Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Berjaya</strong> Land <strong>Berhad</strong> (201765-A)<br />

66<br />

Annual Report 2005<br />

Notes To The Financial Statements<br />

30 April 2005<br />

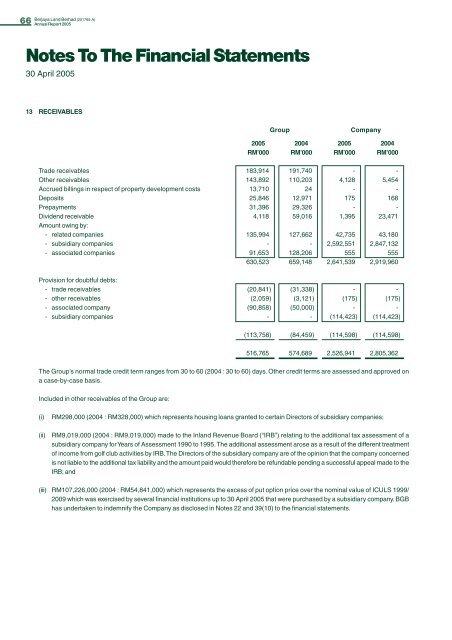

13 RECEIVABLES<br />

Group<br />

Company<br />

2005 2004 2005 2004<br />

RM’000 RM’000 RM’000 RM’000<br />

Trade receivables 183,914 191,740 - -<br />

Other receivables 143,892 110,203 4,128 5,454<br />

Accrued billings in respect of property development costs 13,710 24 - -<br />

Deposits 25,846 12,971 175 168<br />

Prepayments 31,396 29,326 - -<br />

Dividend receivable 4,118 59,016 1,395 23,471<br />

Amount owing by:<br />

- related companies 135,994 127,662 42,735 43,180<br />

- subsidiary companies - - 2,592,551 2,847,132<br />

- associated companies 91,653 128,206 555 555<br />

630,523 659,148 2,641,539 2,919,960<br />

Provision for doubtful debts:<br />

- trade receivables (20,841) (31,338) - -<br />

- other receivables (2,059) (3,121) (175) (175)<br />

- associated company (90,858) (50,000) - -<br />

- subsidiary companies - - (114,423) (114,423)<br />

(113,758) (84,459) (114,598) (114,598)<br />

516,765 574,689 2,526,941 2,805,362<br />

The Group’s normal trade credit term ranges from 30 to 60 (2004 : 30 to 60) days. Other credit terms are assessed and approved on<br />

a case-by-case basis.<br />

Included in other receivables of the Group are:<br />

(i)<br />

(ii)<br />

RM298,000 (2004 : RM328,000) which represents housing loans granted to certain Directors of subsidiary companies;<br />

RM9,019,000 (2004 : RM9,019,000) made to the Inland Revenue Board (“IRB”) relating to the additional tax assessment of a<br />

subsidiary company for Years of Assessment 1990 to 1995. The additional assessment arose as a result of the different treatment<br />

of income from golf club activities by IRB. The Directors of the subsidiary company are of the opinion that the company concerned<br />

is not liable to the additional tax liability and the amount paid would therefore be refundable pending a successful appeal made to the<br />

IRB; and<br />

(iii) RM107,226,000 (2004 : RM54,841,000) which represents the excess of put option price over the nominal value of ICULS 1999/<br />

2009 which was exercised by several financial institutions up to 30 April 2005 that were purchased by a subsidiary company. BGB<br />

has undertaken to indemnify the Company as disclosed in Notes 22 and 39(10) to the financial statements.