DIVA SYNERGY UCITS FUND - Bernheim, Dreyfus & Co.

DIVA SYNERGY UCITS FUND - Bernheim, Dreyfus & Co.

DIVA SYNERGY UCITS FUND - Bernheim, Dreyfus & Co.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

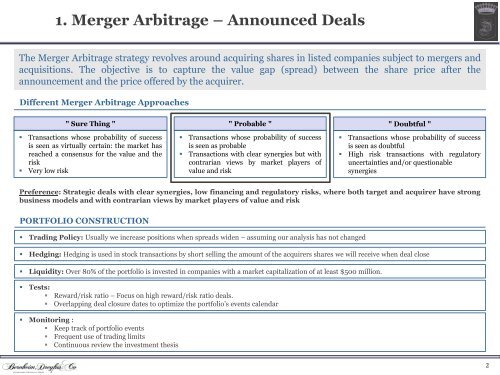

1. Merger Arbitrage – Announced Deals<br />

The Merger Arbitrage strategy revolves around acquiring shares in listed companies subject to mergers and<br />

acquisitions. The objective is to capture the value gap (spread) between the share price after the<br />

announcement and the price offered by the acquirer.<br />

Different Merger Arbitrage Approaches<br />

" Sure Thing "<br />

• Transactions whose probability of success<br />

is seen as virtually certain: the market has<br />

reached a consensus for the value and the<br />

risk<br />

• Very low risk<br />

" Probable "<br />

• Transactions whose probability of success<br />

is seen as probable<br />

• Transactions with clear synergies but with<br />

contrarian views by market players of<br />

value and risk<br />

" Doubtful "<br />

• Transactions whose probability of success<br />

is seen as doubtful<br />

• High risk transactions with regulatory<br />

uncertainties and/or questionable<br />

synergies<br />

Preference: Strategic deals with clear synergies, low financing and regulatory risks, where both target and acquirer have strong<br />

business models and with contrarian views by market players of value and risk<br />

PORTFOLIO CONSTRUCTION<br />

• Trading Policy: Usually we increase positions when spreads widen – assuming our analysis has not changed<br />

• Hedging: Hedging is used in stock transactions by short selling the amount of the acquirers shares we will receive when deal close<br />

• Liquidity: Over 80% of the portfolio is invested in companies with a market capitalization of at least $500 million.<br />

• Tests:<br />

• Reward/risk ratio – Focus on high reward/risk ratio deals.<br />

• Overlapping deal closure dates to optimize the portfolio’s events calendar<br />

• Monitoring :<br />

• Keep track of portfolio events<br />

• Frequent use of trading limits<br />

• <strong>Co</strong>ntinuous review the investment thesis<br />

2