Download June 2012 issue - Institute of Chartered Accountants of BC

Download June 2012 issue - Institute of Chartered Accountants of BC

Download June 2012 issue - Institute of Chartered Accountants of BC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>June</strong>/Summer <strong>2012</strong><br />

Celebrating<br />

achievement<br />

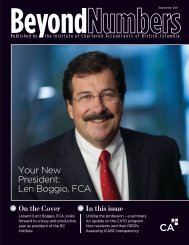

On the Cover<br />

Meet this year’s recipients<br />

<strong>of</strong> the Early Achievement,<br />

Community Service, and<br />

Ritchie McCloy Awards<br />

In this <strong>issue</strong><br />

Unification update<br />

Regional Check-Up summary<br />

Status report on transfer pricing<br />

Practice review program update

A voice for women<br />

in the pr<strong>of</strong>ession<br />

Go to www.cica.ca/women<br />

and join the conversation.<br />

The CICA's Women's Leadership Council is a voice for women CAs. We act as a catalyst for change, promoting<br />

a work environment within the <strong>Chartered</strong> Accountancy pr<strong>of</strong>ession that provides for the retention, promotion<br />

and advancement <strong>of</strong> women to positions <strong>of</strong> leadership without bias, unintended or otherwise, based on gender.<br />

We provide resources and education to further women's advancement in the CA pr<strong>of</strong>ession.

contents<br />

On the Cover<br />

10<br />

Meet the Early<br />

Achievement Award<br />

Winners<br />

6<br />

Unification Update<br />

14<br />

Community Service<br />

Awards<br />

20<br />

Ritchie W. McCloy<br />

Award<br />

22<br />

Regional Check-Up<br />

summary<br />

24<br />

Making the Most <strong>of</strong><br />

Your Retirement<br />

4 Notes from the President<br />

A final update, and a thank<br />

you...<br />

26 Tax Traps & Tips<br />

Transfer pricing – latest<br />

status report<br />

28 Financial Facts &<br />

Money Matters<br />

Wealth management –<br />

discover what you don’t<br />

know about your clients<br />

30 PD News<br />

Spring/summer PD<br />

highlights<br />

32 Plugged In<br />

News for and about members<br />

& students<br />

Member announcements<br />

Event notice<br />

In memoriam<br />

Notice to all <strong>BC</strong> members<br />

Notice to all Yukon<br />

members<br />

PRL notice<br />

38 For the Pr<strong>of</strong>ession<br />

An update on national<br />

harmony in practice review<br />

programs<br />

Want to get<br />

the word out?<br />

Advertise in Beyond Numbers!<br />

Here’s why:<br />

90% <strong>of</strong> <strong>BC</strong> CAs surveyed read<br />

Beyond Numbers<br />

Beyond Numbers goes out to<br />

more than 9,000 members,<br />

more than 1,800 students,<br />

and over 200 external<br />

stakeholders—including<br />

other institutes, associations,<br />

and pr<strong>of</strong>essional organizations<br />

Beyond Numbers has won<br />

awards for both content<br />

and design, including<br />

Blue Wave Awards <strong>of</strong> Merit<br />

from the International<br />

Association <strong>of</strong> Business<br />

Communications – <strong>BC</strong> Branch<br />

To place an ad in<br />

Beyond Numbers, contact our<br />

representatives at:<br />

Advertising in Print<br />

200 - 896 Cambie Street<br />

Vancouver, <strong>BC</strong> V6B 2P6<br />

Tel: 604-681-1811<br />

Fax: 604-681-0456<br />

Email:<br />

info@advertisinginprint.com<br />

Cover image: Fuse/Getty Images

<strong>June</strong>/Summer <strong>2012</strong>, No.504<br />

Published eight times annually by the<br />

<strong>Institute</strong> <strong>of</strong> <strong>Chartered</strong> <strong>Accountants</strong><br />

<strong>of</strong> British Columbia.<br />

Editor<br />

Michelle McRae<br />

A final update,<br />

and a thank you...<br />

Design<br />

Blindfolio Design<br />

604-761-9212<br />

Advertising<br />

Advertising In Print<br />

Phone: 604-681-1811<br />

Fax: 604-681-0456<br />

Director <strong>of</strong> External Affairs<br />

Kerri Brkich Wilcox<br />

<strong>Institute</strong> Council<br />

Lenard F. Boggio, FCA<br />

President<br />

Gordon Holloway, FCA<br />

1st Vice-President<br />

Karen Christiansen, CA<br />

2nd Vice-President<br />

Michael Macdonell, CA<br />

Treasurer<br />

Rosemary Anderson, CA<br />

Olin Anton, CA<br />

Barbara Brink<br />

Don Coulter, CA<br />

John Crawford, CA<br />

John Gingell, CA<br />

Andrew (Sandy) Hilton, CA<br />

David Hughes<br />

Roland Krueger<br />

Dan Little, FCA<br />

John Mackenzie, CA<br />

Sheila Nelson, CA<br />

Ben Sander, FCA<br />

Eric Watt, CA<br />

Chief Executive Officer<br />

Richard Rees, FCA<br />

Beyond Numbers is printed in British Columbia and<br />

mailed eight times annually to more than 9,000<br />

chartered accountants and more than 1,800 CA students<br />

in public practice, industry, education, and government<br />

service throughout <strong>BC</strong>, Canada, and other countries.<br />

Beyond Numbers’ editorial and business <strong>of</strong>fices<br />

are located at:<br />

Suite 500, One Bentall Centre, 505 Burrard St., Box 22<br />

Vancouver, <strong>BC</strong> V7X 1M4<br />

Phone: 604-681-3264<br />

Toll-free in <strong>BC</strong>: 1-800-663-2677<br />

Fax: 604-681-1523<br />

Internet: www.ica.bc.ca<br />

Opinions expressed are not necessarily<br />

endorsed by the <strong>Institute</strong>.<br />

Beyond Numbers supports the CA pr<strong>of</strong>ession in <strong>BC</strong><br />

by sharing news from the <strong>Institute</strong> and news about<br />

members, by sharing viewpoints on <strong>issue</strong>s <strong>of</strong> specific<br />

interest to members, and by promoting member<br />

involvement in <strong>Institute</strong> activities.<br />

Publications Mail Agreement No: 40062742<br />

Notes from the President<br />

In my final column as president, I would like to provide one last update on the<br />

matter that Council and <strong>Institute</strong> staff have been busy with for the past year:<br />

the unification initiative.<br />

As you’re likely aware, Council’s draft report to government with<br />

recommendations was made available to members on April 27, and a members’<br />

vote was open from May 1-18. Through that vote, members provided their views<br />

on six important questions that were based on the report recommendations.<br />

At the time <strong>of</strong> this writing, the preliminary results indicate that over 4,800 <strong>BC</strong><br />

CAs voted, representing 43% <strong>of</strong> the membership—the highest participation level<br />

in decades; 52% <strong>of</strong> these respondents support the unification <strong>of</strong> the existing<br />

accounting Acts into one Act; 9% believe that elected Council should decide;<br />

and 39% do not support unification.*<br />

Given the amount <strong>of</strong> consultation that was undertaken over the last year, and<br />

the results <strong>of</strong> the earlier survey, these results did not come as a surprise. We<br />

now believe that we have a very clear picture <strong>of</strong> how the membership views the<br />

unification initiative.<br />

Looking ahead, your next Council, which will be elected in <strong>June</strong>, has a mandate<br />

to continue unification discussions in <strong>BC</strong> as part <strong>of</strong> a national initiative. It’s<br />

important to note that while the vote is a significant milestone, it is not the end<br />

<strong>of</strong> the unification process. Council will continue working on your behalf and on<br />

behalf <strong>of</strong> the public and our pr<strong>of</strong>ession, monitoring national developments and<br />

deliberating on next steps.<br />

I would like to thank all the members who participated in the unification<br />

initiative through meetings, our surveys, and the vote. Your feedback provided<br />

Council with invaluable insight in our decision-making process.<br />

I would also like to thank my fellow Council members—particularly the<br />

incoming president, Gord Holloway, FCA—for their dedication and support<br />

during my time on Council. And I would like to extend a special thanks to<br />

Richard Rees and his team at the <strong>Institute</strong> who worked especially hard this year<br />

in support <strong>of</strong> the initiative. I am incredibly proud <strong>of</strong> the role I was able to play in<br />

shaping the future <strong>of</strong> our pr<strong>of</strong>ession, and honoured to have had the opportunity<br />

to serve as your president over this past year.<br />

—Len Boggio, FCA<br />

*Not all paper ballots had been received at the time <strong>of</strong> this writing; therefore, they were<br />

not counted in this total. The full vote results will be posted online at www.ica.bc.ca as<br />

soon as they are available.<br />

4 ica.bc.ca <strong>June</strong>/Summer <strong>2012</strong>

Left to Right:<br />

Vern Blair, Cheryl Shearer, Robert D. Mackay, Kiu Ghanavizchian, Chad Rutquist, Gary M. W. Mynett,<br />

