You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

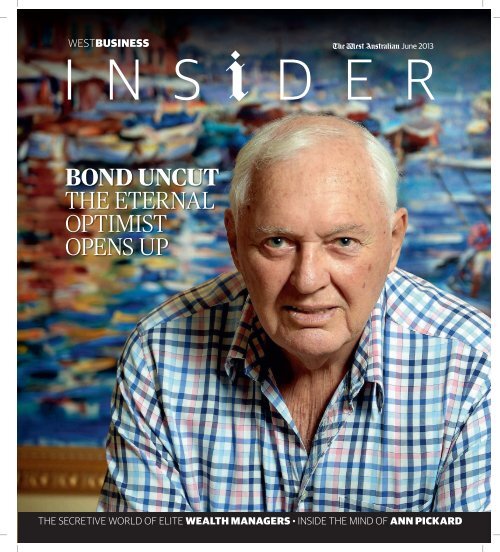

WESTBUSINESSJune 2013I N S D E RBOND UNCUTTHE ETERNALOPTIMISTOPENS UPTHE SECRETIVE WORLD OF ELITE WEALTH MANAGERS • INSIDE THE MIND OF ANN PICKARD

Gripping value across a wide range of quattro® all-wheel drive models.Free CTPInsuranceFreeRegistrationFreeStampDutyFreeMetallicPaintExonquOffer ends June 30, while stocks last. Visit Audi Centre Perth today.337 Harborne Street, Osborne Park | 08 9231 5888 | audicentreperth.com.auMD22023*Offer of free CTP insurance, free registration, free stamp duty and free metallic paint is available on new Audi quattro® stock vehicles (excluding Q5 and RS4 models) ordered and delivered between 1 May 2013 and 30 June2013. While stocks last. Excludes fleet, government and rental buyers. Not available with any other offer except the advertised 0.9% comparison rate offer on A4 quattro® models.^0.9% p.a. comparison rate available to approved personal applicants of Audi Finance** for the financing of new Audi A4 quattro® stock vehicles over 36 or 48 months. Balloon restrictions apply. Vehicles must be sold anddelivered between 9th May and the 30th June 2013. While stocks last. Standard fees and charges apply. Full conditions are available on application. Not available in conjunction with any other offer except the advertisedfree C**Audof $3

Travel ina worldof your ownRetreat to a quiet space with personalised servicedesigned around you and delivered right to your door.Say hello to your First Class Private Suite.Gourmet cuisine w Unrivalled inflight entertainment w Chauffeur-drive service**Mileage restrictions apply.

WESTBUSINESSWELCOMEFrom the editorBOND OPENS UPAs the 30th anniversary of the America’s Cup win off Newportnears, Alan Bond talks about life, death and God. Ben Harveydiscovers there are many layers to a corporate villain whocontinues to be loved and loathed by the people of WA. P10-13Cover picture: Ian MunroWA LAWWomen are an increasingly powerful voice in the State’s legalprofession but it has been a hard slog. Daniel Hatch speaks toWA’s leading female lawyers and finds there is still some way togo before we have equality in the chambers. P14-16OFFICE POLITICSDemocracy is sweeping through Perth’s corporate offices and thecatalyst for this Arab Spring at workplaces across the CBD is“activity-based working”. Marissa Lague talks to the local firmsabout the pros and cons of life without cubicles. P19-25ANN’S WAYIn 27 months she shattered Perth’s glass ceiling and defied apremier. As Ann Pickard steps down as chair of Shell Australia,Nick Sas spoke to the “bravest woman in oil” about how shemakes the big decisions. P28-30WEALTH PROTECTORSWA’s wealthy are just as worried about how wildly the marketsare swinging. Sean Smith spoke to the managers who are incharge of preserving their cash pile. P32-35PLUSMotoring: Maserati magic P26Wine: Inside the cellar of E&Y’s Mike Anghie P35Fashion: Making scents of it P36-37P10-13P19-25It is hard to believe but it has been 30years since John Bertrand outfoxedDennis Conner off the coast ofNewport.The triumph of September 26, 1983,etched itself into the memories of WestAustralians and propelled Alan Bond ontothe international stage.Three decades later, Bond has givenWestBusiness Insider a most revealinginterview about his memories from theAmerica’s Cup win and about histumultuous life since Australia II leftLiberty in its wake.<strong>This</strong> edition of WestBusiness Insidercomes out barely a fortnight before “thebravest woman in oil”, Ann Pickard, leavesPerth for the US. So we have devotedspace to the outgoing head of ShellAustralia, who punched her own hole inPerth’s glass ceiling.Other mould-breaking businesswomenare profiled in a separate feature on theState’s legal profession.With record-low interest rates forcinginvestors back into the market, we spoketo WA’s best-connected wealth managersabout how they are plying their trade.To finish, a reminderthat entries are open forWA’s premier businessawards, the AIM WAWestBusiness PinnacleAwards. Visitpinnacleawards.com.au for details.Ben HarveyP14-16Whether it’s during a boardroompresentation or at drinks after work,knowing when to tell a good joke isjust as important as knowing how to.Four of WA’s premier humoristsgive some serious advice about anot-so serious matter.Claire Hooper, comedian and formerGood News Week panellistPerfect the ‘throwaway’ — adopt thetone of a person who doesn’t carewhether people laugh or not. Don’t tellany joke that starts with “I’m not racist,P32-35 P28-30but…” or any variation of that phrase.YouTube how Obama does it.Andrea Gibbs, comedian and host ofBarefaced StoriesSelf-deprecation always makes melaugh, however if you’re a managerspeaking to your employees you mightget more nods of agreement thanlaughter.Don’t try too hard to be funny. Berelatable, honest and humble — thelaughs will come automatically. Andremember, if things aren’t going well juststart dancing like David Brent.Joel Creasey, comedian and son ofWA McDonald’s businessman TerryCreaseyHave confidence and back yourself. Evenif it isn’t funny they’ll believe you — I’vebeen doing that for years and peoplestill haven’t worked it out.Jason Chatfield, comedian andGinger Meggs cartoonistIf the joke dies, try not to stand therewith your palms open saying “rightguys?” Also, try not to repeat the joke abit louder if people don’t laugh. Theyprobably heard it the first time.ContactEDITORIAL Ben Harvey. Group business editorWest Australian Newspapers08 9482 3752 ben.harvey@wanews.com.auADVERTISINGWA: Elizabeth Poustie08 9482 3254 elizabeth.poustie@wanews.com.auNational: Peter Stevens0412 922 839 peter.stevens@pubintl.com.auNSW: Charlton D’Silva02 9252 3476 charlton.dsilva@pubintl.com.auTHE ART OF TIMING AND TELLING A GOOD JOKEJUNE 2013 7

I N S G H THeirs to apost-GoyderWesfarmersSean SmithAs Richard Goyder’s tenurematures, the chatter about hislikely successor will inevitablybecome louder.Wesfarmers’ chief executive isn’tgoing anywhere just yet. At 53 andwith eight years at the helm of WA’sbiggest company, he has time andhistory on his side, provided thecompany performs.After all, Wesfarmers’ bosses arenoted for their longevity in the job.Goyder is just the seventh chiefexecutive in the formerco-operative’s near 100 years, hisimmediate predecessor MichaelChaney guiding the group for 13years.But given the company’straditional preferencefor internalappointments, it isalmost certainGoyder’s successor isalready working atWesfarmers.It means thatmovements within thesenior managementranks are even moreclosely scrutinised forsuggested changes inthe successionpecking order.At the moment,finance director TerryBowen, Bunningsboss John Gillam and chemicals,energy and fertilisers chief TomO’Leary are seen as the leadinginternal candidates, ahead ofinsurance boss Rob Scott.With a board seat and the chieffinancial officer’s job, Bowen is thefrontrunner. Significantly, bothGoyder and Chaney were promotedinto the top job directly from theCFO role after running divisions.Gillam has the more recentoperational experience. The head ofBunnings since 2004, he isWesfarmers’ long-serving divisionalboss. But his resume includesfinance stints at both Bunnings andWesfarmers’ head office.O’Leary, whose backgroundincludes investment banking, has ledhis expanded division for the pastthree years. Scott has directedWesfarmers Insurance for six.8 JUNE 2013Significantly, bothGoyder and Chaneywere promoted intothe top job directlyfrom the CFO roleafter runningdivisions.MY OFFICESTEVE HARRISIt’s digital first at the new West Perth offices of The Brand AgencyAfter 21 years in a traditional “office and cubicle”environment, we have gone fullyopen plan. <strong>This</strong> is our first day of the newsetup for the entire business, although thechange has been staged in over the last fourweeks so most people have had a few weeks to getused to it.I joined the agency 16 years ago and spent myfirst two years in the open plan, or the ‘pig pen’as it was known back then, before moving to anoffice. Back then it was a big deal to have yourown office. It implied power — that you’dmade it.My office was known as the departure loungebecause all the prior occupants ended up leavingin unusual circumstances. I’m sure there weresome who hoped it would be the same for me.We’ve made the move to open plan to helpdrive cultural change, integration and bettercommunication in our business. Almost half ofthe revenue in the agency comes from serviceswe weren’t providing two years ago, so we needto physically reflect a more agile approach tobusiness and communication.We also needed to get people sharing their expertisemore. We wanted to dissolve the powerbalance between those who had offices and thosewho didn’t. I told everyone that if the open planmade them uncomfortable it was havingApple MacBook Pro,iPad and iPhone. I am100 per cent Appleand love it. I alwaystravel with my iPadand iPhone.The mural on theback wall, fromour design team,featuresvariations on theX in our logo.its desired effect. I know it’s made meuncomfortable. Certainly the communicationand sharing of information is already changingfor the better, even if the general noise anddistraction levels have increased.I’m 47 and the fourth-oldest person of about170 staff nationally and 85 in this office, so wehave a very young and vibrant culture. Workingwith young people is one of the best things aboutan ad agency.My wife thinks my sleeping patterns areerratic. I’m normally up between 5am and 6amand generally like to be in the office by 7, but I’mrarely in the office after 5.30 at night.I will run five to 10km before or after work fouror five times a week, depending on my schedule.If I go two days without running I tend to get alittle uptight. I need the dopamine and like thesolitude to think.Lunch has typically been at my desk in theoffice, but that will have to change now we are allopen plan. I have a stockpile of microwaveinstant soups that has made me an agency-widelaughing stock. Once or twice a week I’ll meetclients or staff for a working lunch. The biglunch days of advertising in the 80s and 90s aresadly long gone. Well mostly!Harris is managing director of The Brand AgencyThe Pacman cupbelongs to one ofour developers whowon’t be happy tosee I’m the onewho stole it.Under-desk filing cabinet:Everyone gets the samecabinet for storage. We arepushing hard to eliminatepaper. Mine has my shoecleaninggear and somepersonal items.Empty chair onmy left: Paul Yolesits here. He gaveme my first job inadvertising andwe have workedtogether at Brandfor six years. Thepile of paper inthe in-tray isPaul’s ... somepeople stilllove paper.The red file, knownas the red terror,contains our monthlyinvoicing summariesand job reports.Picture: Steve Ferrier

