DIVA SYNERGY UCITS FUND - Bernheim, Dreyfus & Co.

DIVA SYNERGY UCITS FUND - Bernheim, Dreyfus & Co.

DIVA SYNERGY UCITS FUND - Bernheim, Dreyfus & Co.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

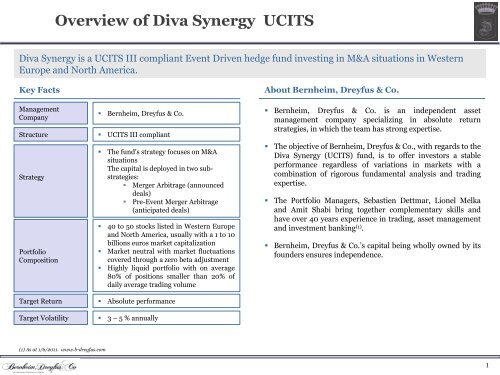

Overview of Diva Synergy <strong>UCITS</strong><br />

Diva Synergy is a <strong>UCITS</strong> III compliant Event Driven hedge fund investing in M&A situations in Western<br />

Europe and North America.<br />

Key Facts<br />

Management<br />

<strong>Co</strong>mpany<br />

• <strong>Bernheim</strong>, <strong>Dreyfus</strong> & <strong>Co</strong>.<br />

Structure • <strong>UCITS</strong> III compliant<br />

Strategy<br />

Portfolio<br />

<strong>Co</strong>mposition<br />

• The fund's strategy focuses on M&A<br />

situations<br />

The capital is deployed in two substrategies:<br />

• Merger Arbitrage (announced<br />

deals)<br />

• Pre-Event Merger Arbitrage<br />

(anticipated deals)<br />

• 40 to 50 stocks listed in Western Europe<br />

and North America, usually with a 1 to 10<br />

billions euros market capitalization<br />

• Market neutral with market fluctuations<br />

covered through a zero beta adjustment<br />

• Highly liquid portfolio with on average<br />

80% of positions smaller than 20% of<br />

daily average trading volume<br />

About <strong>Bernheim</strong>, <strong>Dreyfus</strong> & <strong>Co</strong>.<br />

• <strong>Bernheim</strong>, <strong>Dreyfus</strong> & <strong>Co</strong>. is an independent asset<br />

management company specializing in absolute return<br />

strategies, in which the team has strong expertise.<br />

• The objective of <strong>Bernheim</strong>, <strong>Dreyfus</strong> & <strong>Co</strong>., with regards to the<br />

Diva Synergy (<strong>UCITS</strong>) fund, is to offer investors a stable<br />

performance regardless of variations in markets with a<br />

combination of rigorous fundamental analysis and trading<br />

expertise.<br />

• The Portfolio Managers, Sebastien Dettmar, Lionel Melka<br />

and Amit Shabi bring together complementary skills and<br />

have over 40 years experience in trading, asset management<br />

and investment banking (1) .<br />

• <strong>Bernheim</strong>, <strong>Dreyfus</strong> & <strong>Co</strong>.’s capital being wholly owned by its<br />

founders ensures independence.<br />

Target Return • Absolute performance<br />

Target Volatility • 3 – 5 % annually<br />

(1) As at 1/6/2011. www.b-dreyfus.com<br />

1