Chris Halsey-Brandt, Andy Shaw, Jeff P. Matthews, Farida Sukhia<br />

Blair Mackay Mynett Valuations Inc.<br />

is the leading independent business valuation and litigation support practice in British<br />

Columbia. Our practice focus is on business valuations, mergers and acquisitions,<br />

economic loss claims, forensic accounting and other litigation accounting matters.<br />

We can be part <strong>of</strong> your team, providing you with the experience your clients require.<br />

Suite 1100<br />

1177 West Hastings Street<br />

Vancouver, <strong>BC</strong>, V6E 4T5<br />

Telephone: 604.687.4544<br />

Facsimile: 604.687.4577<br />

www.bmmvaluations.com<br />

Vern Blair: 604.697.5276<br />

Rob Mackay: 604.697.5201<br />

Gary Mynett: 604.697.5202<br />

Andy Shaw: 604.697.5212<br />

Jeff Matthews: 604.697.5203<br />

Cheryl Shearer: 604.697.5293<br />

Farida Sukhia: 604.697.5271<br />

Chris Halsey-Brandt: 604.697.5294<br />

Kiu Ghanavizchian: 604.697.5297<br />

Chad Rutquist: 604.697.5283

Unification Update: Members Vote to<br />

Endorse Council’s Recommendations<br />

By Richard Rees, FCA<br />

At the time <strong>of</strong> this writing, the ICA<strong>BC</strong><br />

unification vote had just closed, and<br />

we now know that the majority <strong>of</strong> <strong>BC</strong><br />

CAs voted to endorse Council’s draft recommendations<br />

to the provincial government. 1 I’d<br />

like to begin by thanking everyone involved<br />

in the unification initiative—a challenging and<br />

emotional <strong>issue</strong> that is complex and multidimensional.<br />

Over the last year, we undertook the largest<br />

outreach effort to date on any <strong>Institute</strong> initiative.<br />

Our objective was to fulfill our dual mandate <strong>of</strong><br />

representing both the public, and our members’<br />

interests; to engage, inform, and establish the<br />

views <strong>of</strong> members and stakeholders on unification;<br />

and ultimately, to ask members to vote on<br />

Council’s draft recommendations.<br />

Through this outreach, Council President Len<br />

Boggio and I have enjoyed talking to you. We’ve<br />

heard a diversity <strong>of</strong> opinions, both for and<br />

against change, and the fact that that so many<br />

CAs took an interest in the unification initiative<br />

helped us understand, and take into account,<br />

the memberships’ perspective throughout these<br />

discussions.<br />

From my perspective, this vote is not about<br />

having a “winning” or “losing” side; rather, it’s<br />

about whether or not our recommendations are<br />

appropriate and truly reflective <strong>of</strong> what we heard<br />

during the consultation: In essence, are we doing<br />

what we should to support Council, represent<br />

members, and fulfill our public interest mandate.<br />

Looking at the outcome, the preliminary results<br />

indicated over 4,800 <strong>BC</strong> CAs voted, representing<br />

43% <strong>of</strong> the membership—an excellent response<br />

rate and the largest in recent memory. Of those<br />

who voted, 52% support the unification <strong>of</strong> the<br />

existing accounting Acts into one Act, and 9%<br />

believe that elected Council should decide. Given<br />

that Council has stated that it unanimously<br />

supports unification as part <strong>of</strong> a national initiative,<br />

this equates to 61% supporting unification.<br />

39% <strong>of</strong> members who voted do not support<br />

unification.<br />

1<br />

Not all paper ballots had been received at the time <strong>of</strong> this writing; therefore, they were not counted in this total. The full vote results will be posted online<br />

at www.ica.bc.ca as soon as they are available.<br />

6 ica.bc.ca <strong>June</strong>/Summer <strong>2012</strong>

Council will continue working with those accounting bodies that are supportive <strong>of</strong> the unification<br />

initiative and will also continue to play a leadership role at the national level on such <strong>issue</strong>s as certification<br />

and uniform regulation—areas that we know are critical to our members as we participate in the process<br />

going forward.<br />

Looking at unification across Canada, the situation is fluid:<br />

• In <strong>BC</strong>, our colleagues at CMA<strong>BC</strong> have released member survey results that are overwhelmingly<br />

supportive <strong>of</strong> unification (91%), and they remain committed to the goal <strong>of</strong> a unified accounting<br />

pr<strong>of</strong>ession, and we know our own members endorse Council’s recommendation to unify as part <strong>of</strong> a<br />

national initiative;<br />

• In Alberta, the CMA and CGA bodies have released a provincial merger proposal;<br />

• In Saskatchewan, all three bodies have released a provincial merger proposal;<br />

• In Manitoba, 59.5% <strong>of</strong> CAs voted in favour <strong>of</strong> unifying with the CMA body, which also received<br />

endorsement from its members;<br />

• In Ontario, the CAs have reaffirmed their commitment to unification, while the CGA and CMA<br />

bodies have withdrawn from discussions;<br />

• In Quebec, the CPA legislation has been enacted, and there is now one accounting body, ending the<br />

status quo for Canada’s accounting pr<strong>of</strong>ession; and<br />

• In the Maritime provinces and northern territories, unification discussions are ongoing.<br />

We have stated all along that this process would be complicated, and as discussions have progressed,<br />

some bodies have become uncomfortable with the process and have withdrawn.<br />

The largest ones are CA Alberta, CMA Ontario, and CGA-Ontario. As we go to press, we have just<br />

been notified that CGA-<strong>BC</strong> is also withdrawing from discussions, citing the uncertainty in Ontario,<br />

and it is likely that other, smaller CGA bodies may follow their lead.<br />

While this is incredibly disappointing—especially given the level <strong>of</strong> support from <strong>BC</strong> CGA members<br />

(with 84% supportive, 11% neutral, and 5% not supportive)—as we move from concept to action,<br />

it is inevitable that the volume <strong>of</strong> <strong>issue</strong>s and concerns will increase. This jockeying for position is<br />

absolutely par for the course, especially given the divergent interests at the table.<br />

However, it is important to note that even with these organizations withdrawing, there are still<br />

accounting bodies in every jurisdiction in Canada participating in unification discussions. These<br />

participating bodies represent the majority <strong>of</strong> pr<strong>of</strong>essional accountants in Canada and include all <strong>of</strong> the<br />

CA <strong>Institute</strong>s, with the exception <strong>of</strong> Alberta. The Alberta CA <strong>Institute</strong> continues to say they will not<br />

walk away from their partners in the CA pr<strong>of</strong>ession.<br />

Moving forward, at the core <strong>of</strong> this initiative is the premise that the pr<strong>of</strong>ession is better <strong>of</strong>f<br />

recommending a solution rather than having one imposed by provincial governments. In Quebec, the<br />

government effectively facilitated unification, and this encouragement could happen elsewhere. In<br />

addition, the Quebec legislation has established good precedents that should be emulated and built<br />

upon across Canada.<br />

A significant step is the implementation <strong>of</strong> the new CPA certification program in 2013. Given that<br />

we’ve heard from many CA Training Offices that they want a consistent national program, and<br />

Quebec’s CPA body will use the new certification program that is being developed, it is very likely that<br />

the new program will be implemented across the country. As such, it is likely to be the only<br />

program that can deliver a national designation. We intend to see this program <strong>of</strong>fered in <strong>BC</strong> in<br />

conjunction with the other provincial bodies who can commit to unification.<br />

At present, I remain optimistic that we will ultimately be able to make a strong recommendation to<br />

the <strong>BC</strong> government around potential unification and enhanced uniform regulation in <strong>BC</strong>. Given the<br />

support in each body’s respective vote and surveys, I would expect the government will be prepared to<br />

work with us.<br />

The <strong>BC</strong> CA vote has established that there is a consensus and support for the work <strong>of</strong> Council, who<br />

have positioned <strong>BC</strong> to align with the dominant and pre-eminent pr<strong>of</strong>ession across the country—<br />

currently, those accounting bodies working towards unification.<br />

The next few months are likely to be challenging, and I do not know when it will be the appropriate<br />

time to make a recommendation to the <strong>BC</strong> government. We will continue to keep members informed<br />