R E P U T A T O N SBOND SIt has been almost 30 years since Australia IIwon the America’s Cup. The man of thathour, Alan Bond, talks to Ben Harveyabout life, love and regret since 1983.Picture:Ian Munro10 JUNE 2013

SAILS ONIImy name’s Ben Harvey, Iam a journalist with The West‘Alan,Australian newspaper. I waswondering whether you are availableto speak to me.”The silence on the other end of thephone hangs long enough to becomeawkward.“Alan, are you there?”More silence. Then, just when I amconvinced that I have the wrong number,a measured response comes downthe line.“What is the nature of this call?”Alan Bond’s voice has changed overthe years. Still deliberate, after morethan seven decades his tone seems tohave developed a slight timidity,which throws me for a second.“I am writing afeature for thepaper about the 30thanniversary of theAmerica’s Cup win and Iwas hoping to have a chatto you about your memoriesfrom 1983 and life since then.”Not a shred of hesitation thistime. <strong>This</strong> was the voice of the AlanBond who strode the world stage fromthe late 1970s until the 1990s.“Of course, of course. Yes, of course.”The weekend before we were scheduledto meet at his beachside house inCottesloe, I receive a call.“Did we arrange something for tomorrow?Was it 11.45am? I am writingsomething in my diary now and I havesomething else on that day.”There is no introduction and ittakes me a while to realise it is Bond.Phoning someone and starting to talkwithout introducing yourself is usuallya mark of arrogance but the uncertaintone which I detected in my originalconversation with him was back.<strong>This</strong> wasn’t arrogance, it was befuddlement— the same kind of momentaryconfusion which many peoplewho are 75 experience.We reconfirm details for the followingMonday’s meeting.Bond’s house is not grand. Built alittle more than 10 years ago, theneo-classical style is aped byMcMansions along the Perth coast.It is, however, elegant — a descriptionwhich fits Bond as he walks down hishallway towards his front door. Hiscasual checked shirt is tucked neatlyinto faded denim jeans and light pinksocks peek out above smart brown,leather shoes. He has an admirableamount of hair for his age but he isclearly an old man. Not frail but mostdefinitely grandfatherly.He smiles as he shakes my hand andtwo decades fall from his face. He is instantlytransformed into the sharpeyedwheeler-dealer whose rise andfall became business lore. Here beforeme was the robber baron who becameAustralia’s most notorious corporatecrook — St Georges Terrace’s ownGordon Gekko.We sit down in his study and as helowers himself gently into his chair,asking his housekeeper for two cupsof tea, he is again a gentlegrandfather.Is he feigning age to disarm me, Iask myself ? Is this some defencemechanism, developed during thepast two decades of court cases andcharacter beatings, to discourage peoplefrom kicking him?I begin by apologising for callingthe man almost 40 years my seniorAlan, rather than Mr Bond.The unthinking familiarity, Iexplain clumsily, is born of the factthat as a child of the 1970s, I grew upwith Bond everywhere. Buying breweries,winning yacht races, sellingland, taking over newspapers, buyingTV stations, being feted by primeministers, entering courtrooms, beingled to prison.He waves away my apology and westart talking in earnest about eventsoff Newport’s Rhode Island 30years ago.One and a half hours later I walk outof his front door clear in my mind thatof all the impossible highs and incomprehensiblelows that Bond hasweathered in public life — a soap operawhich opens with him as an influentialbillionaire, climaxes with himbeing thrown in jail and closes withthe sad denouement of a daughter’saccidental death and a lover’s suicide— it is the America’s Cup win of 1983which defines him.The walls of his office groan underthe weight of sailing pictures.Models of his 12-metre yachts siton every available flat space. His collectionof books represents an eclecticmix of authors, including Geri Halliwelland Frederick Forsyth, but thetopic of sailing dominates the titles.Ben Lexcenpunched throughthe wall at onestage and brokehis hand.He launches into the conversationwith infectious enthusiasm, talkingwith such animation that his wordsoccasionally trip over each other.“The yacht itself had the capacity towin, no question about that,” he says,leaning forward earnestly, “but it wasalso very light and fragile. The advantageof putting the keel in the shape itwas, that wing was all lead, so it wasable to keep the yacht upright.“The engineering, in hindsight, andin practice, when we had so manybreakages, showed that we wereunder-engineered.“Everybody thinks it was the keelthat won the race. It really wasn’t. Thekeel had the stability that allowed usto have more sail. If you had a yachtthat was stable you could then pulleverything to create a lovely shape inthe sail but it was under a lot of stress.So that’s why we had the breakage atthe time.“We should have won the first tworaces. We shouldn’t have been in theposition that we got to.”The position to which he refers isbeing down three races to one in theseven-race series, with Dennis Conneragain poised to retain the trophyfor the New York Yacht Club.The first race, on September 14, endedin catastrophe when the steeringbroke. The next day’s race saw Connerflutter easily to the finish line afterAustralia II suffered problems withthe main sail.It was a terrible start and Bond hadto work hard to keep the team together.The strain on yacht designer BenLexcen and skipper John Bertrandwas clear.“When the yacht came in, peopledon’t really know, but I acted as teamcaptain,” Bond remembers. “I madeall the important decisions, based onadvice. We would have a review of therace immediately. We had a plotter onthe tender who would plot, based onthe wind and the sea, the perfect raceon that leg that you could sail. Thenwe would plot where we went and wediscussed how much you would getaway from that. There was a postmortem,if you like.”Were there any recriminations inthe camp? With all the equipment failuressurely Lexcen was in the frame?Bond pauses before choosinghis words“Well … Ben would get very iratewith it. He was always heated up. Hepunched his hand through the wall atone stage and broke his hand. Wewouldn’t criticise the crews at night atall. The guys get disappointed. It’s likea football team.“They lose one game, confidencegoes and they lose the second game.Yachting is no different to that.“On the mornings I’d join them allfor breakfast and then I used to do thepositive that came out of the race beforeand how we should be able to win,how Benny had given them a greatyacht, that it was the human elementthat would win it.“My job was to do the last-minutemotivation. Not just motivationbut also covering some of the(tactical) things.”I suggest that, surely, after threefailed challenges since 1974 under hisbelt, and Conner’s Liberty beatingthem so comprehensively again in thefirst meets of 1983, he must havethought defeat was inevitable.“Well, we weren’t pessimistic butwe were conscious that we needed toget around the track,” he says.The refusal to concede selfdoubtwould prove an enduring themein the interview.The eternal optimism was wellfounded because in race three the boatcomprehensively outperformed theAmericans, with Bertrand almostsix minutes clear of Conner whenthe wind died and the contestwas aborted.“The yacht was fast,” Bond says ashe recounts the elation of knowingthey had a chance. “There was a senseof adulation because we didn’t haveany breakages. We had a yacht racewhere we were way in front.”The Australians won the rescheduledthird race but, after losingthe fourth, were faced with the dauntingtask of having to sweep the lastthree contests.Three decades later, Bond again dismissesany notion that he ever entertainedany other result than victory.“People tend to forget that this wasCONTINUES PAGE 12JUNE 2013 11

