br />

update around the Plutonic<br />

mine, which earned it the<br />

medal of Most Outstanding<br />

Producer.<br />

Claiming the title of<br />

Australia’s best mining<br />

conference for Diggers &<br />

Dealers, organiser Geoff Stokes<br />

said the number of delegates<br />

would be capped about 800.<br />

“What we set out to do and<br />

what we achieved has been<br />

quality, not quantity,” Mr Stokes<br />

said.<br />

And quality was certainly on<br />

the menu as well.<br />

No fewer than four road trains<br />

brought up essential items<br />

for the conference, including<br />

3000 cans of beer and 1080<br />

bottles of fine wine for the gala<br />

dinner. The menu also boasted<br />

crayfish, smoked salmon, 100<br />

dozen oysters, 20 sides of<br />

Norwegian smoked salmon,<br />

30kg of fresh crabs plus beef,<br />

chicken and 24 wheels of<br />

Margaret River cheese.<br />

ch<br />

Pe<br />

hi<br />

of<br />

dis<br />

in<br />

in<br />

to<br />

Au<br />

we<br />

se<br />

in<br />

gr<br />

an<br />

co<br />

th<br />

De<br />

Ba<br />

Go<br />

ro<br />

Pr<br />

sh<br />

pr<br />

fou<br />

en<br />

co<br />

M<br />

aft<br />

M<br />

qu<br />

co<br />

tim<br />

div<br />

He was known in life as<br />

an accountant,<br />

husband, father,<br />

company promoter,<br />

director, racehorse owner,<br />

publican, confidante and<br />

chairman of the<br />

Kalgoorlie-Boulder Racing Club.<br />

Yet Geoff Stokes will arguably<br />

be best remembered for decades<br />

as a good bloke and the man<br />

who put the momentum into the<br />

Diggers & Dealers juggernaut.<br />

When he died in February<br />

1997, Diggers & Dealers was<br />

already being noticed around<br />

the world and it had become a<br />

major forum for industry<br />

players to pitch their case.<br />

As Mr Stokes said in 2006:<br />

“It’s sort of grown from a fun<br />

thing to a bloody serious thing.”<br />

Former Diggers & Dealers<br />

chairman David Reed said<br />

the late Mr Stokes was a<br />

major figure in the mining<br />

industry and instrumental in<br />

lifting the profile of Diggers &<br />

Dealers.<br />

“He was incredibly<br />

generous.<br />

Ian Taylor, former MLA<br />

For his Dad: David Stokes stands in<br />

for Geoff at the 1996 forum.<br />

Sa<br />

los

S<br />

Diggers&Dealers 11<br />

20-year anniversary edition<br />

1996<br />

WESTBUSINESS<br />

Native title flak<br />

s<br />

s<br />

Things kept getting bigger<br />

and the gas was about to<br />

start coming down the<br />

Pilbara to Goldfields gas<br />

pipeline, but there was also a<br />

sense of worry in the air.<br />

Diggers & Dealers deputy<br />

chairman Peter Hawkins, a<br />

Perth stockbroker, warned in<br />

his keynote address that the rate<br />

of gold exploration and<br />

discoveries would need to<br />

increase if the Australian<br />

industry was to keep growing.<br />

He said with dollars heading<br />

to Indonesia and West Africa,<br />

Australia and WA, in particular,<br />

were now being seen “as a<br />

second rate address”.<br />

There was anxiety in the<br />

industry as it tried to come to<br />

grips with new native title laws<br />

and dealing with highly<br />

complex claims, as well as<br />

threats from Resources<br />

Development Minister Colin<br />

Barnett that the Coalition State<br />

Government could look at a gold<br />

royalty after the next election.<br />

Premier Richard Court quickly<br />

shot his rocks minister’s idea.<br />

Native Title Tribunal<br />

president Justice Robert French<br />

found himself at the receiving<br />

end of a free education session<br />

courtesy of forum veteran Ron<br />

Manners. During question time<br />

after Justice French’s talk, Mr<br />

Manners unfolded a two-page<br />

question that included a<br />

comment that a great deal of<br />

time and effort was being<br />

diverted from productive<br />

Without some prompt action from<br />

Canberra, all Australians will be poorer<br />

as a result of the mineral exploration<br />

dollar going elsewhere.<br />

Ron Manners<br />

pursuits in trying to understand<br />

“this unworkable Native Title<br />

Act”. Never mind such<br />

important matters, the question<br />

on the lips of a lot of delegates in<br />

1996 was: “Where are the<br />

Diggerettes?”<br />

Where indeed. Certainly not<br />

at the forum’s traditional<br />

welcoming cocktail party on<br />

Monday night and even more<br />

conspicuous by their absence at<br />

the Bash on Tuesday night.<br />

A furore which erupted in<br />

some quarters after the<br />

previous year’s event had<br />

organisers deciding that it<br />

would be in the best interests of<br />

the forum’s image to drop the<br />

Diggerettes.<br />

<strong>This</strong> did not slow the drinking<br />

at the traditional Diggers &<br />

Dealers Bash party at the<br />

racecourse, which ran out of<br />

beer and wine — necessitating<br />

the sending of reinforcements<br />

from the Palace Hotel.<br />

At the more formal dinner the<br />

following night, the highlight<br />

was arguably a 1.5 metre replica<br />