<strong>of</strong> developments, and we <strong>of</strong>fer thanks, again, to everyone who has contributed to the process.<br />

Richard Rees , FCA, is the CEO <strong>of</strong> the <strong>Institute</strong> <strong>of</strong> <strong>Chartered</strong> <strong>Accountants</strong> <strong>of</strong> <strong>BC</strong>.<br />

Top-line vote results*<br />

Q1: Do you support a common<br />

regulatory framework for all<br />

pr<strong>of</strong>essional accountants that<br />

reflects current high standards?<br />

Yes: 63% No: 37%<br />

Q2: Do you support a new<br />

rigorous internationally<br />

recognized pr<strong>of</strong>essional<br />

accounting certification program<br />

that meets the high standards <strong>of</strong><br />

the existing programs?<br />

Yes: 63% No: 37%<br />

Q3: Do you support the<br />

pr<strong>of</strong>ession <strong>of</strong>fering a separate<br />

intermediate certificate program<br />

for those who aspire to a career<br />

in accountancy but choose not to<br />

complete the full <strong>Chartered</strong><br />

Pr<strong>of</strong>essional Accountant<br />

program?<br />

Yes: 58% No: 42%<br />

Q4: Do you support granting a<br />

new common designation<br />

(<strong>Chartered</strong> Pr<strong>of</strong>essional<br />

Accountant)?<br />

Yes: 52% No: 48%<br />

Q5: Do you support mandatory<br />

use <strong>of</strong> legacy designations (i.e.:<br />

CA, CGA, CMA) in conjunction<br />

with the new <strong>Chartered</strong><br />

Pr<strong>of</strong>essional Accountant<br />

designation for a period <strong>of</strong> 10<br />

years, with optional use <strong>of</strong> the<br />

legacy designations with the CPA<br />

thereafter?<br />

Yes: 74% No: 26%<br />

Q6: Do you support the<br />

unification <strong>of</strong> the current existing<br />

accounting Acts into one Act as<br />

part <strong>of</strong> a national initiative across<br />

Canada?<br />

Yes: 52%<br />

Elected Council Should Decide: 9%<br />

No: 39%<br />

*As at May 22, <strong>2012</strong> (Not all paper<br />

ballots had been received at the<br />

time <strong>of</strong> this writing; therefore,<br />

they were not counted in this<br />

total. The full vote results will be<br />

posted online at www.ica.bc.ca as<br />

soon as they are available.)<br />

<strong>June</strong>/Summer <strong>2012</strong> ica.bc.ca 7

Recommendations contained in the draft report to the<br />

<strong>BC</strong> government<br />

The leadership <strong>of</strong> <strong>BC</strong>’s CAs recommend to the <strong>BC</strong> provincial government that current provincial accounting<br />

regulations be modernized and streamlined. Specifically, we recommend that, as part <strong>of</strong> a broader, national initiative<br />

that will better protect the public interest and better serve British Columbia and Canada’s economic interests both<br />

domestically and abroad, the government:<br />

• Unify the three current existing accounting Acts into one.<br />

> The benefit <strong>of</strong> this change is a robust, consistent, regulatory environment that will provide protection for<br />

consumers and other users <strong>of</strong> accounting services.<br />

> Another benefit <strong>of</strong> this change would be the establishment <strong>of</strong> a single governing body that would continue to<br />

provide the existing mandates <strong>of</strong> self-regulation, education, and advocacy for all pr<strong>of</strong>essional accountants in <strong>BC</strong>.<br />

We recommend that the new Act continue the current high standards <strong>of</strong> the accounting pr<strong>of</strong>ession by empowering<br />

the new body to:<br />

• Create and implement a new, common regulatory framework, including codes <strong>of</strong> conduct, practice inspection,<br />

disciplinary processes, and an effective and consistent public accounting regime. This would be developed in<br />

concert with other Canadian jurisdictions.<br />

> The benefit <strong>of</strong> this change would be a regulatory framework that is nationally consistent, which facilitates labour<br />

mobility and inter-jurisdictional business.<br />

• Create a new, rigorous, internationally recognized pr<strong>of</strong>essional accounting certification program that meets the<br />

high standards <strong>of</strong> the existing programs. In addition, a separate certificate program will be <strong>of</strong>fered for those who<br />

aspire to a career in accountancy but choose not to complete the full pr<strong>of</strong>essional accounting program.<br />

> The benefit <strong>of</strong> this change would be a harmonized training and certification program for all pr<strong>of</strong>essional<br />

accountants in <strong>BC</strong>.<br />

• Grant a new common designation, <strong>Chartered</strong> Pr<strong>of</strong>essional Accountant (CPA). During the transition, existing<br />

members <strong>of</strong> each accounting body will be required to display their legacy designations (CA, CMA, CGA) in<br />

conjunction with the CPA designation for a period <strong>of</strong> 10 years, with optional use <strong>of</strong> the legacy designations with<br />

CPA thereafter.<br />

> The benefit <strong>of</strong> this change would be the evolution to a single designation, CPA, which would align <strong>BC</strong> and the<br />

rest <strong>of</strong> Canada with the globally dominant designation that is recognized by our largest trading partners.<br />

In addition, we recommend that the new Act provide greater protection <strong>of</strong> the public by:<br />

• Enabling the body to oversee undesignated and unregulated individuals providing public accounting services in <strong>BC</strong>.<br />

> The benefit <strong>of</strong> this change would be greater protection <strong>of</strong> the public interest and would align <strong>BC</strong> with many<br />

jurisdictions in North America, where there are regulations in place regarding the practice <strong>of</strong> public accounting,<br />

including the new CPA legislation introduced in Quebec.<br />

In summary, with government’s support, unification <strong>of</strong> the province’s three<br />

accounting Acts, consistent with other provinces, could result in a common<br />

regulatory structure affecting approximately 26,000 CPAs in <strong>BC</strong>, as well as 2,000<br />

firms that practise public accounting—all <strong>of</strong> which would become CPA firms.<br />

These firms employ well over 10,000 pr<strong>of</strong>essional accountants and others.<br />

8 ica.bc.ca <strong>June</strong>/Summer <strong>2012</strong>

The ICA<strong>BC</strong> Member Recognition Program<br />

Some <strong>of</strong> our 2010/2011 award winners, photographed by Kent Kallberg <strong>of</strong> Kent Kallberg Studios Ltd.<br />

Do you know a CA who’s gone the extra mile in the community, made an exemplary contribution<br />

to the pr<strong>of</strong>ession, or achieved outstanding success early in his or her career? Acknowledge their<br />

achievements by nominating them for an ICA<strong>BC</strong> award!<br />

You can nominate a colleague for:<br />

Fellowship (FCA)<br />

Lifetime Achievement<br />

The Honorary CA Designation<br />

Nomination deadlines:<br />

• Fellowship, Lifetime Achievement, Honorary CA:<br />

October 15, <strong>2012</strong><br />

Nomination forms<br />

Forms are available on the <strong>Institute</strong> website at www.ica.bc.ca under Member Centre/Forms and<br />