R E P U T A T I O N SFROM PAGE 11my fourth challenge,” he says. “I hadbeen at this racing game for a longtime.“In a yacht race the game isn’t overuntil the gun goes. Anything can happen,you can pick a wind shift up andthings can change.”Bond’s self-assuredness in the faceof 132 years of contrary evidence wascompletely different to John Bertrand’sperspective.It is well known that the skipper’spsychological state became increasinglyfragile after the disastrous firsttwo starts.It would not be the first time thethen-millionaire and soon-to-be billionairewould see someone close to himstruggle with mental demons.was under such pressure,”Bond stresses. “He would go to‘Johnthese media conferences andAmericans like to analyse everything.Why did you do that? Did youmake a mistake here?“I used to protect him when I couldand keep him out of that because thepressure had gotten to him. At thatstage we were on psych tapes.“He didn’t sail for a long time afterthat. Even though he won, he couldn’tsail for a year or maybe two years.“He had the talent but he couldn’thave done another race.”Bertrand was using self-motivationtapes as a crutch, Bond explains, andthe skipper was slavishly dependenton them.“He was wearing those tapes all theway down until he went down (to theyacht) but he didn’t need those tapesin the early races. Jimmy (Sir James)Hardy had to fill in on a few races inelimination because he (Bertrand)had a difficult bout then.“All sportsmen of such high calibreand intensity go through theseperiods and it’s about how they get outof it. Some take a lot longer.“It’s well known that if you go to theOlympic Games and you win or don’twin you go into almost a collapsed position.They can fall apart.“That crew, they were talking toJohn, saying ‘Come on John, youcan do it’.”It was under this mountain of pressurethat Bertrand held the hopes of anation going into the seventh race.Bond remembers that morning: “Isaid to them ‘You will be in some of thebooks. But if you really want, individually,to make history, we have to win.We can’t come second, even though wehave done so well’.”After four legs Liberty was firmlyin front. Observers who knew basicsailing tactics wrote off Australia II.“If you are behind all the other guyhas got to do is sit in front of you,”Bond explains. “He doesn’t have to doanything else.“You can go anywhere you like onthe course but if he stays in front ofyou he is going to beat you home.”The millions of Australians whowoke up early to watch the race hadthe luxury of not understanding thisimmutable law of regattas and so continuedbarracking for Bertrand in hisbid to close the gap.Almost 19,000km away from wherebleary-eyed Australians were staringat their TV screens, a forlorn Bondwas bobbing up and down on an observationboat, watching his nemesisConner protect his lead over AustraliaII by methodically mirroring everychange of direction by Bertrand.Bond knew this tactic, known as“covering” and perfected by sailorsover centuries of naval warfare, wasunbeatably sound.Preparing himself for the inevitable,he went below decks to sit withhis equally pessimistic, but stillcharacteristically fiery, yachtdesigner.“I went down below and Benny wasthere and he had a stress headacheand could not get his head up. He wasthumping his seat because the guys,he said, let the boat down.”I was really distraught after losingDi. I am able to talk about it now. Iwas distraught after losing her and Ijust couldn’t get my head around it.It was at this point that Bond beganto pray.“I am glad I have had my faith becauseit has carried me through somedifficult times,” he rationalises. “Iwas and am a strong Catholic.”Had it helped him in other times?Through court cases? Prison?“Well, that’s another time when youneed faith. It’s a hard thing to put intopractice but you de-stress yourself.And that’s your ability if you havefaith.“I had it from when I was young. Imean, I turned Catholic when I was 15.I became a Catholic, I was Church ofEngland before. High Church ofEngland, too. You get brought up in it.It becomes a part of your life.”He starts talking about the death ofhis wife, Di Bliss. It is an unexpecteddiversion, given he has never talkedpublicly about how he coped with theaftermath of her suicide in Januarylast year.“I had circumstances about eightmonths ago,” he says quietly. “I wasreally distraught after losing Di. I amable to talk about it now.“I was distraught after losing herand I just couldn’t get my head aroundit. I was spending a lot of time in London.I used to go to church every Sundayand I would light candles.“I felt that this weight was never goingto lift. I was never going to get outof this.“But you know, one day, I was atFarm Street Church and I was walkingback to the hotel and all of asudden it was gone. Completely gone.“I could then deal with it. I knew shewas gone, completely, and I could dealwith it. It was quite uplifting.”His speech slows and for the firsttime in the interview he doesn’t holdmy eye.“For me, it was a very, very importantpart of my faith.”I ask whether he believes there is aconnection between society’s loss offaith and the emergence of many modernemotional problems.He isn’t convinced, explaining thatBliss was beset by mental health problemsdespite enjoying a heavy religiousinfluence in her life.“Di’s father was a minister,” heexplains. “All of a sudden she had goneinto a black hole and couldn’t get outof it. It was just awful. It went on forabout 18 months before she …” hetrails off, his voice having fallenalmost to a whisper.He is obviously confused about howhis life’s great love had spiralled souncontrollably into such a dark place.For a little while he loses his train ofthought. Jumbled words spill from hismouth almost silently before hestumbles on a line of thought withwhich he feels comfortable.“She just didn’t want to live in thisworld,” he says, with resigned conviction.“It was a most unusual thing. Itried taking her to her church and shewould go through the motions of coming.She had lost the ability to absorb.So, she was in such a deep, deep depressionshe couldn’t dig herself out. Ihave always wondered, umm what …”Again he trails off, appearing bewildered.His voice drops so low I have tolean forward to hear him.“We don’t know the reason why itgot to that stage. I mean, she made alovely letter to me. There was nothingyou could identify.”The power of prayer gave Bond therelief from despair he sought inthe Farm Street Church.But it was perhaps not the first timethat he leant on his faith in a time ofneed.Decades earlier in the AtlanticOcean on September 26, a defining,perhaps a miraculous, moment for theAustralian nation was about to occur.Almost a minute behind Liberty,with 6km of option-sapping light windahead of them, Australia II veered toanother side of the course in a desperatebid to find a breeze.Exactly what was going throughConner’s mind in those late stages ofthe seventh race of the 1983 America’sCup is still debated.Maybe he was so confident in hishandsome 57-second lead, backed bymoprbalivDaAuLethofnotendeYawaforbefartancawhfluowinonmeaslonthRutenadpr12 JUNE 2013

Jubilant: John Bertrand and AlanBond celebrate in Perth in October1983 after the America’s Cup victory.Jail hobby: Alan Bond, at homein Cottesloe, in front of three ofhis own paintings, including acopy of Renoir’s Luncheon of theBoating Party. Picture: Ian Munrohsc-Ie-b.e-I”l-oitagenefcg,er.y,dor-hf’ssymore than 130 years of American supremacy,that he felt he could defy abasic tenet of ocean racing.He didn’t cover.Conner, along with just about everyliving soul between Perth and Sydney,Darwin and Hobart, then watchedAustralia II’s spinnaker grow taut asLexcen’s fabled winged keel pulledthe yacht upright and made full useof a strong breeze that came fromnowhere.On Bond’s observation boat, maintenancechief Ken Beashel went belowdecks to tell the forlorn Royal PerthYacht Club member that somethingwas happening.“You couldn’t see it from off the boatfor a while,” Bond recalls.“You couldn’t see the relationshipbetween the two yachts. They were toofar apart. You didn’t know the distanceyou were behind until they bothcame back to get to the mark. Andwhen she came back on course shefluttered through beautifully on ourown private breeze.”At 5.21pm Alan Bond became aninternational celebrity feted equallyon the streets of Perth as in the investmentbanks of Wall Street.“You get high,” he laughs, whenasked what is it like to realise a lifelongambition.“No question about that. I went tothe press conference afterwards.Rupert Murdoch had been on ourtender with Lachlan and he wasadvising me about how to handle thepress.“Your ego goes up. Of course it does.Your ego is ‘if you can do that, you cando anything’. You have to rememberthat we had to beat all the other nationsbefore we got the right to challengeand we did that every time. Youhad to beat the French, the English,the Swedes, the Italians.”Did this “God complex” affect hisjudgment in business life?“When you win the America’s Cupyou have to take risks and I think I appliedsome of that strategy to business.I mean, every door in the worldopened. It was unbelievable. Not justhere but you could go anywhere inNew York, all the big houses, like JPMorgan, they all wanted to do businesswith you.”He drops his eyes and searches forhis words.“If things hadn’t occurred withHolmes a Court then things would bedifferent,” he says in an obtuse referenceto Bond Corporation’s investmentin the corporate raider’s Bell Resources— the catalyst for a series ofasset transfers which resulted inBond going to jail.“It’s just you make a wrong step inthe process. I believed we would havebeen able to carry that through.“But it wasn’t a yacht race,unfortunately.”He then comes close to a rare admissionof personal responsibility for thecorporate collapse which ended withhim being sentenced to four years jailfor fraud and investors owed$1.8 billion.“I really think at some stage, whetherthe word ego is the correct word,but you believe in yourself that youare infallible,” he says.“You can do things that other peoplecan’t.”His famously pugnacious sidedoesn’t let this moment of contritionlast long.“It’s very interesting that all of thecompanies that we acquired and developed,the companies didn’t (fail) —it was the financial structure,” he saysdefiantly.He finds it easier to talk about anothergreat moment of regret in hislife — the shambolic cup defence of1987 in Fremantle.“There weren’t enough resources inAustralia to have two yachts campaigning,”he says, referring to hisdefeat at the hands of Kevin Parry’sKookaburra III.“There wasn’t the expertise here. Ifwe weren’t fighting each other wecould have retained the cup.”Has he ever thought of giving itanother crack?“Oh yeah, of course I have,” hereplies instantly. “But you probablycouldn’t win it first time up, forstarters.”He would have a couple ofchallenges left in him though?“No, not really,” he says, in a dismissivenod to his own mortality.“It’s like, if you climb Mount Everest,do you want to go and climb itagain? Well, you have already donethat. There are other challenges.”‘She just didn’t want to live in this world’: Alan Bond andthe late Di Bliss on their wedding day in 1995.Besieged: Alan Bond outside Observation City after aBond Corporation annual general meeting.When talk returns to his legacyhe points to Bond University,the Harvard-style privateinstitution he established on the GoldCoast in 1987.“It’s a success story. It has been profitablefor 23 years,” he says. “Thenumber one law school in Australia.Their own medical school there now.“In 100 years time will peopleremember the America’s Cup?Probably. But more likely BondUniversity will have overtaken that interms of significance.”CONTINUES PAGE 36JUNE 2013 13