of a Goldfields headframe made<br />

by Kalgoorlie College<br />

hospitality lecturer Glenn Jones<br />

and his students using 30kg of<br />

commercial moulding<br />

margarine.<br />

Colin Barnett collected the<br />

forum’s most outstanding<br />

achievement award on behalf of<br />

the Ministry for Resources<br />

Development and Energy, which<br />

was recognised for its work with<br />

the development of the Pilbara<br />

to Goldfields gas pipeline.<br />

Normandy chairman Robert<br />

de Crespigny said the pipeline<br />

project would do to the<br />

Goldfields what the CY<br />

Good company: Sons of Gwalia’s Peter Lalor (left) with Ausdrill chairman<br />

Terry O’Connor and Resources Development Minister Colin Barnett.<br />

O’Connor water pipeline had<br />

done for the region. Mr de<br />

Crespigny, whose group had a 25<br />

per cent stake in the pipeline,<br />

said it would deliver long-term<br />

low cost power.<br />

And the forum moved into<br />

cyberspace, with papers<br />

available online within minutes<br />

of being presented and punters<br />

able to register for the 1997<br />

conference through the website.<br />

Geoff Stokes was absent<br />

fighting cancer in Perth, but the<br />

industry stalwart was keen not<br />

to miss out on what was<br />

happening around his beloved<br />

forum and had an associate<br />

organise some video footage.<br />

Highlight: Palace Hotel executive<br />

chef Alan Thorley and Kalgoorlie<br />

College lecturer Glenn Jones with<br />

the margarine headframe.<br />

good bloke<br />

In 1901 the Chamber of Minerals and Energy of<br />

Western Australia (CME) was established in Kalgoorlie.<br />

Since then, we have grown hand in hand with the<br />

resource sector.<br />

Supporting over 200 member companies, CME<br />

provides an avenue for extensive collaboration on<br />

industry matters and is dedicated to maintaining WA’s<br />

reputation as a globally significant resource province.<br />

www.cmewa.com.au<br />

Sad loss: Geoff Stokes with a copy of the 1996 Diggers, the last before he<br />

lost his battle with cancer.<br />

1488478πJEGT040812

Diggers&Dealers 12<br />

20-year anniversary edition 1997<br />

Gold in<br />

spotlight<br />

WESTBUSINESS<br />

Prime Minister John<br />

Howard was supposed to<br />

be the headline act but<br />

had to cancel after being<br />

hospitalised with pneumonia.<br />

Some industry figures were<br />

hoping to get stuck into the PM<br />

over his government’s<br />

endorsement of a Reserve Bank<br />

decision to dump 167 tonnes of<br />

its gold reserve and Treasurer<br />

Peter Costello saying gold no<br />

longer played an important part<br />

in the world financial system.<br />

The gold price and stocks had<br />

plunged, and diggers and<br />

dealers alike were ropeable.<br />

Stockbroker and forum<br />

sponsor David Reed told<br />

journalists he believed Mr<br />

Costello’s comments lacked<br />

foresight and had a big<br />

psychological effect on the<br />

industry.<br />

“The vibes that went out<br />

internationally were not good,”<br />

Mr Reed said.<br />

Diggers&Dealers<br />

20-year anniversary edition<br />

Mining magnate Joseph<br />

Gutnick, who called for the<br />

Government to intervene when<br />

prices plummeted, said he was<br />

disappointed the Treasurer did<br />

not attend the forum and “face<br />

the music” over the decision.<br />

Facing the chorus of discord<br />

instead was Federal Resources<br />

Minister Warwick Parer, who<br />

asked delegates to keep the<br />

Reserve Bank’s sale in<br />

perspective.<br />

“The Reserve Bank is a player<br />

in the market just like everyone<br />

else,” he said.<br />

New York-based analyst for<br />

the Gold Council, George<br />

Milling-Stanley, told delegates<br />

that speculators were driving<br />

down the price by selling gold<br />

they did not have.<br />

“I talk to several of the large<br />

speculators on a regular basis<br />

and there is no doubt in my<br />

mind that they are taking<br />

advantage of the market’s fear of<br />

Facing the music: Warwick Parer<br />

addresses delegates.<br />

Concerned: George Milling-Stanley blamed<br />

speculators for forcing down the gold price.<br />

central bank sales to bully down<br />

the gold price and make huge<br />

profits, ” Mr Milling-Stanley<br />

said. The Association of Mining<br />

and Exploration Companies<br />

proposed a series of measures to<br />

assist and promote the industry<br />

after the “potentially<br />

catastrophic” selldown. “The<br />

Australian gold industry is now<br />

in need of urgent<br />

encouragement and incentives if<br />

it is to satisfactorily recover<br />

Unhappy with gold decision: George Savell, David Reed and Bill Ryan at an<br />

AMEC press conference.<br />

There has been no great wave<br />

of central bank sales in recent<br />

months but the fear is there.<br />

George Milling-Stanley<br />

from this recent setback and the<br />

long-term problem of a<br />

downward trend in the gold<br />

price and the domestic<br />

economic problems it is facing,”<br />