Dues/Member Recognition/Nomination Forms.<br />

<strong>June</strong>/Summer <strong>2012</strong> ica.bc.ca 9

On the Cover<br />

Awards for Early Achievement:<br />

Bob Sanghera, CA & Mike Stubbing, CA<br />

By Jennifer Weintraub<br />

Every year the <strong>Institute</strong> grants awards<br />

for early achievement to CAs who<br />

have made significant pr<strong>of</strong>essional<br />

accomplishments within ten years <strong>of</strong> earning the<br />

CA designation. This year’s award recipients are:<br />

Bob Sanghera, CA, and Mike Stubbing, CA.<br />

Balraj (Bob) Sanghera, CA<br />

Bob Sanghera grew up in Lillooet, <strong>BC</strong>, with his<br />

parents and older brother, Barinder. In 1990,<br />

the family moved to Richmond, the city Bob<br />

still calls home to this day.<br />

“My brother and I were close growing up, and<br />

I ended up following in his footsteps,” he says. “I<br />

entered the commerce program at the University<br />

<strong>of</strong> British Columbia two years after he did.”<br />

While Barinder went on to become a lawyer,<br />

Bob decided to pursue a career in business. After<br />

graduating from U<strong>BC</strong> in 1997, he took a job<br />

with the Canada Customs & Revenue Agency,<br />

initially as a customs <strong>of</strong>ficer. After his brief stint<br />

in government—first with the CCRA and later<br />

with the CRA—Bob decided to pursue his CA<br />

designation.<br />

“I was ready for a change,” he remembers,<br />

“and I’d been told that having a CA would open<br />

a lot <strong>of</strong> doors in the business world.”<br />

After landing a position with Ernst & Young<br />

in Vancouver, Bob started his articles in January<br />

<strong>of</strong> 2000. He qualified as a CA in 2002, and was<br />

promoted to manager just one year later.<br />

While working at Ernst & Young, Bob was<br />

asked to join a four-person committee that was<br />

tasked with creating the initial curriculum for a<br />

development program for the firm’s tax staff.<br />

This curriculum included both theoretical and<br />

practical components, and served as a recruiting<br />

tool and career track guide for all tax staff<br />

employees at the firm.<br />

“It was a great experience for me to assist in<br />

establishing a work curriculum and career track<br />

that could be used by the firm,” he says. “I was<br />

fortunate to be able to get involved in such a big<br />

project so early on in my career.”<br />

10 ica.bc.ca <strong>June</strong>/Summer <strong>2012</strong>

In December 2003, Bob made the decision to<br />

join Smythe Ratcliffe as a manager.<br />

“This was an exciting move for me,” he explains,<br />

“because as it was an opportunity to do<br />

tax planning and work closely with a wide<br />

variety <strong>of</strong> clients—particularly family-owned<br />

businesses.”<br />

Bob quickly established himself as a leader at<br />

Smythe Ratcliffe. He was promoted to senior<br />

manager in 2006, and was invited to become a<br />

tax partner in 2009. Currently, he’s the practice<br />

group leader <strong>of</strong> the firm’s tax practice.<br />

“The most rewarding part <strong>of</strong> my job is the<br />

variety <strong>of</strong> work—that, and the people,” he says.<br />

“Each day, I’m dealing with different tasks, new<br />

<strong>issue</strong>s, new challenges. And I work with incredibly<br />

bright people here. The relationships I’ve built<br />

are so rewarding.”<br />

As for his biggest challenge, Bob points to his<br />

schedule.<br />

“Juggling everything is challenging,” he says.<br />

“It’s a demanding, deadline-oriented pr<strong>of</strong>ession,<br />

and you’re always on the go. It’s important to<br />

balance work and family needs. Taking my<br />

daughters to their activities and spending time<br />

with my family—these are things you just need<br />

to make a priority.”<br />

Despite the various demands for his time and<br />

attention, Bob has been giving back to the CA<br />

pr<strong>of</strong>ession for almost 10 years. He joined the<br />

ICA<strong>BC</strong>’s Young CA Forum soon after earning<br />

his designation, and was an active member <strong>of</strong><br />

the group for several years.<br />

“This was a great opportunity for me to provide<br />

a younger CA prospective and to give back to<br />

the pr<strong>of</strong>ession,” he says. “There are many <strong>issue</strong>s<br />

relevant to new CAs, and it’s important for them<br />

12.RTurnbullChartAd 5/17/12 10:44 AM Page 1<br />

Bob Sanghera, CA<br />

odlumbrown.com<br />

Tired <strong>of</strong> portfolios that simply<br />

follow the S&P/TSX?<br />

> We think for ourselves.<br />

Ross Turnbull, CA, CBV, CFA<br />

Vice President, Director,<br />

Portfolio Manager<br />

T 604 844 5363 or 1 888 886 3586<br />

rturnbull@odlumbrown.com<br />

odlumbrown.com<br />

comparative performance*<br />

odlum brown model portfolio<br />

s&p/tsx total return index<br />

2.4%<br />

-12.8%<br />

1-year<br />

14.6%<br />

8.3%<br />

since inception<br />

* Compound annual growth rates are from inception December 15, 1994 to May 15, <strong>2012</strong>. The Odlum Brown Model Portfolio is a hypothetical, all-equity portfolio that was established by the Odlum Brown<br />

Research Department in December 1994. Trades are made using the closing price on the day a change is announced. These are gross figures before fees. Past performance is not indicative <strong>of</strong> future performance.<br />

Member-Canadian Investor Protection Fund.<br />

<strong>June</strong>/Summer <strong>2012</strong> ica.bc.ca 11

to have a voice at the <strong>Institute</strong>.”<br />

Currently, Bob serves as a member <strong>of</strong> the<br />

ICA<strong>BC</strong>/CRA Liaison Committee, and as chair<br />

<strong>of</strong> the PKF Canadian Tax Interest Group, which<br />

consists <strong>of</strong> 12 associated firms across Canada. In<br />

this latter role, he oversees monthly conference<br />

calls and organizes two annual tax conferences.<br />

Also a strong believer in giving back to the<br />

community, Bob has served on the cabinet <strong>of</strong><br />

the <strong>BC</strong> Children’s Hospital Night <strong>of</strong> Miracles<br />

Gala Dinner for the past three years. The Night<br />

<strong>of</strong> Miracles Gala Dinner is an annual event that<br />

targets the South Asian Community and raises<br />

approximately $300,000 for <strong>BC</strong> Children’s<br />

Hospital each year. The cabinet is committed to<br />

raising $3 million to support the construction <strong>of</strong><br />

an international radiology room in the new <strong>BC</strong><br />

Children’s Hospital.<br />

“There was an opportunity to join the cabinet,<br />

and it was an easy decision for me to make,” Bob<br />

says. “We were invited to go on a tour <strong>of</strong> the<br />

hospital, and got the chance to talk to the doctors,<br />

as well as to the mother <strong>of</strong> a heart surgery patient<br />

who was just a baby. As a parent, it’s easy to take<br />

for granted having healthy children. This is a<br />

great cause, and it’s important that the doctors<br />

and the patients have the resources they need.”<br />

Bob also supports the Vancouver Board <strong>of</strong><br />

Trade’s Leaders <strong>of</strong> Tomorrow (LOT) Program,<br />

and in 2010-2011, he mentored a business<br />

student who ended up entering the CA program.<br />

“I think finding a good mentor is very critical<br />

to being successful,” he says. “I’ve been fortunate<br />

to have great mentors throughout my career,<br />

and the LOT Program presented me with a<br />

great opportunity to give back.”<br />

As for the Early Achievement Award, Bob says<br />

it came as a complete surprise.<br />

“I’m very grateful and happy, but I was<br />

certainly not expecting this,” he <strong>of</strong>fers. “I don’t<br />

think I’ve done anything that other people don’t<br />

do. I also just feel fortunate to have great colleagues<br />

who would think to nominate me. It is<br />

very humbling to receive this award.”<br />

Bob credits much <strong>of</strong> his success to his family,<br />

friends, and colleagues.<br />

“My parents, Balwant and Baldev Sanghera,<br />

immigrated to Canada from India, and were<br />

great role models,” he says. “They instilled in me<br />

the values <strong>of</strong> education and hard work. Without<br />

them, there’s no way I’d be where I am today.<br />

And, <strong>of</strong> course, my wife, Raj, and kids, Nisha (6)<br />

and Saiya (3)—none <strong>of</strong> my success would be<br />

possible without Raj’s support. My brother was<br />

also an excellent role model for me.<br />

“I also want to thank Devinder Gill, CA,” Bob<br />

adds. “He’s a long-time family friend, and he<br />

played a big role in pushing me in the direction<br />

<strong>of</strong> the CA. Devinder was a few years ahead <strong>of</strong> me in school and then in the CA program, so I was really<br />

able to look to him for guidance and advice.”<br />

Bob also acknowledges the support <strong>of</strong> his colleagues—both past and present.<br />

“I’d like to thank Billie Raptis, CA, and Jas Hayre, CA, for the guidance they provided when I was<br />

at Ernst & Young,” he says. “And the mentorship I have received from Larry Vicic, CA, the managing<br />

partner at Smythe Ratcliffe, and from Tom Morton, CA, and Bill Macaulay, CA—the other two tax<br />

partners here—has been incredible. They created these great opportunities for me... paved the way,<br />

really. I’m thankful to them and to the rest <strong>of</strong> the staff—I’m fortunate to work with such a great team<br />

<strong>of</strong> people.”<br />

Michael (Mike) Stubbing, CA<br />

As a small child growing up in Frobisher Bay, Northwest Territories (now Iqaluit, Nunavut), Mike<br />

Stubbing was sure he was destined to become a pr<strong>of</strong>essional hockey player. As he got a bit older,<br />

though, his future career path wasn’t so clear.<br />

“I really had no idea what I wanted to be when I grew up,” he says. “I just knew I didn’t want to be<br />

a doctor—I saw the crazy hours my dad worked and wanted to steer clear <strong>of</strong> that.”<br />