P R O F E S S I O N SWomen were banned from beinglawyers until an Act of Parliament90 years ago. WA’s leading femalelegal minds told Daniel Hatchabout their fight for equality inthe chambers.They are some of the sharpestlegal brains in the State:courtroom-hardened litigators,keen-eyed negotiators and deeplyknowledgeable advocates.Some are specialists, entrusted bytheir clients to win or save millions,even billions of dollars.Some are performers and persuaderswho thrive in the theatre of thecourtroom. Some prefer to guide andnurture clients through the legal minefieldthat confronts them at traumatictimes in their personal life.One works in tax, another in successionplanning. One heads the Perthchambers of a global law firm. Onedeals with big insurance companiesand three work with the mining andresources sector. Two went to CambridgeUniversity. One worked on theBell litigation.Three are family lawyers, most arebarristers. One is a silk.They may not be household namesbut if you are going to court, these arethe people you want in your corner.If there is one thing these lawyersall have in common, besides beingwomen, it is their passion for whatthey do.As a lawyer, barrister Rebecca Leesays, you make a valuable differenceto businesses and individuals.“I love what I do. It is dispute resolutionwithout the use of outwardweapons and, as such, is an importantpart of our ongoing civil society.”It is also challenging and rewardingmentally, barrister Sarah Russellsays.“I enjoy working on complex litigationand mastering the nuances andfacts of each case. The litigation processis generally the same in all mattersbut every case involves learningsomething new and developing a clearunderstanding of things at the heartof the case.”Until 1923, both of these top-flightlegal careers would have been impossible.It was only 90 years ago that anAct of Parliament allowed women topractise law in WA. Now, as FamilyLaw Practitioners Association of WApresident Teresa Farmer points out,women are everywhere in theprofession.“We have a male Chief Justice,although a female head of the Court ofAppeal,” she explains. “We have amale chief judge at the District Court,although he succeeded a female. Wehave a male chief magistrate althoughthe deputy is female.“We have a male chief judge of theFamily Court of Western Australia althoughthe Chief Justice of the FamilyCourt of Australia is female. There arewomen on every bench in every court,every tribunal or on every legal committeeor society.“Women are senior partners, partnersand associates in firms includingthe national and international firms.”In 2011, there were more than 5100registered legal practitioners in WA.About two-fifths of those were women.Of the total number of lawyers, 203were barristers. Just 35 of those barristerswere women. WA has only twofemale State Counsels, or “silks”. Oneof those is Gail Archer.Archer joined what was then theCrown Solicitor’s Office in 1989,where she did her articles, beforemoving to the Director of Public Prosecutionsin 1993. She joined the bar in2004 and was made a silk in 2007.“Once we finished our articles, mycolleagues and I were let loose on thecourts and were able to do countlessappearances and trials, at a very earlystage of our careers,” she says.“I vividly remember my first jurytrial in 1992. I felt like a complete imposterstanding up to represent theState at the age of 24, but at the sametime I was exhilarated by the process.“My love of advocacy was cementedin those early years, and has remainedwith me ever since. I have never wantedto do anything else.”Archer says that in her early career,when there were not many female advocatesdoing trials, her gender wasan advantage.“<strong>This</strong> meant that a moderately competentfemale lawyer would be memorable,whereas a moderately competentmale lawyer would be less so. I alsoreceived some very interestingwork and opportunities from an attorneygeneral who…was keen to promotesenior professional women.”Family law barrister PenelopeGiles, a former president of theWomen Lawyers’ Association of WA,said the growing number of femalejudges and magistrates represented“a seismic shift”.“Now it is possible to appear in acourt in which the judge and all thecounsel are women, and it does notraise an eyebrow,” she says.“Many great strides were made inthe early 90s and 2000s with the ap-pointment of women judges andmagistrates.”Giles says that in family law, someclients requested a barrister of a particulargender, but most people justwanted a barrister who was skilful,effective and cost-efficient.The law is less of a “boys’ club” anda more civil place than it used to be,WA LTrMPeGa14 JUNE 2013

LAWTrailblazers: Elizabeth Heenan, Jenni Hill, Sarah Russell,Maria Saraceni, Katrina Banks-Smith, Rebecca Lee,Penelope Giles, Clare Thompson, Bettina Mangan,Gail Archer and Teresa Farmer. Picture: Michael Wilsonaccording to barrister Clare Thompson.“To the point that the boys whoconduct themselves like it’s a boys’club get called for it. It’s very collegialtoday,” she says.Thompson fell in love with the lawwatching her father — a country solicitorin her home State of Tasmania —in the theatre of the courtroom andhad no doubt that she wanted to followin his footsteps.“Dad thought law wasn’t a goodcareer for a woman because it wouldbe so difficult to run a law practiceand have children,” she remembers.“He was very frank about it — he wasjust of that generation.”Thompson did a business degreebut it was clear that her interests layelsewhere.“I really always wanted to be incourt.”Now a barrister specialising in taxand property law, Thompson returnedto study law at the University of Tasmaniaas a mature-aged student. Shethen spent 10 years at Freehills workingin general litigation before movingto the bar in 2004. In 2002 she becamethe most junior person ever tobe elected president of the LawSociety of WA.Eighteen months ago, after thedeath of her father, Thompsonused her inheritance to establishthe Aboriginal Women’s LegalEducation Trust. <strong>This</strong> yearthere are two youngAboriginal womenstudying law in WA universitiesthanks to scholarshipsprovided by thetrust. One scholarship will beawarded each year.“I’m a huge believer in educationas a transformative factorin our society,” Thompson says.“That’s how you go from myDad, as the middle child of alcoholicparents living in povertyin Sydney, to me in these beautifulchambers, earning plenty ofmoney and living in a beautifulplace. It’s all about education.”June Kenny is managing directorof Dwyer Durack and one ofthe few Aboriginal people practisinglaw in WA. She welcomes the“huge difference” the education trustwill make to the opportunities availableto Aboriginal women, having herselfstudied as a mature-aged studentwith the help of an indigenous entryprogram, Koora Kudidj.“I wanted to be able to provide adviceas an Aboriginal person to otherAboriginal people who were in business,”she says.A former convenor of the WA LawAt international law firms, youhave an obligation to have apractice worth $2 million a year— that doesn’t happen between9am and 5pm.Maria SaraceniSociety Aboriginal Lawyers Committee,Kenny did her articles at DwyerDurack in 2000 and was managing directorwithin 10 years.Between 60 and 65 per cent of the undergraduatescurrently studying laware female, according to former LawSociety of WA president and MurdochUniversity adjunct professor of law,Maria Saraceni.The prominent employment lawyersays the high number of women enteringthe profession means the way itoperates needs to change, includingthe idea that women must break theircareers to have children.“Once breastfeeding is over there isno need for the woman to be the one tostay home to care for the child,” shesays. “There should be equal parenting.”Breaking their careers meanswomen are disadvantaged when itcomes to becoming partners in firms,she says.“At international law firms, youhave an obligation to have a practiceworth $2 million a year — that doesn’thappen between 9am and 5pm, there’sa hell of a lot of long days and weekendsgo into that,” she says.Of the 331 practitioners who weredirectors of their companies in 2011,just 65 were women. Of the 333 practitionerswho were equity partners intheir firm, 42 were women.One of those is Jenni Hill, who in2011 became the first woman to bemade head of any office of legal firmNorton Rose in Australia.“My colleagues and clients have alwaysbeen aware of my equal commitmentto them and to time with my family,”she says.“Balancing those commitments hasbeen challenging but never insurmountable.”Hill was named WA Women Lawyerof the Year in 2011 for her work on creatingflexible work practices at NortonRose, which have seen the numberof women lawyers working under flexiblearrangements increase from 15per cent in 2009 to 27 per cent in 2013.There was an increase in the rate of returnof women from parental leave forat least one year from 50 per cent to 75per cent.CONTINUES PAGE 16JUNE 2013 15