AMEC chief executive George<br />

Savell said.<br />

Amid the gloom, there was a<br />

record attendance of 780 at the<br />

conference but with one very<br />

notable absence — Geoff Stokes.<br />

The long-time driving force<br />

behind Diggers & Dealers died<br />

from cancer in February.<br />

With support of industry<br />

colleagues spurred on by Mr<br />

Stokes’ fight, industry veteran<br />

Phil Crabb unveiled plans to<br />

develop an accommodation<br />

centre in Perth for cancer<br />

patients and carers from<br />

regional and country areas.<br />

WMC chairman Sir Arvi<br />

Parbo was chosen as the<br />

recipient of the inaugural GJ<br />

Stokes Memorial Award.<br />

1998<br />

Gloom not boom<br />

The mood was subdued, as<br />

both the gold industry<br />

and Kalgoorlie’s skimpy<br />

barmaid culture was<br />

under siege.<br />

The ailing gold price, which<br />

had fallen below $US300/oz and<br />

was heading towards a 19-year<br />

low, looked to have taken its toll<br />

on gold companies.<br />

Gone was the cautious<br />

optimism of three years before:<br />

it was more like 1997 when the<br />

industry was still suffering the<br />

affects of the Reserve Bank’s<br />

decision to dump its gold onto<br />

world markets.<br />

An update on the on-time and<br />

on-budget commissioning of two<br />

of the emerging laterite nickel<br />

mines, both in the Goldfields,<br />

was well received. Centaur<br />

Mining and Exploration, in<br />

particular, was applauded for its<br />

strong focus on cobalt at the<br />

Cawse project. The existing<br />

economic environment for<br />

resources was described at<br />

different times during the<br />

conference as “tough times”, “a<br />

trough”, and “the bottom”.<br />

Normandy executive<br />

chairman Robert Champion de<br />

You can’t promote tourism to come and<br />

see a hole in the ground. Kalgoorlie is<br />

about girls. It’s gambling, it’s grog and<br />

it’s gold. They’re trying to destroy that<br />

history.<br />

Exchange Hotel owner Ashok Parekh on the skimpy crackdown<br />

Crespigny set the tone for the<br />

with his opening speech. “The<br />

industry is no doubt under real<br />

pressure,” he said.<br />

Mr de Crespigny and other<br />

delegates pointed to problems in<br />

the junior sector, with countless<br />

small companies lacking the<br />

cash to carry out meaningful<br />

exploration programs.<br />

The best stories came from<br />

the big producers, those with<br />

low cash costs and good hedge<br />

books who were making healthy<br />

profits and pouring some of that<br />

back into exploration.<br />

And it was not only the start<br />

of the markets that was causing<br />

spirits to sag. Police came under<br />

fire for cracking down on<br />

jaywalking and the behaviour of<br />

skimpy barmaids during the<br />

forum, with police detaining one<br />

at the Federal Hotel for exposing<br />

her breasts on the first night of<br />

Diggers. “About 800 people from<br />

all over the world were here<br />

experiencing part of Kalgoorlie<br />

culture and they loved it, ”<br />

outraged Federal Hotel owner<br />

Alan Hinchliffe said. “The<br />

police are only doing it because<br />

it is Diggers & Dealers, they’re<br />

morons.”<br />

Premier Richard Court was<br />

on a political winner when he<br />

In the pipeline: Richard Court pledges his government’s support for the<br />

Esperance desalinated water project for the Goldfields.<br />

vowed the State Government<br />

would support plans to pump<br />

desalinated water from<br />

Esperance to Kalgoorlie.<br />

Former stockbroker and<br />

alpaca scheme promoter<br />

Andrew Forrest finally got<br />

recognition from the industry,<br />

winning the dealer of the year<br />

award for his work financing<br />

Anaconda Nickel’s $1.2 billion<br />

Murrin Murrin laterite nickel<br />

development. And in the shape<br />

of things to come with Fortescue<br />

Metals Group, he told<br />

conference the dinner that any<br />

dream could come true if it was<br />

backed by persistence.<br />

Firm views: Ashok Parekh

Diggers&Dealers 13<br />

20-year anniversary edition 1999<br />

Tonics for<br />

hard times<br />

WESTBUSINESS<br />

More than 800 people<br />

came to the<br />

Goldfields capital<br />

again for Diggers &<br />

Dealers, despite many money<br />

players being far more<br />

interested in mining the market<br />

for technology deals.<br />

Commodity prices were down,<br />

pulling rocks out of the ground<br />

was being written off by<br />

technophiles as “old economy”<br />

and the gold price had been<br />

whacked again by the the Bank<br />

of England joining the Reserve<br />

Bank of Australia in dumping<br />

its gold holdings.<br />

Gold had hit a 20-year low of<br />

$US255.50/oz, exacerbating a<br />

crisis of confidence in the<br />

industry and a dearth of<br />

greenfields exploration.<br />

Industry giant Newcrest<br />

estimated the number of gold<br />

miners had fallen to 14 from 44<br />

since the mid-1990s.<br />

But Diggers & Diggers<br />

chairman Graeme Smith said<br />