Mike laughs as he realizes he’s in the heart <strong>of</strong> tax season, adding: “I may have chosen the wrong<br />

pr<strong>of</strong>ession.”<br />

His path to the CA designation was a gradual one. At 15 years old, Mike moved to Ottawa to<br />

complete his last three years <strong>of</strong> high school. Still not sure what career path he wanted to follow after<br />

graduating, he applied to a number <strong>of</strong> universities across the country. After being accepted to Simon<br />

Fraser University’s business program, he started his studies in 1995.<br />

“There was never a real ‘Aha!’ moment that led me to the CA program,” Mike remembers. “I took a<br />

stab at accounting and liked it. Plus, SFU had a great CA co-op program that guaranteed five work<br />

terms and a full-time job afterwards. I got a placement with Grant Thornton’s New Westminster<br />

Office, and it was an incredible experience.”<br />

Mike completed all five work terms at Grant Thornton, graduated from SFU in the summer <strong>of</strong> 2000,<br />

and wrote the UFE that September. He qualified as a CA in late fall <strong>of</strong> 2001, soon after transferring to<br />

the firm’s Edmonton <strong>of</strong>fice. While in Edmonton, he also transferred out <strong>of</strong> audit and into tax.<br />

“It was an exciting move for me, because I felt I had a real knack for tax, and I enjoyed its practicability,”<br />

he explains. “I love that you can give useful, tangible advice to people.”<br />

Mike was promoted to manager in 2002, and became a senior manager just two years later. Then, in<br />

the fall <strong>of</strong> 2006, he made the decision to transfer to the West Coast.<br />

“My wife Natalie and I were ready to start a family, and we’d always loved the charm and beauty <strong>of</strong><br />

Victoria,” he says.<br />

Within three years <strong>of</strong> transferring to Grant Thornton’s Victoria <strong>of</strong>fice, Mike was made a partner. He<br />

was 32.<br />

Looking back, he credits much <strong>of</strong> his rapid career advancement to Terry Wainman, CA, a tax partner<br />

at Grant Thornton Edmonton who introduced him to the world <strong>of</strong> teaching and writing.<br />

“Terry was a phenomenal mentor to me,” he says. “He showed a lot <strong>of</strong> trust in me and would give<br />

me very challenging work from an early stage. Pretty early in my tax career, Terry was asked to teach<br />

a couple <strong>of</strong> two-day courses for the <strong>Institute</strong> <strong>of</strong> <strong>Chartered</strong> <strong>Accountants</strong> <strong>of</strong> Alberta that he didn’t have<br />

time to take on. He immediately suggested that I teach them. I was pretty hesitant, because I’d only<br />

been a CA for a couple <strong>of</strong> years. But because Terry put his confidence in me, I agreed.”<br />

It was a pivotal opportunity, as Mike discovered a passion for teaching and writing. Since teaching<br />

that first course in 2002, he has taught a number <strong>of</strong> income tax courses, and a component <strong>of</strong> the ICAA<br />

course, “Managing Financial Risk for Millionaires.” He has also lectured on tax and business matters<br />

for the Canadian Tax Foundation, the University <strong>of</strong> Alberta, Grant MacEwan University, the<br />

National Judicial <strong>Institute</strong>, and Camosun College, and continues to present on technical tax <strong>issue</strong>s to<br />

various pr<strong>of</strong>essionals, such as bankers, brokers, lawyers, and other accountants.<br />

“It’s always a challenge, and I still get butterflies in my stomach,” he says, “but by the end I feel great.”<br />

In terms <strong>of</strong> writing, Mike co-authored a paper for the Canadian Tax Foundation’s 2007 <strong>BC</strong> Conference,<br />

a white paper on farm succession (2010), and a two-and-a-half day course for Grant Thornton’s senior<br />

non-tax pr<strong>of</strong>essionals.<br />

His enthusiasm for working with students has also made him a natural fit for recruiting at his firm.<br />

“I truly enjoyed my years as a student,” he says, “so helping with recruiting is a small way <strong>of</strong> giving<br />

back.”<br />

12 ica.bc.ca <strong>June</strong>/Summer <strong>2012</strong>

Mike Stubbing, CA<br />

In addition to his involvement in the CA pr<strong>of</strong>ession,<br />

Mike is an active board member for the<br />

Vancouver Chapter <strong>of</strong> the Society <strong>of</strong> Trust &<br />

Estate Practitioners (STEP).<br />

“Trust and estate planning is something I’m<br />

very interested in,” he says. “I benefited from<br />

STEP for several years, so I felt like it was my<br />

turn to pitch in. It’s really nice to be involved in<br />

an organization that puts so much effort into<br />

continually educating others.”<br />

When asked what keeps him ticking, Mike<br />

immediately credits those around him.<br />

“It’s the people,” he says. “I love my job because<br />

I get to interact with other pr<strong>of</strong>essionals, staff,<br />

and clients on a regular basis. I feel fortunate to<br />

be exposed to so many different perspectives.<br />

“People are always saying, ‘You must be so<br />

good at math,’” he adds. “I tell them: ‘I can add<br />

and subtract and multiply, but even that I don’t<br />

do on a daily basis.’ Being a CA is really not a<br />

numbers job at all.”<br />

What he finds most rewarding, however, is also<br />

what he finds most challenging.<br />

“I’m really driven to please people,” Mike says.<br />

“In this field, though, that’s not always easy. I’m<br />

constantly trying to ensure that each client and<br />

staff member feels as though our relationship is<br />

rewarding in some way.”<br />

Receiving the Early Achievement Award for<br />

his efforts is just icing on the cake.<br />

“I thought it was extremely touching that my<br />

colleagues would even think to nominate me,”<br />

he says. “I feel really lucky to be surrounded by<br />

such a thoughtful, generous group <strong>of</strong> people.”<br />

Mike credits a number <strong>of</strong> people for helping<br />

him get to where he is today.<br />

“First, I need to thank my family,” he says.<br />

“I’m so lucky to be able to go home to my wife,<br />

Natalie, and kids, Anna (5) and Jason (2), each<br />

day. They’ve put a lot <strong>of</strong> balance into my life,<br />

and changed me in a good way.<br />

“I also thank my parents for being phenomenal<br />

role models,” he adds. “My mom is one <strong>of</strong> the<br />

kindest people you could ever meet, and she<br />

modelled the importance <strong>of</strong> treating people<br />

properly. And my dad—he received the Order<br />

<strong>of</strong> Canada in 2009. He’s a very smart guy and a<br />

real hard worker, who gave his patients the best<br />

care possible, every day. I try to emulate that.”<br />

On the pr<strong>of</strong>essional side, Mike thanks Terry<br />

Wainman, CA, and two other mentors: Bob<br />

Broder, CA, a partner at Grant Thornton’s<br />

Victoria <strong>of</strong>fice, and Susan Mehinagic, FCA, the<br />

<strong>of</strong>fice’s now-retired managing partner.<br />

“I’ve worked closely with Bob over the past few<br />

years,” Mike says. “He is very knowledgeable<br />

about tax and accounting, but he’s also phenomenal<br />

at providing clients with excellent advice.<br />

Most importantly, he treats our staff properly—<br />

the way they should be treated. Bob leads by<br />

example, and I’ve really enjoyed learning from<br />

him.<br />

“And Susan was the <strong>of</strong>fice managing partner I<br />

worked with before I became a partner here in<br />

Victoria,” he adds. “She saw potential in me,<br />

took me under her wing, and gave me a lot <strong>of</strong><br />

guidance in that transition from senior manager<br />

to partner.”<br />

Jennifer Weintraub is the CA recruiter for the<br />

<strong>Chartered</strong> <strong>Accountants</strong> <strong>of</strong> <strong>BC</strong>.<br />

Photo <strong>of</strong> Bob Sanghera by Kent<br />

Kallberg <strong>of</strong> Kent Kallberg Studios in<br />

Vancouver. Photo <strong>of</strong> Mike Stubbing<br />

by John Yanyshyn <strong>of</strong> Visions West<br />

Photography in Victoria.<br />

<strong>June</strong>/Summer <strong>2012</strong> ica.bc.ca 13

Community Service Award Winners<br />

By Michelle McRae and Vanessa Woznow<br />

Seven CAs have been recognized this year for their outstanding contributions to the community:<br />

