BUSINESS ACTIVITY STATEMENT CHECKLIST

BUSINESS ACTIVITY STATEMENT CHECKLIST

BUSINESS ACTIVITY STATEMENT CHECKLIST

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

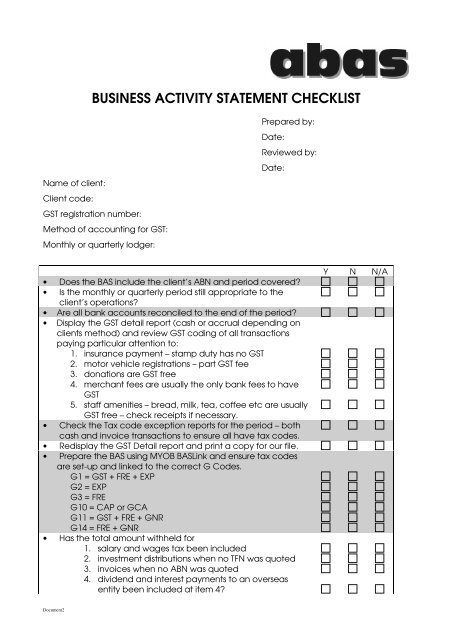

<strong>BUSINESS</strong> <strong>ACTIVITY</strong> <strong>STATEMENT</strong> <strong>CHECKLIST</strong><br />

Prepared by:<br />

Date:<br />

Reviewed by:<br />

Date:<br />

Name of client:<br />

Client code:<br />

GST registration number:<br />

Method of accounting for GST:<br />

Monthly or quarterly lodger:<br />

• Does the BAS include the client’s ABN and period covered?<br />

• Is the monthly or quarterly period still appropriate to the<br />

client’s operations?<br />

• Are all bank accounts reconciled to the end of the period?<br />

• Display the GST detail report (cash or accrual depending on<br />

clients method) and review GST coding of all transactions<br />

paying particular attention to:<br />

1. insurance payment – stamp duty has no GST<br />

2. motor vehicle registrations – part GST fee<br />

3. donations are GST free<br />

4. merchant fees are usually the only bank fees to have<br />

GST<br />

5. staff amenities – bread, milk, tea, coffee etc are usually<br />

GST free – check receipts if necessary.<br />

• Check the Tax code exception reports for the period – both<br />

cash and invoice transactions to ensure all have tax codes.<br />

• Redisplay the GST Detail report and print a copy for our file.<br />

• Prepare the BAS using MYOB BASLink and ensure tax codes<br />

are set-up and linked to the correct G Codes.<br />

G1 = GST + FRE + EXP<br />

G2 = EXP<br />

G3 = FRE<br />

G10 = CAP or GCA<br />

G11 = GST + FRE + GNR<br />

G14 = FRE + GNR<br />

• Has the total amount withheld for<br />

1. salary and wages tax been included<br />

2. investment distributions when no TFN was quoted<br />

3. invoices when no ABN was quoted<br />

4. dividend and interest payments to an overseas<br />

entity been included at item 4?<br />

Y N N/A<br />

Document2

• Have the individual PAYG withholding items been included<br />

at items W1 to W4?<br />

• Has the client received a Pay As You Go instalment rate<br />

notice or made an annual payment election?<br />

• If the client provided any benefits subject to Fringe Benefits<br />

Tax has the instalment amount included at item 6A been<br />

checked?<br />

• If the Fringe Benefits Tax instalment is to be varied, have items<br />

F1 to F4 been completed?<br />

• If the client elected to defer part or all of the 1999-2000 tax<br />

instalment, has the timing and instalment amount included at<br />

item 7 been agreed to the ATO notification?<br />

• Print the BASlink for the period.<br />

• Save the BASlink on the clients computer.<br />

• Lock the periods to the end of the bas just completed.<br />

NOTES<br />

_______________________________________________________________________________________<br />

_______________________________________________________________________________________<br />

_______________________________________________________________________________________<br />

_______________________________________________________________________________________<br />

_______________________________________________________________________________________<br />

_______________________________________________________________________________________<br />

_______________________________________________________________________________________<br />

_______________________________________________________________________________________<br />

_______________________________________________________________________________________<br />

_______________________________________________________________________________________<br />

_______________________________________________________________________________________<br />

Document2