the price had bottomed and<br />

things could only improve. “In<br />

the next 12 months we will see a<br />

major turnaround in market<br />

sentiment,” he said.<br />

“The Goldfields is alive and<br />

well and is recovering. All<br />

answers to the downturn cannot<br />

be tied to a scientific formula. It<br />

has to do with opinion, attitude<br />

and emotions. Sentiment defies<br />

scientific measurement. ”<br />

In his keynote address,<br />

recently retired WMC chairman<br />

Sir Arvi Parbo said gold mining<br />

had continued uninterrupted in<br />

Kalgoorlie-Boulder for 100 years<br />

and he tipped it would continue<br />

to be the backbone of the<br />

economy for many more years.<br />

“The mining industry has<br />

slain many dragons in the past<br />

and companies which survive<br />

will benefit, ” Sir Arvi said.<br />

“Gold miners are not strangers<br />

to hard times.”<br />

Welcome arrival: Sir Arvi Parbo is met by<br />

Kate Stokes and Graham Thomson.<br />

Sir Arvi and my father Allan used to<br />

frequent the billiard room of the<br />

Hannans Club playing billiards and<br />

drinking bullock’s blood, a special brew<br />

that Sir Arvi designed.<br />

Diggers & Dealers chairman Graeme Smith<br />

In recognition of his<br />

contribution to the WA<br />

resources sector, former<br />

Premier Sir Charles Court was<br />

presented with the GJ Stokes<br />

Memorial Award by the late<br />

Geoff Stokes’ son David.<br />

Nickel had been providing a<br />

Honoured: Sir Charles Court receives the GJ Stokes Memorial<br />

Award from Geoff’s son David.<br />

glimmer of hope despite prices<br />

being down — thanks to the<br />

Cawse, Bulong and Murrin<br />

Murrin nickel projects coming<br />

on stream and potentially<br />

making WA the world’s premier<br />

nickel region.<br />

And consumption was not<br />

down either. Graham Thomson<br />

revealed delegates downed<br />

580kg of fruit and vegetables,<br />

700kg of meat and chicken, 1500<br />

bread rolls, 1800 small pastry<br />

products, 210 litres of milk, 600<br />

litres of fruit juice, 300 litres of<br />

spring water, 65kg of raw rice,<br />

40kg of noodles, 28kg of olives,<br />

and 100 continental loaves. The<br />

busiest booth, besides Nurse<br />

Nightingale’s stand that<br />

provided a free supply of<br />

painkillers and fizzy hangover<br />

antidotes, was the power hire<br />

group Aggreko. Its marketing<br />

department had hired a<br />

cafe-sized cappuccino machine<br />

and three women to serve up<br />

steaming heart starters.<br />

Unsurpisingly, the cappuccinos<br />

were far more popular than the<br />

instant coffee offered elsewhere.<br />

AMEC Convention 2012<br />

Explore, Extract, Excel<br />

4 - 6 September 2012<br />

Burswood Convention Centre, Perth, Western Australia<br />

Why attend:<br />

<br />

listen to presentations on global economics, commodity forecasts and trends and<br />

developments in technology<br />

<br />

meet leading industry representatives and investors all under one roof<br />

hear over 25 company updates from leading MD’s and CEO’s of exploration and mining<br />

companies<br />

<br />

visit the exhibition, showcasing mineral exploration, mining companies and service providers<br />

to the industry<br />

<br />

organised by Australia’s peak industry body for mineral exploration and mining.<br />

Key speakers:<br />

“<br />

<strong>This</strong> event showcases a<br />

fantastic line up of speakers<br />

and with exceptional<br />

industry backing, this<br />

convention is the key<br />

industry event in Australia.<br />

Peter Buck, Director,<br />

Antipa Minerals<br />

”<br />

The Hon Julia<br />

Gillard MP<br />

Prime Minister of<br />

Australia<br />

Leigh Clifford AO<br />

Chairman, Qantas<br />

Airways Limited &<br />

Former CEO, Rio<br />

Tinto Group<br />

Peter van Onselen<br />

Contributing Editor,<br />

The Australian<br />

Rob Heferen<br />

Executive Director,<br />

Revenue Group,<br />

The Treasury<br />

The Hon Norman<br />

Moore MP<br />

Minister for Mines<br />

and Petroleum,<br />

Western Australia<br />

Grey Egerton-<br />

Warburton<br />

Head of Corporate<br />

Finance, Hartleys<br />

Craig James<br />

Chief Economist,<br />

Commsec<br />

Chris Hinde<br />

Editorial Director,<br />

Intierra Resource<br />

Intelligence, London<br />

Proudly supported by:<br />

Visit www.amecconvention.com.au to register today

Diggers&Dealers<br />

20-year anniversary edition<br />

P<br />

Flash dance: AngloGold Ashanti shows off some of its jewellery during its<br />

Diggers & Dealers presentation.<br />

Finale: The WesTrac gala dinner to wrap up Diggers & Dealers.<br />

Write stuff: Kalgoorlie Miner reporter Thomas Nelson<br />

with some of the pens on offer at the conference.<br />

Coffee break: Oonagh Lancaster<br />

and Ron Cunneen.<br />

Face look: Deloitte Touche Tohmatsu’s partner Luke<br />

Martino and associate director Ashley Pattison.<br />

Welcome home: Nola Wolski helps find a place for the conference delegates.<br />

Diggers, Dealers and Doers: An irreverent Christo<br />

days as Fanny Cracker.