C. Edward (Ted) Butterfield, CA; Grant Gilmour, CA; Gordon Gunn, CA·CISA; Doug Johnstone, CA;<br />

Jasvinder S. (Jas) Kalsi, CA, CPA (Illinois); Doug Wallis, CA; and Paul Winstanley, CA.<br />

C. Edward (Ted) Butterfield, CA<br />

Ted Butterfield, CFO <strong>of</strong> IWG Technologies Inc. and International Water-Guard<br />

Industries Inc., credits much <strong>of</strong> his lifelong interest in volunteerism and<br />

philanthropy to the example set by his parents.<br />

“My parents were both teachers, and were very involved in our community<br />

for as long as I remember,” says Ted. “Their admirable example motivated me<br />

to help build better outcomes for our society.”<br />

Ted’s many contributions to the community have included serving on the<br />

executive and board <strong>of</strong> the Boys and Girls Clubs <strong>of</strong> Greater Vancouver from<br />

the early 1980s to 2004, during which time he also chaired several <strong>of</strong> the organization’s committees. In<br />

the 1990s, he served as both a director and member <strong>of</strong> the executive <strong>of</strong> the McMillan Space Centre.<br />

A committed member <strong>of</strong> his church, he has served as chair <strong>of</strong> its board on three separate occasions.<br />

One <strong>of</strong> Ted’s recent commitments has been his role as chair and president <strong>of</strong> Prostate Cancer<br />

Foundation <strong>BC</strong>, which sees him working not only with the organization’s board, but with other<br />

like-minded organizations across Canada. These efforts have already helped lead to the emergence <strong>of</strong><br />

a collective, Canada-wide voice and fundraising organization: Prostate Cancer Canada.<br />

“The great thing about collaboration is how much we are able to achieve working together,” Ted says.<br />

“Through our shared efforts, and a strong regional<br />

organization, we have not only seen an increase<br />

in fundraising, but also a significant growth in<br />

awareness <strong>of</strong> prostate cancer across the country.<br />

This is the most common cancer affecting men<br />

today, with one in seven receiving the diagnosis.”<br />

The cause is a deeply personal one, as Ted,<br />

himself, is a cancer survivor, having received his<br />

first diagnosis 10 years ago. He credits dedicated<br />

volunteers, all <strong>of</strong> whom had experience with<br />

prostate cancer, with helping him select and prepare<br />

for his best treatment option. Once treated,<br />

he eagerly accepted an invitation to give back.<br />

“I wanted to help lead this passionate, growing<br />

community to better serve those men and their<br />

families affected by the disease,” he says.<br />

Through strong board leadership, and interorganizational<br />

partnership, Ted is working to<br />

raise funds, spread awareness and knowledge,<br />

and seek better treatments for both initial and<br />

reoccurring cancer diagnoses.<br />

In addition to his work with Prostate Cancer<br />

Foundation <strong>BC</strong>, Ted currently serves on the<br />

board <strong>of</strong> the Lion’s Gate Rotary Club and volunteers<br />

his leadership to the Club’s international<br />

affairs program.<br />

“My CA training and leadership experience<br />

has actually enabled me to make a difference<br />

where needed,” says Ted, when asked about the<br />

rewards <strong>of</strong> giving back. “Not to mention the<br />

friendships that I’ve formed, as a result <strong>of</strong> my<br />

participation with these incredibly worthwhile<br />

volunteer service organizations.<br />

“In all honesty,” he adds, “I have benefited so<br />

much from my volunteering experiences. And it<br />

wouldn’t be possible for me to engage in these<br />

activities—alongside my career and family<br />

adventures—if it weren’t for the support <strong>of</strong> my<br />

family and my employers.”<br />

Ted’s wife Fay, and their three grown children and<br />

four grandchildren, are also involved in volunteer<br />

activities.<br />

14 ica.bc.ca <strong>June</strong>/Summer <strong>2012</strong>

S. Grant<br />

Gilmour, CA<br />

Grant Gilmour, co-owner<br />

<strong>of</strong> the firm Gilmour<br />

Knotts Incorporated in<br />

Langley, has been giving<br />

back to the community<br />

steadily for many years,<br />

particularly through his<br />

involvement with the Rotary Club <strong>of</strong> Langley<br />

Sunrise.<br />

One <strong>of</strong> his major contributions through Rotary<br />

has been his leadership <strong>of</strong> the Sunrise Club’s<br />

dictionary project. When he first took on the<br />

project in 1998, the plan was to donate dictionaries<br />

to one class <strong>of</strong> grade 4 students at one local<br />

school. Within the span <strong>of</strong> approximately four<br />

months, Grant successfully drove the expansion<br />

<strong>of</strong> the project to include all grade 4 students in<br />

the entire Langley School District.<br />

“I believe literacy is as important as health,” he<br />

says. “I came to the thought that a dictionary is<br />

like a vaccination—that if we could reach<br />

enough kids, we were certain to reach the ones<br />

who really needed the dictionaries.”<br />

To put a human face to the project, Grant had<br />

the idea to deliver the dictionaries via a one-day<br />

car rally involving teams <strong>of</strong> Rotarians. It was<br />

a huge success, and continues on today. Each<br />

September, as they hand deliver approximately<br />

1,600 dictionaries to the grade 4 students at<br />

35 local schools, volunteers demonstrate their<br />

commitment to both community spirit and<br />

literacy. Moreover, the dictionary project has<br />

branched out to other Rotary clubs across the<br />

country, including 15 in Western Canada alone.<br />

“It’s amazing how a good idea just gets legs <strong>of</strong><br />

its own and grows,” Grant says.<br />

Case in point: “Shred-a-thon.”<br />

“The Scouts’ after-Christmas tree-chipping<br />

fundraiser gave me the idea to create an event<br />

where the public could ‘chip’ (shred) documents<br />

after tax season in exchange for donations,” he<br />

explains. “It was a solution to a problem clients<br />

had been asking me about for years—how to get<br />

rid <strong>of</strong> old documents without risking identity<br />

theft.”<br />

To date, the Langley Club has hosted six<br />

Shred-a-thons. After the inaugural event in<br />

2005, Grant created a how-to manual for other<br />

Rotary clubs, and the ripple effect has led to<br />

Shred-a-thons across North America.<br />

His contributions as a Rotarian have reached<br />

beyond North America as well. In 2010, he<br />

played an instrumental role in the delivery <strong>of</strong><br />

$400,000 in medical supplies to a hospital in<br />

Iligan City, in the Philippines.<br />

“I acted as a ‘connector’ for a contact <strong>of</strong> mine<br />

named Jun Tallo,” he says. “I must have spoken to the right people, because the project came together<br />

in record time and with great results. I am still surprised today at how much one phone call can achieve.<br />

The people at both ends <strong>of</strong> the project have been great, especially Jun.”<br />

Their collaboration is ongoing.<br />

“This year, we connected him with a fire truck from White Rock,” Grant says. “It now has a new<br />

home in the Philippines.”<br />

In addition to his ongoing work with Rotary, the father <strong>of</strong> four has served on the planning council at<br />

his children’s school for two years, and also volunteers as a Cub Scout leader.<br />

“Seeing smiles on kids’ faces is the most rewarding thing,” Grant says. “There’s nothing like having a<br />

10-year-old in a shopping mall yell: ‘Hey mom, there’s the dictionary man!’”<br />

Gordon Gunn, CA•CISA<br />

For over two decades, Gordon Gunn has energetically and selflessly committed<br />

himself to advancing community initiatives through his various volunteer<br />

roles, and it’s fair to say that his work has greatly contributed to both the<br />

vitality <strong>of</strong> Victoria’s not-for-pr<strong>of</strong>it sector, and to Canada’s financial management<br />

industry.<br />

“It was instilled in me in the very early stages <strong>of</strong> my career that CAs should<br />

give back to their communities,” Gordon says. “Non-pr<strong>of</strong>it organizations are<br />

<strong>of</strong>ten looking for financial competencies, so my early volunteering typically<br />

involved acting as a treasurer. In some cases, I was asked by my employers to take on specific volunteer<br />

roles when a need was identified.”<br />

Gordon has contributed his leadership to the community in a variety <strong>of</strong> ways, including serving as<br />

treasurer and vice-president <strong>of</strong> finance with the Boy Scouts <strong>of</strong> Canada; president, treasurer, and director<br />

<strong>of</strong> the Great Canadian Family Picnic Society (an initiative aimed a promoting national unity); and<br />

secretary-treasurer <strong>of</strong> the Ballet Victoria Society.<br />

In 2007, Gordon was named to the Mayor’s Task Force on Ending the Cycle <strong>of</strong> Addiction,<br />

