Buongiorno Spa Interim Report as of March 31, 2009

Buongiorno Spa Interim Report as of March 31, 2009

Buongiorno Spa Interim Report as of March 31, 2009

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

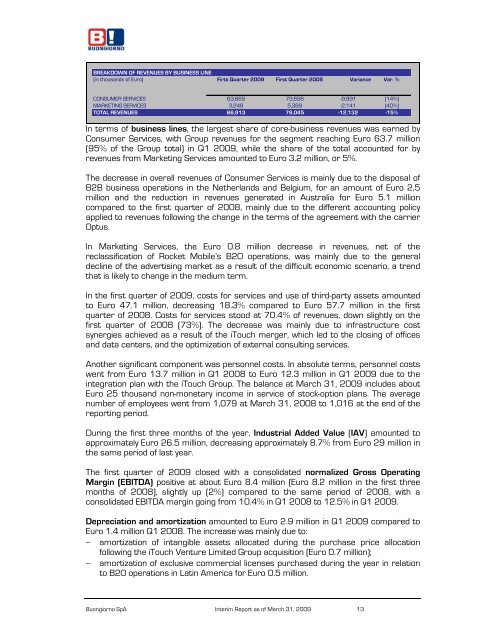

BREAKDOWN OF REVENUES BY BUSINESS LINE<br />

(in thousands <strong>of</strong> Euro) Firts Quarter <strong>2009</strong> First Quarter 2008 Variance Var. %<br />

CONSUMER SERVICES 63,665 73,656 -9,991 (14%)<br />

MARKETING SERVICES 3,248 5,389 -2,141 (40%)<br />

TOTAL REVENUES 66,913 79,045 -12,132 -15%<br />

In terms <strong>of</strong> business lines, the largest share <strong>of</strong> core-business revenues w<strong>as</strong> earned by<br />

Consumer Services, with Group revenues for the segment reaching Euro 63.7 million<br />

(95% <strong>of</strong> the Group total) in Q1 <strong>2009</strong>, while the share <strong>of</strong> the total accounted for by<br />

revenues from Marketing Services amounted to Euro 3.2 million, or 5%.<br />

The decre<strong>as</strong>e in overall revenues <strong>of</strong> Consumer Services is mainly due to the disposal <strong>of</strong><br />

B2B business operations in the Netherlands and Belgium, for an amount <strong>of</strong> Euro 2,5<br />

million and the reduction in revenues generated in Australia for Euro 5.1 million<br />

compared to the first quarter <strong>of</strong> 2008, mainly due to the different accounting policy<br />

applied to revenues following the change in the terms <strong>of</strong> the agreement with the carrier<br />

Optus.<br />

In Marketing Services, the Euro 0.8 million decre<strong>as</strong>e in revenues, net <strong>of</strong> the<br />

recl<strong>as</strong>sification <strong>of</strong> Rocket Mobile’s B2O operations, w<strong>as</strong> mainly due to the general<br />

decline <strong>of</strong> the advertising market <strong>as</strong> a result <strong>of</strong> the difficult economic scenario, a trend<br />

that is likely to change in the medium term.<br />

In the first quarter <strong>of</strong> <strong>2009</strong>, costs for services and use <strong>of</strong> third-party <strong>as</strong>sets amounted<br />

to Euro 47.1 million, decre<strong>as</strong>ing 18.3% compared to Euro 57.7 million in the first<br />

quarter <strong>of</strong> 2008. Costs for services stood at 70.4% <strong>of</strong> revenues, down slightly on the<br />

first quarter <strong>of</strong> 2008 (73%). The decre<strong>as</strong>e w<strong>as</strong> mainly due to infr<strong>as</strong>tructure cost<br />

synergies achieved <strong>as</strong> a result <strong>of</strong> the iTouch merger, which led to the closing <strong>of</strong> <strong>of</strong>fices<br />

and data centers, and the optimization <strong>of</strong> external consulting services.<br />

Another significant component w<strong>as</strong> personnel costs. In absolute terms, personnel costs<br />

went from Euro 13.7 million in Q1 2008 to Euro 12.3 million in Q1 <strong>2009</strong> due to the<br />

integration plan with the iTouch Group. The balance at <strong>March</strong> <strong>31</strong>, <strong>2009</strong> includes about<br />

Euro 25 thousand non-monetary income in service <strong>of</strong> stock-option plans. The average<br />

number <strong>of</strong> employees went from 1,079 at <strong>March</strong> <strong>31</strong>, 2008 to 1,016 at the end <strong>of</strong> the<br />

reporting period.<br />

During the first three months <strong>of</strong> the year, Industrial Added Value (IAV) amounted to<br />

approximately Euro 26.5 million, decre<strong>as</strong>ing approximately 8.7% from Euro 29 million in<br />

the same period <strong>of</strong> l<strong>as</strong>t year.<br />

The first quarter <strong>of</strong> <strong>2009</strong> closed with a consolidated normalized Gross Operating<br />

Margin (EBITDA) positive at about Euro 8.4 million (Euro 8.2 million in the first three<br />

months <strong>of</strong> 2008), slightly up (2%) compared to the same period <strong>of</strong> 2008, with a<br />

consolidated EBITDA margin going from 10.4% in Q1 2008 to 12.5% in Q1 <strong>2009</strong>.<br />

Depreciation and amortization amounted to Euro 2.9 million in Q1 <strong>2009</strong> compared to<br />

Euro 1.4 million Q1 2008. The incre<strong>as</strong>e w<strong>as</strong> mainly due to:<br />

− amortization <strong>of</strong> intangible <strong>as</strong>sets allocated during the purch<strong>as</strong>e price allocation<br />

following the iTouch Venture Limited Group acquisition (Euro 0.7 million);<br />

− amortization <strong>of</strong> exclusive commercial licenses purch<strong>as</strong>ed during the year in relation<br />

to B2O operations in Latin America for Euro 0.5 million.<br />

<strong>Buongiorno</strong> SpA <strong>Interim</strong> <strong>Report</strong> <strong>as</strong> <strong>of</strong> <strong>March</strong> <strong>31</strong>, <strong>2009</strong> 13