Pick of the pics 15<br />

WESTBUSINESS<br />

Ready room: Gophers Ken Jensen, Bob Cable, Allan Francis and Graham Thomson in a quiet moment.<br />

Casa Tranquila: Questa Casa owner<br />

Carmel Galvin told of quiet times in<br />

the bordellos.<br />

It’s serious work promoting<br />

ventures and mulling over<br />

industry challenges, but<br />

delegates at Diggers & Dealers<br />

have learnt to make the most of<br />

a tough gig.<br />

Copious amounts of food and<br />

drink have helped the delegates<br />

make it through the three days<br />

and at least as many nights of<br />

work and play.<br />

Brokers, bankers, miners,<br />

spruikers and various<br />

hangers-on have enjoyed the<br />

best that Kalgoorlie-Boulder has<br />

to offer, including the cheeky<br />

Diggers, Dealers and Doers<br />

Exhibition in 2009 at the WA<br />

Museum building.<br />

Tonnes of food are consumed<br />

each year in pursuit of the new<br />

big deal, as are unfathomable<br />

volumes of beer and cartons of<br />

wine.<br />

The pubs do very well indeed,<br />

as did the skimpy barmaids.<br />

Making friends: Stockbroker Tim Cruise<br />

with skimpy Alannah at the Federal<br />

Hotel.<br />

Tough job but someone…<br />

Behind the scenes, organiser<br />

Graham Thomson and his teams<br />

have put in thousands of hours<br />

of work each year to build<br />

Diggers from a relatively small<br />

gathering in 1992 to one of the<br />

world’s premier mining<br />

conferences.<br />

As the event has grown,<br />

accommodation has become a<br />

premium and homeowners like<br />

Nola Wolski have opened their<br />

doors to delegates.<br />

everent Christopher Jordan-Wright relives his<br />

On duty: Kerena Wright with Citigold chairman John Foley at one of the<br />

many Diggers & Dealers stands.<br />

Crowded house: Part of the crowd at least year’s event gather for the<br />

conference presentations.<br />

0022_bciron

Diggers&Dealers 16<br />

20-year anniversary edition<br />

2000<br />

WESTBUSINESS<br />

Bigger and better<br />

The dot.com boom had<br />

come and gone, and<br />

Diggers & Dealers had<br />

emerged bigger and with<br />

a proven durability.<br />

Almost 1000 people signed up<br />

for the forum, floor space had to<br />

be increased by 50 per cent to<br />

accommodate the 76 exhibitors<br />

and most of the hotels and<br />

motels in Kalgoorlie-Boulder<br />

were booked out. District Court<br />

proceedings had to be called off<br />

because they could not find a<br />

place to stay for the judge or the<br />

Diggers&Dealers<br />

20-year anniversary edition<br />

court crew. Outgoing Diggers &<br />

Dealers chairman Graeme<br />

Smith used his parting speech to<br />

give some customary free advice<br />

to politicians, decrying a raft of<br />

new Commonwealth and State<br />

legislation that had increased<br />

the costs of doing business and<br />

reduced Australia’s<br />

attractiveness for investors.<br />

“The Goldfields remains the<br />

best place to make that<br />

investment — in spite of our<br />

lacklustre political<br />

performance,” he said.<br />

Removalists Ian Atthowe and Rob Howard carry a mattress into the new<br />

and fully-booked Yelverton motel.<br />

There was a notable South<br />

African presence, including<br />

Harmony Gold, AngloGold, Gold<br />

Fields and Impala Platinum.<br />

Gold Fields used the forum to<br />

flag a major push into the<br />

Australian gold sector. The<br />

company’s exploration boss<br />

Craig Nelsen said it had a list of<br />

targets it wanted to approach.<br />

“I think Australia has some of<br />

the premier hunting ground on<br />

the planet, and we think that in<br />

Australia land is really a huge<br />

asset,” he said.<br />

AngloGold chief executive of<br />

Australasia, Nigel Unwin, said<br />

the big miner still had an<br />

appetite for Australian<br />

companies but ruled out a<br />

takeover bid for Normandy<br />

Mining — for the time being at<br />

least. Long-time forum backer<br />

David Reed said South Africans<br />

far outnumbered other offshore<br />

delegates, in contrast to<br />

previous years when North<br />

Americans were more<br />

prevalent. And with the strong<br />

turnout, Mr Reed said the forum<br />

had shrugged off doubts about<br />

its durability and “made the<br />

transition from being a child of<br />

It started off as a Kal show mainly for<br />

junior WA explorers, but because it’s<br />

just such a brilliant formula, it’s just<br />

grown and grown.<br />

Incoming Diggers & Dealers chairman Brian Hurley<br />

Looking Down Under: AngloGold<br />

chief executive of Australasia Nigel<br />

Unwin<br />

the boom-time, to an essential<br />