BDO PROVIDES<br />

FAIR VALUE<br />

SOLUTIONS<br />

Relax and allow our team <strong>of</strong> valuation experts to assist you in solving your client’s fair value<br />

reporting requirements under ASPE, IFRS or US GAAP:<br />

• Purchase price allocation<br />

• Impairment testing<br />

Spencer Cotton, CA, CBV, Partner<br />

Margaret C. McFarlane, LLB, CA•IFA/CBV, Partner<br />

600 – 925 West Georgia Street<br />

Vancouver <strong>BC</strong><br />

604 688 5421<br />

www.bdo.ca<br />

• Fair value measurement<br />

• Financial instruments<br />

BDO Canada LLP, a Canadian limited liability partnership, is a member <strong>of</strong> BDO International Limited, a UK company<br />

limited by guarantee, and forms part <strong>of</strong> the international BDO network <strong>of</strong> independent member firms. BDO is the<br />

brand name for the BDO network and for each <strong>of</strong> the BDO Member Firms.<br />

<strong>June</strong>/Summer <strong>2012</strong> ica.bc.ca 15

A Comprehensive US IQEX Program<br />

for Canadian <strong>Chartered</strong> <strong>Accountants</strong><br />

Fulfill the new IRS tax preparer<br />

requirements by<br />

becoming a US CPA<br />

Why not combine a pr<strong>of</strong>essional designation with the fulfi llment<br />

<strong>of</strong> your provincial institute’s educational requirements?<br />

Our program includes an intensive 2-day live weekend<br />

session in Toronto and Vancouver and a 2-hour personal<br />

telephone tutorial with course developer Henry Zimmer<br />

Email: cpa-now@dc.rr.com<br />

www.cpa-now.org

Mental Health, and Homelessness. The next year,<br />

he became involved with the Greater Victoria<br />

Coalition to End Homelessness. For the past three<br />

years, he has served as the Coalition’s secretarytreasurer.<br />

“Street homelessness in Greater Victoria had,<br />

over 15 years, grown to become the leading<br />

social <strong>issue</strong> in our community,” he explains. “ I<br />

leapt at the opportunity to join the Coalition as<br />

secretary-treasurer when it arose. We are now<br />

halfway through our 10-year mission to end<br />

homelessness in Victoria by 2018. We have<br />

made a difference, and more projects are on the<br />

way.”<br />

Also keenly involved with financial management<br />

boards and organizations, Gordon has volunteered<br />

as treasurer and director <strong>of</strong> the Canadian<br />

Association <strong>of</strong> Management Consultants, as<br />

director <strong>of</strong> the Information Systems Audit<br />

and Control Association International, and as<br />

director and president <strong>of</strong> the Association’s<br />

Victoria Chapter. In 2005, he was elected<br />

president <strong>of</strong> the Victoria Chapter <strong>of</strong> the Financial<br />

Management <strong>Institute</strong> <strong>of</strong> Canada (FMIC), a<br />

pr<strong>of</strong>essional association for those interested in<br />

public sector financial management.<br />

A partner in KPMG’s Risk Consulting practice,<br />

Gordon also leads his <strong>of</strong>fice’s community service<br />

program, and his keen interest in volunteerism<br />

has inspired many peers to find their own ways<br />

to give back. In recognition <strong>of</strong> his efforts, he was<br />

awarded KPMG’s CEO Community Service<br />

Excellence Award in 2008.<br />

“I think every volunteer sets a positive example<br />

for others, including the coming generations,”<br />

says Gordon, when asked what he enjoys most<br />

about his volunteer work. “It is also a great way<br />

<strong>of</strong> building a community network. I love to<br />

meet people who are passionate and enthusiastic<br />

about their community, and I am proud that I<br />

live in a city where so many people choose to<br />

give back.”<br />

In addition to his CA·CISA designation, Gordon<br />

holds the certified management consultant (CMC)<br />

designation and the project management pr<strong>of</strong>essional<br />

(PMP) certification. This won’t be his first<br />

time at the awards podium—in 1992, he received<br />

the ICA<strong>BC</strong>’s “CA <strong>of</strong> the Year Award,” (now the<br />

Community Service Award).<br />

Doug<br />

Johnstone, CA<br />

Since moving back to his<br />

hometown <strong>of</strong> Castlegar<br />

15 years ago, Doug<br />

Johnstone has been involved<br />

with a number<br />

<strong>of</strong> grassroots initiatives<br />

aimed at improving the<br />

quality <strong>of</strong> life in his community. Focusing<br />

on arts and culture, he has contributed greatly<br />

to the town’s overall social and economic revitalization.<br />

“I grew up here,” says Doug. “It’s my hometown.<br />

I want to help it prosper economically through<br />

successful enterprise, but also spiritually through<br />

artistic endeavours.”<br />

Pinnacle Pr<strong>of</strong>essional Accounting Corporation<br />

(PAC), Doug’s accounting firm, provides pro<br />

bono accounting services to a number <strong>of</strong> diverse<br />

organizations, including the Rossland Chamber<br />

<strong>of</strong> Commerce, the Doukhobor Heritage Retreat<br />

Society, and the Castlegar Sculpture Walk Society.<br />

His firm is also involved in a “greenification”<br />

project, an initiative that focuses on providing<br />

options to clients that benefit the environment,<br />

local charities, and not-for-pr<strong>of</strong>its. As part <strong>of</strong><br />