P R O F E S S O N SFROM PAGE 14Another lawyer who knows allabout juggling family and makingpartner is Culshaw Miller seniorcounsel Elizabeth Heenan.Last August she received a nationalhonour from Australian Women Lawyersfor her “extraordinary contributionto the Australian legal community”at a gala event in Canberra.The wife of Supreme Court JusticeEric Heenan, she was recognised forher time as president of the Law Society,her work as a director of the LawCouncil and as Pro-Chancellor of CurtinUniversity, and for her work at lawfirms including Minter Ellison andMarks & Sands. She did it all, as theorganisation pointed out, while raisingtwo children.Heenan had to make partner notonce but twice during her career: firstat the family firm, EM Heenan & Co,and then again when it merged withNorthmore Hale Davy & Leake (nowMinter Ellison).“I became a partner there eventually— it was far more challenging becauseit wasn’t a family firm and itwas a far more competitive environment,”she says.Managingdirector ofDwyer DurackJune Kenny.Picture:Michael O’BrienHeenan, who specialises insuccession law, including wills andprobate, studied monetary economicsat Cambridge in the 1960s before marryinginto the renowned WA legalfamily and studying law.Bettina Mangan, a barrister specialisingin insurance, became a partnerat what is now Lavan Legal in the late1980s. She encouraged women to “dowhat men do” and become a partnerbefore having their families.“I think it’s more important to getup there and get your partnership andthen you’ve got far more autonomy,you can juggle your commitments farbetter and you can organise the workhours you want to do or work fromhome,” she says.Katrina Banks-Smith is one of thenew generation of lawyers who chooses,and is able, to work flexibly.A barrister specialising in largescalecommercial disputes, bankingand insolvency, Banks-Smith saysemail and smartphones are changingthe way lawyers worked.“I have children and the ability towork remotely and utilise everymodern device has really helped mecontinuing to work and be very involvedin my children’s day-to-daylives,” she says.“(I’m) coming and going, workingvery odd hours, but I’m always available.It’s not an easy way to practisebut we managed by understanding thereal priorities and trying to stayorganised.”Banks-Smith was part of the teamthat worked on the Bell litigation, theSons of Gwalia administration and,more recently, the dispute over theRaine Square development. She wasalso part of the team representing the2009 Toodyay fire victims.She says the real challenge towomen in the profession was simplyencouraging them to persevere.When asked what advice they wouldgive young women upon entering theprofession, most said to grasp everyopportunity, learn from the experiencearound you and remember tomaintain a life outside of work.“You can’t change the world,”Farmer says. “But with hard work,current knowledge and a positive attitude,you can achieve a long andsatisfying career.”Do morethan bank acrossAsia Pacific.Do business.IndiaVietnamLaosCambodiaThailandMalaysiaSingaporeIndonesiaSouth KoreaChinaJapanHong KongTaiwanPhilippinesPapua New GuineaThe Pacific IslandsNo-one connects Australian business to Asia Pacific like ANZ. With businessbankers where you want to do business, we can connect you to thefastest growing region in the world. You’ll have access to our bankers’ localcontacts and invaluable business knowledge in 28 markets across Asia Pacific.Visit anz.com/inasiaAsia Pacific Desk on 0403 017 439New Zealandanz.com/inasiaANZ has been awarded Business Bank of the Year 2013 by Money magazine. <strong>This</strong> was awarded on the basis of ANZ’s strength across selected price and product related categories. Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522. ANZ’s colour blueis a trade mark of ANZ. ANB1054/A/L

Emeritus Professor Gary MartinCEO AIM WAContinue your journeyto leadership excellencewith AIM WAwww.aimwa.com

THE CLEVER AUSTRALIANMoving mountains with the cloudInnovation is part of the Komatsu DNA, and it’sa passion that’s enabled them to build some ofthe most technically advanced earthmovingmachinery in the world – including Australia’sfirst hybrid excavator.CEO, Sean Taylor and CIO, Ian Harvison’sunrelenting pursuit of new technology also sawKomatsu Australia being among the first in thecountry to move their entire ICT infrastructureto the cloud.Telstra Cloud Services provide Komatsu with asmarter, safer, and more productive way to work.And without the distraction of having to managetheir ICT, they can focus their attention on doingwhat they do best – leading the innovation oftheir industry.We believe in The Clever Australian, and wantto create partnerships that ensure Australianthinking and skills remain in demand theworld over.Search ‘Clever Australian’ to find out more.

OFFICE POLITICSNo desks, no cubicles, sound-deadened walls,wi-fi accessible everywhere, GPS trackers onlaptops so staff can be located. Welcome tothe offices of the future being built in Perthright now. Marissa Lague reports.JUNE 2013 19

THE HOLIDAYPLANET GROUPPROUDLY ANNOUNCE THE LAUNCH OFTHEIR TWO NEW EXCLUSIVE PROGRAMESTHE AROUND WORLD COLLECTIONA luxurious selection of Holidays that encompass Four & FiveStar Cruises, World Class Airlines and magnificent stopoversat some of the World’s most exciting cites. In total we have 23Tours featured in our brand new catalogue which is only availablefrom the Holidayplanet Group either by post ot online.Our Luxurious Selection of Holidays Includes:t#FWFSMZ)JMMT-BT7FHBT/FX:PSL-VYVSZ$SVJTFt"SHFOUJOBUP&VSPQF$SVJTF5PVS4UBZt1BSJT-POEPO/FX:PSL-BT7FHBT4BO'SBODJTDP-VYVSZ$SVJTFt4PVUI"GSJDBUP&VSPQF$SVJTFUPVS4UBZt(SFFL*TMFT&HZQU/FX:PSL4BO'SBODJTDPXJUI-VYVSZ$SVJTFt#FSNVEB'MPSJEB-BT7FHBT#FWFSMZ)JMMTMVYVSJPVTDSVJTFt4QBJOUP/FX0SMFBOT-VYVSZDSVJTF-BT7FHBT#FWFSMZ)JMMT/FX:PSLt1MVTBUMFBTUBOPUIFSJODSFEJCMFIPMJEBZTFYDMVTJWFMZBWBJMBCMFPOMZUISPVHIɨ F)PMJEBZQMBOFU(SPVQTHE AFRICA COLLECTIONAn exclusive selection of holidays that encompass some ofthe world’s most enviable destinations in Africa including awhole range of holidays from luxurious cruises, through tomagnificent safaris at some of Africa’s best including Kruger -Chobe - Okavango and the Kalahari.Our Luxurious Selection of Holidays Includes:t$IPCF/BUJPOBM1BSLt,SVHFS4BGBSJ1BSLt,BMBIBSJ3FTFSWFt0LBWBOHP%FMUBt)JHIMJHIUTPG4PVUIFSO"GSJDBt&BTU"GSJDBO&YQMPSFSt$IPCF)PVTFCPBU$SVJTJOHtɨ F3PWPT3BJM+PVSOFZtɨ F1SJEFPG"GSJDB5PVSt2VFFO.BSZ$SVJTFUPVSTo Order yourPersonal Copy pleasecall now 1300 789 567or go onlineto check out ourBrochure atcruiseplanet.com.au/thearoundworldcollectionTo Order yourPersonal Copy pleasecall now 1300 789 242or go onlineto check out ourBrochure atholidayplanet.com.au/theafricacollectionAround The WorldOPENING HOURS: MONDAY-FRIDAY 8am-6pm130613TW SATURDAY 9am-3pm 1300 789 567Africa1300 789 242Free Parking- Central locationOpen Mon-Fri 8am-6pmPrivate AppointmentsMon-Fri if you preferInstore288 Stirling St, East PerthOnline Emailholidayplanet.com.aucruises@cruiseplanet.com.au