feature of the industry”.<br />

Delegates proved they knew<br />

how to dig deep for a cause,<br />

raising a staggering $597,000 in<br />

22 minutes for Kalgoorlie-<br />

Boulder’s proposed Prospectors<br />

and Miner’s Hall of Fame.<br />

Delegates at the annual<br />

dinner were prepared to fork out<br />

after key committee members<br />

threatened to do a “full<br />

monty-style” performance at the<br />

dinner. Scared by the promise of<br />

what might be revealed,<br />

delegates coughed up the<br />

$597,000 towards the $21 million<br />

construction, which was set to<br />

open in October 2001.<br />

Dave “Shorty” Ryan from<br />

Aggreko scooped the unofficial<br />

award for the best promotional<br />

stunt to follow on from the<br />

previous year’s hit — the<br />

cappuccino machine in his<br />

firm’s booth. His 2000 gimmick<br />

was to bring big game fishing to<br />

the Goldfields — or at least a<br />

virtual reality version of the<br />

ocean pursuit.<br />

Mr Ryan spent about $15,000<br />

on the arcade game with the<br />

big-screen TV and life-size game<br />

fishing rod.<br />

2001<br />

MP gets<br />

message<br />

While it is probably an<br />

exaggeration to call<br />

it a politician-free<br />

zone, Diggers &<br />

Dealers organisers have always<br />

tried to control the access of<br />

MPs to the forum’s functions<br />

and festivities.<br />

Ambitious new State Member<br />

for Kalgoorlie, Matt Birney, fell<br />

foul of the loose “no pollies” rule<br />

and was promptly given his<br />

marching orders by organiser<br />

Graham Thomson.<br />

When the Liberal MP pointed<br />

out he was a delegate for the<br />

local Chamber of Commerce, Mr<br />

Thomson bellowed: “I don’t<br />

care, you’re a politician and<br />

you’re not welcome here. Get<br />

out.”<br />

Labor Federal candidate Paul<br />

Browning was also peeved about<br />

being excluded, pointing out the<br />

forum’s admirable history of<br />

pollie bashing. “It’s outrageous<br />

they have this dinner where<br />

speakers can attack politicians<br />

but they don’t give us a chance<br />

to respond, ” Mr Browning<br />

thundered.<br />

That said, new Labor Premier<br />

Geoff Gallop was invited to<br />

attend the main dinner, and<br />

escorted to his seat by the<br />

hardhat-wearing Thomson and<br />

gave the keynote speech.<br />

Rationalisation of the<br />

Australian gold industry was<br />

put firmly on the agenda at the<br />

conference when two of the<br />

world’s biggest companies<br />

signalled they were ready to go<br />

shopping. Second-ranked<br />

Barrick Gold Co and fifth-placed<br />

Placer Dome were both keen to<br />

add to their Australian assets.<br />

Homestake Mining’s<br />

Australian managing director<br />

Greg Lang said his group’s<br />

recent $4.7 billion merger with<br />

Barrick Gold gave it $US900<br />

million in corporate firepower.<br />

In another shape of things to<br />

We have instigated a process where we<br />

talk to all of our banks quite regularly<br />

and have very good relations and at<br />

this stage don’t see any problems.<br />

Sons of Gwalia chief executive Mark Cutifani<br />

You’re welcome: Graham Thomson escorts Geoff Gallop to his table at the<br />

Diggers & Dealers dinner.<br />

come, Sons of Gwalia’s<br />

out-of-the money hedge book<br />

also came under focus, with<br />

chief executive Mark Cutifani<br />

saying the Perth-based company<br />

was in constant contact with its<br />

bankers and had not come<br />

under pressure. “It’s probably<br />

like a few players, when the<br />

exchange rate changed, or<br />

moved, we had more foreign<br />

exchange than we would have<br />

liked and we had discussions<br />

with our banks as part of that<br />

No pressure: Mark Cutifani.<br />

process and we are working<br />

through that and restructuring<br />

as we go,” he said.<br />

Mr Cutifani refused to reveal<br />

the mark-to-market value of the<br />

currency hedge book but<br />

analysts predicted it could be as<br />

much as $650 million.<br />

Aggreko continued to be<br />

arguably the most popular<br />

booth, thanks to the cappuccino<br />

machine that first made its<br />

appearance two years earlier.<br />

“On the first morning of Diggers<br />

you saw 500 Aggrekos running<br />

around the place,” resources<br />

manager David Ryan said.<br />

Phil Crabb’s diamond hopeful<br />

Thundelarra Exploration also<br />

got plenty of attention with its<br />

promise to part with a bottle of<br />

Grange for the person who could<br />

come up with the closest guess<br />

for the weight of a parcel of raw<br />

diamonds from some of its<br />

Kimberley properties.

