International journal of Contemporary Business Studies

International journal of Contemporary Business Studies

International journal of Contemporary Business Studies

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>International</strong> Journal <strong>of</strong> <strong>Contemporary</strong> <strong>Business</strong> <strong>Studies</strong><br />

Vol: 3, No: 6. June, 2012 ISSN 2156-7506<br />

Available online at http://www.akpinsight.webs.com<br />

DATA ANALYSIS AND INTERPRETATION<br />

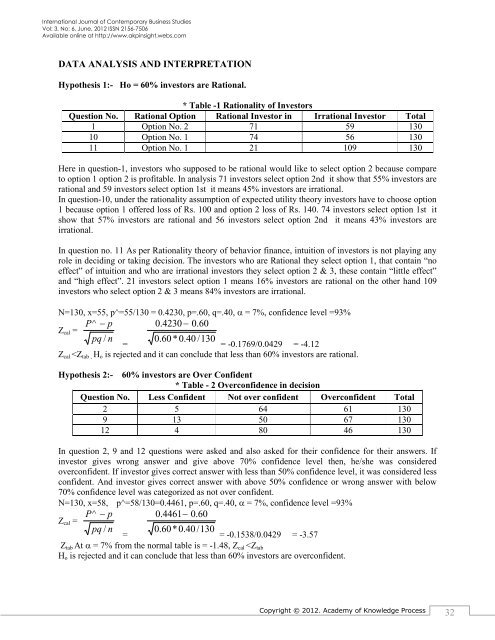

Hypothesis 1:- Ho = 60% investors are Rational.<br />

* Table -1 Rationality <strong>of</strong> Investors<br />

Question No. Rational Option Rational Investor in Irrational Investor Total<br />

1 Option No. 2 71 59 130<br />

10 Option No. 1 74 56 130<br />

11 Option No. 1 21 109 130<br />

Here in question-1, investors who supposed to be rational would like to select option 2 because compare<br />

to option 1 option 2 is pr<strong>of</strong>itable. In analysis 71 investors select option 2nd it show that 55% investors are<br />

rational and 59 investors select option 1st it means 45% investors are irrational.<br />

In question-10, under the rationality assumption <strong>of</strong> expected utility theory investors have to choose option<br />

1 because option 1 <strong>of</strong>fered loss <strong>of</strong> Rs. 100 and option 2 loss <strong>of</strong> Rs. 140. 74 investors select option 1st it<br />

show that 57% investors are rational and 56 investors select option 2nd it means 43% investors are<br />

irrational.<br />

In question no. 11 As per Rationality theory <strong>of</strong> behavior finance, intuition <strong>of</strong> investors is not playing any<br />

role in deciding or taking decision. The investors who are Rational they select option 1, that contain “no<br />

effect” <strong>of</strong> intuition and who are irrational investors they select option 2 & 3, these contain “little effect”<br />

and “high effect”. 21 investors select option 1 means 16% investors are rational on the other hand 109<br />

investors who select option 2 & 3 means 84% investors are irrational.<br />

N=130, x=55, p^=55/130 = 0.4230, p=.60, q=.40, = 7%, confidence level =93%<br />

P^ p 0.4230<br />

0.60<br />

Z cal =<br />

pq / n 0.60 *0.40 /130<br />

=<br />

= -0.1769/0.0429 = -4.12<br />

Z cal