this project, when clients choose to receive their<br />

year-end documents in an electronic format, a<br />

contribution is made in their name to one <strong>of</strong><br />

seven local charities. In recognition <strong>of</strong> its work<br />

to promote green initiatives, Pinnacle PAC was<br />

awarded the Green Award from the Castlegar<br />

Chamber <strong>of</strong> Commerce in 2011.<br />

In addition, Doug was instrumental in turning<br />

a once desolate residential lot into the “Downtown<br />

Art Farm,” an outdoor art gallery<br />

and urban community garden that supports<br />

Castlegar’s food bank. He donated the land,<br />

provided the funding, and contributed countless<br />

volunteer hours to the project.<br />

“On a personal level,” he says, “I’m really<br />

proud <strong>of</strong> what we were able to achieve with the<br />

Art Farm.”<br />

Doug credits much <strong>of</strong> his interest in the arts to<br />

his partner Willow.<br />

“Before I met Willow, I think I was much<br />

more <strong>of</strong> a left-brain thinker,” he says. “It was her<br />

passion for the arts, and her artistic nature,<br />

that really spurred my interest in these kinds <strong>of</strong><br />

projects.”<br />

Doug’s other forays into the arts community<br />

include serving as logistics coordinator on the<br />

board <strong>of</strong> the Castlegar Sculpture Walk, a legacy<br />

project aimed at beautifying the downtown core.<br />

Through sponsorships from local businesses and<br />

individuals, Sculpture Walk oversees the installation<br />

<strong>of</strong> sculptures and art pieces around town.<br />

“One <strong>of</strong> my goals for the future is to turn<br />

Sculpture Walk into a self-sustaining initiative,”<br />

he says. “It has grown into such an amazing<br />

program, and we want to make sure it continues<br />

to succeed.”<br />

Currently, Doug is also spearheading efforts<br />

to revitalize downtown Castlegar through an<br />

initiative called the “Vacant Windows Project,”<br />

which aims to beautify the city by placing local<br />

art in the windows <strong>of</strong> vacant buildings. In<br />

addition, his firm features local artists on its<br />

company homepage every month, and contributes<br />

gallery space showcasing local talent in three <strong>of</strong><br />

its <strong>of</strong>fices on an ongoing basis.<br />

“I am lucky enough to be in a position where<br />

I can contribute to the economic and social<br />

well-being <strong>of</strong> my community,” Doug says. “I<br />

do what I can to support and empower local<br />

businesses, artists, and food providers. The end<br />

result will be enrichment <strong>of</strong> our whole region.”<br />

Jasvinder S.<br />

(Jas) Kalsi, CA,<br />

CPA (Illinois)<br />

Jas Kalsi, a sole-practitioner<br />

in Surrey, has<br />

been an active volunteer<br />

with Lower Mainlandbased<br />

organizations for<br />

many years—particularly<br />

athletic and cultural programs and initiatives.<br />

His involvement with the Canadian International<br />

Dragon Boat Festival Society is his most<br />

long-standing, spanning more than 14 years.<br />

“I initially became involved as a paddler in the<br />

mid-1990s, joining ‘Team Masala’ with a group<br />

<strong>of</strong> friends,” Jas says. “I enjoyed competing in the<br />

event so much, that when I heard the Society<br />

was looking for a treasurer, I jumped at the<br />

chance to apply for the position.”<br />

He has been a fixture on the board ever since.<br />

“I’ve continued to work with the organization<br />

because I believe in its goals and objectives,” he<br />

says. “I work with great people, and we organize an<br />

event that is truly world class. Dragon boating<br />

is an event where people <strong>of</strong> all capabilities—<br />

juniors, seniors, individuals with physical<br />

challenges such as visual impairment, survivors<br />

<strong>of</strong> cancer and other diseases—can all come<br />

together and compete on an equal basis.”<br />

<strong>June</strong>/Summer <strong>2012</strong> ica.bc.ca 17

In 2005, Jas took on the role <strong>of</strong> chair.<br />

“My responsibilities include ensuring that the<br />

festival continues to be successful—not only<br />

financially, but also for every single participant,<br />

volunteer, spectator, and sponsor,” he says. “We<br />

now operate a year-round facility, which includes<br />

training for coaches and paddlers, and educational<br />

activities for our junior members. This initiative<br />

culminates every year with the Dragon Boat<br />

Festival in <strong>June</strong>. It is the largest and most<br />

successful annual dragon boat festival outside<br />

<strong>of</strong> Hong Kong, with over 100,000 spectators<br />

coming out to watch.”<br />

Under his leadership, the Society has increased<br />

revenues from year-long programs by 50%, and<br />

continually operates without a deficit. Together<br />

with staff and board members, Jas has also<br />

helped build and implement the Society’s plans<br />

for succession and strategic leadership. He also<br />

played a lead role in organizing an initiative to<br />

develop a community boathouse in Vancouver.<br />

The community boathouse was recently recognized<br />

by City Council as an approved amenity<br />

centre, and Jas and his colleagues are now working<br />

on a conceptual plan.<br />

When it comes to the Society’s success, Jas is<br />

quick to credit his tight-knit team, saying: “I am<br />

so proud <strong>of</strong> the staff, my fellow board members,<br />

and the literally hundreds <strong>of</strong> volunteers who<br />

have helped to shape this Society and make it a<br />

key Vancouver event.”<br />

In addition to volunteering with the Society,<br />

Jas serves on the advisory board <strong>of</strong> the Vancouver<br />

International Bhangra Celebration, and as a<br />

director and treasurer for Badminton <strong>BC</strong>. Past<br />

volunteerism includes coaching for five years<br />

with the Surrey Youth Soccer Association.<br />

“From a very young age, my siblings and I<br />

were brought up with the notion that giving<br />

back to the community should be an extremely<br />

important part <strong>of</strong> our lives,” Jas explains. “I’m<br />

grateful to my parents for that lesson. And I’m<br />

also grateful for the support my girlfriend Walaa<br />

and my four kids give me in pursuing these<br />

activities, because my volunteer work provides<br />

me with a great sense <strong>of</strong> accomplishment, pride,<br />

and happiness.”<br />

Doug Wallis,<br />

CA<br />

For more than 10 years,<br />

Doug Wallis has been<br />

committed to furthering<br />

the goals <strong>of</strong> the Canadian<br />

Network for International<br />

Surgery (CNIS),<br />

a Vancouver-based organization<br />

created to promoting lasting and<br />

sustainable improvements in health and safety in<br />

developing countries.<br />

He first learned about the organization in 2001,<br />

while working as the director <strong>of</strong> pr<strong>of</strong>essional<br />

advisory services for the ICA<strong>BC</strong>.<br />

“I <strong>of</strong>ten dealt with the public, including<br />

NPOs, and I was very aware <strong>of</strong> the need for the<br />

skills that CAs can bring to such NPOs,” says<br />

Doug, now a partner with Smythe Ratcliffe<br />

in Vancouver. “The CNIS was looking for a<br />

volunteer CA, and I called to learn more. Their<br />

capacity-building model was and continues<br />

to be a major impetus to my involvement. The<br />

organization sends MDs and nurses to Africa to<br />

teach skills to local practitioners, and the local<br />

practitioners who receive this training then use<br />

those skills to improve the lives <strong>of</strong> many, many<br />

Africans over an extended period. The ripple<br />

effect is quite amazing.”<br />

He joined the organization in 2002 as chair <strong>of</strong><br />

the finance committee. At that time, the CNIS<br />

was struggling with its finances, so Doug helped<br />

organize the records and provided guidance<br />

and assistance in developing the accounting and<br />

funding systems. By helping to make the organization<br />

more stable, he also helped the CNIS<br />

address its biggest challenge: obtaining funding<br />

from the Canadian International Development<br />

Agency (CIDA).<br />

Special grants from the CIDA, in turn, enabled<br />

Doug to travel to Africa in 2004 and 2006 to<br />

volunteer in the field. During his first trip, he<br />

spent two weeks in Uganda, working with the<br />

administrator <strong>of</strong> one <strong>of</strong> the CNIS’s African<br />

partner organizations, the Injury Control Centre<br />

at Makerere Medical School in Kampala to help<br />

the Centre improve its financial systems and the<br />

quality <strong>of</strong> financial reporting to stakeholders.<br />

“It was fascinating to experience the cultural<br />

differences in how the business side <strong>of</strong> health<br />

pr<strong>of</strong>essions in Africa differs from our North<br />

American model,” Doug recounts. “The differences<br />

are indeed striking.”<br />

In 2006, he travelled to Ethiopia to contribute to<br />

a six-day workshop presented by the CNIS, during<br />

which he taught participants about accountability<br />

through budgeting, financial reporting, and<br />

communication. The workshop was part <strong>of</strong> a<br />

larger project to build six sustainable teaching<br />

laboratories for surgical skills in the country’s<br />

main medical teaching institutions.<br />

“Now that I’ve had the opportunity to travel<br />

to Africa myself, I have a sense <strong>of</strong> what our<br />

Canadian volunteers receive back for their<br />

participation,” he says. “It’s very gratifying. And<br />

it’s also gratifying to work with the qualified and<br />

dedicated individuals who serve on our board.”<br />

Doug chaired the CNIS board from 2006 to<br />

2008, and continues to chair the finance committee.<br />

Earlier in his career, he volunteered with<br />

the Crisis Centre <strong>of</strong> <strong>BC</strong> in Vancouver, and with<br />

a variety <strong>of</strong> organizations in Prince Rupert<br />

(where he lived during the 1970s and 1980s).<br />

“In the end, you do the volunteer work<br />

because it’s important,” he says. “You just find<br />

the time. The internal rewards are clearly worth it.”<br />

Paul<br />

Winstanley, CA<br />

Paul Winstanley has been<br />

contributing to the community<br />

ever since his days<br />

as an articling student.<br />

“While playing in the<br />

field hockey section <strong>of</strong><br />

the Vancouver Rowing<br />

Club, I was put forward as a director <strong>of</strong> the<br />

board by that section,” Paul recounts. “Once the<br />

other board members found out I was a CA<br />

student, they pressed me into service as treasurer.<br />

I was by far the youngest on the board, and it<br />

was very educational to be around such capable,<br />

experienced volunteers.”<br />

An accomplished amateur athlete who played<br />

cricket for the Canadian Junior National Team<br />

and field hockey for both the <strong>BC</strong> Senior Field<br />

Hockey Team and the Senior National Field<br />

Hockey Team during the 1970s, Paul eventually<br />

parlayed his love <strong>of</strong> team sports into a new<br />

volunteer role as coach <strong>of</strong> youth boys’ soccer<br />

with the Lynn Valley Soccer Association in<br />

1986. Since then, he has gone on to coach youth<br />

girls’ soccer with the West Vancouver Soccer<br />

Association, youth boys’ baseball with the Lynn<br />

Valley Little League, and field hockey with local<br />

clubs, and regional and provincial organizations.<br />

“Coaching is about helping young people<br />

develop self-confidence to allow their potential<br />

to be realized,” Paul <strong>of</strong>fers. “Team sports are an<br />

18 ica.bc.ca <strong>June</strong>/Summer <strong>2012</strong>

excellent forum to develop social skills and how<br />

to work together towards a common goal.”<br />

He continues to serve as head coach for<br />

Handsworth Secondary School’s senior field<br />

hockey team, having coached the team since<br />

2003. Under his leadership, the team has won<br />

numerous championships, including the 2011<br />

<strong>BC</strong> “AAA” Provincial Championship.<br />

In 2010, Paul received the Community Sport<br />

Volunteer Award from the North Shore<br />

Sports Awards. The award recognized not<br />

only his coaching efforts but also his extensive<br />