Diggers&Dealers 17<br />

20-year anniversary edition<br />

2002<br />

WESTBUSINESS<br />

Exploring<br />

key theme<br />

Optimism was returning<br />

to the mining sector<br />

and more than 1000<br />

delegates plus 100<br />

exhibitors descended on the<br />

conference.<br />

With the gold price up on 2001<br />

and sitting just above<br />

$US300/oz, Newmont president<br />

Pierre Lassonde set the tone on<br />

the first day when he predicted<br />

happy times ahead. Mr<br />

Lassonde tipped the price would<br />

be as high as $US350/oz range<br />

over 18 months as producers,<br />

including Newmont, unwound<br />

their hedge books. “We take our<br />

role of number one in the<br />

industry very seriously — we<br />

are always a leader, ” he said.<br />

Speaking almost six years<br />

before the global financial crisis<br />

would rock financial markets,<br />

the charismatic French-<br />

Canadian said gold would also<br />

be boosted by the “dislocation”<br />

in the US economy and the<br />

corresponding impact it would<br />

have on the gold price due to a<br />

weaker US dollar.<br />

“Gold is the ultimate reserve<br />

currency, ” he said.<br />

And with the nickel price<br />

having enjoyed some rises in<br />

recent months and the outlook<br />

for 2003 positive, attention also<br />

turned to nickel companies with<br />

strong assets. A key conference<br />

theme was exploration, with the<br />

point being made that even a<br />

gold price of $US500/oz would<br />

not be much good to WA if there<br />

were no new mines to exploit it.<br />

Diggers & Dealers chairman<br />

Brian Hurley pointed to<br />

exploration expenditure having<br />

been slashed more than 60 per<br />

cent over the five previous years<br />

and warning of a danger that<br />

new ore bodies would not be<br />

discovered to replace ageing<br />

mines. “<strong>This</strong> great nation needs<br />

a growing and vibrant mining<br />

industry, ” Mr Hurley said.<br />

There’s an old<br />

saying around here<br />

that a bad day in<br />

Kalgoorlie is a<br />

good day<br />

anywhere else.<br />

City of Kalgoorlie-Boulder chief<br />

executive Ian Fletcher<br />

“A vibrant mining industry<br />

needs an active exploration<br />

industry.”<br />

Sandy Gray, a director of<br />

Victorian equipment group<br />

Gekko Systems, summarised<br />

some of the key reasons for so<br />

many industry players making<br />

the journey from near and afar.<br />

“At the end of the day it’s good to<br />

meet and know the guys who<br />

sign the cheques, ” Mr Gray<br />

said. “All the cheque signers are<br />

here. It’s good fun, too.<br />

Something always happens at<br />

Diggers.” Late night boozing<br />

and carousing (known in<br />

corporate parlance as<br />

“networking”) are as much a<br />

part of the forum as the formal<br />

activities, but the unofficial<br />

Upbeat: Pierre Lassonde from Newmont Mining Corporation.<br />

nightshift is known to result in<br />

upset stomaches, headaches and<br />

generalised fatigue. But there<br />

was some unusual and<br />

unexpected gastrointestinal<br />

activity before the main dinner<br />

on Wednesday night, with<br />

organisers receiving<br />

confirmation that 16 delegates<br />

had fallen sick during the<br />

conference.<br />

A Health Department<br />

investigation later found out 78<br />

delegates became sick, but the<br />

source of the outbreak was not<br />

determined and a City of<br />

Kalgoorlie-Boulder official<br />

wrote to the Palace Hotel, a<br />

long-time provider of food to the<br />

event, giving an assurance its<br />

food had been ruled out.<br />

Golden future: Brian Hurley, Kate<br />

Stokes and Suzanne Morrin with<br />

some of the precious stuff.<br />

Government of Western Australia<br />

Department of Mines and Petroleum<br />

As West Australians we know<br />

how important the resources<br />

sector is to this State<br />

We know the importance of safety and that every person working in the resources<br />

sector should come home safely.<br />

We know that when a mine closes, the environment should be rehabilitated so that<br />

in time you may never even know a mine was there.<br />

And we know there are still untapped resources across this vast State of ours.<br />

The Department of Mines and Petroleum knows this too – which is why it plays a<br />

vital role in regulating safety and environmental standards across the industry.<br />

It is also why the State Government is providing more than $130 million in funding<br />

for the department’s Exploration Incentive Scheme to encourage investment in<br />

exploration across the State.<br />

For more information about the department and these programs go to<br />

www.dmp.wa.gov.au

Diggers&Dealers<br />

20-year anniversary edition<br />

Skywest offers more<br />

than just scheduled<br />

flights<br />

Corporate and Group Travel<br />

Skywest offers discounts for frequent corporate and group travel on the<br />

Skywest Network. Skywest can tailor a corporate sales solution or group<br />

booking to specifically suit the needs of your company or organisation.<br />

Email corporatesales@skywest.com.au or groups@skywest.com.au<br />

for more information.<br />

Charter Services<br />

Skywest can provide regular and ad-hoc charter services for organisations with<br />

fly-in-fly-out requirements, servicing destinations and flight schedules to the<br />

specific needs of each business.<br />

Email charter@skywest.com.au for more information.<br />

Holiday Packages<br />

Skywest Holidays offers competitive holiday packages in Western Australia,<br />

the Northern Territory, and Melbourne. Skywest Holidays packages combine<br />

accommodation, car hire or tours and activities with Skywest flights.<br />

Email bookings@skywestholidays.com.au for more information.<br />

Sports and Events Packages<br />

Skywest Sports and Skywest Events offer individuals and small or large<br />

groups all-inclusive sports and event packages within Western Australia and<br />