Organisations going down the ABW path needto step back and look at their philosophy.Matt StrudwickThere is a counter culture growingin Perth offices which isbased on delivering a streamlinedwork environment that isfunctional and pared back.In this new world, most notable willbe the absence of personal effects belongingto the people who work there.Family photographs and deskornaments belong to yesterday’swork space.Also missing will be the vastreserves of paper that clutter desks intraditional offices.As part of the move towards paperindependence, legislation and regulationsused by your company have beendigitised and follow-me printing technologyensures printers are only activatedwith the swipe of your accesscard.The meeting you’re attending startson time because punctuality is strictlyenforced in an office where the locationof staff is no longer fixed.When it gets under way, the gatheringtakes place in a customised meetingarea where wrap-around soundproofing mutes the conversation andensures nearby teams are not disturbed.Technology abounds in this wififloodedoffice and laptops around thetable replace the notepads and diariesof the past.The corner office that was once amilestone in career development is asymbol of the past for the businessesaround Australia who have signed upfor the new religion for office managers— activity-based working.It has already been embraced bysome of the country’s leading companies,which have embarked on a radicalchange in the way they work anddeliver their services.According to its converts, ABW reversesthe entrenched practice ofworkplace design that for so long hasdone little more than replicate theconcept that assigns one employee toone desk or work area.It replaces this with a workplacewhere there are no assigned desksand a range of freely accessible areasthat are specifically designed tomatch a task.In this new environment, so thetheory goes, discussions, ideas,collaboration and teamwork flourish.At the new ABW office set up by PricewaterhouseCoopersat its Perthheadquarters in Brookfield Place, individualwork stations are interspersedwith group work areas forteam projects, semi-secluded workand meeting areas with sound-proofsurrounds and designated meetingrooms where more confidential clientwork can be carried out.The layout also comes with new terminologyto describe work areas. Thesnail is a meeting hub with wraparoundacoustic walls and the NedKelly is a work area partitioned by acurved wallMatt Strudwick, senior workplaceconsultant at the Sydney office ofVeldhoen + Company, which foundedABW in the Netherlands in 1994, saysswitching the focus so workplaces aredesigned around an organisation’skey objectives offers adaptability andagility in a work model that changeswith a business so it’s not stuck withwhat was designed on day one.In an ideal world, he says, the firststep is to set the aspirations for theworkplace.“Organisations going down theABW path need to step back and lookat their philosophy,” Strudwick says.“They need to ask themselves‘What’s the activity that’s really importantto my business and will makeit successful into the future andhow do we base the workplace aroundthat’. The office should service youand produce an outcome.”Veldhoen + Company has implementedmore than 80 ABW projectsaround the world for a client line-upincluding banking and finance,professional services, healthorganisations, IT, government andeducation.In Sydney, Macquarie Bank, CommonwealthBank of Australia, GoodmanGroup and real estate firm JonesLang LaSalle have made the switchand KPMG will be taking it up in 2016when it moves into its new office.Along with PwC in Perth, Bankwesthas also adopted ABW for its offices.A random snapshot of most officeswill reveal empty desks and workspaces devoid of people. Surveys showthat at any given time, 40 to 60 per centof work points are vacant while staffattend out-of-office work commitments,sales calls, meetings or takeannual leave.With climbing office rents a majorexpense for businesses, and Perthleading the nation for high CBD rents,vacant or underutilised workspacesare a costly luxury.And there’s the rub — ABW offersbig savings on a businesses’ propertybill.CONTINUES PAGE 22Activity-basedworking inaction:Bankwest’sRussell Quinnand Andy Weirplan their day.Picture:Lee GriffithJUNE 2013 21

Egalitarian: PwC managing partnerfor WA Justin Carroll, like his staff,relishes no longer having an office.Picture: Michael WilsonFROM PAGE 21According to Strudwick, organisationscan typically save 20 to 30 percent on property expenses, with savingscoming from leased space and theoperational expenses of having to servicea smaller number of squaremetres.And in terms of the net spend, hesays ABW doesn’t have to be an investment.“If you’re talking about an organisationof 100 to 200 people it’s probablygoing to be cost-neutral,” he says.“Anything below that is an investmentand for organisations abovethat, it should result in a saving.”Despite high-profile corporate takeups,ABW is often confused with hotdesking,as practised in offices thatare not divided into work areas andwhere there is more staff than workstations.Property expert Judith van der Lindenwas recruited by Bankwest tohelp guide its ABW introduction. Shebelieves the negative connotations ofhot-desking still cloud the ABW message.“ABW at its core looks at what peopledo and looks to support their outcomesso it is really people-centric,”van der Linden says.“There are benefits in cost savingsbut it puts people first by asking‘where can I be to best deliver the outcomes’.It’s a very different conceptfrom hot-desking.”PwC formed a steering committeeto guide its workforce through thethree components of an ABW transition— the physical layout, use of newtechnology and the new behaviouralapproach needed to operate in theworkplace.“At its heart, the reason we’ve gonedown this road is that it provides fantasticflexibility,” says PwC managingpartner Justin Carroll.“When we started, we thought of itas a property or an office concept butwhen we got into it, we realised itwould enable us to transform the waywe do business.”After seven months in their new office,PwC’s steering committee hasmorphed into a working group andthe feedback has been positive.“We periodically check staff pulseand a report is close to coming out butanecdotally, there’s been overwhelminglypositive support for the new wayof working,” says Carroll, who nolonger has a private office.“I do still have an office though, it’sacross four floors and I get to share itwith 600 of my best friends.”He says the new office doesn’t resemblea kaleidoscope and there isstill a tendency for workers to clusterwith their service teams.One of the hoped-for benefits toemerge at the new PwC office has beenthe extent of collaboration that followedthe flattening of the officestructure.According to Carroll, the new environmentfacilitates client conversationsthat wouldn’t occur in a morestructured office.“An organisation like ours has specialisedgroups and as we continue togrow, there’s a risk that we will losesome connectivity between thepractitioners.“If you can mitigate that risk, fundamentallythe client is benefiting.”Pwanselocfirchbefut73enwaworiemoflea fdainwodischderamaBusiness travel made easyMKT130612_2004112Flying for business should be stress free, leaving you to focus on the reasonfor your trip. The West Australian aviation editor Geoffrey Thomas andhis experienced team make this easier with airlineratings.comairlineratings.com is an easy to use site that provides an objective safetyand product analysis of over 400 airlines worldwide.Not only can you find the safest airline on your route, you can read reviews by the expertteam and other passengers, and find out which airlines offer the best flying experience.Before your next business trip, visit airlineratings.comVisit airlineratings.com today for your chanceto win $5000 towards your ultimate travel experience.POWERED BY

Bollig Design GroupOne year after ABW: Andy Weir, ofBankwest, in one of the communalareas staff have enjoyed for the past12 months. Picture: Lee Griffithdet-yost-srol-e--e-oee-Just one restricted area remains atPwC’s Perth office — the firm’s fraudand forensics practice, which storessensitive material and occupies alocked office.Bankwest has just notched up itsfirst year with an ABW workplace andchief information officer Andy Weirbelieves the approach will be the newfuture for Australian workplaces.“Feedback from colleagues shows73 per cent feel inspired by the workenvironment and 98 per cent wouldn’twant to go back to a different way ofworking,” he says.“Technology is breaking down barriersand enabling people to workmore collaboratively and far moreflexibly.“The concept of people being tied toa fixed point is becoming pretty outdatedand there are very few roles andindustries where you don’t need towork with other people from differentdisciplines to be successful.”Even for those who embracechange, Weir says ABW is still a bigdeparture from the way most corporateenterprises operate.“For us this was the biggest changemanagement exercise undertaken.”Each employee took part in a trainingprogram over 14 weeks to learnthe new technology and the soft side ofthe ABW change — how they wouldwork and behave differently in thenew environment.Like PwC, Bankwest has gone allthe way with ABW.There are meeting rooms but no officesand the cultural change has beena comprehensive one.“Cultural change needs to be ledfrom the top,” Weir says. “As a leaderyou can’t stand up and espouse thevalues if you’re not prepared to do thatyourself.”One sign of the degree of interest inthe new approach is that there hasbeen a steady stream, 40 to date, of organisationsinspecting Bankwest’sABW environment and taking the opportunityto touch and feel a futuristicworkplace where there are no individualoffices.Bankwest also sees its ABW officeas a recruitment benefit in acompetitive job market and a boost toproductivity.“We see it as part of our employeevalue proposition,” Weir says.“Having a premium environmentthat maximises collaboration, fun,teamwork, flexibility and freedom ofchoice is not only a fantasticattraction for potential employees, it’salso a terrific way to maximiseproductivity.“At the end of the day it depends onthe type of culture you are trying to establishand cultivate.”Managing the change to a workplacewithout personal offices ordesks is an important part of the transition.“From a behavioural point of viewit’s a big change because you are takingaway an employee’s desk, photosof their family or the dog and you nowexpect them to share an environmentwith other people,” says van der Linden.ABW also drives a shift in managementstyles because without assigneddesks, managers can no longer visuallymonitor their staff in the same way.CONTINUES PAGE 24Architectural ExcellenceClient FocusCommercial SuccessCost ControlSustainabilityConstruction ManagementTotal Project DeliveryArchitectureUrban DesignMasterplanningInterior DesignT 61 8 9321 4402 F 61 8 9481 8259E bdg@bollig.com.au W bollig.com.au8 Cook Street, West Perth WA 6005ABN 62 968 268 6231980075πSLLP130613