Melbourne for sports such as AFL, cricket or horse racing and events such as<br />

concerts, festivals or musicals.<br />

Email sports@skywest.com.au or events@skywest.com.au for more<br />

information.<br />

Las Vegas f<br />

WA’s resources sector<br />

had survived some<br />

dark years of falling<br />

metal prices,<br />

dot.com fads and central bank<br />

gold sell downs. There was a<br />

sense that good times were<br />

coming again.<br />

Reflecting the resurgent<br />

confidence, organisers gave the<br />

conference a Las Vegas feel that<br />

included a replica sphinx and an<br />

operational mini-casino at the<br />

front of the big marquee in the<br />

Goldfields Arts Centre car park.<br />

Coordinator Graham<br />

Thomson said the vibe was<br />

more upbeat than it had been in<br />

a long time, with attendance<br />

approaching 1100 delegates.<br />

“The whole attitude of people<br />

was the best it has been for the<br />

past four or five years,” he said.<br />

Diggers is all about making an<br />

impression and Canada’s Robert<br />

Friedland, the world’s richest<br />

prospector and discoverer of the<br />

Voisey’s Bay nickel project, did<br />

just that when he jetted into the<br />

Goldfields on the Sunday before<br />

the conference. Those who<br />

touched down subsequently<br />

couldn’t help but notice Mr<br />

Friedland’s impressive<br />

Gulfstream jet, parked on the<br />

tarmac at Kalgoorlie airport.<br />

As they say: If you’ve got it,<br />

flaunt it. But arguably a bigger<br />

impression was made by<br />

another visiting Canadian,<br />

Newmont Mining boss Pierre<br />

Lassonde.<br />

At the 2002 conference, when<br />

the price had only just managed<br />

to poke its head above<br />

$US300/oz after years in the<br />

doldrums, Mr Lassonde boldly<br />

predicted that it was “only at<br />

the beginning of a gold bull<br />

market”. That year, he said, he<br />

was “fully confident we will see<br />

$US350/oz sometime in the next<br />

18 to 24 months but we’ll<br />

possibly see much higher<br />

prices”. Some saw his prediction<br />

as overly optimistic, but less<br />

than six months later the gold<br />

price hit $US350/oz, peaked at<br />

Gold prophet: Robert Friedland<br />

$US389/oz in February and had<br />

settled just back in the mid-300s.<br />

So gold pundits hung onto Mr<br />

Lassonde’s every word at<br />

Diggers in 2003 as he forecast<br />

the bullion price could reach<br />

$US450/ozwithin a year.<br />

“We continue to be very, very<br />

bullish on the US dollar gold<br />

price, ” he said.<br />

With four years still to go to<br />

the global financial crisis, he<br />

stuck by his gloomy outlook for<br />

the US and its greenback. “The<br />

fact is the US cannot afford to<br />

have a $US550 billion ($843<br />

billion) deficit year in, year out.<br />

It is unsustainable,” he said.<br />

Industry veteran Joshua Pitt<br />

had wasted no time putting his<br />

name to two new mining<br />

ventures after the recent $150<br />

million takeover of his company<br />

Dalrymple Resources by<br />

LionOre Mining International.<br />

And there is no better place to<br />

start promoting new floats than<br />

among the movers and shakers<br />

at the annual mining conference<br />

in Kalgoorlie.<br />

Mr Pitt, who listed the Golden<br />

Grove polymetallic discovery<br />

among his mining<br />

achievements, was looking to<br />

raise more than $10 million for<br />

Red Metal, a float of the<br />

Australian exploration interests<br />

of major US copper producer<br />

Phelps Dodge. He and his<br />

Ke<br />

W<br />

o<br />

d<br />

co<br />

He<br />

ha<br />

Da<br />

To<br />

bo<br />

Re<br />

ra<br />

a s<br />

Ra<br />

am<br />

In<br />

a n<br />

Lo<br />

W<br />

Ch<br />

Freight Services<br />

Skywest offers air freight solutions across Skywest’s domestic network<br />

including animal transport, same day freight (subject to Skywest Airlines<br />

schedules), perishable freight and valuable or fragile freight.<br />

Email freight@skywest.com.au for more information.<br />

1300 66 00 88 | www.skywest.com.au Your State. Your Airline.<br />

High score: Geoff Lowdon gets in some cricket practice on the<br />

pre-conference flight to Kalgoorlie-Boulder.

2003<br />

19<br />

WESTBUSINESS<br />

feel as good times head back<br />

Key players: Ross Ashton, Chris Bonwick, Peter Tomsett, Kate Stokes and David Reed<br />

Glistering glee: Andrew Forrest with the gold bar<br />

from Siberia Mining’s first pour the following year.<br />