WorkZone: Still under construction butdesigned to offer a campus feel forincoming tenant Leighton.Picture: Michael WilsonFROM PAGE 23“Line-of-sight management is also areally important change and it doesn’tcome naturally to everyone,” she says.“ABW asks more of a manager orleader — they really need to be able toset performance indicators for theirstaff and management based on theoutcomes rather than the physicalpresence.“From a managers’ perspective,that’s a really big shift, some love itand naturally manage that way andothers not so much.”Van der Linden, who recentlyjoined Colliers International’s strategicbuilding solutions as a changemanager, says ABW is more than asexy new office, it’s really about a culturalchange.“The fit-out is the physical componentbut it’s the cultural componentthat holds together the other parts —the technology and behaviouralchanges,” she says.“If you take one away, the other twowon’t work, ABW needs the full suiteof things.”A shared office space also comeswith strictly enforced office etiquettewhere personal effects must be storedin a locker at the end of the day.The shared obligation also sets newrules for office behaviour, making itunacceptable to leave coffee mugs at awork station, right the way through tomaking sure workspaces are used forthe appropriate purpose.Psychologist Alistair Box, from TotalLeader and Coach, specialises inthe work environment as a counsellorand facilitator.With ABW, he says, comes the needto understand the relationship betweenactivity and space and newrules around workspaces, such astalking areas and hushed areas.“There are extroverts who willstruggle to contain their extroversionand introverts who may struggle withsome of the collaborative elementsand miss their private space,” he says.“I think ABW enables collaborationbut people still need to know how touse the environment, the physicallayout is only half the equation, peopleneed to understand how to use thatand benefit from using the space.”Box says adjustments that comewith ABW can be hard and adverse reactionsneed to be managed.By way of example, he says the lossof an office can also be accompaniedby a loss of identity and there can be alot of resistance that requires a shiftin mindset.“You’re going to get some peoplewho say ‘I’ve lost my corner office andI’ve worked really hard to get that privatespace and I need it because Ideal with a lot of confidentialinformation’.”Looking into workplaces of the future,Box believes ABW is here to stay.“What we need to get clear is how weare going to work in an ABW workplace,”he says.

Change manager: Judith van derLinden, from Colliers International,helped Bankwest introduce ABW.She says the concept is more about acultural change than a sexy newoffice. Picture: Lee Griffith“If we’re in a team environment,what are our mutual commitmentsand how will we communicate, collaborate,make decisions and make ourselvesavailable?“These are not new issues but theyneed to be thought through for anABW environment.”Ensuring the right people in an organisationare driving the ABW messageis also crucial, according to vander Linden, who says acceptance ofthe change and role modelling by theleadership was powerful.“You can ask management to nominatechange champions and in somecases it’s useful to get someone who’snot too bought in yet and if you can getthem on board, it really helps with therest,” she says.Although ABW has been endorsedby major businesses, Y Research propertyconsultant Damien Stone says itstake-up rate in Perth is likely to hingeon the supply of new buildings becauseof high fit-out costs and the factthat it needs big floor plates.“Most companies don’t reconfigureworkspaces until they move into anew lease or a new premise,” he says.“The catalyst will be in about twoyears with the next batch of buildingsto come out of the ground but organisationsgoing down the ABW path willnow be starting to have those conversationswith their staff.”After 10 years in QV1 office tower,PwC’s move into the new BrookfieldPlace ran parallel with its adoption ofABW and the company’s Canberra officewill also roll out an ABW workplacewhen it moves into a new buildinglater this year.Similarly, Bankwest also lined-upthe adoption of ABW with its movesinto its new city building.The next big tenant shift in Perth islikely to be Leighton’s move into thesoon-to-be finished WorkZone building.Although the construction companysays it won’t be setting up anABW office, developer Charter Hallsays the campus-style office projecthas been designed with the flexibilityto accommodate an ABW workplace.“One of the by-products of the ABWmovement is, because of the multitudeof options that workers have, it’sless likely that you will need to substantiallychange the fit-out,” saysCharter Hall’s national leasing managerEmil Joubert.“We have done a number of verylarge buildings and some occupierswill fit out the space and then within12 or 24 months they go back to redesignthe space because either theydidn’t get it right the first time or theirrequirements have changed.“At WorkZone we have tried to designa building with the flexibilitythat responds to a lot of the contemporarythinking about fit-out designfor tenants.”WorkZone’s two office towers havelarge floor plates, 2000sqm and2400sqm respectively, and side coresinstead of central cores have beenused for lifts, stairs and amenities toallow for natural light and lines ofsight across the buildings.“The fundamental constituent of abuilding is its tenant and whether youcan provide a space that is going to berelevant now and for the foreseeablefuture and that benefit flows directlyto the owner,” Joubert says.“How a building will perform overthe long term is critical to ourthinking.”ZONEINON PERTH’S NEWESTA-GRADE, SUSTAINABLEOFFICE CAMPUS.NOW LEASINGFINAL OPPORTUNITYWelcome to WorkZone – a truly innovative, inner cityoffice campus that puts people at its centre.Here, your people will thrive in an effi cient and healthy workplace.With large, open spaces fi lled with natural light, WorkZone presentsa superb, cost-effective opportunity to relocate to a collaborative andproductive environment.Ready for occupation in September 2013Your chance to occupy the top 3 floors// A total of 27,911sqm of A-grade offi ce space - over 75% leased with6,500sqm remaining// Lucrative location opposite McIver train station and close to Perth CBD,transport and amenities// Inner city benefi ts without the central CBD price// Large outdoor landscaped social and relaxation space// 224 car spaces, plus secure bike racks, lockers and showers// Targeting a 5 star Green Star rating and a 5 star NABERS Energy ratingZone in on the opportunity today and move in this September.Artist impressionSimon Hulett 0412 247 225Simon.Hulett@charterhall.com.auworkzone.com.au

M O T O R N GTRIDENT TESTEDMaserati occupies amotoring no-man’s landbetween Ferrari and BMWbut Ben Harvey finds thecar knows its own identityIt was 23 years ago that RichardGere’s character Edward Lewis,after struggling to drive a LotusEsprit home from a party, pulled overon Hollywood Boulevard and washelped by Julia Roberts’ whore-withheart-of-gold,Vivian Ward.A lot has changed since PrettyWoman was released in 1990. The first,and most obvious, is that streetwalkinghookers no longer look likeimmaculately groomed supermodels.The second is that highperformancecars have become soeasy to drive that even a moronic billionairefilm character can hammer itaround the Nurburgring in times thatwould make The Stig blush.Like Lotus, Maserati occupies a motoringno-man’s land between thepseudo-Formula 1 world of Ferrariand Lamborghini and the go-fastluxury of BMW and Mercedes.Like Lotus, Maserati has made extraordinaryadvances in the area ofdriver comfort. The reason for this, inthe case of the Maserati GranTurismoSport pictured, comes down to transmissionand suspension.Both have been honed relentlesslyover past years and the GranTurismoSport is the latest evidence that supercarmanufacturers are coming closeto nailing the Holy Grail of their trade— drivability.Of course, advances in suspensionand torque transfer mean nothing ifyou are slower than a white man inslippers because you have the motorfrom a Datsun 120Y under the bonnet.The GranTurismo’s 4.7L V8 generates338kw of power and a robust520nm of torque. That’s roughly equalto seven 120Ys and enough go-juice topropel you from a standing start to100km/h in 4.8 seconds. Keep yourright foot flat and you will eventuallytop out around 300km/h.Read in isolation, these stats are impressive.But let’s put things in perspective.Spend an extra $50,000 and you willbe in a Lamborghini Gallardo LP550,which gets to 100kmh a full secondfaster.Spend $40,000 less and the BMW M6will get you to 100kmh half a secondfaster. Small gains in absolute numbersbut considerable margins inpercentage terms.So why buy the Maserati? It’s superficial,but looks will definitely informyour choice.There is something about themenacing elegance of that front grille.It will remind you of the immortallycool front end of the AC Cobra.The understated flare of the frontguards, combined with a shortishfront overhang (the distance from thefront wheels to the front bumper), givethe car the muscled shoulders of afighting dog.Then there is the sound. Put theboot in while you are in the GrahamFarmer Freeway tunnel andmotorists around you glance intotheir rear view mirrors, wonderingwhat an F16 fighter jet is doing underNorthbridge.Even at low revs this car announcesMaserati magic:Everything youexpect in aluxury marque.Pictures:Rob DuncanBarbagallo Ferrariand Maserati9 Frobisher StreetOsborne ParkWA 6017Phone: 9231 5999its arrival like Steven Tyler at an Aerosmithstadium concert, which meanscoming home late at night will makeyou as popular with your neighboursas a Christian Brother in a boardinghouse dorm.With this amount of power effortlesslyaccessible, the car’s rear end shouldbe twitchier than a rhesus monkey at aSARS lab.But the engineers at Maserati havemarried shock absorbers with doublewishbone suspension (which, amongother things, allows better camber control)so well that the car behaves itselfnicely.In the unlikely event that you domanage to get yourself into some highspeedstrife, you can hit the anchorsknowing you will pull up from100km/h to zero in 35m.Stopping distance is not one of thesexiest statistics to consider when buyinga supercar but when you are spendingthe $334,770 needed to get a basemodel GranTurismo on the road, it’snot a bad idea to ensure you can pullthe thing up smartly.The interior is replete with the lashingsof carbon fibre which have becomethe material de rigueur for marquesworth more than some Wheatbelttowns.And you will enjoy all the conveniencesyou would expect of an expensivevehicle, even though, like in allmodern cars, they are about as usefulin everyday life as a media degree fromEdith Cowan University.The GranTurismo is fast and comfortableand achieves this with thekind of casual arrogance which radiatesfrom Chris Gayle when he stridesto the crease.Buy one and you might even getsome roadside advice from amisunderstood streetwalker.WHAT’S IN MY GARAGE?Lindsay ReedChief executive, Aviva CorporationJBA Tourer Kit CarI always liked the idea of owning an oldersports car but not maintaining one. My wife,Jenni, saw the JBA kit car written up in anRACWA magazine and thought it had thelook without the issues and called MurrayFraser at JBA and bought a four-seater kit.Eight years later it was on the road.Our JBA started life in the garage ofDeputy Police Commissioner Chris Dawson, arenowned hoarder. I did him a favour keepinghis garage accessible for three years butwithin weeks of the car leaving he wasstruggling to find his lawnmower. We hit upmutual friend Pete Davey at Automasters forcheap parts.The JBA rolled out of the Dawsons’ garageto the paint shop and then to our own newgarage for drive train, upholstery and prettybits. Daughters Emma and Georgina spentplenty of weekend hours under the car intight spaces poking wires and bolts throughholes.It was finally finished in 2006 after Jenniand Murray decided I wasn’t getting it donefast enough and shipped it out to Murray’sworkshop for finishing touches while I was inBotswana.Both daughters had their first drivinglesson in the JBA without incident, apartfrom some deep angle parking in newlandscaping at the Perry Lakes subdivision.Life lessons learnt along the way: buildinga project with your kids is special, the bestbeer in the world is garage beer, MarkDownsborough knows more about autoelectrics than Japan and Korea combined,and the big one — measure twice, cut once.26 JUNE 2013

oyster perpetual sky-dwellerin 18 ct white gold

I N T E R V E WInside the mindof the bravestwoman in oilAs Ann Pickard prepares toleave Perth at the end ofthis month, Nick Sasexamines how in 27 monthsshe shattered WA’s glassceiling and defied a premierIt seems strangely apt now.March 22, 2010: the same day ShellAustralia boss Ann Pickard cameto town, the skyline of Perth resembledthe apocalypse.The “great Perth storm” came andconquered, dumping hail the size ofcricket balls on an unsuspecting —and unprepared — city.Just hours before the dark cloudscame rolling in, Ann Pickard addressedher 450-odd staff for the firsttime at Shell’s Victoria Avenueoffices.A nervous air floated about theroom. Not that the staff knew thestorm was coming; they were moreconcerned about their new boss.“I guess we were curious as to whatthis American lady would bring toShell in WA,” one staff member toldWestBusiness Insider.“I don’t remember that much fromthe talk, but I do remember she saidPerth reminded her of San Francisco— San Francisco in the 1950s.”That afternoon the storm that cameand went, claiming a place in Perth’shistory in the process.Now, after more than three years atthe helm, Ann Pickard is leaving townto take up a new post as head of Shell’sArctic Circle division.Just like the storm, she has left aninimitable imprint on our city.In her own way, she has changedPerth, and helped shape its future.Born in the rural US state of Wyoming,Pickard was an air force brat, followingher father as he was movedaround the US and the world.It took her a while to get to university,changing courses mid-degree.Pickard took even longer to decidewhat she wanted to do.Those who know her say it is perhapsthe only time in her life shedidn’t know what she wanted, andhow to get there.Eventually she set her sights on acareer. Oil negotiator.“I was always interested in internationalpolitics, and resources. InWyoming it’s a big deal,” she saysbetween sips of Diet Coke in Shell’sPerth office.“I wanted to find out how thesedecisions get made — I’d done somegeology — and a few other things sostarted trying to put it all together.“I decided on the spot I wanted to bewas an oil negotiator. And that’s kindawhat I aimed for.”It is an extremely specific careerpath; one which requires highly specialisedskills and attributes. Thereare only 4000 oil negotiatorsworldwide.When asked if knowing exactlywhat she wants, and how to get it, is apersonality trait, Pickard gives an answerwhich, in many ways, sums upher three years in Perth.“One of my strengths is that I cansee the answers,” she says with asteely resolve that has become a trademarkof her time in Australia.“And it doesn’t mean I can get therestraight away.“One of the things about leadership— and I said this in a speech I saidwhen I got here — is about makingsure the herd is with you.“Being a Wyoming cowgirl you gotto make sure the cows are behind you.So one of my strengths is that I can seethe answers but it doesn’t necessarilymean I’ve got everybody with me.“So a lot of the time I’m trying tomake sure I keep people with me —that’s one of the challenges. But Ithink I do see answers where I want togo pretty easily.”If you need someone to vouch forthat comment, just ask Colin Barnett.The Shell boss is one of the few leadersin the country, in business or politics,to stare down the WA Premier.Despite vehement opposition fromMr Barnett, which at one point descendedinto a slanging match betweenthe Premier and the resourcesindustry (namely Pickard and Shell),in April the worst-kept secret in Australianbusiness was out: James PricePoint was dead and floating liquid naturalgas (FLNG) was thealternative.Shell was the first company to developthe floating oil equivalent, backin the 1970s. Now there are hundredsacross the world, enabling once“stranded oil” to be developed.Shell believes FLNG, which wasfirst introduced in WA for the Preludefield, will revolutionise the industryand become just as common as thenow stock-standard floating oil rigs.For Pickard, the Browse decisionwas a no-brainer. She just needed toget the herd, which included Mr Barnettand Woodside, to follow her lead.“I think if there’s a phrase peopleuse around me it’s tough love,” shesays. “I care a lot, I try and use constructivehelp, I use humour a lot, butI’m also pretty firm on where thingshave to go.”A Shell employee has another go atdescribing Pickard’s style.“She’s very smart and capable butshe’s also very personable,” the employeesays. “Whilst having to dealwith stress and big decisions she managesto keep a sense of humour.“But she can be fearsome, for sure.If you can tell she’s got a lot on youdon’t want to spend a lot of time tellingjokes. You’ve got to read her right.“You don’t see a lot of temper tantrumsor anything like that. But if youdo see her busy you just get out.”For a person in Pickard’s position,it’s hard not to see any other way.First and foremost, oil negotiatorsare not generally known for beingsweet or nice.Further, anyone in her shoes hasbeen forced to make some hairy decisionsalong the vocational highway.For Pickard, it’s even more perverse.She is widely known in the oil andgas world as skilled negotiator, brokeringdeals in heightened democraciessuch as the former Soviet Union,Cameroon, Nigeria and Libya — someof the toughest places to do businesson earth — and was famously labelledthe bravest woman in oil for efforts inAfrica.And now she adds the environmentalhot potato of the Arctic to the list.Industry insiders say in light of herdiverse background she was handpickedfor the role.The processes behind these decisionsare kept closely guarded in corporationssuch as Shell.But even though Pickard herselfPicture: Michael Wilson28 JUNE 2013

But like I said a lot oftimes — and it’s one ofmy strengths — I cansee answers.Ann Pickardadmitted earlier this year the Australianposition could be her last hurrah,it’s fair to say she could not say no todeveloping challenging projects in anothergreenfields environment.One of her favourite phrases comesto mind. It’s a phrase those who workclose to her say she puts on the tableconsistently.“It’s time to step up,” Pickard says.“For me it actually goes back to theleadership thing.“Personally, it’s something that’sbeen fairly easy for me — somethingI’ve always wanted to do, to take moreand more responsibility. It’s a desire.“But I believe there’s lots of differentwords for it distributing leadership— because I’m not the one thatshould be making all the leadershipdecisions.“If I’m making all the decisions itreally takes power from your organisation,so pushing leadership and decision-makingdown into the organisation— that can be scary to peoplewho have never been there before:what if I make a mistake, what if thishappens that happens. The reality iswe all learn by making our mistakes.“That’s usually where the step-upterm comes from — all right, time foryou to step up.”One of the issues Pickard had toaddress when choosing to leave Perthand take up the new Arctic role wasfamily.Like all business people in positionsof importance, the balance betweencareer and family is often tough tomanage.Pickard has two children, aged 11and 13.The new role is based in Houston,meaning she will be closer to family inthe US, which proved to be anotherpart of the pull factor.However, as she explains, the balancehas become more black andwhite later in her career.“I think the challenge in the last fewyears, and now it’s no longer a challenge,but it’s about prioritisation,”she says.“I tell people there are three thingsyou’ve got to manage: you’ve got locationfor job, you’ve got the job itselfand you’ve got family.CONTINUES PAGE 30JUNE 2013 29